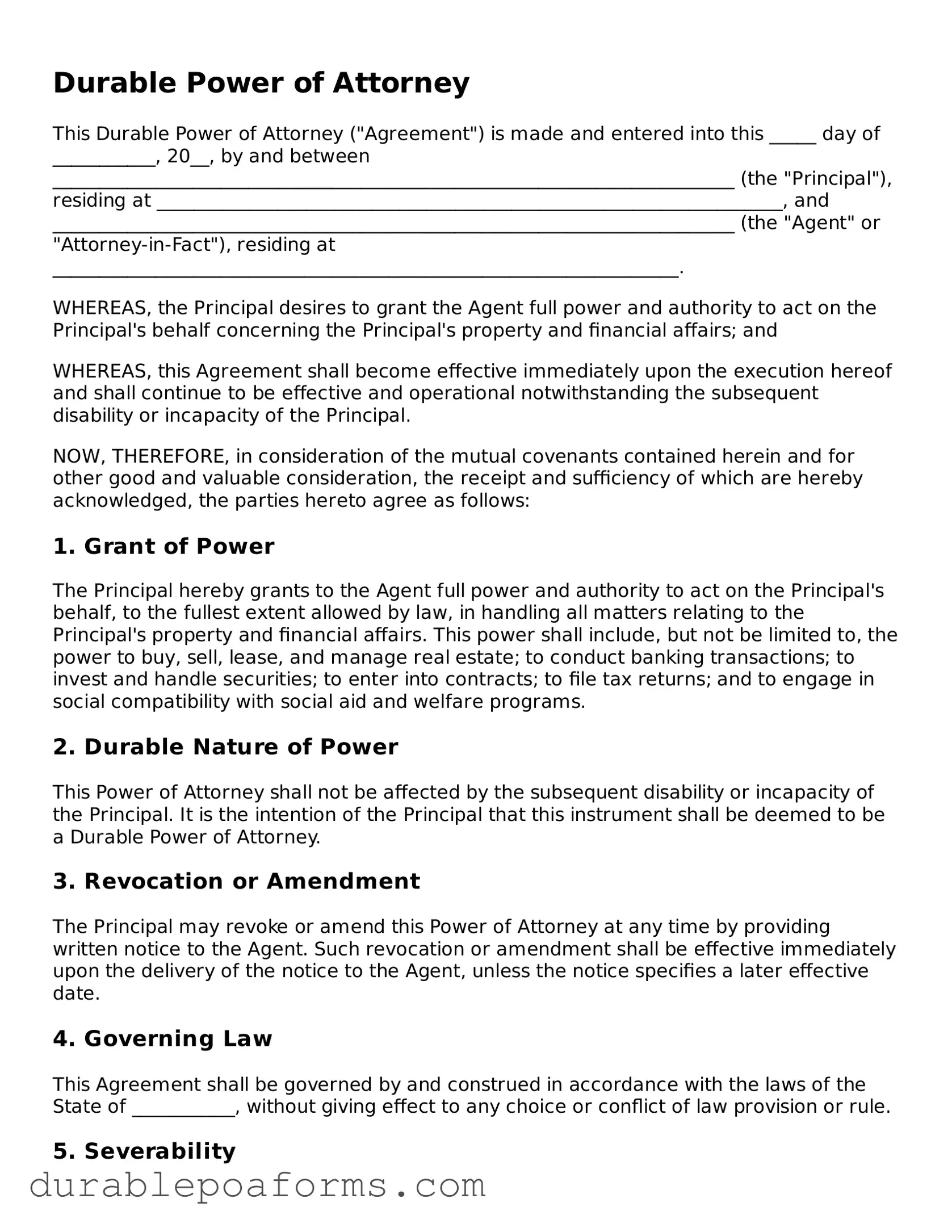

Durable Power of Attorney

This Durable Power of Attorney ("Agreement") is made and entered into this _____ day of ___________, 20__, by and between _________________________________________________________________________ (the "Principal"), residing at ___________________________________________________________________, and _________________________________________________________________________ (the "Agent" or "Attorney-in-Fact"), residing at ___________________________________________________________________.

WHEREAS, the Principal desires to grant the Agent full power and authority to act on the Principal's behalf concerning the Principal's property and financial affairs; and

WHEREAS, this Agreement shall become effective immediately upon the execution hereof and shall continue to be effective and operational notwithstanding the subsequent disability or incapacity of the Principal.

NOW, THEREFORE, in consideration of the mutual covenants contained herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

1. Grant of Power

The Principal hereby grants to the Agent full power and authority to act on the Principal's behalf, to the fullest extent allowed by law, in handling all matters relating to the Principal's property and financial affairs. This power shall include, but not be limited to, the power to buy, sell, lease, and manage real estate; to conduct banking transactions; to invest and handle securities; to enter into contracts; to file tax returns; and to engage in social compatibility with social aid and welfare programs.

2. Durable Nature of Power

This Power of Attorney shall not be affected by the subsequent disability or incapacity of the Principal. It is the intention of the Principal that this instrument shall be deemed to be a Durable Power of Attorney.

3. Revocation or Amendment

The Principal may revoke or amend this Power of Attorney at any time by providing written notice to the Agent. Such revocation or amendment shall be effective immediately upon the delivery of the notice to the Agent, unless the notice specifies a later effective date.

4. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of ___________, without giving effect to any choice or conflict of law provision or rule.

5. Severability

If any term or provision of this Agreement is found by a court of competent jurisdiction to be invalid, illegal, or unenforceable, such invalidity, illegality, or unenforceability shall not affect any other term or provision of this Agreement or invalidate or render unenforceable such term or provision in any other jurisdiction.

6. Execution

IN WITNESS WHEREOF, the Principal and Agent have executed this Durable Power of Attorney as of the date first above written.

Principal's Signature: __________________________________________

Principal's Printed Name: _______________________________________

Agent's Signature: ______________________________________________

Agent's Printed Name: ___________________________________________

State of ___________ )

County of _________ )

Subscribed and sworn to (or affirmed) before me this _____ day of ___________, 20__, by ___________________________________________________________________ (Principal) and ___________________________________________________________________ (Agent).

Notary Public: __________________________________________________

My commission expires: _________________________________________