Attorney-Verified Durable Power of Attorney Document for Massachusetts

The Massachusetts Durable Power of Attorney Form stands as a cornerstone in planning for future financial management and decision-making. In the face of uncertainty, it provides individuals with the comfort of knowing that their affairs will be in capable hands, chosen by them, should they become unable to manage on their own. This document, imbued with legal force, allows a person, the principal, to appoint an agent or attorney-in-fact to make financial decisions on their behalf. Its durability means that the agent’s power remains effective even if the principal loses capacity due to health issues or accidents. Unlike some legal instruments that may seem ephemeral in the face of changing circumstances, the durability aspect ensures continuity and stability across unpredictable life events. Structured to be comprehensive, yet specific, the form requires careful consideration of the powers granted to the agent, highlighting the importance of trust and communication in these decisions. It addresses various facets of one's financial life, from routine transactions to the management of real estate and investments, ensuring that the scope of authority can be tailored to fit the principal's needs and preferences. Given the form's legal implications and the potential ramifications of the decisions made within it, the drafting process encourages thoughtful deliberation, often with the guidance of legal counsel, to ensure that the document accurately reflects the principal’s wishes and adheres to Massachusetts law.

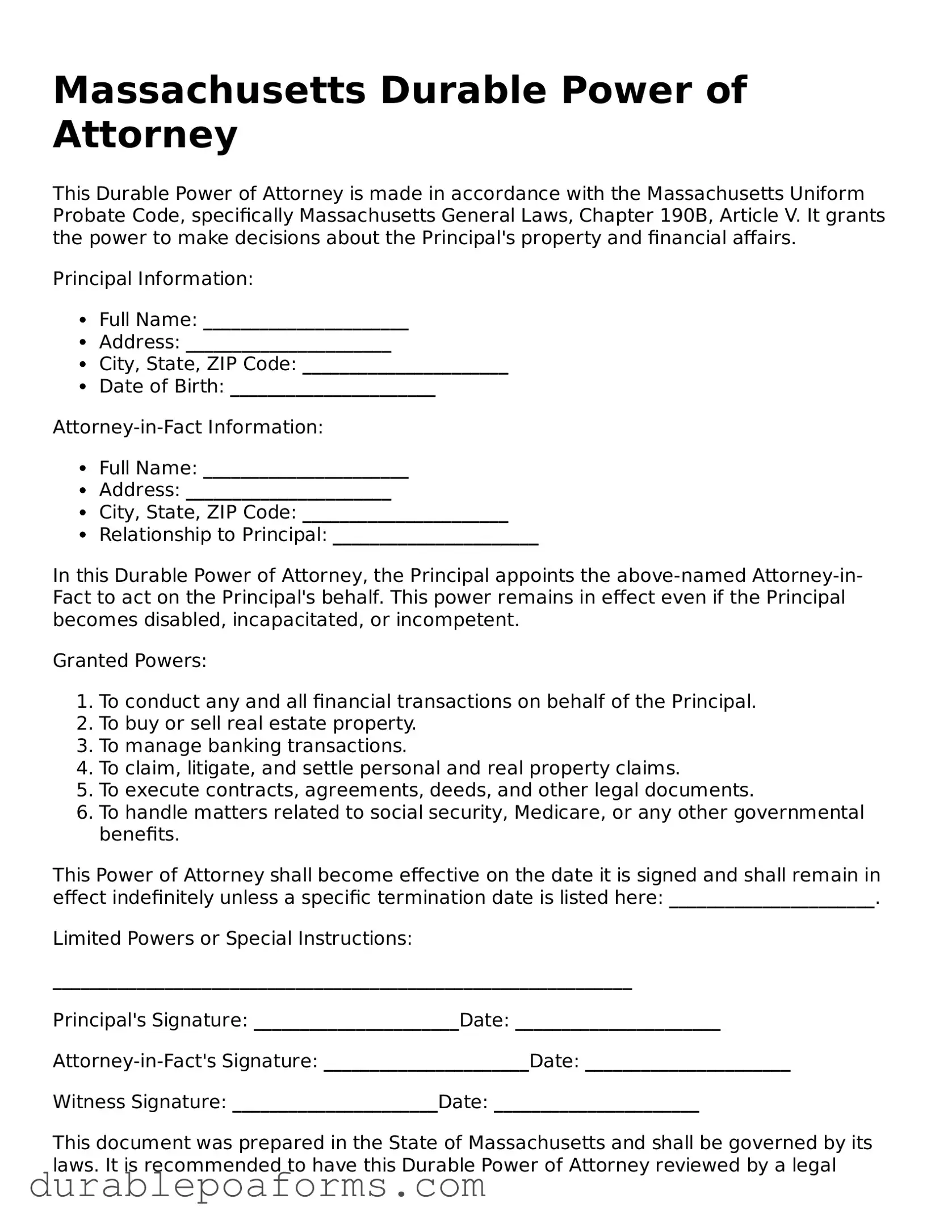

Form Preview

Massachusetts Durable Power of Attorney

This Durable Power of Attorney is made in accordance with the Massachusetts Uniform Probate Code, specifically Massachusetts General Laws, Chapter 190B, Article V. It grants the power to make decisions about the Principal's property and financial affairs.

Principal Information:

- Full Name: ______________________

- Address: ______________________

- City, State, ZIP Code: ______________________

- Date of Birth: ______________________

Attorney-in-Fact Information:

- Full Name: ______________________

- Address: ______________________

- City, State, ZIP Code: ______________________

- Relationship to Principal: ______________________

In this Durable Power of Attorney, the Principal appoints the above-named Attorney-in-Fact to act on the Principal's behalf. This power remains in effect even if the Principal becomes disabled, incapacitated, or incompetent.

Granted Powers:

- To conduct any and all financial transactions on behalf of the Principal.

- To buy or sell real estate property.

- To manage banking transactions.

- To claim, litigate, and settle personal and real property claims.

- To execute contracts, agreements, deeds, and other legal documents.

- To handle matters related to social security, Medicare, or any other governmental benefits.

This Power of Attorney shall become effective on the date it is signed and shall remain in effect indefinitely unless a specific termination date is listed here: ______________________.

Limited Powers or Special Instructions:

______________________________________________________________

Principal's Signature: ______________________Date: ______________________

Attorney-in-Fact's Signature: ______________________Date: ______________________

Witness Signature: ______________________Date: ______________________

This document was prepared in the State of Massachusetts and shall be governed by its laws. It is recommended to have this Durable Power of Attorney reviewed by a legal advisor familiar with Massachusetts laws to ensure compliance and address any state-specific requirements.

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Massachusetts Durable Power of Attorney form allows an individual (the principal) to appoint someone else (the agent) to manage their financial affairs on their behalf, even if the principal becomes incapacitated. |

| Governing Law | This form is governed by Chapter 190B, Article 5, Sections 5-501 to 5-507 of the Massachusetts General Laws (M.G.L. ch. 190B, §§ 5-501 to 5-507), which outlines the requirements and powers related to durable powers of attorney. |

| Duration | It remains effective even if the principal becomes incapacitated, distinguishing it from a non-durable power of attorney, which becomes invalid if the principal loses the ability to make decisions. |

| Agent's Powers | The agent can be granted a wide range of financial powers, including but not limited to handling bank transactions, managing real estate, investing, and executing contracts on behalf of the principal. |

| Revocation | The principal has the right to revoke the durable power of attorney at any time, as long as they are mentally competent. Revocation must be done in writing and communicated to the agent and any third parties relying on the document. |

Massachusetts Durable Power of Attorney - Usage Guide

Filling out a Durable Power of Attorney (POA) form in Massachusetts is a critical step in planning for future financial management. This document allows a person to appoint an agent to handle financial matters on their behalf, should they become incapacitated. It's important to approach this process with attention to detail, ensuring that all information provided is accurate and reflects the current wishes of the person filling out the form. Following a step-by-step guide can help streamline the process, making it easier to understand and complete.

Here are the steps needed to fill out the Massachusetts Durable Power of Attorney form:

- Download the official Massachusetts Durable Power of Attorney form from a reliable source or obtain a copy from an attorney.

- Read through the form carefully to understand all sections and instructions.

- Enter the full legal name and address of the person granting the power, known as the Principal, in the designated section at the beginning of the form.

- Provide the full legal name and address of the person being granted the power, known as the Agent or Attorney-in-Fact, in the appropriate field.

- Review the powers listed on the form that the Agent will have. These typically include handling financial and real estate transactions, managing bank accounts, and more. Initial next to each power you are granting to the Agent, or initial the section that grants all powers listed.

- If there are specific powers you wish to withhold from the Agent, clearly detail these in the designated section of the form.

- Decide if the POA will become effective immediately or upon a certain event, such as the Principal's incapacity, and mark the appropriate option on the form.

- If required, specify the termination date for the POA or the conditions under which it will end. Some choose to have the POA remain in effect indefinitely, unless revoked.

- Sign and date the form in the presence of a notary public, and have the notary public complete their section, confirming the identity of the Principal.

- If the form requires witness signatures, ensure two witnesses sign the form, adhering to Massachusetts requirements regarding who may serve as a witness.

- Provide the Agent with a copy of the signed form and keep the original in a safe but accessible place. Also, consider giving copies to financial institutions and anyone else who might need to recognize the Agent's authority.

After completing these steps, the Durable Power of Attorney form is legally effective and the Agent has the authority to act on behalf of the Principal, within the scope of the powers granted. It's advisable to review and potentially update this document periodically, or if significant life events occur that might affect its provisions or relevancy.

Common Questions

What exactly is a Massachusetts Durable Power of Attorney form?

A Massachusetts Durable Power of Attorney (DPOA) form is a legal document that grants someone the authority to act on your behalf in financial matters if you become incapacitated or unable to do so yourself. Unlike a standard Power of Attorney, it remains effective even if you lose mental capability. The person you appoint is called the "agent" or "attorney-in-fact", and they can handle tasks such as paying bills, managing investments, and making real estate transactions in your stead.

How do I choose an agent for my Durable Power of Attorney in Massachusetts?

Choosing an agent is a critical decision. It should be someone you trust implicitly, such as a close family member or a longtime friend. Consider their ability to handle financial matters wisely and their willingness to take on this responsibility. It's also recommended to discuss your expectations with them before making it official to ensure they're comfortable acting in this capacity. Additionally, you may want to name a successor agent in case your primary choice is unable or unwilling to serve when needed.

Do I need a lawyer to create a Durable Power of Attorney in Massachusetts?

While it is not legally required to have a lawyer to create a Durable Power of Attorney in Massachusetts, consulting with one can provide valuable guidance. A lawyer can ensure your document complies with state laws, meets your specific needs, and addresses any complex financial situations you might have. However, there are also do-it-yourself templates available, but it's essential to ensure they are up-to-date and state-specific.

How can I revoke a Durable Power of Attorney in Massachusetts?

You can revoke your Durable Power of Attorney at any time, as long as you are mentally competent. To do so, you should provide a written notice to your current agent and any institutions or parties they have interacted with on your behalf. This notice should state your intention to revoke the power of attorney. It's also a good practice to destroy all copies of the old power of attorney document to prevent confusion. If you wish, you can then create a new Durable Power of Attorney to replace the old one.

Common mistakes

When individuals fill out a Massachusetts Durable Power of Attorney form, it's essential to approach the task with caution and thoroughness. However, common mistakes often occur, which can lead to significant legal consequences. By understanding these pitfalls, individuals can better prepare themselves to create a document that accurately reflects their wishes and stands up to legal scrutiny. Here are several mistakes to avoid:

Not specifying the powers granted: A prevalent mistake is failing to clearly articulate the scope of authority granted to the agent. Without specific details, it might lead to confusion or abuse of power. The document should precisely outline what the agent can and cannot do on behalf of the principal.

Choosing the wrong agent: The appointment of an agent requires careful consideration. Selecting someone who is not trustworthy or lacks the ability to handle financial matters wisely can result in mismanagement of the principal's assets.

Ignoring the need for witnesses and notarization: In Massachusetts, for a Durable Power of Attorney to be legally valid, it must be signed in the presence of two witnesses and notarized. Overlooking this requirement can render the document unenforceable.

Lack of specificity regarding gifts: If the principal intends for the agent to have the authority to make gifts on their behalf, this must be explicitly stated. Without this provision, the agent’s ability to make gifts could be severely restricted.

Forgetting to specify a successor agent: Failing to designate a successor agent leaves a gap in planning, should the initial agent be unable or unwilling to serve. It's crucial to have a backup to ensure continuous management of affairs.

Not considering the durability clause: While the term "durable" implies that the Power of Attorney will remain in effect even if the principal becomes incapacitated, the document must explicitly state this to avoid any ambiguity regarding its effectiveness.

Assuming one form fits all: Massachusetts residents might think one standard form is suitable for everyone, which is not the case. The form should be tailored to fit the specific needs and circumstances of the principal.

Failing to review and update the document: Circumstances change, and a Durable Power of Attorney should reflect the principal's current wishes. Regular reviews and updates are necessary to ensure its relevancy.

Neglecting to discuss the document with the appointed agent: Not discussing the responsibilities and expectations with the agent can lead to misunderstandings and mismanagement. Open communication is key to ensuring that the agent fully understands their role and duties.

Avoiding these mistakes requires attention to detail and a comprehensive understanding of the form's requirements and implications. When filled out correctly and thoughtfully, a Massachusetts Durable Power of Attorney can provide peace of mind, knowing that the principal's financial matters will be handled according to their wishes, even in times of incapacity.

Documents used along the form

When preparing for the future, particularly in matters of health and finances, it is prudent to have all necessary legal documents in order. A Massachusetts Durable Power of Attorney (DPOA) form is a critical document that empowers another individual to make decisions on one's behalf should they become unable to do so themselves. However, the DPOA is often just one part of a larger set of documents that are essential for comprehensive planning. Below is a list of other forms and documents that are frequently used alongside the Massachusetts Durable Power of Attorney, each serving its unique purpose in a person's legal and healthcare planning strategy.

- Health Care Proxy: This form designates another person as the agent responsible for making health care decisions if the individual is incapable of making those decisions themselves.

- Living Will: Sometimes referred to as an advance directive, it outlines an individual's preferences regarding end-of-life care, complementing the functions of a Health Care Proxy.

- Will: A legal document specifying how an individual's property and affairs should be handled after death.

- Trust: A fiduciary arrangement that allows a third party, or trustee, to hold assets on behalf of a beneficiary or beneficiaries, potentially avoiding probate.

- HIPAA Authorization Form: Authorizes the release of an individual's health information to designated persons, crucial for agents under a Health Care Proxy or DPOA to make informed decisions.

- Declaration of Homestead: Protects a portion of an individual's home value from creditors.

- Personal Property Memorandum: Often accompanies a will to specify the distribution of tangible personal property not otherwise designated in the will.

- Funeral Planning Declaration: Allows an individual to outline their preferences for funeral arrangements and designate an agent to carry out these wishes.

- Financial Statement: While not a legal document, maintaining a recent financial statement can assist the agent appointed under a DPOA in managing financial matters efficiently.

- Letter of Intent: A non-binding document that provides additional context and guidance for the executors and beneficiaries of an estate, potentially covering everything from the rationale behind distributions to personal messages.

Together, these documents create a safety net that covers a wide array of situations, from medical emergencies to the distribution of assets upon death. It is vital to consult with legal professionals to ensure that each document is properly executed and reflects the current legal requirements of Massachusetts. Proper planning with these documents in place offers peace of mind, knowing that one's affairs are arranged according to their wishes and that they are prepared for the future, however uncertain it may be.

Similar forms

The Massachusetts Durable Power of Attorney form is similar to other estate planning documents that designate representatives and specify wishes in various circumstances. However, each document serves a different, albeit occasionally overlapping, purpose. Among these are the Healthcare Proxy, Will, and Living Trust. While all these documents involve planning for future events and designating representatives, they differ in focus and scope.

The Healthcare Proxy is similar to the Durable Power of Attorney (DPOA) in that it allows one to appoint a representative to make healthcare decisions on one's behalf should they become unable to do so themselves. The key similarity is the foundational concept of appointing someone else to act in your best interests. However, while a DPOA typically covers a wide range of legal and financial actions the appointed person can take, a Healthcare Proxy is specifically limited to medical decisions, underlining its narrower scope.

Will, also known as a Last Will and Testament, is another document that shares a commonality with the DPOA, particularly in its function of designating individuals to handle one's affairs. The significant similarity lies in the aspect of appointing a representative—through a Will, one appoints an executor to manage estate matters after death. Unlike the DPOA, which is effective during the individual’s lifetime, especially in the event of incapacitation, a Will comes into effect only after the person’s death, covering the distribution of assets rather than managing healthcare or financial decisions while the individual is alive.

Living Trust, similar to a DPOA, involves managing and protecting assets. A Living Trust allows one to appoint a trustee to manage their assets for the benefit of chosen beneficiaries, which mirrors the DPOA’s concept of appointing an agent to handle one's financial affairs. The distinction, however, lies in the Living Trust’s focus on providing a means to bypass probate, manage assets during one's lifetime and after death, and offering a degree of privacy not available through a DPOA. Moreover, while a DPOA ceases to be effective upon the individual’s death, a Living Trust continues to operate following the terms set out by the creator.

Dos and Don'ts

Filling out a Massachusetts Durable Power of Attorney Form is a significant step in managing your affairs and ensuring that your wishes are honored, should you become unable to make decisions for yourself. The process can be complex, but understanding both what to do and what not to do can make it smoother and more effective. Here are some key points to consider.

Do:

- Choose a trusted individual as your agent. This person should be someone you trust implicitly to make decisions in your best interest.

- Be specific about the powers you are granting. Ensure the document clearly outlines what your agent can and cannot do on your behalf.

- Consider a consultation with an attorney. Although not required, speaking with a legal professional who is familiar with Massachusetts law can provide valuable guidance.

- Sign in the presence of a notary public. This step is essential for the document to be legally binding in Massachusetts.

Don't:

- Procrastinate. Waiting until an emergency arises to create this crucial document can leave your affairs in limbo and your loved ones in a difficult situation.

- Forget to inform your agent. Make sure the person you've chosen knows they've been appointed and understands the responsibilities involved.

- Overlook the need for witnesses. While the laws vary, having witnesses sign can add an additional layer of validity to the document.

- Ignore reviewing and updating the document. Circumstances change, so it’s important to revisit and potentially revise your durable power of attorney as needed.

Misconceptions

Understanding the Massachusetts Durable Power of Attorney (DPOA) is crucial for effectively managing one's affairs. However, there are common misconceptions that can confuse individuals. Below are six misconceptions clarified to help in understanding the DPOA more clearly.

It grants immediate control over all matters. Many believe that by signing a DPOA, they are immediately handing over their rights. In reality, the document specifies when the powers become effective, and the principal can restrict or specify the types of decisions the agent can make.

The agent can do whatever they want. Even though the agent has significant powers, they are legally obligated to act in the principal's best interests. Their actions are limited to the scope defined in the DPOA document.

It's only for the elderly or terminally ill. A common misconception is that DPOAs are only necessary for those in declining health. However, any adult can benefit from having a DPOA as unpredictable situations can arise at any time.

A DPOA and a will are the same. Unlike a will, which provides instructions after one's death, a DPOA is effective during the principal’s lifetime, particularly if they become unable to make decisions for themselves.

Creating a DPOA is complicated and expensive. The process can be straightforward with the right guidance. There are resources available to make creating a DPOA accessible and affordable.

Once signed, it is permanent. A principal has the right to revoke or change their DPOA as long as they are mentally competent. It's recommended to review and possibly update the document regularly.

Key takeaways

Understanding and correctly filling out the Massachusetts Durable Power of Attorney form is essential for ensuring that your financial matters are handled according to your wishes, especially in scenarios where you may not be able to manage them yourself. Here are key takeaways to consider:

A Durable Power of Attorney in Massachusetts allows you to appoint an agent or attorney-in-fact to make financial decisions on your behalf. This authority can take effect immediately and continues even if you become incapacitated.

Choosing your agent wisely cannot be overstated. This person should be someone you trust implicitly, as they will have broad powers to manage your financial affairs, including but not limited to, buying or selling property, managing bank accounts, and handling tax matters.

The form must be filled out clearly and without any ambiguity. Ensure that the full legal names of all parties involved are used and that their roles are clearly defined.

To be legally binding, the Massachusetts Durable Power of Attorney form requires your signature and the signatures of two witnesses. All parties involved should be over the age of 18 and mentally competent at the time of signing.

It’s highly recommended to have the form notarized, even if not explicitly required by Massachusetts law. Notarization adds a layer of verification and can help prevent challenges to the document’s authenticity.

Review and update your Durable Power of Attorney as needed. Life changes such as marriage, divorce, the death of a designated agent, or a change in your wishes are all reasons to update your documents.

Lastly, once the form is completed, give your agent a copy and inform them of their appointment. It’s also important to store the document in a safe, accessible place and let trusted family members or friends know where it is, in case it needs to be accessed quickly.

Properly completing the Durable Power of Attorney form ensures that your financial matters will be managed according to your wishes, providing peace of mind for you and your loved ones. If you find the process daunting, consider seeking the guidance of a legal professional to help navigate the specifics of Massachusetts law and ensure that the form meets all legal requirements.

More Durable Power of Attorney State Forms

Maryland Power of Attorney - This document should be stored in a safe but accessible place, and relevant parties, like financial institutions, should be informed of its existence.

Power of Attorney Form Idaho - It can cover a broad range of activities, from paying bills to selling real estate on your behalf.

Louisiana Power of Attorney Template - The agent's authority under a Durable Power of Attorney is immediately effective upon signing, prepared for any sudden health changes.

Power of Attorney Form North Dakota - It is particularly important for unmarried couples, as it grants the partner rights that might not be recognized otherwise in times of crisis.