Attorney-Verified Durable Power of Attorney Document for New Hampshire

For individuals seeking to manage their financial affairs with foresight and security, the New Hampshire Durable Power of Attorney form emerges as a crucial document. Seamlessly blending the authority to act on one's behalf with the reassurance of durability, this legal instrument remains effective even when the individual, also known as the principal, becomes incapacitated. Principals can therefore entrust their financial transactions, property management, and business operations to a chosen representative, known as the agent, with confidence. Such empowerment is particularly indispensable in ensuring that personal financial matters are handled according to the principal's wishes, regardless of unforeseen health issues that might impair their decision-making capabilities. In New Hampshire, this form not only serves as a testament to proactive financial planning but also reflects a deep trust placed in the chosen agent, whose actions can significantly impact the principal's estate and financial legacy.

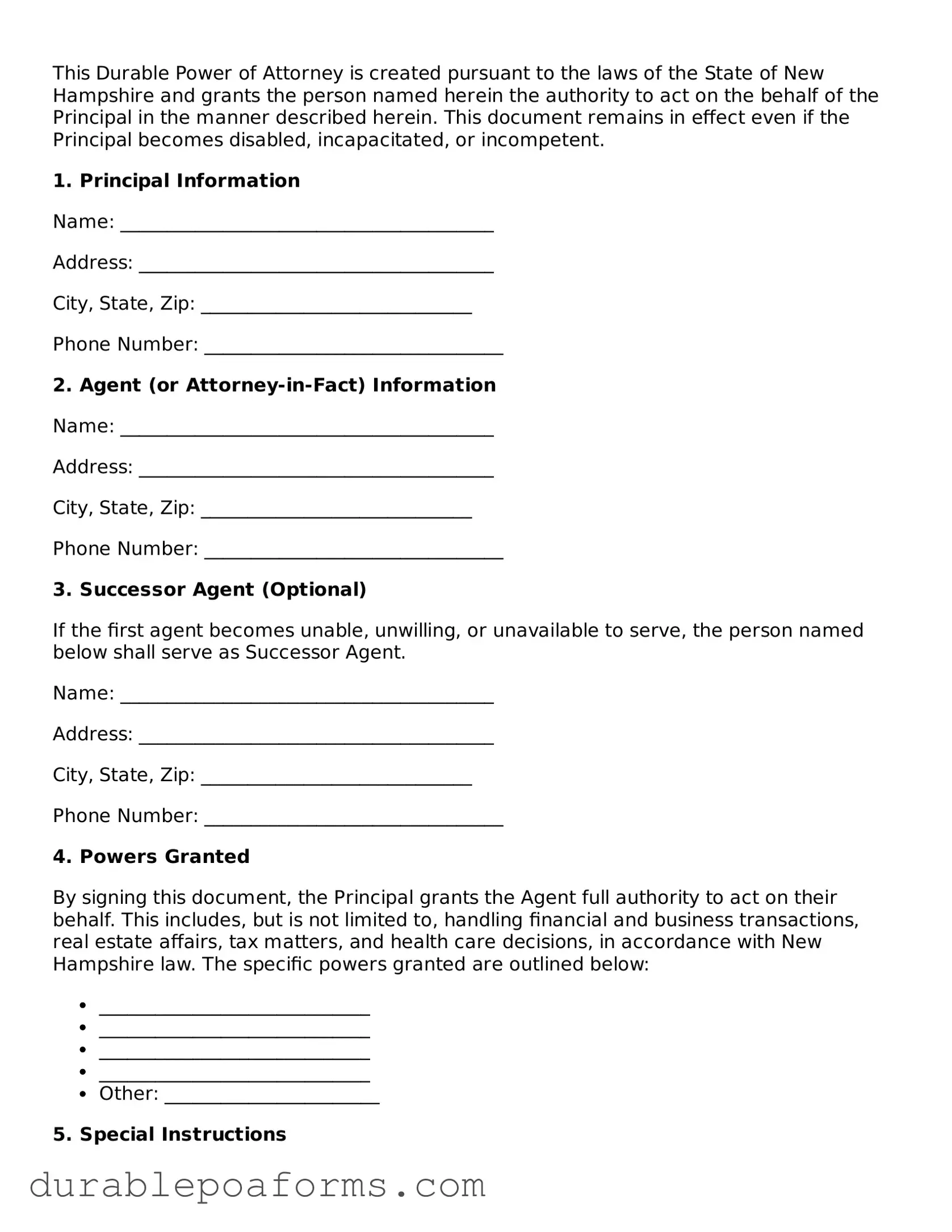

Form Preview

This Durable Power of Attorney is created pursuant to the laws of the State of New Hampshire and grants the person named herein the authority to act on the behalf of the Principal in the manner described herein. This document remains in effect even if the Principal becomes disabled, incapacitated, or incompetent.

1. Principal Information

Name: ________________________________________

Address: ______________________________________

City, State, Zip: _____________________________

Phone Number: ________________________________

2. Agent (or Attorney-in-Fact) Information

Name: ________________________________________

Address: ______________________________________

City, State, Zip: _____________________________

Phone Number: ________________________________

3. Successor Agent (Optional)

If the first agent becomes unable, unwilling, or unavailable to serve, the person named below shall serve as Successor Agent.

Name: ________________________________________

Address: ______________________________________

City, State, Zip: _____________________________

Phone Number: ________________________________

4. Powers Granted

By signing this document, the Principal grants the Agent full authority to act on their behalf. This includes, but is not limited to, handling financial and business transactions, real estate affairs, tax matters, and health care decisions, in accordance with New Hampshire law. The specific powers granted are outlined below:

- _____________________________

- _____________________________

- _____________________________

- _____________________________

- Other: _______________________

5. Special Instructions

The Principal may specify any limitations on the Agent's powers or provide any special instructions here:

_________________________________________________________

_________________________________________________________

6. Effective Date and Duration

This Durable Power of Attorney becomes effective immediately upon signing unless stated otherwise and remains in effect indefinitely unless a termination date is specified or the Principal revokes it.

Effective Date: _____________________

Termination Date (Optional): _____________________

7. Signature of Principal

By signing below, I confirm that I understand the contents of this document and willingly grant the powers specified here to the named Agent.

Signature: ___________________________ Date: _____________

8. Acknowledgment by Agent

By signing below, the named Agent accepts the authority granted under this Durable Power of Attorney and vows to act in the Principal’s best interest to the best of their abilities and in accordance with New Hampshire laws.

Signature of Agent: ______________________ Date: _____________

9. Witness and Notarization

This section should be filled out only in the presence of a Notary Public and/or required witnesses as per New Hampshire state law.

Witnesses are required to confirm that the Principal is signing the document willingly and is aware of its contents.

Witness 1 Signature: ______________________ Date: _____________

Witness 2 Signature: ______________________ Date: _____________

Notary Public Acknowledgment

State of New Hampshire

County of ___________

On this _____ day of ___________, 20____, before me, a Notary Public, personally appeared ________________________________, known to me to be the person whose name is subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

______________________________________

Notary Public

My Commission Expires: _______________

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | Allows a person to appoint someone else to handle financial affairs on their behalf. |

| Governing Law | New Hampshire Revised Statutes, Section 564-E:105 for Durable Powers of Attorney. |

| Duration | Remains effective even if the person who creates it becomes incapacitated. |

| Revocation | Can be revoked by the person who created it as long as they are competent. |

| Requirements | Must be signed by the person creating it in the presence of a notary public. |

New Hampshire Durable Power of Attorney - Usage Guide

Filling out a Durable Power of Attorney (DPOA) form in New Hampshire is an important process that grants someone you trust the legal authority to act on your behalf in financial matters, if you're unable to do so yourself. This step is crucial in ensuring that your affairs are handled according to your wishes, even when you're not in a position to oversee them directly. The following steps are designed to guide you through the completion of the form seamlessly. It's advisable to review each section carefully and consult with a legal professional if you have any uncertainties before finalizing the document.

- Begin by downloading the correct version of the Durable Power of Attorney form specific to New Hampshire. Ensure it's the most recent version to comply with current state laws.

- Enter your full legal name and address at the top of the form to identify yourself as the Principal—the person granting authority to another.

- Designate an Agent by providing their full legal name and address. This is the person you are giving the power to act on your behalf. It's important to choose someone you trust implicitly.

- Specify the powers you're granting to your Agent. These can range from handling financial transactions to making decisions about your property. Be as clear and specific as possible to avoid any ambiguity.

- If you wish to impose any restrictions on the powers granted, clearly detail these limitations in the designated section of the form.

- Decide if the Durable Power of Attorney will become effective immediately or only upon your incapacitation. Mark the corresponding option on the form. This is an important decision that affects when your Agent can start making decisions on your behalf.

- Some states require a notary public to witness the signing of the form. Check if this is a requirement in New Hampshire and, if so, arrange for a notary to be present at the signing.

- Sign and date the form in the presence of the required witnesses and/or notary public, depending on the state's requirements. Ensure your Agent also signs the form, if required.

- Keep the original document in a safe but accessible place. Provide your Agent with a copy so they can prove their authority when needed. It's also wise to inform a close family member or friend about the arrangement.

- Review the document periodically and update it if necessary, especially after major life events or changes in your personal wishes or situation.

Completing the Durable Power of Attorney form is a significant step in managing your future financial wellbeing and peace of mind. By carefully selecting a trusted individual to act as your Agent and clearly outlining the scope of their authority, you can ensure that your affairs will be handled according to your wishes, even in situations when you're not able to manage them yourself. Remember, laws can vary from state to state, so it's important to make sure the form meets all the legal requirements specific to New Hampshire.

Common Questions

What is a Durable Power of Attorney (DPOA) in New Hampshire?

A Durable Power of Attorney is a legal document that allows an individual (the principal) to appoint someone else (the agent) to make decisions on their behalf, even if the principal becomes incapacitated. The term "durable" means that the power of attorney will remain in effect even if the principal loses the ability to make decisions for themselves.

Why would someone need a DPOA in New Hampshire?

Individuals may choose to set up a DPOA for various reasons, such as being prepared for unexpected accidents, illnesses, or the onset of a condition that could impair their ability to manage their own affairs. It ensures that their financial, legal, and healthcare matters can be handled by a trusted person if they become unable to do so themselves.

How can I create a DPOA in New Hampshire?

To create a DPOA in New Hampshire, one must complete the Power of Attorney form, specifying the powers granted to the agent. The document must be signed by the principal in front of a notary public or two adult witnesses, neither of whom can be the agent, to be legally valid. It's recommended to seek legal advice to ensure the form accurately reflects the principal's wishes and complies with state laws.

Who should I choose as my agent?

Choosing an agent is a significant decision. It should be someone you trust implicitly to act in your best interest. Consider selecting a family member, a close friend, or a professional you have confidence in. It's vital that the agent understands their responsibilities and is willing to take on the role.

What powers can I grant to my agent under a DPOA in New Hampshire?

In New Hampshire, you can grant your agent a wide range of powers, including handling financial matters, real estate transactions, managing business operations, and making healthcare decisions, among others. You can choose to grant broad authority or specify only certain powers. It's essential to be clear about what your agent can and cannot do on your behalf.

Can I revoke a DPOA?

Yes, as long as you, the principal, are mentally competent, you can revoke your DPOA at any time. To do so, you should provide a written notice to your agent and to any institutions or individuals that were aware of the power of attorney. Destroying the original document and any copies can also help prevent it from being used after it's been revoked.

Is a DPOA different from a healthcare power of attorney in New Hampshire?

While a durable power of attorney can include healthcare decisions, New Hampshire allows for a separate document known as a Healthcare Power of Attorney or Advance Directive. This document specifically addresses medical decisions, including the types of treatments you may or may not want, in case you can't make those decisions yourself.

What if I change my mind about my appointed agent?

If you decide to change your agent, you should formally revoke the existing DPOA and create a new one. Make sure to communicate the change to your previous agent and anyone else involved. It's crucial to ensure that all relevant parties are informed to prevent confusion or misuse of the former document.

Can a DPOA be used to take decisions after the death of the principal?

No, a Durable Power of Attorney becomes null and void upon the death of the principal. After the principal's death, the executor or administrator of the estate, as appointed in the will or by a court, becomes responsible for managing the deceased's affairs according to their will or state law.

Common mistakes

When completing the New Hampshire Durable Power of Attorney form, a significant number of individuals inadvertently make errors. These mistakes can lead to complications, delays, and sometimes, the invalidation of the form. Understanding and avoiding these common pitfalls can ensure the document fulfills its intended purpose without unnecessary legal complications.

Not Specifying Powers Clearly: One of the most common mistakes is not specifying the powers granted to the agent with adequate clarity. It's essential to delineate the extent of powers, such as financial decisions or property management, to prevent any ambiguity or misuse of authority.

Choosing the Wrong Agent: The appointment of an unreliable or inappropriate agent can lead to problems. Entrusting someone who lacks the understanding, willingness, or capability to manage your affairs as you would wish is a mistake that can have lasting consequences.

Failing to Include a Successor Agent: Neglecting to appoint a successor agent can create a void in case the primary agent is unable or unwilling to serve. Having a backup ensures continuity in managing affairs without interruption.

Overlooking the Need for Notarization: Forgetting to have the form notarized is a critical error that can render the document invalid. Notarization is a legal requirement that provides a layer of verification and authenticity to the power of attorney.

Ignoring Limitations and Conditions: Failing to set limitations and conditions on the agent's power can lead to overreach. It is important to tailor the authority granted, possibly by setting duration limits or specifying conditions under which powers can be exercised.

Inaccurate or Incomplete Information: Entering inaccurate or incomplete information about the principal, agent, or the powers being granted can lead to misunderstandings and legal challenges. Accuracy is paramount in all sections of the document.

Lack of Witnesses: While not always a requirement, lacking witness signatures can impact the document’s strength and validity, especially in situations where its authenticity might be questioned.

Not Updating the Document: Failing to update the power of attorney to reflect changes in circumstances, such as a change in the agent or in the principal's wishes, can lead to an outdated document that does not accurately reflect current intentions.

Not Consulting Legal Advice: Many individuals complete the form without seeking legal advice, risking missing critical legal requirements or making decisions that could have been more strategically advantageous with professional guidance.

By being aware of and actively avoiding these mistakes, individuals can ensure their New Hampshire Durable Power of Attorney form is legally sound and reflective of their intentions. This proactive approach can safeguard against potential disputes and ensure that one's affairs are managed as desired, even in their absence.

Documents used along the form

When preparing for the future, it's crucial to consider not only how your decisions will be handled should you become unable to make them yourself, but also to ensure your wishes are followed in various scenarios. The New Hampshire Durable Power of Attorney (DPOA) form is a vital document for granting someone the authority to make decisions on your behalf. However, it's often accompanied by other essential documents to provide a comprehensive approach to planning. Here's a look at some of these documents and what they entail.

- Advance Healthcare Directive: This document combines a living will and healthcare power of attorney. It outlines your healthcare preferences, including life support and pain management, if you're unable to communicate these wishes due to illness or incapacity.

- Will: A legal document that spells out how you want your property and affairs to be handled after you die. It can also include guardianship choices if you have minor children.

- Limited Power of Attorney: Unlike the DPOA, which is broad, a limited power of attorney grants specific powers to an agent for a limited task or period, such as handling certain financial transactions.

- HIPAA Release Form: This document allows designated individuals to access your medical records and speak with healthcare providers, crucial for making informed healthcare decisions on your behalf.

- Living Trust: A living trust enables you to manage your assets during your lifetime and specify how they are distributed upon your death, often allowing your estate to bypass the lengthy and public probate process.

- Funeral Planning Declaration: This form lets you outline your preferences for funeral arrangements and burial or cremation, relieving your loved ones of the burden of making these decisions during a difficult time.

Each of these documents plays a unique role in comprehensive estate planning, working alongside the New Hampshire Durable Power of Attorney to ensure your wishes are honored in various aspects of life and death. As situations can vary widely, it’s advisable to consult with a professional to understand which documents best suit your individual needs and to ensure they are prepared and executed correctly.

Similar forms

The New Hampshire Durable Power of Attorney form is similar to several other important legal documents, each serving unique yet occasionally overlapping functions. Understanding these similarities can help individuals ensure they have comprehensive plans for their health, finances, and personal wishes.

The form is similar to a General Power of Attorney. Both grant someone else the authority to make decisions or take actions on the principal's behalf. However, the Durable Power of Attorney remains in effect if the principal becomes incapacitated, while a General Power of Attorney does not. This critical difference means that for those seeking to plan for unforeseen health issues, a Durable Power of Attorney provides a more resilient solution.

Another document it resembles is the Health Care Proxy or Advance Directive. Both allow you to designate an agent to make health care decisions for you if you're unable to do so yourself. The similarity lies in the concept of appointing another person to act on your behalf. However, a Durable Power of Attorney typically covers a broader range of decision-making powers, extending beyond health care to include financial and other personal matters. In contrast, a Health Care Proxy is expressly for health care decisions.

It is also akin to a Living Will. While both a Durable Power of Attorney and a Living Will are designed to operate in situations where the principal is incapacitated, they serve different functions. A Living Will specifies your preferences regarding life-sustaining treatment, whereas a Durable Power of Attorney appoints someone to make decisions on a wide range of matters, not limited to health care. Together, they provide a comprehensive approach to planning for incapacity.

Lastly, the Durable Power of Attorney shares similarities with a Trust. Both can be used to manage your assets, but they do so in different contexts and ways. A Durable Power of Attorney allows someone to manage your assets only while you are alive and becomes ineffective upon your death. In contrast, a Trust can be used to manage assets during your lifetime and continue after your death, directing how your assets are distributed to your beneficiaries. Therefore, while both documents play a key role in financial planning, the Durable Power of Attorney focuses on management during incapacity, whereas a Trust focuses on asset distribution before and after the trustee's death.

Dos and Don'ts

Filling out a Durable Power of Attorney (DPOA) form in New Hampshire is a trusted method to ensure your affairs are managed according to your wishes should you become unable to handle them yourself. It's essential to approach this task with diligence and care. Here are several dos and don'ts to guide you through this process:

What You Should Do:

- Read Instructions Carefully: Before filling out the form, make sure to thoroughly read all provided instructions. Understanding the scope and implications of the document is crucial.

- Choose a Trusted Agent: Select someone you trust implicitly to act as your agent. This person will be making decisions on your behalf, so trust and reliability are paramount.

- Be Specific: Clearly define the powers you are granting to your agent. Specificity can prevent ambiguity and ensure your wishes are carried out exactly as you envision.

- Seek Legal Advice: Consulting with a legal professional can provide valuable insight and ensure that the form complies with New Hampshire law and addresses all relevant considerations.

- Sign in the Presence of a Notary: New Hampshire law requires that a DPOA be notarized to be valid. Ensure the document is signed in the presence of a licensed notary public.

- Keep Copies in a Safe Place: After completing the form, keep the original in a secure location and provide copies to your agent and any relevant institutions, such as your bank or healthcare provider.

- Review and Update Periodically: Circumstances change, and it may become necessary to update your DPOA. Regularly review the document and make any required adjustments.

What You Shouldn't Do:

- Don't Rush the Process: Take your time to consider all your options and the implications of your decisions. Rushing through the form can lead to errors or oversight.

- Don't Choose an Agent Lightly: Avoid hastily selecting your agent without thorough consideration of their reliability and capability to manage your affairs responsibly.

- Don't Leave Ambiguities: Vague language can lead to interpretation issues down the line. Strive for clarity and specificity in assigning powers to your agent.

- Don't Skip Legal Counsel: Failing to consult a legal professional may result in a document that does not fully protect your interests or meet all legal requirements.

- Don't Forget to Notify Your Agent: Ensure your chosen agent is aware of their appointment and fully understands their responsibilities and the scope of their authority.

- Don't Neglect Witness Requirements: Besides notarization, ensure any additional witness requirements under New Hampshire law are met to validate the document.

- Don't Fail to Communicate Your Wishes: Discuss your decisions, especially those regarding end-of-life care, with your agent and loved ones to prevent conflicts and ensure your wishes are honored.

Misconceptions

When discussing the New Hampshire Durable Power of Attorney (DPOA) form, it's important to dispel several common misconceptions that may confuse or mislead individuals considering this crucial legal document. Understanding these misconceptions ensures that one makes informed decisions regarding their personal and financial affairs.

- Misconception 1: It Grants Unlimited Power Immediately

Many believe that by creating a Durable Power of Attorney, they are immediately handing over unlimited control over all their personal and financial decisions. This is not accurate. In reality, the DPOA can be crafted to specify exactly which powers are granted and when they become effective. For example, many choose a "springing" DPOA that only takes effect upon the occurrence of a specific event, such as the principal's incapacity.

- Misconception 2: It's Only for the Elderly

Another common misunderstanding is that the DPOA is solely for senior citizens. However, adults of any age can benefit from having a DPOA. Life's unpredictability, including accidents and sudden illnesses, can happen at any age, making it wise for everyone to prepare a DPOA. This ensures that your affairs can be managed according to your wishes, regardless of your age or health status.

- Misconception 3: It Overrides a Will

Some people mistakenly believe that a DPOA can override their will. However, a DPOA and a will serve different purposes and operate at different times. A DPOA is effective during the principal's lifetime, particularly in situations where they cannot make decisions for themselves. In contrast, a will takes effect upon the principal's death, directing the distribution of their estate. The powers granted in a DPOA cease upon the principal's death, at which point the instructions in the will take precedence.

- Misconception 4: It Is Irrevocable

A widespread misconception exists that once a DPOA is created, it cannot be changed or revoked. This is not true. The principal has the right to revoke or amend their DPOA as long as they are mentally competent. Circumstances change, and it is not uncommon for individuals to update their DPOA to reflect new wishes or to appoint a different attorney-in-fact.

Correcting these misconceptions about the New Hampshire Durable Power of Attorney form is essential for individuals to effectively plan for their future and ensure their affairs will be handled according to their precise wishes. Legal documentation like the DPOA is a powerful tool, but its potential is fully realized only when understood correctly.

Key takeaways

When preparing to fill out and use the New Hampshire Durable Power of Attorney form, individuals should consider various important aspects to ensure that the form fulfills its intended purpose effectively and legally. Below are key takeaways that provide guidance through this critical process.

Understanding of the Durable Power of Attorney (DPOA): A DPOA is a legal document that allows you to appoint someone else to manage your affairs if you become unable to do so. It’s crucial that both the person creating the power of attorney (the principal) and the person being appointed (the agent) understand the responsibilities and powers being entrusted.

Selecting an Agent: The choice of an agent is a significant decision. This person will have control over your affairs, possibly for a long time. It's essential to choose someone who is not only trustworthy but also capable of handling the responsibilities that come with the role.

Scope of Authority: The document allows you to specify the extent of power granted to the agent. These powers can include handling financial matters, real estate transactions, and other personal and business decisions. Careful consideration should be given to what powers are given, ensuring they align with the principal's needs and intentions.

Durability: The “durable” aspect of the power of attorney means that the agent’s power remains effective even if the principal becomes incapacitated. This feature is what differentiates a DPOA from a general power of attorney, which loses its effectiveness if the principal becomes unable to make decisions.

Legally Binding Signature: For the New Hampshire Durable Power of Attorney form to be legally binding, it must be signed by the principal in the presence of notary public or two witnesses, depending on the state’s requirements. This step is crucial for the document's validity.

Revocation Process: It is within the principal’s rights to revoke the DPOA at any time as long as they are mentally competent. The revocation must be done in writing and communicated to the agent and any institutions or parties that were relying on the previous DPOA.

State-Specific Requirements: New Hampshire may have specific requirements for the DPOA to be considered valid, including particular wording, formatting, or registration processes. Ensuring that these state-specific requirements are met is essential for the rightful use and legitimacy of the document.

Safekeeping and Copies: Once signed, the original DPOA should be kept in a secure but accessible place. Copies should be distributed to relevant parties such as financial institutions, healthcare providers, and the agent themselves to ensure that the agent’s authority is recognized when needed.

Taking these considerations into account can significantly impact the effectiveness and reliability of a New Hampshire Durable Power of Attorney. It’s advised to consult with a legal professional to ensure that all legal requirements are met, and the document is tailored to the principal's specific needs and circumstances.

More Durable Power of Attorney State Forms

Does a Power of Attorney Need to Be Recorded in Florida - This legal document ensures your financial, legal, and health decisions are taken care of by someone you trust.

New York Durable Power of Attorney - There are different types of DPOAs, such as those specifically for healthcare decisions or financial matters, allowing for tailored planning.