Attorney-Verified Durable Power of Attorney Document for Alabama

When individuals contemplate safeguarding their future, particularly in scenarios that may render them incapacitated, the Alabama Durable Power of Attorney form stands out as an essential legal tool, ensuring their affairs are managed according to their wishes. This critical document bestows upon a trusted individual, known as an agent, the authority to handle matters ranging from financial decisions to property management on behalf of the principal. Its 'durable' nature signifies that the agent's power remains effective even if the principal becomes physically or mentally incapacitated. Unique to Alabama, this form complies with specific state laws, mandating precise language and formalities to certify its legality. Besides offering peace of mind, it circumvents the need for court-appointed guardianships, thereby simplifying the process involved in decision-making during challenging times. Its importance is magnified by the security and control it provides, making it imperative for Alabama residents to understand its functionalities, legal requirements, and the profound impact it can have on their personal and financial well-being.

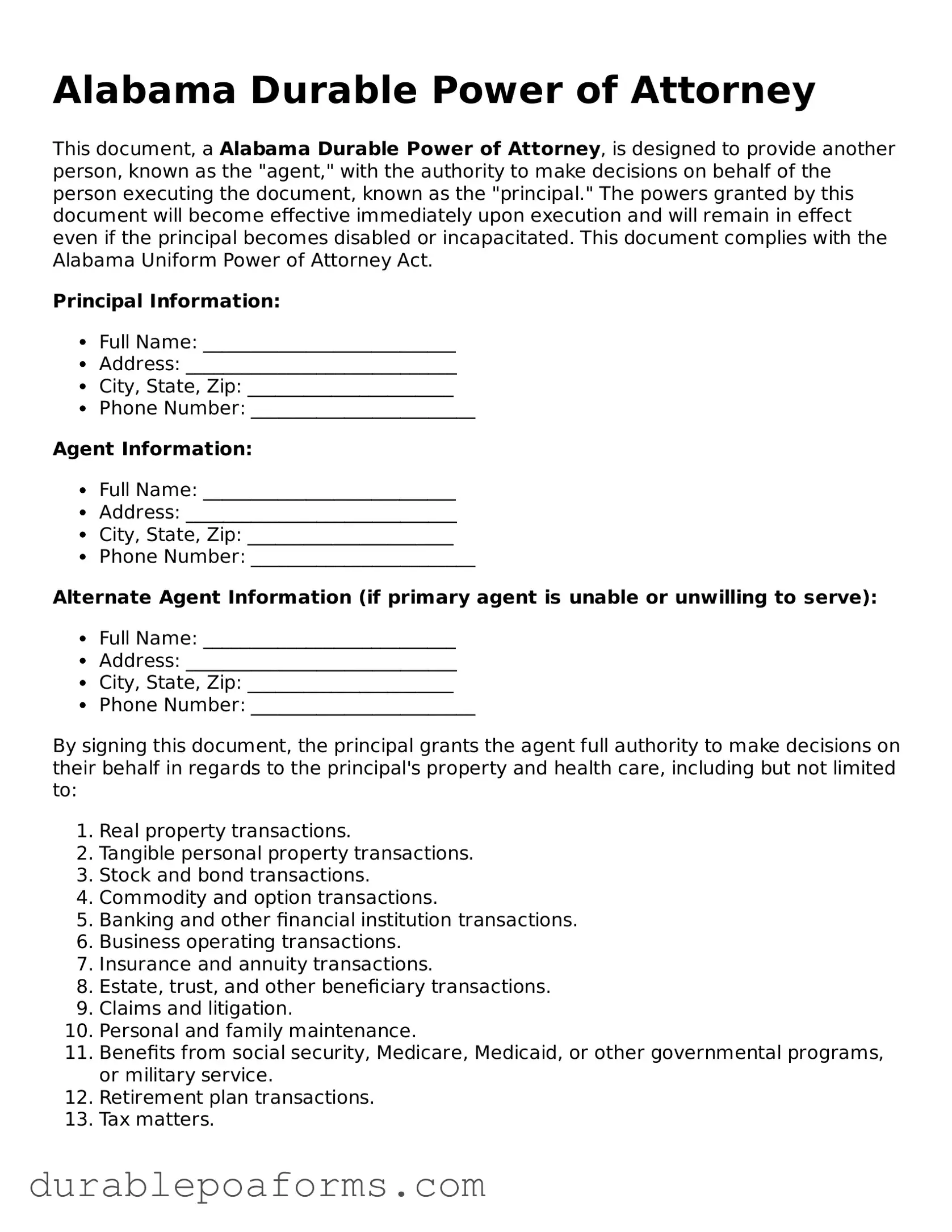

Form Preview

Alabama Durable Power of Attorney

This document, a Alabama Durable Power of Attorney, is designed to provide another person, known as the "agent," with the authority to make decisions on behalf of the person executing the document, known as the "principal." The powers granted by this document will become effective immediately upon execution and will remain in effect even if the principal becomes disabled or incapacitated. This document complies with the Alabama Uniform Power of Attorney Act.

Principal Information:

- Full Name: ___________________________

- Address: _____________________________

- City, State, Zip: ______________________

- Phone Number: ________________________

Agent Information:

- Full Name: ___________________________

- Address: _____________________________

- City, State, Zip: ______________________

- Phone Number: ________________________

Alternate Agent Information (if primary agent is unable or unwilling to serve):

- Full Name: ___________________________

- Address: _____________________________

- City, State, Zip: ______________________

- Phone Number: ________________________

By signing this document, the principal grants the agent full authority to make decisions on their behalf in regards to the principal's property and health care, including but not limited to:

- Real property transactions.

- Tangible personal property transactions.

- Stock and bond transactions.

- Commodity and option transactions.

- Banking and other financial institution transactions.

- Business operating transactions.

- Insurance and annuity transactions.

- Estate, trust, and other beneficiary transactions.

- Claims and litigation.

- Personal and family maintenance.

- Benefits from social security, Medicare, Medicaid, or other governmental programs, or military service.

- Retirement plan transactions.

- Tax matters.

This document does not authorize the agent to make health care decisions for the principal. A separate document is required under Alabama law for health care decisions.

If any provision of this document is found to be invalid or unenforceable, the remaining provisions will remain effective.

Signature of Principal: ___________________________ Date: ___________

Signature of Agent: ___________________________ Date: ___________

State of Alabama

County of _____________

This document was acknowledged before me on (date) ___________ by (name of principal) _______________________.

Signature of Notary Public: ___________________________

My commission expires: ___________

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | Allows an individual to appoint someone else to manage their financial affairs. |

| Durability | Remains effective even if the principal becomes incapacitated. |

| Legal Requirements | Must be signed by the principal, two witnesses, and a notary public. |

| Governing Laws | Governed by the Alabama Uniform Power of Attorney Act, Sections 26-1A-101 through 26-1A-403 of the Code of Alabama. |

| Revocation | Can be revoked by the principal at any time, as long as they are competent. |

| Scope of Authority | The principal can define the extent of power granted to the agent, including limits and specific duties. |

Alabama Durable Power of Attorney - Usage Guide

In Alabama, a Durable Power of Attorney (DPOA) form allows you to designate someone else, known as an agent, to make decisions on your behalf should you become unable to do so yourself. Filling out this form is a proactive step in planning for the unexpected, ensuring that your affairs can be managed according to your wishes regardless of what the future holds. Properly completing and filing this document is crucial for its effectiveness and to guarantee that your chosen agent has the authority needed when required. Below are the steps needed to fill out the form accurately.

- Download the latest version of the Alabama Durable Power of Attorney form from a reliable source to ensure it complies with current state law.

- Read the form thoroughly before filling it out to understand the scope of the authority you're granting and the responsibilities of your designated agent.

- Enter your full legal name and address in the designated section to clearly identify yourself as the principal.

- Specify the full legal name and address of the person you are appointing as your agent.

- Detail the powers you are granting to your agent. These can include managing real estate, financial, business, and legal decisions among others. Be as specific as necessary to ensure your wishes are clearly understood.

- If you wish to impose any limitations on the powers granted, list them in the specified section. This helps ensure your agent acts within the bounds of authority you're comfortable with.

- Decide on the durability of the power of attorney. The form assumes durability, meaning it remains in effect even if you become incapacated, but you must confirm this intention within the document.

- Include any additional instructions or preferences regarding how your agent should act. This might involve specifying how they should handle certain assets or situations.

- Select a successor agent if desired. This person would take over if your primary agent is unable or unwilling to serve.

- Date and sign the form in the presence of a notary public to validate it. The notary will also need to sign and possibly seal the document, making it legally binding.

- Provide your agent with a copy of the signed form, and consider giving a copy to relevant financial institutions, your attorney, or healthcare providers as applicable.

Once the Alabama Durable Power of Attorney form is properly filled out and signed, it's a good idea to keep it in a safe but accessible place. Inform trusted family members or advisors where this document can be found, ensuring that it can be quickly accessed when needed. Remember, this form can be revoked or replaced at any time, provided you are of sound mind to do so, emphasizing the need for ongoing conversations about your wishes with your chosen agent.

Common Questions

What is a Durable Power of Attorney in Alabama?

In Alabama, a Durable Power of Attorney (DPOA) is a legal form that allows an individual, known as the principal, to appoint another person, called the agent, to make decisions on their behalf. This document remains effective even if the principal becomes incapacitated. It can cover a wide range of matters, including financial, real estate, and personal decisions.

Who can act as an agent under a Durable Power of Attorney?

Any competent adult can serve as an agent under a Durable Power of Attorney in Alabama. It's important for the principal to choose someone they trust completely, as the agent will have significant control over the principal’s affairs. Family members, close friends, or trusted advisors are common choices.

How do you execute a Durable Power of Attorney in Alabama?

To execute a Durable Power of Attorney in Alabama, the principal must complete the DPOA form, stating clearly the powers granted to the agent. The document must be signed by the principal in the presence of a notary public to be legally binding. Alabama law may also require the presence of witnesses, depending on the powers being granted.

When does a Durable Power of Attorney become effective?

The effectiveness of a DPOA in Alabama can vary based on the preferences of the principal. It can become effective immediately upon signing or upon the occurrence of a specific event, such as the principal's incapacity. This should be clearly specified within the document.

Can a Durable Power of Attorney be revoked?

Yes. In Alabama, as long as the principal is competent, they can revoke a Durable Power of Attorney at any time. To do so, the principal needs to inform the agent in writing and, if the DPOA has been registered or shared with any institutions, these institutions should also be notified of the revocation.

What happens if there is no Durable Power of Attorney in place and the individual becomes incapacitated?

If an individual in Alabama becomes incapacitated without a Durable Power of Attorney in place, a court may need to appoint a guardian or conservator to make decisions on their behalf. This court process can be lengthy, expensive, and stressful for the family. Having a DPOA helps avoid this situation by ensuring that the individual's chosen agent can act on their behalf without court intervention.

Common mistakes

When individuals take on the task of filling out an Alabama Durable Power of Attorney (POA) form, they often underestimate the nuances of legal documentation. This form grants another person the authority to make significant decisions on one's behalf, making accuracy and foresight essential. However, mistakes can and do happen, stemming from a variety of oversights and misunderstandings.

One common error is the failure to specify the powers granted clearly. The Alabama Durable Power of Attorney form allows individuals to tailor the extent of power given to the agent. A vague description can lead to confusion or misuse of authority, affecting financial and healthcare decisions. Including precise language about the powers granted and any limitations is crucial for the document to serve its intended purpose effectively.

Another frequently observed mistake is not choosing the right agent. The importance of selecting an agent who is not only trustworthy but also capable of handling responsibilities under the POA cannot be overstated. Designating an agent based solely on personal relationships without considering their ability to act judiciously and in the principal's best interest can lead to problems down the line.

Many individuals overlook the importance of having alternate agents. In the event that the primary agent is unable or unwilling to serve, having a successor agent listed can prevent a legal vacuum, ensuring continuous representation. This foresight can be critical during unforeseen circumstances.

A further common misstep is neglecting to specify the duration of the power of attorney. Unless otherwise stated, a durable power of attorney in Alabama remains in effect until the principal's death or revocation. Specifying conditions for termination or a specific end date can provide additional control over the arrangement.

Additionally, the failure to sign the document in the presence of the required witnesses or a notary public can render it invalid. Alabama law mandates specific witnessing and notarization requirements to ensure the document's legality and enforceability.

The mistake of not reviewing and updating the POA periodically is also common. Life changes, such as marriage, divorce, relocation, or changing relationships, can impact the relevance and effectiveness of the power of attorney, necessitating regular reviews and possible amendments.

Lastly, many fail to properly distribute copies of the executed POA. The agent, financial institutions, healthcare providers, and any other relevant parties should have access to the document to ensure it can be acted upon when necessary.

In conclusion, careful consideration and attention to detail can prevent these common mistakes when completing an Alabama Durable Power of Attorney form. Consulting with a legal professional can also provide guidance and ensure that the form accurately reflects the principal's wishes and meets all legal requirements.

Documents used along the form

When individuals in Alabama establish a Durable Power of Attorney (POA) to ensure their financial and legal affairs are managed according to their wishes, they often consider creating additional documents to complement their estate plan. These forms and documents each serve specific but complementary roles, making it easier for individuals to maintain control over their personal, financial, and health decisions in various circumstances. Below is a list of documents that are commonly used alongside the Alabama Durable Power of Attorney form to provide a comprehensive approach to estate planning and personal care.

- Advance Directive for Health Care: This document combines a living will and a health care proxy, allowing a person to specify their preferences for medical treatment at the end of life and appoint someone to make health care decisions on their behalf if they are unable to do so.

- Last Will and Testament: Outlines how a person’s property and assets should be distributed after their death. It also specifies an executor who will manage the estate until its final distribution.

- Guardianship Designation: Enables an individual to nominate a guardian for their minor children or dependents in the event of the individual’s incapacity or death.

- Revocable Living Trust: Allows individuals to manage their assets during their lifetime and specify how these assets should be distributed upon their death, often bypassing the need for probate.

- Financial Inventory: Although not a legal document, maintaining a comprehensive list of financial accounts, assets, and liabilities can be invaluable for the person appointed under a POA or any other fiduciary acting on another’s behalf.

- Medical Information Release: Authorizes healthcare providers to disclose medical records and information to designated individuals, ensuring decision-makers have access to important health information when making care decisions.

- HIPAA Release Form: Complements the Medical Information Release by specifically authorizing the disclosure of an individual’s health information in accordance with the Health Insurance Portability and Accountability Act.

- Funeral and Burial Instructions: Allows individuals to outline their preferences for funeral arrangements and burial or cremation, easing the decision-making burden on loved ones during a difficult time.

- Letter of Intent: Provides an informal means to communicate wishes and instructions that may not be legally binding but can guide those managing affairs or executing a will or trust.

Together, these documents create a thorough and well-rounded estate and personal planning strategy. By considering the inclusion of these additional forms alongside the Alabama Durable Power of Attorney, individuals can ensure a greater degree of preparation and peace of mind for themselves and their loved ones. Addressing the wide range of potential legal and personal issues in advance promotes clarity, reduces the likelihood of future disputes, and ensures that an individual’s wishes are respected and followed.

Similar forms

The Alabama Durable Power of Attorney form is similar to other estate planning documents that people use to manage their affairs. This form allows an individual, known as the "principal," to appoint another person, known as the "agent" or "attorney-in-fact," to make decisions on their behalf. While it specifically focuses on financial matters, its purpose and structure resemble other legal documents used for planning one's estate and future care.

One document it closely aligns with is the Medical Power of Attorney. Like the durable power of attorney for finances, a medical power of attorney grants an agent the authority to make healthcare decisions for the principal, should they become unable to do so themselves. The primary difference lies in the scope of decision-making authority: the Medical Power of Attorney focuses exclusively on healthcare decisions, while the Durable Power of Attorney typically addresses financial and property matters.

Another related document is the Living Will. Whereas a Durable Power of Attorney for health care and finances allows an agent to make decisions on the principal's behalf, a Living Will specifies the principal's wishes regarding end-of-life care. It comes into play when the individual cannot communicate their preferences due to a severe health condition. The Living Will provides medical teams with directions and does not appoint an agent. Hence, it complements the Durable Power of Attorney by covering aspects of care and treatment preferences not typically addressed in the latter.

The Last Will and Testament is another related document, albeit focused on posthumous affairs. It specifies how a person's assets should be distributed upon their death and can appoint guardians for minor children. While a Durable Power of Attorney is operational during the principal's lifetime and ceases to be effective upon their death, a Last Will and Testament takes effect only after the principal has passed away. Together, these documents ensure that an individual's affairs are managed according to their wishes both during their lifetime and after.

Dos and Don'ts

Filling out a Durable Power of Attorney form in Alabama is an important task that requires careful attention to detail. This document grants someone else the authority to make decisions on your behalf, so it's crucial to approach it thoughtfully. Here are six dos and don'ts to keep in mind as you navigate this process:

- Do thoroughly read the entire form before you start filling it out. It’s important to understand each section to ensure that your wishes are accurately represented.

- Do choose someone you trust implicitly as your agent. This person will have a significant amount of control over your affairs, so it’s crucial to select someone who has your best interests at heart.

- Do be very specific about the powers you are granting. The form allows you to delineate exactly what your agent can and cannot do on your behalf. Clarity here can prevent future confusion or misuse of power.

- Don’t leave any sections blank. If a section doesn’t apply, it’s better to write “N/A” than to leave it empty, to avoid any potential misunderstandings.

- Don’t forget to have the form notarized. In Alabama, for a Durable Power of Attorney to be legally binding, it must be notarized. This formal step is crucial for the document's validity.

- Don’t neglect to inform your agent about their appointment. They should be fully aware of their responsibilities and agree to take on this role. Additionally, they should know where the original document is stored.

By following these guidelines, you can ensure that your Durable Power of Attorney form correctly reflects your wishes and meets all necessary legal standards. Remember, handling this document with care can provide you and your loved ones with peace of mind, knowing that your affairs will be managed according to your preferences.

Misconceptions

The Alabama Durable Power of Attorney (DPOA) form is instrumental in estate planning but often misunderstood. Learning the truths behind these misconceptions ensures individuals can make informed decisions for their futures and the well-being of their lovedacquisition ones.

It Grants Unlimited Power: A common misconception is that the Durable Power of Attorney form grants an agent unrestricted control over all affairs. In reality, the form's scope can be as broad or as narrow as the principal desires, governing specific actions or decisions as outlined.

It Becomes Effective Immediately: Many people believe a Durable Power of Attorney becomes effective as soon as it is signed. However, the document can be structured to become effective upon the occurrence of certain events, such as the principal’s incapacity, if so desired.

It Is Void After the Principal's Death: Another misunderstanding is that the Durable Power of Attorney remains in effect after the principal’s death. This is not the case; the authority it grants ends upon the principal's death, at which point the executor of the estate takes over.

It Overrides a Will: Some people mistakenly believe that a Durable Power of Attorney can override the principal's will. The truth is, the DPOA is only operational during the principal's lifetime and does not affect the distribution of the estate after death.

Only Family Members Can Be Agents: While family members are often chosen, the principal can select anyone they trust as their agent. This individual does not need to be a family member; what matters most is the principal’s confidence in the agent’s ability to act in their best interest.

It's Too Complicated for Individuals to Complete: Some people are deterred by the false notion that the process of executing a Durable Power of Attorney is too complex. With proper guidance and understanding, individuals can successfully complete the form to ensure their affairs are managed according to their wishes.

No Legal Assistance Is Needed: On the flip side, there's a misconception that legal assistance isn't necessary when completing a Durable Power of Attorney. While it's possible to fill out the form without a lawyer, consulting with one can ensure it accurately reflects the principal’s intentions and complies with Alabama law.

Dispel these misconceptions to confidently proceed with creating a Durable Power of Attorney. This tool is vital for ensuring your affairs are managed according to your wishes, should you become unable to do so yourself.

Key takeaways

Filling out and using the Alabama Durable Power of Attorney form is an important step in planning for future financial and personal decision-making. This form allows an individual to appoint someone they trust to make decisions on their behalf should they become unable to do so themselves. Here are key takeaways to consider when dealing with this form:

- Understanding the Purpose: This form grants the appointed person, known as an agent, the authority to handle financial affairs, including but not limited to banking transactions, real estate management, and tax filings.

- Choosing an Agent Wisely: The appointed agent should be a trustworthy individual, capable of making responsible decisions that reflect the principal’s wishes and interests.

- Durability: The term "durable" indicates that the agent's power remains effective even if the principal becomes incapacitated, ensuring uninterrupted management of the principal's affairs.

- Specific Powers: While filling out the form, be clear about the powers being granted. Specificity helps in avoiding confusion and disputes regarding the agent’s authority.

- Multiple Agents: Principals may appoint more than one agent. Directions should be provided on whether they must make decisions together (jointly) or if each can act independently (severally).

- Revocation: The principal has the right to revoke the power of attorney at any time, as long as they are competent. This should be done in writing and communicated to the agent and any institutions relying on the document.

- Signing Requirements: Alabama law requires the principal to sign the power of attorney in the presence of a notary public to ensure its validity.

- Witnesses: While not all states require witnesses for the signing of a power of attorney, having it witnessed can add to the document’s credibility and may be required by certain institutions.

- Legal Advice: Prior to execution, consulting a lawyer can provide valuable insights, especially when dealing with complex estates or specific legal requirements.

- Safekeeping: Once signed, the original document should be kept in a secure location. Copies should be provided to the agent and possibly financial institutions or others who might need to recognize the agent’s authority.

By understanding these key takeaways, individuals can more confidently navigate the process of assigning a durable power of attorney in Alabama, ensuring their affairs are managed according to their wishes, even in times of incapacity.

More Durable Power of Attorney State Forms

Power of Attorney Nevada - While state laws vary regarding the creation and execution of this form, its fundamental purpose is universal in providing peace of mind.

Ca Durable Power of Attorney - The chosen agent is legally obligated to act in your best interests, with their actions subject to review and potential legal consequences if they fail to do so.