Attorney-Verified Durable Power of Attorney Document for Montana

The intricacies of planning for the future, especially in terms of legal and financial affairs, cannot be overstated. Among the vital documents that ensure a person's preferences are respected during incapacity is the Montana Durable Power of Attorney form. This crucial piece of legal paperwork allows individuals, referred to as principals, to appoint someone they trust, known as an agent, to manage their financial affairs. It's uniquely durable, meaning it remains in effect even if the principal becomes incapacitated. The form covers a broad array of responsibilities, from managing real estate transactions and handling financial decisions to addressing matters of personal property and investments. Its importance lies not only in safeguarding the principal's assets but also in ensuring that decisions are made according to their wishes, thereby relieving family members of making tough decisions during stressful times. Completing this form requires thoughtful consideration, as it entails selecting a trustworthy individual to carry out one's preferences and stipulations clearly and effectively.

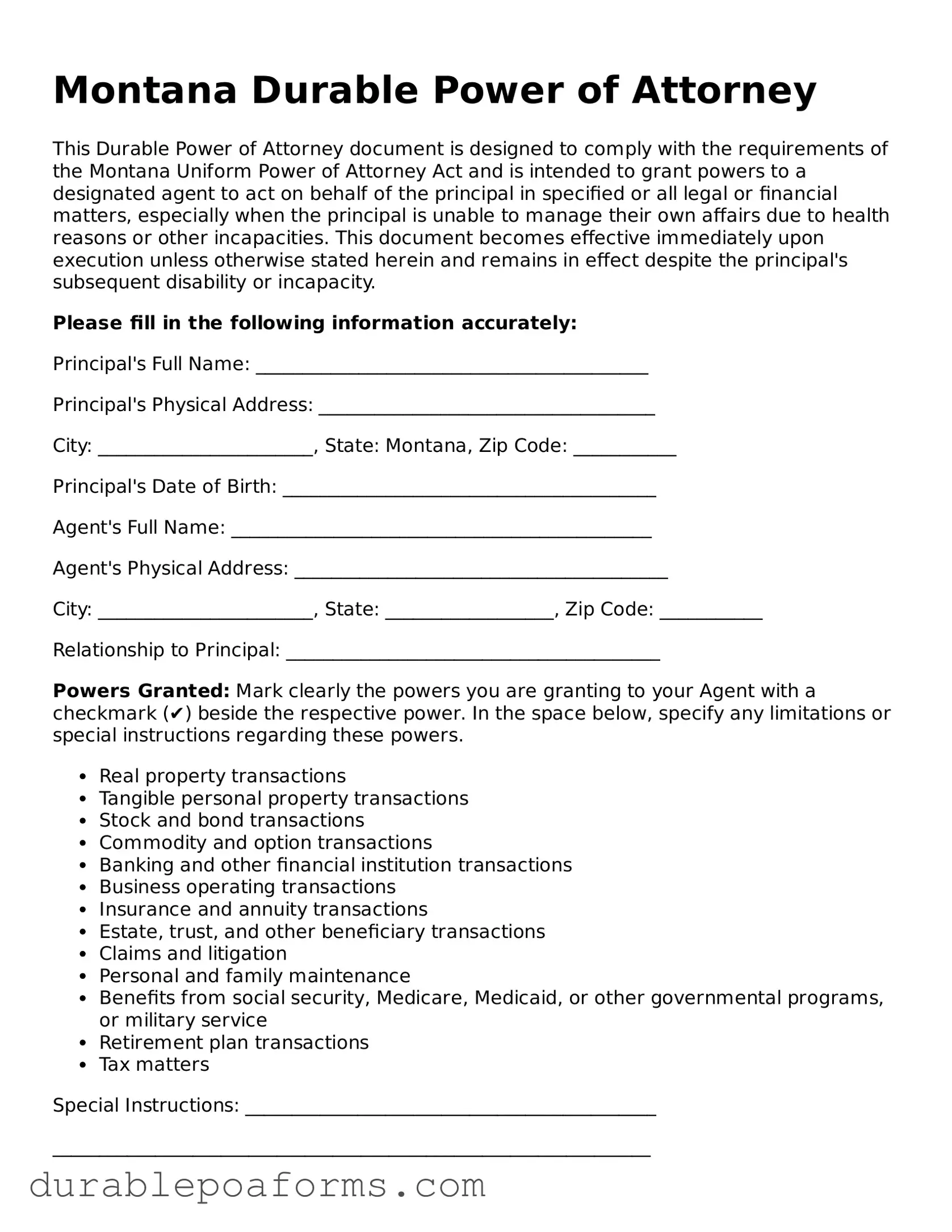

Form Preview

Montana Durable Power of Attorney

This Durable Power of Attorney document is designed to comply with the requirements of the Montana Uniform Power of Attorney Act and is intended to grant powers to a designated agent to act on behalf of the principal in specified or all legal or financial matters, especially when the principal is unable to manage their own affairs due to health reasons or other incapacities. This document becomes effective immediately upon execution unless otherwise stated herein and remains in effect despite the principal's subsequent disability or incapacity.

Please fill in the following information accurately:

Principal's Full Name: __________________________________________

Principal's Physical Address: ____________________________________

City: _______________________, State: Montana, Zip Code: ___________

Principal's Date of Birth: ________________________________________

Agent's Full Name: _____________________________________________

Agent's Physical Address: ________________________________________

City: _______________________, State: __________________, Zip Code: ___________

Relationship to Principal: ________________________________________

Powers Granted: Mark clearly the powers you are granting to your Agent with a checkmark (✔) beside the respective power. In the space below, specify any limitations or special instructions regarding these powers.

- Real property transactions

- Tangible personal property transactions

- Stock and bond transactions

- Commodity and option transactions

- Banking and other financial institution transactions

- Business operating transactions

- Insurance and annuity transactions

- Estate, trust, and other beneficiary transactions

- Claims and litigation

- Personal and family maintenance

- Benefits from social security, Medicare, Medicaid, or other governmental programs, or military service

- Retirement plan transactions

- Tax matters

Special Instructions: ____________________________________________

________________________________________________________________

Effective Date and Duration: Unless a different effective date is specified here, this Power of Attorney is effective immediately upon signing and continues to be effective even if the principal becomes disabled, incapacitated, or incompetent.

Effective Date: __________________________________________________

Third Party Reliance: It is expressly understood that third parties may rely upon the representations of the Agent as if the Principal had personally conducted such affairs. This document is intended to be relied upon by any person, organization, corporation, or government agency.

Revocation: This Durable Power of Attorney may only be revoked by the Principal through a written document specifically indicating the desire to revoke, signed and dated by the Principal, and provided to any entity or individual that has, or would have had, reliance on this document.

Signature of Principal: ___________________________ Date: ______________

Signature of Agent: _____________________________ Date: ______________

This document was prepared in accordance with the laws of the State of Montana and should be signed in the presence of a notary public or other individuals as required by state law.

State of Montana

County of __________________________

On this ______ day of ________________, 20____, before me, ______________________________, a notary public, personally appeared ______________________________, known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument and acknowledged that they executed the same for the purposes therein contained.

In witness whereof I hereunto set my hand and official seal.

______________________________________

Notary Public

My commission expires: __________________

Form Specifications

| Fact Name | Description |

|---|---|

| 1. Purpose | A Montana Durable Power of Attorney form is designed to grant a trusted person the authority to make financial decisions on behalf of the principal, even in the event the principal becomes incapacitated. |

| 2. Durability | This form remains in effect even if the principal becomes mentally incapacitated, differing from a general power of attorney which becomes invalid under such circumstances. |

| 3. Governing Law | The form is governed by the Montana Uniform Power of Attorney Act, specifically found in Title 72, Chapter 31 of the Montana Code Annotated. |

| 4. Signing Requirements | For a Durable Power of Attorney to be valid in Montana, it must be signed by the principal in the presence of a notary public or at least two witnesses who are not related to the principal or named as agents. |

| 5. Revocation | The principal can revoke the power of attorney at any time, as long as they are competent, by providing written notice to the appointed agent and any institutions or persons that may be affected. |

Montana Durable Power of Attorney - Usage Guide

Filling out a Durable Power of Attorney form in Montana is a significant step in planning for future financial and personal management. This document grants someone you trust the authority to handle your affairs if you're unable to do so yourself. While the process may seem daunting at first, breaking it down into simple steps can make it more manageable. Here are the necessary steps to correctly fill out this form, ensuring your wishes are clearly documented and legally recognized.

- Gather required information: Before you start, make sure you have all the necessary personal information for yourself (the principal) and the person or persons (the agent/s) you wish to grant power to. This includes full legal names, addresses, and contact details.

- Select the form: Obtain the most current version of the Montana Durable Power of Attorney form. This can typically be found online through legal resources or local government sites.

- Read instructions carefully: Take your time to thoroughly read any instructions provided with the form. These instructions can guide you through each section and ensure you understand the document's implications.

- Fill in personal details: Fill in the principal’s full legal name and address in the designated spaces. Double-check for accuracy to avoid any legal issues later on.

- Designate your agent(s): Clearly write the name(s) of the person or persons you are appointing as your agent(s). You can appoint more than one agent and specify whether they must make decisions together (jointly) or if each can act separately (severally).

- Specify powers granted: Carefully review the powers you are granting to your agent. These can cover a wide range of activities, including financial dealings, real estate transactions, and personal affairs. Cross out any powers you do not wish to grant, and be as specific as possible where needed.

- Special instructions: If you have any specific wishes or limitations you want to impose, clearly detail them in the space provided. This might include restrictions on selling particular assets or specific guidance on managing your affairs.

- Sign and date the form: Once all sections are completed to your satisfaction, sign and date the form in the presence of a notary public. This is essential for the form to be legally binding.

- Store the document safely: Keep the original signed document in a secure but accessible location. Inform your agent(s) where the document is stored and consider providing them with copies for their records.

- Regularly review and update: Circumstances change, and it may be necessary to update your Durable Power of Attorney form. Regularly review the document and make necessary amendments to ensure it continues to reflect your wishes and address your needs.

By following these steps, you can successfully fill out a Durable Power of Attorney form in Montana, providing peace of mind for yourself and your loved ones. Remember, this document is a critical component of estate planning, empowering you to have control over your future, even in situations where you might not be able to express your wishes directly.

Common Questions

What is a Montana Durable Power of Attorney?

A Durable Power of Attorney in Montana is a legal document that allows an individual, known as the principal, to appoint another person, called the agent or attorney-in-fact, to make decisions and take actions on their behalf in various matters, including financial, real estate, and personal matters. Unlike other powers of attorney, its durability means it remains effective even if the principal becomes incapacitated.

How do I set up a Durable Power of Attorney in Montana?

To set up a Durable Power of Attorney in Montana, you must complete a Durable Power of Attorney form that complies with Montana state laws. The principal must sign the form in the presence of a notary public. It's also recommended to clearly define the powers granted to the agent in the document to prevent any future confusion or legal issues.

Who can serve as an agent under a Montana Durable Power of Attorney?

Any competent adult who the principal trusts can serve as an agent under a Montana Durable Power of Attorney. Often, people choose a close family member or friend, but it can also be an attorney or another trusted individual. The chosen agent should be someone reliable, trustworthy, and capable of handling the responsibilities involved.

Does a Montana Durable Power of Attorney need to be notarized?

Yes, for a Durable Power of Attorney to be legally effective in Montana, it must be signed by the principal in the presence of a notary public. This requirement helps to ensure the document's authenticity and protects against potential fraud.

Can I revoke a Durable Power of Attorney in Montana?

Yes, a Durable Power of Attorney in Montana can be revoked at any time by the principal, as long as the principal is mentally competent. To revoke it, the principal should inform the agent in writing and also notify any third parties who may be affected, such as financial institutions. Destroying the document and creating a new one, if desired, is also advisable.

What happens if my agent is unable or unwilling to serve?

If the appointed agent is unable or unwilling to serve, the Durable Power of Attorney can designate an alternate agent. If no alternate is named and the original agent cannot serve, the principal may need to appoint a new agent through a new Durable Power of Attorney document, assuming the principal has the capacity to do so.

Is a Montana Durable Power of Attorney effective in other states?

In many cases, a Montana Durable Power of Attorney will be honored in other states, but it's not guaranteed. Laws regarding the acceptance of out-of-state powers of attorney vary by state. To ensure acceptance, it may be wise to consult an attorney in the state where the document will be used.

How can I ensure my Montana Durable Power of Attorney is not abused?

To minimize the risk of abuse, choose an agent who is trustworthy and responsible. Clearly outline the agent’s powers and limitations within the document, and consider requiring the agent to provide regular accountings. You may also appoint a trusted individual to oversee the agent's actions. Finally, keep records of all transactions made under the authority of the power of attorney.

What are the advantages of having a Durable Power of Attorney in Montana?

Having a Durable Power of Attorney in Montana ensures that someone you trust can make important decisions on your behalf if you become unable to do so yourself. This can include managing your finances, handling real estate transactions, and dealing with other personal affairs. It allows for continuity in managing your affairs without the need for court intervention.

Can a Montana Durable Power of Attorney be used for health care decisions?

No, a Durable Power of Attorney in Montana is typically used for financial and administrative matters. Health care decisions require a different legal document known as a Durable Power of Attorney for Health Care or a Health Care Directive. This document specifically grants an agent the authority to make medical and health care decisions on the principal's behalf.

Common mistakes

When individuals fill out the Montana Durable Power of Attorney form, they often aim to ensure their affairs are managed according to their wishes should they no longer be able to make decisions themselves. Despite these good intentions, mistakes can occur during the completion of this important document. Recognizing and avoiding these errors can help in establishing a clearer and more effective power of attorney.

One common mistake involves not selecting an appropriate agent. The person chosen to act on your behalf, known as your agent, should be someone you trust implicitly. They should also have a good understanding of your wishes and be willing to act in your best interest. People often choose an agent without considering if the person is willing or able to take on such responsibilities.

Another error is not being specific enough about the granted powers. The Montana Durable Power of Attorney form allows you to designate a wide range of duties to your agent. If you're too general or vague, it can lead to confusion and misinterpretation. Specifying which decisions your agent can make on your behalf, from financial matters to health-related decisions, ensures they can act accurately according to your wishes.

People also frequently forget to specify a start date or conditions for the power of attorney to become effective. Without clear instructions, it can be challenging to determine when the agent’s authority should begin. Establishing clear terms for activation—whether immediately, upon a certain date, or upon the occurrence of a specific event—helps prevent confusion and ensures your wishes are followed.

Ignoring the need for a successor agent is another oversight. If your initially chosen agent is unable or unwilling to serve, having no backup plan can create a significant dilemma. Naming a secondary, or "successor," agent is an essential step that people often overlook. It ensures your affairs remain in trusted hands, even if your first choice can’t fulfill their duties.

Many individuals fail to review and update the document periodically. Life changes, such as marriages, divorces, the birth of children, or even changing wishes, can impact the relevance of your durable power of attorney. Regularly reviewing and potentially updating your document ensures it always reflects your current wishes and circumstances.

Common mistakes also include the following:

- Not having the form properly witnessed or notarized, which is required for it to be legally valid.

- Failing to provide copies to essential parties, such as financial institutions or healthcare providers.

- Assuming one form covers all aspects of your life, rather than preparing separate forms for healthcare and financial decisions.

- Not discussing your wishes and expectations with the selected agent beforehand.

- Using outdated forms that may not comply with current laws, leading to potential legal issues.

Avoiding these mistakes when filling out the Montana Durable Power of Attorney form can help ensure that it is a reliable document that accurately conveys your wishes. It's about protecting yourself, your assets, and your future by making thoughtful decisions and being detail-oriented in the process. Consulting with a professional to assist in preparing the form can also help mitigate these errors, ensuring that your durable power of attorney is both effective and legally compliant.

Documents used along the form

When preparing for the future, especially in matters of health and financial well-being, it's pivotal to have all necessary documents in order. The Montana Durable Power of Attorney is a critical document that allows individuals to appoint someone to manage their financial affairs if they become unable to do so. However, it's often beneficial to consider other legal forms and documents to ensure comprehensive coverage in all areas of one’s life. The following list outlines additional documents frequently used alongside the Montana Durable Power of Attorney to provide a fuller scope of legal preparation and protection.

- Advance Health Care Directive: This document specifies an individual's health care preferences in case they become unable to make decisions for themselves. It often includes a Living Will and a Health Care Power of Attorney.

- Living Will: Part of an Advance Health Care Directive, a Living Will outlines specific medical treatments an individual wishes or does not wish to receive if they are terminally ill or permanently unconscious and cannot communicate their preferences.

- Health Care Power of Attorney: Also part of the Advance Health Care Directive, it appoints someone to make health care decisions on behalf of the individual if they are incapacitated.

- Last Will and Testament: This document communicates an individual’s preferences about how their estate should be handled and distributed upon death, including naming guardians for any minor children.

- Revocable Living Trust: A legal arrangement that allows for the management of an individual’s assets during their lifetime and specifies how these assets are to be distributed after their death. It can help avoid probate.

- Financial Information Sheet: A comprehensive list of personal financial information, including account numbers, contacts for financial advisors, and login information for online banking. It complements the Durable Power of Attorney by providing necessary details to the appointed agent.

- HIPAA Authorization Form: This form allows designated individuals to access an individual’s healthcare information. It is essential for the person appointed in the Health Care Power of Attorney to have this access for decision-making purposes.

- Funeral Planning Declaration: A document outlining an individual's preferences for their funeral arrangements, such as burial or cremation, location of the funeral, and specific services. It helps to alleviate the decision-making burden on loved ones.

Creating a comprehensive estate plan is a thoughtful way to ensure that an individual's health care preferences and financial matters are handled according to their wishes, even when they are not in a position to communicate those wishes themselves. While the Montana Durable Power of Attorney is a significant part of this process, integrating it with other legal documents like those described above can offer peace of mind to both the individual and their loved ones. It's essential to consult with a legal advisor to tailor these documents to one's specific needs and circumstances.

Similar forms

The Montana Durable Power of Attorney form is similar to other legal documents that also establish a person's authority to make decisions on behalf of another. However, each document serves a unique purpose and is used in different contexts. Known for its comprehensive scope in financial matters, the Montana Durable Power of Attorney can be compared with the Healthcare Power of Attorney, General Power of Attorney, and Living Will in terms of functionality and purpose.

Healthcare Power of Attorney: This document resembles the Montana Durable Power of Attorney in its fundamental purpose of designating an agent to make decisions on someone's behalf. While the Durable Power of Attorney focuses on financial and property decisions, the Healthcare Power of Attorney is specifically tailored to medical decisions. It empowers an agent to make healthcare decisions for the principal when they are incapacitated or otherwise unable to make these decisions themselves. The critical similarity lies in the inherent trust and authority granted to another person, though the areas of decision-making are distinctly different.

General Power of Attorney: The General Power of Attorney and the Montana Durable Power of Attorney share a common feature in that they both authorize an agent to perform a wide range of acts on the principal’s behalf. However, the durability aspect is what differentiates them significantly. A General Power of Attorney usually ceases to be effective if the principal becomes incapacitated or disabled. On the other hand, a Durable Power of Attorney is specifically designed to remain in effect even if the principal loses the ability to make decisions, making it a crucial document for long-term planning.

Living Will: Although a Living Will and the Montana Durable Power of Attorney seem to operate in different legal arenas, they both contribute to a person's preparations for future incapacity. A Living Will documents a person's wishes regarding medical treatments and life-sustaining measures in the event they become terminally ill or permanently unconscious. Unlike the Durable Power of Attorney, which appoints another person to make decisions, a Living Will directly communicates the individual's decisions ahead of time, reflecting personal choices about end-of-life care.

Dos and Don'ts

Filling out a Montana Durable Power of Attorney (POA) form requires careful attention to detail and an understanding of your rights and responsibilities. When you decide to give someone the authority to make decisions on your behalf, it's important to be thorough and precise to ensure your wishes are legally respected. Below are several dos and don'ts to guide you through this process.

- Do read the entire form before filling it out to understand the scope and implications of the powers you're granting.

- Do choose an agent whom you trust completely, as this person will have the authority to make significant decisions on your behalf.

- Do be very specific about the powers you are granting to your agent. Vagueness can lead to uncertainty and misuse of the authority given.

- Do discuss your wishes and expectations with the chosen agent before finalizing the POA to ensure they are willing and prepared to act in your best interest.

- Do sign the form in the presence of a notary public or other authorized official to ensure its legality and reduce the likelihood of challenges.

- Don't leave any sections of the form blank. If a section does not apply, you should write "N/A" (not applicable) to prevent unauthorized additions after you’ve signed the document.

- Don't forget to date the form. A POA without a valid date may not be recognized by financial institutions, healthcare providers, or courts.

- Don't hesitate to seek advice from a legal professional if you have questions or concerns about filling out your POA form. This can help avoid common mistakes and ensure that the document reflects your wishes accurately.

- Don't neglect to inform close family members or other important people in your life about your POA, particularly those who might be affected by the decisions made by your agent.

By following these guidelines, you can fill out the Montana Durable Power of Attorney form correctly and with confidence. Making informed decisions now will protect your interests and ensure that your affairs are managed as you wish in the future.

Misconceptions

One common misconception is that a Durable Power of Attorney (DPOA) in Montana is difficult to set up. In fact, with clear guidelines and possibly legal assistance, it's straightforward to establish, ensuring your wishes are honored even if you can't speak for yourself.

Many people believe that a DPOA only covers financial decisions. However, in Montana, a DPOA can also include healthcare decisions, allowing a trusted individual to make medical decisions on your behalf, should you become unable to do so.

There's a misconception that once you sign a DPOA, you lose control over your affairs. The truth is, you maintain control until the document specifies otherwise or until you are no longer able to make decisions due to incapacity.

Some think that a DPOA is only for the elderly. While it's particularly important for older adults, anyone can face situations where they're unable to make decisions for themselves, making a DPOA a wise consideration at any age.

A false belief exists that a Montana DPOA is immediately active upon signing. You can specify that the DPOA only becomes active under certain conditions, like if you become incapacitated.

Many assume DPOA documents are standard and don't need customization. Actually, it's crucial to tailor your DPOA to fit your specific needs and wishes to ensure they're executed exactly as you'd prefer.

Another misconception is that a lawyer is not necessary to create a DPOA. While it's possible to create a DPOA on your own, legal advice can help avoid any issues and ensure that the document fully reflects your intentions and complies with Montana law.

Lastly, people often mistake a DPOA for being irrevocable. In Montana, as long as you're competent, you can revoke or change your DPOA at any time, allowing you to adjust to new circumstances or change your designated agent.

Key takeaways

In the state of Montana, a Durable Power of Attorney (DPOA) serves as a vital legal document. Its primary function is to empower a chosen individual, commonly referred to as the "agent," to make decisions on your (the "principal's") behalf, particularly in matters related to financial and property interests. Understanding the nuances of how to properly fill out and utilize this form is essential. Here are key takeaways to guide you through this process:

- Choose Your Agent Wisely: The individual you select as your agent holds significant authority to make decisions impacting your financial and property matters. It’s crucial that this person is not only trustworthy but also has the capability to manage these responsibilities effectively. Consider their judgment, reliability, and the ease with which they can carry out your wishes, even in challenging circumstances.

- Be Specific in Your Powers: The DPOA allows you to grant broad or limited powers to your agent. You have the flexibility to specify exactly what your agent is authorized to do. For example, you might limit your agent's authority to certain assets or to specific types of decisions. Clarity here can prevent confusion and ensure your agent acts within the boundaries you've set.

- Understand the "Durable" Aspect: The term "durable" signifies that the power of attorney remains in effect even if you become incapacitated. This is crucial for ensuring that your agent can manage your affairs without the need for court intervention, providing peace of mind for you and your loved ones.

- Sign in the Presence of a Notary: For your DPOA to be legally valid in Montana, it must be signed in the presence of a notary public. This requirement helps safeguard against fraud and confirms that you are signing the document willingly and without duress.

- Keep Records and Provide Copies: Once your DPOA is executed, it’s important to keep it in a secure yet accessible location. Inform your agent, family members, or trusted friends of where to find it. Additionally, providing copies to your financial institutions and other relevant entities ensures that your agent’s authority is recognized and can be acted upon without delay.

By meticulously following these guidelines, you can create a durable power of attorney that effectively safeguards your interests and provides clear direction for the management of your affairs should you be unable to do so yourself.

More Durable Power of Attorney State Forms

Ohio Power of Attorney Requirements - Can be revoked or amended by the principal at any time, as long as they are mentally competent, ensuring that the arrangement remains reflective of their current wishes.

Maryland Power of Attorney - It ensures that the management of your affairs aligns with your personal values and wishes, even if you're not able to express them.

How to Get Power of Attorney in Alabama - A forward-thinking tool that enables someone to select a reliable representative to handle their financial matters under specific conditions.