Attorney-Verified Durable Power of Attorney Document for Maryland

Navigating life's unpredictability can be a daunting undertaking, particularly when it involves making crucial decisions in times of incapacitation. The Maryland Durable Power of Attorney form emerges as a beacon of preparedness, allowing individuals to designate a trusted person to manage their financial affairs if they become unable to do so themselves. This form not only covers a broad spectrum of financial decisions, ranging from handling bank transactions to real estate management but also ensures continuity in managing one's affairs without the need for court intervention. Its durability aspect is particularly significant, as it remains effective even if the principal becomes incapacitated. Unlike other forms of power of attorney, the Maryland Durable Power of Attorney form is specifically designed to withstand the challenges posed by the principal's incapacity, providing peace of mind to both the individual and their loved ones. Crafting this document requires a thorough understanding of its elements to tailor it accurately to the principal's needs, making it an essential component of planning for the future with confidence and clarity.

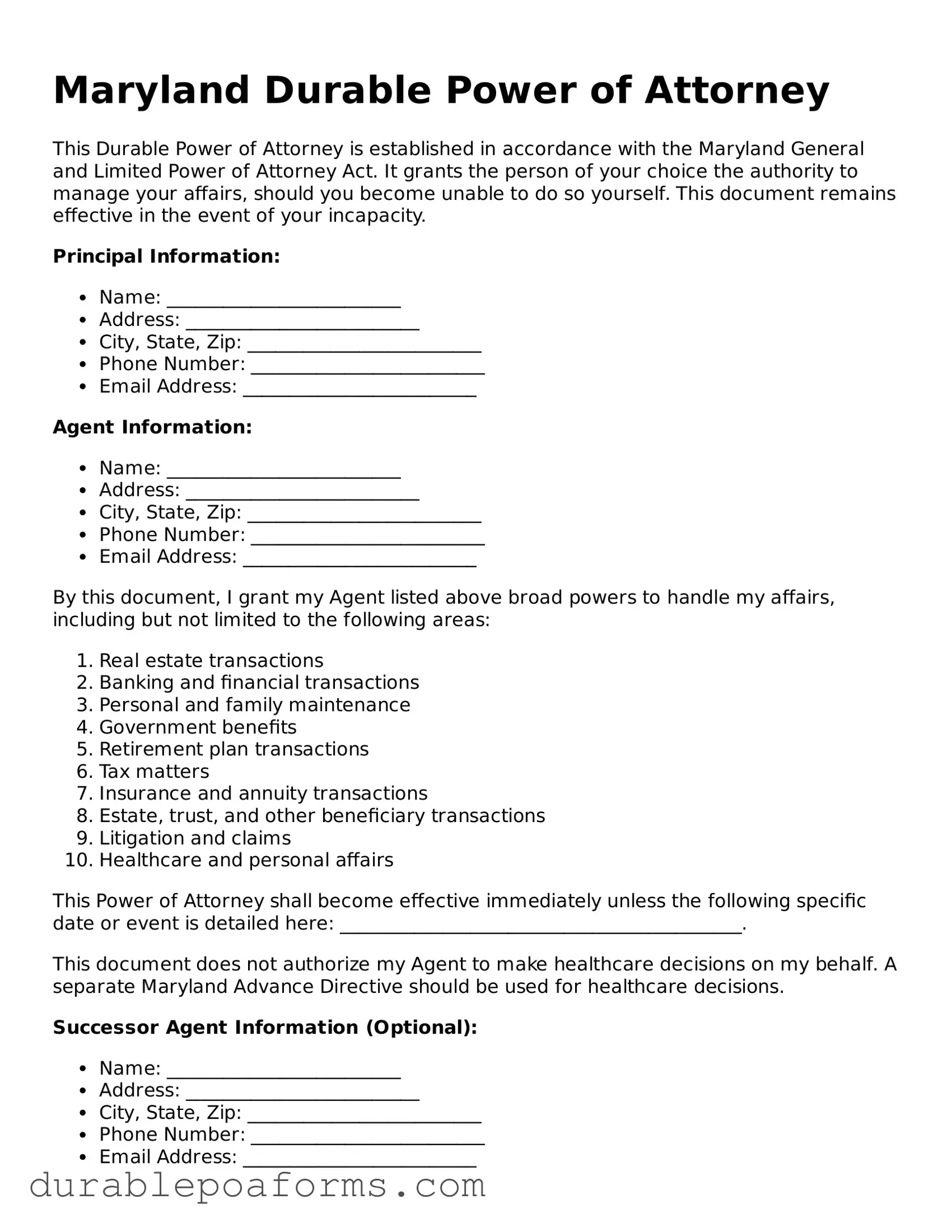

Form Preview

Maryland Durable Power of Attorney

This Durable Power of Attorney is established in accordance with the Maryland General and Limited Power of Attorney Act. It grants the person of your choice the authority to manage your affairs, should you become unable to do so yourself. This document remains effective in the event of your incapacity.

Principal Information:

- Name: _________________________

- Address: _________________________

- City, State, Zip: _________________________

- Phone Number: _________________________

- Email Address: _________________________

Agent Information:

- Name: _________________________

- Address: _________________________

- City, State, Zip: _________________________

- Phone Number: _________________________

- Email Address: _________________________

By this document, I grant my Agent listed above broad powers to handle my affairs, including but not limited to the following areas:

- Real estate transactions

- Banking and financial transactions

- Personal and family maintenance

- Government benefits

- Retirement plan transactions

- Tax matters

- Insurance and annuity transactions

- Estate, trust, and other beneficiary transactions

- Litigation and claims

- Healthcare and personal affairs

This Power of Attorney shall become effective immediately unless the following specific date or event is detailed here: ___________________________________________.

This document does not authorize my Agent to make healthcare decisions on my behalf. A separate Maryland Advance Directive should be used for healthcare decisions.

Successor Agent Information (Optional):

- Name: _________________________

- Address: _________________________

- City, State, Zip: _________________________

- Phone Number: _________________________

- Email Address: _________________________

If my primary Agent is unable or unwilling to serve, I designate the above-named successor Agent to serve with the same powers and duties.

Signature of Principal:

_________________________

Date: _________________________

Signature of Agent:

_________________________

Date: _________________________

Signature of Successor Agent (if applicable):

_________________________

Date: _________________________

This document was executed in the state of Maryland and shall be governed by its laws. I certify that I understand the contents of this document, and I voluntarily sign it.

Witness Declaration:

We, the undersigned, declare that the Principal appears to be of sound mind and not under duress, fraud, or undue influence. We are not the appointed Agent or Successor Agent. We are not related to the Principal by blood or marriage, nor do we stand to inherit from the Principal's estate.

Witness #1:

Name: _________________________

Address: _________________________

City, State, Zip: _________________________

Signature: _________________________

Date: _________________________

Witness #2:

Name: _________________________

Address: _________________________

City, State, Zip: _________________________

Signature: _________________________

Date: _________________________

Notarization: This document was acknowledged before me on (date) _______ in the state of Maryland, County of _______.

Notary Public: _________________________

My Commission Expires: _________________________

Seal:

Form Specifications

| Fact | Description |

|---|---|

| Definition | A Maryland Durable Power of Attorney is a legal document that allows someone (the principal) to appoint another person (the agent) to manage their financial affairs, and it remains effective even if the principal becomes incapacitated. |

| Governing Law | The Maryland General and Limited Power of Attorney Act, found in the Estates and Trusts Article of the Annotated Code of Maryland, governs the creation and use of durable powers of attorney within the state. |

| Legal Requirements | To be valid, the form must be signed by the principal, who must be of sound mind at the time of signing, in the presence of two witnesses. It also needs to be notarized to be considered durable. |

| Revocation | The principal has the right to revoke the durable power of attorney at any time, as long as they are mentally competent. This revocation must be done in writing and communicated to the agent and any institutions or parties relying on the document. |

| Activation | While some durable powers of attorney are effective immediately upon signing, others may include a springing clause, making the document effective only upon the principal's incapacitation, as verified by one or more physicians. |

| Scope of Authority | The document can grant broad or limited financial powers to the agent, including but not limited to managing bank accounts, selling property, and handling tax matters, depending on the specific desires and needs of the principal. |

Maryland Durable Power of Attorney - Usage Guide

The journey of filling out a Maryland Durable Power of Attorney (DPOA) form is a significant step towards ensuring your affairs are managed according to your wishes, should you become unable to do so yourself. While the process may seem daunting at first, breaking it down into manageable steps can simplify it greatly. A correctly completed DPOA not only grants peace of mind but also ensures that the individuals you trust can legally make decisions on your behalf. Before diving into the steps, it’s essential to have all the required information handy, including the full legal names and contact details of the agents you wish to appoint.

- Identify the parties involved: Begin by filling in your full legal name, address, and the date at the top of the form, thereby identifying yourself as the principal. Next, detail the full legal name(s) and contact information of your chosen agent(s) who will act on your behalf.

- Grant of Authority: Specify the powers you are granting your agent. The form allows you to give general authority over your financial and legal matters or to limit it to specific actions. Consider each category carefully and indicate your choices clearly.

- Special Instructions: Use the space provided to outline any particular wishes or limitations you want to impose on the authority granted. This section helps customize the DPOA to your specific needs and wishes.

- Choose the Powers’ Effective Date: Clearly state when the powers granted will begin. You can opt for it to take effect immediately or only if you become incapacitated, as verified by a medical professional.

- Signatures: For the document to be legally valid, you must sign and date it in the presence of a notary public and two adult witnesses. The witnesses cannot be the agent(s) you have appointed or related to you or the agent(s) by blood or marriage.

- Notarization: Have the form notarized. The notary public will fill out their section, confirming your identity and your understanding of the document, as well as the absence of coercion.

- Make Copies: After the form is fully executed, make several copies. Keep the original in a safe but accessible place. Provide copies to your agent(s), financial institutions, and family members who should be aware of the arrangement.

Filling out the Maryland Durable Power of Attorney form is a proactive measure to protect your interests and ensure your affairs are handled with care and attention, according to your exact wishes. By following these steps carefully and consulting with a trusted professional if necessary, you can achieve a sense of security, knowing your future is in capable hands.

Common Questions

What is a Durable Power of Attorney in Maryland?

In Maryland, a Durable Power of Attorney is a legal document that allows an individual (the "principal") to appoint someone else (the "agent") to make decisions on their behalf. What makes it "durable" is its capacity to remain in effect even if the principal becomes incapacitated or unable to make decisions for themselves.

Who can be appointed as an agent under a Durable Power of Attorney?

Any competent adult can be appointed as an agent. It’s important that the principal trusts this individual, as they will be making financial, legal, and sometimes medical decisions on the principal's behalf. Often, people choose a close family member or a trusted friend.

What types of decisions can an agent make under a Durable Power of Attorney?

An agent can be authorized to make a wide range of decisions, which can include financial transactions, real estate management, and handling legal matters. The specific powers granted to the agent are detailed in the Durable Power of Attorney document and can be customized based on the principal's preferences.

How does someone create a Durable Power of Attorney in Maryland?

To create a Durable Power of Attorney in Maryland, one must complete the appropriate form, specifying the powers being granted to the agent. The form must then be signed by the principal in the presence of a notary public. It is highly recommended that this process be completed with the help of a legal professional to ensure accuracy and legality.

When does the Durable Power of Attorney become effective?

This depends on the preferences of the principal. Some choose to have it become effective immediately upon signing, while others specify that it should only become effective upon their incapacitation. This choice is clearly indicated within the document itself.

Can a Durable Power of Attorney be revoked?

Yes, as long as the principal is still competent, they can revoke their Durable Power of Attorney at any time. This revocation must be done in writing and communicated to the agent and any third parties who were relying on the document.

Is a Durable Power of Attorney from another state valid in Maryland?

Generally, Maryland will recognize a Durable Power of Attorney created in another state as long as it complies with the laws of that state or Maryland’s laws. However, it's always a good idea to consult with a legal professional to ensure validity.

What happens if someone doesn't have a Durable Power of Attorney and becomes incapacitated?

If someone becomes incapacitated without a Durable Power of Attorney in place, it may be necessary for a court to appoint a guardian or conservator to make decisions on their behalf. This process can be lengthy, expensive, and stressful for families. Having a Durable Power of Attorney can prevent this situation and ensure that the individual's affairs are managed according to their wishes.

Common mistakes

Filling out a durable power of attorney (POA) form is a crucial step in managing one's financial and legal affairs, particularly in Maryland where laws specific to these documents can navigate an individual's abilities to maintain control over their responsibilities if they become unable to do so themselves. However, people often make mistakes during this process, which can lead to undesirable outcomes. Understanding these common errors can help one ensure that their interests are protected and their wishes are clearly expressed.

Not choosing the right agent. One of the most significant mistakes is failing to pick the right person to act as their agent. This decision should not be taken lightly. The chosen agent will have considerable control over the principal's affairs, so it's critical to select someone who is not only trustworthy but also has the capability to handle financial matters competently. People sometimes choose a close friend or family member based on emotional reasons rather than assessing their ability and willingness to perform the required duties effectively.

Failing to specify limitations. Another common error is not clearly defining the agent's powers or limitations within the document. A durable POA grants broad powers to the agent, and without clear limitations, the agent could potentially make decisions that the principal might not have wanted. It’s essential to tailor the document to the principal's specific needs and wishes, including what the agent can and cannot do on the principal's behalf. This ensures the POA serves its intended purpose without giving undue power to the agent.

Overlooking the need for a successor agent. Many individuals forget to appoint a successor agent in their durable POA. If the original agent is unable or unwilling to serve, having a successor agent named ensures that the document remains effective. Without a named successor, the POA might be rendered useless at a time when it's most needed, forcing loved ones to seek court intervention to manage the principal’s affairs.

Not keeping the document updated. Circumstances change, and a durable POA made several years ago may not reflect the principal's current wishes or situation. People often make the mistake of filling out the POA form and then forgetting about it. Regularly reviewing and updating the document as necessary is crucial. Changes in relationships, financial situations, or simply a change in the principal's wishes are all valid reasons to update a POA. Failing to do so could lead to confusion or mismanagement of the principal's affairs at a critical time.

In summary, when completing a Maryland durable power of attorney form, it's vital to carefully select an agent, clearly define their powers and limitations, appoint a successor agent, and keep the document up-to-date. Avoiding these common mistakes can help ensure that the POA effectively protects the principal's interests and provides peace of mind for both the principal and their loved ones.

Documents used along the form

When preparing for future uncertainties, creating a Durable Power of Attorney (DPOA) in Maryland is a crucial step. However, to ensure comprehensive protection and clarity regarding one's wishes, several other documents are often used alongside the DPOA. These documents complement the DPOA by covering different aspects of a person’s personal, health, and financial decisions. Presented below is a list of other forms and documents typically utilized in conjunction with the Maryland Durable Power of Attorney form to provide a robust legal framework.

- Advance Directive: This document allows individuals to outline their wishes concerning medical treatment and end-of-life care if they become unable to communicate these preferences themselves. It often includes a Living Will and Health Care Proxy or Power of Attorney, specifically focusing on healthcare decisions.

- Last Will and Testament: This document outlines how a person’s property and assets are to be distributed after their death. It can appoint an executor who will manage and distribute the assets according to the documented instructions. While this operates posthumously, it's an essential complement to a DPOA that addresses control and management during the individual’s lifetime.

- Revocable Living Trust: This is a document that allows individuals to manage their assets during their lifetime and specify how these assets should be handled after their death. A revocable living trust can help avoid probate and easily transfer management to a successor trustee if the individual becomes incapacitated or passes away.

- Letter of Intent: This is a more informal document that provides additional details and instructions not covered in the legal documents. It can include the person's wishes regarding funeral arrangements or personal items of sentimental value. Although not legally binding, it serves as a guideline for the executor or personal representative.

- HIPAA Authorization Form: This form allows designated individuals to access the person’s health information. This access can be crucial for making informed medical decisions on behalf of the person if they are unable to do so themselves. It ensures that privacy laws do not hinder the health care proxy’s decision-making capacity.

In conclusion, while the Maryland Durable Power of Attorney form is a pivotal legal document for managing one's affairs, it's often part of a suite of documents designed to cover various facets of a person's life and wishes. Utilizing these complementary documents can provide a comprehensive legal strategy to ensure both financial and healthcare decisions are in trusted hands. Together, they secure a person’s legacy and health preferences, offering peace of mind to all involved.

Similar forms

The Maryland Durable Power of Attorney form is similar to various other legal documents, each designed to delegate responsibilities and outline specific duties. However, the primary similarity lies in its power to authorize someone else to act on your behalf. Let's explore a few related documents and see how they relate to the Maryland Durable Power of Attorney form.

Medical Power of Attorney: Like its durable counterpart, the Medical Power of Attorney allows you to appoint a trusted individual, known as a healthcare agent, to make medical decisions for you if you are unable to do so yourself. While the Durable Power of Attorney covers a broad scope of authority, including financial and legal matters, the Medical Power of Attorney is specifically focused on healthcare decisions. Both documents share the common purpose of ensuring your wishes are followed when you're not in a position to voice them yourself.

General Power of Attorney: This document also authorizes someone to act on your behalf, but unlike the durable or medical types, the General Power of Attorney's powers cease if the principal becomes incapacitated. This is a key distinction; the "durable" in Durable Power of Attorney means the document remains in effect even if the principal loses the ability to make decisions. The Maryland Durable Power of Attorney form ensures your appointed agent can continue to act for you, particularly when it's most needed.

Living Will: Often confused with a Medical Power of Attorney, a Living Will is another document that comes into play under dire health circumstances. While it does not appoint an agent, it provides specific instructions regarding end-of-life care. In contrast, a Durable Power of Attorney for healthcare decisions (a type of Medical Power of Attorney) allows someone else to make those decisions for you if you can't make them yourself. Both serve critical roles in managing your healthcare preferences, but they do so in markedly different ways.

Dos and Don'ts

Filling out the Maryland Durable Power of Attorney (DPOA) form is a significant step in planning for future financial management. To ensure the process is done correctly, some guidelines are helpful to follow. Here's a concise list of dos and don'ts:

What You Should Do:- Review the form carefully. Understand each section to ensure the decisions you make accurately reflect your wishes.

- Choose a trustworthy agent. This person will have considerable control over your finances, so it’s crucial they are reliable and capable.

- Be specific about powers granted. Clearly outline what your agent can and cannot do to prevent any misuse of authority.

Discuss your decision. It’s vital to talk with the person you intend to name as your agent to ensure they’re willing and able to take on the responsibilities.- Sign in the presence of a notary. The Maryland DPOA needs to be notarized to be legally valid, so make sure to complete this crucial step.

- Don’t rush the process. Take your time to fill out the form accurately and reflect on your choices.

- Avoid using vague language. Be as precise as possible to ensure your wishes are clearly understood and there are no ambiguities.

- Don’t forget to specify a successor agent. In case your first choice cannot serve, having an alternate ensures your affairs are still managed according to your wishes.

- Refrain from not discussing your plans with family. Though not a requirement, informing family members of your decisions can prevent conflicts later on.

- Don’t neglect to review and update the document. Life changes such as marriages, divorces, and the birth of children can affect your choices, so keep your DPOA current.

Misconceptions

Many misconceptions surround the Maryland Durable Power of Attorney (DPOA) form, leading to confusion and sometimes even the misuse of this vital legal document. Below, we debunk some of the most common myths to provide clearer understanding and better guidance.

- It takes effect immediately after signing. While this can be true, the Maryland DPOA does not automatically become effective as soon as it is signed. The person who creates the DPOA, known as the principal, can specify that it only becomes effective upon a certain condition, usually upon the principal's incapacity.

- It's only for the elderly. This misconception might deter younger individuals from preparing a DPOA. In reality, adults of any age can benefit from having a DPOA, as it provides a mechanism for managing one's affairs in the event of unexpected illness or incapacitation.

- Creating a DPOA means losing control over your finances and property immediately. The truth is that a DPOA allows the principal to define the extent of power granted to the agent, which can be as limited or as broad as the principal chooses. The principal also retains the right to revoke or change the DPOA as long as they are competent.

- A spouse automatically has the same authority as a Durable Power of Attorney. Marriage alone does not grant one spouse legal authority over the other's finances or health decisions in Maryland. A DPOA is necessary to legally authorize a spouse to act on the other's behalf in specific matters.

- All DPOAs are the same. Contrary to this belief, DPOAs can be customized to fit the specific needs and preferences of the individual, including setting limits on the agent's powers and specifying which decisions they can make.

- You can sign a DPOA on someone else’s behalf. Legally, the individual creating the DPOA must have the capacity to understand the document and must sign it themselves, or at their clear direction, in the presence of a notary. Signing for someone else without their express consent and understanding is not valid.

- A DPOA is valid after death. DPOAs are only effective during the lifetime of the principal. Upon the principal's death, the executor or personal representative named in the will takes over, or if there's no will, state law dictates the process for handling the deceased's estate.

- Only family members can be named as agents. While family members are often chosen, the principal can select any trusted adult, including friends or professional advisors, to act as their agent under a DPOA.

- Once a DPOA is created, it cannot be changed. As long as the principal is competent, they can revoke or amend their DPOA at any time. It's advisable to review and possibly update a DPOA periodically, especially after major life events.

Clarifying these misconceptions about the Maryland Durable Power of Attorney form is crucial for effectively managing one's future health and financial decisions. By understanding the specifics of how DPOAs work, individuals can make informed decisions that best suit their needs and circumstances.

Key takeaways

Filling out and using the Maryland Durable Power of Attorney (POA) form is an important step in planning for future financial management and healthcare decision-making. This legal document allows you to appoint someone you trust to manage your affairs if you're unable to do so. Here are key takeaways to keep in mind:

- Understanding the form is crucial. The Maryland Durable Power of Attorney form empowers another individual, known as the agent, to make decisions on behalf of the principal (the person creating the POA). This form remains effective even if the principal becomes incapacitated, hence the term "durable."

- Choose your agent wisely. The individual you appoint as your agent should be someone trustworthy and capable of handling financial and legal matters responsibly. It's also advisable to discuss your expectations with your agent before finalizing the document to ensure they're willing and able to act on your behalf.

- Be specific about powers granted. The Maryland Durable POA form allows you to specify exactly what powers your agent will have. These can range from managing bank accounts to making healthcare decisions. Clearly outlining these powers can prevent confusion and misuse of authority.

- Legal requirements must be met. For a Durable Power of Attorney to be valid in Maryland, certain legal requirements, such as proper signing and witnessing, must be fulfilled. It's recommended to consult with a legal professional to ensure that the form complies with Maryland law and to fully understand its implications.

Completing a Durable Power of Attorney form is a proactive measure to protect your interests. By considering these key takeaways, you can make informed decisions that ensure your affairs are managed according to your wishes, even in unforeseen circumstances.

More Durable Power of Attorney State Forms

Arizona Durable Power of Attorney - It's vital to choose someone trustworthy as your agent, as they will have significant power over your affairs.

Poa Papers - A smart choice for anyone wanting to have a plan in place for unanticipated events.

Power of Attorney Form Kansas - It is a legally binding document that requires proper execution and notarization to be valid.

Power of Attorney Rhode Island - Decision-making authority can include, but is not limited to, handling business operations, making gifts, and hiring professional services on behalf of the principal.