Attorney-Verified Durable Power of Attorney Document for Minnesota

In the landscape of legal documents that safeguard individuals' rights and intentions, the Minnesota Durable Power of Attorney form stands out for its critical role in estate planning and personal welfare. This form enables a person to appoint another, known as an agent, to manage their financial affairs, possibly extending beyond the principal's incapacity. Unlike a general power of attorney, its durability ensures that the agent's authority persists even when the principal can no longer make decisions due to health reasons. Such documents are tailored to meet Minnesota's specific legal standards, requiring careful consideration of the form's content and the powers granted within. As individuals prepare for future uncertainties, understanding the nuances of this form becomes paramount in ensuring that their financial matters are managed according to their wishes, under any circumstance.

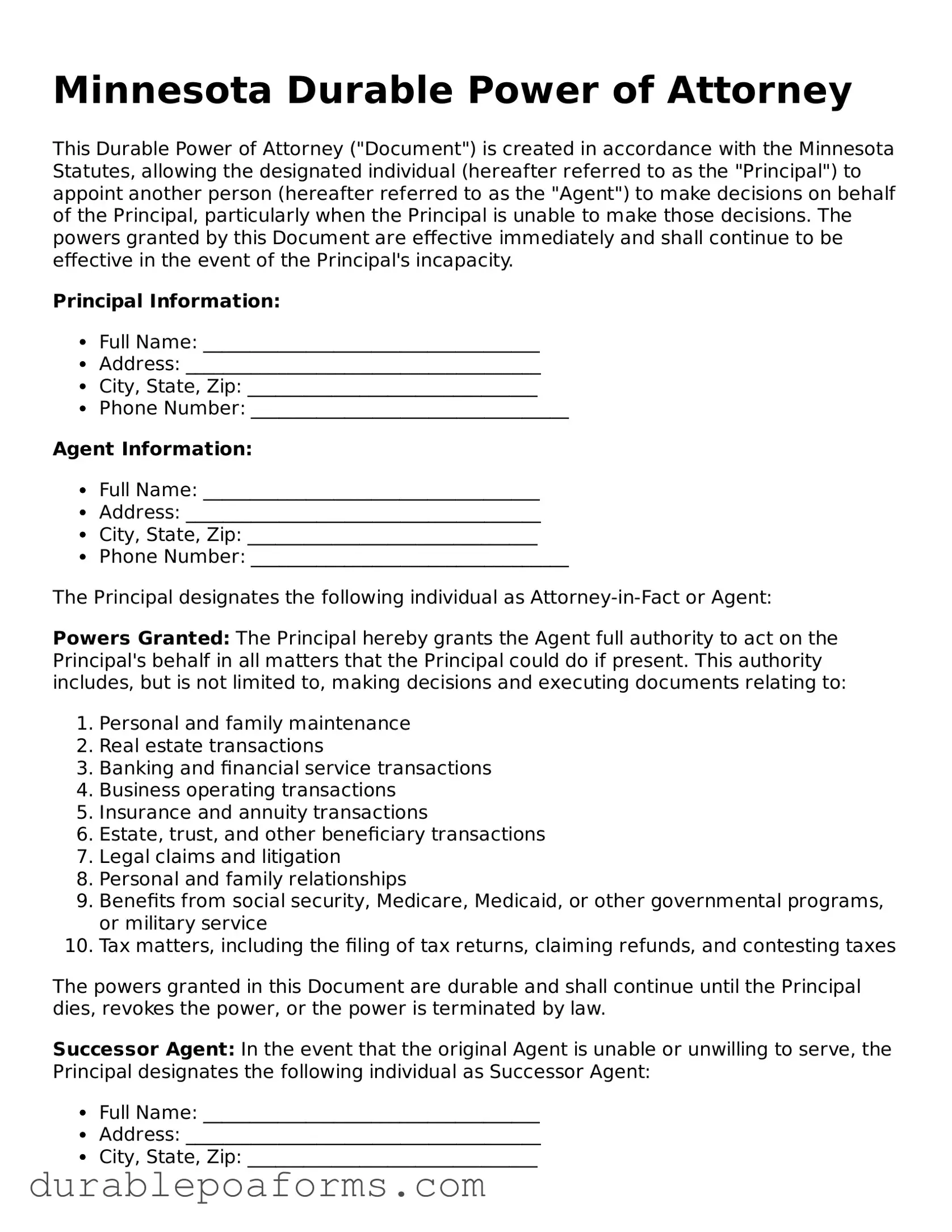

Form Preview

Minnesota Durable Power of Attorney

This Durable Power of Attorney ("Document") is created in accordance with the Minnesota Statutes, allowing the designated individual (hereafter referred to as the "Principal") to appoint another person (hereafter referred to as the "Agent") to make decisions on behalf of the Principal, particularly when the Principal is unable to make those decisions. The powers granted by this Document are effective immediately and shall continue to be effective in the event of the Principal's incapacity.

Principal Information:

- Full Name: ____________________________________

- Address: ______________________________________

- City, State, Zip: _______________________________

- Phone Number: __________________________________

Agent Information:

- Full Name: ____________________________________

- Address: ______________________________________

- City, State, Zip: _______________________________

- Phone Number: __________________________________

The Principal designates the following individual as Attorney-in-Fact or Agent:

Powers Granted: The Principal hereby grants the Agent full authority to act on the Principal's behalf in all matters that the Principal could do if present. This authority includes, but is not limited to, making decisions and executing documents relating to:

- Personal and family maintenance

- Real estate transactions

- Banking and financial service transactions

- Business operating transactions

- Insurance and annuity transactions

- Estate, trust, and other beneficiary transactions

- Legal claims and litigation

- Personal and family relationships

- Benefits from social security, Medicare, Medicaid, or other governmental programs, or military service

- Tax matters, including the filing of tax returns, claiming refunds, and contesting taxes

The powers granted in this Document are durable and shall continue until the Principal dies, revokes the power, or the power is terminated by law.

Successor Agent: In the event that the original Agent is unable or unwilling to serve, the Principal designates the following individual as Successor Agent:

- Full Name: ____________________________________

- Address: ______________________________________

- City, State, Zip: _______________________________

- Phone Number: __________________________________

Signatures: This Document must be signed by the Principal and either notarized or witnessed by two adults who are not the Agent or related to the Principal by blood or marriage. The signatures below constitute acceptance of this appointment according to the Minnesota Statutes.

Principal's Signature: ___________________________ Date: ____________

Agent's Signature: _______________________________ Date: ____________

Successor Agent's Signature: _____________________ Date: ____________

State of Minnesota

County of ___________________

This document was acknowledged before me on (date) ______________ by (name of Principal) ____________________________.

_________________________________

(Signature of Notarial Officer)

Notary Public for the State of Minnesota

My commission expires: ______________

Form Specifications

| Fact Number | Detail |

|---|---|

| 1 | Minnesota's durable power of attorney allows a person to designate another individual to make financial decisions on their behalf. |

| 2 | This form remains in effect even if the principal becomes incapacitated, ensuring continuous management of their affairs. |

| 3 | The durable power of attorney can be revoked by the principal at any time, as long as they are mentally competent. |

| 4 | Choosing an agent requires careful consideration since this individual will have broad authority over the principal's financial matters. |

| 5 | The document needs to be signed by the principal and notarized to be legally binding in Minnesota. |

| 6 | Minnesota Statutes, Section 523.23, provides the legal basis for the creation and use of a durable power of attorney in the state. |

| 7 | The agent must act in the principal's best interest, maintaining a fiduciary duty to manage the principal's finances prudently. |

| 8 | It is possible to name a successor agent in the document, ensuring continuity in management if the primary agent cannot serve. |

| 9 | The powers granted through this document can be as broad or limited as the principal desires, specified at the time of creation. |

| 10 | A durable power of attorney for finances is distinct from a medical power of attorney, which covers health care decisions. |

Minnesota Durable Power of Attorney - Usage Guide

Creating a Durable Power of Attorney in Minnesota is an important step in managing your affairs. This document allows you to appoint someone you trust to handle your financial and legal matters in case you're unable to do so yourself due to illness or incapacity. While the thought of filling out legal forms can be daunting, the process is straightforward when you understand what information is required. Following these step-by-step instructions will help ensure that your Durable Power of Attorney form is filled out correctly and legally binding.

- Gather all necessary information, including your full legal name, address, and the full legal name and address of the person you are appointing as your attorney-in-fact (the individual who will make decisions on your behalf).

- Read through the entire form first to familiarize yourself with its sections and what each requires.

- Start by entering your full legal name and address at the top of the form, where it designates space for the principal's information—that's you.

- In the section designated for the appointment of your attorney-in-fact, enter the full legal name and address of the person you have chosen for this role. Ensure the information is accurate to avoid any future confusion.

- Review the powers you are granting to your attorney-in-fact. These are usually listed in a series of statements or clauses on the form. If there are any powers you do not wish to grant, you may need to initial next to each specific clause to indicate this decision.

- If the form includes a section for special instructions, use this space to detail any specific limitations or conditions you want to apply to the powers granted to your attorney-in-fact.

- Locate the section on the form that specifies the durability of the power of attorney. Ensure it states that the power remains in effect even in the event of your incapacity. This is essential for a Durable Power of Attorney.

- Check if the form requires you to fill in the date when the powers granted will become effective. If so, write this date clearly in the designated space.

- Review the entire form to ensure all information provided is accurate and no sections have been missed.

- Sign and date the form in the designated areas. Your signature may need to be witnessed or notarized, depending on state requirements. Make sure to comply with these requirements to ensure the form’s validity.

- If required, have your attorney-in-fact sign the form to acknowledge their acceptance of the responsibilities being assigned to them.

- Store the completed form in a safe place and provide copies to your attorney-in-fact, family members, or anyone else who may need to know of its existence.

By carefully following these steps, you can smoothly navigate the process of establishing a Durable Power of Attorney in Minnesota. This document plays a crucial role in ensuring your affairs can be managed according to your wishes, even if you cannot oversee them yourself. Taking the time to complete this form accurately offers peace of mind to you and your loved ones.

Common Questions

What is a Durable Power of Attorney in Minnesota?

A Durable Power of Attorney in Minnesota is a legal document that allows an individual, known as the principal, to designate another person, referred to as the agent or attorney-in-fact, to manage their financial affairs. This designation remains effective even if the principal becomes incapacitated. This ensures that the principal's financial matters can be taken care of without court intervention.

How does one create a Durable Power of Attorney in Minnesota?

To create a Durable Power of Attorney in Minnesota, the principal must complete a power of attorney document that meets the state’s legal requirements. This includes stating explicitly that the power granted is “durable” in nature. The document must be signed by the principal, and typically, it must be notarized or witnessed as required by Minnesota law to be legally valid. It is recommended to seek legal advice to ensure the document meets all legal standards and fully represents the principal's wishes.

Who should be chosen as an agent in a Durable Power of Attorney?

When choosing an agent for a Durable Power of Attorney, it's essential to select someone who is trustworthy, reliable, and capable of managing financial affairs. This person could be a close family member, a trusted friend, or a professional advisor. The principal should have confidence in the agent's integrity and judgment, as they will be making decisions that could impact the principal's financial well-being.

Can a Durable Power of Attorney in Minnesota be revoked?

Yes, a Durable Power of Attorney in Minnesota can be revoked at any time by the principal as long as they are mentally competent. To revoke the power, the principal needs to provide a written notice to the agent and to any institutions or parties that were relying on the original power of attorney. It's also beneficial to notify these parties through a formal revocation document and retrieve any copies of the original power of attorney to prevent further use.

What happens if there is no Durable Power of Attorney in place and the principal becomes incapacitated?

If there is no Durable Power of Attorney in place and the principal becomes incapacitated, it may be necessary for a court to appoint a conservator or guardian to manage the principal’s affairs. This process can be lengthy, costly, and stressful for family members. Having a Durable Power of Attorney in place helps to avoid this process, allowing the agent to act on the principal's behalf without court intervention.

Common mistakes

The Minnesota Durable Power of Attorney form is a legal document designed to grant someone else the authority to act on your behalf, particularly in decisions related to financial matters. This form, when filled out properly, can be an effective tool in planning for the future. However, people often make mistakes when completing this document, which can lead to unintended consequences or even invalidate the form. Understanding these common pitfalls can help individuals in ensuring their wishes are accurately and effectively documented.

Not choosing the right agent: The choice of an agent (or attorney-in-fact) is crucial. People sometimes select an agent without considering if the individual is trustworthy, financially savvy, and willing to take on the responsibilities. It’s important to select someone who you trust implicitly and who has the requisite skills to manage your affairs.

Lack of specificity in granted powers: The form allows you to specify the exact powers you grant to your agent. A common mistake is being too vague or too broad in this section. It’s better to be clear and detailed about what your agent can and cannot do.

Ignoring the need for alternates: Life is unpredictable. The initially chosen agent might not always be available or willing to serve. Failing to name an alternate agent leaves you unprotected if your first choice can no longer fulfill their duties.

Not having the document properly witnessed or notarized: The requirements for a valid Durable Power of Attorney vary from state to state. In Minnesota, the form must be notarized or witnessed by two non-related, competent adults. Overlooking this step can render the document invalid.

Omitting the durational term: If the document is supposed to have a specific start or end date, failing to include these details can create confusion. Some might desire the document to take effect immediately, while others might want it to commence upon incapacity. Clearly state your preferences.

Failing to communicate with the chosen agent: Merely completing the form without discussing it with the appointed agent can lead to problems. It’s vital that the agent understands their responsibilities and agrees to them beforehand.

Not keeping the document accessible: After finalizing the form, storing it in a secure, yet accessible location is important. If the document can’t be found when needed, its existence is of little use.

Forgetting to update the document: Life changes such as divorce, death, or estrangement can affect your choice of agent. Regularly review and update the form as necessary to reflect your current preferences and circumstances.

DIY without legal guidance: While many opt to complete the form themselves to save on cost, consulting with a legal professional can prevent common mistakes and ensure the document’s effectiveness and legality.

In summary, the Minnesota Durable Power of Attorney is a powerful tool for managing your affairs, but it requires careful attention to detail when being filled out. Avoiding these common mistakes can ensure that the document fulfills its intended purpose, granting peace of mind to both the principal and the agent. For many, seeking professional legal advice can provide additional assurance that all bases are covered.

Documents used along the form

When preparing for future uncertainties, it is wise to have a comprehensive legal plan. The Minnesota Durable Power of Attorney (DPOA) form plays a pivotal role in this planning, granting someone you trust the authority to handle your affairs if you're unable to do so. However, to ensure all aspects of your well-being and estate are thoroughly covered, several other forms and documents should also be considered. These documents not only complement the DPOA but also help in addressing different areas of your personal and financial life. Let’s explore a few of these essential forms.

- Health Care Directive (Living Will): This document allows you to outline your wishes for medical treatment and end-of-life care, in case you become unable to communicate them yourself. It functions alongside the DPOA, covering the healthcare decisions not included in the financial or legal authority of the DPOA.

- Will: This is a legal document that spells out how you want your property and possessions to be distributed after your death. It’s crucial for estate planning and ensures that your assets are distributed according to your wishes, not the state’s default laws.

- Revocable Living Trust: This tool helps you manage your assets during your lifetime and distribute them upon your death, often without the need for probate. You can revise it as your situation changes over time.

- HIPAA Authorization Form: This form allows designated individuals to access your health information. It is essential for the person(s) managing your healthcare decisions under a Healthcare Directive or DPOA to have access to your medical records.

- Declaration of Homestead: This legal document protects your home from creditors in the event of bankruptcy or other financial issues. Not directly related to estate planning, but it’s another layer of security for your assets.

- Funeral Planning Declaration: This allows you to specify your wishes for your funeral services, potentially relieving your loved ones from making these difficult decisions during a time of mourning.

- Personal Property Memorandum: Often attached to a will, this lists items of personal property and whom you wish to inherit them. It can usually be changed without amending the will itself, offering flexibility to modify your bequests.

Combining the Minnesota Durable Power of Attorney with these additional documents provides a robust legal framework to protect you and your assets. Each document serves a unique purpose, addressing different aspects of your life and ensuring your wishes are honored. Consulting with a legal professional to develop and implement this comprehensive plan can offer peace of mind to you and your loved ones, securing your legacy and personal wishes for the future.

Similar forms

The Minnesota Durable Power of Attorney form is similar to the General Power of Attorney form, but it has key differences that set it apart. While both documents allow you to appoint someone to make financial decisions on your behalf, the Durable Power of Attorney remains in effect if you become incapacitated. In contrast, a General Power of Attorney usually becomes invalid if you can no longer make decisions for yourself.

Another document the Minnesota Durable Power of Attorney form resembles is the Health Care Directive. Both forms are used to delegate decision-making authority. However, the Durable Power of Attorney focuses on financial and legal decisions, whereas the Health Care Directive concentrates on medical decisions, including end-of-life care. This difference is crucial in planning for all aspects of personal welfare.

The Minnesota Durable Power of Attorney form also shares similarities with a Springing Power of Attorney. The key difference between them lies in when they become effective. A Durable Power of Attorney takes effect as soon as it is signed. In contrast, a Springing Power of Attorney becomes active only under specific conditions, typically the principal's incapacitation. This feature makes the Springing Power of Attorney appealing for those seeking to maintain control over their affairs unless they are unable to do so.

Dos and Don'ts

Creating a Durable Power of Attorney (POA) in Minnesota is an important step in planning for the future. It allows you to designate someone to make financial decisions on your behalf, should you be unable to do so. While filling out the form, there are key dos and don'ts that can help ensure your intentions are clearly stated and legally sound.

What You Should Do:

- Choose your agent carefully. Ensure the person you're appointing is trustworthy, understands your wishes, and is willing to carry out your requests. Consider discussing your decision with them before finalizing the document.

- Be specific about the powers you are granting. Detail the exact authority you're giving to your agent, whether it's handling your banking transactions, managing your properties, or making investment decisions. This clarity can prevent any confusion or misuse of power.

- Consult with an attorney. Even though filling out the form may seem straightforward, consulting with a legal professional can help you navigate any complex issues and tailor the POA to your specific needs.

- Sign in the presence of a notary. Minnesota law requires that your Durable Power of Attorney be notarized to be valid. This process adds a layer of legal legitimacy and helps protect against fraud.

What You Shouldn't Do:

- Don't leave any sections incomplete. An incomplete form can lead to misunderstandings or challenges to the document's validity. Ensure that every required section is filled out accurately.

- Don't forget to consider alternates. Circumstances change, and your first choice for an agent might not always be available. If possible, designate a successor agent in your POA.

- Don't rely on generic templates without personalization. While online forms can be a good starting point, make sure your POA addresses your unique situation and complies with Minnesota's specific legal requirements.

- Avoid using unclear language. Ambiguity in your POA can lead to disputes among family members or with financial institutions. Be clear and precise in your wording to ensure your wishes are understood and followed.

Misconceptions

When people consider establishing a Durable Power of Attorney (DPOA) in Minnesota, they often come across a variety of misconceptions. Understanding these false impressions is crucial for making informed decisions. Here, we will clarify seven common misunderstandings related to the Minnesota Durable Power of Attorney form.

- It only covers financial matters after death. Many people think a DPOA is only effective after the principal, the person who makes the form, has passed away. However, the truth is that it allows the agent, the person chosen by the principal, to make financial decisions on the principal's behalf while the principal is still alive, particularly when they are unable to manage their affairs themselves.

- The agent can do anything they want. While it's true the agent has broad powers, these are specifically outlined in the DPOA document and are subject to state laws and regulations. The agent must act in the principal’s best interest; they cannot simply act however they please.

- A DPOA is the same as a will. Some people confuse a DPOA with a will, but they serve very different purposes. A will takes effect after death, detailing how a person's assets should be distributed. A DPOA, on the other hand, grants an agent authority to make financial decisions while the principal is alive, but incapacitated.

- You cannot revoke it. A common myth is that once a DPOA is created, it is irreversible. In reality, as long as the principal is mentally competent, they can revoke the DPOA at any time.

- It’s too complicated and expensive to set up. Many are under the impression that creating a DPOA involves complicated legal procedures and significant expense. Although it is important to carefully draft this document to ensure it accurately reflects the principal’s wishes, the process can be straightforward and relatively inexpensive, especially with legal guidance.

- Only elderly people need one. There is a misconception that DPOAs are only necessary for the elderly. Accidents or illnesses can happen at any age, making it imperative for anyone to consider who would manage their financial affairs if they were unable to do so themselves.

- It covers medical decisions. Though DPOAs in some states can include provisions for health care decisions, in Minnesota, financial and health care decisions are typically handled by separate legal documents. A Health Care Directive or a separate Power of Attorney for Health Care is necessary for those wishing to appoint someone to make medical decisions on their behalf.

Demystifying these misconceptions can empower individuals to make well-informed decisions about establishing a Durable Power of Attorney. It is an essential tool in planning for the future, ensuring that one's financial matters are in trusted hands, even in circumstances where one is not able to manage them personally.

Key takeaways

The Minnesota Durable Power of Attorney form is a legal document that allows an individual, referred to as the principal, to designate another person, known as the agent, to manage their financial affairs. This document can be incredibly useful in situations where the principal cannot handle their financial matters due to health reasons or other circumstances. Here are seven key takeaways for anyone considering filling out and using the Minnesota Durable Power of Attorney form:

- Understanding the purpose: A Durable Power of Attorney remains in effect even if the principal becomes mentally incapacitated, unlike a general power of attorney. This is crucial for long-term planning.

- Choosing the right agent: The principal should select an agent they trust implicitly, as this person will have broad authority over their financial affairs. It's often advisable to discuss the responsibilities with the chosen agent before completing the form.

- Specifying powers granted: The form allows the principal to grant comprehensive powers to the agent, including but not limited to, managing bank accounts, real estate transactions, and filing taxes. The principal can also limit these powers based on their preferences.

- Signing requirements: To be legally valid, the Minnesota Durable Power of Attorney form must be signed by the principal, two witnesses, and a notary public. These requirements help protect against fraud and ensure that the principal's decision is voluntary.

- Revocation process: The principal has the right to revoke or change the Durable Power of Attorney at any time, as long as they are mentally competent. This should be done in writing and communicated to the agent and any institutions that were informed of the original document.

- Record-keeping: Both the principal and the agent should keep copies of the Durable Power of Attorney form. If the agent is called upon to act on the principal's behalf, they may need to provide a copy of the document to prove their authority.

- Legal advice: Considering the significant legal and financial implications, it's wise for both the principal and the agent to seek legal advice before executing a Durable Power of Attorney. A professional can help clarify the form's terms and ensure that it aligns with the principal's wishes and best interests.

Filling out a Minnesota Durable Power of Attorney form is a step that should be taken with care and consideration. By understanding these key points, individuals can ensure that their financial matters will be handled according to their wishes, even if they are unable to manage them personally.

More Durable Power of Attorney State Forms

General Power of Attorney California - A document allowing one to appoint another person to manage their affairs should they become unable to do so.

Ca Durable Power of Attorney - This document can help ensure that your personal affairs, business dealings, and medical care are managed according to your values and wishes.

Power of Attorney Delaware - A carefully crafted document that delegates authority to a person you trust, covering extensive legal matters.