What is a Kansas Durable Power of Attorney?

A Kansas Durable Power of Attorney (DPOA) is a legal document that allows one person, known as the principal, to appoint another person, known as the agent or attorney-in-fact, to make decisions on their behalf. This includes handling financial affairs, property, and other personal matters. Unlike other power of attorney documents, a durable power of attorney remains effective even if the principal becomes incapacitated.

Why would someone need a Durable Power of Attorney?

People often create a Durable Power of Attorney as part of planning for the future. It ensures that someone they trust can manage their financial and legal affairs if they become unable to do so themselves due to illness, injury, or incapacity. Having a DPOA in place can provide peace of mind and protect the principal's assets.

Who can serve as an agent under a Kansas Durable Power of Attorney?

Any competent adult can serve as an agent, including a family member, friend, or professional advisor. The chosen individual should be trustworthy, reliable, and capable of handling the responsibilities that come with managing another person's affairs. It's important to discuss the duties with the potential agent before appointing them to ensure they are willing and able to serve.

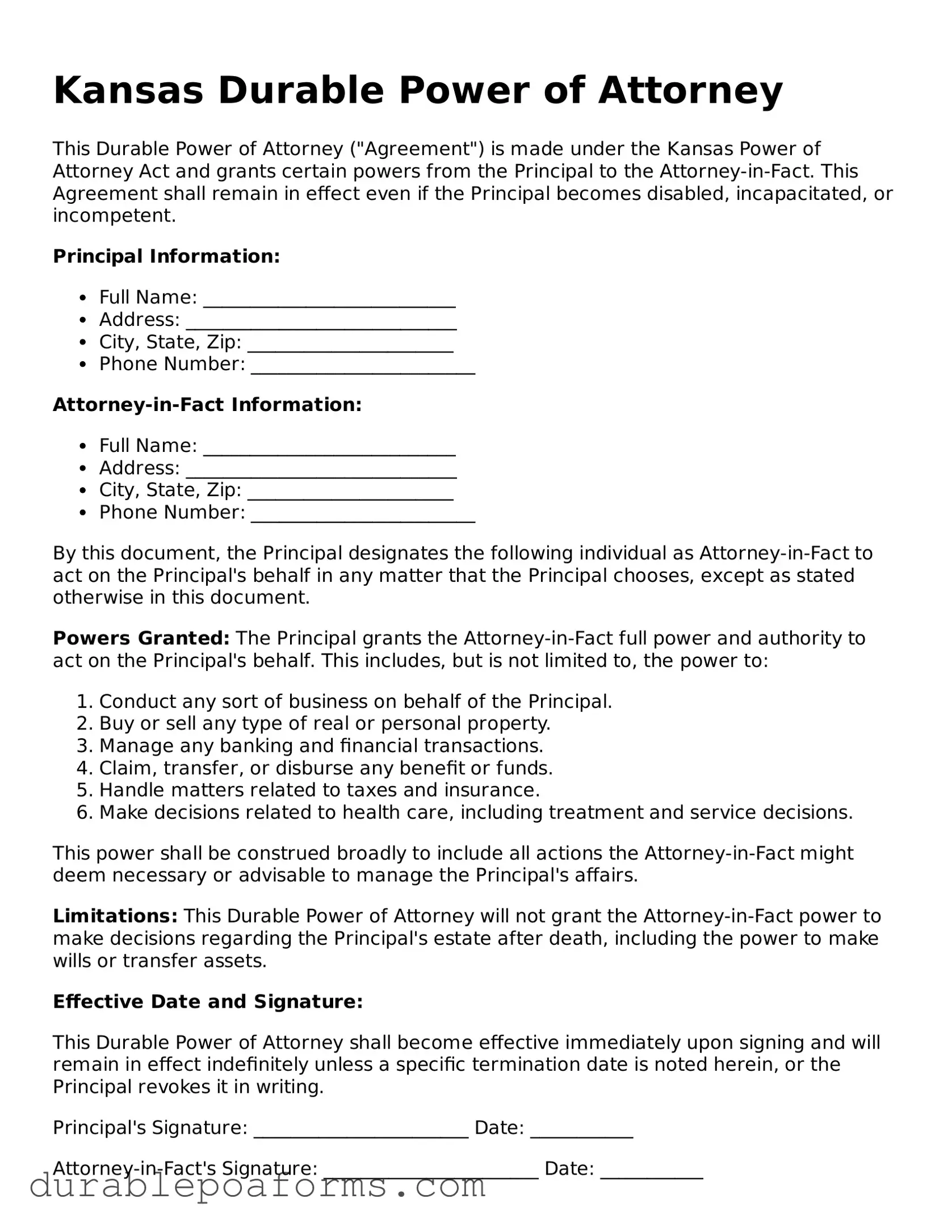

What kind of powers can be granted with a Kansas Durable Power of Attorney?

A DPOA can grant broad or limited authority to the agent. This can range from accessing bank accounts, paying bills, and managing investments, to selling property and making legal decisions. The powers granted can be customized to suit the principal's needs and preferences.

How is a Durable Power of Attorney activated in Kansas?

A Kansas Durable Power of Attorney becomes effective as soon as it is signed and notarized unless the document specifies a different effective date or triggering event, such as the principal's incapacitation. It is crucial that the document is executed properly to ensure its validity.

Can a Durable Power of Attorney be revoked?

Yes, as long as the principal is competent, they can revoke their Durable Power of Attorney at any time. To do this, they should provide written notice to the agent and to any institutions or parties that were relying on the DPOA. It is also recommended to destroy all copies of the original document.

What happens if there is no Durable Power of Attorney and the individual becomes incapacitated?

If someone becomes incapacitated without a Durable Power of Attorney in place, a court may need to appoint a guardian or conservator to make decisions on their behalf. This process can be time-consuming, costly, and may not result in the selection of the person the individual would have chosen themselves.

Where can one get a Kansas Durable Power of Attorney form?

A Kansas Durable Power of Attorney form can be obtained from a legal document service, an attorney, or online legal resources. It's important to ensure that the form complies with Kansas law and is tailored to the principal's specific needs. Considering having the document reviewed by a legal professional can also help guarantee its effectiveness.