Attorney-Verified Durable Power of Attorney Document for New Jersey

In New Jersey, individuals have the option to prepare for the future through the execution of a Durable Power of Attorney form, a crucial document that enables one to designate another person to manage their financial affairs in the event of incapacitation. This form stands out due to its durability, which means it remains in effect even if the principal loses the ability to make decisions for themselves, providing a seamless transition of financial management without the need for court intervention. Key elements of this form include the designation of an agent or attorney-in-fact, the specification of powers granted, and the conditions under which these powers become operative. It's important for residents of New Jersey to understand the responsibilities and powers that come with the role of an attorney-in-fact, encompassing a wide range of tasks from managing everyday expenses to handling real estate transactions. Additionally, the form's customization options allow the principal to tailor the scope of authority granted to their unique situation, ensuring that their financial matters are handled according to their wishes. For those considering the creation of a Durable Power of Attorney, awareness of its components, execution requirements, and the implications for both the principal and their designated agent is essential for its effective use.

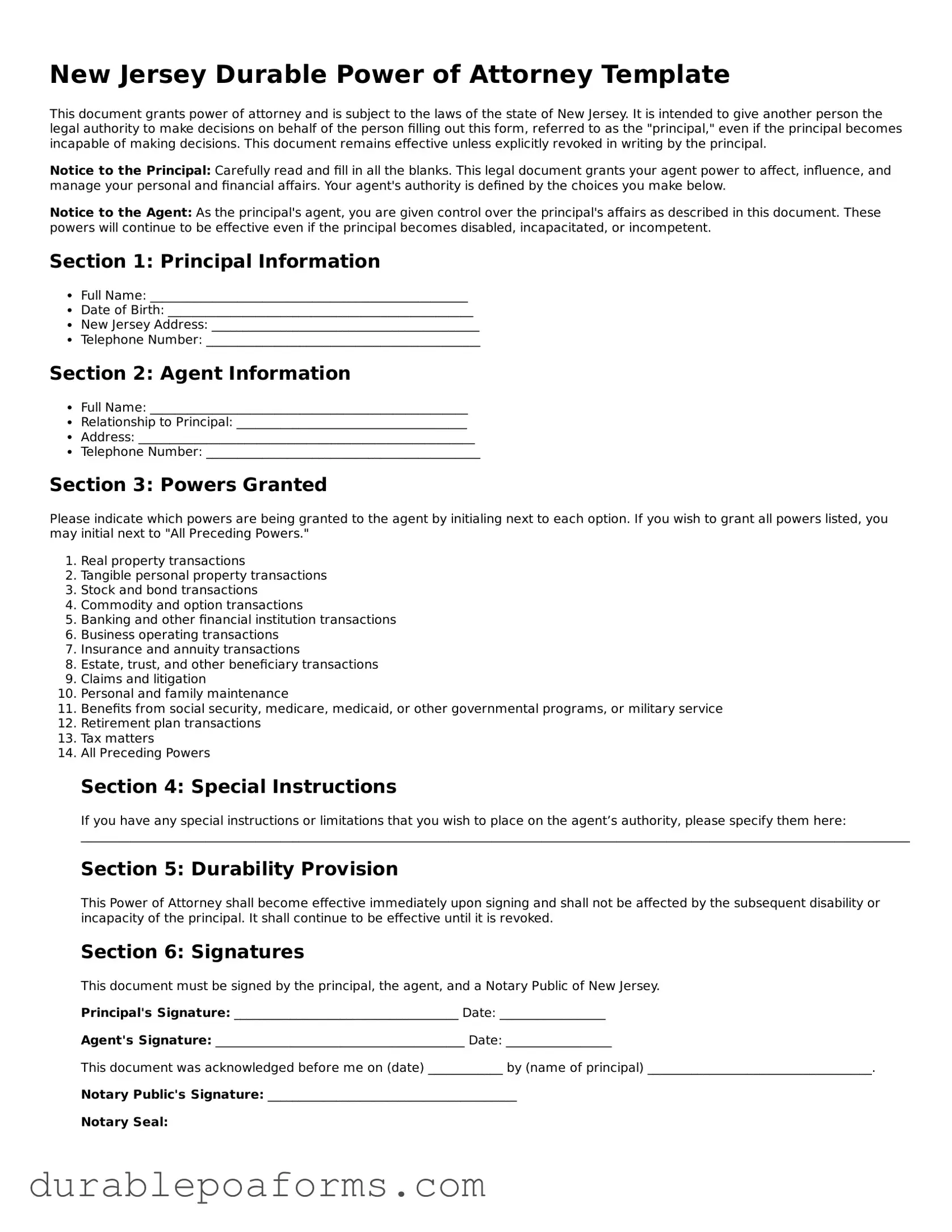

Form Preview

New Jersey Durable Power of Attorney Template

This document grants power of attorney and is subject to the laws of the state of New Jersey. It is intended to give another person the legal authority to make decisions on behalf of the person filling out this form, referred to as the "principal," even if the principal becomes incapable of making decisions. This document remains effective unless explicitly revoked in writing by the principal.

Notice to the Principal: Carefully read and fill in all the blanks. This legal document grants your agent power to affect, influence, and manage your personal and financial affairs. Your agent's authority is defined by the choices you make below.

Notice to the Agent: As the principal's agent, you are given control over the principal's affairs as described in this document. These powers will continue to be effective even if the principal becomes disabled, incapacitated, or incompetent.

Section 1: Principal Information

- Full Name: ___________________________________________________

- Date of Birth: _________________________________________________

- New Jersey Address: ___________________________________________

- Telephone Number: ____________________________________________

Section 2: Agent Information

- Full Name: ___________________________________________________

- Relationship to Principal: _____________________________________

- Address: ______________________________________________________

- Telephone Number: ____________________________________________

Section 3: Powers Granted

Please indicate which powers are being granted to the agent by initialing next to each option. If you wish to grant all powers listed, you may initial next to "All Preceding Powers."

- Real property transactions

- Tangible personal property transactions

- Stock and bond transactions

- Commodity and option transactions

- Banking and other financial institution transactions

- Business operating transactions

- Insurance and annuity transactions

- Estate, trust, and other beneficiary transactions

- Claims and litigation

- Personal and family maintenance

- Benefits from social security, medicare, medicaid, or other governmental programs, or military service

- Retirement plan transactions

- Tax matters

- All Preceding Powers

Section 4: Special Instructions

If you have any special instructions or limitations that you wish to place on the agent’s authority, please specify them here: ______________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

Section 5: Durability Provision

This Power of Attorney shall become effective immediately upon signing and shall not be affected by the subsequent disability or incapacity of the principal. It shall continue to be effective until it is revoked.

Section 6: Signatures

This document must be signed by the principal, the agent, and a Notary Public of New Jersey.

Principal's Signature: ____________________________________ Date: _________________

Agent's Signature: ________________________________________ Date: _________________

This document was acknowledged before me on (date) ____________ by (name of principal) ____________________________________.

Notary Public's Signature: ________________________________________

Notary Seal:

Form Specifications

| Fact | Description |

|---|---|

| Definition | A New Jersey Durable Power of Attorney (DPOA) allows an individual, known as the principal, to designate another person, the agent, to manage their financial affairs, even if the principal becomes incapacitated. |

| Governing Law | In New Jersey, the Durable Power of Attorney is governed by the New Jersey Statutes Section 46:2B-8.1 to 46:2B-8.14. |

| Durability | Under New Jersey law, for a power of attorney to be considered "durable," it must state that the agent's authority remains effective even if the principal becomes incapacitated. |

| Witness Requirement | The signing of a DPOA in New Jersey requires two adult witnesses. These witnesses cannot be the designated agent or the principal's spouse or heir. |

| Notarization | Notarization is not strictly required by New Jersey law for a DPOA to be valid, but it is highly recommended to facilitate acceptance by financial institutions and other parties. |

| Financial Powers | The agent under a DPOA can be given broad financial powers, including managing bank accounts, real estate transactions, and personal property, or specific powers as detailed by the principal. |

| Revocation | A DPOA in New Jersey can be revoked by the principal at any time, as long as the principal is competent. Revocation should be made in writing and communicated to the agent and any third parties relying on the document. |

| Recordation | If real estate transactions are involved, the DPOA must be recorded with the county clerk in the county where the property is located. |

New Jersey Durable Power of Attorney - Usage Guide

When preparing to fill out the New Jersey Durable Power of Attorney form, it's important to approach the task with clarity and attention to detail. This form is a legal document that allows you to designate someone to make decisions on your behalf should you be unable to do so yourself. It is paramount to choose a trustworthy individual who understands your preferences and will act in your best interest. Following are step-by-step instructions designed to guide you through the process of completing the form effectively.

- Begin by reading the form thoroughly to ensure you understand the scope and implications of the document. Knowing what each section means can help you fill it out correctly and confidently.

- Identify the person you wish to grant authority to, known as the 'Agent.' Include their full legal name, address, and contact information. It's essential to discuss this with them beforehand to ensure they are willing and able to take on this responsibility.

- Specify the powers you are granting to your Agent. The form may include a list of standard powers, such as handling financial transactions, real estate matters, and personal care decisions. If there are any powers you do not wish to grant, these should be clearly crossed out or omitted.

- For added specificity and clarity, include any special instructions that you wish to apply to the powers granted. This might involve limitations, conditions, or preferences about how your Agent should act on your behalf.

- Determine the duration of the Power of Attorney. A 'Durable' Power of Attorney remains in effect even if you become incapacitated. However, you might wish to specify a termination date or event.

- Arrange for two non-family member witnesses to observe the signing of the document. Their presence serves as a testament to the voluntary nature of your decision and the authenticity of your signature.

- Sign and date the form in the presence of a Notary Public. The Notary will verify your identity and apply their seal, formally notarizing the document.

- Finally, distribute copies of the notarized document to your Agent, any institutions or individuals that may require it, and retain a copy for your records.

With the form properly filled out, you have taken a significant step in securing your future well-being and ensuring your affairs are handled according to your wishes. Remember, the New Jersey Durable Power of Attorney form is a powerful tool in estate planning, and seeking legal advice can provide additional peace of mind and guidance through the process.

Common Questions

What is a Durable Power of Attorney in New Jersey?

A Durable Power of Attorney (DPOA) in New Jersey is a legal document that allows an individual (the principal) to assign another person (the agent) the authority to make decisions regarding their finances, property, and other legal matters. The "durable" aspect indicates that the document remains in effect even if the principal becomes incapacitated.

How do I know if I need a Durable Power of Attorney?

If you want to ensure that someone you trust can handle your financial affairs if you're unable to do so yourself due to illness, injury, or any other reason, you should consider creating a Durable Power of Attorney. It's a proactive step to safeguard your interests and provide peace of mind for both you and your loved ones.

Who should I choose as my agent?

Choosing an agent is a critical decision. This person should be someone you trust implicitly, as they will have significant power and responsibility. Consider selecting a close family member, a trusted friend, or a professional with experience in managing financial affairs. It's also wise to discuss your decision with them to ensure they're willing and able to take on the role.

Can I have more than one agent?

Yes, New Jersey law allows you to appoint more than one agent. You can decide whether these agents must make decisions together (joint agents) or if each can act independently (several agents). Having multiple agents can provide an extra layer of protection, but be sure to clearly state in the document how conflicts between agents should be resolved.

What specific powers can I grant to my agent?

The powers you can grant to your agent can be as broad or as specific as you choose. Common powers include handling banking transactions, buying or selling real estate, managing your taxes, and investing your money. However, you can tailor the powers to meet your specific needs and preferences. Make sure to clearly outline these powers in the DPOA document.

How can I ensure my Durable Power of Attorney is legally valid in New Jersey?

To ensure your Durable Power of Attorney is legally valid in New Jersey, you must sign the document in the presence of a notary public. Additionally, while not always required, it's recommended to have witnesses present who can attest to your capacity to understand and agree to the document’s terms. Ensuring these steps are properly followed will help validate the document.

Can I revoke or change my Durable Power of Attorney?

You have the right to revoke or change your Durable Power of Attorney at any time as long as you are mentally competent. To do so, you should provide written notice to your current agent and any institutions or individuals that have a copy of the document. If you wish to replace your agent or modify the powers granted, a new DPOA document must be created and signed.

What happens if I don't have a Durable Power of Attorney and become incapacitated?

Without a Durable Power of Attorney, if you become incapacitated, your family may have to go through a potentially lengthy and costly court process to appoint a guardian or conservator to make decisions on your behalf. This process can add stress and uncertainty during already difficult times. Having a DPOA in place helps avoid this situation and ensures your affairs are managed according to your wishes.

Common mistakes

Filling out a New Jersey Durable Power of Attorney form is a critical step in planning for future decisions about one's finances and property. However, people often make mistakes during this process, which could lead to complications or even invalidate the document. Understanding these common errors can help ensure that the power of attorney serves its intended purpose effectively.

First and foremost, one significant mistake is not choosing the right agent. The role of an agent, someone who makes decisions on another's behalf, is paramount. The agent should be trustworthy, reliable, and possess an understanding of the principal's wishes and values. Unfortunately, people sometimes select an agent based on proximity or relationship status alone, without considering whether the person is the best choice for managing their financial affairs.

- Ignoring specific powers: The form allows the principal to grant specific powers to the agent, such as handling real estate transactions, managing bank accounts, or making investment decisions. Often, individuals fail to tailor these powers to their needs, either granting too much authority or not enough, which can lead to issues down the line.

- Not specifying durability: The term "durable" in the context of a Power of Attorney means that the document remains in effect if the principal becomes incapacitated. Some people assume all powers of attorney are durable by default, which is not the case. Ensuring the document explicitly states its durability is crucial.

- Forgetting to include contingencies: Life is unpredictable. A well-prepared Durable Power of Attorney should account for potential changes. This could mean appointing a successor agent if the original choice can no longer serve. Neglecting to consider such contingencies can result in a lack of legal authority when it's needed most.

- Overlooking the need for witnesses and notarization: New Jersey law requires that Durable Powers of Attorney be witnessed and notarized to be valid. Some individuals complete the form but skip these critical steps, either through oversight or misunderstanding of the requirements.

In addition to these specific errors, there are two overarching mistakes that people often make:

- Lack of clarity: Being vague or imprecise in the document can sow confusion among agents, financial institutions, and others who need to understand the principal's intentions. Clarity and specificity are your best tools in creating an effective Durable Power of Attorney.

- Procrastination: Perhaps the most common mistake is simply waiting too long to create a Durable Power of Attorney. Some people put off this essential planning step until it's too late, which can create significant legal and financial complications during times of unexpected illness or incapacity.

By avoiding these common mistakes, individuals can ensure their New Jersey Durable Power of Attorney is a strong and effective document that accurately reflects their wishes and safeguards their financial well-being, even in the face of future uncertainties.

Documents used along the form

When preparing for the future, it's important to consider all aspects of your affairs. In addition to a Durable Power of Attorney (POA) in New Jersey, several other forms can help ensure your wishes are respected and your affairs are in order. These documents complement the Durable POA, covering various aspects from healthcare decisions to your financial legacy.

- Advance Health Care Directive: This document, also known as a living will, outlines your wishes regarding medical treatment and end-of-life care. It becomes effective if you're unable to make decisions for yourself.

- Will: A will is a legal document that states how you want your property and assets distributed after your death. It can also appoint guardians for minor children.

- Health Care Proxy: Similar to the POA but specifically for health care decisions, this form appoints someone to make medical decisions on your behalf if you're unable to do so.

- Revocable Living Trust: This allows you to manage your assets during your lifetime and specify how they should be distributed upon your death, potentially avoiding probate.

- Declaration of Homestead: This legal document protects your home from unsecured creditors by designating it as your homestead.

- Do Not Resuscitate (DNR) Order: A DNR order instructs health care providers not to perform CPR if your breathing stops or if your heart stops beating.

Each of these documents serves a unique purpose and, when used together, can provide comprehensive protection for your health and assets. It's a good idea to consult with a legal professional to understand how these documents work together and ensure they align with your overall planning goals. Tailoring these documents to fit your specific needs can offer peace of mind to you and your loved ones.

Similar forms

The New Jersey Durable Power of Attorney form is similar to several other legal instruments that allow individuals to designate representatives to act in their stead for various purposes. These documents, while sharing similarities with the New Jersey form, serve unique functions under the law. Understanding these parallels and distinctions helps clarify the specific and vital role each document plays in personal and legal planning.

Medical Power of Attorney: Like the New Jersey Durable Power of Attorney, which authorizes an agent to handle financial and legal matters, a Medical Power of Attorney enables an individual to appoint someone to make healthcare decisions on their behalf if they become unable to do so. The main similarity is the designation of an agent; however, the scope of authority in the Medical Power of Attorney is strictly limited to medical and health-related decisions, contrasting with the broader financial authority granted in the Durable Power of Attorney.

General Power of Attorney: This document also shares some common ground with the New Jersey Durable Power of Attorney in that it allows an individual to appoint an agent to act on their behalf in various matters. The key distinction lies in the durability aspect. A General Power of Attorney often ceases to be effective if the principal becomes incapacitated, whereas a Durable Power of Attorney is specifically designed to remain in effect even after the principal's incapacitation, ensuring continuous management of their affairs.

Living Will: Although a Living Will may seem similar because it also deals with preparations for incapacity, it actually serves a different purpose compared to the New Jersey Durable Power of Attorney. A Living Will is a document that outlines an individual's wishes regarding medical treatment in the event they are unconscious or otherwise unable to communicate their healthcare preferences. Unlike a Durable Power of Attorney, which appoints another person to make decisions, a Living Will directly informs healthcare providers of the principal's wishes, without appointing an intermediary.

Dos and Don'ts

When creating a Durable Power of Attorney (DPOA) in New Jersey, it’s important to approach the document with care and diligence. The DPOA is a powerful tool, allowing someone you trust to make decisions on your behalf should you become unable to do so. Here are some guidelines to help ensure that the process goes smoothly and effectively:

- Do choose a trusted individual as your agent. It should be someone you have full confidence in, as they will have significant control over your affairs.

- Do fully understand the powers you are granting. This means taking the time to read and comprehend each provision in the DPOA form to ensure it aligns with your wishes.

- Do be specific about the powers granted. If you wish to limit the authority you're giving, clearly specify these limitations in the document.

- Do sign in the presence of a notary public and witnesses. New Jersey law requires notarization for the DPOA to be valid. Witnesses add an additional layer of legality and security.

- Do keep the document in a safe, yet accessible location. Inform your agent and loved ones where the document is stored so they can access it when needed.

- Don’t leave any sections incomplete. An incomplete DPOA form may lead to confusion or disputes, potentially making the document invalid.

- Don’t choose an agent without discussing it with them first. It’s crucial that the person you’re appointing is willing and able to take on the responsibilities outlined.

- Don’t forget to periodically review and update the document. Over time, your situation and relationships may change, necessitating updates to your DPOA.

- Don’t use a generic form without ensuring it complies with New Jersey law. State-specific requirements vary, so it’s important that the form you use meets all legal standards in New Jersey.

By following these guidelines, you can create a DPOA that effectively safeguards your interests and ensures your affairs are managed according to your preferences, should the need arise.

Misconceptions

Understanding the New Jersey Durable Power of Attorney form is crucial for making informed decisions. However, there are several misconceptions that can confuse individuals about its use and implications. Here are seven common misunderstandings:

The form grants unlimited power. Many believe that once signed, the New Jersey Durable Power of Attorney form gives the agent complete control over all affairs. In reality, the scope of authority can be specifically tailored according to the principal's wishes.

It is effective immediately upon signing. While this can be true, the principal also has the option to stipulate that the powers granted only take effect under certain conditions, such as the principal's incapacitation.

A doctor's certification is always needed to activate it. The need for a doctor's certification depends on how the document is drafted. If it specifies that the principal must be medically deemed incapacitated, then certification is required; otherwise, it might not be.

It’s too complicated for non-lawyers to understand. The form and the process can be straightforward if clear, simple language is used and both parties are well informed about their rights and responsibilities.

Only the elderly or seriously ill need it. Accidents or sudden illness can happen at any age, making a Durable Power of Attorney a wise precaution for anyone over the age of 18.

Signing one means losing control over personal affairs. The principal retains the power to revoke or modify the Durable Power of Attorney at any time, as long as they are mentally competent.

It continues after the principal’s death. The authority granted through a Durable Power of Attorney ends upon the principal’s death. At that point, the executor of the estate, as stated in the will, takes over.

Addressing these misconceptions can help individuals in New Jersey understand how a Durable Power of Attorney can be a beneficial tool for managing their affairs, ensuring their wishes are respected, and providing peace of mind.

Key takeaways

Filling out and using the New Jersey Durable Power of Attorney form comes with a set of crucial steps and considerations that you should be aware of to ensure your legal and financial matters are handled according to your wishes if you ever become unable to manage them yourself. Here are key takeaways to guide you through this process effectively:

- Understanding the purpose: The New Jersey Durable Power of Attorney form allows you to appoint someone you trust, known as an "agent," to manage your financial affairs. This arrangement can remain in effect even if you become mentally incapacitated.

- Choosing the right agent: It's essential to select someone reliable, trustworthy, and capable of managing your financial matters. This person should act in your best interest at all times.

- Compliance with state laws: Ensure the form meets all New Jersey state requirements. These regulations can change, so it’s wise to consult with a legal professional or review the most current laws to guarantee compliance.

- Specificity is key: Be as detailed as possible when outlining the powers you are granting to your agent. This clarity will prevent confusion and potential legal challenges in the future.

- Witness and notarization requirements: New Jersey law may require your Durable Power of Attorney form to be witnessed and/or notarized to be valid. This process adds a layer of legal protection and authenticity.

- Revocation process: Understand how to revoke the power of attorney if your situation changes. This typically involves notifying your agent in writing and destroying all copies of the form.

- Safe storage: Keep the original document in a safe but accessible place. Inform your agent and loved ones where it is stored so it can be easily found when needed.

- Regular reviews and updates: Over time, your circumstances or relationships might change, necessitating updates to your Durable Power of Attorney form. Regularly reviewing and revising the document ensures it continually reflects your wishes.

By keeping these takeaways in mind, you can make informed decisions when preparing a New Jersey Durable Power of Attorney form, providing peace of mind for you and your family regarding the management of your affairs.

More Durable Power of Attorney State Forms

Maryland Power of Attorney - It can include broad powers, like handling financial transactions and real estate decisions, or be limited to specific actions.

Power of Attorney Wyoming - Even if you become incapacitated, the Durable Power of Attorney remains in effect, ensuring continuous management of your finances.

General Power of Attorney California - Allows individuals to proactively appoint a representative to act in a wide range of legal and financial matters.