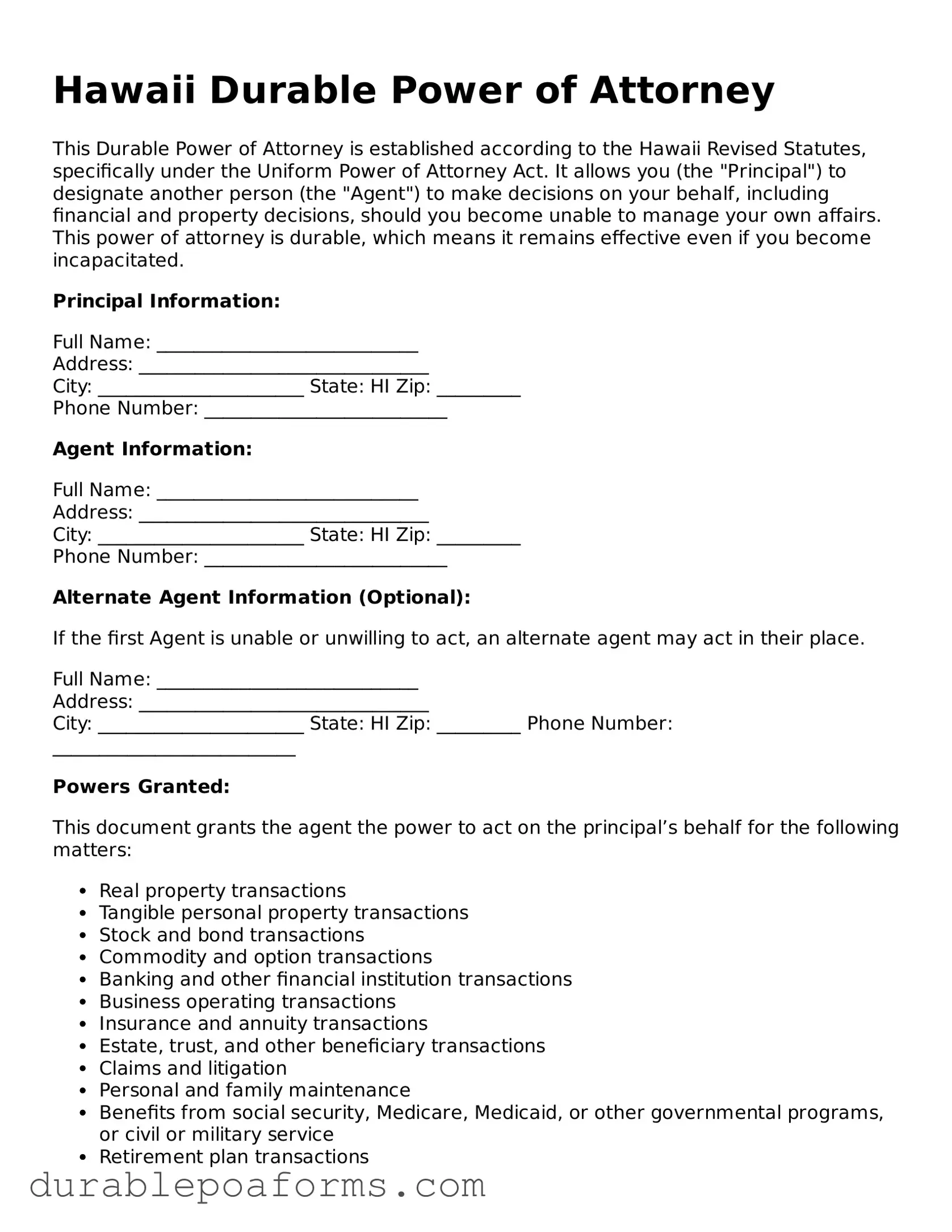

Hawaii Durable Power of Attorney

This Durable Power of Attorney is established according to the Hawaii Revised Statutes, specifically under the Uniform Power of Attorney Act. It allows you (the "Principal") to designate another person (the "Agent") to make decisions on your behalf, including financial and property decisions, should you become unable to manage your own affairs. This power of attorney is durable, which means it remains effective even if you become incapacitated.

Principal Information:

Full Name: ____________________________

Address: _______________________________

City: ______________________ State: HI Zip: _________

Phone Number: __________________________

Agent Information:

Full Name: ____________________________

Address: _______________________________

City: ______________________ State: HI Zip: _________

Phone Number: __________________________

Alternate Agent Information (Optional):

If the first Agent is unable or unwilling to act, an alternate agent may act in their place.

Full Name: ____________________________

Address: _______________________________

City: ______________________ State: HI Zip: _________

Phone Number: __________________________

Powers Granted:

This document grants the agent the power to act on the principal’s behalf for the following matters:

- Real property transactions

- Tangible personal property transactions

- Stock and bond transactions

- Commodity and option transactions

- Banking and other financial institution transactions

- Business operating transactions

- Insurance and annuity transactions

- Estate, trust, and other beneficiary transactions

- Claims and litigation

- Personal and family maintenance

- Benefits from social security, Medicare, Medicaid, or other governmental programs, or civil or military service

- Retirement plan transactions

- Tax matters

This power of attorney becomes effective immediately unless a different effective date or circumstance is indicated here: _______________________________.

Duration:

This power of attorney shall remain in effect until it is revoked by the principal or the principal dies, whichever occurs first unless a different termination date or condition is specified here: _______________________________.

Signature:

By signing below, the principal acknowledges that they have read and understood this power of attorney and have had the opportunity to seek legal counsel before signing.

Principal's Signature: ___________________________ Date: ____________

State of Hawaii )

County of ___________ )

Subscribed and sworn to (or affirmed) before me on this ___ day of ___________, 20__, by _________________________, who is personally known to me or has provided _________________________ as identification.

Notary Public Signature: ___________________________

Notary Public Name (Printed): _________________________

My Commission Expires: __________________