Attorney-Verified Durable Power of Attorney Document for Indiana

When considering the future, it's essential to prepare for every possibility, including those times we might not be able to make decisions for ourselves. This is where the Indiana Durable Power of Attorney form becomes crucial. Tailored to safeguard one's interests and ensure decisions align with personal wishes, this legal document empowers another person, known as an agent, to make important decisions on one's behalf. This appointment spans a range of responsibilities, from financial matters to personal affairs, ensuring that your choices are respected, even in your absence. Recognized for its permanence, the form remains in effect even if the individual becomes incapacitated, providing peace of mind to all involved. The process of setting up a Durable Power of Attorney in Indiana is straightforward but requires careful consideration in selecting the right agent, understanding the scope of powers granted, and adhering to state laws to ensure its validity. Preparing this document is a proactive step in managing your future, offering security and clarity for both you and your loved ones.

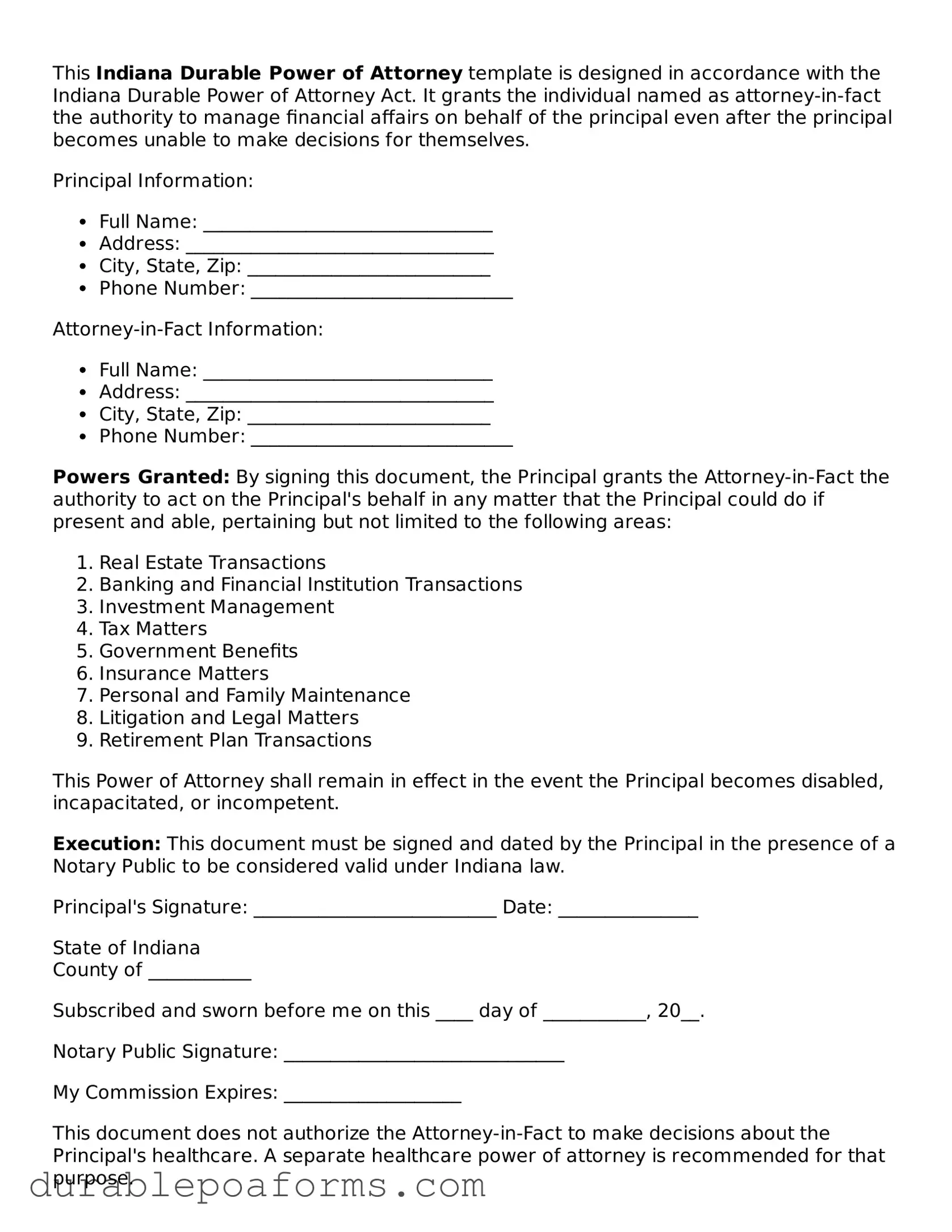

Form Preview

This Indiana Durable Power of Attorney template is designed in accordance with the Indiana Durable Power of Attorney Act. It grants the individual named as attorney-in-fact the authority to manage financial affairs on behalf of the principal even after the principal becomes unable to make decisions for themselves.

Principal Information:

- Full Name: _______________________________

- Address: _________________________________

- City, State, Zip: __________________________

- Phone Number: ____________________________

Attorney-in-Fact Information:

- Full Name: _______________________________

- Address: _________________________________

- City, State, Zip: __________________________

- Phone Number: ____________________________

Powers Granted: By signing this document, the Principal grants the Attorney-in-Fact the authority to act on the Principal's behalf in any matter that the Principal could do if present and able, pertaining but not limited to the following areas:

- Real Estate Transactions

- Banking and Financial Institution Transactions

- Investment Management

- Tax Matters

- Government Benefits

- Insurance Matters

- Personal and Family Maintenance

- Litigation and Legal Matters

- Retirement Plan Transactions

This Power of Attorney shall remain in effect in the event the Principal becomes disabled, incapacitated, or incompetent.

Execution: This document must be signed and dated by the Principal in the presence of a Notary Public to be considered valid under Indiana law.

Principal's Signature: __________________________ Date: _______________

State of Indiana

County of ___________

Subscribed and sworn before me on this ____ day of ___________, 20__.

Notary Public Signature: ______________________________

My Commission Expires: ___________________

This document does not authorize the Attorney-in-Fact to make decisions about the Principal's healthcare. A separate healthcare power of attorney is recommended for that purpose.

It is recommended to review and possibly update this document regularly to ensure it continues to reflect the Principal's wishes.

Form Specifications

| Fact | Description |

|---|---|

| Purpose | Allows an individual to appoint someone else to manage their financial affairs. |

| Durability | Remains in effect even if the principal becomes incapacitated or unable to make decisions for themselves. |

| Governing Laws | Regulated by Indiana Code Title 30, Article 5, Chapter 3 (IC 30-5-3). |

| Principal | The person who grants another the authority to act on their behalf. |

| Agent (or Attorney-in-Fact) | The individual appointed by the principal to make decisions regarding financial matters. |

| Requirements for Validity | Must be signed by the principal, witnessed by a notary public, and it is recommended, but not required, to have two adult witnesses. |

| Revocation | The principal may revoke the power of attorney at any time, provided they are mentally competent. |

| Scope of Authority | The document specifies the extent of power given to the agent, which can include handling financial and real estate transactions among others. |

| Recognition Outside Indiana | While primarily for use in Indiana, the durable power of attorney is generally recognized in other states due to similar legal structures. |

Indiana Durable Power of Attorney - Usage Guide

Filling out a Durable Power of Attorney form in Indiana is a crucial step for anyone looking to ensure their affairs are managed according to their wishes, should they become unable to do so themselves. This document grants someone you trust, often referred to as the "agent," the authority to make decisions on your behalf. Doing this correctly is vital to its effectiveness and to your peace of mind. The following steps are designed to guide you through the process with clarity and precision, ensuring that every necessary detail is addressed.

- Start by entering your full legal name and address in the designated section at the top of the form. This identifies you as the "principal" - the person granting the power.

- Designate your chosen agent by writing their full legal name and address in the specified field. Ensure the information is accurate to avoid any future disputes or confusion.

- If you wish to appoint a successor agent, in case your primary agent is unable or unwilling to serve, fill in the details of the successor agent in the provided area.

- Specify the powers you are granting to your agent. The form may contain a list of standard powers with checkboxes next to each. Read each item carefully and mark the appropriate boxes to grant these powers to your agent. If you wish to grant all the listed powers, you may just need to check a single box indicating so.

- In the event you desire to grant your agent power not listed on the form, use the section provided for special instructions. Here, you can detail any additional powers or limitations you want to apply.

- Indicate the duration of the power of attorney. If it is to remain in effect even if you become incapacitated, ensure the wording reflects that it is a "durable" power of attorney. Some forms may have a box to check to indicate this explicitly.

- Date and sign the form. Your signature must be made in the presence of a notary public. The notary will then fill in their part, confirming they witnessed your signature, thus making the document legally binding.

- Finally, share a copy of the signed document with your agent, any successor agents, and perhaps a trusted family member or lawyer. It’s also advisable to discuss your wishes and any specific directions you have included in the document with your agent to ensure they understand their responsibilities.

Completing the Indiana Durable Power of Attorney form is a forward step in ensuring that your personal, financial, and health-related affairs are responsibly managed in your stead. By following these detailed steps, you can accomplish this task with confidence, knowing your wishes will be honored and carried out as you intended.

Common Questions

What is a Durable Power of Attorney in Indiana?

A Durable Power of Attorney (DPOA) in Indiana is a legal document that allows you to designate someone else, known as your agent, to make decisions on your behalf should you become incapacitated or unable to make those decisions yourself. It is "durable" because it remains effective even if you become incapacitated.

How do I choose an agent for my Durable Power of Attorney in Indiana?

Choosing an agent is a crucial decision. You should select someone you trust deeply, such as a family member or close friend, who is willing and able to handle the responsibilities involved. Consider their ability to make tough decisions under pressure and their understanding of your wishes. It's also wise to name a successor agent in case your first choice is unavailable or unwilling to serve when needed.

What powers can I give to my agent under a Durable Power of Attorney in Indiana?

In Indiana, you can grant your agent a wide range of powers, including managing your financial affairs, making healthcare decisions, handling real estate transactions, and more. However, there are certain decisions that your agent cannot make for you, such as making a will. It's important to clearly outline the powers you are granting in the DPOA document.

How can I ensure my Durable Power of Attorney is legally valid in Indiana?

For your Durable Power of Attorney to be legally valid in Indiana, you must be of sound mind when you sign the document. It must be in writing, and you must sign it in the presence of a notary public. Indiana law also requires your DPOA to include specific wording to make it durable. It's advisable to consult with a legal professional to ensure your document meets all legal requirements and accurately reflects your wishes.

Can I revoke my Durable Power of Attorney in Indiana?

Yes, you can revoke your Durable Power of Attorney at any time, as long as you are of sound mind. To revoke it, you should provide a written notice of revocation to your agent and any institutions or individuals that were relying on the original DPOA. It's also recommended to destroy all copies of the original document. If you wish to replace your DPOA with a new one, ensure that the new document clearly states that it revokes any prior DPOAs.

Common mistakes

Filling out a Durable Power of Attorney (DPOA) form in Indiana is a critical process, empowering another person to make important decisions on one's behalf. Unfortunately, several common errors can compromise the effectiveness of this vital document. Understanding these mistakes is the first step toward creating a reliable and functional DPOA.

The most common mistakes include:

- Failing to specify powers comprehensively. Individuals often overlook the need to detail the extent and limitations of the agent's authority, potentially leading to confusion or misuse of power.

- Choosing an agent without enough consideration. The agent's reliability, willingness to serve, and ability to make prudent decisions under the law are paramount. A hastily chosen agent can lead to unintended consequences.

- Not updating the form. Life changes such as marriage, divorce, or the death of the designated agent necessitate revisions to the DPOA to ensure its relevancy and effectiveness.

- Omitting a successor agent. Failure to appoint a secondary, or successor, agent leaves a gap should the primary agent become unable or unwilling to serve.

- Ignoring the need for witness signatures. Indiana law requires the DPOA to be witnessed, ensuring its validity and protecting against fraud.

- Using incorrect or outdated forms. Regulations and requirements can evolve, making it crucial to use the most current DPOA form applicable in Indiana.

- Overlooking state-specific requirements. Each state has unique laws governing DPOAs, and not tailoring the document to Indiana’s specifications can render it invalid.

- Not specifying durability. A DPOA must clearly state that the agent's power remains effective even if the principal becomes incapacitated, hence the term “durable.”

- Failure to distribute copies. The agent, healthcare providers, and relevant financial institutions should have copies of the DPOA to ensure recognized authority.

- Hesitating to seek legal advice. The complexities of DPOA documents often necessitate professional assistance to avoid errors and legal pitfalls.

Addressing these common pitfalls can ensure that the DPOA effectively represents the principal's wishes and legal rights in Indiana. A DPOA is a powerful legal instrument that requires careful consideration and attention to detail. By avoiding these mistakes, individuals can provide their chosen agent with the clear authority needed to act in their best interests, thus ensuring peace of mind for all parties involved.

Documents used along the form

When preparing for the future, particularly for instances concerning health or financial decisions, it’s prudent to have certain documents in place. An Indiana Durable Power of Attorney (DPOA) form is one vital component, empowering someone to act on your behalf should you become unable to make decisions. Accompanying this form, several other documents are frequently utilized to ensure comprehensive planning. Each serves a distinct purpose, complementing the DPOA by covering various aspects of personal and healthcare decisions.

- Advance Directive for Health Care: This document goes hand-in-hand with a DPOATA, specifically focusing on an individual's preferences regarding medical treatments, end-of-life care, and other healthcare decisions if they become incapacitated. It may include a living will and appointment of a healthcare representative.

- Living Will Declaration: Detailing an individual's wishes concerning life-prolonging treatments in case they can no longer communicate their desires, a living will is crucial for end-of-life planning. It's a specific part of an Advance Directive that addresses the desire for, or against, the use of life-sustaining measures.

- HIPAA Authorization Form: This form permits designated individuals or entities to access an individual's protected health information (PHI). It ensures that a person entrusted with making healthcare decisions has the necessary information to do so, complementing both the DPOA and health care-related directives.

- Last Will and Testament: While not directly related to immediate health or personal care decisions, a Last Will and Testament specifies how an individual’s assets should be distributed after their death. It is an essential document for comprehensive estate planning, ensuring that one's final wishes are honored and disputes among potential heirs are minimized.

Implementing these documents alongside an Indiana Durable Power of Attorney form creates a robust legal framework for protecting individual rights and wishes. It ensures that everything from personal assets to health care decisions is handled according to the person's preferences, providing peace of mind to all involved. Knowing and understanding each document’s purpose and how they work together reinforces one’s preparedness for any situation that might arise.

Similar forms

The Indiana Durable Power of Attorney form is similar to other estate planning documents that allow individuals to designate representatives to make decisions on their behalf. However, its functions, implications, and specific applications differ depending on the document it is compared to. Key similarities to other documents include the delegation of decision-making authority, but the scope and duration of that authority can vary significantly.

Advance Directive: The Indiana Durable Power of Attorney form shares some similarities with an advance directive. Both documents allow a person to make provisions for their healthcare and personal affairs in anticipation of a time when they might not be able to make those decisions themselves. While an advance directive often includes living wills and healthcare proxy designations, focusing specifically on healthcare decisions, a durable power of attorney can be broader, potentially covering financial and legal decisions in addition to health-related matters.

General Power of Attorney: Another document akin to the Indiana Durable Power of Attorney is the general power of attorney. Both empower a chosen agent to act on the principal's behalf. The critical difference lies in their durability. A general power of attorney typically ceases to be effective if the principal becomes incapacitated. In contrast, a durable power of attorney remains in effect, or only becomes effective, upon the incapacitation of the principal, ensuring continuous management of the principal's affairs during periods of incapacity.

Springing Power of Attorney: The Indiana Durable Power of Attorney also resembles a springing power of attorney in that it can be crafted to become effective only upon the occurrence of a specified event, usually the principal's incapacitation. However, unlike a standard springing power of attorney, which might be limited to a specific event or timeframe, a durable power of attorney aims to remain in effect for the principal's lifetime, unless revoked, covering a broad range of actions and decisions as specified by the principal.

Dos and Don'ts

Filling out an Indiana Durable Power of Attorney form is a significant step in managing your affairs and ensuring your wishes are followed, should you become incapacitated. It's crucial to do it correctly. Here are some key dos and don'ts to keep in mind:

Do:

- Read the entire form carefully before you start filling it out. Understand every section to ensure that it aligns with your wishes.

- Choose a trusted person as your agent. This individual will act on your behalf, so it's important they understand your preferences and have your best interests at heart.

- Be specific about the powers you grant to your agent. If there are any limitations you want to impose, make sure they are clearly outlined in the form.

- Discuss your decision with your chosen agent. They need to be aware of their responsibilities and agree to take on this role.

- Sign the form in the presence of a notary public. In Indiana, a durable power of attorney needs to be notarized to be legally binding.

- Keep the original document in a safe place, and provide copies to your agent and possibly your healthcare provider.

- Regularly review and update the document as needed. Life changes such as a divorce, death, or a shift in your relationship with the agent may necessitate modifications.

Don't:

- Fill out the form in haste. Take your time to ensure that every decision is made thoughtfully and aligns with your current wishes.

- Choose an agent solely based on relationship. Instead, select someone who is capable, reliable, and understands your healthcare preferences well.

- Leave any sections of the form blank. If a specific section does not apply, it's better to write "N/A" (not applicable) than to leave it empty.

- Forget to discuss your plans and wishes with the person you appoint as your agent. Their understanding of your desires is crucial for effective decision-making.

- Overlook the need for a notary public. Your signature on the form must be notarized to make the document valid and enforceable in Indiana.

- Fail to inform relevant parties, such as family members or doctors, about the existence of your Durable Power of Attorney or where it can be found.

- Assume that a one-time setup is sufficient. Review the document periodically to ensure it continues to reflect your current wishes and circumstances.

Misconceptions

When it comes to planning for the future, understanding the legal documents that protect you and your interests is crucial. Among these, the Durable Power of Attorney (DPOA) is particularly significant in Indiana. Unfortunately, misconceptions abound, potentially leading to misinformed decisions. Let’s clear up some common misunderstandings.

- It grants immediate control over all personal affairs. Many believe that upon signing a Durable Power of Attorney in Indiana, they are immediately handing over control of all their personal and financial affairs. However, the truth is more nuanced. The specific powers granted are outlined in the document itself, and you can choose to have the DPOA activate only if you are unable to make decisions for yourself.

- A Durable Power of Attorney is the same in every state. Laws surrounding DPOAs vary significantly from one state to another. While the core concept—a designation allowing someone else to make decisions on your behalf—is consistent, the specific laws and requirements are unique to each state. In Indiana, specific statutes governing the execution and use of a DPOA must be adhered to for it to be valid.

- Creating a Durable Power of Attorney is a complex and expensive process. Many people shy away from setting up a DPOA because they believe it involves an intricate and costly legal process. In reality, creating a Durable Power of Attorney in Indiana can be relatively straightforward and affordable. While legal advice is invaluable in ensuring that the document meets all legal requirements and aligns with your wishes, the process doesn’t have to be daunting or break the bank.

- Once executed, it cannot be changed or revoked. Some hesitate to execute a Durable Power of Attorney under the mistaken belief that it is permanent and cannot be altered. The truth is, as long as you are competent, you can amend or revoke your DPOA at any time in Indiana. It’s important to review it regularly and make necessary adjustments to reflect changes in your life or your wishes.

Understanding the true nature and flexibility of a Durable Power of Attorney in Indiana is the first step in making informed decisions about your future and ensuring your interests are protected. Dispelling these common misconceptions allows you to approach this valuable legal tool with confidence and peace of mind.

Key takeaways

When filling out and using the Indiana Durable Power of Attorney form, there are several key takeaways to keep in mind. This document plays a crucial role in planning for the future, allowing someone you trust to make decisions on your behalf should you become unable to do so yourself. Here are some important aspects to consider:

- Choose a trusted agent carefully. The person you appoint as your agent will have significant power over your affairs. It's vital to select someone who is not only trustworthy but also capable of handling the responsibility.

- Be specific about the powers granted. The form allows you to specify exactly what decisions your agent can make on your behalf. This could range from financial decisions to medical care. Clarity here helps prevent misunderstandings in the future.

- The form must be properly executed. For a Durable Power of Attorney to be valid in Indiana, certain legal requirements must be met, including signing in the presence of a notary public. This formalizes the document and helps protect against fraud.

- Understand it can be revoked. As long as you are mentally competent, you have the power to revoke the Durable Power of Attorney at any time. This gives you the flexibility to change your agent or your wishes as circumstances change.

Creating a Durable Power of Attorney is a proactive step in managing your future. It's about ensuring that your affairs will be handled as you see fit, even if you're not able to oversee them yourself. Careful consideration and proper execution of this document can offer peace of mind to you and your loved ones.

More Durable Power of Attorney State Forms

Georgia Financial Power of Attorney - This form is highly recommended for individuals who want to proactively plan for the future management of their assets and decision-making capabilities.

Free Power of Attorney Form Mississippi - Authorizing a reliable individual to act on your behalf can make all the difference in managing unforeseen challenges.