Attorney-Verified Durable Power of Attorney Document for Florida

In the face of life’s uncertainties, preparing for the future has become more crucial than ever. Among the most important legal tools for such preparation is the Florida Durable Power of Attorney form. This form empowers individuals to designate another person, known as an agent, to manage their financial affairs, either immediately or in the event they become unable to do so themselves due to incapacitation. The "durable" nature of this power of attorney ensures that the agent's authority persists even when the principal is no longer mentally competent to handle their own financial matters, a feature that sets it apart from other forms of power of attorney. In Florida, the laws governing the execution and use of this powerful document are specific, designed to protect both the one granting the power and the one accepting it. Understanding these laws, the form's requirements, and the responsibilities it bestows upon the agent is crucial for anyone considering creating a durable power of attorney. It helps individuals to navigate the complexities of planning for future financial management, safeguarding their assets, and ensuring their welfare in challenging times.

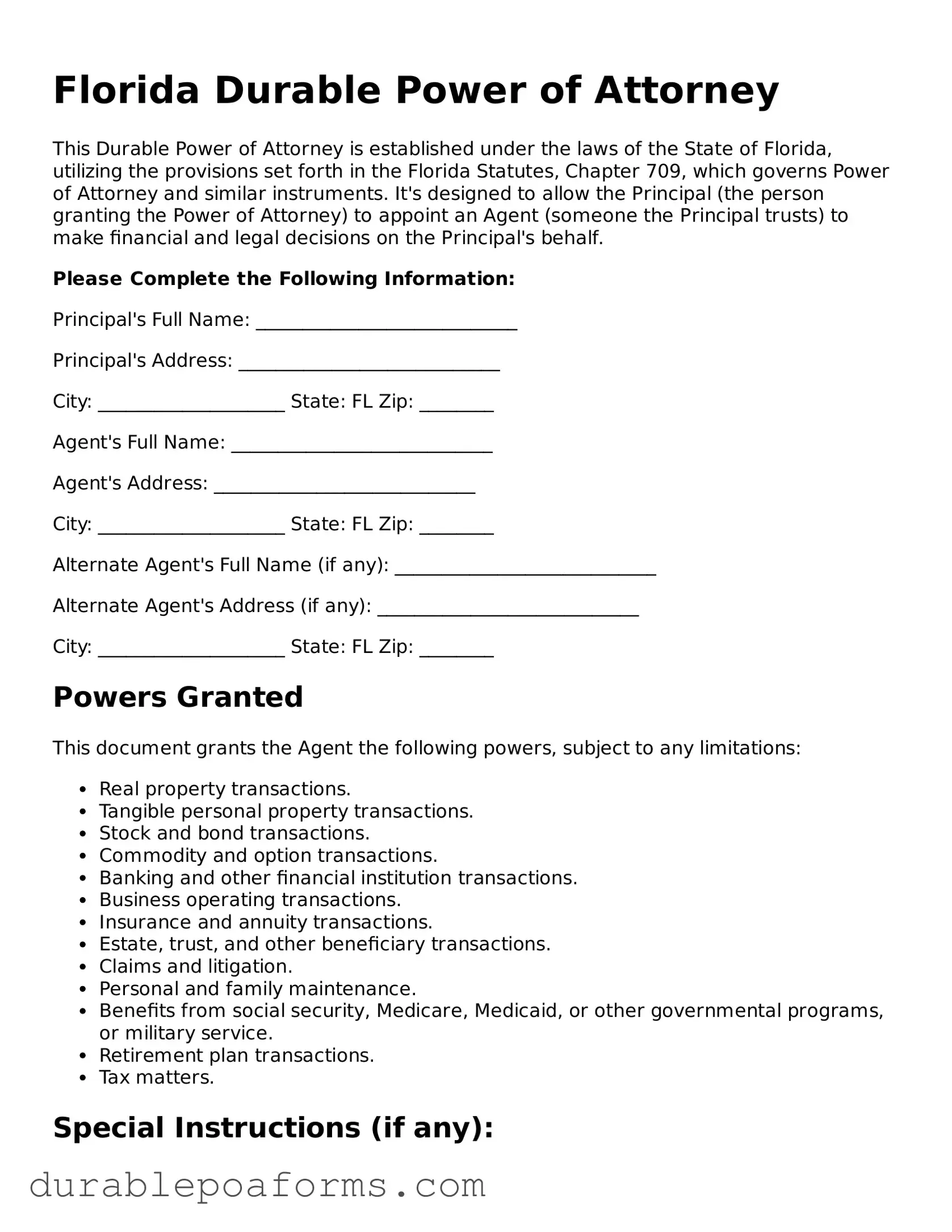

Form Preview

Florida Durable Power of Attorney

This Durable Power of Attorney is established under the laws of the State of Florida, utilizing the provisions set forth in the Florida Statutes, Chapter 709, which governs Power of Attorney and similar instruments. It's designed to allow the Principal (the person granting the Power of Attorney) to appoint an Agent (someone the Principal trusts) to make financial and legal decisions on the Principal's behalf.

Please Complete the Following Information:

Principal's Full Name: ____________________________

Principal's Address: ____________________________

City: ____________________ State: FL Zip: ________

Agent's Full Name: ____________________________

Agent's Address: ____________________________

City: ____________________ State: FL Zip: ________

Alternate Agent's Full Name (if any): ____________________________

Alternate Agent's Address (if any): ____________________________

City: ____________________ State: FL Zip: ________

Powers Granted

This document grants the Agent the following powers, subject to any limitations:

- Real property transactions.

- Tangible personal property transactions.

- Stock and bond transactions.

- Commodity and option transactions.

- Banking and other financial institution transactions.

- Business operating transactions.

- Insurance and annuity transactions.

- Estate, trust, and other beneficiary transactions.

- Claims and litigation.

- Personal and family maintenance.

- Benefits from social security, Medicare, Medicaid, or other governmental programs, or military service.

- Retirement plan transactions.

- Tax matters.

Special Instructions (if any):

________________________________________________________________

________________________________________________________________

Effective Date and Validity

This Power of Attorney will become effective immediately upon signing and will remain in effect indefinitely unless revoked by the Principal or upon the Principal's death. Being "durable," it will remain in effect even if the Principal becomes incapacitated, unless a court determines otherwise.

Signatures

Principal's Signature: ____________________________ Date: _______________

Agent's Signature: ____________________________ Date: _______________

Alternate Agent's Signature (if any): ____________________________ Date: _______________

Acknowledgment

This document was acknowledged before me on _____(date) by _______________________(name of Principal), who is personally known to me or has produced ________________________(type of identification) as identification and who did/did not take an oath.

Signature of Notary Public: ____________________________

Name of Notary Typed, Printed, or Stamped: ____________________________

Commission Number: ____________________________

My Commission Expires: ____________________________

Form Specifications

| Fact | Detail |

|---|---|

| Governing Law | The Florida Durable Power of Attorney is regulated by the Florida Statutes, Chapter 709 - Power of Attorney and Similar Instruments. These statutes especially address the creation, use, and limitations of durable powers of attorney. |

| Definition | This form allows an individual, known as the 'principal', to designate another person, called an 'agent' or 'attorney-in-fact', to manage their financial, property, and medical decisions in the event that they are unable to do so themselves. |

| Durability | A key feature of this type of power of attorney is its durability. This means it remains effective even if the principal becomes incapacitated, unlike other forms of power of attorney which may terminate upon the principal's incapacity. |

| Requirements for Validity | To be valid, the Florida Durable Power of Attorney must be signed by the principal in the presence of two witnesses and a notary public. Specific powers that can be granted must be clearly detailed within the document to avoid any ambiguity. |

Florida Durable Power of Attorney - Usage Guide

Filling out a Florida Durable Power of Attorney form is an essential step for ensuring that your affairs are managed according to your wishes, even when you're unable to take care of them yourself. This powerful document allows you to appoint someone you trust to make decisions on your behalf. The process requires careful attention to detail and understanding to ensure that it accurately reflects your intentions. Follow the steps outlined below to complete your Florida Durable Power of Attorney form correctly and efficiently.

- Start by downloading the official Florida Durable Power of Attorney form. Make sure you have the latest version by checking the Florida Department of Revenue or a similar authoritative source.

- Enter your full legal name and address at the top of the form to identify yourself as the principal—the person who is granting the power.

- Designate your Attorney-in-Fact (also known as your Agent) by writing their full legal name and address. This is the person you're choosing to act on your behalf.

- Specify the powers you are granting to your Attorney-in-Fact. Carefully read each section and mark the relevant boxes that apply to the authority you wish to give. These can range from managing financial and legal decisions to making medical and personal decisions on your behalf.

- If you desire to grant your Attorney-in-Fact general authority over all aspects listed, you may be required to initial a specific section designated for this purpose.

- Include any specific limitations or special instructions you wish to apply to the powers granted. This is crucial for ensuring that your Agent acts within the bounds you are comfortable with.

- Review the section regarding the effective date and durability of the power of attorney. Make a decision on when you want this document to come into effect—whether immediately or upon a certain event, such as incapacitation.

- Have your signature witnessed by two non-related individuals who are not named in the power of attorney. Each witness must sign the document in the designated spaces.

- In Florida, it is also required that the Durable Power of Attorney be notarized. This involves signing the document in front of a Notary Public who will also sign and seal the document, officially acknowledging it.

- Finally, give a copy of the signed and notarized Durable Power of Attorney to your Attorney-in-Fact. It’s also advisable to keep original copies in a safe but accessible place and inform trusted family members or advisors of its location.

Completing your Florida Durable Power of Attorney form with precision is a pivotal step towards safeguarding your future. It's a clear expression of your trust and confidence in the appointed individual to manage your affairs responsibly. While this guide aims to simplify the process, always consider seeking legal advice to ensure that the document fully aligns with your intentions and complies with current Florida laws.

Common Questions

What is a Florida Durable Power of Attorney?

A Florida Durable Power of Attorney is a legal document that allows one person, known as the principal, to designate another person, known as the agent or attorney-in-fact, to manage their financial affairs if they become unable to do so themselves. Unlike a general power of attorney, a durable power remains effective even if the principal becomes incapacitated.

How can someone create a Durable Power of Attorney in Florida?

To create a Durable Power of Attorney in Florida, the principal must fill out a form that meets Florida’s legal requirements. This includes using clear language to specify what powers the agent will have, signing the document in front of two witnesses, and having it notarized. It's recommended to consult with a legal professional to ensure the form accurately reflects the principal's wishes and adheres to all state laws.

Who should be chosen as an agent under a Durable Power of Attorney?

Choosing an agent is a significant decision. The person selected should be trustworthy, reliable, and competent to manage financial matters. Often, people choose a close family member, such as a spouse or adult child, but an attorney or trusted friend can also serve in this role. It's critical that the principal has full confidence in the agent’s ability to act in their best interest.

Can a Durable Power of Attorney in Florida be revoked?

Yes, as long as the principal is mentally competent, they can revoke their Durable Power of Attorney at any time. To do this, they should provide written notice to the agent and to any institutions or parties that were relying on the document. For clarity and to avoid legal complications, it might also be wise to record the revocation with the same authorities where the original was filed, if applicable.

Does a Durable Power of Attorney cover healthcare decisions?

No, a Durable Power of Attorney in Florida is solely for financial matters and does not cover healthcare decisions. If someone wishes to designate an agent to make healthcare decisions on their behalf, they should complete a separate document known as a Designation of Health Care Surrogate. This ensures that both financial and health care preferences are respected in the event of incapacity.

Common mistakes

When individuals in Florida prepare a Durable Power of Attorney (POA), the intention is to establish a reliable process that ensures their affairs are managed effectively in situations where they cannot make decisions themselves. However, common mistakes can significantly hinder this objective. The Durable POA, a crucial legal document, grants another person the authority to act on one's behalf concerning financial and legal matters. Its complexity and the magnitude of power it confers require careful attention to detail during completion.

Firstly, a prevalent mistake is the failure to choose the right agent. The designated person or agent holds considerable influence and responsibility. Hence, selecting someone who is not only trustworthy but also possesses the necessary aptitude to manage financial matters is imperative. Another common oversight is not specifying the powers granted. A Durable POA can encompass a wide range of authorities, from managing bank accounts to selling property. Without clear directives, the document might not serve its intended purpose or could grant too much latitude.

Further complexities arise with the failure to regularly update the document. Life changes, such as marriage, divorce, or the death of the chosen agent, necessitate revisions to ensure the POA remains valid and reflective of the current situation. Similarly, not understanding state requirements can lead to a non-compliant POA. Each state has its nuances concerning legal documents, and Florida is no exception. Ignorance of these specificities can invalidate the entire effort.

- Lack of specificity in powers granted

- Choosing an inappropriate agent

- Not updating the document regularly

- Overlooking state-specific requirements

- Failing to acknowledge the document's durability

- Omitting a successor agent

- Notarization and witnessing oversights

- Underestimating the importance of legal advice

- Ignoring the need for clear revocation terms

Ignoring the durability aspect of the POA represents another mistake. The 'durable' aspect ensures the document remains in effect if the principal becomes incapacitated. Without this specification, the document's purpose is defeated. Additionally, the absence of a successor agent leaves a void if the original agent can no longer fulfill their duties. The role of notarization and witnessing is also crucial for validity but is often underestimated or incorrectly executed.

Underestimating the importance of professional legal advice is a critical misstep. While templates and DIY resources are accessible, the complexities and nuances of a Durable POA often require professional guidance to avoid pitfalls. Lastly, failing to include clear revocation terms can lead to complications if one wishes to terminate the document. Without such provisions, revoking the power granted can become a convoluted process.

In conclusion, while creating a Durable Power of Attorney in Florida is a step towards securing one's financial and legal affairs, attention to detail is paramount. Common mistakes can undermine the document's effectiveness, leaving individuals vulnerable. Careful consideration of the document's contents, along with professional legal consultation, is advisable to ensure that the Durable POA fully serves its purpose.

Documents used along the form

The Florida Durable Power of Attorney is a crucial legal document that allows an individual to appoint someone they trust as an agent to make financial decisions on their behalf, should they become unable to do so themselves. This form empowers the agent to manage the principal's financial affairs, ensuring continuity in times of unexpected illness or incapacitation. Alongside this important document, several other forms and documents are frequently utilized to ensure comprehensive protection and clarity regarding one’s wishes and legal affairs. Below is an overview of these commonly used forms and documents.

- Advance Healthcare Directive: This document, also known as a living will, specifies an individual’s health care preferences in case they are unable to communicate their decisions due to illness or incapacitation. It guides healthcare providers and loved ones in making medical decisions that align with the individual's wishes.

- Designation of Health Care Surrogate: This form appoints a specific person to make healthcare decisions on behalf of the individual, should they become unable to make these decisions themselves. It complements the advance healthcare directive by nominating a trusted individual to advocate for the principal's healthcare preferences.

- Last Will and Testament: This essential document outlines how an individual’s assets and estate are to be distributed upon their death. It can also designate guardians for minor children, ensuring that their care is entrusted to someone who reflects the decedent's values and wishes.

- Revocable Living Trust: A revocable living trust is a document that allows individuals to manage their assets during their lifetime and specify how those assets should be distributed upon their death. It offers the benefit of avoiding probate, potentially saving time and reducing estate expenses.

- Declaration of Preneed Guardian: This form allows an individual to nominate a guardian in advance, in the event of their future incapacity. It can provide peace of mind, knowing that guardianship decisions have been made according to the individual’s preferences.

- HIPAA Release Form: The Health Insurance Portability and Accountability Act (HIPA) form authorizes the disclosure of an individual’s health information to specified persons. It is particularly useful when a designated healthcare surrogate or power of attorney needs access to the individual’s medical records to make informed healthcare decisions.

- Do Not Resuscitate Order (DNRO): This medical order instructs healthcare providers not to perform cardiopulmonary resuscitation (CPR) if an individual’s breathing stops or if the heart stops beating. It is created in consultation with a healthcare provider and reflects the individual’s end-of-life care preferences.

- Declaration of Domicile: This is a legal document filed with the local courthouse, declaring Florida as the individual’s primary and permanent home. It is particularly relevant for estate planning and tax purposes, especially for those who own property in multiple states.

When preparing a comprehensive estate plan, it's advisable to consider each of these documents in conjunction with a Florida Durable Power of Attorney. Crafting a thorough and legally sound estate plan involves thoughtful consideration of each document's role in protecting an individual's rights, assets, and wishes. Working with a legal professional can help ensure that all documents are correctly executed and effectively aligned with the individual's overall planning goals.

Similar forms

The Florida Durable Power of Attorney form is similar to several other legal documents in terms of providing authority to another individual but differs in scope and duration. This form specifically allows an individual, also known as the principal, to designate another person, called the agent or attorney-in-fact, to manage their financial, legal, and sometimes health care decisions in the event that the principal becomes incapacitated or unable to make decisions for themselves. Below are comparisons with similar documents:

General Power of Attorney: Like the Florida Durable Power of Attorney, a General Power of Attorney grants an agent broad powers to handle the principal's affairs. However, the key difference lies in the durability aspect. A General Power of Attorney typically becomes invalid if the principal loses mental capacity. In contrast, a Durable Power of Attorney remains in effect even if the principal becomes incapacitated, ensuring continuity in managing the principal’s affairs without court intervention.

Health Care Proxy (or Health Care Power of Attorney): This document is similar to the Durable Power of Attorney for financial matters, but it specifically addresses health care decisions. While the Florida Durable Power of Attorney can include provisions for health care decisions, a Health Care Proxy explicitly allows an agent to make medical decisions on behalf of the principal if they are unable to do so. The focus here is purely on health-related issues, unlike the broader financial scope of the Durable Power of Attorney.

Living Will: A Living Will, also known as an advance directive, is often mentioned alongside the Florida Durable Power of Attorney but serves a different purpose. This document outlines the principal’s preferences regarding end-of-life care and medical treatments. Unlike the Durable Power of Attorney, which authorizes someone else to make decisions, a Living Will directly communicates the principal’s wishes to health care providers, without assigning decision-making power to another individual.

Springing Power of Attorney: Similar to a Durable Power of Attorney, a Springing Power of Attorney is designed to become effective only under certain circumstances, such as the principal’s incapacitation. The main distinction between the two lies in the timing of when the power becomes active. The Durable Power of Attorney is typically effective as soon as it is signed, whereas the Springing Power of Attorney “springs” into action based on specific events defined in the document, offering a layer of control over when the agent can start making decisions.

Dos and Don'ts

Filling out a Durable Power of Attorney (POA) form in Florida is a significant step that requires careful attention. This document grants someone else the authority to make decisions on your behalf should you become unable to do so yourself. To ensure the process goes smoothly and the document is legally binding, here are eight do's and don'ts to consider:

- Do choose a trusted individual as your agent. This person will have considerable power over your affairs, so it’s crucial to select someone who is reliable, trustworthy, and capable of handling the responsibilities.

- Do clearly specify the powers you are granting. Florida law allows you to tailor the authority you give to your agent. Be specific about what they can and cannot do on your behalf.

- Do ensure the form complies with Florida law. The state has specific requirements for a Durable Power of Attorney to be valid. This includes witnessing by two adults and notarization.

- Do consider consulting an attorney. While it’s possible to fill out the form on your own, legal advice can help you understand the implications and ensure the POA meets all legal standards.

- Don’t leave any sections incomplete. An incomplete form may be considered invalid, potentially causing significant legal issues in the future.

- Don’t use vague language. Ambiguities in a Durable Power of Attorney can lead to interpretation issues and may not be executed as you intended. Be clear and precise in your wording.

- Don’t forget to update it as necessary. Life changes, such as divorce, the death of your chosen agent, or a move to another state, can affect the validity of your POA. Review and update it as your situation changes.

- Don’t neglect to inform your chosen agent. Make sure the person you’ve designated as your agent is willing to take on the responsibility and understands their duties. Communication is key to ensuring your wishes are carried out.

Misconceptions

When considering the creation of a Durable Power of Attorney (DPOA) in Florida, it's quite common to come across a wealth of information that, while well-intentioned, may not be entirely accurate. Understanding what a DPOA actually involves and clearing up common misunderstandings can empower individuals to make more informed decisions. Here are four prevalent misconceptions about the Florida Durable Power of Attorney form:

- It grants control immediately upon signing. Many believe that once the Durable Power of Attorney form is signed, the agent immediately gains control over all affairs. However, the specifics of when the agent can act on behalf of the principal (the person granting the power) depend on the stipulations laid out in the DPOA document. In Florida, the principal can specify whether the powers become effective immediately or only upon the occurrence of a future event, often the principal’s incapacitation.

- It's too complex for anyone without a legal background. While legal documents can sometimes be intricate and difficult to understand, Florida's DPOA form is designed to be accessible. Florida law requires clear language to be used in these forms, and resources are available to help individuals understand the necessary steps. With or without legal assistance, understanding and completing a DPOA in Florida is achievable for most people.

- It ceases to be effective if the principal becomes incapacitated. This is a misconception; in fact, the very essence of a Durable Power of Attorney in Florida is its durability. Unlike a general power of attorney, a DPOA is specifically designed to remain in effect even if the principal becomes mentally incapacitated. This ensures that the agent can continue to make decisions on the principal’s behalf under such circumstances.

- One size fits all. There is a common belief that a single DPOA form could adequately cover everyone’s needs. However, the reality is that the DPOA should be customized to reflect the principal’s specific wishes and the powers they wish to grant to their agent. Florida law allows for considerable flexibility in crafting these documents, enabling individuals to tailor the powers granted to their unique situations.

Addressing these misconceptions helps clarify the nature and scope of the Florida Durable Power of Attorney. It’s crucial for individuals to approach this important legal tool with a clear understanding and accurate information, ensuring they are effectively planning for their future while protecting their autonomy.

Key takeaways

The Florida Durable Power of Attorney (DPOA) form is an important legal document that allows an individual, known as the principal, to appoint someone else, called the agent or attorney-in-fact, to manage their financial affairs if they become unable to do so. Here are some key takeaways to consider when filling out and using this form:

- Choose Your Agent Wisely: The person you appoint as your agent will have significant power over your financial and potentially personal affairs. It's crucial to choose someone who is not only trustworthy but also capable of managing the responsibilities that come with this role.

- Be Specific about Powers Granted: The Florida DPOA form allows you to specify exactly what powers your agent can exercise. These can range from managing your daily finances to making real estate transactions on your behalf. Clear communication about what your agent can and cannot do will help prevent abuse of power and confusion in the future.

- Understand the Durability Aspect: The "durable" nature of this power of attorney means that the agent's authority continues even if you become incapacitated. This is crucial for ensuring that someone can legally make decisions on your behalf without needing to go through court procedures to be appointed as your guardian or conservator.

- Keep the Document Accessible: Once the DPOA is signed and notarized, it's important to keep it in a safe yet accessible place. Inform the appointed agent of its location and consider providing copies to financial institutions or others who may need to recognize the agent's authority as outlined in the document.

More Durable Power of Attorney State Forms

Illinois Power of Attorney for Property Form - A Durable Power of Attorney remains effective even if you become mentally or physically unable to make decisions.

Indiana Durable Power of Attorney - It provides a legal pathway for chosen representatives to manage investments, property, and other financial affairs during incapacitation.