Attorney-Verified Durable Power of Attorney Document for Illinois

In Illinois, the Durable Power of Attorney form serves as a crucial legal document, enabling individuals to designate a trusted agent to manage their affairs should they become unable to do so themselves. This form covers a broad spectrum of powers, from financial decisions to real estate transactions. It assures that, in the face of incapacity, the personal and financial matters of the individual are handled according to their wishes. It is designed to be effective immediately upon signing or upon the occurrence of a specified event, ensuring that individuals have control over when their agent's power commences. The choice of an agent requires careful consideration, as this person will have substantial authority over the individual's affairs. Understanding the form's intricacies and the responsibilities it entails is essential for anyone considering creating a Durable Power of Attorney in Illinois. This document not only provides peace of mind for the person making it but also outlines clear directives for the appointed agent, making the process of managing one’s affairs as seamless as possible during challenging times.

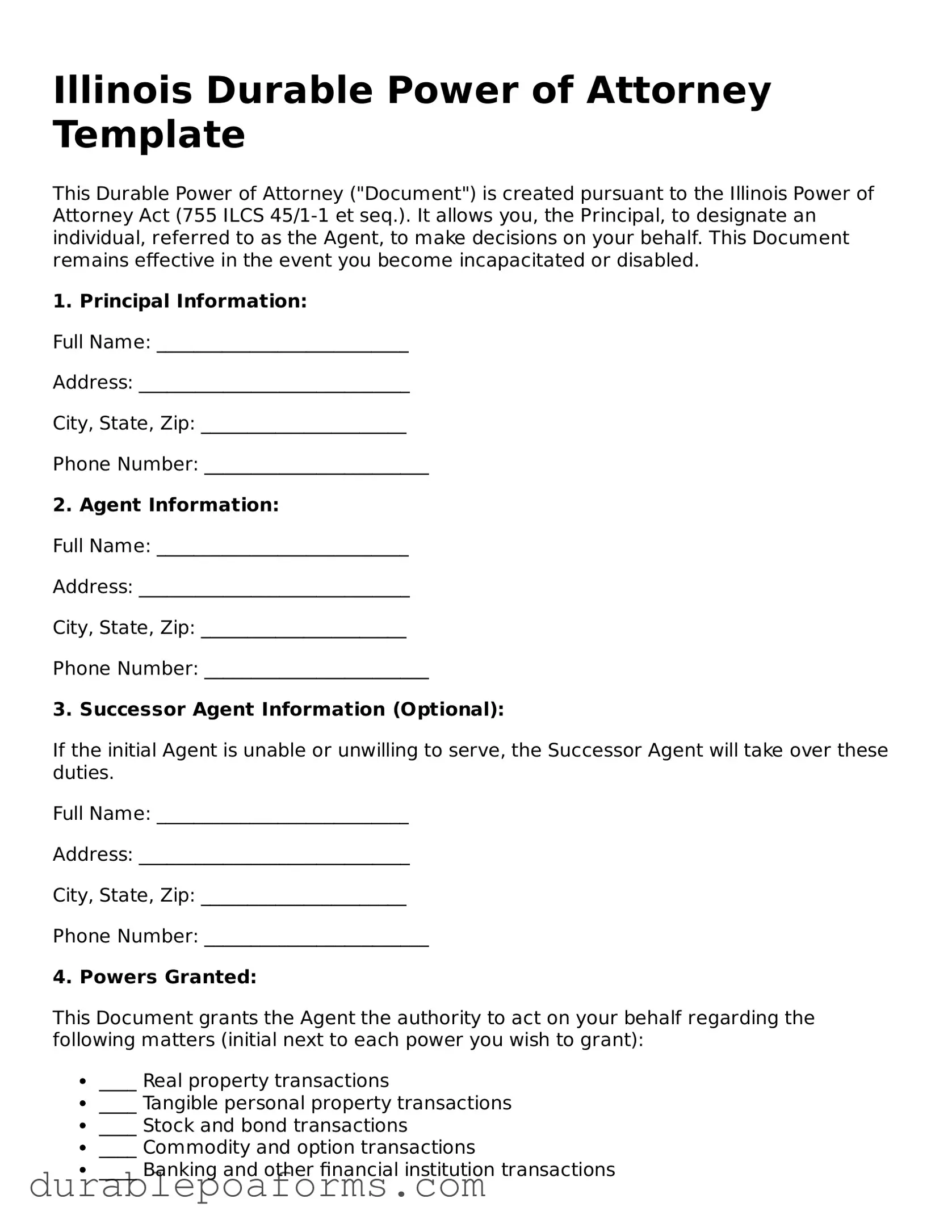

Form Preview

Illinois Durable Power of Attorney Template

This Durable Power of Attorney ("Document") is created pursuant to the Illinois Power of Attorney Act (755 ILCS 45/1-1 et seq.). It allows you, the Principal, to designate an individual, referred to as the Agent, to make decisions on your behalf. This Document remains effective in the event you become incapacitated or disabled.

1. Principal Information:

Full Name: ___________________________

Address: _____________________________

City, State, Zip: ______________________

Phone Number: ________________________

2. Agent Information:

Full Name: ___________________________

Address: _____________________________

City, State, Zip: ______________________

Phone Number: ________________________

3. Successor Agent Information (Optional):

If the initial Agent is unable or unwilling to serve, the Successor Agent will take over these duties.

Full Name: ___________________________

Address: _____________________________

City, State, Zip: ______________________

Phone Number: ________________________

4. Powers Granted:

This Document grants the Agent the authority to act on your behalf regarding the following matters (initial next to each power you wish to grant):

- ____ Real property transactions

- ____ Tangible personal property transactions

- ____ Stock and bond transactions

- ____ Commodity and option transactions

- ____ Banking and other financial institution transactions

- ____ Business operating transactions

- ____ Insurance and annuity transactions

- ____ Estate, trust, and other beneficiary transactions

- ____ Claims and litigation

- ____ Personal and family maintenance

- ____ Benefits from social security, Medicare, Medicaid, or other governmental programs, or military service

- ____ Retirement plan transactions

- ____ Tax matters

5. Durable Nature of Power of Attorney:

This Power of Attorney shall continue to be effective in the event that I become disabled, incapacitated, or incompetent.

6. Effective Date and Signatures:

This Document becomes effective immediately upon the date of signing, unless otherwise specified:

Effective Date: ________________________

Principal's Signature: ____________________ Date: _____________

Agent's Signature: ______________________ Date: _____________

Successor Agent's Signature (If Applicable): ____________________ Date: _____________

7. Acknowledgement of Notary Public:

State of Illinois

County of _______________

On this day, before me appeared _______________ [Principal], to me known to be the person(s) described in and who executed the foregoing instrument, and acknowledged that he/she/they executed the same as his/her/their free act and deed.

Notary Signature: ________________________

Date: __________________

My Commission Expires: _________________

Form Specifications

| Fact Number | Fact Detail |

|---|---|

| 1 | The Illinois Durable Power of Attorney form allows an individual to appoint another person to manage their financial affairs. |

| 2 | This form remains in effect even if the person who created it becomes incapacitated. |

| 3 | It is governed by the Illinois Power of Attorney Act (755 ILCS 45/1-1 et seq.). |

| 4 | The appointed person, known as the agent, must act in the best interests of the person who appointed them. |

| 5 | The form must be signed by the person creating the power of attorney in the presence of a witness for it to be valid. |

| 6 | Notarization of the form, while not required by state law, is highly recommended to affirm the authenticity of the signatures. |

| 7 | The person creating the power of attorney can specify when the powers begin and any limitations on the agent's authority. |

| 8 | Should the person wish to revoke the power of attorney, they must do so in writing and inform the previously named agent and any affected parties. |

Illinois Durable Power of Attorney - Usage Guide

Filling out an Illinois Durable Power of Attorney (POA) form is an important step in planning for future financial management. This legal document allows you to appoint someone you trust, often called an "agent", to make financial decisions on your behalf in the event that you're unable to do so yourself. To ensure accuracy and validity, it's crucial to follow the correct steps in completing the form. Below is a step-by-step guide designed to help you navigate the process smoothly.

- Begin by downloading the latest version of the Illinois Durable Power of Attorney form from a reliable source to ensure it's up-to-date with current laws.

- Read the form thoroughly before filling it out. Understanding every section is essential for accurately reflecting your wishes.

- Enter your full legal name and address at the top of the form to identify yourself as the "principal".

- Designate your agent by entering their full legal name, address, and contact information. Make sure the person you choose is someone you trust completely.

- If you wish to appoint a successor agent (a backup individual) in case the primary agent is unable or unwilling to serve, provide the successor agent's full legal name, address, and contact information as well.

- Specify the powers you're granting your agent by initialing next to each power listed on the form that you want to include. Be as specific as possible to ensure your wishes are accurately represented.

- For powers not explicitly listed or for specific instructions, use the special instructions section to detail your wishes. Clear instructions help in avoiding any confusion or misinterpretation in the future.

- If you wish the POA to become effective immediately, state this clearly in the designated section. Alternatively, if the POA should only come into effect upon your incapacitation, specify the conditions and who can determine your incapacitation.

- Review the form thoroughly to ensure all information is accurate and complete. Any mistakes could cause legal difficulties down the line.

- Sign and date the form in front of a notary public. This step is essential as it legally acknowledges your signature. The notary will also sign and seal the document, adding an additional layer of legal validity.

- Finally, provide your agent with the original signed document or a certified copy. It's also advisable to keep a copy for your records and inform close family members or advisers of the POA's existence and location.

By carefully following these steps, you can effectively complete the Illinois Durable Power of Attorney form. This document plays a crucial role in your financial planning, ensuring that your financial matters are handled according to your wishes, should you be unable to manage them yourself. It's recommended to consult with a legal professional if you have any questions or need guidance through this process.

Common Questions

What is a Durable Power of Attorney in Illinois?

A Durable Power of Attorney (DPOA) in Illinois is a legal document that allows an individual, known as the principal, to appoint another person, the agent, to make decisions and act on their behalf in financial matters. Unlike a general Power of Attorney, it remains effective even if the principal becomes incapacitated.

Why do I need a Durable Power of Attorney?

Having a DPOA provides peace of mind that someone you trust will manage your financial affairs if you're unable to do so yourself due to illness, injury, or incapacity. It ensures that your financial responsibilities are handled according to your wishes.

Who should I choose as my agent?

Choose someone you trust implicitly, such as a family member or close friend, who is organized, financially savvy, and capable of acting in your best interests. It’s essential that the person you select can handle the responsibility and is willing to serve as your agent.

How do I create a Durable Power of Attorney in Illinois?

To create a DPOA, you must complete a form that meets Illinois state requirements, which includes specifying the powers you grant to your agent. You and the agent must sign the document, and it's recommended to have it notarized. Illinois law may require witnesses in certain circumstances, so consult the specific state requirements or a legal professional.

Can I revoke or change my Durable Power of Attorney?

Yes, you can revoke or change your DPOA at any time, as long as you're mentally competent. To revoke it, you should inform your agent in writing and destroy all copies of the document. To change your agent or modify the powers granted, you'll need to create a new DPOA.

When does a Durable Power of Attorney become effective?

In Illinois, a DPOA becomes effective as soon as it's signed, unless the document specifies a different start date, or it is a "springing" power, set to become effective upon a certain condition, such as the principal's incapacitation.

Is a lawyer required to create a Durable Power of Attorney in Illinois?

While not required, consulting with a lawyer when creating a DPOA is highly recommended, especially to ensure it meets all legal requirements, accurately reflects your wishes, and provides the specific powers needed for your agent to act on your behalf.

What if my Durable Power of Attorney is not accepted by a third party?

If a third party refuses to accept your DPOA, you may need legal assistance to enforce it. In Illinois, a third party may be required to accept a DPOA unless they have a valid reason for refusal, such as suspecting fraud or forgery.

Does a Durable Power of Attorney cover healthcare decisions?

No, a DPOA for finances in Illinois does not cover healthcare decisions. To appoint someone to make healthcare decisions on your behalf, you would need a separate document known as a Healthcare Power of Attorney.

What happens if I don’t have a Durable Power of Attorney?

If you become incapacitated without a DPOA in place, a court may need to appoint a conservator or guardian to make decisions for you. This process can be time-consuming, costly, and might not result in the person you would have chosen yourself.

Common mistakes

Filling out the Illinois Durable Power of Attorney (POA) form is a critical step for many individuals planning for the future of their finances and health. However, mistakes can often occur during this process, undermining the form's effectiveness. To ensure that your document accurately reflects your intentions and is legally binding, here are five common mistakes to avoid:

- Not Specifying Powers Clearly: Many individuals fail to clearly outline the scope of the agent's powers. It's vital to detail what decisions the agent can make on your behalf, whether it's managing your finances, selling property, or making medical decisions. Ambiguity in this area can lead to confusion and potentially legal challenges down the line.

- Omitting Alternates: Failure to name an alternate agent is another common oversight. If the primary agent is unable or unwilling to act, having an alternate agent ensures that your affairs can still be managed without interruption. It's a safeguard that shouldn't be overlooked.

- Ignoring the Need for Witnesses and/or Notarization: The Illinois Durable Power of Attorney form may require witnessing, notarization, or both, depending on the powers being granted. Some individuals complete the form without these crucial steps, rendering the document invalid or subject to scrutiny and rejection when it's most needed.

- Lack of Specificity in Terms: Another mistake is being too vague about the term or duration of the POA. It's important to specify when the POA becomes effective and under what conditions it should expire. Without this clarity, parties might be uncertain about when the agent's authority begins and ends.

- Not Updating the Document: Circumstances change, and a POA that was executed years ago may no longer reflect your current wishes or situation. Not regularly reviewing and updating your POA can lead to an outdated document that doesn't serve your best interests or fails to comply with current laws.

To avoid these pitfalls, it's important to approach the preparation of the Illinois Durable Power of Attorney with careful attention to detail. Consultation with a professional can provide valuable guidance, ensuring that the document is both comprehensive and compliant with Illinois law. By sidestepping these common errors, individuals can secure peace of mind, knowing their affairs will be managed according to their wishes, should they ever be unable to do so themselves.

Documents used along the form

When preparing for the future, it's prudent to arrange not only an Illinois Durable Power of Attorney but other essential documents as well. This ensures comprehensive coverage of one’s affairs, legal, financial, and health-related. The Durable Power of Attorney allows someone to act on your behalf in financial matters, but its effectiveness is magnified when accompanied by other critical documents. Below is a list of forms and documents often used alongside the Illinois Durable Power of Attorney, each playing a unique role in safeguarding a person's welfare and intentions.

- Living Will: This document outlines your wishes regarding medical treatment in the event you are unable to communicate your decisions due to illness or incapacity. It works in conjunction with the Durable Power of Attorney by providing guidance on health care preferences.

- Health Care Power of Attorney: Specifically designates a person to make health care decisions on your behalf if you're unable to do so. Unlike the Durable Power of Attorney, which covers financial decisions, this focuses on medical choices.

- Last Will and Testament: Specifies how your assets will be distributed after your death. It names an executor to manage this process, ensuring that your assets go to the intended beneficiaries.

- Revocable Living Trust: Helps manage your assets during your lifetime and distribute them after your death, potentially avoiding the time and expense of probate. You can change or revoke this type of trust at any time.

- Do-Not-Resuscitate (DNR) Order: A medical order that tells health care professionals not to perform CPR if your breathing stops or if your heart stops beating. It's important for those who want to ensure that no extraordinary measures are taken to prolong life in terminal situations.

- Declaration for Mental Health Treatment: Indicates your preferences for mental health treatment and medication, and appoints someone to make these decisions if you are found incapable of making them yourself.

- Funeral and Burial Instructions: Allows you to specify your wishes regarding funeral arrangements, burial or cremation, and other related preferences. This can alleviate the burden on family members during a difficult time.

- Personal Property Memorandum: Linked to your will, this document lets you specify whom you want to inherit your tangible personal property, like jewelry, furniture, or art. The items and recipients can be updated without needing to amend your will.

Alongside the Illinois Durable Power of Attorney, these documents collectively offer a robust plan for various aspects of one’s life, covering financial, health, and personal preferences. Each plays a crucial role in ensuring your wishes are respected and your loved ones are provided for. Taking the time to create and update these documents can offer peace of mind, knowing that you're prepared for whatever the future holds.

Similar forms

The Illinois Durable Power of Attorney form is similar to other legal documents that allow individuals to appoint someone to make decisions on their behalf. These documents are particularly useful in planning for future health care decisions and managing personal and financial affairs if one becomes unable to do so themselves. While each documents serves a slightly different purpose, they all play a critical role in estate planning and personal care planning.

Advanced Healthcare Directive: This document resembles the Illinois Durable Power of Attorney in that it permits an individual to designate another person, often referred to as a healthcare proxy or agent, to make healthcare decisions on their behalf if they are incapacitated or otherwise unable to make decisions for themselves. The major difference lies in the scope of the authority granted. While a Durable Power of Attorney can cover a wide range of decisions including financial and medical, an Advanced Healthcare Directive is specifically tailored to healthcare decisions.

General Power of Attorney: Like the Illinois Durable Power of Attorney, a General Power of Attorney allows an individual to appoint someone to manage their affairs. However, it is important to note that a General Power of Attorney becomes void if the person who made it becomes incapacitated. This is a crucial distinction because a Durable Power of Attorney, as suggested by its name, remains effective even after the principal's incapacitation.

Springing Power of Attorney: This form is similar to the Illinois Durable Power of Attorney in terms of allowing an individual to appoint someone else to manage their affairs. The key difference is in its activation; a Springing Power of Attorney only comes into effect upon the occurrence of a specific event, usually the principal's incapacitation. This feature provides an added level of control over when the powers are granted to the agent, in contrast to the Durable Power of Attorney, which is effective immediately upon signing.

Dos and Don'ts

When filling out the Illinois Durable Power of Attorney form, it's important to approach the task with careful attention to detail. The choices you make on this form can have significant implications for your future and that of your loved ones. Here are a few dos and don'ts to consider:

Do:

- Read the form thoroughly before beginning. Understanding all the sections will help you make informed decisions about your power of attorney.

- Choose a trusted individual as your agent. This person should be reliable, trustworthy, and have a good understanding of your wishes.

- Be specific about the powers you grant your agent. Clearly outline what they can and cannot do on your behalf to prevent any confusion in the future.

- Discuss your intentions with the person you plan to appoint as your agent. It's important they understand the responsibilities and agree to take them on.

- Have the form notarized. In Illinois, notarizing your Durable Power of Attorney can add a layer of legality and help ensure it is recognized by financial institutions and healthcare providers.

- Keep the document in a safe, accessible place and inform your agent and family members where it is stored. This ensures it can be found easily when needed.

Don't:

- Don't choose an agent based solely on their relationship to you. Make sure the person is capable and willing to act in your best interest.

- Don't leave any sections blank. If a section does not apply, mark it N/A (not applicable) to show that you did not overlook it.

- Don't fail to consider alternate agents. If your first choice is unable to serve, having an alternate can prevent the need for court intervention.

- Don't ignore the need to update the document as your situation changes. If you experience major life changes, reviewing and updating the document is necessary.

- Don't attempt to make changes to the document by hand after it has been completed. If changes are needed, a new form should be filled out to avoid confusion and potential legal issues.

- Don't forget to sign and date the document in the presence of a witness and a notary. An unsigned power of attorney is not valid.

Misconceptions

Understanding the Durable Power of Attorney (DPOA) in Illinois is crucial, yet numerous misconceptions exist regarding its use and powers. Below, we dispel some common errors in thinking about this legal document.

- It goes into effect immediately upon signing. Many believe that a DPOA is only activated when the individual becomes incapable of making decisions. However, unless the document specifically states otherwise, it becomes effective as soon as it is signed and notarized.

- A doctor's verification of incapacity is always required. More often than not, the wording within the DPOA document itself dictates when it becomes effective, especially concerning the principal's capacity to make decisions. While some may require a doctor's verification, others do not, relying instead on the determination as outlined within the document.

- It grants unlimited power. Though a DPOA grants significant authority to the agent, its scope is strictly limited to what is outlined in the document. The principal can restrict or specify the powers granted.

- It's only for the elderly or terminally ill. A common misconception is that DPOA forms are solely for individuals who are aging or have terminal conditions. In reality, unforeseen situations, such as accidents or sudden illness, can make this document essential for anyone, regardless of age or health.

- The appointed agent can make medical decisions. A Durable Power of Attorney in Illinois is specifically designed for financial and property matters, not medical decisions. For healthcare-related decisions, a separate document, known as a Healthcare Power of Attorney, is required.

- It overrides a will upon death. Some individuals mistakenly believe that a DPOA continues to grant the agent authority even after the principal's death. In truth, the authority granted by a DPOA ends upon the death of the principal, and the executor named in the will then takes over the management of the principal's estate.

Dispelling these misconceptions about the Durable Power of Attorney in Illinois ensures that individuals can make informed decisions when preparing their own DPOA, recognizing its limitations and the protections it offers.

Key takeaways

When dealing with an Illinois Durable Power of Attorney form, understanding the essential factors involved in filling out and using the document is crucial for ensuring that your financial affairs are properly managed in the event you are unable to do so yourself. Here are four key takeaways:

- Choose a trusted agent carefully. The person you appoint as your agent will have significant control over your financial affairs, including but not limited to managing bank accounts, paying bills, and making investment decisions. It's imperative to select someone who is not only trustworthy but also capable of handling these responsibilities.

- Be specific about granted powers. The Illinois Durable Power of Attorney form allows you to specify exactly what financial powers your agent can exercise. This can range from broad authority across all financial matters to limited powers for specific transactions. Clarifying these details can prevent future confusion and ensure your wishes are followed.

- Understand the durability aspect. The term "durable," in this context, means that the power of attorney will remain in effect even if you become incapacitated. This feature is what primarily distinguishes a durable power of attorney from other forms, making it a critical tool for long-term planning.

- Follow legal requirements for execution. For the power of attorney to be valid in Illinois, certain legal requirements must be met, including proper witnessing and notarization. These requirements are designed to protect you by ensuring the document truly reflects your wishes and was executed without undue influence.

Ensuring that the Illinois Durable Power of Attorney form is filled out accurately and in accordance with state laws will help secure your financial wellbeing and peace of mind, knowing that your affairs will be in capable hands should the need arise.

More Durable Power of Attorney State Forms

Power of Attorney Ct - It specifies who can make decisions about finances, healthcare, or property on behalf of the principal.

Durable Power of Attorney Form Mn - Helps in avoiding the cost and complexity of guardianship or conservatorship proceedings in court.