Attorney-Verified Durable Power of Attorney Document for Missouri

When it comes to preparing for the future, one of the most crucial steps anyone in Missouri can take is to ensure they have a Durable Power of Attorney (DPOA) in place. This form is a key legal document that empowers another person to make decisions on your behalf, particularly when you're not in a position to do so yourself, whether due to illness, incapacity, or any other reason. The "durable" nature of this power means it remains effective even if you become mentally incapacitated. It covers a broad range of decision-making powers, from financial matters, including managing bank accounts and real estate transactions, to making critical health care decisions. Having this document prepared and properly executed can provide peace of mind to you and your loved ones, knowing that your affairs can be managed according to your wishes by someone you trust. In addition, navigating the requirements to make the document legally binding, such as the need for it to be witnessed or notarized, is vital for ensuring its effectiveness in Missouri. This introduction aims to shed light on the major facets of the Missouri Durable Power of Attorney form, illustrating its importance in comprehensive personal and estate planning.

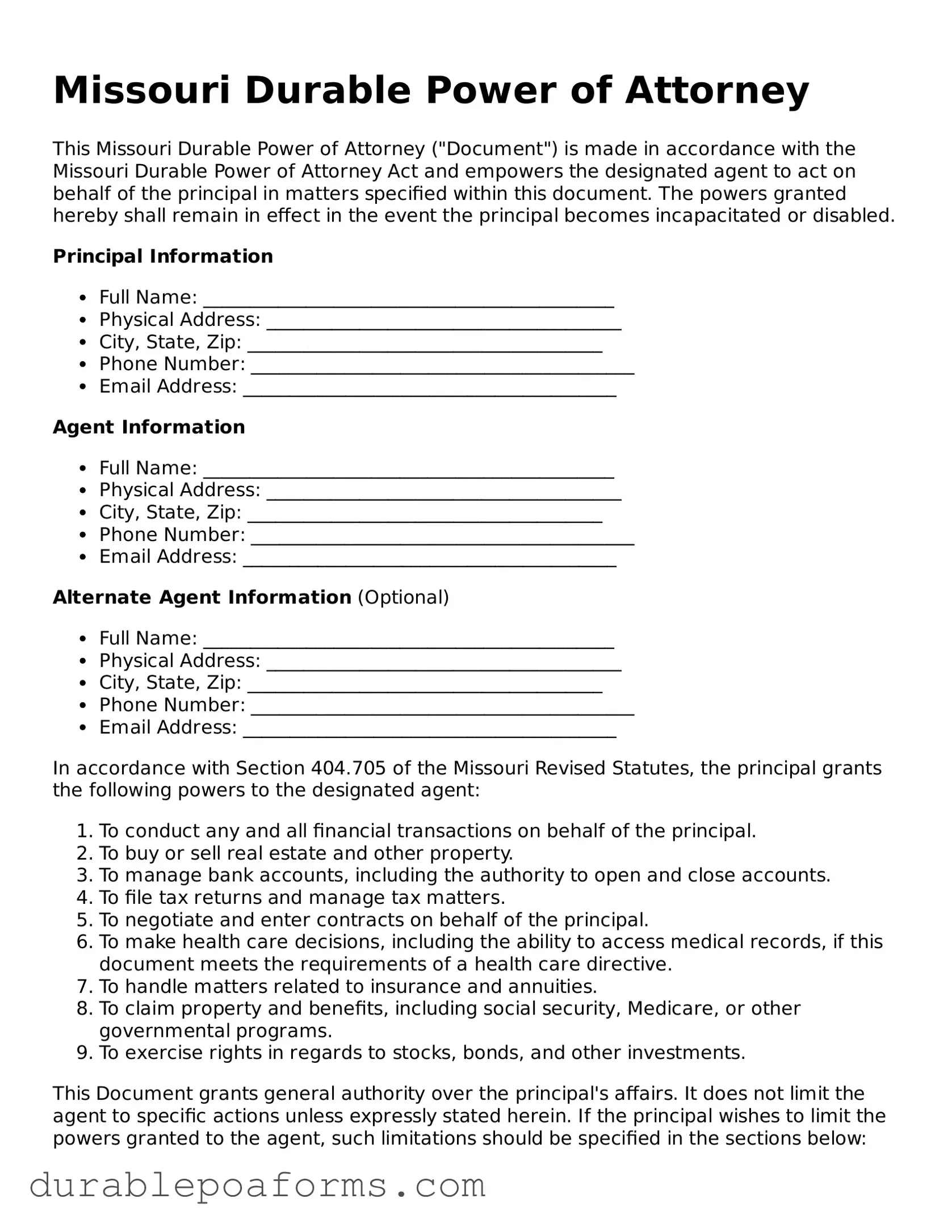

Form Preview

Missouri Durable Power of Attorney

This Missouri Durable Power of Attorney ("Document") is made in accordance with the Missouri Durable Power of Attorney Act and empowers the designated agent to act on behalf of the principal in matters specified within this document. The powers granted hereby shall remain in effect in the event the principal becomes incapacitated or disabled.

Principal Information

- Full Name: ____________________________________________

- Physical Address: ______________________________________

- City, State, Zip: ______________________________________

- Phone Number: _________________________________________

- Email Address: ________________________________________

Agent Information

- Full Name: ____________________________________________

- Physical Address: ______________________________________

- City, State, Zip: ______________________________________

- Phone Number: _________________________________________

- Email Address: ________________________________________

Alternate Agent Information (Optional)

- Full Name: ____________________________________________

- Physical Address: ______________________________________

- City, State, Zip: ______________________________________

- Phone Number: _________________________________________

- Email Address: ________________________________________

In accordance with Section 404.705 of the Missouri Revised Statutes, the principal grants the following powers to the designated agent:

- To conduct any and all financial transactions on behalf of the principal.

- To buy or sell real estate and other property.

- To manage bank accounts, including the authority to open and close accounts.

- To file tax returns and manage tax matters.

- To negotiate and enter contracts on behalf of the principal.

- To make health care decisions, including the ability to access medical records, if this document meets the requirements of a health care directive.

- To handle matters related to insurance and annuities.

- To claim property and benefits, including social security, Medicare, or other governmental programs.

- To exercise rights in regards to stocks, bonds, and other investments.

This Document grants general authority over the principal's affairs. It does not limit the agent to specific actions unless expressly stated herein. If the principal wishes to limit the powers granted to the agent, such limitations should be specified in the sections below:

Specific Limitations

________________________________________________________________________________

________________________________________________________________________________

________________________________________________________________________________

This Document is effective immediately upon execution and shall remain in effect indefinitely, or until expressly revoked by the principal in writing.

The principal acknowledges the importance of this Document and the powers herein granted. They affirm their understanding and grant these powers freely and after careful consideration.

Signatures

Principal's Signature: _______________________________ Date: ________________

Agent's Signature: ___________________________________ Date: ________________

Alternate Agent's Signature (If applicable): _________________ Date: ________________

State of Missouri

County of ___________________

This document was acknowledged before me on (date) ____________________ by (name of principal) ____________________.

______________________

Notary Public

My Commission Expires: ___________

Form Specifications

| Fact | Description |

|---|---|

| Definition | A Missouri Durable Power of Attorney form is a legal document that allows one person to designate another as their agent to make decisions on their behalf, even if they become incapacitated. |

| Governing Law | This form is governed by the Missouri Uniform Durable Power of Attorney Act, Sections 404.700 to 404.735 of the Missouri Revised Statutes. |

| Scope | The scope of authority granted can include financial, real estate, personal, and health care decisions, among other areas, as specified by the principal in the document. |

| Durability Clause | The term "durable" means that the power of attorney remains effective even if the principal becomes mentally incapacitated. |

| Witness Requirement | For the document to be legally binding, it must be signed by the principal and two witnesses who are not related to the principal nor stand to inherit anything from them. |

| Notarization | Although not a requirement by Missouri law for the power of attorney to be effective, notarization is highly recommended for the purpose of authenticating the document. |

| Revocation | The principal may revoke the power of attorney at any time as long as they are mentally competent, through a written document signed and dated by the principal, and by notifying the attorney-in-fact of the revocation. |

Missouri Durable Power of Attorney - Usage Guide

Filling out a Missouri Durable Power of Attorney form is a straightforward process that allows you to select someone you trust to manage your financial affairs if you're unable to do so yourself. Whether you're planning for the future or facing a current need, completing this form ensures that your financial matters are in capable hands. The steps outlined below will guide you through completing the form accurately and effectively.

- Start by downloading the latest version of the Missouri Durable Power of Attorney form from a reputable source, ensuring it complies with Missouri law.

- Fill in your full name and address at the top of the form to establish your identity as the principal who is granting the power.

- Designate your chosen agent (or attorney-in-fact) by writing their full name and address in the space provided. This person will have the authority to make financial decisions on your behalf.

- Review the powers listed on the form that you can grant to your agent. These typically include handling financial transactions, managing real estate, and dealing with government benefits, among others. Check the boxes next to the powers you wish to assign.

- If you want to grant your agent additional powers not listed on the form, detail these powers in the section provided for special instructions.

- Decide whether your Durable Power of Attorney will become effective immediately or only upon a doctor's certification that you are unable to manage your own affairs. Clearly indicate your choice in the relevant section.

- If required, specify any limitations to the duration of the power of attorney, although "durable" typically means it remains in effect until your death unless revoked.

- Read the form carefully and sign and date it in front of a notary public. Missouri law requires your Durable Power of Attorney to be notarized to be legally valid.

- Finally, give the original signed form to your designated agent and keep a copy for yourself. It's also wise to inform close family members or trusted individuals of its existence and location.

After completing these steps, your Missouri Durable Power of Attorney will be legally binding. This action empowers your selected agent to act in your best interests, ensuring that your financial matters are well-managed during times when you are unable to do so yourself. Remember, reviewing and updating your document as circumstances change ensures that it continually meets your needs and wishes.

Common Questions

What is a Missouri Durable Power of Attorney?

A Missouri Durable Power of Attorney is a legal document that allows an individual, often referred to as the 'Principal', to appoint another person, known as the 'Agent' or 'Attorney-in-Fact', to make decisions on their behalf. This arrangement continues to remain in effect even if the Principal becomes incapacitated or unable to make decisions for themselves.

Why do I need a Durable Power of Attorney in Missouri?

Having a Durable Power of Attorney in place is crucial for ensuring that your affairs, including financial, legal, and health-related decisions, continue to be handled according to your wishes in the event that you are unable to make these decisions yourself. It provides peace of mind to you and your loved ones that there is a trusted individual appointed to manage your affairs.

How do I choose an Agent for my Durable Power of Attorney?

Choosing an Agent is a significant decision. The selected individual should be someone trustworthy, responsible, and capable of handling financial and legal responsibilities. They should understand your wishes and be committed to acting in your best interest. Consider discussing the responsibilities with potential Agents to ensure they are willing and able to take on the role.

What powers can I grant to my Agent in Missouri?

You can grant your Agent a wide range of powers, including the ability to make financial decisions, manage property, handle banking transactions, and make medical decisions on your behalf, among others. It's important to clearly specify in the document the specific powers you are granting to ensure there is no confusion about your Agent's authority.

Can I revoke a Durable Power of Attorney?

Yes, as long as you are mentally competent, you can revoke a Durable Power of Attorney at any time. To do so, inform your Agent in writing about the revocation and retrieve all copies of the document. It's also recommended to notify any financial institutions or other entities that had been informed of the power of attorney.

Do I need a lawyer to create a Durable Power of Attorney in Missouri?

While it's not legally required to have a lawyer to create a Durable Power of Attorney, consulting with a legal professional experienced in Missouri law can help ensure that the document is completed accurately and reflects your wishes. A lawyer can also advise you on the most appropriate powers to grant your Agent based on your individual circumstances.

Common mistakes

Filling out the Missouri Durable Power of Attorney form is a significant step in planning for the future. It grants someone you trust the power to make decisions on your behalf should you become unable to do so. However, common mistakes can significantly impact its effectiveness. Here are ten missteps individuals frequently make:

Not specifying the powers granted. Many people assume that a durable power of attorney automatically covers all decisions. However, it's essential to detail the powers you are transferring, such as financial decisions or health care directives.

Choosing the wrong agent. The person you appoint as your agent holds a significant responsibility. Ensuring they are trustworthy and capable of managing your affairs is crucial. Failure to choose wisely can lead to mismanagement of your assets.

Forgetting to designate a successor agent. Life is unpredictable. If your first choice is unable to serve, having a backup can ensure your affairs are still managed as you wish.

Overlooking the need for witnesses or notarization. The Missouri Durable Power of Attorney form often requires notarization and/or witnesses to be legally binding. Skipping these steps can render the document invalid.

Not specifying a start date or triggering event. Without clear instructions on when the power of attorney begins, there can be confusion, potentially delaying important decisions.

Ignoring the option for durability. A power of attorney needs to be expressly stated as "durable" to remain in effect if you become incapacitated. Failing to do so could limit its usefulness when it's most needed.

Failing to communicate with the appointed agent. It's not enough to fill out the form; you must also discuss your wishes and expectations with the agent to ensure they understand their role and your preferences.

Not reviewing and updating the document. As life changes, so might your choices for your agent or your instructions. Regularly reviewing and updating your power of attorney ensures it always reflects your current wishes.

Incomplete information. Leaving sections of the form blank or not providing sufficient detail can lead to ambiguity, making the power of attorney difficult to enforce.

Ignoring state-specific requirements. Each state has its own laws governing durable powers of attorney. Missourians must ensure their form complies with Missouri law to avoid potential legal issues.

By avoiding these common mistakes, you can create a Missouri Durable Power of Attorney that effectively protects your interests and provides clear guidance for managing your affairs, even in the most challenging times. Paying attention to detail and consulting with a professional can help you navigate this process successfully.

Documents used along the form

When preparing for the future, especially concerning healthcare decisions and financial management in the event of incapacitation, the Missouri Durable Power of Attorney form is essential. However, to ensure a comprehensive approach, other documents are often used in conjunction with this powerful legal instrument. The following list outlines some of these key documents, each serving its unique purpose in safeguarding an individual's wishes and legal rights.

- Advance Directive (Living Will): This document allows individuals to outline their preferences for medical treatment should they become unable to communicate their wishes due to illness or incapacitation. It often covers decisions regarding life-prolonging treatments, resuscitation, and end-of-life care.

- Health Care Power of Attorney: While a Durable Power of Attorney covers a wide range of financial decisions, a Health Care Power of Attorney is specifically designed to grant a trusted person the authority to make health care decisions on the individual's behalf.

- Last Will and Testament: This legal document specifies how an individual’s assets and property should be distributed upon their death. It also can appoint guardians for minor children and specify funeral arrangements.

- Living Trust: A Living Trust allows an individual to manage their assets during their lifetime and specify how those assets are distributed after their death. It can help avoid the lengthy and public process of probate.

- Do Not Resuscitate (DNR) Order: A DNR order is a medical order signed by a physician that instructs healthcare providers not to perform cardiopulmonary resuscitation (CPR) if a patient's breathing stops or if the heart stops beating.

- HIPAA Authorization Form: This form allows designated individuals to access an individual's protected health information. It can be crucial for the person holding a Health Care Power of Attorney to make informed decisions on the individual’s behalf.

Together with the Missouri Durable Power of Attorney form, these documents can provide a comprehensive legal framework to protect an individual's health care and financial decisions. It’s important to consult with a legal professional when preparing these documents to ensure they accurately reflect the individual's wishes and comply with Missouri law. Considering each document’s unique role, individuals can achieve peace of mind for themselves and their loved ones by taking a holistic approach to planning for the future.

Similar forms

The Missouri Durable Power of Attorney form is similar to other estate planning documents that also focus on delegating authority and specifying wishes in case of incapacity. Despite sharing a common purpose, each document has its unique applications and scope. Three notable documents similar to the Missouri Durable Power of Attorney include a General Power of Attorney, a Healthcare Power of Attorney, and a Living Will. Exploring these documents can provide clarity on their distinctions and how they complement one another in a comprehensive estate plan.

The General Power of Attorney is similar because it grants someone else the authority to make decisions on your behalf. However, unlike the durable variant, this document typically becomes invalid if the person who created it becomes incapacitated. The main similarity lies in the delegation of decision-making authority, but a key difference is its lack of endurance in scenarios where its use is most needed—during the principal's incapacity. Thus, while both documents involve assigning an agent, the durability clause in the Missouri Durable Power of Attorney ensures that the agent's power persists even if the principal is unable to participate in decision-making.

The Healthcare Power of Attorney is another document with a similar goal of naming someone to make decisions on your behalf, but it specifically covers healthcare decisions. While the Missouri Durable Power of Attorney can include provisions for healthcare decisions, a Healthcare Power of Attorney focuses exclusively on medical treatments, procedures, and end-of-life care. The similarity lies in the appointment of an agent to act on your behalf; however, the primary difference is the specialized scope of decision-making power, restricted solely to healthcare matters in the Healthcare Power of Attorney.

The Living Will, also known as an advance directive, is similar to the Missouri Durable Power of Attorney in its consideration of future incapacity. It allows individuals to outline their wishes concerning life-sustaining treatments if they become unable to communicate these preferences themselves. While it does not designate an agent to make decisions, it provides guidance on specific medical interventions the principal does or does not want. The major difference is that a Living Will dictates medical treatment preferences directly, whereas a Durable Power of Attorney for healthcare decisions appoints another person to make those decisions based on outlined preferences or best judgment.

Dos and Don'ts

Filling out the Missouri Durable Power of Attorney form is an important step in planning for future financial management and care. This document allows you to appoint someone you trust to manage your affairs if you are unable to do so. To ensure this process goes smoothly, here are some essential dos and don'ts:

Do:

- Read all instructions carefully before you begin filling out the form. Understanding each section is crucial to accurately completing the document.

- Choose a trusted individual to act as your agent. This person should be reliable, financially savvy, and fully understand your wishes.

- Be specific about the powers you are granting. The more detailed you are, the easier it will be for your agent to act on your behalf.

- Consider appointing a successor agent. Should your primary agent be unable or unwilling to serve, having a backup can ensure your affairs are managed without interruption.

- Sign the document in the presence of a notary public. This step is vital for the document’s legality and enforceability.

- Keep the original document in a safe but accessible place, and inform your agent and a trusted family member or friend of its location.

- Review and update the document as needed. Changes in your personal situation or in the law can affect the document's effectiveness.

Don't:

- Wait until it’s too late. It’s wise to prepare a Durable Power of Attorney while you are in good health and have the capacity to make informed decisions.

- Use a generic form without verifying it complies with Missouri’s specific legal requirements. State laws vary, and using a form not tailored to Missouri could result in an invalid document.

- Forget to discuss your wishes and the responsibilities with the person you plan to appoint as your agent. They need to be willing and ready to take on this role.

- Overlook the importance of having a witness or notary. Their presence during the signing helps validate the document.

- Leave any sections of the form blank. If a section does not apply to your situation, mark it as "N/A" (not applicable) instead of leaving it empty.

- Fail to consider how your Durable Power of Attorney might interact with other legal documents, such as your Will or Medical Directives. They should all work together cohesively.

- Assume the document is automatically revoked if you recover from a period of incapacity. If you wish to revoke the power, you must do so explicitly in writing.

Misconceptions

Many people hold misconceptions about the Missouri Durable Power of Attorney (DPOA) form, which can lead to confusion or errors when preparing one. Here are seven common misunderstandings explained to help ensure clarity:

- It becomes effective immediately after it is signed. The truth is that the document's effective date is determined by what is specified within the document itself. While some DPOAs become effective immediately, others may only do so upon the occurrence of a specific event, such as the principal's incapacity.

- It grants unlimited power to the agent. In reality, the powers granted to an agent under a DPOA can be as broad or as limited as the principal desires. The document should clearly outline what decisions the agent can and cannot make.

- It cannot be revoked. Contrary to this belief, the principal can revoke a DPOA at any time as long as they are mentally competent to do so, typically by notifying the agent in writing.

- All DPOA forms are the same. While many forms may look similar, each state has its own specific requirements and legal language. It's important to use a form that complies with Missouri law to ensure it is valid.

- The appointed agent can make health care decisions. Unless specifically stated in the DPOA document, agents generally do not have the authority to make health care decisions for the principal. A separate document, known as a Health Care Directive or Medical Power of Attorney, is needed for this purpose.

- A lawyer must prepare the form. While it is highly recommended to consult a lawyer to ensure the form meets all legal requirements and accurately reflects the principal's wishes, it is not a legal requirement to have a lawyer prepare the document.

- It continues after the death of the principal. A DPOA is only valid during the lifetime of the principal. Upon the principal’s death, the authority of the agent ceases, and the executor or administrator of the estate takes over.

Key takeaways

Understanding how to properly fill out and use the Missouri Durable Power of Attorney form is crucial for ensuring your wishes are followed in the event that you cannot make decisions for yourself. Here are four key takeaways to keep in mind:

Choose Your Agent Wisely: The person you appoint as your agent will have broad powers to manage your affairs. It's important to select someone who is trustworthy, responsible, and capable of acting in your best interest. Consider how well they handle their own financial and medical decisions as a reflection of how they might manage yours.

Be Specific About Powers Granted: Although the form may provide general powers, you have the option to specify or limit the powers you grant to your agent. Being clear about what your agent can and cannot do will help prevent any confusion or misuse of the power of attorney.

Understand the "Durable" Aspect: The term "durable" means that the power of attorney remains in effect even if you become incapacitated. This feature is particularly important for ensuring that your appointed agent can continue to make decisions on your behalf without any interruption in authority.

Follow Missouri Signing Requirements: For a Durable Power of Attorney to be legally valid in Missouri, it must be signed by the principal (the person making the Power of Attorney), in the presence of a notary public. Some circumstances may also require witnesses. Always check the most current Missouri laws to ensure all requirements are met for your document to be valid.

Properly filling out and executing the Missouri Durable Power of Attorney form can provide peace of mind and protection. It ensures that someone you trust is legally authorized to act on your behalf when you’re not able to. Taking the time to carefully select your agent and clearly define their powers can save you and your loved ones from unnecessary stress later on.

More Durable Power of Attorney State Forms

Oregon Durable Power of Attorney Form Free - A Durable Power of Attorney remains in effect even if the person who created it becomes mentally or physically unable to make decisions.

Ohio Power of Attorney Requirements - When paired with a healthcare power of attorney, it forms a comprehensive approach to planning for incapacity, covering both financial/legal and medical decision-making aspects.