Attorney-Verified Durable Power of Attorney Document for Mississippi

When individuals consider planning for their future, especially in terms of legal matters, one important document that often comes to mind is the Durable Power of Attorney (DPOA). This legal document is pivotal for residents living in Mississippi, as it allows them to designate another person, known as an agent, to handle their financial affairs. The designation is "durable" in nature, meaning it remains effective even if the individual becomes incapacitated. This form plays a crucial role in ensuring that one's financial matters are managed according to their wishes, should there come a time when they are unable to make decisions for themselves. The Durable Power of Attorney form requires careful consideration and understanding of its components, including the selection of a trusted agent, the specific powers granted, and the conditions under which it becomes effective. By granting someone you trust the legal authority to manage your financial affairs, you can provide not only peace of mind for yourself but also for your loved ones, ensuring that your financial well-being is protected no matter what the future holds.

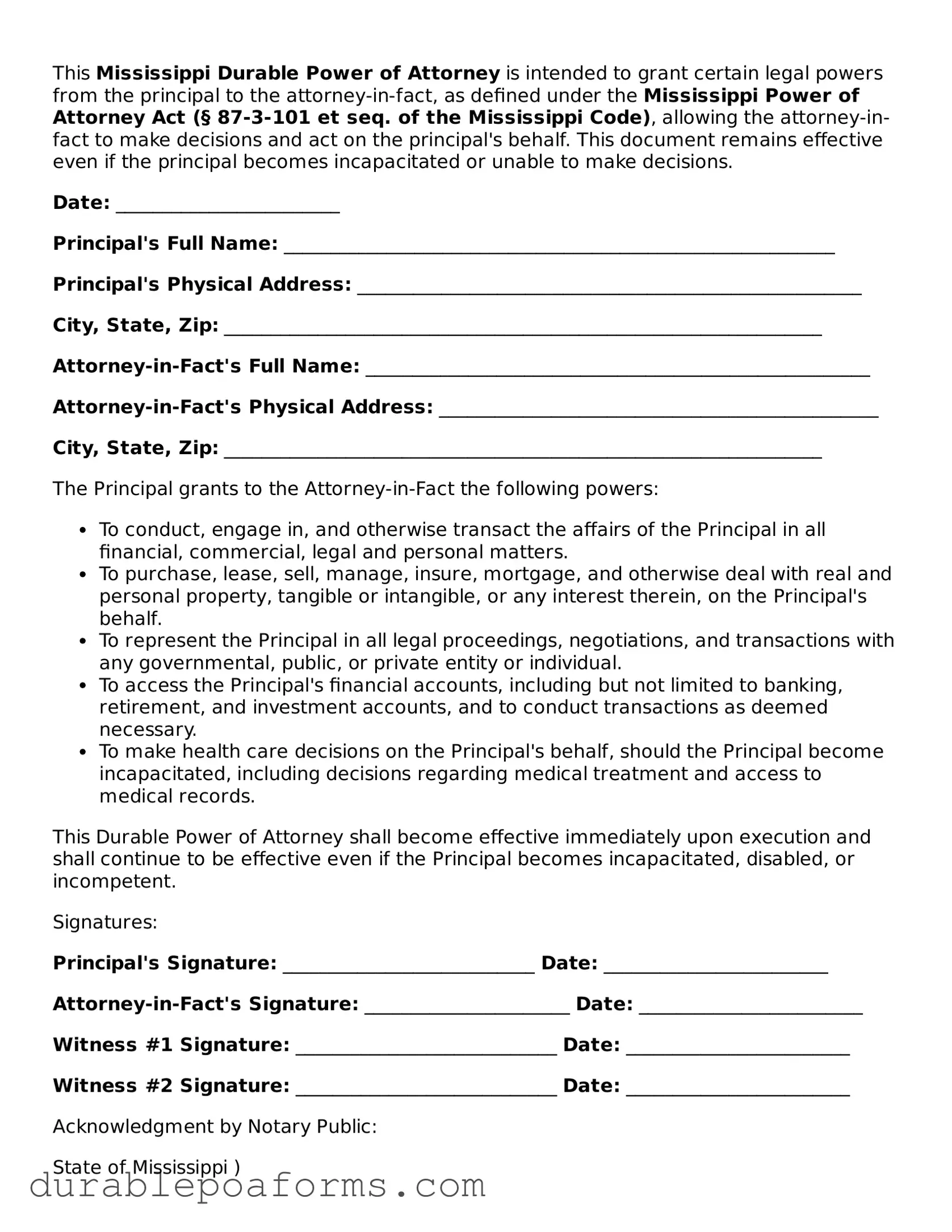

Form Preview

This Mississippi Durable Power of Attorney is intended to grant certain legal powers from the principal to the attorney-in-fact, as defined under the Mississippi Power of Attorney Act (§ 87-3-101 et seq. of the Mississippi Code), allowing the attorney-in-fact to make decisions and act on the principal's behalf. This document remains effective even if the principal becomes incapacitated or unable to make decisions.

Date: ________________________

Principal's Full Name: ___________________________________________________________

Principal's Physical Address: ______________________________________________________

City, State, Zip: ________________________________________________________________

Attorney-in-Fact's Full Name: ______________________________________________________

Attorney-in-Fact's Physical Address: _______________________________________________

City, State, Zip: ________________________________________________________________

The Principal grants to the Attorney-in-Fact the following powers:

- To conduct, engage in, and otherwise transact the affairs of the Principal in all financial, commercial, legal and personal matters.

- To purchase, lease, sell, manage, insure, mortgage, and otherwise deal with real and personal property, tangible or intangible, or any interest therein, on the Principal's behalf.

- To represent the Principal in all legal proceedings, negotiations, and transactions with any governmental, public, or private entity or individual.

- To access the Principal's financial accounts, including but not limited to banking, retirement, and investment accounts, and to conduct transactions as deemed necessary.

- To make health care decisions on the Principal's behalf, should the Principal become incapacitated, including decisions regarding medical treatment and access to medical records.

This Durable Power of Attorney shall become effective immediately upon execution and shall continue to be effective even if the Principal becomes incapacitated, disabled, or incompetent.

Signatures:

Principal's Signature: ___________________________ Date: ________________________

Attorney-in-Fact's Signature: ______________________ Date: ________________________

Witness #1 Signature: ____________________________ Date: ________________________

Witness #2 Signature: ____________________________ Date: ________________________

Acknowledgment by Notary Public:

State of Mississippi )

County of _______________ )

On this, the ____ day of ___________, 20__, before me appeared _______________ [Name of Principal], to me personally known, who, being duly sworn, did execute the foregoing Durable Power of Attorney and acknowledged that he/she executed the same as his/her free act and deed.

Notary Public's Signature: ____________________________

Printed Name: _______________________________________

My Commission Expires: ______________

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Mississippi Durable Power of Attorney form grants an agent the authority to make financial decisions on behalf of the principal, even if the principal becomes incapacitated. |

| Governing Laws | It is governed by the Mississippi Code, specifically Title 87 - Contracts and Agency, Chapter 3 - Powers of Attorney. |

| Durability | This power of attorney is considered 'durable' because it remains in effect even if the principal becomes mentally incapacitated, unlike a general power of attorney which would terminate under such conditions. |

| Principal Requirements | The principal must be of sound mind when signing the document, meaning they understand the meaning and importance of the document they are signing. |

| Witness and Notarization | The form must be signed by the principal in the presence of two witnesses and a notary public to be legally binding in Mississippi. |

Mississippi Durable Power of Attorney - Usage Guide

The Mississippi Durable Power of Attorney form is an important document for anyone wanting to ensure their affairs are managed according to their wishes, even if they become unable to make decisions for themselves. This form allows you to appoint someone you trust as your agent, giving them the authority to handle your financial and legal matters. Filling out this form accurately is crucial for it to be effective and to provide peace of mind for you and your loved ones. Follow these steps to complete the form properly.

- Gather the required information, including your full legal name, address, and the name and address of the person you are appointing as your agent.

- Read through the entire form to understand the scope of authority you are granting to your agent.

- In the "Designation of Agent" section, fill in the name, address, and contact information of the individual you are designating as your agent.

- If you wish to appoint a successor agent in case your primary agent is unable or unwilling to serve, complete the "Designation of Successor Agent(s)" section with their information.

- Specify the powers you are granting to your agent in the "Grant of General Authority" section by initialing next to each authority you want to include. If you do not initial next to an authority, your agent will not have that power.

- In the "Grant of Specific Authority" section, initial next to any additional powers you wish to grant your agent. This section covers powers that are not included in the general authority section.

- Review the "Special Instructions" area where you can provide any specific instructions or limitations on the authority you are granting to your agent. If you have no special instructions, you can leave this section blank.

- Enter the effective date of the Power of Attorney. If you want it to become effective immediately, note that. If you prefer it to become effective upon your disability or incapacity, make sure to specify the conditions for determining your disability or incapacity.

- Sign and date the form in the presence of a notary public. The notary will then fill out their part, certifying that you signed the document willingly and were of sound mind.

- Finally, give the completed and notarized form to your designated agent and keep a copy for yourself in a safe place where it can be easily accessed when needed.

Completing the Mississippi Durable Power of Attorney form is a significant step in planning for the future. By carefully selecting your agent and specifying the powers you grant them, you can ensure that your financial matters are managed according to your preferences. Remember, it's advisable to review this document periodically and update it as your situation or wishes change.

Common Questions

What is a Mississippi Durable Power of Attorney?

A Mississippi Durable Power of Attorney is a legal document that allows someone (the "principal") to grant another person (the "agent" or "attorney-in-fact") the authority to make decisions on their behalf. Unlike other forms of power of attorney, it remains effective even if the principal becomes incapacitated or unable to make decisions for themselves.

Why might someone need a Durable Power of Attorney in Mississippi?

There are several reasons why establishing a Durable Power of Attorney might be beneficial. It ensures that your personal, financial, and health-related decisions can be made by a trusted individual if you ever become unable to do so yourself due to illness, injury, or another form of incapacitation. This proactive step can save significant time and legal expense later on and provides peace of mind.

How can you create a Mississippi Durable Power of Attorney?

To create a Mississippi Durable Power of Attorney, the principal must complete a specific legal document that outlines the powers being granted to the agent. This document must be signed by the principal in the presence of a notary public to ensure its legitimacy. It's also a good practice to consult with a legal professional to ensure the document accurately reflects the principal's wishes and adheres to state laws.

Who should be chosen as an agent in a Durable Power of Attorney?

When selecting an agent for a Mississippi Durable Power of Attorney, it's important to choose someone who is trustworthy, dependable, and willing to take on the responsibilities outlined in the document. This person should also have a good understanding of the principal's wishes and be able to act in the principal's best interest. Common choices include family members, close friends, or legal advisors.

Can a Mississippi Durable Power of Attorney be revoked?

Yes, a Mississippi Durable Power of Attorney can be revoked at any time by the principal as long as they are mentally competent to make this decision. To revoke the power of attorney, the principal should notify the agent in writing and destroy all copies of the document. It may also be beneficial to notify any institutions or individuals that were aware of the power of attorney about its termination.

Is a lawyer required to create a Durable Power of Attorney in Mississippi?

While it's not legally required to have a lawyer to create a Durable Power of Attorney in Mississippi, consulting with one can be very valuable. A lawyer can offer guidance on how to structure the document according to the principal's specific circumstances and ensure that it complies with state law. Additionally, a lawyer can provide advice on choosing an agent and delineating the powers granted to them.

Common mistakes

Filling out the Mississippi Durable Power of Attorney form is a significant step in ensuring that your affairs can be managed in line with your wishes should you be unable to do so yourself. However, mistakes in its completion can significantly impair its effectiveness. It's critical to approach this form with careful consideration to avoid common pitfalls.

One frequent mistake is not specifying powers clearly. The principal (the person granting the power) must clearly outline the scope of authority they are granting to the agent (the person receiving the power). Without specificity, it leaves room for interpretation, which can lead to disputes or the agent being unable to act as intended.

Another mistake is choosing the wrong agent. The role of an agent is pivotal and requires someone who is not only trustworthy but also capable of making decisions under pressure. Often, individuals select an agent based on personal relationships rather than the person’s ability to handle financial or legal responsibilities effectively.

A third misstep involves neglecting to sign in the presence of the required witnesses or notarize the document if applicable. These formalities are crucial for the document's legality and enforceability. Skimping on these steps can render the document void or subject to challenge.

- Not specifying powers clearly.

- Choosing the wrong agent.

- Neglecting to sign in the presence of the required witnesses or notarize the document if applicable.

- Failure to regularly review and update the document.

Last but certainly not least, a common oversight is the failure to regularly review and update the document. Circumstances change; the designated agent might become unwilling or unable to serve, or the principal’s wishes regarding which powers to grant might evolve. Regular reviews ensure the document reflects the principal's current wishes and circumstances.

To ensure the document achieves its intended purpose without unintended consequences, avoiding these mistakes is crucial. Attention to detail, selecting the right agent, and periodic reviews are key steps in the process.

Documents used along the form

When a person is preparing a Durable Power of Attorney in Mississippi, it's often a piece of a larger plan designed for managing personal and financial affairs. This planning may involve several other documents that complement or enhance the protections the Durable Power of Attorney provides. Understanding each of these documents and how they interact with a Durable Power of Attorney is crucial for comprehensive planning.

- Advanced Health Care Directive (Living Will): This legal document outlines a person's wishes regarding medical treatment in situations where they are unable to make decisions for themselves. It often accompanies a Durable Power of Attorney to ensure health care wishes are respected.

- Health Care Power of Attorney: While a Durable Power of Attorney can cover financial decisions, a Health Care Power of Attorney is specifically for making medical decisions on someone's behalf, fitting together with the document to manage comprehensive care.

- Last Will and Testament: This document specifies how a person’s assets will be distributed upon their death. It works alongside a Durable Power of Attorney by managing affairs after the principal's passing.

- Revocable Living Trust: This allows an individual to control their assets during their lifetime and specify how those assets should be handled after death, potentially simplifying or avoiding probate. It can complement a Durable Power of Attorney for financial management.

- HIPAA Release Form: The Health Insurance Portability and Accountability Act (HIPAA) privacy rule restricts access to an individual's health information. A HIPAA release form allows designated individuals to receive health information, important for those making health decisions.

- Declaration of Guardian in Advance: This document names the preferred guardian for an individual and their estate in the event that they become incapacitated, supporting the choices made in a Durable Power of Attorney.

- Financial Disclosure Form: When a Durable Power of Attorney is set up, a Financial Disclosure Form may be needed to inventory the assets and liabilities being managed, providing transparency and accountability.

- Real Estate Deeds: To manage or transfer real estate properties effectively under a Durable Power of Attorney, specific deeds might be required, each tailored to the particular transaction and property type.

- Vehicle Power of Attorney: This specialized form allows the agent to buy, sell, or manage vehicle transactions on the principal's behalf, highlighting the need for explicit authority in specific areas.

- Business Operating Agreements: For principals who own businesses, these agreements are crucial for defining the management and financial arrangements, especially if the Durable Power of Attorney includes authority over business affairs.

In conclusion, while a Durable Power of Attorney is a significant legal tool for managing affairs in Mississippi, it's often just one component of a broader estate and health care planning strategy. Including other forms like Advanced Health Care Directives, Wills, and Trusts ensures a comprehensive approach to caring for oneself and one's assets. Individuals should consider consulting with a legal professional to understand how these documents work together and to tailor a plan to their specific needs.

Similar forms

The Mississippi Durable Power of Attorney form is similar to other legal documents that enable individuals to appoint representatives to make decisions on their behalf. These documents vary based on the decisions they cover and the conditions under which they become effective. Some notable ones include the Health Care Proxy, General Power of Attorney, and Living Will. Each plays a unique role in estate planning and personal care, but they share the common thread of delegating authority.

Health Care Proxy: Much like the Durable Power of Attorney, a Health Care Proxy allows an individual to appoint someone else to make health care decisions for them. The key similarity lies in the delegation of decision-making authority to another person. However, the Health Care Proxy specifically pertains to medical decisions, such as treatment options and end-of-life care, and only comes into effect if the person becomes unable to make their own health care decisions.

General Power of Attorney: This document is broader than the Mississippi Durable Power of Attorney form but shares the basic principle of appointing another individual to make decisions on one's behalf. Unlike the durable version, a General Power of Attorney usually becomes null and void if the person becomes incapacitated. Therefore, while both documents allow for the designation of an agent, the durable power remains in effect under conditions that would typically revoke a General Power of Attorney.

Living Will: A Living Will, also known as an advance directive, is another document that bears similarities to the Durable Power of Attorney. It allows individuals to express their wishes regarding end-of-life care and other medical decisions should they become incapacitated. The major difference is that with a Living Will, the individual is communicating their decisions directly, rather than appointing someone else to make decisions on their behalf, as is the case with the Durable Power of Attorney.

Dos and Don'ts

When preparing a Mississippi Durable Power of Attorney, it's crucial to pay careful attention to detail and adhere to best practices. By understanding both what you should and shouldn't do, you can ensure that your document accurately reflects your wishes and stands up to legal scrutiny. Below are key dos and don'ts to consider during this important process.

Things You Should Do

- Clearly identify the person you are appointing as your agent and any successor agents, providing their full legal names and contact information to avoid any confusion.

- Specify the powers you are granting to your agent in detail, ensuring they align with your needs and intentions.

- Include any limitations on the agent's power or any specific instructions you wish them to follow, to ensure your wishes are carried out as you intend.

- Sign the document in the presence of two witnesses and a Notary Public to validate its authenticity and comply with Mississippi law.

- Discuss your decision and the contents of the document with your appointed agent, so they understand their responsibilities and your expectations.

- Review the document periodically and update it as necessary to reflect changes in your circumstances or wishes.

- Keep the original document in a safe but accessible location, and provide copies to your agent and any relevant institutions or individuals.

- Consult with a legal professional if you have any questions or need assistance in drafting the document to ensure it meets all legal requirements.

Things You Shouldn't Do

- Don't appoint an agent without thoroughly considering their ability and willingness to act on your behalf.

- Don't leave any sections blank or assume certain powers are implied; explicitly state all powers and conditions.

- Don't forget to date the document, as this is crucial for its validity and enforcement.

- Don't neglect to inform your family members or other relevant parties about the existence and specifics of the document, to avoid surprises or disputes later on.

- Don't fail to review and possibly update the document after major life events, such as marriage, divorce, the birth of a child, or the death of your appointed agent.

- Don't rely solely on generic forms or online templates without ensuring they comply with Mississippi's specific legal requirements.

- Don't sign the document under pressure or without fully understanding its implications and the powers you are granting.

- Don't overlook the importance of having a comprehensive document that anticipates and provides for a range of circumstances.

Misconceptions

When it comes to planning for the future, understanding the tools and forms you can use is essential. The Mississippi Durable Power of Attorney form is a vital document that allows someone to act on your behalf if you're unable to do so. However, there are some common misconceptions about this form that need to be cleared up.

- It's only for the elderly. Many people believe that a Durable Power of Attorney is something only the elderly need to consider. This is not true. Anyone can face situations where they are incapacitated due to accidents or sudden illness. It's a practical measure for any adult to have in place.

- It grants unlimited power. Another misunderstanding is that the person you appoint (your agent) will have unlimited control over your affairs. The truth is, you can specify exactly what powers your agent has, including limits that you’re comfortable with. It's about giving as much or as little control as you think is necessary.

- It's effective immediately upon signing. People often think that as soon as the Mississippi Durable Power of Attorney form is signed, the agent has immediate authority. Actually, you can specify whether it becomes effective immediately or only activates if a doctor certifies that you’re unable to handle your affairs.

- It can't be revoked. There's a notion that once a Durable Power of Attorney is created, it's set in stone. This isn't the case. As long as you're mentally capable, you can revoke or change your Power of Attorney at any time. This flexibility ensures that it always reflects your current wishes.

- It overrides a will. Some people think that a Durable Power of Attorney can change or override their will. However, its power ends at your death. After that, your will is what governs the distribution of your estate. They serve different purposes and work together as part of a comprehensive estate plan.

Understanding these points ensures that you’re better prepared to make informed decisions about your estate planning. The Mississippi Durable Power of Attorney is a powerful tool, but like all tools, it’s most effective when used correctly and with a clear understanding of its function.

Key takeaways

When it comes to preparing and using the Mississippi Durable Power of Attorney form, there are several key points that individuals should keep in mind. This document grants another person the power to make decisions on your behalf, so it’s crucial to understand the implications and requirements:

- Choose a trusted individual as your agent. This person will have the authority to make decisions related to your finances, property, and even legal matters if you're unable to do so yourself.

- Be specific about the powers you grant. The form allows you to outline specific powers your agent will have, ensuring they can make decisions in your best interest.

- The form must be signed in the presence of a Notary Public or two witnesses to be legally valid. This step is crucial for the document to be recognized under Mississippi law.

- Consider specifying a durability clause. This clause ensures that the power of attorney remains in effect even if you become incapacitated.

- Discuss your decision with the chosen agent. It’s important they understand the responsibilities and expectations before accepting the role.

- The form can be revoked at any time, as long as you are mentally competent. This allows you to change your agent or withdraw their powers if circumstances change.

- Keep the original document in a safe place, but also make sure that your agent and any relevant institutions (like your bank) have certified copies.

- Review the form periodically. As your life circumstances evolve, you may need to update the document to reflect new wishes or to appoint a different agent.

Remember, the Mississippi Durable Power of Attorney is a powerful legal document that requires careful consideration. By being informed and taking the proper steps, you can ensure that your interests are protected, and your affairs are in good hands.

More Durable Power of Attorney State Forms

Power of Attorney Alaska - A legal agreement transferring financial decision power from one person to an assigned agent.

Power of Attorney Form North Dakota - Once in effect, the Durable Power of Attorney allows the agent to handle tasks such as paying bills, managing investments, and making healthcare decisions.