Attorney-Verified Durable Power of Attorney Document for District of Columbia

Empowering an individual to make significant decisions on one’s behalf can be a formidable yet necessary action, especially when unexpected life events occur. The District of Columbia Durable Power of Attorney form serves as a critical legal instrument in these circumstances. This document, designed with the foresight of unforeseen incapacitations, allows a person, known as the principal, to delegate authority to another, known as the agent or attorney-in-fact, to manage affairs ranging from financial to health-related decisions. Unlike other power of attorney forms, its durability ensures that the agent's power remains in effect even if the principal becomes mentally incapacitated. It is an essential component of estate planning, giving individuals peace of mind, knowing their matters will be handled according to their wishes, should they be unable to do so themselves. This form, tailored to meet the specific legal requirements of the District of Columbia, must be completed with great care, underscoring the importance of understanding its provisions, implications, and the process of its execution.

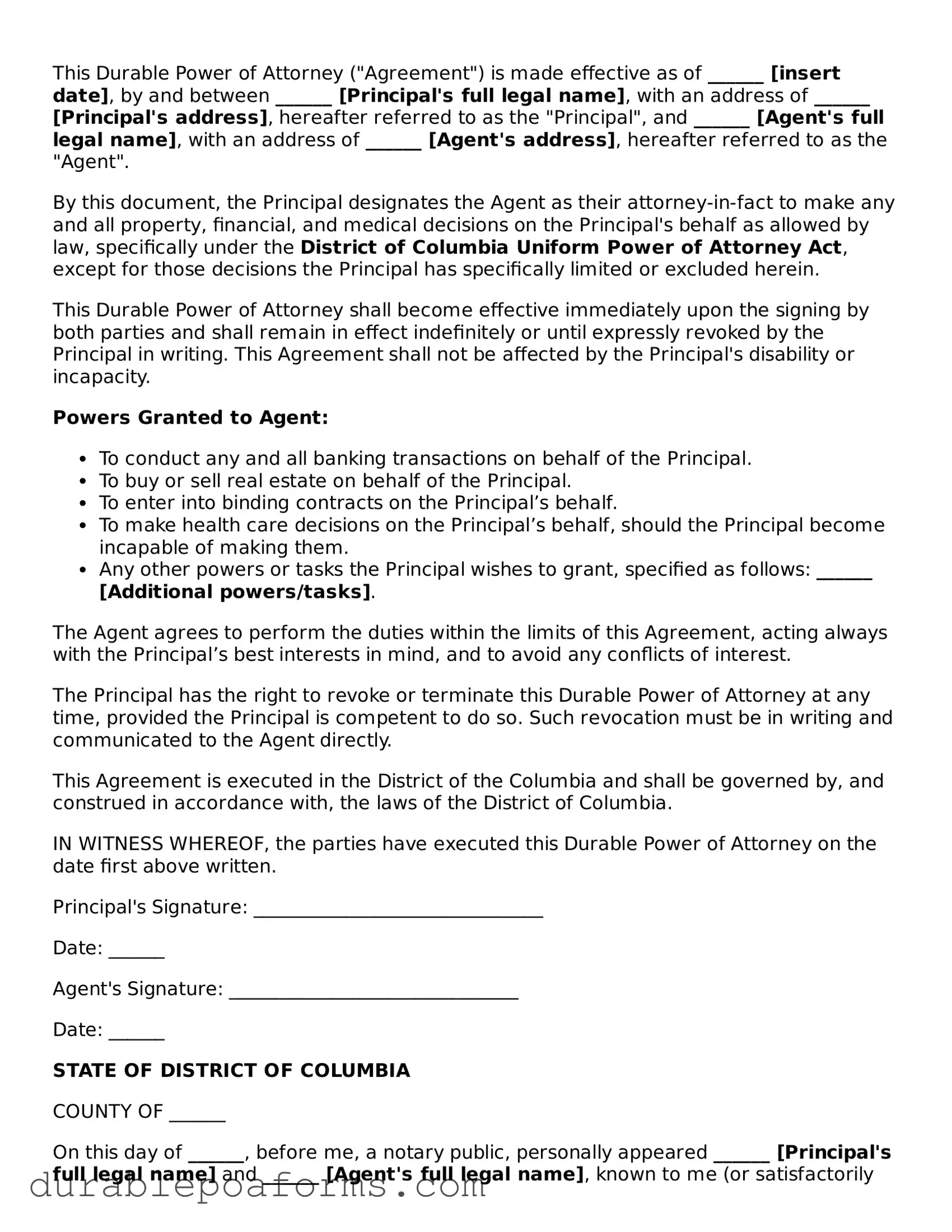

Form Preview

This Durable Power of Attorney ("Agreement") is made effective as of ______ [insert date], by and between ______ [Principal's full legal name], with an address of ______ [Principal's address], hereafter referred to as the "Principal", and ______ [Agent's full legal name], with an address of ______ [Agent's address], hereafter referred to as the "Agent".

By this document, the Principal designates the Agent as their attorney-in-fact to make any and all property, financial, and medical decisions on the Principal's behalf as allowed by law, specifically under the District of Columbia Uniform Power of Attorney Act, except for those decisions the Principal has specifically limited or excluded herein.

This Durable Power of Attorney shall become effective immediately upon the signing by both parties and shall remain in effect indefinitely or until expressly revoked by the Principal in writing. This Agreement shall not be affected by the Principal's disability or incapacity.

Powers Granted to Agent:

- To conduct any and all banking transactions on behalf of the Principal.

- To buy or sell real estate on behalf of the Principal.

- To enter into binding contracts on the Principal’s behalf.

- To make health care decisions on the Principal’s behalf, should the Principal become incapable of making them.

- Any other powers or tasks the Principal wishes to grant, specified as follows: ______ [Additional powers/tasks].

The Agent agrees to perform the duties within the limits of this Agreement, acting always with the Principal’s best interests in mind, and to avoid any conflicts of interest.

The Principal has the right to revoke or terminate this Durable Power of Attorney at any time, provided the Principal is competent to do so. Such revocation must be in writing and communicated to the Agent directly.

This Agreement is executed in the District of the Columbia and shall be governed by, and construed in accordance with, the laws of the District of Columbia.

IN WITNESS WHEREOF, the parties have executed this Durable Power of Attorney on the date first above written.

Principal's Signature: _______________________________

Date: ______

Agent's Signature: _______________________________

Date: ______

STATE OF DISTRICT OF COLUMBIA

COUNTY OF ______

On this day of ______, before me, a notary public, personally appeared ______ [Principal's full legal name] and ______ [Agent's full legal name], known to me (or satisfactorily proven) to be the persons whose names are subscribed to the within instrument and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

Notary's Signature: _______________________________

Seal:

Form Specifications

| Fact | Description |

|---|---|

| Definition | A Durable Power of Attorney in the District of Columbia is a legal document allowing an individual (the principal) to appoint another person (the agent) to manage their financial affairs even if they become incapacitated. |

| Governing Law | It is governed by the District of Columbia Code, specifically Division I, Title 21, Chapter 20, Sections 21-2041 to 21-2060. |

| Capacity Requirement | The individual making the Durable Power of Attorney (Principal) must be of sound mind, meaning they understand the nature and implications of the document at the time of signing. |

| Witness Requirement | When executed, the document must be signed by the Principal in the presence of two competent adult witnesses, neither of whom can be the appointed agent. |

| Notarization | The Durable Power of Attorney form should be notarized to add an extra layer of legal protection and to ensure its acceptance by third parties. |

| Effective Date | It becomes effective immediately upon signing unless the document specifies otherwise, such as a condition that must be met for it to come into effect. |

District of Columbia Durable Power of Attorney - Usage Guide

Filling out the District of Columbia Durable Power of Attorney form is a pivotal step in planning for the future. It allows you to designate someone to manage your affairs if you're unable to do so yourself. Unlike a general power of attorney, this one remains in effect even if you become incapacitated. The process might seem daunting, but following these structured steps can make it more manageable. It's crucial to approach this task with clarity and precision to ensure your wishes are accurately represented.

- Gather all necessary information, including your full legal name, address, and the details of the person you're designating as your attorney-in-fact (the individual who will make decisions on your behalf).

- Locate the current District of Columbia Durable Power of Attorney form. Ensure you're using the most recent version by checking the District of Columbia government's website or contacting an attorney.

- Start by entering your full legal name and address in the designated sections at the top of the form.

- Fill in the full legal name, address, and contact information of the person you have chosen as your attorney-in-fact.

- Specify the powers you are granting to your attorney-in-fact. This could range from making financial decisions to handling real estate transactions on your behalf. Be as detailed as possible to ensure there's no ambiguity.

- Include any special instructions or limitations to the powers granted. This is where you can outline any specifics that you want your attorney-in-fact to follow or any powers you wish to withhold.

- Identify the effective date of the power of attorney. This can be immediately upon signing, on a specified date, or upon the occurrence of a certain event, such as your incapacitation.

- Review the form thoroughly. Make sure all information is accurate and that you fully understand the powers being granted. It's advisable to consult with an attorney if you have any questions or concerns.

- Sign the form in the presence of a notary public. The District of Columbia requires that your signature be notarized for the document to be legally binding.

- Have your attorney-in-fact sign the form, if required. Some versions of the form may also require the signature of the person accepting the responsibility.

- Keep the original document in a safe place, such as a fireproof lockbox or safe deposit box. Provide copies to your attorney-in-fact, close family members, or anyone else who may need to be aware of its existence.

Once you've completed these steps, you have successfully created a Durable Power of Attorney in the District of Columbia. This document is a critical component of your personal and financial planning, ensuring that your affairs can be managed according to your wishes, even if you're unable to oversee them yourself. Remember, the needs and circumstances of every individual are different, so consider consulting with a legal professional to ensure that your document fully meets your specific requirements.

Common Questions

What is a Durable Power of Attorney in the District of Columbia?

A Durable Power of Attorney (DPOA) in the District of Columbia is a legal document that allows an individual, known as the principal, to appoint someone else, referred to as the agent or attorney-in-fact, to make decisions on their behalf. Unlike other forms of power of attorney, a DPOA remains effective even if the principal becomes incapacitated, ensuring that the agent can continue to make financial, legal, and sometimes medical decisions according to the principal's wishes.

How do I establish a Durable Power of Attorney in DC?

To establish a Durable Power of Attorney in the District of Columbia, the principal must complete and sign a DPOA form. This process typically requires accurately filling out the form with details about the powers being granted, the principal's information, and the designated agent's information. It's crucial that the form is signed in the presence of a notary public and, depending on the specifics of the DPOA, may also need to be witnessed by one or two adults who are not named as agents in the document. After notarization, the DPOA becomes legally binding.

Can I revoke a Durable Power of Attorney?

Yes, as long as the principal is mentally competent, they can revoke a Durable Power of Attorney at any time. To do so effectively, the principal should provide written notice of the revocation to the appointed agent and any institutions or individuals that were relying on the DPOA. Additionally, destroying all copies of the DPOA document can help prevent its future use. It is advisable to also notarize the revocation document to ensure its acceptance by third parties.

Who should I choose as my agent?

Choosing an agent is a decisive step in creating a Durable Power of Attorney. It's essential to select an individual who is trustworthy, reliable, and capable of handling the responsibilities that come with the role. Consider someone who understands your values, is organized, and can communicate effectively with your family, your doctors, and financial institutions. Often, people choose close family members or friends, but it's also possible to appoint a professional such as an attorney or accountant, depending on the complexity of your needs.

Is a lawyer required to create a Durable Power of Attorney in the District of Columbia?

While it is not strictly required to have a lawyer to create a Durable Power of Attorney in DC, consulting with one can be highly beneficial. Lawyers can offer expert advice tailored to your specific circumstances, ensuring that the DPOA reflects your wishes accurately and is drafted in compliance with District of Columbia law. They can also provide guidance on choosing an agent and the scope of powers to include, which can help avoid issues and confusion in the future.

Common mistakes

When individuals take the step to fill out a Durable Power of Attorney (POA) form in the District of Columbia, it's crucial that the process is approached with due diligence to avoid common errors, each of which could potentially undermine the document's legality or its effectiveness in representing the principal’s wishes. Understanding these mistakes can greatly assist in ensuring the document serves its intended purpose without unforeseen complications.

- Not Specifying Powers Broadly or Narrowly Enough: An often-encountered mistake is the failure to clearly articulate the extent of powers granted to the attorney-in-fact. This can result in a POA that is either too broad, giving the agent more power than intended, or too narrow, limiting the agent’s ability to make comprehensive decisions.

- Choosing the Wrong Agent: The selection of an attorney-in-fact is paramount. A common pitfall is appointing an agent without fully considering their ability or willingness to act in the principal's best interest, potentially leading to misuse of power or inadequate decision-making.

- Overlooking the Need for a Successor Agent: People often fail to appoint a successor agent, creating a risky situation where the POA becomes ineffective if the original agent can no longer serve, due either to unwillingness, illness, or death.

- Failing to Specify a Start Date: Neglecting to define clearly when the POA goes into effect can lead to confusion and legal complications. Whether it's immediately upon signing, upon a specific date, or upon the occurrence of an event, such clarity is crucial.

- Not Properly Acknowledging the Document: In the District of Columbia, for a POA to be considered durable and effective, it must be acknowledged before a notary public. An error made is the failure to correctly execute this step, which can invalidate the document.

- Forgetting to Discuss the POA with the Agent: Failing to discuss the POA's contents and expectations with the chosen agent is a mistake that can lead to surprises, reluctance, or even refusal to act when the time comes because they aren't prepared or aware of their responsibilities.

- Omitting the Termination Date: While durable powers of attorney are designed to be long-lasting, not specifying a termination date or condition, such as the principal's death or revocation, can create legal ambiguities.

- Not Reviewing and Updating the Document: Circumstances change, and a POA made several years ago might not reflect current wishes or relationships. Not regularly reviewing and updating the document as needed is a common oversight.

Each of these mistakes carries its own set of potential challenges and implications. By addressing these common oversights and ensuring the POA is properly filled out, individuals can provide themselves and their loved ones with peace of mind, knowing their affairs will be managed as they wish in times of need. The power of attorney is a powerful legal tool, but its effectiveness is directly tied to the care taken in its execution.

Documents used along the form

When managing legal and financial affairs, particularly in the District of Columbia, the Durable Power of Attorney form is a crucial document. This form gives someone you trust the authority to manage your legal and financial matters if you're unable to do so. However, it's often not the only document you'll need to fully prepare for the future. Here is a list of other forms and documents that are commonly used alongside the Durable Power of Attorney to ensure a comprehensive approach to planning.

- Medical Power of Attorney: This document allows you to appoint someone to make healthcare decisions on your behalf in case you are not able to do so yourself, complementing the financial authority granted by the Durable Power of Attorney.

- Living Will: Also known as an advance healthcare directive, it specifies your wishes regarding medical treatment if you become unable to communicate them in the future. It's an essential document for end-of-life care preferences.

- Last Will and Testament: This document outlines how you want your assets to be distributed after your death. It's crucial for estate planning alongside the Durable Power of Attorney.

- Revocable Living Trust: This allows you to manage your assets during your lifetime and specify how they should be handled after your death, potentially bypassing the probate process.

- HIPAA Release Form: The Health Insurance Portability and Accountability Act (HIPAA) release form gives your healthcare provider the permission to share your health information with people you designate, helping in situations that require medical decision-making.

- Financial Information Release Form: Similar to the HIPAA release, this form permits financial institutions to share your financial information with individuals you specify, aiding in the management of your financial affairs.

- Guardianship Designation: This document allows you to nominate a guardian for your minor children or dependents in case you can no longer care for them.

- Funeral Directive: Although not always considered a legal document, it specifies your preferences for your funeral arrangements and can be a helpful guide for your family during a difficult time.

Together with the Durable Power of Attorney, these documents create a comprehensive plan, covering various aspects of personal and financial well-being. Consulting with a legal professional to understand and prepare these documents can provide peace of mind for both you and your loved ones, ensuring that your wishes are respected and carried out no matter what the future holds.

Similar forms

The District of Columbia Durable Power of Attorney form is similar to other legal documents that empower someone to act on another's behalf. These documents vary in scope and purpose, but they share the commonality of designating an agent or proxy to make decisions when the principal cannot. The Durable Power of Attorney (DPOA) specifically allows this delegation to continue even if the principal becomes incapacitated. This is a critical feature that distinguishes it from some other forms but aligns closely with certain comparable documents.

The first document similar to the DPOA is the General Power of Attorney (GPOA). Like the Durable Power of Attorney, a GPOA authorizes an agent to perform a wide range of acts on behalf of the principal. The scope can include financial, legal, and business decisions. However, the critical difference lies in the effect of the principal's incapacity. A General Power of Attorney typically becomes invalid if the principal becomes incapacitated, unlike the durable variant which is expressly designed to remain in effect under those circumstances. This distinction is paramount for those who wish to ensure continuity of agency regardless of their health status.

Another document akin to the DPOA is the Medical Power of Attorney (MPOA). This form specifically focuses on healthcare decisions. An MPOA grants an agent the authority to make medical and healthcare-related decisions on behalf of the principal, should they become unable to express their medical wishes. While this is a narrower scope of authority compared to the broad range included in a Durable Power of Attorney, which can also encompass healthcare decisions, the key similarity is the durability aspect. Both these documents are crafted to survive the incapacitation of the principal, ensuring decisions can still be made in their best interest.

The Limited or Special Power of Attorney is yet another document that parallels the DPOA in certain respects. This type is tailored to grant an agent authority to act in specific situations, such as selling a property, handling certain financial transactions, or managing a particular legal matter. While its scope is more narrowly defined than a DPOA, a Limited Power of Attorney might be crafted to include durability if the principal desires. However, unlike the broad-ranging Durable Power of Attorney, its power is confined to precise actions or events, making its application more restricted.

Dos and Don'ts

When preparing the District of Columbia Durable Power of Attorney form, it's crucial to keep certain guidelines in mind to ensure your document is legally sound and reflects your wishes accurately. Below are key dos and don'ts to follow during this important process.

Do:

- Read the form carefully to understand each section fully before filling it out. This understanding is crucial to accurately reflect your decisions.

- Choose a trusted individual as your agent. This person will make decisions on your behalf, so their integrity and reliability cannot be overstressed.

- Be specific about the powers you are granting. Clearly specifying the scope of authority can prevent misunderstandings and ensure your agent acts within the bounds of your wishes.

- Sign the form in the presence of a notary public. This step is essential to validate the form legally.

Don't:

- Rush the process. Taking your time to fill out each part meticulously will help prevent errors that could make the document ineffective.

- Leave any sections blank. If a section does not apply, write “N/A” (not applicable) to indicate this. Blank sections can lead to confusion or misinterpretation.

- Forget to discuss your wishes with the selected agent. Clear communication ensures they understand their responsibilities and your expectations.

- Fail to keep the completed form in a safe yet accessible place. Inform a family member or close friend of its location so it can be found when needed.

Misconceptions

The District of Columbia Durable Power of Attorney (DPOA) form is an essential legal document, yet it is often misunderstood. This list clears up some common misconceptions to help ensure that individuals are better informed when making decisions about granting someone else the authority to act on their behalf.

All powers of attorney are the same. This is not true. A Durable Power of Attorney in the District of Columbia is specifically designed to remain in effect even if the person who made it (the principal) becomes incapacitated. Other types of powers of attorney may not have this feature.

You lose control over your affairs as soon as you sign a DPOA. In fact, the DPOA can be structured so that it only takes effect under certain conditions, such as if and when you become incapacitated, allowing you to retain control over your affairs until then.

The agent can do whatever they want. The agent under a DPOA has the duty to act in your best interest. The powers granted can be as broad or as limited as you decide. Plus, the agent is legally obliged to act within the scope of authority granted by the DPOA document.

A durable power of attorney covers medical decisions. This is not the case unless specifically stated. A Durable Power of Attorney in the District of Columbia typically covers financial and legal decisions. Medical decisions are usually covered under a separate document known as a medical power of attorney or healthcare directive.

It’s too complicated to set up a DPOA. While it's important to ensure that the DPOA accurately reflects your wishes and complies with local laws, setting one up isn't necessarily complicated. Many find it relatively straightforward, especially with the help of a legal professional.

A durable power of attorney grants the agent power after the principal’s death. A DPOA is only effective during the lifetime of the principal. Upon the principal's death, the authority granted through the DPOA ends, and the executor or administrator of the estate takes over.

You can wait until you need it to set up a DPOA. By the time you realize you need a DPOA, it might be too late. If you become unable to sign documents or make decisions, you can't create a DPOA. Planning ahead is key.

Only seniors need a DPOA. Adults of any age can benefit from having a DPOA. Accidents, illness, or sudden incapacitation can happen at any time, so it's wise for everyone to prepare.

Setting up a DPOA is too expensive. The cost of not having a DPOA can be much higher, considering the potential legal fees and court costs associated with establishing a guardianship or conservatorship if you become incapacitated without a DPOA. Many find that setting up a DPOA is a cost-effective way to plan for the future.

Understanding the truths behind these misconceptions can help individuals make informed choices about their estate planning needs, including the decision to set up a Durable Power of Attorney.

Key takeaways

The District of Columbia Durable Power of Attorney (DPOA) form is a legally binding document that grants an individual (referred to as the "agent") the authority to make decisions on behalf of another person (the "principal") in financial and other matters, should the principal become incapacitated or unable to make those decisions themselves. Understanding the key takeaways about filling out and using this form is vital for ensuring that the principal's wishes are respected and their affairs are managed properly in any given circumstances. Below are five important points to consider.

- Choose your agent wisely: The person you appoint as your agent will have significant control over your affairs, so it's critical to select someone who is trustworthy, reliable, and capable of handling financial decisions responsibly. Consider discussing the responsibilities with potential agents to ensure they are willing and able to act on your behalf.

- Be specific about powers granted: The DPOA allows you to be explicit about the powers you grant to your agent. You can include powers related to real estate, personal property, banking, and other financial transactions. It's essential to specify what your agent can and cannot do to avoid any confusion or abuse of power.

- Understand the "durable" aspect: A "durable" power of attorney remains in effect even if you become incapacitated. This feature is crucial for ensuring that your agent can manage your affairs without the need for court intervention, which can be costly and time-consuming. Make sure the document explicitly states its durability to avoid any legal ambiguities.

- Witnesses and notarization may be required: For a DPOA to be legally binding in the District of Columbia, it must be signed in the presence of witnesses and may also need to be notarized, depending on the specific requirements at the time of execution. This step ensures the authenticity of the document and protects against fraud.

- Keep the document accessible: After the DPOA is filled out and executed, it's important to keep it in a safe but accessible place. Inform your agent and any relevant family members of its location. Should the need arise for your agent to act on your behalf, they will need to provide the DPOA as proof of their authority.

Filling out a Durable Power of Attorney form is a significant step in managing your future financial and personal affairs. By carefully selecting an agent and specifying their powers, you can ensure that your wishes are carried out responsibly should you be unable to make decisions yourself. Remember, legal documents such as a DPOA are powerful tools that require careful consideration and understanding before they are executed.

More Durable Power of Attorney State Forms

Power of Attorney Form North Dakota - It eliminates ambiguity and provides a clear legal framework for the agent to act within, protecting both the principal's interests and the agent from potential legal challenges.

New Mexico Durable Power of Attorney - Once in effect, it gives the agent immediate authority to act, although the principal can revoke it at any time as long as they are competent.