Attorney-Verified Durable Power of Attorney Document for Colorado

Planning ahead for unforeseen circumstances is a wise step that anyone can take to ensure peace of mind for themselves and their loved ones. In Colorado, the Durable Power of Attorney form is a crucial tool that allows individuals to appoint someone they trust to manage their affairs if they become unable to do so themselves. This form, recognized by state law, is not just about financial matters; it extends to various aspects of life where decision-making is key. It stands out because it remains in effect even if the person who made it becomes incapacitated. This means the chosen representative, or "agent," has the authority to act in the best interest of the "principal" - the person who created the power of attorney. Understanding the ins and outs of this form is essential, as it covers who can be an agent, what powers can be granted, and how it can be revoked, ensuring that individuals are well-prepared for any eventuality.

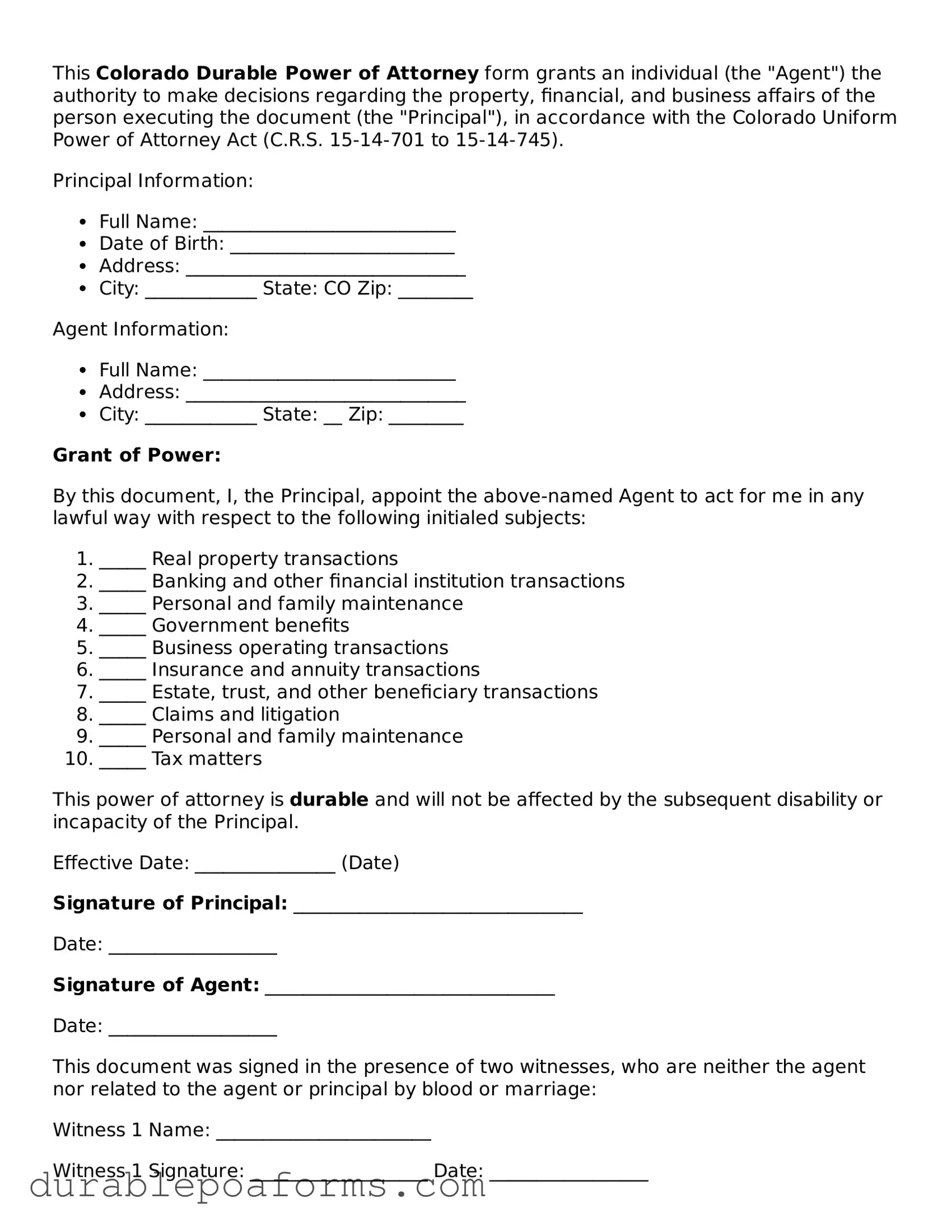

Form Preview

This Colorado Durable Power of Attorney form grants an individual (the "Agent") the authority to make decisions regarding the property, financial, and business affairs of the person executing the document (the "Principal"), in accordance with the Colorado Uniform Power of Attorney Act (C.R.S. 15-14-701 to 15-14-745).

Principal Information:

- Full Name: ___________________________

- Date of Birth: ________________________

- Address: ______________________________

- City: ____________ State: CO Zip: ________

Agent Information:

- Full Name: ___________________________

- Address: ______________________________

- City: ____________ State: __ Zip: ________

Grant of Power:

By this document, I, the Principal, appoint the above-named Agent to act for me in any lawful way with respect to the following initialed subjects:

- _____ Real property transactions

- _____ Banking and other financial institution transactions

- _____ Personal and family maintenance

- _____ Government benefits

- _____ Business operating transactions

- _____ Insurance and annuity transactions

- _____ Estate, trust, and other beneficiary transactions

- _____ Claims and litigation

- _____ Personal and family maintenance

- _____ Tax matters

This power of attorney is durable and will not be affected by the subsequent disability or incapacity of the Principal.

Effective Date: _______________ (Date)

Signature of Principal: _______________________________

Date: __________________

Signature of Agent: _______________________________

Date: __________________

This document was signed in the presence of two witnesses, who are neither the agent nor related to the agent or principal by blood or marriage:

Witness 1 Name: _______________________

Witness 1 Signature: ___________________ Date: _________________

Witness 2 Name: _______________________

Witness 2 Signature: ___________________ Date: _________________

Notarization

This document was acknowledged before me on ________ (date) by ________________________ (name of Principal).

Notary Public: ___________________________

Date Commission Expires: _________________

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Colorado Durable Power of Attorney form is used to grant someone authority to act on another person's behalf in financial matters. |

| Durability | This form remains in effect even if the principal becomes incapacitated, ensuring decisions can still be made on their behalf. |

| Governing Law | The form is governed by Colorado Revised Statutes, specifically under Title 15 concerning probate, trusts, and fiduciaries. |

| Requirements | It must be signed by the principal and notarized in Colorado for it to be legally valid. |

| Revocation | The principal can revoke the power of attorney at any time, as long as they are mentally competent. |

| Agent Duties | The appointed agent is legally required to act in the principal’s best interests and avoid conflicts of interest. |

Colorado Durable Power of Attorney - Usage Guide

Completing the Colorado Durable Power of Attorney form is a step many take to ensure their financial matters are handled by someone they trust, should they become unable to manage them personally. This document grants a designated person or entity the authority to act on your behalf. It’s a significant step in planning for the future, and while the process may seem daunting, breaking it down into steps can make it manageable and less overwhelming.

Here is how you can fill out the Colorado Durable Power of Attorney form:

- Begin by reading the entire form carefully to understand the implications and responsibilities involved in granting someone else power of attorney.

- Enter your full legal name and address in the designated space to identify yourself as the principal, the person granting the authority.

- Designate your attorney-in-fact (agent) by entering their full legal name and address. This is the person you are granting authority to act on your behalf.

- Specify the powers you are granting to your attorney-in-fact. The form may include a list of standard powers; check those applicable. If you wish to grant additional powers not listed, specify these powers clearly in the space provided.

- If you desire, set limitations on the powers granted to your attorney-in-fact. Clearly describe any restrictions in the space provided.

- Determine the duration of the power of attorney. If it is to be durable, it will continue to be effective even if you become incapacitated. Ensure the form reflects this intention.

- Review the special instructions section, if applicable, and provide any specific directions or limitations you wish to impose that might not have been covered in the previous sections.

- Sign and date the form in the presence of a notary public. Some states may require witness signatures in addition to notarization, so be sure to comply with Colorado's specific requirements.

- Have the attorney-in-fact sign the form, if required by state law, acknowledging their acceptance of the responsibilities being granted to them.

- Keep the original signed document in a safe place, and provide copies to your attorney-in-fact and any financial institutions or entities that might need it.

By methodically following these steps, you can complete the Colorado Durable Power of Attorney form accurately and provide for the management of your affairs with confidence. It’s a prudent action that not only protects your interests but also simplifies the responsibilities of those who may need to act on your behalf.

Common Questions

What is a Colorado Durable Power of Attorney?

A Colorado Durable Power of Attorney is a legal form that allows someone (the principal) to designate another person (the agent) to make decisions on their behalf. This includes decisions about property, financial affairs, and other non-healthcare matters. The term "durable" means that the agreement remains in effect even if the principal becomes incapacitated.

Who should have a Durable Power of Attorney?

Anyone over the age of 18 who wants to ensure that their affairs are handled according to their wishes in case they become unable to manage them should consider creating a Durable Power of Attorney. This is particularly important for individuals with health concerns, those entering older age, or anyone who is at risk of becoming incapacitated.

How is a Durable Power of Attorney established in Colorado?

To establish a Durable Power of Attorney in Colorado, the principal must complete and sign the form, typically in front of a notary. The form must clearly list the powers granted to the agent. Additionally, it is advisable to consult with a legal professional to ensure the form meets all legal requirements and accurately reflects the principal's wishes.

Can a Durable Power of Attorney be revoked?

Yes, as long as the principal is of sound mind, they can revoke a Durable Power of Attorney at any time. To do so, they should provide written notice to the agent and to any institutions or individuals that might be affected. Destroying the original document and creating a new one can also help to indicate revocation.

What powers can be granted with a Durable Power of Attorney?

With a Durable Power of Attorney, a principal can grant broad or limited powers to an agent. This may include the power to buy or sell property, manage bank accounts, invest money, file taxes, and handle legal claims. It's crucial for the principal to clearly outline the extent of these powers within the document.

What happens if there is no Durable Power of Attorney in place and the principal becomes incapacitated?

If no Durable Power of Attorney exists and the principal becomes incapacitated, a court may need to appoint a conservator or guardian. This process can be time-consuming, expensive, and stressful for family members. It also means that someone the principal might not have chosen could end up making important decisions about their affairs.

Common mistakes

When filling out the Colorado Durable Power of Attorney form, individuals often aim to ensure their financial affairs will be handled according to their wishes, should they become unable to manage them personally. However, several common errors can significantly undermine these intentions. Understanding these mistakes can enhance the effectiveness of the document, and ensure that the chosen agent can act in the principal's best interests without unnecessary complications.

- Omitting Details on the Powers Granted: Many individuals fail to specify the extent of powers they are granting to their agent. This vagueness can lead to disputes over what the agent is legally permitted to do, potentially requiring judicial intervention to clarify the powers.

- Not Specifying Limits: Equally important is clearly outlining the limits of the agent’s authority. Without this detail, an agent might unintentionally overstep their bounds, leading to financial decisions that the principal might not have approved of.

- Choosing the Wrong Agent: The selection of the agent is crucial. Unfortunately, people often choose an agent based on emotional reasons rather than considering the individual's capability and trustworthiness to manage complex financial matters.

- Ignoring the Need for a Successor Agent: Failing to appoint a successor agent can result in complications if the original agent is unable or unwilling to serve, potentially leaving the principal's affairs in limbo.

- Not Updating the Document: Life changes such as divorce, death, or estrangement can make the original Durable Power of Attorney document outdated. Regularly reviewing and updating this document is critical to reflect current wishes and circumstances.

- Improper Execution: For a Durable Power of Attorney to be legally valid in Colorado, it must meet specific signing and witnessing requirements. Errors in execution can invalidate the document.

- Not Considering State Laws: Colorado has its own laws governing Durable Powers of Attorney. Not tailoring the document to comply with these laws can lead to parts of it being unenforceable.

- Lack of Specificity for Real Estate Transactions: If the principal intends for the agent to handle real estate transactions, this must be explicitly stated in the document. A general grant of powers might not be sufficiently specific under Colorado law.

Avoiding these mistakes requires careful consideration and, often, professional advice. Drafting a Durable Power of Attorney is a significant step in planning for the future. It's not just about filling out a form but making informed decisions that will ensure one's financial health and peace of mind. In Colorado, like in most states, the nuances of state law and the complexity of personal finances mean that attention to detail and clarity in drafting this legal document cannot be overstated.

Documents used along the form

When preparing for the future, it’s wise to consider more than just a Durable Power of Attorney. This document is a vital component of a well-rounded plan, allowing someone you trust to make decisions on your behalf if you’re unable to do so. However, it is often accompanied by other important documents that provide a comprehensive approach to planning. Below is a list of additional forms and documents that are commonly used alongside the Colorado Durable Power of Attorney form.

- Last Will and Testament: Specifies how your assets will be distributed after your death. It’s essential for ensuring your wishes are followed.

- Living Will: Outlines your preferences for medical treatment in situations where you cannot make decisions yourself, often addressing end-of-life care.

- Medical Power of Attorney: Appoints someone to make healthcare decisions on your behalf if you’re unable to communicate your medical wishes.

- Declaration of Mental Health Treatment: States your preferences for mental health treatment, including medications, hospitalization, and psychotherapy.

- Revocable Living Trust: Allows you to manage your assets during your lifetime and specify how they should be handled after your death, potentially avoiding probate.

- Beneficiary Designations: Specifies who will receive the benefits of life insurance policies, retirement accounts, and other financial products.

- Guardianship Designation: Names a guardian for your minor children or dependents in the event of your incapacity or death.

- Financial Records Organizer: Helps you compile a comprehensive list of your accounts, policies, and other critical financial information for your agents or family.

- Personal Property Memorandum: Lists items of personal property and whom you wish to inherit them, often referenced in your will.

- Digital Assets Inventory: Documents your digital property, including online accounts and digital files, and provides instructions for handling them.

Together, these documents form a robust safety net, ensuring that all aspects of your life are considered and protected. Each plays a unique role in your comprehensive estate and health care planning strategy. It’s important to regularly review and update these documents to reflect your current wishes and circumstances. Whether used individually or as part of a broader plan, they provide peace of action for both you and your loved ones.

Similar forms

The Colorado Durable Power of Attorney form is similar to the Medical Power of Attorney form in that both authorize another person to make decisions on one's behalf. The distinction lies in the type of decisions each covers; the Durable Power of Attorney pertains to financial and legal decisions, while the Medical Power of Attorney focuses on health care decisions. This means that while both forms enable a designated agent to act in the principal's best interest, the scopes of their authority are tailored to different aspects of the principal's life.

It also shares similarities with the General Power of Attorney form. Both documents empower an agent to perform actions or make decisions on behalf of the principal. However, the Durable Power of Attorney remains in effect even if the principal becomes incapacitated, which is not the case with a General Power of Attorney. The durability aspect ensures that the agent can continue to manage the principal's affairs without interruption in the event of the principal’s incapacity.

Lastly, it is akin to the Living Trust in its purpose of managing the principal's assets. While the Durable Power of Attorney allows an agent to manage all aspects of the principal's financial life, a Living Trust is specifically set up to manage and protect the principal's assets for future beneficiaries. The key difference lies in the Durable Power of Attorney's broader capabilities in financial management versus the Living Trust's focus on asset protection and distribution after the principal's death.

Dos and Don'ts

When completing the Colorado Durable Power of Attorney form, individuals are given the privilege to appoint someone they trust to manage their affairs, assuming the grantor is unable to do so themselves. This document, vital in nature, requires careful attention to detail and a comprehensive understanding of its implications. Presented below are several recommendations to ensure the process is conducted effectively and accurately.

Do:- Review the entirety of the form carefully, ensuring clear understanding of each section before proceeding to fill it out. This proactive approach prevents potential misunderstandings or errors.

- Choose an agent whose integrity and decision-making capabilities you trust implicitly. The selected individual will act on your behalf, making their reliability paramount.

- Consult with a legal professional to clarify any uncertainties and to ensure that the form meets all current Colorado state laws. Legal landscapes evolve, and professional guidance can safeguard against unknowingly outdated practices.

- Be unequivocal and thorough when detailing the powers being granted. Ambiguity can lead to confusion or misinterpretation down the line, likely at times when clarity is most needed.

- Rush through the process without giving due consideration to each decision being made. The implications of this document are far-reaching and warrant a deliberate and cautious approach.

- Use vague language that could be open to interpretation. The document should be as clear and specific as possible to avoid unintended results.

- Forget to update the document as life circumstances change. Power of attorney needs can evolve; hence, the document should reflect current wishes and situations.

- Overlook the requirement for witnesses or notarization, depending on state law. Completing the form in compliance with legal requisites is essential for its validity.

Misconceptions

Understanding the Colorado Durable Power of Attorney (DPOA) form is crucial for anyone preparing for future decision-making regarding their finances and property. However, misconceptions about this legal document can lead to confusion. Here are nine common misunderstandings:

It grants immediate control over all aspects of your life. The DPOA specifically relates to financial and property decisions, not personal health care choices or day-to-day living arrangements.

It's effective only when you're medically incapacitated. The Colorado DPOA can be designed to take effect immediately upon signing, not just when a medical professional determines incapacity.

A DPOA and a will are essentially the same. These are distinct documents; a DPOA pertains to decisions made while you are alive but incapacitated, whereas a will applies after death, detailing how assets should be distributed.

Any form found online is sufficient. While generic forms are accessible, it's important to use one tailored for Colorado to ensure compliance with state-specific laws and requirements.

The appointed agent can make decisions immediately. This depends on how the DPOA is structured; it can be designed as "springing," becoming active only under specific circumstances, such as the principal's incapacitation.

Once signed, it cannot be changed or revoked. As long as the principal is mentally competent, a DPOA can be revised or completely revoked at any time.

It covers health care decisions. In Colorado, health care decisions require a separate legal document known as a Medical Durable Power of Attorney, not the DPOA, which focuses on financial matters.

There’s no need for a lawyer. While not legally required, consulting with a lawyer can ensure that the DPOA meets personal needs, complies with Colorado laws, and provides clear authority to the chosen agent.

The document is only for the elderly. Adults of any age can benefit from a DPOA as unforeseen circumstances, like accidents or sudden illnesses, can happen at any time, necessitating someone to manage financial affairs.

Key takeaways

The Colorado Durable Power of Attorney form is an important document that allows someone you trust to make decisions on your behalf if you are unable to do so. Here are eight key takeaways to remember when filling out and using this form:

- Choose a trusted agent. Select a person you deeply trust to act as your agent, as this individual will have the authority to make financial decisions on your behalf.

- Be specific about powers granted. Clearly specify what financial powers your agent will have. You can grant them broad authority or limit them to specific acts.

- Understand durability. "Durable" means that the power of attorney remains in effect even if you become incapacitated. This is crucial for ensuring that your affairs can be managed without court intervention if you are unable to make decisions yourself.

- Witnesses and notarization may be required. For your durable power of attorney to be valid in Colorado, it must be signed in the presence of a notary public. Some situations may also require witnesses.

- Communicate with your agent. Discuss your expectations and the responsibilities involved with the person you've chosen as your agent. This conversation can help prevent misunderstandings later.

- Keep the document accessible. Store your Durable Power of Attorney in a safe but accessible place. Inform your agent and other important people, such as family members or close friends, where it is kept.

- Review and update regularly. Your circumstances and relationships change over time, so it’s important to review and, if necessary, update your power of attorney periodically.

- Understand revocation. You can revoke your Durable Power of Attorney at any time as long as you are mentally competent. Make sure to provide formal notice to your agent and any institutions or parties they interacted with on your behalf.

By keeping these key points in mind, you can ensure that your Colorado Durable Power of Attorney effectively protects your interests and provides the necessary authority to your chosen agent.

More Durable Power of Attorney State Forms

General Power of Attorney California - Establishes a legal framework for managing an individual's matters through a designated representative if they become incapacitated.

Power of Attorney Ct - Creating a Durable Power of Attorney involves understanding state-specific requirements that may dictate the form's validity.