Attorney-Verified Durable Power of Attorney Document for Georgia

Navigating the complexities of planning for future uncertainties involves making some pivotal decisions, one of which includes the creation and implementation of a Durable Power of Attorney (DPOA). This invaluable tool, particularly within the state of Georgia, serves as a strategic component in managing one’s personal, financial, and health-related decisions should they become incapacitated and unable to make these decisions themselves. The form empowers an individual, referred to as the principal, to designate another, known as the agent or attorney-in-fact, to act on their behalf. Noteworthy about Georgia's DPOA is its "durable" nature, ensuring that the agent's authority persists even if the principal becomes incapacitated. This mechanism not only provides peace of mind but also ensures that personal matters are handled according to the principal’s wishes, without the need for court intervention. As such, understanding the nuances, legal requirements, and the specific processes for executing a DPOA in Georgia is essential for both the principal and the agent to ensure its validity and effectiveness in safeguarding the principal’s affairs.

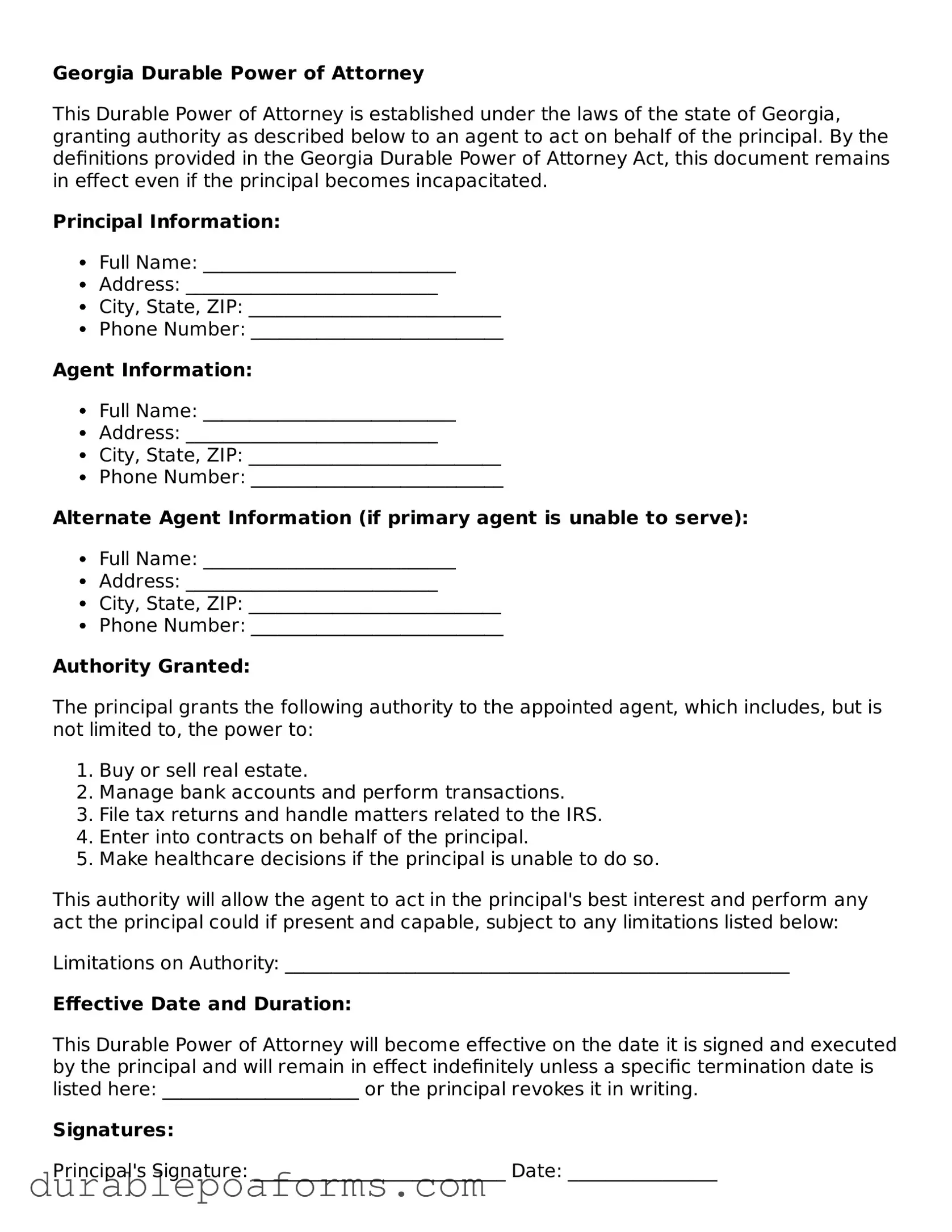

Form Preview

Georgia Durable Power of Attorney

This Durable Power of Attorney is established under the laws of the state of Georgia, granting authority as described below to an agent to act on behalf of the principal. By the definitions provided in the Georgia Durable Power of Attorney Act, this document remains in effect even if the principal becomes incapacitated.

Principal Information:

- Full Name: ___________________________

- Address: ___________________________

- City, State, ZIP: ___________________________

- Phone Number: ___________________________

Agent Information:

- Full Name: ___________________________

- Address: ___________________________

- City, State, ZIP: ___________________________

- Phone Number: ___________________________

Alternate Agent Information (if primary agent is unable to serve):

- Full Name: ___________________________

- Address: ___________________________

- City, State, ZIP: ___________________________

- Phone Number: ___________________________

Authority Granted:

The principal grants the following authority to the appointed agent, which includes, but is not limited to, the power to:

- Buy or sell real estate.

- Manage bank accounts and perform transactions.

- File tax returns and handle matters related to the IRS.

- Enter into contracts on behalf of the principal.

- Make healthcare decisions if the principal is unable to do so.

This authority will allow the agent to act in the principal's best interest and perform any act the principal could if present and capable, subject to any limitations listed below:

Limitations on Authority: ______________________________________________________

Effective Date and Duration:

This Durable Power of Attorney will become effective on the date it is signed and executed by the principal and will remain in effect indefinitely unless a specific termination date is listed here: _____________________ or the principal revokes it in writing.

Signatures:

Principal's Signature: ___________________________ Date: ________________

Agent's Signature: ___________________________ Date: ________________

Alternate Agent's Signature (if applicable): ___________________________ Date: ________________

State of Georgia County of ____________

On this day, ___________________, before me, ______________________________________ (name of notary), a Notary Public in and for said state, personally appeared _________________________, known to me (or proved to me on the oath of _________________________ or through _________________________) to be the person whose name is subscribed to the within instrument and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

Notary Public Signature: ___________________________

My Commission Expires: ______________________

Form Specifications

| Fact Number | Description |

|---|---|

| 1 | The Georgia Durable Power of Attorney form allows an individual to appoint someone to manage their financial affairs. |

| 2 | It remains in effect even if the principal becomes incapacitated. |

| 3 | The form is governed by the Georgia Code, Title 10, Chapter 6B (Uniform Power of Attorney Act). |

| 4 | Without being durable, a Power of Attorney would terminate if the principal becomes mentally incapacitated. |

| 5 | The agent appointed in the form must act in the principal's best interest. |

| 6 | To be valid, it often needs to be notarized and may require witnesses in Georgia. |

| 7 | The principal can specify which financial powers the agent has, such as handling real estate, taxes, or investment decisions. |

| 8 | A principal can revoke the power of attorney at any time, as long as they are mentally competent. |

| 9 | If there is no specified end date, the durable power of attorney remains in effect until the principal dies or revokes the document. |

| 10 | The document can be customized to include springing powers, which only come into effect under circumstances defined by the principal, such as a medical doctor declaring them incapacitated. |

Georgia Durable Power of Attorney - Usage Guide

When preparing to complete the Georgia Durable Power of Attorney form, it's important to understand the steps in order to ensure accuracy and compliance with state regulations. This form is a vital legal document that authorizes another person to make decisions on your behalf. It remains effective even if you become incapacitated. Accuracy is key, as any mistakes may invalidate the document or cause confusion about your intentions. We'll now guide you through the process of filling out this form properly.

- Begin by carefully reading the entire form to familiarize yourself with its contents and requirements.

- Enter your full legal name and address at the top of the form, designating yourself as the "Principal."

- Select an individual whom you trust as your "Agent" or "Attorney-in-Fact." Fill in their complete name and address where indicated.

- Specify the powers you are granting to your Agent. These can include financial, property, and personal decision-making authorities. Be clear and precise to avoid any confusion.

- If you wish to grant your Agent the authority to handle real estate transactions, ensure you comply with Georgia law by including any additional required information.

- Decide whether your Durable Power of Attorney will become effective immediately or only upon your incapacitation. Indicate your choice clearly on the form.

- If you want the Durable Power of Attorney to be springing, meaning it only takes effect under certain conditions, explicitly define these conditions.

- Sign and date the form in the presence of a notary public. Most Georgia Durable Power of Attorney forms require notarization to be legally binding.

- Ensure your Agent signs the form as well, acknowledging their acceptance of the responsibilities you are delegating to them.

- Store the completed form in a safe but accessible place. Provide copies to your Agent, family members, or anyone else who might need to know of its existence.

- Consider informing your financial institutions and medical providers about the Durable Power of Attorney, presenting them with copies if they require it for their records.

After filling out the Georgia Durable Power of Attorney form correctly, you have taken a significant step in managing your affairs and ensuring that your decisions are respected, even if you are unable to make those decisions yourself. Remember, legal documents like these can always benefit from a review by a legal professional to ensure they meet all legal standards and accurately reflect your wishes.

Common Questions

What is a Georgia Durable Power of Attorney?

A Georgia Durable Power of Attorney is a legal document that lets you (the principal) appoint someone else (the agent) to make decisions about your property, finances, or medical care if you're unable to do so yourself. It’s called "durable" because it remains in effect even if you become incapacitated.

Who should have a Durable Power of Attorney?

Anyone over the age of 18 who wants to ensure that their affairs can be handled by someone they trust in case they become unable to manage them themselves should consider having a Durable Power of Attorney. It's especially important for the elderly, those with serious health issues, or those planning major surgeries.

How can I appoint someone as my agent?

To appoint someone as your agent, you must complete the Georgia Durable Power of Attorney form. You’ll need to provide details about yourself and the agent, define the powers you're granting, and sign the document in front of a notary public. The agent you choose should be someone trustworthy and competent to handle your affairs.

What kind of powers can I grant with this form?

You can grant your agent a wide range of powers, including handling your finances, buying or selling property, managing your business, and making medical decisions for you. The form allows for both general powers and specific limitations, so you can tailor it to your needs.

Is the Georgia Durable Power of Attorney revocable?

Yes, a Durable Power of Attorney in Georgia is revocable at any time by the principal, as long as the principal is mentally competent. To revoke it, you should inform your agent in writing and destroy all copies of the document.

How does a Durable Power of Attorney end?

Besides revocation by the principal, a Durable Power of Attorney in Georgia can also end upon the principal's death, if the principal becomes incapacitated and the document doesn’t specify it to be durable, or if a court finds the document to be invalid. Additionally, it can end if the specified term expires or if the purpose of the Power of Attorney has been fulfilled.

Without a Durable Power of Attorney, if you become incapacitated, your family members might have to go through a lengthy and potentially stressful court process to be appointed as your guardian or conservator. This process can be time-consuming and expensive, and it may result in someone you wouldn’t have chosen being in charge of your decisions.

Can I change my Durable Power of Attorney?

Yes, as long as you are mentally competent, you can change or update your Durable Power of Attorney at any time. To make changes, you should complete a new form and revoke the old one, making sure to inform any institutions or individuals who had received the original document.

Common mistakes

When filling out the Georgia Durable Power of Attorney form, individuals often overlook several critical steps or make mistakes that can significantly affect the validity and effectiveness of the document. Understanding these common errors can help ensure the form is filled out correctly, providing peace of mind and legal protection.

Not specifying powers clearly: Users sometimes fail to specify the powers they grant to the agent with enough clarity. This ambiguity can lead to disputes or complications, as third parties may have difficulty determining what the agent is authorized to do. It is vital to detail the scope of powers granted explicitly.

Choosing the wrong agent: The choice of an agent is crucial. People often appoint an agent based on relationship status alone, without considering the person's ability or willingness to handle financial matters prudently and ethically. Choosing a trustworthy and competent agent is paramount for the document's effectiveness.

People also make mistakes related to the technical aspects of filling out the form:

- Failing to comply with state requirements: Georgia law might have specific signatory or witness requirements for a Durable Power of Attorney to be considered valid. Overlooking these requirements can lead to the document being invalidated.

- Omitting the durability provision: Unlike a standard Power of Attorney, a Durable Power of Attorney remains effective even if the principal becomes incapacitated. Failure to include explicit durability language can render the document ineffective when it is most needed.

- Not reviewing and updating the document: Circumstances and relationships change over time, yet individuals often forget to review and update their Durable Power of Attorney accordingly. Regularly revisiting the document ensures that it remains accurate and relevant to the current situation.

- Improper execution: Missing signatures or the presence of improper witnesses can lead to questions about the document's authenticity and validity. Ensuring the form is executed correctly according to Georgia law is critical.

Lastly, individuals sometimes neglect to consider the broader impact of their decisions:

- Failure to discuss their wishes and the scope of authority granted with the appointed agent often leads to misunderstandings or conflict.

- Not storing the document securely and in a location known to both the principal and the agent can cause delays or problems when it is needed.

By avoiding these common pitfalls, individuals can create a Durable Power of Attorney that effectively communicates their wishes, appoints a trusted agent, and meets the legal requirements of Georgia. This careful preparation helps in managing affairs efficiently and ensures that the principal's financial matters are in good hands, even in times of unforeseen circumstances.

Documents used along the form

When individuals in Georgia set up a Durable Power of Attorney, it's often a part of a broader approach to planning for the future. This critical document allows someone to appoint an agent to handle their affairs if they become unable to do so themselves. However, to fully ensure that all aspects of one’s personal and medical wishes are respected and adhered to, there are several other forms and documents usually considered alongside the Durable Power of Attorney. Let's take a look at a few of these:

- Advance Directive for Health Care - This document allows a person to outline their preferences for medical treatment and appoint a health care agent to make decisions if they're incapacitated.

- Living Will - Often included within the Advance Directive, a Living Will specifies what types of life-sustaining treatments an individual would or would not want if they're unable to communicate their wishes directly.

- Last Will and Testament - This legal document communicates a person’s wishes about how their property and affairs should be handled after their death.

- Financial Power of Attorney - Similar to the Durable Power of Attorney, this focuses specifically on financial matters, allowing the designated agent to manage the financial affairs of the person appointing them.

- Privacy Release Form - In healthcare contexts, this form authorizes the release of medical information to designated individuals, ensuring an appointed agent can access the necessary records to make informed decisions.

- Revocable Living Trust - This estate planning tool lets individuals have control over their assets while they're alive and then transfer ownership to beneficiaries upon their death without the need for probate.

- Guardianship Designation - Used by parents or guardians, this document specifies who should become guardians of their dependents should they no longer be able to care for them themselves.

- HIPAA Release Form - Since the Health Insurance Portability and Accountability Act (HIPAA) restricts access to an individual’s personal health information, this form is crucial for permitting appointed agents to obtain necessary medical information.

Collectively, these documents provide a comprehensive framework for managing both health care and financial decisions, offering peace of mind and ensuring that an individual's wishes are honored, even in times when they might not be able to articulate them personally. While the Durable Power of Attorney is pivotal for financial and legal affairs, integrating it with other planning documents ensures a well-rounded safeguard for future unknowns.

Similar forms

The Georgia Durable Power of Attorney form is similar to other estate planning documents in significant ways, but also unique in its purpose and function. This form enables an individual, referred to as the principal, to appoint another person as their agent (or attorney-in-fact) to manage their financial affairs. This appointment remains in effect even if the principal becomes incapacitated.

The form is similar to a General Power of Attorney in that it grants an agent authority to make decisions on behalf of the principal. However, unlike a General Power of Attorney, which becomes void if the principal loses mental capacity, the Durable Power of Attorney remains effective. This distinction is crucial for long-term planning and ensures that the principal's affairs can be managed without court intervention.

Another comparable document is the Medical Power of Attorney, which also allows an individual to appoint an agent. This agent, however, is specifically empowered to make healthcare decisions on the principal's behalf if they cannot do so themselves. While the Medical Power of Attorney and the Durable Power of Attorney serve different purposes—one for health care decisions and the other for financial decisions—they share the common feature of allowing representation if the principal is incapacitated.

The Georgia Durable Power of Attorney form also has parallels with a Living Will. Both documents come into play when an individual cannot make decisions due to incapacitation. A Living Will, however, is focused on end-of-life decisions, outlining the principal's wishes regarding life-sustaining treatment, whereas the Durable Power of Attorney appoints someone to manage financial and legal matters. Despite these differences, both documents are essential for comprehensive estate and health care planning.

Dos and Don'ts

When filling out a Georgia Durable Power of Attorney form, it's important to consider both the actions that should be taken to ensure the form is properly executed, as well as those that should be avoided. Below are lists that highlight four key points in each category.

Things You Should Do

- Review the form thoroughly to ensure understanding of the powers being granted.

- Choose a trusted individual who understands your wishes and is willing to act on your behalf.

- Have the form notarized to solidify its legitimacy and enforceability.

- Provide copies of the completed form to relevant parties, such as healthcare providers or financial institutions.

Things You Shouldn't Do

- Leave any sections blank or incomplete, as this could lead to misinterpretation or exploitation.

- Appoint someone without discussing your expectations and confirming their willingness and ability to act on your behalf.

- Forget to specify limitations or conditions under which the power of attorney is effective.

- Fail to review and update the document as circumstances change, to ensure it still reflects your wishes.

Misconceptions

When discussing the Georgia Durable Power of Attorney form, there are several common misconceptions. Clear understanding is crucial for making informed decisions about legal and financial affairs. Below is a list of 10 common misconceptions with explanations to correct them.

- It grants unlimited power. Many believe that this form gives the agent the power to do anything with the principal's assets. However, the document specifies the scope of authority granted to the agent, which can be as broad or as limited as the principal desires.

- It’s only for the elderly. While it's essential for the aging population, adults of all ages can benefit from having a Durable Power of Attorney, especially in unexpected health crises or accidents.

- It becomes effective immediately after signing. The principal can specify whether it becomes effective immediately or only upon the occurrence of a specified event, such as the principal’s incapacity.

- It overrides a will. Some think it can dictate what happens to assets upon death. In reality, it is only effective during the principal's lifetime and does not override a will or other estate planning documents.

- The appointed agent can make health care decisions. This form specifically covers financial and property decisions; health care decisions require a separate Health Care Power of Attorney.

- It can be signed on behalf of the principal. Legally, the principal must be the one to sign the form, ensuring they understand and agree to the designation of power freely and without coercion.

- A spouse automatically has the same powers without a form. Without a Durable Power of Attorney, even a spouse may face limitations on the ability to manage assets not jointly held or decisions about the individual’s affairs.

- It is valid after the principal’s death. The authority granted through this form ceases upon the principal’s death; thereafter, the executor of the estate takes over responsibility for the decedent's affairs.

- Any form found online is sufficient. Generic forms might not comply with Georgia's specific requirements, potentially rendering them invalid. It's critical to use state-specific forms or consult with a legal professional.

- It is irrevocable. Unless expressly stated as irrevocable in the document, the principal can modify or revoke a Durable Power of Attorney at any time as long as they are competent.

Key takeaways

When preparing a Durable Power of Attorney (DPOA) form in Georgia, individuals are taking a significant step toward ensuring their affairs are managed according to their wishes, should they become unable to make decisions for themselves. Here are key takeaways to keep in mind during this important process:

- The person creating the DPOA is referred to as the Principal, and the individual granted the authority to act on the principal's behalf is known as the Agent or Attorney-in-Fact.

- A DPOA becomes effective immediately upon signing, unless the document specifies a different commencement date or triggering event.

- Choosing an Agent requires careful consideration, as this person will have broad powers to manage the Principal's financial affairs. Trustworthiness, reliability, and the ability to manage tasks such as banking, real estate transactions, and investment decisions are essential qualities.

- The DPOA should be formally executed, meaning it must be signed by the Principal in the presence of a notary public to ensure its legality and authenticity.

- Georgia law requires that the DPOA must include specific language and meet certain statutory requirements to be considered "durable." This ensures the Agent's authority continues even if the Principal becomes incapacitated.

- To ensure the DPOA is acknowledged by financial institutions and other entities, it may be necessary to register the document with the county recorder's office or present it directly to the institutions involved.

- It's recommended to regularly review and possibly update the DPOA. Life changes such as marriage, divorce, the birth of a child, or a significant change in financial status can affect one's choices in selecting an Agent.

- If at any point the Principal wishes to revoke the DPOA, they may do so as long as they are mentally competent. This revocation must be made in writing and communicated to the Agent as well as any institutions or parties that were made aware of the original DPOA.

Proper preparation and understanding are key to ensuring that the Durable Power of Attorney serves the Principal's interests best. Consulting with a legal professional can provide valuable guidance tailored to an individual's specific circumstances.

More Durable Power of Attorney State Forms

Power of Attorney Delaware - A critical legal document that anticipates the need for someone else to handle your affairs without interruption.

Durable Power of Attorney Form Mn - It's separate from a medical power of attorney, which exclusively covers health care decisions.