Attorney-Verified Durable Power of Attorney Document for Nevada

In the journey of life, securing one’s future and the management of personal affairs, especially during unforeseeable circumstances, is paramount. This is where the Nevada Durable Power of Attorney form steps in as a vital legal document. It empowers someone you trust deeply to manage your financial affairs, potentially a safeguard against difficult times when you might not be able to make decisions yourself. What sets this document apart in Nevada is its ‘durable’ aspect, ensuring that the powers granted remain in effect even if you're unable to communicate or make decisions due to health reasons. From real estate transactions to handling bank accounts, and even making decisions about personal property, the scope of authority you can grant is broad yet customizable according to your needs and wishes. Understanding the ins and outs of this document, its implications, and the proper way to execute it, can make all the difference in ensuring that your affairs are handled according to your precise instructions, offering peace of mind to you and your loved ones.

Form Preview

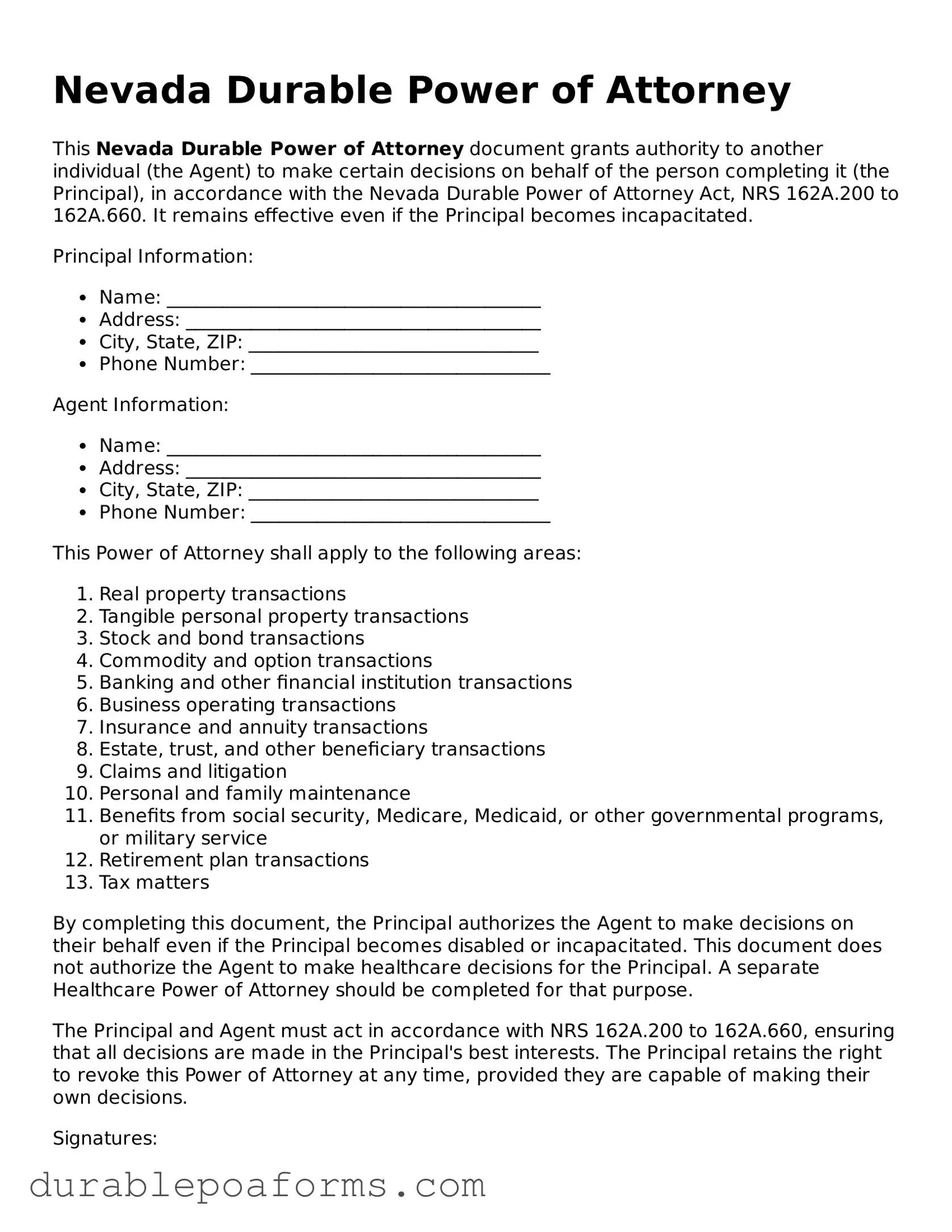

Nevada Durable Power of Attorney

This Nevada Durable Power of Attorney document grants authority to another individual (the Agent) to make certain decisions on behalf of the person completing it (the Principal), in accordance with the Nevada Durable Power of Attorney Act, NRS 162A.200 to 162A.660. It remains effective even if the Principal becomes incapacitated.

Principal Information:

- Name: ________________________________________

- Address: ______________________________________

- City, State, ZIP: _______________________________

- Phone Number: ________________________________

Agent Information:

- Name: ________________________________________

- Address: ______________________________________

- City, State, ZIP: _______________________________

- Phone Number: ________________________________

This Power of Attorney shall apply to the following areas:

- Real property transactions

- Tangible personal property transactions

- Stock and bond transactions

- Commodity and option transactions

- Banking and other financial institution transactions

- Business operating transactions

- Insurance and annuity transactions

- Estate, trust, and other beneficiary transactions

- Claims and litigation

- Personal and family maintenance

- Benefits from social security, Medicare, Medicaid, or other governmental programs, or military service

- Retirement plan transactions

- Tax matters

By completing this document, the Principal authorizes the Agent to make decisions on their behalf even if the Principal becomes disabled or incapacitated. This document does not authorize the Agent to make healthcare decisions for the Principal. A separate Healthcare Power of Attorney should be completed for that purpose.

The Principal and Agent must act in accordance with NRS 162A.200 to 162A.660, ensuring that all decisions are made in the Principal's best interests. The Principal retains the right to revoke this Power of Attorney at any time, provided they are capable of making their own decisions.

Signatures:

Principal Signature: _______________________________ Date: ____________

Agent Signature: _________________________________ Date: ____________

This document was prepared on the date indicated above and does not require notarization to be effective. However, getting it notarized may help to avoid disputes about its authenticity.

This document is intended to provide the Principal with the necessary authority to handle matters pertaining to the specified areas. It should be used in compliance with Nevada law and is not a substitute for legal advice.

Form Specifications

| Fact | Description |

|---|---|

| Governing Law | The Nevada Durable Power of Attorney form is governed by Chapter 162A of the Nevada Revised Statutes, which specifically addresses powers of attorney. |

| Purpose | It allows an individual (the principal) to designate another person (the agent) to make financial decisions on their behalf. | (tr>

| Durability | The "durable" nature of this power of attorney means that the agent's authority persists even if the principal becomes incapacitated. |

| Requirements for Execution | For the form to be valid, it must be signed by the principal, in the presence of a notary public or two adult witnesses, as specified by Nevada law. |

| Agent's Duties | The chosen agent is required to act in the principal's best interest, maintaining accuracy in records and acting according to the principal's instructions. |

| Revocation | The principal has the right to revoke the power of attorney at any time, provided they are competent to do so. |

| Power Limitations | Certain decisions, such as health care directives, cannot be made by the agent under this power of attorney and require a separate legal document. |

| Effective Date | The form becomes effective immediately upon proper execution unless a different commencement date is specified in the document itself. |

Nevada Durable Power of Attorney - Usage Guide

When someone decides they want another person to make decisions on their behalf, they can use a Durable Power of Attorney (DPOA) form. This document is particularly important in situations where the person might become unable to make decisions due to health issues or other reasons. In Nevada, filling out a Durable Power of Attorney form correctly is essential to ensure it's legally binding. The process isn't complicated, but it does require attention to detail and understanding of what each section demands. Here is a clear step-by-step guide to help you fill out the Nevada Durable Power of Attorney form.

- First, gather all the necessary information, including the full legal names and addresses of both the principal (the person granting the power) and the agent (the person receiving the power).

- Identify the powers you want to grant. The form may list various options, such as financial decisions, real estate transactions, and personal care, among others. Check the boxes next to the powers you are assigning to the agent.

- Specify any special instructions or limits to the powers being granted. This section is particularly important if you wish to restrict the agent's authority in certain areas.

- Enter the date the DPOA will become effective. Some forms allow you to choose whether the powers become effective immediately or only upon the principal's incapacity.

- Decide on a termination date for the DPOA, if applicable. While "durable" implies that the document remains in effect even if the principal becomes incapacitated, it can be set to expire on a specific date.

- Review any sections that may require witnesses or a notary public. The requirements can vary depending on the state law, but generally, signatures from witnesses or acknowledgement by a notary can add to the document's legality.

- Both the principal and the agent need to sign and date the form. Ensure this is done in the presence of any required witnesses or a notary, if necessary.

- Keep the original signed document in a safe but accessible place, and provide the agent with a copy. It's also wise to inform a trusted third party, such as a family member or attorney, where the original document is stored.

Following these steps carefully will help ensure that the Durable Power of Attorney form is filled out correctly and reflects the principal's wishes. Remember, this form grants significant authority to another person. It's a good practice to consult with a legal professional if you have questions or concerns about the process or the implications of the powers being granted.

Common Questions

What is a Nevada Durable Power of Attorney?

A Nevada Durable Power of Attorney is a legal document that allows an individual, known as the principal, to appoint another person, referred to as the agent, to make decisions on their behalf regarding financial, real estate, and other matters. The "durable" aspect means that the power of attorney remains effective even if the principal becomes incapacitated.

Who can be appointed as an agent in Nevada?

Any competent adult, such as a trusted family member, friend, or professional like an attorney, can be appointed as an agent in Nevada. It’s vital to choose someone who is reliable and capable of handling the responsibilities that come with the role.

What kind of powers can I grant to my agent?

In Nevada, you can grant your agent a wide range of powers, including handling financial transactions, managing real estate properties, dealing with government benefits, and more. You have the option to grant broad authority or limit the powers to specific acts, depending on your personal needs and preferences.

Is a Nevada Durable Power of Attorney revocable?

Yes, as long as the principal is mentally competent, a Nevada Durable Power of Attorney can be revoked at any time. Revocation should be done in writing and communicated to the agent and any third parties relying on the document.

Does the Durable Power of Attorney need to be notarized in Nevada?

Yes, for a Durable Power of Attorney to be legally valid in Nevada, it must be notarized. Some situations may also require the presence of witnesses during the signing, but notarization is a fundamental requirement for the document's legality.

What happens if the principal becomes incapacitated without a Durable Power of Attorney in Nevada?

If the principal becomes incapacitated without a Durable Power of Attorney in place, a court may need to appoint a guardian or conservator to make decisions on behalf of the principal. This process can be time-consuming and costly, and it may result in a less desirable outcome for the principal.

Can I include instructions regarding my healthcare in a Durable Power of Attorney?

In Nevada, a Durable Power of Attorney for healthcare is a separate document from a Durable Power of Attorney for financial matters. If you want to designate someone to make healthcare decisions on your behalf, you should complete a separate healthcare power of attorney or an advance healthcare directive.

How can I ensure that my Nevada Durable Power of Attorney is effective?

To ensure your Nevada Durable Power of Attorney is effective, make sure it is properly completed, notarized, and kept in a safe place where your agent can access it if needed. Additionally, inform your family members and any financial institutions or other entities that may be affected of its existence and the identity of your appointed agent.

Common mistakes

When individuals attempt to fill out the Nevada Durable Power of Attorney form, several common mistakes can hinder the document's effectiveness. These errors may seem minor, but they can have significant implications for the validity of the form and the ease with which the appointed agent can carry out their duties.

Firstly, not specifying the powers granted is a critical oversight. The form allows the principal (the person granting the power) to specify exactly which powers they are granting to their agent (the person receiving the power). When people fail to detail these powers, it leaves room for confusion and potential legal challenges. It's essential to list the agent's powers explicitly to ensure they can act in the principal's best interests without unnecessary hurdles.

Another frequent mistake is neglecting to choose a successor agent. Life is unpredictable. If the primary agent is unable to serve for any reason, having a successor already named in the document ensures that the principal's affairs can still be managed without delay. Failing to designate a successor can complicate matters significantly, possibly requiring court intervention to appoint a new agent.

Additionally, many people forget to sign and date the document in the presence of the required witnesses or a notary. This oversight can entirely invalidate the document, as Nevada law requires these formalities for a Durable Power of Attorney to be legally binding. Without proper execution, the document may be considered null and void, leaving the principal without the representation they intended to establish.

Last but not least, not reviewing and updating the document regularly can lead to issues. Circumstances change, and a Durable Power of Attorney should reflect the current wishes of the principal and their current situation. An outdated form may grant powers to an agent the principal would no longer choose or fail to include powers that have become relevant. Regularly reviewing and, if necessary, updating the form ensures that it remains effective and relevant.

Common mistakes include:

- Not specifying the powers granted to the agent, leading to ambiguity.

- Neglecting to choose a successor agent, creating potential issues if the primary agent cannot serve.

- Forgetting to properly execute the document in front of required witnesses or a notary, risking the document's validity.

- Not updating the document to reflect current wishes and circumstances, making it potentially outdated or irrelevant.

Addressing these mistakes when filling out the Nevada Durable Power of Attorney form can save individuals and their families from future legal troubles and ensure their affairs are managed as intended.

Documents used along the form

When preparing a durable power of attorney in Nevada, individuals often find it necessary to gather and understand several other related documents to ensure a comprehensive approach to their legal and financial matters. Durable power of attorney forms allow individuals to appoint someone else to manage their affairs if they become incapacitated, but this document is just one piece of the puzzle. Here are five additional forms and documents often used alongside the Nevada Durable Power of Attorney form to provide a full scope of legal protections and instructions.

- Living Will: This document, also known as an advance directive, allows individuals to express their wishes regarding end-of-life medical treatments, should they become unable to communicate their decisions themselves. It works in tandem with a durable power of attorney by guiding the appointed agent’s decisions about health care.

- Medical Power of Attorney: While a durable power of attorney typically covers financial and legal affairs, a medical power of attorney designates someone to make health care decisions on behalf of the individual if they're unable to do so. This can cover a wide range of decisions, from routine medical care to critical life-saving interventions.

- Last Will and Testament: This essential legal document outlines how an individual’s estate will be distributed upon their death, including who will inherit assets, property, and guardianship of minor children if applicable. It complements the durable power of attorney by handling affairs after the individual's death.

- Revocation of Power of Attorney: This form is crucial for when an individual decides to cancel or change the powers granted in a previously executed power of attorney. It legally terminates the authority given to the agent, allowing the principal to appoint a new agent if desired.

- Declaration of Homestead: While not directly related to personal decision-making authority, a Declaration of Homestead is often considered in estate planning. It protects a primary residence from certain types of creditors, which can be especially important if the durable power of attorney involves managing real estate or preparing for a future where long-term care may be needed.

In summary, while the Nevada Durable Power of Attorney is a key component of managing one's personal affairs, it is just one part of a suite of documents that work together to ensure individuals' health, financial, and personal wishes are respected and protected. It's always recommended to consult with a legal professional when preparing these documents to ensure they align with personal circumstances and state laws.

Similar forms

The Nevada Durable Power of Attorney form is similar to several key legal documents that allow individuals to designate others to act in their stead for various decisions. This similarity often lies in their purpose to provide peace of mind and ensure that personal, financial, or health-related decisions are made according to the principal's wishes if they're unable to do so themselves.

The Medical Power of Attorney: Similar to the Nevada Durable Power of Attorney, which can include provisions for financial and legal decisions, the Medical Power of Attorney focuses specifically on health care decisions. Both documents operate under the premise that the principal (the person making the designation) may become unable to make decisions at some point. They allow the principal to appoint an agent to decide in accordance with the principal's wishes, interests, and directives. However, while the Durable Power of Attorney can cover a broad spectrum of decisions beyond health care, the Medical Power of Attorney is strictly limited to medical decisions.

The General Power of Attorney: This document and the Nevada Durable Power of Attorney share the feature of allowing someone else to make decisions on behalf of the principal. The key difference between the two lies in their durability. The General Power of Attorney ceases to be effective if the principal becomes incapacitated or unable to make decisions. In contrast, the Durable Power of Attorney, as its name suggests, remains in effect even if the principal loses the capacity to make decisions. Both documents grant authority to an agent, though the scope and permanence of that authority differ significantly.

The Limited or Special Power of Attorney: Much like the Durable Power of Attorney, the Limited or Special Power of Attorney allows a principal to grant specific powers to an agent. The crucial difference lies in the scope of authority granted. The Limited Power of Attorney is highly specific, often restricted to particular transactions or types of decisions, such as selling a property or managing certain financial matters for a short period. Conversely, the Durable Power of Attorney tends to cover a broader range of decisions and remains in effect until the principal revokes it or passes away, making it a more comprehensive and enduring document.

The Living Will: While not a Power of Attorney in the traditional sense, the Living Will shares a common purpose with the Durable Power of Attorney for Health Care, a variant that sometimes appears in Nevada's legal documents. Both allow individuals to lay out their wishes regarding medical treatment and end-of-life care. The Living Will specifically captures wishes regarding life-sustaining treatment if the individual becomes terminally ill or permanently unconscious, with no likelihood of recovery. The Durable Power of Attorney for Health Care goes a step further by appointing an agent to make decisions that align with those wishes, offering a dynamic approach to unforeseen situations vs. the static directives of a Living Will.

Dos and Don'ts

Nevada's Durable Power of Attorney (POA) is an essential document that allows you to appoint someone else to manage your affairs if you're unable to do so. It's a powerful tool, but with that power comes responsibility. Here are some tips on what you should and shouldn't do when filling one out.

What You Should Do:

- Choose a trusted agent: Select someone you trust implicitly to act in your best interests. This person will have considerable control over your finances and legal decisions, so it's crucial to choose wisely.

- Be specific about powers granted: Clearly define what your agent can and cannot do on your behalf. Vagueness can lead to confusion or abuse of power, so it's better to be precise in your instructions.

- Consult with a lawyer: Even if you're using a form, consulting with a legal professional can help ensure that the document meets all legal requirements in Nevada and truly reflects your wishes.

- Notarize the document: Nevada law requires durable powers of attorney to be notarized to be legally valid. Ensure that you complete this step to avoid any issues with the document's recognition.

What You Shouldn't Do:

- Don't leave any sections blank: If a section does not apply to your situation, mark it with "N/A" (not applicable) instead of leaving it empty. Empty sections can lead to confusion or misinterpretation.

- Don't forget to update it: Life changes, such as divorce, the death of an agent, or moving to another state, may require updates to your POA. Failing to keep it current can render the document ineffective when it's most needed.

- Don't use generic forms without verification: While generic forms are a starting point, ensure that the form complies with Nevada laws. Without this verification, you risk creating a document that is not legally enforceable.

- Don't neglect to communicate your wishes: Discuss your instructions and wishes with the person you've appointed as your agent. Understanding your expectations can help them make decisions that align with your preferences.

Misconceptions

When it comes to the Nevada Durable Power of Attorney form, a myriad of misconceptions float around, clouding the judgment of many. It's crucial to dispel these myths for individuals to make informed decisions regarding their legal and financial futures. Here are nine common misunderstandies about the Nevada Durable Power of Attorney and the truth behind each:

It's only for the elderly: Many believe that a Durable Power of Attorney (DPOA) is a tool just for the aging population. In reality, unforeseen circumstances like accidents or sudden illnesses can happen at any age, making a DPOA a wise choice for virtually anyone.

It grants unlimited power: Some fear that by signing a DPOA, they are giving away unfettered control over all their affairs. However, Nevada law allows for the document to be as broad or as specific as the principal desires, offering a way to tailor the authority given to the agent.

The agent can make health decisions: A common misconception is that a DPOA includes health care decisions, but in Nevada, financial and health care powers of attorney are separate documents. A DPOA in Nevada strictly deals with financial matters.

It's effective immediately upon signing: While many DPOAs become effective as soon as they are signed, Nevada law also permits "springing" powers, which means the document only takes effect upon the occurrence of a specific event, typically the principal's incapacity.

It overrides a will: Some individuals mistakenly believe a DPOA can change their will. A DPOA is only effective during the individual's lifetime and does not have any control over the distribution of assets after death; that's the role of a will.

Signing one means losing control: A common fear is that creating a DPOA means the principal will lose control over their finances and cannot override the agent's decisions. In truth, the principal can revoke or change the DPOA at any time as long as they are mentally competent.

Any form will do: With the abundance of generic legal documents online, there's a myth that any DPOA form will suffice. However, Nevada has specific requirements for a DPOA to be valid, including witness or notarization criteria, which may not be met by a generic form.

It's too complicated and expensive: Some are under the impression that creating a DPOA is a complex and costly affair. While it's wise to seek legal advice, the process can be straightforward and affordable, especially compared to the potential costs and legal hurdles of not having one if needed.

Lasts after death: Another misconception is that a DPOA remains in effect after the principal's death. In actuality, the authority granted through a DPOA ceases when the principal dies, at which point the executor of the will or state laws governing intestate succession take over.

Understanding the nuances of a Nevada Durable Power of Attorney can safeguard an individual's financial well-being and ensure their wishes are honored, regardless of what the future holds. Clearing up these misconceptions empowers individuals to make informed, confident decisions about their estate planning needs.

Key takeaways

The Nevada Durable Power of Attorney (DPOA) is a crucial document that enables you to appoint someone you trust to manage your financial affairs if you're unable to do so yourself. Understanding how to properly fill out and utilize this form is essential to ensure your financial matters are handled according to your wishes should you become incapacitated. Here are key takeaways to guide you through this process:

- Selecting an agent: Choose a person you trust implicitly as your agent. This is the individual who will have the authority to make financial decisions on your behalf. Consider their ability to manage financial tasks and their willingness to act in your best interest.

- Scope of authority: Be clear about the powers you are granting to your agent. The form allows you to specify which financial decisions they can make, such as managing real estate, handling banking transactions, and dealing with tax matters.

- Term: The "durable" nature of the power of attorney means it remains effective even if you become incapacitated. Specify any conditions under which you want the DPOA to start or end, aside from your incapacity.

- Signing requirements: Nevada law requires your signature and the signatures of two witnesses or a notary public. This ensures the document is legally binding. Ensure these requirements are met to avoid any disputes about the document's validity.

- Notify financial institutions: Inform your bank and any other financial institutions of the DPOA. Providing them with a copy can help smooth transactions made by your agent on your behalf.

- Revocation: You retain the right to revoke the DPOA at any time, as long as you're mentally competent. Make sure to notify your agent and any financial institutions if you decide to revoke the document.

- Choosing a successor agent: Consider appointing a successor agent. If your first choice is unable or unwilling to serve, having a backup ensures your financial matters won't be left unattended.

- Legal advice: Consulting with a legal professional can help you understand the nuances of the DPOA form. They can ensure the form aligns with your wishes and adheres to Nevada law.

- Keep it accessible: Store the DPOA in a safe but accessible place. Inform your agent and a trusted family member or friend of its location.

By keeping these key points in mind, you can more confidently navigate the process of establishing a Durable Power of Attorney. It's an important step in managing your financial well-being and ensuring your peace of mind.

More Durable Power of Attorney State Forms

Durable Power of Attorney Arkansas - It remains in effect even if you become mentally incapacitated, ensuring your affairs are managed according to your wishes.

Durable Power of Attorney Form Pennsylvania - Legal paperwork authorizing a trusted individual to manage your affairs.

Louisiana Power of Attorney Template - This document necessitates thoughtful consideration in selecting an agent, as they will have significant influence over your financial well-being.