Attorney-Verified Durable Power of Attorney Document for Nebraska

In the picturesque state of Nebraska, with its wide-open skies and hardworking residents, the importance of planning ahead cannot be overstated, especially when it comes to legal and financial matters. Among the most pivotal documents that safeguard one's interests is the Nebraska Durable Power of Attorney form. This form acts as a beacon of security and foresight, allowing individuals to appoint a trusted agent who can make substantial financial decisions on their behalf, should they ever become unable to do so themselves. It's designed to be robust, remaining in effect even if the person faces severe health challenges that impair their decision-making capabilities. Covering a comprehensive range of actions, from handling bank transactions to managing real estate affairs, this form ensures that the financial life of an individual is maintained with the same diligence and integrity they would employ themselves. Embracing this document is akin to putting a safety net under one's future, making it an essential part of financial planning for every Nebraskan eager to provide for their own welfare and peace of mind.

Form Preview

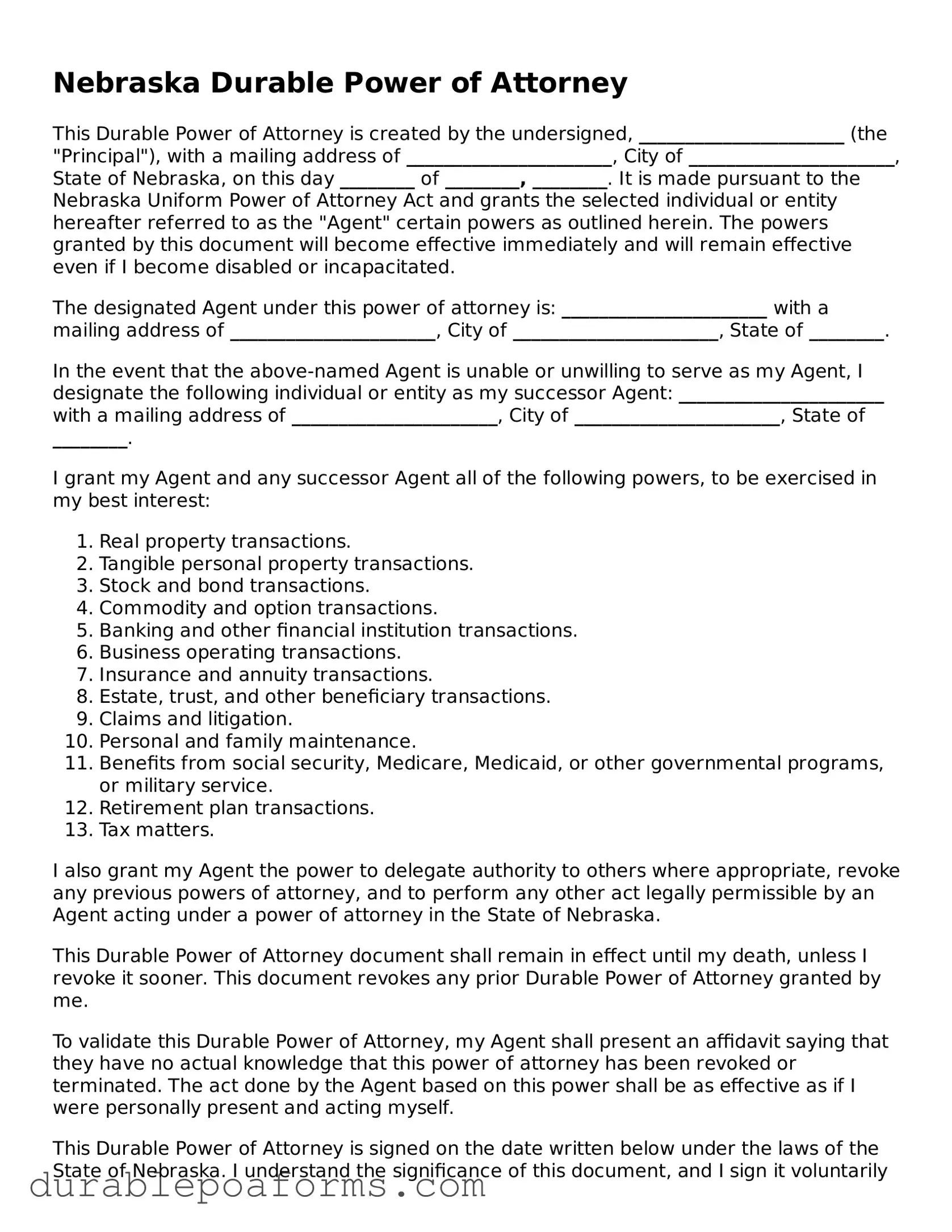

Nebraska Durable Power of Attorney

This Durable Power of Attorney is created by the undersigned, ______________________ (the "Principal"), with a mailing address of ______________________, City of ______________________, State of Nebraska, on this day ________ of ________, ________. It is made pursuant to the Nebraska Uniform Power of Attorney Act and grants the selected individual or entity hereafter referred to as the "Agent" certain powers as outlined herein. The powers granted by this document will become effective immediately and will remain effective even if I become disabled or incapacitated.

The designated Agent under this power of attorney is: ______________________ with a mailing address of ______________________, City of ______________________, State of ________.

In the event that the above-named Agent is unable or unwilling to serve as my Agent, I designate the following individual or entity as my successor Agent: ______________________ with a mailing address of ______________________, City of ______________________, State of ________.

I grant my Agent and any successor Agent all of the following powers, to be exercised in my best interest:

- Real property transactions.

- Tangible personal property transactions.

- Stock and bond transactions.

- Commodity and option transactions.

- Banking and other financial institution transactions.

- Business operating transactions.

- Insurance and annuity transactions.

- Estate, trust, and other beneficiary transactions.

- Claims and litigation.

- Personal and family maintenance.

- Benefits from social security, Medicare, Medicaid, or other governmental programs, or military service.

- Retirement plan transactions.

- Tax matters.

I also grant my Agent the power to delegate authority to others where appropriate, revoke any previous powers of attorney, and to perform any other act legally permissible by an Agent acting under a power of attorney in the State of Nebraska.

This Durable Power of Attorney document shall remain in effect until my death, unless I revoke it sooner. This document revokes any prior Durable Power of Attorney granted by me.

To validate this Durable Power of Attorney, my Agent shall present an affidavit saying that they have no actual knowledge that this power of attorney has been revoked or terminated. The act done by the Agent based on this power shall be as effective as if I were personally present and acting myself.

This Durable Power of Attorney is signed on the date written below under the laws of the State of Nebraska. I understand the significance of this document, and I sign it voluntarily for the purposes stated herein.

Date: ________

Principal's Signature: ______________________

Principal's Printed Name: ______________________

Agent's Signature: ______________________

Agent's Printed Name: ______________________

Witnesses' Signatures and Printed Names (if required by law or desired):

_________________________________ _________________________________

Printed Name: ____________________ Printed Name: ____________________

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | A Nebraska Durable Power of Attorney form allows one to appoint another person, known as an agent, to make financial and legal decisions on their behalf. |

| Governing Law | This form is governed by the Nebraska Uniform Power of Attorney Act, found in Nebraska Revised Statutes, sections 30-4001 to 30-4045. |

| Durability | The term "durable" signifies that the power of attorney remains in effect even if the principal becomes incapacitated or unable to make decisions for themselves. |

| Agent's Powers | The agent can handle tasks like managing bank accounts, signing checks, buying or selling property, and more, according to the permissions granted in the form. |

| Requirements | The form must be signed by the principal and notarized to be legally valid. Witnesses may also be required depending on the circumstances. |

| Revocation | The principal has the right to revoke the power of attorney at any time, as long as they are mentally competent, by issuing a written notice of revocation. |

| Special Considerations | Certain financial institutions may require the form to meet additional criteria or be on file for a specific period before it is honored. |

Nebraska Durable Power of Attorney - Usage Guide

Preparing a Durable Power of Attorney (DPOA) in Nebraska carries significant importance, as it empowers another person to make critical financial decisions on your behalf, should you become unable to do so. It's essential to approach this process with diligence and attention to detail to ensure that all your preferences are accurately reflected. The steps below are designed to guide you through the procedure of filling out a Nebraska DPOA form effectively, safeguarding your interests and providing peace of mind for both you and your loved ones.

- Begin by obtaining the latest Nebraska Durable Power of Attorney form. Ensure you have the most current version by visiting the official Nebraska government website or consulting with a legal professional.

- Enter your full legal name and address at the top of the form, identifying you as the principal. Ensure this information is accurate and matches any identification documents.

- Designate your attorney-in-fact (agent) by providing their full legal name and address. Choose someone you trust implicitly to manage your financial affairs.

- Detail the powers you are granting to your attorney-in-fact. Be as specific as possible, indicating which financial decisions they can and cannot make on your behalf. This can range from property transactions to managing your bank accounts.

- For a Durable Power of Attorney, ensure the document specifies that the powers granted will remain in effect even if you become incapacitated. This language is critical for the DPOA to be considered "durable."

- If you wish to impose any specific limitations or conditions on your attorney-in-fact’s powers, clearly spell them out in the designated section of the form.

- Select an effective date for when the DPOA will go into effect. Some choose to have it take effect immediately, while others may specify a future date or event, such as the determination of incapacity by a medical professional.

- Sign and date the form in the presence of a notary public to ensure it is legally binding. Nebraska law requires the DPOA to be notarized for it to be effective.

- Have your attorney-in-fact sign the form, acknowledging their acceptance of the responsibilities you are entrusting to them. While not always mandatory, this step helps clarify that the designated individual is willing and prepared to act on your behalf.

- Store the signed and notarized DPOA in a safe, accessible location. Provide copies to your attorney-in-fact, financial institutions, and anyone else who may need to be aware of its existence and contents.

Completing a Durable Power of Attorney is a proactive step toward managing your financial health and ensuring your wishes are honored, no matter what the future holds. It reflects careful consideration and planning, offering assurance that your affairs will be handled according to your exact specifications. Remember, carefully selecting your attorney-in-fact and specifying your wishes in clear, unequivocal terms can prevent confusion and conflict down the line. Taking these steps allows you to safeguard your future financial well-being with confidence.

Common Questions

What is a Nebraska Durable Power of Attorney?

A Nebraska Durable Power of Attorney (DPOA) is a legal document that allows you (the "principal") to appoint someone you trust (the "agent" or "attorney-in-fact") to make decisions on your behalf. This document remains in effect even if you become unable to make decisions for yourself due to an illness or incapacity. It can cover a wide range of decisions, including financial, real estate, and personal matters.

How do I know if my Nebraska Durable Power of Attorney form is completed correctly?

To ensure your Nebraska Durable Power of Attorney form is completed correctly, it must meet certain requirements. First, it should be written clearly, naming you as the principal and the person you choose as your agent. You need to specify the powers you are granting to your agent and indicate that it is durable, meaning it remains effective if you become incapacitated. The form must be signed by you and notarized. Many people also choose to have witnesses sign, although not strictly required, it can add an extra layer of validity.

Who should I choose as my agent in a Durable Power of Attorney?

Choosing an agent is a significant decision. It should be someone you trust completely, as they will have the authority to make important decisions on your behalf. Most people select a close family member or a trusted friend. Consider the person's ability to handle financial matters, their understanding of your wishes, and their willingness to act on your behalf in potentially difficult situations.

When does the Durable Power of Attorney become effective in Nebraska?

In Nebraska, a Durable Power of Attorney can become effective as soon as it is signed and notarized, unless the document specifies a different starting date or a triggering event (such as the principal's incapacitation). It is crucial to read and understand the terms outlined in your DPOA to know when your agent can start making decisions for you.

Can I revoke a Durable Power of Attorney in Nebraska, and if so, how?

Yes, you can revoke a Durable Power of Attorney in Nebraska at any time, as long as you are mentally competent. To revoke it, you should provide a written notice to your agent and to any institutions or individuals that were relying on the original DPOA. It's also a good idea to destroy all copies of the original document. To ensure the revocation process is handled correctly, you may wish to consult with a legal professional.

Common mistakes

A durable power of attorney (POA) is a vital legal document that allows an individual, known as the principal, to designate another person, called the agent or attorney-in-fact, to make decisions on their behalf should they become unable to do so. In Nebraska, when creating a durable power of attorney, people often make mistakes that can significantly impact the document's effectiveness. Understanding these common errors can help individuals avoid potential complications.

Failing to Specify Powers Clearly: One of the most critical mistakes is not being specific about the powers granted to the agent. The form should detail the extent of decisions the agent can make, whether financial, medical, or both. Vague language can lead to misinterpretation and legal challenges.

Choosing the Wrong Agent: The importance of selecting a trustworthy and competent agent cannot be overstated. Sometimes individuals choose an agent based on personal relationships rather than the agent's ability to handle responsibilities effectively and ethically.

Not Having a Successor Agent: Failing to designate a successor agent is a common oversight. If the original agent is unable or unwilling to serve, having a successor agent ensures that the principal's affairs can still be managed without interruption.

Overlooking the Need for Witnesses or Notarization: Depending on state requirements, a durable power of attorney might need to be witnessed or notarized to be valid. In Nebraska, ignoring these formalities can invalidate the document.

Not Specifying Durability: A power of attorney must explicitly state that it remains in effect if the principal becomes incapacitated. Without this clarification, the document may not serve its intended purpose of allowing the agent to act when the principal is most vulnerable.

Ignoring State-Specific Requirements: Each state has its own laws governing durable powers of attorney. Nebraska residents must ensure their document complies with Nebraska law to avoid potential invalidation.

Delaying the Process: Waiting until an emergency occurs to create a durable power of attorney is a grave mistake. At that point, the principal might no longer have the capacity to sign legal documents, complicating the situation further.

Failing to Update the Document: Circumstances change, and so should the durable power of attorney. It's essential to review and update the document periodically to reflect current wishes and relationships as well as any changes in the law.

To ensure the durable power of attorney effectively represents the principal's interests and complies with legal standards, individuals should avoid these common errors. Consulting with a legal professional knowledgeable in Nebraska's specific requirements for durable powers of attorney can provide invaluable guidance in this process. By carefully selecting the agent, clearly defining their powers, and adhering to state laws, principals can create a robust document that safeguards their well-being and financial affairs.

Documents used along the form

When preparing a Durable Power of Attorney (DPOA) in Nebraska, several other forms and documents may also be needed to ensure comprehensive coverage of legal and medical matters. These documents help in specifying personal wishes, managing assets, and ensuring that personal healthcare decisions are respected. Below is a list of commonly used forms and documents that are typically associated with or might complement a Nebraska Durable Power of Attorney.

- Advance Health Care Directive: This document allows an individual to outline their preferences for medical care if they become unable to make decisions for themselves. It often includes a Living Will and a Health Care Power of Attorney.

- Living Will: Part of an Advance Health Care Directive, a Living Will specifies what kinds of life-sust aining treatments someone would or would not want if they were critically ill or near the end of life.

- Health Care Power of Attorney: Also a component of an Advance Health Care Directive, this appoints a person to make healthcare decisions on behalf of someone if they are incapacitated.

- Last Will and Testament: A legal document that outlines how an individual's property and assets will be distributed after their death.

- Revocable Living Trust: This allows an individual to manage their assets during their lifetime and specify how these assets should be handled upon their death. It can help avoid probate.

- HIPAA Release Form: Authorizes healthcare providers to share an individual’s health information with specified persons.

- General Power of Attorney: Grants a designated person authority to handle financial and legal matters on someone's behalf, but unlike a DPOA, it becomes ineffective if the person becomes incapacitated.

- Mental Health Care Power of Attorney: Specifically permits an appointed agent to make decisions about mental health care if the individual is unable to do so themselves.

- Declaration for Mental Health Treatment: Allows individuals to make decisions about their mental health treatment in advance, in case they are deemed incapable of making those decisions down the line.

Together with the Nebraska Durable Power of Attorney, these documents can provide a comprehensive framework to manage one's affairs. It's essential to consider each document's role and implications carefully and consult with a legal professional to ensure they are correctly executed and reflect the individual's wishes. Preparing these documents well in advance offers peace of mind knowing that personal, financial, and health-related matters will be handled according to one’s preferences.

Similar forms

The Nebraska Durable Power of Attorney form is similar to other legal documents that allow people to appoint someone to make decisions on their behalf. However, it specifically enables an individual to name an agent to handle their financial affairs, not just for a limited time but continuing even if the person becomes incapacitated. This distinction sets it apart from a General Power of Attorney, which loses its validity if the person can no longer make their own decisions.

One similar document is the General Power of Attorney (GPA). Both the GPA and the Durable Power of Attorney (DPOA) empower an appointed representative to manage the affairs of the person who creates the document. However, the key difference lies in their durability. Unlike the DPOA, the authority granted through a GPA ends if the person becomes mentally incapacitated. This means that for long-term planning, especially concerning health issues or the desire to ensure financial matters are handled if one cannot make decisions, the DPOA is more appropriate.

Another document that shares similarities is the Health Care Power of Attorney. It also allows someone to appoint an agent to make decisions on their behalf, but it is specifically limited to medical decisions, in contrast to the broader financial focus of the DPOA. The Health Care Power of Attorney becomes crucial in situations where the individual cannot make their own health care decisions. While it operates similarly in appointing an agent, the types of decisions the agent can make are limited to health care, highlighting the DPOA’s broader scope in financial affairs.

A third comparable document is the Living Will. While a Living Will does not appoint an agent to act on the person’s behalf, it provides specific instructions on the type of medical care the individual wishes to receive should they become incapacitated and unable to communicate their wishes. It complements a Health Care Power of Attorney by guiding the appointed agent’s decisions, but unlike the DPOA, it does not involve financial decisions or appoint someone to manage financial matters.

Dos and Don'ts

When it comes to preparing a Nebraska Durable Power of Attorney form, it’s crucial to handle the process with care and attention. A well-prepared form ensures your wishes are respected and your affairs are managed precisely as you intend. To guide you, here’s a list of dos and don'ts that will help streamline the process and safeguard your interests.

Do:

- Read the form thoroughly before beginning to fill it out. Understanding every section will help prevent mistakes and ensure that you are fully aware of the powers you are granting.

- Choose a trustworthy agent. This person will have considerable control over your affairs, so it’s crucial to select someone who is not only reliable but also has your best interests at heart.

- Be specific about the powers granted. Clearly define what your agent can and cannot do on your behalf to avoid any confusion or misuse of the power granted.

- Consult a professional if needed. Seeking advice from a lawyer or a professional knowledgeable about Nebraska’s laws can provide clarity and ensure the form is completed correctly.

Don't:

- Leave any sections blank. If a section does not apply, write “N/A” to indicate this. Blank sections can lead to misunderstandings or a misuse of the form.

- Forget to sign and date the form in the presence of the required witnesses or a notary public. This step is essential for the form to be legally valid.

- Rely solely on generic forms without verifying that they comply with Nebraska’s specific laws and requirements.

- Postpone the task of completing the form. Life is unpredictable, and having this document prepared and properly filed can provide peace of mind for you and your loved ones.

Misconceptions

When discussing a Nebraska Durable Power of Attorney (POA), several misconceptions often arise. It's important to clarify these misunderstandings to ensure your rights and intentions are accurately represented. Here are seven common misconceptions:

Only elderly people need a Durable Power of Attorney. This is inaccurate. Accidents or sudden illness can happen at any age, making a Durable POA essential for anyone over 18.

Creating a Durable Power of Attorney means losing control over your finances immediately. Not true. The document can be designed to only take effect under circumstances you specify, allowing you to retain control until it's necessary.

Any Power of Attorney form works in Nebraska. This is a myth. Nebraska has specific requirements for a Durable Power of Attorney to be valid, including witness or notarization stipulations depending on the document.

A Durable Power of Attorney covers medical decisions. Wrong again. In Nebraska, a separate document, a healthcare power of attorney or advance directive, is needed for medical decisions.

Once signed, a Durable Power of Attorney can't be changed or revoked. This is not the case. As long as the person is mentally competent, they can amend or revoke their POA document at any time.

A Durable Power of Attorney will be recognized in all states. While generally true, some states have specific forms or provisions that might not align with Nebraska's version. It's important to check the requirements if you move or have assets in another state.

If married, my spouse automatically has the same authority as a Durable Power of Attorney. Incorrect. Without a formal POA document, your spouse might be unable to make certain financial or legal decisions on your behalf.

Understanding these misconceptions about the Nebraska Durable Power of Attorney form is vital for effective planning. Whether you're preparing for the unexpected or ensuring your affairs are managed according to your wishes, clarity about this powerful document can provide peace of mind for you and your loved ones.

Key takeaways

Completing the Nebraska Durable Power of Attorney (POA) form is a critical process that grants someone else the authority to make important decisions on your behalf. Understanding its key components can ensure that this power is exercised according to your wishes. Here are six essential takeaways:

- Identify the right agent: Choosing a reliable and trustworthy agent is paramount. This person will be making decisions regarding your finances, property, and potentially your health care, so make sure they understand your wishes and are willing to act in your best interest.

- Be specific about powers granted: The form allows you to specify exactly what powers your agent will have. You can grant broad authority or limit it to specific actions. It’s important to be as clear as possible to avoid any ambiguity about your agent's authority.

- Understand the durability aspect: A Durable Power of Attorney means that the document remains in effect even if you become incapacitated. This feature is crucial for ensuring that someone can legally make decisions for you when you are unable to do so yourself.

- Sign in the presence of witnesses or a notary: Nebraska law may require your Durable Power of Attorney to be witnessed or notarized to be valid. This step also helps protect against fraud and ensures that the document is legally binding.

- Consider a successor agent: It's wise to appoint a successor agent in the event your primary agent is unable or unwilling to serve. Having a backup helps to ensure that your affairs will be managed without interruption.

- Review and update regularly: Your circumstances and relationships can change; therefore, it’s a good practice to review and potentially update your Durable Power of Attorney periodically. This ensures that it continues to reflect your current wishes and circumstances.

Following these guidelines can provide peace of mind that your affairs will be handled according to your preferences, even if you cannot make decisions for yourself. Always consider consulting with a legal professional to tailor your Durable Power of Attorney to your specific needs and situation.

More Durable Power of Attorney State Forms

Power of Attorney Michigan - It can dramatically reduce the administrative burdens on family members during challenging times by having a plan already in place.

New Mexico Durable Power of Attorney - Effective communication with the chosen agent about expectations and the scope of their responsibilities is crucial for the arrangement to work as intended.

Louisiana Power of Attorney Template - Its existence can deter potential legal disputes among heirs by establishing clear financial stewardship in advance.

Indiana Durable Power of Attorney - This legal framework protects the principal’s assets and financial legacy, providing a sense of security for the future.