Attorney-Verified Durable Power of Attorney Document for Arizona

In the vast landscape of Arizona's legal documents, the Durable Power of Attorney stands out as an essential tool for individuals seeking to ensure their affairs are managed in alignment with their wishes, especially during times when they may not be able to articulate these preferences themselves. This significant form empowers a chosen agent, or attorney-in-fact, to make pivotal decisions across a broad spectrum of personal matters, ranging from financial management to health-related issues. The durability aspect of this document signifies its continuous effectiveness, even in scenarios where the individual, or principal, encounters physical or mental incapacitation. It is crafted with careful attention to Arizona state laws, underpinning its validity and enforceability. The form intricately balances simplicity with comprehensive legal coverage, providing peace of mind to both the person it represents and the designated agent tasked with its execution. With provisions that can be customized to reflect the specific wishes of the individual, it embodies a proactive approach to personal and estate planning, standing as a testament to the foresight of individuals who prioritize preparedness and autonomy in managing their affairs.

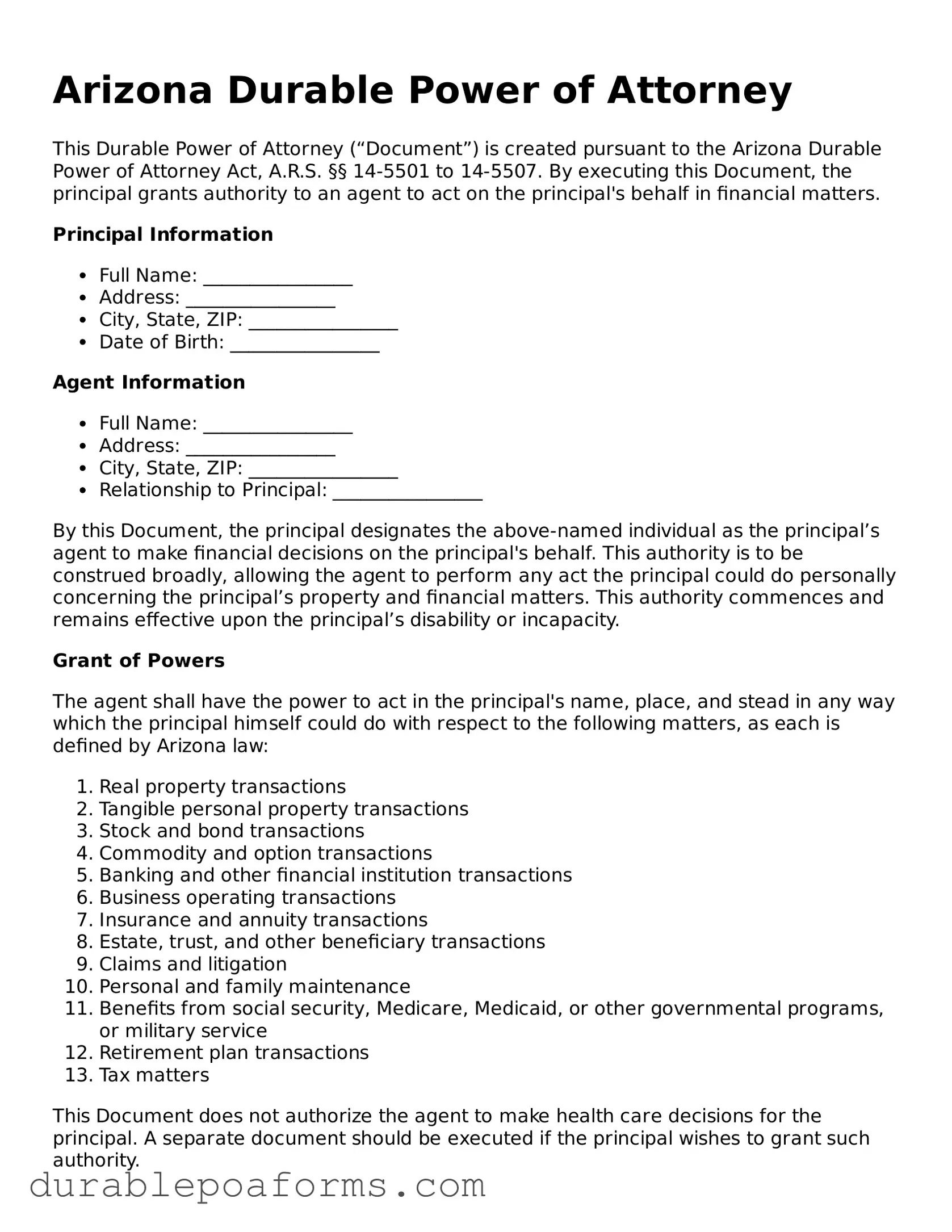

Form Preview

Arizona Durable Power of Attorney

This Durable Power of Attorney (“Document”) is created pursuant to the Arizona Durable Power of Attorney Act, A.R.S. §§ 14-5501 to 14-5507. By executing this Document, the principal grants authority to an agent to act on the principal's behalf in financial matters.

Principal Information

- Full Name: ________________

- Address: ________________

- City, State, ZIP: ________________

- Date of Birth: ________________

Agent Information

- Full Name: ________________

- Address: ________________

- City, State, ZIP: ________________

- Relationship to Principal: ________________

By this Document, the principal designates the above-named individual as the principal’s agent to make financial decisions on the principal's behalf. This authority is to be construed broadly, allowing the agent to perform any act the principal could do personally concerning the principal’s property and financial matters. This authority commences and remains effective upon the principal’s disability or incapacity.

Grant of Powers

The agent shall have the power to act in the principal's name, place, and stead in any way which the principal himself could do with respect to the following matters, as each is defined by Arizona law:

- Real property transactions

- Tangible personal property transactions

- Stock and bond transactions

- Commodity and option transactions

- Banking and other financial institution transactions

- Business operating transactions

- Insurance and annuity transactions

- Estate, trust, and other beneficiary transactions

- Claims and litigation

- Personal and family maintenance

- Benefits from social security, Medicare, Medicaid, or other governmental programs, or military service

- Retirement plan transactions

- Tax matters

This Document does not authorize the agent to make health care decisions for the principal. A separate document should be executed if the principal wishes to grant such authority.

Signature and Acknowledgment

The principal and agent must sign and date this Document before a notary public or another individual authorized by law to take acknowledgments.

Principal’s Signature: ________________ Date: ________________

Agent’s Signature: ________________ Date: ________________

This Document was acknowledged before me on (date) ________________ by (name of principal) ________________ and (name of agent) ________________, who are personally known to me or have produced ________________ as identification.

Notary Public/Other official: ________________

Date: ________________

My commission expires: ________________

Form Specifications

| Fact Name | Detail |

|---|---|

| Definition | A Durable Power of Attorney in Arizona allows an individual (the "principal") to appoint someone else (the "agent") to make decisions on their behalf, specifically decisions that remain in effect even if the principal becomes incapacitated. |

| Governing Law | Arizona Revised Statutes, specifically Title 14 - Trusts, Estates and Protective Proceedings, govern the Durable Power of Attorney forms and their execution in Arizona. |

| Types of Decisions Covered | This document can cover a broad range of decisions, including but not limited to financial matters, real estate transactions, and personal and family maintenance, depending on how it's drafted. |

| Capacity Requirement | The principal must be mentally competent at the time of signing the Durable Power of Attorney to ensure the document's validity. |

| Witnesses and Notarization | Arizona law requires the Durable Power of Attorney to be either witnessed by a notary public or by at least one adult witness to ensure its legal validity. Specific requirements for witnesses can be found in the statutes. |

| Revocation Process | The principal can revoke the Durable Power of Attorney at any time as long as they are competent, through a written revocation notice to the agent and to any institutions or persons that were relying on the original document. |

| Durability Clause | To ensure the power of attorney remains effective even if the principal becomes incapacitated, a durability clause must be included, specifying that the powers granted to the agent are intended to be durable. |

Arizona Durable Power of Attorney - Usage Guide

Filling out the Arizona Durable Power of Attorney (DPOA) form is a key step in planning for the future. This document allows an individual to designate another person, known as an agent, to make financial decisions on their behalf should they become unable to do so. The process requires attention to detail to ensure the form is completed accurately and reflects the individual's wishes. Below is a straightforward guide to assist you in filling out the Arizona DPOA form.

- Begin by obtaining the most current version of the Arizona Durable Power of Attorney form. This can generally be found through state government websites or legal resources online.

- Read the entire form thoroughly before filling it out. This helps understand all the sections and what information you'll need to provide.

- In the designated section at the top of the form, enter your full legal name and address. This identifies you as the principal—the person granting the power of attorney.

- Identify your chosen agent by writing their full legal name and contact details in the designated section. Ensure the agent is someone you trust to manage your financial affairs.

- If you wish to appoint a successor agent (an alternate in case the first agent is unable or unwilling to serve), fill in their information in the provided section. This step is optional but recommended.

- Specify the powers you are granting to your agent. This could include managing bank accounts, real estate, personal property, or legal matters. Be as clear and specific as possible to avoid any confusion later on.

- Determine whether you want the DPOA to become effective immediately or only upon your incapacitation. Mark the appropriate box or specify your conditions clearly if the form allows for it.

- If the form has a section for special instructions, use it to provide any additional directives or limitations on the agent's power. This might include restrictions on selling certain assets or specific wishes regarding how your affairs are to be handled.

- Review the form with your agent to ensure they understand their duties and are willing to accept the responsibility.

- Sign and date the form in the presence of a notary public. Arizona law requires notarization for the DPOA to be legally valid.

- Have the agent sign the form if required by its instructions. Not all forms require the agent's signature, but it’s good practice to have it.

- Distribute copies of the signed and notarized form to your agent, any successor agents, and perhaps your lawyer or trusted family members. Retain the original in a safe but accessible location.

By following these steps, you can successfully complete the Arizona Durable Power of Attorney form. It's a wise move to consult with a lawyer if you have specific concerns or complex financial matters to ensure your DPOA accurately reflects your intentions and compliances with Arizona law.

Common Questions

What is a Durable Power of Attorney in Arizona?

A Durable Power of Attorney in Arizona is a legal document that allows an individual, known as the principal, to designate another person, referred to as the agent or attorney-in-fact, to manage their affairs. This designation remains effective even if the principal becomes incapacitated or unable to make decisions for themselves. The powers granted can cover a wide range of actions, including financial decisions, real estate management, and personal care arrangements.

How is a Durable Power of Attorney activated in Arizona?

In Arizona, a Durable Power of Attorney becomes active as soon as it is signed by the principal, in the presence of a notary public or two adult witnesses. The document must follow specific legal requirements outlined by Arizona law to be considered valid. While it becomes effective immediately, the powers outlined within can be exercised by the agent only as per the principal's wishes or if the principal is deemed incapacitated and unable to handle their affairs.

Can a Durable Power of Attorney be revoked in Arizona?

Yes, in Arizona, as long as the principal is of sound mind, they have the right to revoke a Durable Power of Attorney at any time. To do so effectively, the principal should provide a written notice of revocation to the previously named agent and to any institutions or parties that were aware of the original document. It is advisable to also destroy all copies of the revoked Power of Attorney to prevent future confusion or misuse.

What decisions can an agent make with a Durable Power of Attorney in Arizona?

An agent can make a broad range of decisions on behalf of the principal, depending on the authorities specifically granted in the Durable Power of Attorney document. Common powers include managing financial accounts, buying or selling real estate, handling transactions with governmental organizations, and making healthcare decisions. However, the scope of the agent's authority is defined by the wishes of the principal as outlined in the document. It's crucial for the principal to clearly specify what decisions the agent is authorized to make.

How can one ensure their Durable Power of Attorney is legally binding in Arizona?

To ensure a Durable Power of Attorney is legally binding in Arizona, the document must comply with state laws. This includes being signed by the principal with sound mind, in the presence of a notary public or two adult witnesses not related to the agent. The form should clearly outline the powers granted to the agent and any conditions or limitations to these powers. Consulting with a legal professional can help ensure that the document meets all necessary legal standards and truly reflects the principal's wishes.

Common mistakes

Filling out the Arizona Durable Power of Attorney form is a significant step for individuals who are looking to ensure their affairs are handled in case they become unable to do so themselves. However, it's not uncommon for mistakes to be made during this process. These errors can range from minor oversights to significant blunders that can impact the validity of the document or its execution according to the principal's wishes. Here are six common mistakes people make when completing this form:

Not understanding the document: A common mistake is not fully understanding the implications of granting someone else power of attorney (POA). This misunderstanding can lead to selecting an agent who might not act in the principal's best interest or not granting enough power to effectively manage affairs.

Choosing the wrong agent: The choice of agent is crucial. People often choose an agent based on their relationship rather than their capability to handle financial or health decisions. An effective agent should be trustworthy, reliable, and capable of managing affairs in a manner that aligns with the principal's wishes.

Failing to specify powers and limitations: Another mistake is not being clear about the scope of authority granted to the agent. Without specific instructions, an agent may be unsure about the extent of their powers or may overstep their boundaries. It's important to clearly outline what the agent can and cannot do.

Not having the document properly witnessed or notarized: For a Durable Power of Attorney to be legally binding in Arizona, it must be properly witnessed or notarized. Skipping this step can result in the document being considered invalid which means it wouldn't be enforceable if challenged.

Forgetting to update the document: Life changes such as divorce, relocation, or a change in health can affect the relevance of your Power of Attorney. Failing to review and update the document as necessary can lead to complications or an agent who is no longer the best choice.

Not discussing plans with the chosen agent: It's essential to have a detailed conversation with the chosen agent about duties, expectations, and the principal's wishes. Not having this conversation can lead to confusion, mismanagement, or an agent feeling overwhelmed by their responsibilities.

When individuals avoid these common mistakes, they can ensure that their Arizona Durable Power of Attorney form accurately reflects their wishes and provides for seamless management of their affairs, should the need arise. It's always recommended to seek legal advice when preparing such important documents to ensure all aspects are correctly addressed and legally sound.

Documents used along the form

When preparing for the management of one's personal and financial affairs, the Arizona Durable Power of Attorney (DPOA) form plays a vital role. However, this form does not stand alone. There are several other important documents and forms that individuals often use alongside it to ensure a comprehensive legal and financial management strategy. Each of these documents serves a specific purpose and complements the DPOA in safeguarding an individual's wishes regarding their health, financial, and personal matters.

- Advance Health Care Directive – This document allows individuals to outline their healthcare preferences, including end-of-life care and organ donation wishes, should they become unable to make these decisions themselves.

- Last Will and Testament – This ensures that a person's assets are distributed according to their wishes after their death. It appoints a personal representative to manage the estate distribution.

- Living Trust – A tool for estate planning that helps avoid probate by transferring assets into a trust during an individual's lifetime. The grantor can specify how these assets are managed and distributed.

- Living Will – Specifies a person’s preferences for medical treatments in situations where they are unable to communicate their decisions. It is often used in tandem with the Advance Health Care Directive.

- Health Care Power of Attorney – Appoints a trusted individual to make healthcare decisions on behalf of the grantor if they become incapacitated. It complements the Durable Power of Attorney by covering health care specifically.

- Mental Health Care Power of Attorney – Specifically allows the individual appointed to make decisions related to mental health care if the grantor is unable to do so.

- HIPAA Release Form – Authorizes the release of an individual's medical records to designated persons. This is essential for health care agents to make informed decisions.

- Financial Information Statement – Although not a legal document, this form lists an individual's financial accounts, assets, and debts. It is useful for the person holding the Durable Power of Attorney to manage financial affairs efficiently.

Understanding each document’s purpose allows for a more structured approach to personal and estate planning, ensuring that all aspects of an individual’s care and wishes are considered and legally documented. Together with the Durable Power of Attorney, these documents form a network of legal protections to give individuals and their families peace of mind during uncertain times.

Similar forms

The Arizona Durable Power of Attorney form is similar to a number of other legal documents that allow individuals to make arrangements for how decisions should be made on their behalf, should they become unable to make those decisions themselves. Each document has its own specific focus and scope, but generally, they all facilitate a means through which an individual can convey their wishes regarding financial, healthcare, and personal matters.

A Medical Power of Attorney is one document closely resembling the Arizona Durable Power of Attorney, but with a specific focus on healthcare decisions. Like a Durable Power of Attorney, which allows an appointed agent to make financial or legal decisions, a Medical Power of Attorney permits an agent to make healthcare decisions on behalf of the grantor. The main difference lies in the scope of decisions each agent can make; while the former includes a broader spectrum of decisions, including financial and some legal decisions, the latter is strictly limited to medical and healthcare-related decisions.

A Living Will, another comparable document, outlines an individual's preferences regarding medical treatments and life-sustaining measures in situations where they might be unable to express their wishes verbally. This contrasts with a Durable Power of Attorney in Arizona, which grants an agent authority to make decisions rather than merely outlining the principal's wishes. The Living Will speaks when the individual cannot, usually at the end stage of life, whereas a Durable Power of Attorney provides a trusted person with the legal authority to make decisions on a broader range of issues on behalf of the individual.

A General Power of Attorney is also akin to the Arizona Durable Power of Attorney, but it lacks the "durable" feature. A General Power of Attorney typically becomes invalid if the person who granted the power (the principal) becomes incapacitated. On the other hand, a Durable Power of Attorney remains in effect even if the principal becomes unable to make decisions themselves, which is a crucial characteristic that distinguishes it from the general version.

Dos and Don'ts

When completing the Arizona Durable Power of Attorney form, individuals are embarking on an important step towards securing their legal and financial affairs. To ensure this process is handled correctly, there are several key practices to follow, as well as some pitfalls to avoid. Here's a guide that outlines the dos and don'ts when filling out this critical document.

Do:

- Read the entire form carefully before you start filling it out. This ensures you understand the scope and implications of the document.

- Use precise and clear language to describe the powers being granted. Ambiguities can lead to misinterpretations in the future.

- Include specific start and end dates if you wish the power of attorney to be limited in duration. Otherwise, it will remain in effect indefinitely or until revoked.

- Select a trusted individual who is capable and willing to act on your behalf. This person should be reliable and have a good understanding of your wishes and best interests.

- Have the document notarized, as required by Arizona law, to authenticate its validity. This step is crucial for the power of attorney to be recognized legally.

Don't:

- Leave any sections incomplete. If a section does not apply to your situation, clearly mark it as "N/A" (not applicable) to demonstrate that it was reviewed but deemed irrelevant.

- Grant powers that you do not fully understand. If there are terms or provisions that are not clear, seek clarification from a legal professional before proceeding.

- Forget to provide a copy of the power of attorney to the person you have designated as your agent. They will need this document to prove their authority when acting on your behalf.

- Overlook the need to update the document as circumstances change. Review and revise the power of attorney periodically, especially after major life events.

- Assume a durable power of attorney encompasses health care decisions. For medical issues, a separate health care power of attorney form is required in Arizona.

By following these guidelines, individuals can ensure that their durable power of attorney form is correctly filled out and legally sound. This not only protects the individual's interests but also provides clear instructions for the designated agent on how to act in the principal's best interests. Remember, when in doubt, consulting with a legal expert can help navigate any complexities and provide peace of mind.

Misconceptions

When it comes to managing one's personal affairs, particularly in times of incapacitation, the Arizona Durable Power of Attorney (DPOA) is a critical document. However, there are several misconceptions surrounding this document that can lead to confusion. Below is a list of common misconceptions and the facts that dispel them:

- Only the elderly need a Durable Power of Attorney. This is a common misconception. In reality, unexpected situations can occur at any age, making a DPOA a wise precaution for adults of all ages.

- A Durable Power of Attorney grants unlimited power. Many believe that by assigning a DPOA, they are giving away control over all their affairs. However, the scope of authority is determined by the specific terms outlined in the document itself. It can be as broad or as limited as desired.

- A Durable Power of Attorney is the same as a will. Some people confuse these two documents. While a DPOA allows someone to make decisions on your behalf while you are alive, a will is a document that outlines your wishes after your death.

- Any form downloaded from the internet is sufficient. While templates are available online, it's important to use a form that complies with Arizona's specific legal requirements to ensure it's legally valid.

- Setting up a Durable Power of Attorney is a long and complicated process. Although it involves legal documentation, with proper guidance, the process can be straightforward. It's about protecting yourself and making sure your affairs are in trusted hands.

- Once signed, a Durable Power of Attorney is irrevocable. Many believe that once a DPOA is signed, it cannot be changed or revoked. However, as long as the person who created the DPOA is mentally competent, they can revoke or amend it at any time.

Understanding these facts can help individuals make informed decisions about their future and ensure that their rights and wishes are respected. It's always advisable to consult with a legal professional when creating or amending any legal document to ensure it meets all legal requirements and accurately reflects the individual's wishes.

Key takeaways

Filling out an Arizona Durable Power of Attorney (POA) form is an important step in planning for future financial management. Here are the key takeaways to ensure the process is smooth and the document serves its intended purpose effectively:

- Understand the purpose: A Durable Power of Attorney allows you to appoint someone to handle your financial matters if you are unable to do so.

- Choose the right agent: Carefully select someone you trust to act in your best interests, as this person will have significant control over your financial affairs.

- Be specific: Clearly outline the powers you are granting to your agent. You can limit their authority to certain tasks or grant broad powers.

- Durability clause: Ensure the document includes a durability clause. This clause keeps the POA in effect even if you become incapacitated.

- Legal requirements: The form must meet Arizona's legal requirements, including being witnessed or notarized as per state law.

- Review periodically: Periodically review and update your POA to reflect any changes in your preferences or life circumstances.

- Safekeeping: Keep the original document in a safe place. Provide copies to your agent and any financial institutions they will be dealing with on your behalf.

- Communication: Discuss your wishes and expectations with the person you've chosen as your agent. Clear communication can prevent misunderstandings.

- Revoke if necessary: You have the right to revoke your Durable Power of Attorney at any time, as long as you are mentally competent. Notify your agent and any institutions in writing.

- Seek advice: Consider consulting with an attorney to ensure the form reflects your intentions and is executed correctly according to Arizona law.

More Durable Power of Attorney State Forms

Indiana Durable Power of Attorney - This form can avert financial and emotional turmoil by providing authorized agents the means to act when the principal is vulnerable.

Georgia Financial Power of Attorney - Upon signing, the Durable Power of Attorney form grants the designated agent the power to manage the signee's affairs, continuing to do so even in the event of the signee's incapacitation.