Attorney-Verified Durable Power of Attorney Document for California

Life is unpredictable, and having plans in place for unexpected situations is a wise step. Among these preparations, the California Durable Power of Attorney (DPOA) form holds a crucial spot. This legal document allows an individual, known as the principal, to appoint someone they trust, referred to as the agent, to manage their financial affairs. It is called 'durable' because it remains in effect even if the principal becomes incapacitated. The beauty of this tool lies in its power to ensure that a person's financial matters are handled according to their wishes, even when they are unable to make decisions themselves. From paying bills and managing investments to buying or selling real estate, the agent can do it all on the principal's behalf, without the need for court involvement. The California DPOA form is specifically designed to comply with the state's laws, making it a vital document for residents who wish to secure their financial future, come what may.

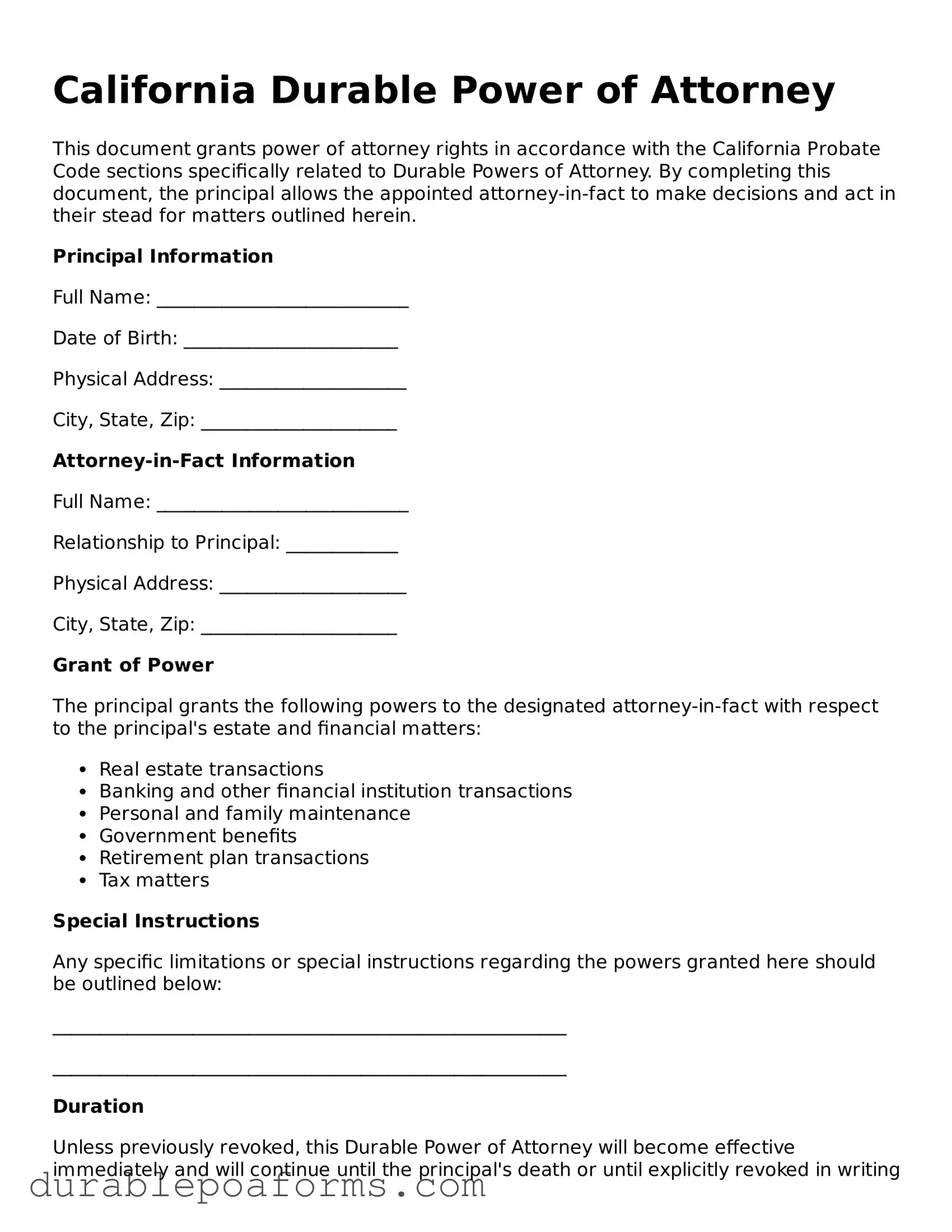

Form Preview

California Durable Power of Attorney

This document grants power of attorney rights in accordance with the California Probate Code sections specifically related to Durable Powers of Attorney. By completing this document, the principal allows the appointed attorney-in-fact to make decisions and act in their stead for matters outlined herein.

Principal Information

Full Name: ___________________________

Date of Birth: _______________________

Physical Address: ____________________

City, State, Zip: _____________________

Attorney-in-Fact Information

Full Name: ___________________________

Relationship to Principal: ____________

Physical Address: ____________________

City, State, Zip: _____________________

Grant of Power

The principal grants the following powers to the designated attorney-in-fact with respect to the principal's estate and financial matters:

- Real estate transactions

- Banking and other financial institution transactions

- Personal and family maintenance

- Government benefits

- Retirement plan transactions

- Tax matters

Special Instructions

Any specific limitations or special instructions regarding the powers granted here should be outlined below:

_______________________________________________________

_______________________________________________________

Duration

Unless previously revoked, this Durable Power of Attorney will become effective immediately and will continue until the principal's death or until explicitly revoked in writing by the principal.

Signatures

This document must be signed by the principal, the attorney-in-fact, and a notary public to be legally binding.

Principal's Signature: _____________________ Date: ________

Attorney-in-Fact's Signature: _______________ Date: ________

State of California

County of _________________

On this day, before me, _________________________ (name of notary), personally appeared _________________________ (name of principal), known to me (or proved to me on the oath of _____________________ (name of credible witness) or through (____________ state identification, passport, etc.) to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged that he/she/they executed the same.

Witness my hand and official seal.

Notary Public: ___________________________

Seal:

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | Allows an individual to appoint someone else to manage their financial affairs either immediately or in the event they become incapacitated. |

| Governing Laws | Governed by the California Probate Code sections 4000 to 4545. |

| Durability | Remains effective even if the principal becomes incapacitated, ensuring continuous management of their financial matters without court intervention. |

| Revocation | Can be revoked by the principal at any time as long as they are mentally competent, through a written notice to the appointed attorney-in-fact. |

California Durable Power of Attorney - Usage Guide

The California Durable Power of Attorney (DPOA) form is a legal document that allows you to designate another person, known as an agent, to manage your financial affairs if you are unable to do so yourself. It's a critical step in planning for future uncertainties. Filling out this form accurately ensures that your financial matters will be handled according to your wishes, thereby providing peace of mind for you and your loved ones. Here are the step-by-step instructions to help you fill out the California DPOA form correctly.

- Start by obtaining the most current version of the California Durable Power of Attorney form. This can typically be found online through legal resources or state government websites.

- Read each section of the form carefully before you begin filling it out. Understanding every part is crucial to accurately convey your wishes.

- Enter your full legal name and address in the designated section at the top of the form to identify yourself as the principal.

- Designate your agent by writing their full legal name and address in the specified section. Ensure the person you choose is someone you trust implicitly to handle your financial affairs.

- If you wish to appoint a successor agent in case your primary agent is unable or unwilling to serve, include their full name and address in the appropriate section.

- Specify the powers you are granting your agent by initialing next to each power listed on the form. If you opt for a blanket power, you may need to initial a specific line that grants all listed powers.

- Read the special instructions section if applicable. Here, you can outline any specific wishes or limitations on the authority you are granting your agent.

- If the form requires witnessing or notarization, arrange to sign the form in front of the necessary parties. This may include a notary public and/or witnesses depending on state requirements.

- Sign and date the form once you’ve reviewed it for accuracy and completeness. Ensure your agent, and any required witnesses or a notary, also sign the form if required.

- Ensure copies of the completed and signed form are distributed to your agent, any successor agents, and possibly a trusted family member or attorney. Keeping the original in a safe, accessible place is also recommended.

Comple-provided, your agent will have the legal authority to act on your behalf in financial matters, guided by the specifications you’ve outlined. It’s advisable to discuss your intentions and the contents of the DPOA with your chosen agent before finalizing the document, ensuring they understand their responsibilities and your expectations.

Common Questions

What is a California Durable Power of Attorney (DPOA)?

A Durable Power of Attorney in California is a legal document that grants someone you trust the authority to make decisions on your behalf. This could relate to financial, legal, or property matters. Being "durable" means it remains in effect even if you become incapacitated.

How do you choose the right person to act as your Power of Attorney?

Choosing the right person requires careful consideration. You should trust this person to act in your best interests. Often, people select a close family member or a trusted friend. Consider their ability to handle financial matters and their willingness to take on this responsibility. It's also advisable to have a conversation with them about your expectations and their duties as your Power of Attorney.

Are there any restrictions on who can be named as a DPOA in California?

Yes, there are restrictions. The individual you choose must be a legal adult, typically 18 years or older. They must also be mentally competent at the time of appointment. California law prohibits certain individuals from acting as a DPOA, such as your healthcare provider, unless they are a close relative.

Does a California DPOA need to be notarized or witnessed?

For a Durable Power of Attorney to be legally valid in California, it must be either notarized or signed by at least two adult witnesses. These witnesses cannot be the person appointed as your agent, related to you, or have any interest in your estate. Notarization, though not always mandated, is highly recommended as it strengthens the document's validity, especially when dealing with financial institutions.

When does the authority of a Durable Power of Attorney begin and end in California?

The authority granted by a Durable Power of Attorney can begin immediately upon signing the document or start when a specific event occurs, like the principal becoming incapacitated. This should be clearly specified in the document itself. The authority remains in effect until the principal's death, unless the principal revokes it while still competent.

Can a California DPOA be revoked?

Yes, a Durable Power of Attorney can be revoked at any time by the principal, as long as they are mentally competent. Revocation can be done in writing and should be communicated to the former agent and any institutions or individuals that were relying on the previous DPOA. For added precaution, a revocation notice should be notarized and distributed similarly to how the original DPOA was circulated.

Common mistakes

The California Durable Power of Attorney form is a critical document that allows someone to act on another person's behalf in legal and financial matters. When filling out this form, attentiveness to detail is crucial. Unfortunately, several common mistakes often occur, leading to complications or the document not being legally effective.

- Not Specifying Powers Clearly: One of the most significant errors is failing to clearly specify the powers granted. This could result in the agent not having authority to undertake necessary actions, or conversely, having too much power, which might not have been the principal's intention.

- Selecting the Wrong Agent: The choice of agent (or attorney-in-fact) is pivotal. An error often made is selecting an agent based on emotion rather than ability and trustworthiness. The agent needs to be someone who is capable of handling financial matters prudently and acting in the principal's best interest.

- Not Including a Successor Agent: Many individuals forget to appoint a successor agent. If the original agent is unable or unwilling to serve, without a successor, the durable power of attorney might become ineffective, potentially requiring a court process to appoint a new one.

- Omitting the Durability Provision: The durability provision is what ensures the power of attorney remains effective even if the principal becomes incapacitated. If this specific provision is not included, the document might not serve its primary purpose of allowing the agent to manage affairs if the principal cannot do so themselves.

- Ignoring the Need for Witnesses or Notarization: Depending on state laws, having the document witnessed or notarized (or both) might be necessary for it to be legally valid. In California, not properly executing the document with these formalities can lead to it being challenged or not recognized by financial institutions or other entities.

- Incomplete or Inaccurate Information: Mistakes in the principal or agent’s personal information (such as wrong addresses, misspelled names, or incorrect dates) can create confusion and potentially render the document invalid.

- Failing to Provide Specific Instructions for Certain Assets: If there are specific instructions regarding certain assets, such as a business or personal property, failing to include these details can lead to mismanagement or conflict among heirs or beneficiaries.

To avoid these pitfalls, it is advisable to consult with a professional when drafting a California Durable Power of Attorney form. Doing so ensures that the form meets all legal requirements and aligns with the principal's wishes. Rigorous attention to detail and a clear understanding of the implications of each section are necessary to create a document that effectively protects the principal’s interests and provides the appointed agent with the correct guidance and authority.

Documents used along the form

When individuals prepare a California Durable Power of Attorney (POA) form, they're taking a significant step toward managing their personal, financial, and healthcare decisions diligently. This document enables a chosen person, known as an agent, to make decisions on another person's behalf. However, to ensure comprehensive coverage across various areas of one's life, several other documents are often used alongside the California Durable Power of Attorney form. These documents, when combined, provide a robust legal framework that secures an individual's wishes across multiple scenarios.

- Advance Healthcare Directive – This document allows an individual to outline their preferences for medical care if they become unable to make these decisions themselves. It complements a Durable Power of Attorney by covering specific healthcare wishes, including end-of-life decisions.

- Will – A will is pivotal for outlining how an individual's assets and estate will be distributed upon their death. It names beneficiaries and can appoint a guardian for minor children, ensuring that personal and financial matters are handled according to the individual's wishes.

- Living Trust – Similar to a will, a living trust facilitates the transfer of assets while providing the added benefit of avoiding probate. It allows for a more seamless management and distribution of assets during and after the individual's lifetime.

- General Power of Attorney – Unlike the Durable Power of Attorney, a General Power of Attorney ceases to be effective if the individual becomes incapacitated. It's used for granting broad financial powers to an agent, typically until the principal cannot make decisions themselves.

- Limited Power of Attorney – This document grants an agent authority to perform specific acts or handle particular matters on behalf of the principal. It's often used for a single transaction or a defined period.

- HIPAA Release Form – The Health Insurance Portability and Accountability Act (HIPAA) release form permits healthcare providers to disclose an individual's health information to designated persons. It's crucial for agents or family members needing access to medical records.

- Financial Information Sheet – A financial information sheet doesn’t grant authority like a POA, but it provides agents with vital information about assets, accounts, and liabilities. This document ensures that the agent has all necessary information to manage the principal's financial affairs effectively.

Together, these documents form a comprehensive legal toolkit that prepares individuals for a range of future scenarios. By carefully considering and preparing each document, a person can ensure that their health, financial, and personal preferences are respected and managed according to their wishes, providing peace of mind for themselves and their loved ones.

Similar forms

The California Durable Power of Attorney form is similar to various other legal documents in terms of its functionality and purpose. Individuals use this form to assign another person, known as an agent, the authority to make decisions on their behalf. This delegation of power can cover a wide range of actions, from financial decisions to health care directives. It's important to understand how this form aligns with and differs from other legal documents.

The Medical Power of Attorney is one document that shares similarities with the California Durable Power of Attorney, particularly in its foundational purpose of assigning decision-making authority. However, the scope of authority with a Medical Power of Attorney is explicitly limited to medical and health care decisions. This distinction is crucial. While the Durable Power of Attorney can encompass a broad spectrum of decisions, including financial, the Medical Power of Attorney focuses solely on matters related to the individual's health care preferences and treatments.

Another document closely related is the General Power of Attorney. Like the Durable Power of Attorney, it grants an agent the ability to make decisions on the principal's behalf. The key difference lies in the permanence of the powers granted. A General Power of Attorney typically becomes invalid if the principal becomes incapacitated or unable to make decisions themselves. In contrast, a Durable Power of Attorney is specifically designed to remain in effect even if the principal loses mental capacity, ensuring continuous representation in decision-making.

Lastly, the Living Trust shares a resemblance in that it allows an individual to manage their affairs, particularly in how assets are handled and distributed. The person creating a Living Trust, known as the Trustor, can appoint themselves or another as the Trustee, managing the trust's assets on behalf of named beneficiaries. While a Living Trust deals mainly with asset management and distribution, a Durable Power of Attorney can cover a wider array of decisions beyond finances alone. However, both documents are instrumental in estate planning, aiming to ensure that the individual's affairs are managed according to their wishes.

Dos and Don'ts

When it comes to preparing a California Durable Power of Attorney, it's important to tread carefully and ensure everything is done correctly. This legal document grants someone else the authority to make decisions on your behalf, so clarity and precision are key. Here are some dos and don'ts to keep in mind:

Do:- Review the entire form before you start filling it out. This helps you understand the scope of the document and what information you will need to provide.

- Choose a trustworthy agent. This person will have significant power over your affairs, so it’s crucial to select someone who is reliable and has your best interests at heart.

- Be specific about the powers you are granting. The more detailed you can be about what your agent can and cannot do, the better.

- Have the document notarized. This step is often required to make the power of attorney legally binding.

- Keep the original document in a safe place, and let your agent and a trusted family member or friend know where it is.

- Review and update the document as needed. Life changes might necessitate adjustments to the powers granted.

- Rush the process. Taking the time to carefully consider each decision and selection you make within the form can prevent future complications.

- Choose an agent based solely on your personal relationship. Their ability to handle the responsibilities is more important.

- Forget to specify a successor agent. If your first choice is unable or unwilling to act, a backup is essential.

- Use vague language. Ambiguity can lead to misinterpretation of your intentions.

- Fail to discuss your wishes with your agent. Open communication ensures that they are willing and prepared to act on your behalf.

- Overlook state-specific requirements. Ensure the form complies with California laws to avoid any legal issues.

Misconceptions

When it comes to the California Durable Power of Attorney form, several misconceptions often cloud its understanding and execution. It's crucial to dispel these myths, ensuring that individuals are making informed decisions concerning their financial and legal matters. Below are common misconceptions explained to provide clarity:

- It grants complete control over all aspects of one's life. In reality, the form only covers decisions related to financial matters and property. It does not extend to health care decisions or other personal matters unless specifically stated.

- It's only for the elderly. While it's true that the elderly may often use it as part of their estate planning, individuals of any age can benefit from having a Durable Power of Attorney, particularly if they face medical procedures or extended travel.

- The appointed agent can do whatever they want. Although the agent is given broad powers, they are bound by a fiduciary duty to act in the principal’s best interest. Any actions taken must align with what the principal has authorized within the document.

- It's effective immediately upon signing. While this can be true, the document can also be structured to become effective only upon the occurrence of a specific event, such as the incapacity of the principal, commonly known as a "springing" power of attorney.

- Signing one eliminates the principal's powers. The principal retains the ability to continue managing their own financial affairs as long as they are willing and able. The document simply allows another trusted person to act alongside or in place of the principal if needed.

- It's valid even after the principal's death. The Durable Power of Attorney becomes invalid upon the principal’s death. At that point, the executor of the estate, as named in the will, takes over the responsibility for managing the deceased’s affairs.

- Any form found online is sufficient. While many forms are available, it's critical to use one that complies with California's specific legal requirements to ensure its validity. Generic forms might not meet all state-specific stipulations.

- A lawyer is not necessary for creating one. While it's possible to create a Durable Power of Attorney without legal assistance, consulting with an attorney can ensure that the document accurately reflects the principal’s wishes and meets all legal requirements.

- <>It's a one-time decision that can't be changed. The principal can revoke or amend the Durable Power of Attorney as long as they are of sound mind. It's advisable to review and adjust as circumstances change, to ensure it continues to reflect current wishes and needs.

Key takeaways

When it comes to managing your financial affairs, particularly during times when you may not be able to make decisions yourself, having a Durable Power of Attorney (POA) in California is a significant step. This legal document allows someone you trust, often referred to as your agent, to make decisions on your behalf. Below are five key takeaways to consider when filling out and using the California Durable Power of Attorney form:

- Choose your agent wisely. The person you select as your agent will have considerable power over your financial affairs, so it’s essential to choose someone who is not only trustworthy but also capable of handling financial matters competently.

- Understand the powers you're granting. You can choose to grant your agent broad authority or limit them to specific acts. It's crucial to read and understand each section of the form to ensure that you're comfortable with the powers given.

- The form must be properly executed. For your Durable Power of Attorney to be valid, it must be signed in accordance with California law, which typically means having your signature notarized, or signed in the presence of two adult witnesses who understand their role and the document's significance.

- Communicate with your agent. It's not enough to simply fill out the form and store it away. Have a detailed discussion with your agent about your expectations, where to find important documents, and whom to contact in various situations. Clear communication can prevent misunderstandings and ensure your wishes are followed.

- Review and update as necessary. Life changes such as marriage, divorce, the birth of a child, or even moving to another state can affect your Durable Power of Attorney. Regularly review your document to ensure it still reflects your wishes and complies with current laws.

Creating a Durable Power of Attorney is a proactive step in managing your financial well-being. By attending to these key considerations, you can help ensure that your financial matters will be handled according to your preferences, even when you're not able to oversee them yourself.

More Durable Power of Attorney State Forms

Power of Attorney Form Idaho - A Durable Power of Attorney specifies who will manage your finances and how they should do it.

Free Power of Attorney Form Mississippi - It provides a legal way for someone to make critical decisions for you, keeping your best interests in mind.