Attorney-Verified Durable Power of Attorney Document for Arkansas

When individuals look to secure their future and ensure their affairs are handled according to their wishes, especially in circumstances where they may not be able to express their desires directly, the Arkansas Durable Power of Attorney form stands out as an essential legal document. This valuable form grants a trusted individual, known as the agent or attorney-in-fact, the authority to manage financial, legal, and sometimes even healthcare-related decisions on behalf of the principal—the person making the appointment. Its durability is a significant feature, meaning that the agent's power remains in effect even if the principal becomes incapacitated or unable to make decisions. This contrasts with other forms of power of attorney that may become void in such situations. The Arkansas Durable Power of Attorney is designed with flexibility in mind, allowing for customization to fit the unique needs and preferences of the principal, whether it involves handling daily financial transactions, managing real estate, or making critical health care decisions. Understanding its importance, the necessary steps for its creation, and the legal implications can empower individuals to make informed decisions about their future and the protection of their interests.

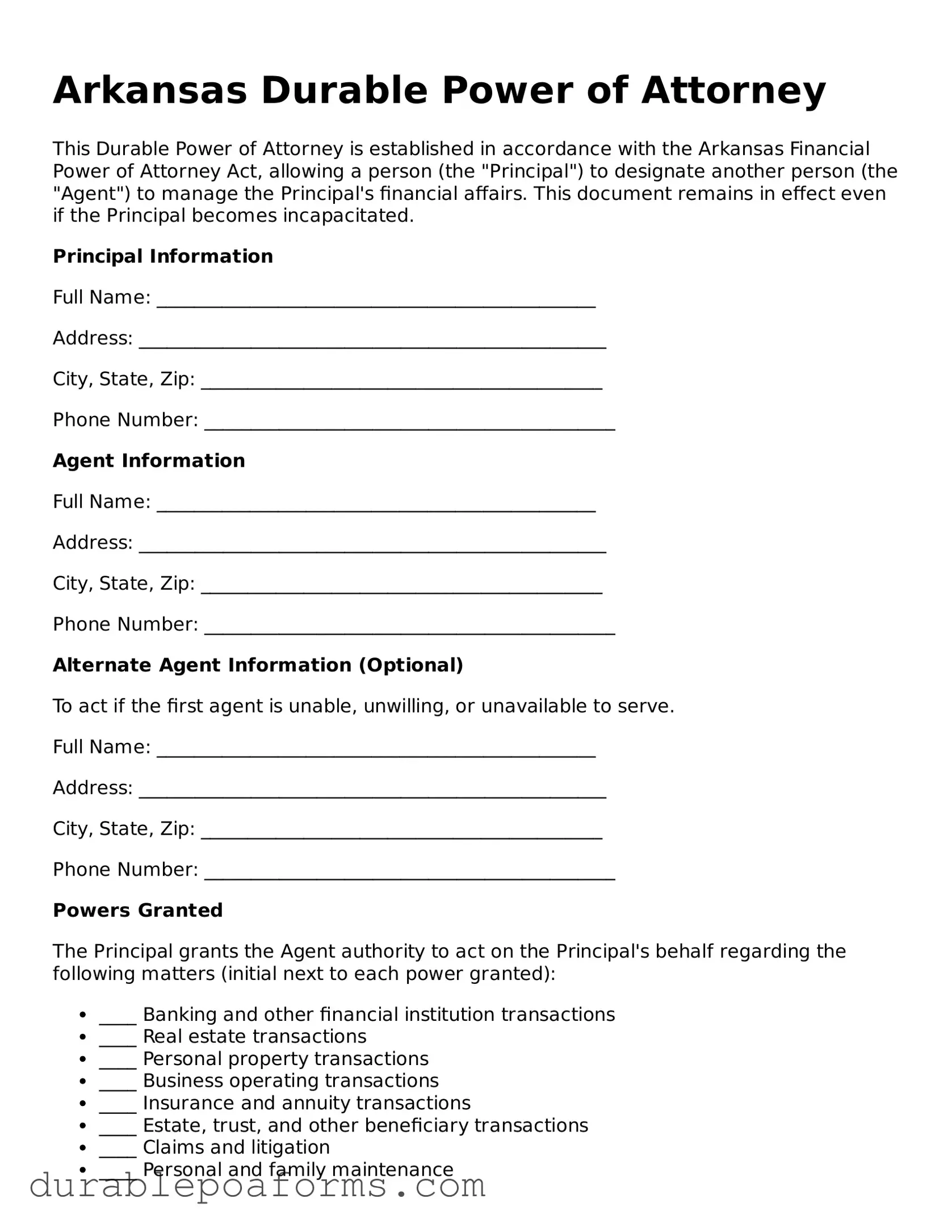

Form Preview

Arkansas Durable Power of Attorney

This Durable Power of Attorney is established in accordance with the Arkansas Financial Power of Attorney Act, allowing a person (the "Principal") to designate another person (the "Agent") to manage the Principal's financial affairs. This document remains in effect even if the Principal becomes incapacitated.

Principal Information

Full Name: _______________________________________________

Address: __________________________________________________

City, State, Zip: ___________________________________________

Phone Number: ____________________________________________

Agent Information

Full Name: _______________________________________________

Address: __________________________________________________

City, State, Zip: ___________________________________________

Phone Number: ____________________________________________

Alternate Agent Information (Optional)

To act if the first agent is unable, unwilling, or unavailable to serve.

Full Name: _______________________________________________

Address: __________________________________________________

City, State, Zip: ___________________________________________

Phone Number: ____________________________________________

Powers Granted

The Principal grants the Agent authority to act on the Principal's behalf regarding the following matters (initial next to each power granted):

- ____ Banking and other financial institution transactions

- ____ Real estate transactions

- ____ Personal property transactions

- ____ Business operating transactions

- ____ Insurance and annuity transactions

- ____ Estate, trust, and other beneficiary transactions

- ____ Claims and litigation

- ____ Personal and family maintenance

- ____ Benefits from social security, Medicare, Medicaid, or other governmental programs, or military service

- ____ Tax matters

- ____ Employment of agents

- ____ Gifts

Special Instructions (Optional)

Any specific limitations on the Agent's power or special instructions are listed here:

_________________________________________________________

_________________________________________________________

_________________________________________________________

Effective Date and Signature

This Durable Power of Attorney will become effective on the date below and will continue until it is revoked by the Principal or as provided by law.

Effective Date: _________________________________________

The Principal and a witness or notary (if required by law) must sign this document for it to be valid.

Principal's Signature: ____________________________________

Date: __________________

Witness or Notary Acknowledgment (if required):

This document was acknowledged before me on (date): _______________

By: _____________________________________________

Notary Public/Attorney/Witness Signature: ________________________

My Commission Expires: __________________________________

Form Specifications

| Fact Number | Fact Detail |

|---|---|

| 1 | Legally binding document allowing individuals to appoint someone to manage their affairs. |

| 2 | Retains its validity even if the principal becomes incapacitated. |

| 3 | Governed by the Arkansas Durable Power of Attorney Act, which is found in Arkansas Code Annotated §§ 28-68-101 through 28-68-213. |

| 4 | Can be revoked by the principal at any time, as long as they are mentally competent. |

| 5 | Requires notarization to be considered valid and legally binding in Arkansas. |

Arkansas Durable Power of Attorney - Usage Guide

Creating a Durable Power of Attorney (DPOA) in Arkansas is an important step in managing your affairs, especially in situations where you may not be able to do so yourself. This legal document allows you to appoint someone you trust to handle your financial and legal decisions on your behalf. The process is straightforward, but it's essential to fill out the form accurately to ensure it clearly reflects your wishes and adheres to Arkansas laws. Follow these steps to complete the Arkansas Durable Power of Attorney form effectively.

- Begin by downloading the most current version of the Arkansas Durable Power of Attorney form. This ensures you're using the right template that complaries with the state's current laws.

- Enter the full legal name and address of the person you are appointing as your attorney-in-fact, also known as your agent. This is the person you are giving authority to act on your behalf.

- Fill in your full legal name and address, confirming that you are the one granting the power.li>

- Specify the powers you are granting to your agent. These can range from handling financial transactions to making decisions about real estate. If there are any powers you do not wish to delegate, be sure to clearly state these exceptions. li>

- Some decisions, like those regarding health care, may require a separate form. Make sure to not include these in your Durable Power of Attorney unless the form specifically allows it.li>

- Choose when the power of attorney will become effective. Some choose for it to be effective immediately, while others may specify for it to activate upon a certain condition, such as the principal's incapacitation.

- Review the form to ensure all information is accurate and complete. Mistakes could lead to disputes or issues with the document's legality later on.

- Sign the form in front of a notary. Arkansas law requires a Durable Power of Attorney to be notarized to be considered valid.

- Have your agent sign the form as well, if required by the form or as a best practice to acknowledge their acceptance of the responsibilities. li>

- Keep the original document in a safe place, and provide copies to your agent and any institutions or individuals that may need it, like your bank, broker, or health care provider.

After completing these steps, your Durable Power of Attorney will be in effect according to the terms you set. This document is a crucial part of your personal and financial planning, offering peace of mind that your affairs will be handled as you wish by someone you trust, should you become unable to manage them yourself. Remember, this form can be revoked or changed as long as you are competent to do so, ensuring they always align with your current wishes and circumstances.

Common Questions

What is a Durable Power of Attorney (DPOA) in Arkansas?

A Durable Power of Attorney (DPOA) in Arkansas is a legal document that allows you (the principal) to designate another person (known as an agent or attorney-in-fact) to make decisions on your behalf should you become unable to do so yourself. Unlike a standard Power of Attorney, a DPOA remains in effect even if you become incapacitated, ensuring that your financial, health, and legal affairs can be managed according to your wishes.

How do I create a Durable Power of Attorney in Arkansas?

To create a Durable Power of Attorney in Arkansas, you need to complete a form that specifies the powers you are granting to your agent. This form must clearly state that the powers remain effective even if you become incapacitated. It should be signed in the presence of a notary public to ensure its validity. Arkansas law may have specific signing requirements, so it's important to consult with a legal expert or review state statutes to ensure your DPOA meets all legal standards.

How is a Durable Power of Attorney activated in Arkansas?

The activation requirements for a Durable Power of Attorney in Arkansas depend on the terms specified within the document. Generally, it becomes active as soon as it is signed and notarized, unless the document specifies a different activation condition, such as a doctor's determination of the principal's incapacity. Always make sure the terms within your DPOA clearly outline when and how it should come into effect.

Can I revoke a Durable Power of Attorney in Arkansas?

Yes, as long as you, the principal, are mentally competent, you can revoke a Durable Power of Attorney at any time in Arkansas. Revocation must be done in writing and communicated to your agent and any institutions or individuals that were informed of the DPOA’s existence. For added clarity and legality, it's also advisable to notarize the revocation document.

Who should I choose as my agent in a Durable Power of Attorney?

Choosing an agent is a significant decision. The person you select should be someone you trust implicitly, such as a close family member or a trusted friend. This individual should have the capability and willingness to handle your affairs and make decisions that align with your wishes and best interests. It’s also wise to designate a successor agent in case your primary agent is unwilling or unable to act on your behalf.

Is a lawyer required to create a Durable Power of Attorney in Arkansas?

While you are not legally required to have a lawyer to create a Durable Power of Attorney in Arkansas, consulting with one can be highly beneficial. A lawyer can ensure that your document adheres to all state laws and truly reflects your wishes. Furthermore, a legal expert can provide invaluable advice on the choices of powers to be granted and the selection of your agent.

Does a Durable Power of Attorney cover medical decisions in Arkansas?

A Durable Power of Attorney for financial affairs does not cover medical decisions in Arkansas. For healthcare-related decisions, you would need to create a separate legal document known as a Durable Power of Attorney for Health Care. This document allows you to appoint someone to make healthcare decisions on your behalf if you’re unable to do so yourself. It's crucial to have both types of DPOA to fully protect your interests in case you become incapacitated.

Common mistakes

In the state of Arkansas, filling out a Durable Power of Attorney (DPOA) form is a significant step in planning for future financial management and health care decisions. However, people often make mistakes during this process, which can lead to confusion, legal challenges, or the document not being executed as intended. It's essential to understand these common pitfalls to ensure that your wishes are accurately represented and can be carried out without issue.

Here is a list of ten frequent mistakes made when completing the Arkansas Durable Power of Attorney form:

- Not specifying the powers granted: People sometimes forget to clearly outline the scope of authority they are giving to their agent. It's crucial to detail which decisions the agent can make, whether financial, medical, or both, to avoid any ambiguity.

- Choosing the wrong agent: The importance of selecting an agent who is not only trustworthy but also capable of making difficult decisions cannot be overstated. A common mistake is choosing someone based on their relationship to you rather than their ability to act on your behalf.

- Forgetting to designate a successor agent: Life is unpredictable. If the primary agent is unable to serve for any reason, having a successor agent named ensures that there is no gap in representation.

- Not discussing the responsibilities with the chosen agent: Failing to communicate with the agent about their duties and your wishes can lead to confusion or hesitance in executing the powers granted, especially in critical situations.

- Overlooking the need for notarization or witnesses: The Arkansas DPOA form requires notarization and/or witnesses for it to be legally valid. Skipping this step can render the document unenforceable.

- Lack of specificity in powers: Vague descriptions of the agent’s powers can lead to interpretation issues. It's better to be as specific as possible about what the agent can and cannot do.

- Not considering state laws: Arkansas has specific laws governing Durable Powers of Attorney. Ignoring state requirements or assuming that all states have similar laws is a mistake.

- Failing to update the document: As life circumstances change, so may your choice of agent or wishes regarding your care. Not updating the DPOA to reflect these changes can lead to problems down the line.

- Not safely storing the document: Once executed, the DPOA should be stored in a safe but accessible place. Failing to inform the agent or loved ones of its location can result in delays when it is needed most.

- Attempting to use a template not specific to Arkansas: Using a generic DPOA form may result in a document that does not comply with Arkansas laws, potentially making it invalid.

Steering clear of these mistakes can significantly increase the effectiveness of a Durable Power of Attorney in Arkansas. It's always recommended to consult with a legal professional to ensure that the form accurately reflects your intentions and complies with state law. Proper execution and attention to detail can provide peace of mind for both the person creating the DPOA and the agent selected to act on their behalf.

Documents used along the form

When preparing for future uncertainties or planning one’s estate, it's crucial to not only draft a Durable Power of Attorney but also consider other essential documents that complement its purpose. Each form serves a unique role in ensuring decisions about health, finances, and personal preferences are respected and followed according to one’s wishes. Below is a curated list of documents often used in conjunction with the Arkansas Durable Power of Attorney, providing a comprehensive legal safety net for individuals and their loved ones.

- Living Will: This document outlines an individual's wishes regarding medical treatment and life-sustaining measures in situations where they are unable to communicate their preferences.

- Last Will and Testament: It specifies how an individual’s assets and property should be distributed after their death. It also can designate guardians for minor children.

- Healthcare Power of Attorney: This legal document allows an individual to appoint someone to make healthcare decisions on their behalf, complementing the Durable Power of Attorney which may focus on financial decisions.

- Revocable Living Trust: It allows an individual to manage their assets during their lifetime and specify how those assets should be distributed upon their death. A trust often helps avoid the lengthy and expensive probate process.

- Advance Healthcare Directive: Similar to a living will, it provides detailed instructions on the type of medical care one prefers if they become incapacitated.

- Do Not Resuscitate (DNR) Order: A medical order that tells health care professionals not to perform CPR if the person's breathing stops or if the heart stops beating.

- Declaration of Guardian in Advance: This document allows individuals to designate a guardian for themselves and their minor children in the event they become unable to make decisions independently.

- HIPAA Authorization Form: This form permits healthcare providers to disclose health information to designated individuals, ensuring loved ones can stay informed about the individual's health condition.

- Financial Inventory Document: While not a legal document, a comprehensive list of accounts, assets, liabilities, and insurance policies aids the individual appointed in the Durable Power of Attorney managing financial affairs efficiently.

Together with the Durable Power of Attorney, these documents form a solid foundation for managing both current and future legal, financial, and health-related matters. It's important to consult with a legal professional when preparing these documents to ensure they accurately reflect your wishes and comply with Arkansas state laws. Doing so can provide peace of mind for you and your loved ones by ensuring that your affairs are in order, no matter what the future holds.

Similar forms

The Arkansas Durable Power of Attorney form is similar to other legal documents that allow a person to appoint someone to make decisions on their behalf. However, the specifics of its features, the scope of authority granted, and the conditions under which it becomes effective or remains in effect distinguish it from other forms. Below are details about how it compares to two other types of documents.

Healthcare Power of Attorney: This document, also known as a healthcare proxy, specifically allows an individual to designate someone to make healthcare decisions for them if they become unable to do so. While the Arkansas Durable Power of Attorney can include provisions for healthcare decisions, its scope is broader, allowing the appointed person (agent) to make not just health-related decisions but also financial, legal, and personal decisions. The Health Care Power of Attorney, on the other hand, is strictly limited to healthcare decisions.

General Power of Attorney: A General Power of Attorney and the Arkansas Durable Power of Attorney share the feature of allowing an individual to grant another person the authority to make decisions on their behalf. The key difference lies in when the document's powers become effective and when they end. A General Power of Attorney typically becomes invalid if the individual who created it (the principal) becomes incapacitated. In contrast, the "durable" aspect of the Arkansas Durable Power of Attorney means that the appointed agent's power remains in effect or becomes effective upon the principal's incapacitation.

Dos and Don'ts

When it comes to managing your affairs, particularly in circumstances when you might not be able to make decisions for yourself, a Durable Power of Attorney (DPOA) in Arkansas is a critical document. It allows you to appoint someone you trust to handle your financial, legal, and health matters. Crafting this document with clarity and precision can avert future complications. Below are essential do's and don'ts to guide you through the process of completing the Arkansas Durable Power of Attorney form:

Do’s:- Read the form thoroughly before filling it out. Understand every section to ensure accurate completion.

- Select a trusted individual as your agent, someone who has your best interests at heart.

- Be specific about the powers you are granting. Clarify what your agent can and cannot do on your behalf.

- Include alternatives for your agent, in case your primary choice is unable or unwilling to serve.

- Sign the form in the presence of a notary public or required witnesses, according to Arkansas law, to ensure its legality.

- Inform your agent and any alternates that they have been appointed and discuss your wishes with them.

- Keep the original document in a secure but accessible location and provide copies to your agent and relevant institutions, like your bank.

- Review and update your DPOA as necessary, especially after major life events.

- Don't choose an agent without considering their willingness, ability, and reliability to manage your affairs.

- Don't leave any sections blank. If a section does not apply, mark it as N/A (not applicable).

- Avoid using vague language that could lead to misinterpretation of your wishes.

- Don't forget to date the document. The date is crucial for determining its validity.

- Do not fail to consult with a legal advisor if you have questions about the DPOA or are unsure about any of its provisions.

- Don't rely solely on generic online forms. Ensure the form complies with Arkansas state laws.

- Refrain from granting powers that you are not comfortable with; you have the right to limit the scope of your agent's authority.

- Don't procrastinate. Unexpected situations can arise at any time, making it imperative to have your DPOA established beforehand.

By adhering to these guidelines, you can facilitate a smoother process in establishing a DPOA that accurately reflects your preferences and needs. Remember, the aim is to ensure your affairs are managed as you would wish, particularly when you're not in a position to do so yourself. Taking the time to properly complete your Arkansas Durable Power of Attorney form is a proactive step toward safeguarding your future.

Misconceptions

When individuals are preparing for their future, especially regarding financial and health decisions, one common instrument that is used is a Durable Power of Attorney. This document, particularly within the context of Arkansas, is surrounded by various misconceptions. Exploring these misunderstandings helps provide clarity and ensures that decisions are made with accurate information.

- Only for the Elderly: A common belief is that the Arkansas Durable Power of Attorney is solely for elderly individuals. However, life is unpredictable, and having this form in place is a wise decision at any adult age, providing peace of mind in case of sudden illness or accidents.

- Immediately Revokes Your Power: Another misconception is that signing an Arkansas Durable Power of Attorney means you immediately lose control over your decisions. In truth, this document only takes effect under the conditions stated within it, such as incapacity, allowing individuals to maintain control until they are unable to make decisions themselves.

- Irrevocable: People often mistakenly believe that once an Arkansas Durable Power of Attorney is signed, it cannot be changed or revoked. However, as long as the person is mentally competent, they can amend or revoke this document at any time.

- Covers Medical Decisions: There's a widespread misunderstanding that a Durable Power of Attorney in Arkansas automatically includes medical decisions. In actuality, a separate document, typically a Healthcare Power of Attorney, is required to designate someone to make healthcare decisions.

- Lawyer Requirement: Many are under the false impression that creating a Durable Power of Attorney in Arkansas requires a lawyer. While legal advice is recommended, particularly to ensure that the document aligns with personal wishes and complies with state laws, it is not a necessity. Forms are available for individuals to complete on their own.

- One Size Fits All: A significant number of people believe that all Durable Powers of Attorney forms are the same. The fact is, Arkansas has specific requirements and protections that might differ from those in other states, highlighting the importance of using a state-specific document.

- Only for Financial Matters: The assumption that the Arkansas Durable Power of Attorney only pertains to financial affairs is incorrect. Depending on how it is structured, it can also grant powers related to real estate, personal property, and other non-financial decisions.

- No Need for Witnesses or Notarization: Lastly, there is a misconception that the form does not require legal witnesses or notarization to be valid. Arkansas law, however, requires that a Durable Power of Attorney be notarized, and having witnesses can further add to its legitimacy, especially for specific powers granted within the document.

Understanding these misconceptions about the Arkansas Durable Power of Attorney form ensures individuals are better equipped to plan for their future, making informed decisions that reflect their wishes and meet legal requirements.

Key takeaways

Understanding the importance and implications of filling out a Durable Power of Attorney (DPOA) form in Arkansas is crucial for anyone looking to ensure their affairs are handled according to their wishes, should they become unable to do so themselves. Here are key takeaways to consider:

Choose an agent wisely: The person you designate as your agent (or attorney-in-fact) will have significant power over your financial or healthcare decisions, depending on the scope of authority you grant. It's essential to choose someone you trust implicitly, who understands your wishes, and is willing and able to carry out those responsibilities.

Be specific about powers granted: The DPOA allows you to specify exactly what powers your agent can exercise. You can grant them broad authority or limit them to specific acts. It's vital to clearly define these powers to prevent any confusion or abuse of authority. Carefully consider what responsibilities you want your agent to have and articulate them precisely in the document.

Durable versus Springing Powers: Understand the difference between a Durable Power of Attorney and a Springing Power of Attorney. A Durable Power of Attorney becomes effective as soon as it is signed, whereas a Springing Power of Attorney becomes effective only upon the occurrence of a specific event, usually the principal's incapacitation. Be mindful of this distinction when preparing your document, as it will affect when your agent can start making decisions on your behalf.

Legal requirements: For a Durable Power of Attorney to be effective in Arkansas, it must comply with state laws. This means it should be signed by the principal (the person granting the power), acknowledged in front of a notary, and, in some cases, witnessed by one or more adults. These requirements can vary, so it's important to understand the specifics to ensure your document is legally binding.

By keeping these key points in mind, individuals can take proactive steps to ensure their personal and financial matters are managed according to their preferences, even in situations where they are not able to make decisions for themselves. Consulting with a legal advisor who understands Arkansas laws can provide additional assurance that your Durable Power of Attorney aligns with your needs and legal standards.

More Durable Power of Attorney State Forms

Power of Attorney Ct - The form grants broad or limited powers depending on the preferences of the person creating it.

Power of Attorney Nevada - Choosing a trusted person as your agent is crucial, as they'll have significant control over your affairs.

Georgia Financial Power of Attorney - A Durable Power of Attorney form allows an individual to name another person to make decisions on their behalf, remaining in effect even if the individual becomes incapacitated.