Attorney-Verified Durable Power of Attorney Document for Iowa

Embarking on planning for one's future involves careful consideration, especially when it comes to making decisions that affect personal and financial matters in times when one might not be able to do so themselves. Within the framework of legal preparations, the Iowa Durable Power of Attorney form emerges as a pivotal document, offering peace of mind and security. This form allows individuals to appoint someone they trust to manage their affairs, ensuring that their personal, financial, or health-related wishes are respected and acted upon, even in their absence or incapacitation. The "durable" aspect of this power of attorney means that the authority granted remains effective even if the person becomes incapacitated, distinguishing it from other forms of power of attorney that may terminate under such circumstances. Considering its significance, this document necessitates a clear understanding of its features, the process of selecting an agent, and the specific powers it grants, alongside the legal requirements in Iowa to ensure it is valid and reflective of the person’s desires.

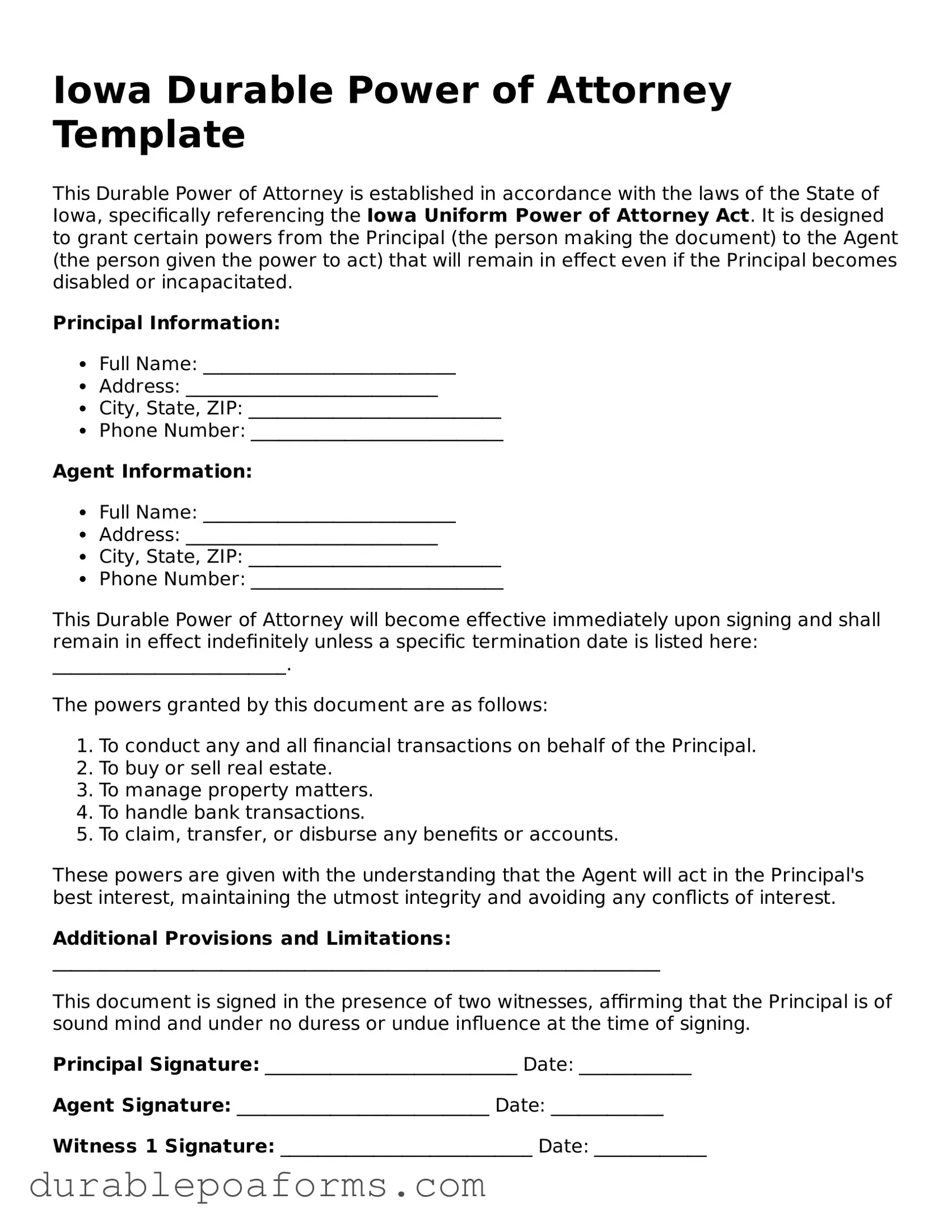

Form Preview

Iowa Durable Power of Attorney Template

This Durable Power of Attorney is established in accordance with the laws of the State of Iowa, specifically referencing the Iowa Uniform Power of Attorney Act. It is designed to grant certain powers from the Principal (the person making the document) to the Agent (the person given the power to act) that will remain in effect even if the Principal becomes disabled or incapacitated.

Principal Information:

- Full Name: ___________________________

- Address: ___________________________

- City, State, ZIP: ___________________________

- Phone Number: ___________________________

Agent Information:

- Full Name: ___________________________

- Address: ___________________________

- City, State, ZIP: ___________________________

- Phone Number: ___________________________

This Durable Power of Attorney will become effective immediately upon signing and shall remain in effect indefinitely unless a specific termination date is listed here: _________________________.

The powers granted by this document are as follows:

- To conduct any and all financial transactions on behalf of the Principal.

- To buy or sell real estate.

- To manage property matters.

- To handle bank transactions.

- To claim, transfer, or disburse any benefits or accounts.

These powers are given with the understanding that the Agent will act in the Principal's best interest, maintaining the utmost integrity and avoiding any conflicts of interest.

Additional Provisions and Limitations: _________________________________________________________________

This document is signed in the presence of two witnesses, affirming that the Principal is of sound mind and under no duress or undue influence at the time of signing.

Principal Signature: ___________________________ Date: ____________

Agent Signature: ___________________________ Date: ____________

Witness 1 Signature: ___________________________ Date: ____________

Witness 2 Signature: ___________________________ Date: ____________

State of Iowa, County of ___________________: This document was acknowledged before me on (date) ___________________ by (name of Principal) _______________________.

Notary Public Signature: ___________________________

My commission expires: _______________

Form Specifications

| Fact | Description |

|---|---|

| Purpose | Allows an individual (the principal) to appoint someone else (the agent) to make decisions regarding their financial affairs. |

| Governing Law | Iowa Code Chapter 633B governs the creation and use of Durable Power of Attorney forms in Iowa. |

| Durability | The form remains effective even if the principal becomes incapacitated, enabling the agent to act on the principal's behalf. |

| Principal Requirements | The individual creating the power of attorney must be at least 18 years old and of sound mind at the time of the document's execution. |

| Agent Qualifications | The agent must be a trusted individual, capable of managing financial matters and acting in the principal's best interest. |

| Signature Requirements | The form must be signed by the principal and notarized to be legally valid in Iowa. |

| Revocation | The principal can revoke the power of attorney at any time, as long as they are mentally competent, through a written notice to the agent. |

Iowa Durable Power of Attorney - Usage Guide

Creating a Durable Power of Attorney (DPOA) in Iowa allows you to appoint someone you trust to manage your financial affairs if you're unable to do so. This could be due to a variety of reasons, such as an illness or absence from the state. The form is straightforward, but it's important to fill it out carefully to ensure your wishes are accurately represented. Below are the steps you need to take to complete the Iowa Durable Power of Attorney form.

- Begin by reading the form thoroughly to understand what each section requires. This ensures you know what information you need before you start filling it out.

- Enter your full legal name and address in the designated space. This identifies you as the principal—the person granting the power.

- Fill in the full name, address, and contact details of the person you're appointing as your agent. This is the individual you trust to handle your affairs.

- If you wish, designate a successor agent in the specified section. This person will take over if your primary agent is unable to fulfill their duties.

- Clearly specify the powers you're granting your agent. This could encompass a wide range of activities, from managing your bank accounts to making real estate transactions on your behalf.

- Include any specific instructions or limitations on your agent's power. This section allows you to delineate what your agent can and cannot do.

- Indicate the duration of the power of attorney. If it's to be effective immediately and continue indefinitely, specify this. If it's to start on a specific date or occasion, make that clear.

- Review the section regarding the acknowledgement of the powers being granted. This part typically requires your agent to acknowledge their understanding and acceptance of their responsibilities.

- Sign and date the form in the presence of a notary public. Your agent may also need to sign, depending on the specific requirements of the Iowa form.

- Lastly, have the form notarized to validate its authenticity. The notary will likely require both your and your agent's presence.

Once completed, keep a copy of the Durable Power of Attorney form in a safe place and provide a copy to your agent as well. It may also be wise to provide copies to relevant financial institutions and anyone else who may need to know about the arrangement. Remember, by taking these steps, you're ensuring that your financial matters will be taken care of according to your wishes should you be unable to manage them yourself.

Common Questions

What is a Durable Power of Attorney (DPOA) in Iowa?

A Durable Power of Attorney in Iowa is a legal document that allows an individual, known as the principal, to designate another person, referred to as the agent or attorney-in-fact, to manage their financial affairs. This document remains in effect even if the principal becomes incapacitated, ensuring that the principal’s financial matters can be handled without court intervention. The "durable" aspect refers to its remaining in force despite the principal’s incapacity.

How do I create a DPOA in Iowa?

To create a DPOA in Iowa, you must complete a form that includes your name, the name of the agent you're appointing, and the specific powers you're granting. It's essential to use clear and precise language to outline the scope of authority granted to the agent. The form must be signed by the principal in the presence of a notary public or other authorized official. Iowa law may have specific signing requirements, so consulting with a legal professional can ensure the document meets all legal standards.

Who should I choose as my agent?

Choosing an agent is a significant decision. It should be someone you trust implicitly, such as a family member, a close friend, or a trusted advisor. This individual should have the ability to manage financial matters prudently and in your best interest. Consider discussing the responsibilities with potential agents to ensure they are willing and able to take on the role. It’s also wise to appoint an alternate agent in case your first choice is unavailable or unwilling to serve when needed.

Can I revoke or change my DPOA?

Yes, you can revoke or change your DPOA at any time as long as you are mentally competent. To revoke the document, you should provide written notice to your current agent, any alternate agents, and any institutions or individuals that are aware of the existing DPOA. To make changes, create a new DPOA that outlines the new terms and make clear it supersedes the previous document. Notifying all relevant parties of the change is crucial to ensure the old DPOA is no longer in effect.

What happens if I don’t have a DPOA and become incapacitated?

If you become incapacitated without a DPOA in place, it may become necessary for a court to intervene and appoint a conservator or guardian to manage your affairs. This process can be time-consuming, expensive, and stressful for your loved ones. Having a DPOA ensures your financial matters are handled according to your wishes without the need for court involvement, providing peace of mind for both you and your family.

Common mistakes

Filling out a Durable Power of Attorney (POA) form is a critical step in planning for future financial and health decisions, especially in Iowa, where specifics of the law require careful attention. However, individuals often fall into common mistakes during this process. Understanding these pitfalls can ensure that the POA form serves its intended role without unnecessary complications.

One of the most significant mistakes is not specifying powers adequately. Many assume that a general statement of power grants their agent authority to handle all matters. Iowa law, however, requires a clear delineation of each power bestowed upon the agent. If the document is too vague, financial institutions and healthcare providers may refuse to honor it, complicating decision-making processes at critical times.

Choosing the wrong agent can also lead to problems. The role of an agent is pivotal, demanding trust and an understanding of the principal's wishes. It's essential to select someone who is not only trustworthy but also has the ability and willingness to act on your behalf according to your wishes. Appointing someone based merely on personal relationships without considering their capability and reliability is a common misstep.

Another common error is failing to sign and witness the document properly. Iowa law requires the presence of a notary and, depending on the document’s specifications, certain numbers of witnesses during the signing. This formal witnessing process legitimizes the document, and overlooking this formality can lead to the POA being considered invalid, nullifying its intended purpose.

Last but not least, many neglect the importance of regular updates. A Durable POA should be reviewed periodically and updated to reflect any changes in the principal’s situation, relationships, or wishes. Life changes, such as a divorce, the death of the named agent, or a move to another state, necessitate updates to ensure the document’s effectiveness and relevance.

By avoiding these common mistakes, individuals can ensure their Durable Power of Attorney forms are robust, valid, and accurately reflect their wishes, providing peace of mind and security in knowing their affairs will be managed according to their precise directions.

Documents used along the form

When preparing for future legal and financial matters, the Iowa Durable Power of Attorney form is often accompanied by several other documents. Together, these forms provide a comprehensive approach to estate planning, health care decisions, and asset management. Knowing the purpose and function of these additional documents is key to ensuring that all areas of potential concern are addressed.

- Advanced Healthcare Directive (Living Will): This document allows individuals to specify their preferences regarding medical treatments and interventions in the event they are unable to communicate their wishes. It often includes decisions about life support and end-of-life care.

- Medical Power of Attorney: Also known as a healthcare proxy, this form appoints a trusted person to make healthcare decisions on behalf of the individual if they become incapacitated. It complements the Advanced Healthcare Directive by covering aspects not specified within it.

- Last Will and Testament: This legal document outlines how an individual's property and assets are to be distributed upon their death. It can also designate guardians for any minor children.

- Revocable Living Trust: A flexible estate planning tool that helps manage assets during an individual's lifetime and distribute them upon their death, often bypassing the probate process. The trust's terms can be changed or revoked by the grantor at any time.

- HIPAA Release Form: Ensures that healthcare providers can share an individual's medical information with designated persons, such as those holding a Medical Power of Attorney or individuals named in the directive, without violating HIPAA regulations.

- Financial Information Sheet: Although not a legal document, this sheet is crucial as it organizes all financial accounts, insurance policies, and other valuable assets, making it easier for the appointed agent under the Durable Power of Attorney to manage the principal's affairs effectively.

Each document serves a unique purpose and collectively they provide a safety net for both present and future circumstances. It is recommended to consult with a professional when creating or updating these documents to ensure that they are legally sound and reflect the individual's current wishes and needs.

Similar forms

The Iowa Durable Power of Attorney form is similar to other vital estate planning documents, each designed to facilitate crucial decisions in the event of incapacity or absence. Among these documents are the living will, healthcare power of attorney, and general power of attorney. While each document serves a specific purpose, their overall intent—to ensure an individual's wishes are honored without court intervention—is a common thread that links them together.

Living Will: The similarity between a living will and the Iowa Durable Power of Attorney form lies in their forward-thinking nature, both preparing for a time when the individual might not be able to articulate their wishes due to incapacity. While the durable power of attorney focuses on financial and legal decisions, a living will directs medical professionals regarding the individual's preferences for medical treatment, particularly life-sustaining treatments, if they become terminally ill or permanently unconscious. The primary distinction is the scope of decisions each document governs.

Healthcare Power of Attorney: Like the Iowa Durable Power of Attorney, a healthcare power of attorney is designed to assign someone the authority to make decisions on the individual's behalf. However, the healthcare power of attorney is specifically oriented towards healthcare decisions. This document becomes active when the individual cannot make their decisions regarding medical treatment. It complements a durable power of attorney by covering personal health and wellbeing, thereby ensuring comprehensive coverage of both health and financial matters.

General Power of Attorney: The general power of attorney shares a foundational similarity with the durable power of attorney in authorizing someone else to act on the individual's behalf. However, a key difference is that a general power of attorney typically becomes ineffective if the individual becomes incapacitated. In contrast, a durable power of attorney specifically remains in effect or becomes active upon the incapacitation of the individual. This distinction is critical in estate planning, emphasizing the durable power of attorney’s importance for long-term planning.

Dos and Don'ts

When filling out the Iowa Durable Power of Attorney form, individuals make decisions that can have a lasting impact on their financial and health-related affairs. It's crucial to approach this task with careful consideration. Below are some recommended dos and don'ts to help guide you through the process:

Do:Read the form thoroughly before starting to fill it out. Understanding every section ensures that you accurately represent your wishes.

Choose a trusted individual as your agent. This person will act on your behalf, so it’s essential they understand your preferences and have your best interests at heart.

Be specific about the powers you are granting. Clearly outline what your agent can and cannot do to avoid any confusion or misuse of the power.

Sign the document in the presence of a notary public or required witnesses. This step is crucial to make the power of attorney legally binding.

Rush through the process. Take your time to consider all aspects and implications of granting someone else power over your affairs.

Forget to discuss your wishes and instructions with the person you are appointing as your agent. Open communication is key to ensuring your desires are fulfilled.

Leave any sections blank. If a section does not apply, clearly indicate with “N/A” or “none” to show that you did not overlook the area.

Fail to keep a copy of the signed document for yourself and another with a trusted family member, friend, or advisor. It’s important to have accessible records.

Misconceptions

When it comes to preparing for the future, understanding legal documents like the Iowa Durable Power of Attorney (DPOA) is crucial. There are, however, common misconceptions that can confuse and deter people from utilizing this important tool effectively. Let's clarify these misunderstandings:

- It's Only for the Wealthy: Many believe that a Durable Power of Attorney is something only the wealthy need. In reality, this document is vital for anyone who wants to ensure their affairs are handled according to their wishes, should they become unable to manage them personally.

- It Grants Unlimited Power: A common fear is that appointing a DPOA gives that person unlimited power over all aspects of your life. However, you can specify exactly what powers your agent has, including any limits you wish to place on their authority.

- It’s the Same as a Will: Some confuse a DPOA with a will. While a will outlines wishes after you pass away, a DPOA is all about managing your affairs while you are alive but incapacitated.

- It Takes Effect Immediately: People often think that once signed, the agent can start making decisions right away. The truth is, you can specify that the DPOA only takes effect under certain conditions, such as a medical doctor declaring you incapacitated.

- You Lose Control Once It’s Signed: A significant concern is the loss of control over personal decisions. It's important to know that as long as you are competent, you can amend or revoke a Durable Power of Attorney at any time.

- It’s Too Complicated to Set Up: It might seem like setting up a DPOA requires jumping through countless legal hoops. Although it does require careful consideration and legal formalities, with the right guidance, it can be straightforward.

- It’s Only for Older Adults: Another misconception is that DPOAs are only necessary for older adults. In reality, unforeseen circumstances can occur at any age, making it wise for adults of all ages to consider having one.

- Doctors Decide When It Takes Effect: While medical professionals can play a part in determining incapacity, the conditions under which your DPOA takes effect are based on what's outlined in the document itself and the relevant state laws.

- It Covers Medical Decisions: Although a Durable Power of Attorney can include provisions for healthcare decisions, there is a separate document called a Medical Power of Attorney or Healthcare Proxy that is specifically designed for health-related decisions.

- It’s Too Expensive: Lastly, the assumption is often that creating a DPOA involves high legal fees. While there can be costs involved, especially if you seek professional legal assistance, the peace of mind and potential financial savings from having your affairs in order far outweigh the initial expense.

Understanding what a Durable Power of Attorney entails and dispelling these misconceptions are the first steps toward securing your and your loved ones' future. It's a powerful tool that, when used correctly, ensures your wishes are honored, no matter what the future holds.

Key takeaways

Filling out and utilizing the Iowa Durable Power of Attorney form involves a series of important steps and considerations. This document allows an individual (the principal) to legally designate another person (the agent) to make decisions on their behalf. It's crucial in planning for situations where the principal might become unable to manage their own affairs due to health issues or other reasons. Here are key takeaways to ensure the process is handled correctly:

- Understand the Purpose: The Durable Power of Attorney in Iowa is designed to grant an agent the authority to act on the principal's behalf in financial and health-related matters that include, but are not limited to, property, banking, and medical decisions.

- Select the Agent Carefully: The choice of an agent should be made with great caution. The agent should be someone trustworthy and capable of handling significant responsibilities, as they will have broad powers over the principal's affairs.

- Be Specific: It’s important to be specific about the powers granted to the agent. The form allows the principal to outline the extent of powers that the agent has, including any limitations.

- Sign in Front of a Notary: To ensure the document’s legality, it must be signed by the principal in the presence of a notary public. This step also helps in safeguarding against claims of fraud or coercion.

- Witnesses: Although not always required, having witnesses at the signing can add an additional layer of validity and may be required in some circumstances.

- Communicate with Your Agent: It’s crucial that the principal communicates their wishes and expectations with the chosen agent. The agent should fully understand their responsibilities and the scope of the powers granted to them.

- Keep the Document Safe but Accessible: Once signed, the Durable Power of Attorney should be kept in a safe place. However, it is also important that the agent and relevant family members know where to find it in case it needs to be used.

- Review and Update as Necessary: Life changes such as divorce, relocation, or the death of the designated agent may necessitate updating the Durable Power of Attorney. Regularly review the document to ensure it aligns with current wishes and circumstances.

- Consult with a Legal Professional: Completing the Durable Power of Attorney form can have significant legal implications. For this reason, it is wise to consult with a lawyer who understands Iowa law and can provide advice tailored to the individual’s specific situation.

By following these steps, individuals can ensure their affairs will be managed according to their wishes even if they are unable to make decisions themselves. It is a powerful tool for proactive legal and personal planning.

More Durable Power of Attorney State Forms

Power of Attorney Form Tn Pdf - It provides a clear directive for financial management, helping avoid confusion and disputes later on.

Power of Attorney Services Near Me - It serves as an essential legal tool in maintaining one's autonomy by having predetermined arrangements for the management of their affairs.

Financial Power of Attorney Colorado Pdf - State-specific forms should be used, as legal requirements for these documents vary across the United States.