Attorney-Verified Durable Power of Attorney Document for Delaware

When considering the future, one's thoughts often drift towards planning for the unforeseen. Within the vast realm of legal documentation geared towards personal and financial security, the Delaware Durable Power of Attorney form holds a place of critical importance. This document extends the power to an individual, often referred to as the agent, to make key decisions on behalf of another, known as the principal. These decisions can range from managing financial portfolios to making critical healthcare decisions when the principal is unable to do so themselves due to incapacity. The 'durable' aspect of this power of attorney is particularly significant; it ensures that the document remains in effect even if the principal becomes incapacitated. This can offer peace of mind not only to the person creating the power of attorney but also to their loved ones, knowing that decisions will be made according to the principal’s wishes. Moreover, the flexibility and breadth of authority granted can be tailored specifically to the principal's needs and can be as broad or as limited as desired. This, combined with the relative ease of creating a durable power of attorney, makes it an essential component of anyone’s contingency planning within the state of Delaware.

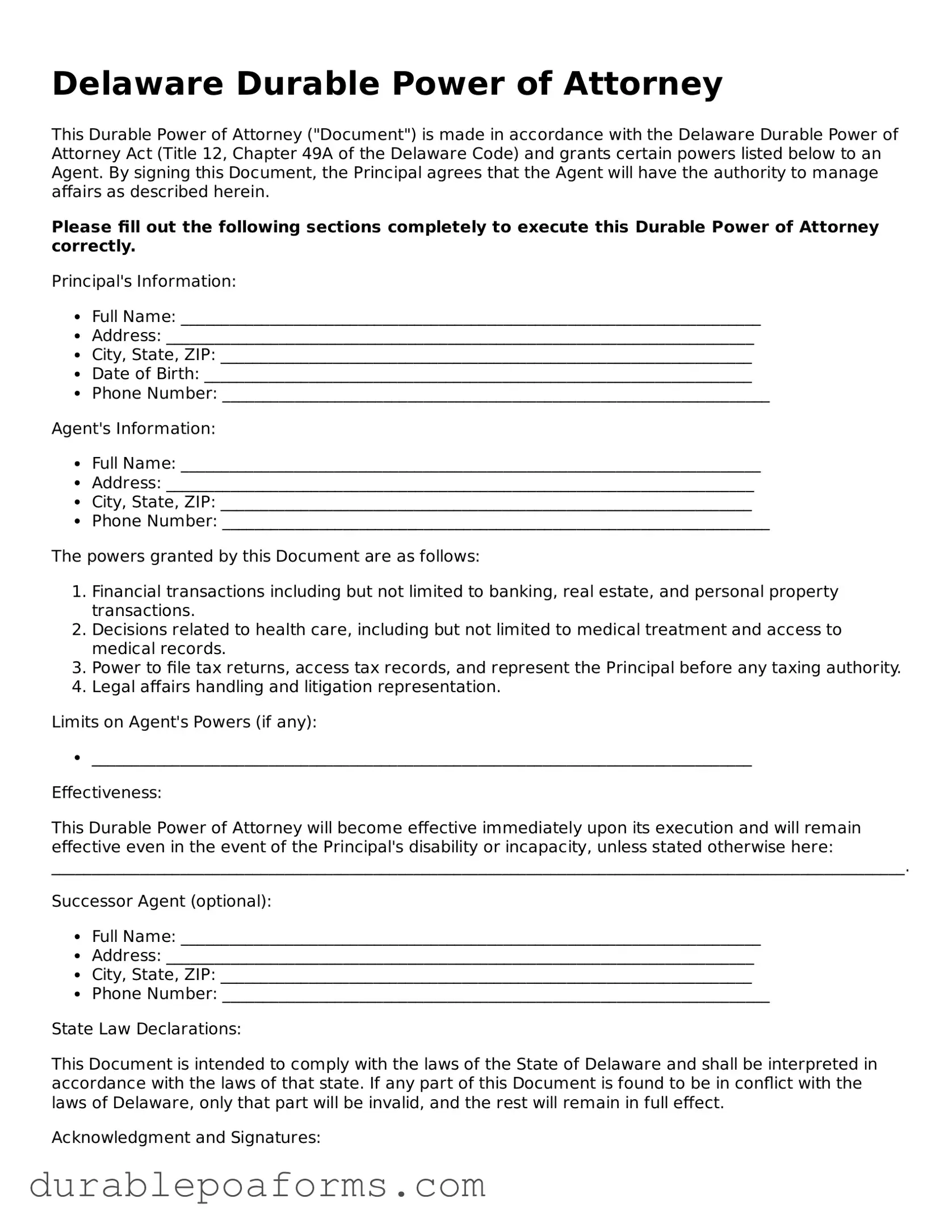

Form Preview

Delaware Durable Power of Attorney

This Durable Power of Attorney ("Document") is made in accordance with the Delaware Durable Power of Attorney Act (Title 12, Chapter 49A of the Delaware Code) and grants certain powers listed below to an Agent. By signing this Document, the Principal agrees that the Agent will have the authority to manage affairs as described herein.

Please fill out the following sections completely to execute this Durable Power of Attorney correctly.

Principal's Information:

- Full Name: ________________________________________________________________________

- Address: _________________________________________________________________________

- City, State, ZIP: __________________________________________________________________

- Date of Birth: ____________________________________________________________________

- Phone Number: ____________________________________________________________________

Agent's Information:

- Full Name: ________________________________________________________________________

- Address: _________________________________________________________________________

- City, State, ZIP: __________________________________________________________________

- Phone Number: ____________________________________________________________________

The powers granted by this Document are as follows:

- Financial transactions including but not limited to banking, real estate, and personal property transactions.

- Decisions related to health care, including but not limited to medical treatment and access to medical records.

- Power to file tax returns, access tax records, and represent the Principal before any taxing authority.

- Legal affairs handling and litigation representation.

Limits on Agent's Powers (if any):

- __________________________________________________________________________________

Effectiveness:

This Durable Power of Attorney will become effective immediately upon its execution and will remain effective even in the event of the Principal's disability or incapacity, unless stated otherwise here: __________________________________________________________________________________________________________.

Successor Agent (optional):

- Full Name: ________________________________________________________________________

- Address: _________________________________________________________________________

- City, State, ZIP: __________________________________________________________________

- Phone Number: ____________________________________________________________________

State Law Declarations:

This Document is intended to comply with the laws of the State of Delaware and shall be interpreted in accordance with the laws of that state. If any part of this Document is found to be in conflict with the laws of Delaware, only that part will be invalid, and the rest will remain in full effect.

Acknowledgment and Signatures:

By signing below, the Principal acknowledges that they have read and understood this Document, and they are acting of their own free will. This Document is not effective unless signed by the Principal and notarized.

Principal's Signature: ___________________________________ Date: ________________________

Agent's Signature: ______________________________________ Date: ________________________Notary Public Signature and Seal (as required): ___________________________________________

Form Specifications

| Fact | Detail |

|---|---|

| Purpose | A Delaware Durable Power of Attorney form grants an agent authority to make financial decisions on behalf of the principal. |

| Durability | This form remains effective even if the principal becomes incapacitated, unless it states otherwise explicitly. |

| Governing Law | Its use and application are governed by Delaware Code Title 12, Chapters 49A to 49K. |

| Agent Designation | The principal can appoint one or more individuals or entities as their agent. |

| Capacity Requirement | The principal must be mentally competent at the time of signing the form. |

| Signature Requirements | The principal’s signature must be witnessed by a notary public to ensure its validity. |

| Springing Powers | Delaware permits the creation of "springing" powers, effective upon the occurrence of a specific event, typically the principal’s incapacity. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent. |

| Limited Powers | The form can be customized to grant limited powers to the agent, specific to certain transactions or areas of authority. |

| Acceptance by Third Parties | Financial institutions and other third parties in Delaware are required to accept a validly executed Durable Power of Attorney. |

Delaware Durable Power of Attorney - Usage Guide

Filling out the Delaware Durable Power of Attorney form is a straightforward process. This legal document allows someone to appoint another person, known as an agent, to make decisions on their behalf. It's a powerful tool, especially in situations where the person may not be able to make decisions for themselves due to illness or absence. The steps below guide you through completing the form accurately to ensure your wishes are legally documented and respected.

- Start by entering your full legal name and address at the top of the form where indicated. This identifies you as the principal granting power to someone else.

- Next, fill in the name and address of the person you are choosing as your agent. This person will have the authority to act on your behalf according to the powers you grant in this document.

- Specify the powers you are granting to your agent. The form may list various decisions your agent can make on your behalf, such as financial, real estate, and medical decisions. Initial next to the powers you are granting, and leave blank any powers you do not wish to grant.

- If there are specific conditions under which the power of attorney should become effective, describe these in the space provided. You can specify a particular event or date that triggers the power of attorney.

- Select whether the power of attorney is durable or terminates upon your incapacity. If it is to be durable, which means it will continue to be in effect if you become incapacitated, make sure to indicate this clearly as per the form's instructions.

- For added protection, you may appoint a successor agent. This is someone who will take over if your first choice is unable or unwilling to act. Provide the name and address of the successor agent, if applicable.

- Review the form carefully to ensure all information is accurate and complete. Any errors can lead to misunderstandings or legal challenges later.

- Sign and date the form in the presence of a notary public. The notary will verify your identity and the voluntary nature of your signature, then notarize the document to make it legally binding.

- Finally, give a copy of the signed document to your agent and keep the original in a safe place. Also, consider giving a copy to your successor agent (if you have named one) and any other interested parties, such as family members or your attorney.

By following these steps, you can successfully complete the Delaware Durable Power of Attorney form, ensuring your affairs can be managed according to your wishes in case you're unable to do so yourself. It's a responsible step to take, providing peace of mind to both you and your loved ones.

Common Questions

What is a Delaware Durable Power of Attorney?

A Delaware Durable Power of Attorney (DPOA) is a legal document that allows an individual, known as the principal, to designate another person, called the agent, to make financial decisions on their behalf. This power remains in effect even if the principal becomes incapacitated.

Who can be designated as an agent in a Delaware Durable Power of Attorney?

Any competent adult, such as a trusted family member, friend, or a professional like an attorney, can be designated as an agent. The chosen individual should be someone the principal trusts implicitly to handle their financial affairs responsibly and in their best interest.

When does a Delaware Durable Power of Attorney become effective?

The effectiveness of a Delaware DPOA can vary based on the preferences of the principal. It can become effective immediately upon signing or can be set to become effective upon the occurrence of a future event, often the principal's incapacitation, as specified in the document.

How can a Delaware Durable Power of Attorney be terminated?

A DPOA can be terminated in several ways: if the principal revokes it in writing, upon the death of the principal, if the document specifies a termination date or event that occurs, or upon the dissolution of marriage if the spouse is the designated agent, unless otherwise stated in the DPOA.

Is a Delaware Durable Power of Attorney valid in other states?

Yes, a Delaware DPOA is generally recognized in other states. However, because laws can vary significantly from one state to another, it is advisable to consult with a legal professional when using a Delaware DPOA outside of Delaware to ensure it meets all legal requirements.

Do I need a lawyer to create a Delaware Durable Power of Attorney?

While it is not strictly necessary to have a lawyer to create a DPOA, consulting with a legal professional experienced in Delaware estate planning law can ensure that the document is correctly prepared and executed, accurately reflects the principal's wishes, and meets all state legal requirements.

Can a Delaware Durable Power of Attorney be changed or revoked?

Yes, as long as the principal is competent, they can modify or completely revoke their DPOA at any time. This is typically done by preparing a new DPOA or a formal revocation document, clearly stating the principal's intention to revoke the powers granted to the agent.

What happens if my Delaware Durable Power of Attorney is not honored by a third party?

If a third party refuses to honor a valid DPOA, the first step is often to seek legal advice. In some cases, it may be necessary to file a legal petition to have a court confirm the DPOA's validity and compel the third party to accept it. Ensuring the DPOA is clearly drafted and complies with Delaware law can help minimize the chances of such disputes.

Common mistakes

Filling out legal forms can often be a daunting task, particularly when it concerns something as critical as a Durable Power of Attorney (DPOA). A DPOA is a legal document that allows an individual to appoint someone else to manage their affairs if they become unable to do so themselves. When it comes to the state of Delaware, there are common mistakes people tend to make while completing this form. Recognizing and avoiding these errors can ensure that the document reflects your wishes accurately and is considered valid under law.

Here is an overview of the eight mistakes frequently made:

- Not Specifying Powers Clearly: One of the most significant errors is the failure to specify the powers granted to the agent clearly. It's essential to detail what exactly the agent can and cannot do on your behalf to prevent any ambiguity or misuse of authority.

- Choosing the Wrong Agent: An equally important mistake is selecting an agent without thoroughly considering their ability to act responsibly in your best interests. The chosen agent should be trustworthy and capable of managing your affairs effectively.

- Forgetting to Date the Document: Without a valid date, a DPOA might not be recognized. It's crucial to include the date on which the document is signed, as this can have implications on its enforceability.

- Omitting a Successor Agent: Failure to appoint a successor agent leaves your affairs in limbo if the primary agent can no longer serve. It's wise to have a backup to ensure continuity of your affairs.

- Not Specifying The Duration: A DPOA in Delaware can be made "durable," meaning it remains in effect even if you become incapacitated. Specifying the duration or conditions under which the power remains in effect is critical.

- Lack of Required Signatures: A common mistake is not obtaining all required signatures, including that of the principal, the agent(s), and sometimes a witness or notary, depending on state laws. This oversight can render the document invalid.

- Ignoring State-Specific Requirements: Each state has unique requirements for DPOA documents. Forgetting to adhere to Delaware's specific legal stipulations can lead to significant legal challenges.

- Not Reviewing Regularly: Circumstances and relationships change. Failing to review and update your DPOA periodically can result in an outdated document that doesn’t reflect your current wishes or situation.

To avoid these common mistakes, individuals should approach the creation of a Durable Power of Attorney with meticulous care. Consulting with a legal professional can also provide clarity and ensure that the DPOA abides by Delaware law, accurately reflects the individual’s wishes, and is executed correctly. Paying attention to these details can safeguard one’s interests and ensure their affairs are managed as they desire, even if they are unable to make those decisions themselves in the future.

By being aware of these pitfalls, you can navigate the complexities of preparing a DPOA with greater confidence. It’s not just about completing a form; it’s about making informed decisions that have lasting impacts. Therefore, taking the time to understand and avoid these mistakes is well worth the effort.

Documents used along the form

When executing a Delaware Durable Power of Attorney (DPOA), several other forms and documents often accompany or support the process, ensuring that all legal, financial, and health-related bases are covered. These documents, used in conjunction, provide a comprehensive approach to estate planning, decision-making in times of incapacity, and other crucial life events, ensuring that an individual's wishes are honored and clearly communicated.

- Advance Health Care Directive: This legal document allows an individual to outline their health care preferences and appoint an agent to make medical decisions on their behalf if they are unable to do so themselves.

- Living Will: Often part of an Advance Health Care Directive, a Living Will specifies an individual’s preferences regarding end-of-life medical treatment.

- Last Will and Testament: This essential document details how an individual’s assets should be distributed after their death. It may also designate guardians for any minor children.

- Revocable Living Trust: This allows an individual to maintain control over their assets during their lifetime, with provisions for management and distribution of those assets upon their incapacity or death.

- HIPAA Authorization Form: This form allows designated individuals to access an individual’s private health information, facilitating informed decisions about care and treatment in situations where the individual is not capable of providing consent.

- Financial Records: Comprehensive lists of assets, liabilities, accounts, and other financial information can support the DPOA by providing a clear overview of an individual’s financial situation.

- Real Estate Deeds: Documents pertaining to any real estate owned, which may need to be managed or sold under the authority granted by the DPOA.

- Letter of Intent: This document provides additional guidance and wishes that may not be legally binding but can inform decisions about personal effects, funeral arrangements, and other personal matters.

- Guardianship Designation: For individuals with minor children or dependent adults, this document appoints a guardian to take responsibility in the event of the principal's incapacity.

Together, these documents form a protective web around an individual’s personal, financial, and health-related affairs. Careful consideration and proper execution of each can provide peace of mind to both the individual and their loved ones, ensuring that wishes are respected and carried out efficiently in any circumstances.

Similar forms

The Delaware Durable Power of Attorney form is similar to other legal documents that allow individuals to appoint someone to make decisions on their behalf. These documents vary mainly in terms of the scope of authority they grant and the specific situations they are designed for. Among these, the General Power of Attorney and the Medical Power of Attorney are the most comparable. The key differences and similarities between these documents stem from their purposes and the circumstances under which they become effective.

General Power of Attorney: This document, like the Delaware Durable Power of Attorney, authorizes someone (often referred to as the agent) to make decisions on the principal’s behalf. However, the scope differs significantly. A General Power of Attorney typically gives the agent broad powers to handle financial and business transactions. It becomes void if the principal becomes incapacitated. In contrast, the Durable Power of Attorney remains in effect even if the principal cannot make decisions for themselves, making it particularly useful for long-term planning.

Medical Power of Attorney: While the Durable Power of Attorney often includes provisions for health care decisions, a Medical Power of Attorney is exclusively focused on medical decisions. This type of document becomes crucial when the principal is unable to communicate their wishes regarding medical treatment directly. Both documents share the feature of durability, meaning they can remain effective after the principal becomes incapacitated. However, the Medical Power of Attorney is limited to health care decisions, whereas the Durable Power of Attorney can cover a broader range of powers, including financial and legal decisions.

Dos and Don'ts

When preparing to fill out the Delaware Durable Power of Attorney form, being meticulous and informed is critical. This document will grant someone else the power to make important decisions on your behalf, so it's vital to approach this with care. Here are some dos and don'ts that can help guide you through the process.

Things You Should Do

- Review the form thoroughly before filling it out. Understanding every section ensures that you accurately convey your wishes regarding the powers you are delegating.

- Choose a trusted individual as your agent. This person will have significant control over your affairs, so it's crucial to select someone who is responsible and has your best interests at heart.

- Be specific about the powers you are granting. The form allows you to specify which decisions your agent can make on your behalf, from financial to healthcare-related. Tailoring these powers helps prevent any confusion or misuse of authority.

- Sign the form in the presence of a notary. Delaware law requires notarization for the form to be legally valid. This step also helps safeguard against any claims that the document was signed under duress or without your full consent.

Things You Shouldn't Do

- Don’t rush through the process. Taking the time to consider each decision carefully is essential for creating a power of attorney that truly reflects your wishes.

- Don’t leave any sections blank. If a section does not apply, it's better to write "N/A" (not applicable) than to leave it blank. This can help prevent unauthorized additions or alterations after you’ve signed the document.

- Don’t forget to discuss your wishes with the person you’ve chosen as your agent. Clear communication ensures they understand their responsibilities and your expectations.

- Don’t neglect to keep a copy for yourself. After the notarization, make sure you secure a copy of the signed document for your records. It's also wise to inform a close family member or friend where this important document is stored.

Misconceptions

Understanding the Delaware Durable Power of Attorney (DPOA) form is crucial for making informed decisions about your future and that of your loved ones. Unfortunately, there are several misconceptions surrounding this document that often lead to confusion. Here are seven common misunderstandings and the facts to set them straight:

- One must be elderly or ill to create a DPOA. This is false. Individuals of any age can benefit from having a DPOA in place. It serves as a precautionary measure, ensuring that your affairs are managed according to your wishes if you are ever incapable of doing so yourself due to any reason.

- A DPOA grants unlimited power. This is misleading. While the DPOA does grant significant authority to the agent, its scope is limited to what is explicitly outlined in the document. The person creating the DPOA can customize it to include specific powers and restrictions.

- The same DPOA form is used across all states. This is incorrect. Each state has its own laws and regulations regarding DPOAs. Therefore, the Delaware DPOA form is specifically designed to comply with Delaware's state laws.

- Setting up a DPOA is a complicated and expensive process. While it is important to ensure that the DPOA is correctly drafted to accurately reflect your wishes, the process does not have to be overly complicated or expensive. Seeking professional advice can simplify the process, but there are also resources available for those who wish to create a DPOA on their own.

- Once a DPOA is created, it cannot be changed. This isn't true. As long as the person who created the DPOA is mentally competent, they can revoke or amend their DPOA at any time to reflect their current wishes and circumstances.

- Choosing a family member as an agent is always the best option. While many people choose a family member as their agent, it's essential to select someone who is trustworthy, capable of handling the responsibilities, and will act in your best interest. This doesn't necessarily have to be a family member.

- A DPOA eliminates the need for a will. This is a misunderstanding. A DPOA and a will serve different purposes. A DPOA is effective during the creator's lifetime, ensuring their financial affairs and healthcare decisions are managed if they're unable to do so themselves. A will takes effect after the creator's death, outlining how their assets should be distributed. It's important to have both documents in place as part of a comprehensive estate plan.

It's natural to have questions and concerns when considering the creation of a Durable Power of Attorney. By clarifying these misconceptions, individuals can make more informed decisions that align with their values and goals. It's advisable to consult with a legal professional to ensure that the DPOA meets all legal requirements and accurately reflects your intentions.

Key takeaways

Filling out a Delaware Durable Power of Attorney (DPOA) form is a significant step in managing your affairs. It allows you to appoint someone you trust to handle your legal and financial matters if you become unable to do so yourself. Here are eight key takeaways to consider:

- Understanding the purpose of a DPOA is crucial. This document empowers another person, known as your "agent," to make decisions on your behalf, ensuring that your financial and legal affairs can be managed without court intervention if you become incapacitated.

- Choosing the right agent is vital. Your agent should be someone you trust implicitly, as they will have broad powers to manage your assets, pay your bills, and make financial decisions for you.

- The DPOA must be completed accurately. Any mistakes in filling out the form can lead to confusion or legal challenges, potentially making the document invalid or ineffective when it is most needed.

- Specifying the powers granted is essential. You can tailor the DPOA to include all the powers you wish to grant to your agent, or limit their authority to certain types of decisions. It's important to be clear and specific about what your agent can and cannot do on your behalf.

- Signing requirements must be adhered to. In Delaware, the DPOA form needs to be signed in the presence of a notary public to be legally valid. This step ensures that the document is officially recognized and can be enforced.

- Consider durability. A durable power of attorney remains in effect even if you become incapacitated, which is precisely when you would need it most. Confirming that your DPOA is durable is a key step in its preparation.

- Keep the original document safe, but accessible. Once signed and notarized, the original DPOA should be kept in a secure location. However, your agent and perhaps others you trust should know where it is and how to access it if necessary.

- Review and update the DPOA as needed. Life changes, such as divorce, death of the agent, or a change in your financial situation, may necessitate updates to your DPOA. Regular reviews ensure that the document remains accurate and relevant to your needs.

By following these guidelines, you can create a robust Delaware Durable Power of Attorney that protects your interests and ensures that your affairs are managed according to your wishes, even in the most challenging circumstances.

More Durable Power of Attorney State Forms

Maryland Power of Attorney - By clarifying your choice of an agent and the powers granted, the Durable Power of Attorney minimizes potential conflicts among family members.

Does a Power of Attorney Need to Be Notarized in Wisconsin - It can include limitations and conditions, offering you flexibility and control over the extent of your agent's powers.

Free Printable Durable Power of Attorney Form Washington State - Designed to remain effective even if you become mentally incapacitated, ensuring your affairs are managed according to your wishes.