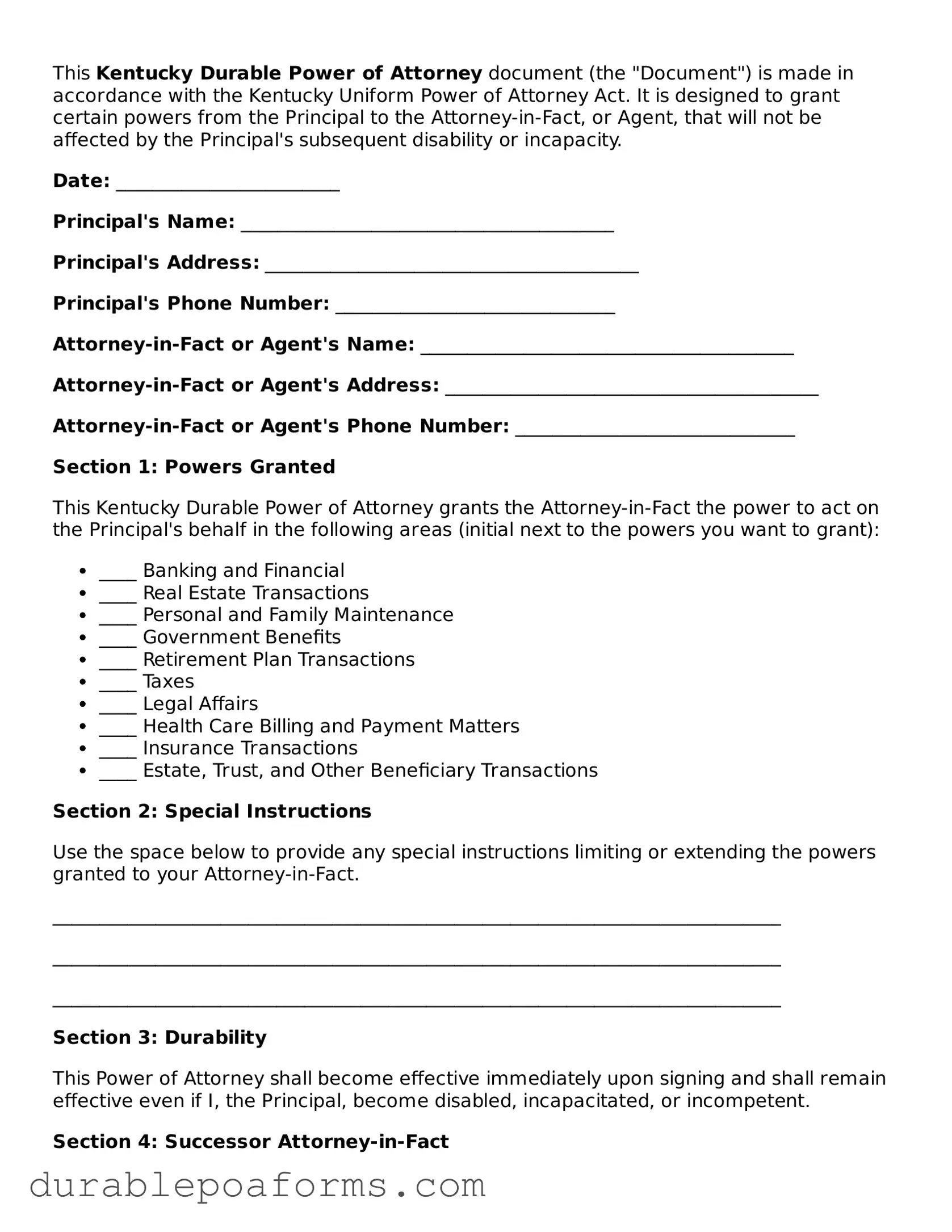

This Kentucky Durable Power of Attorney document (the "Document") is made in accordance with the Kentucky Uniform Power of Attorney Act. It is designed to grant certain powers from the Principal to the Attorney-in-Fact, or Agent, that will not be affected by the Principal's subsequent disability or incapacity.

Date: ________________________

Principal's Name: ________________________________________

Principal's Address: ________________________________________

Principal's Phone Number: ______________________________

Attorney-in-Fact or Agent's Name: ________________________________________

Attorney-in-Fact or Agent's Address: ________________________________________

Attorney-in-Fact or Agent's Phone Number: ______________________________

Section 1: Powers Granted

This Kentucky Durable Power of Attorney grants the Attorney-in-Fact the power to act on the Principal's behalf in the following areas (initial next to the powers you want to grant):

- ____ Banking and Financial

- ____ Real Estate Transactions

- ____ Personal and Family Maintenance

- ____ Government Benefits

- ____ Retirement Plan Transactions

- ____ Taxes

- ____ Legal Affairs

- ____ Health Care Billing and Payment Matters

- ____ Insurance Transactions

- ____ Estate, Trust, and Other Beneficiary Transactions

Section 2: Special Instructions

Use the space below to provide any special instructions limiting or extending the powers granted to your Attorney-in-Fact.

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

Section 3: Durability

This Power of Attorney shall become effective immediately upon signing and shall remain effective even if I, the Principal, become disabled, incapacitated, or incompetent.

Section 4: Successor Attorney-in-Fact

In the event that the initial Attorney-in-Fact is unable or unwilling to serve, the following person is designated as the successor Attorney-in-Fact:

Successor Attorney-in-Fact's Name: ________________________________________

Successor Attorney-in-Fact's Address: ________________________________________

Successor Attorney-in-Fact's Phone Number: ______________________________

Section 5: Governing Law

This Document shall be governed by and construed in accordance with the laws of the State of Kentucky.

Section 6: Signatures

This Document must be signed by the Principal, the Attorney-in-Fact, and a notary public. It is recommended that the Principal also initial each page.

Principal's Signature: ______________________________ Date: _____________

Attorney-in-Fact's Signature: _______________________ Date: _____________

State of Kentucky

County of ___________________

Subscribed and sworn (or affirmed) before me this ____ day of ____________, 20__, by (name of Principal) _________________________________, who is personally known to me or who has produced ___________________________ as identification.

Notary Public: _________________________________

My commission expires: _________________________