Attorney-Verified Durable Power of Attorney Document for New York

When considering the future and the unforeseen turns it may take, ensuring that personal and financial decisions are managed by a trusted individual becomes paramount. In New York, the Durable Power of Attorney form serves as a vital legal instrument in this planning process. It allows one to appoint an agent to handle a wide array of tasks, from financial to real estate transactions, on their behalf. Unlike other power of attorney documents that may become void if the principal becomes incapacitated, the durable nature of this form means it remains in effect, offering peace of mind that one's affairs will be looked after no matter the circumstances. With its comprehensive scope, the New York Durable Power of Attorney form provides both flexibility and security, making it a critical component of prudent personal and financial planning. Understanding the nuances of this document, including its functions, limitations, and the procedure for its execution, is essential in making an informed decision that safeguards your interests and those of your loved ones.

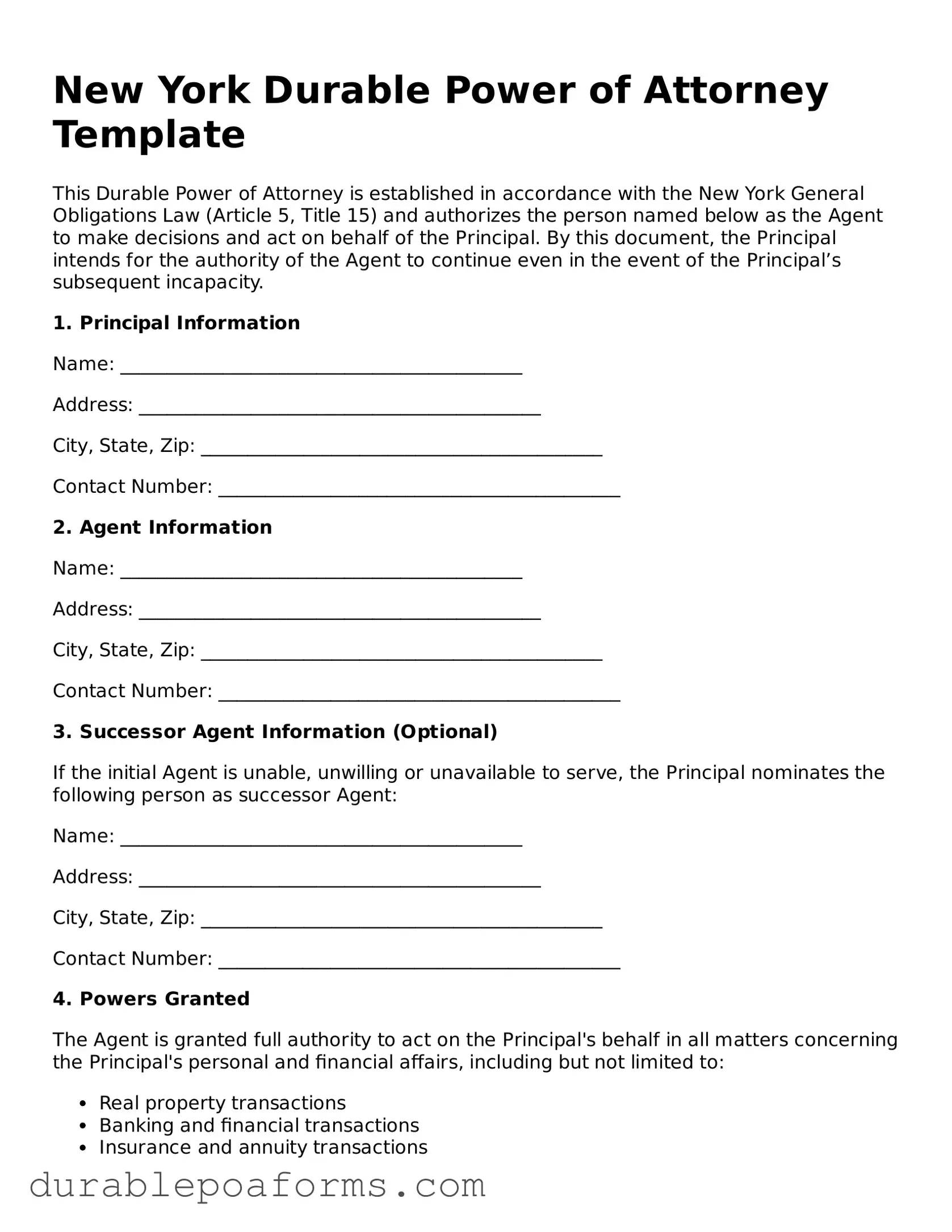

Form Preview

New York Durable Power of Attorney Template

This Durable Power of Attorney is established in accordance with the New York General Obligations Law (Article 5, Title 15) and authorizes the person named below as the Agent to make decisions and act on behalf of the Principal. By this document, the Principal intends for the authority of the Agent to continue even in the event of the Principal’s subsequent incapacity.

1. Principal Information

Name: ___________________________________________

Address: ___________________________________________

City, State, Zip: ___________________________________________

Contact Number: ___________________________________________

2. Agent Information

Name: ___________________________________________

Address: ___________________________________________

City, State, Zip: ___________________________________________

Contact Number: ___________________________________________

3. Successor Agent Information (Optional)

If the initial Agent is unable, unwilling or unavailable to serve, the Principal nominates the following person as successor Agent:

Name: ___________________________________________

Address: ___________________________________________

City, State, Zip: ___________________________________________

Contact Number: ___________________________________________

4. Powers Granted

The Agent is granted full authority to act on the Principal's behalf in all matters concerning the Principal's personal and financial affairs, including but not limited to:

- Real property transactions

- Banking and financial transactions

- Insurance and annuity transactions

- Benefit from Social Security, Medicare, or other governmental programs, or military service

- Tax matters

- Health care decisions, including access to medical records

This power of attorney does not authorize the Agent to make health care decisions.

5. Special Instructions (Optional)

The Principal may set forth any specific limitations on the Agent's authority or any specific instructions regarding decisions and actions that the Agent is authorized to make on the Principal’s behalf:

________________________________________________________________

________________________________________________________________

6. Execution

This Power of Attorney must be dated and signed by the Principal in the presence of a notary public or two witnesses, neither of whom is the Agent or the Successor Agent.

Date: ___________________________________________

Principal’s Signature: ___________________________________________

State of New York, County of _______________________________:

Subscribed and sworn to before me on this ____ day of __________, 20____.

Notary Public: ___________________________________________

(Notary Seal)

7. Acceptance by Agent

By signing below, the Agent named above accepts this appointment and agrees to act and serve to the best of their abilities, in good faith, under the terms set forth herein, and within all applicable laws of the State of New York.

Date: ___________________________________________

Agent’s Signature: ___________________________________________

Successor Agent’s Signature (if applicable): ___________________________________________

This document is intended to be a Durable Power of Attorney and shall continue to be effective in the event of the Principal's incapacity.

Note: This form does not provide for decision-making authority over health care matters. For health care matters, it is recommended to complete a New York Health Care Proxy Form.

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose and Use | A New York Durable Power of Attorney form is used to designate another person, known as an agent, to manage financial and legal matters on behalf of the principal, especially if the principal becomes incapacitated. |

| Durability Clause | The form remains effective even if the principal becomes physically or mentally incapacitated, owing to the "durability" clause which specifies that the power of attorney continues to be operative despite such incapacitation. |

| Governing Laws | It is governed by the New York General Obligations Law, Sections 5-1501 through 5-1514, which outline the requirements and powers associated with a Durable Power of Attorney in the state of New York. |

| Signing Requirements | The form must be signed by the principal and the agent(s) in the presence of a notary public to ensure its legality and validity under New York State law. |

New York Durable Power of Attorney - Usage Guide

Creating a Durable Power of Attorney (POA) is a proactive step in managing your affairs and ensuring that your decisions are in trusted hands, should you become unable to make them yourself. This document allows you to appoint an agent to handle your financial, legal, and personal matters, according to your wishes. While the thought of filling out legal documents can be daunting, the process doesn't have to be overwhelming. Here, we'll guide you through each step needed to fill out the New York Durable Power of Attorney form correctly.

- Start by reading the form thoroughly before filling anything out. This will help you understand the scope of authority you're granting and any specific instructions you must follow.

- Enter your full legal name and address in the space provided at the top of the form to identify yourself as the "principal."

- Choose your agent (also known as an "attorney-in-fact") and enter their full name and contact information. Make sure the person you choose is someone you fully trust to manage your affairs.

- If you want, select a successor agent. Fill in their information as well. This person will take over if your first agent is unable or unwilling to serve.

- Specify the powers you're granting to your agent. Be as clear and detailed as possible to ensure your agent understands the extent of their authority.

- For some decisions, especially those related to real estate, healthcare, or financial matters, you may need to give specific instructions. If this applies, make sure you detail these instructions on the form.

- Decide on the duration of the power of attorney. If it's a Durable POA, it means it will remain in effect even if you become incapacitated. Ensure this intention is clear on the form.

- Check if your state requires witness signatures, notarization, or both. For New York, the current requirement is that your signature must be both witnessed and notarized.

- Sign the document in the presence of a notary and any required witnesses. Your agent will also need to sign the form, acknowledging their acceptance of the responsibilities.

- Keep the original signed document in a safe but accessible place. Give a copy to your agent, any successor agents, and perhaps a trusted family member or advisor.

Remember, the Durable Power of Attorney is a powerful and flexible tool for managing your affairs. It's important to review this document periodically and update it as needed to reflect your current wishes and circumstances. Completing this form with care and foresight ensures that your affairs will be managed according to your wishes, providing peace of mind for you and your loved ones.

Common Questions

What is a Durable Power of Attorney (DPOA) form in New York?

A Durable Power of Attorney form in New York is a legal document that gives someone else, known as the agent, the authority to make decisions on behalf of the person creating the document, known as the principal. This power remains effective even if the principal becomes incapacitated or unable to make decisions for themselves. The form can cover a wide range of decisions, including financial, real estate, and personal matters.

How do I create a Durable Power of Attorney in New York?

To create a Durable Power of Attorney in New York, the principal must complete and sign the form in the presence of a notary public. It is important to choose an agent who is trustworthy and capable of handling the responsibilities. The form must also comply with New York State laws, including specific signing and witnessing requirements. It is advisable to consult with a legal professional to ensure the form is correctly completed and valid.

Who should I choose as my agent?

When choosing an agent for a Durable Power of Attorney, select someone you trust implicitly. This person will have significant control over your affairs if you are unable to manage them yourself. Many people choose a close family member or a trusted friend. Consider the person's ability to handle financial matters diligently and their availability to undertake the responsibilities. It’s also wise to name a successor agent in case your first choice is unable or unwilling to serve.

Can I revoke a Durable Power of Attorney?

Yes, a Durable Power of Attorney can be revoked at any time by the principal, as long as the principal is mentally competent. To revoke the power, the principal should provide a written notice to the agent and to any institutions or parties that were relying on the original Durable Power of Attorney. Creating a new Durable Power of Attorney can also automatically revoke a previous one, depending on the terms of the new document.

When does a Durable Power of Attorney become effective?

In New York, a Durable Power of Attorney becomes effective as soon as it is properly signed and notarized, unless the document specifies a different starting date. It’s also possible to stipulate that the power only becomes effective under certain conditions, such as if the principal is deemed incapacitated by a medical professional.

Does a Durable Power of Attorney grant power over medical decisions?

No, a Durable Power of Attorney in New York is intended for managing the principal’s financial and legal affairs. If you wish to grant someone authority to make medical decisions on your behalf, you should complete a Health Care Proxy form, which is a separate document designed specifically for medical decision-making.

What happens if I don't have a Durable Power of Attorney in New York?

Without a Durable Power of Attorney, if you become incapacitated and are unable to manage your affairs, your family members may need to petition the court for the appointment of a guardian or conservator. This process can be lengthy, stressful, and expensive. Having a Durable Power of Attorney ensures that the person you choose can manage your affairs without court intervention.

Common mistakes

Filling out the New York Durable Power of Attorney (POA) form is a significant step in planning for the future. It allows you to appoint someone else to manage your affairs if you become unable to do so yourself. However, mistakes can be easily made during this process, undermining the purpose of the document and potentially leading to complications. Let's explore four common mistakes people make when filling out this form.

- Not Specifying Powers Clearly: One common mistake is not being specific about the powers granted to the agent. The New York Durable Power of Attorney form allows for a wide range of activities, from handling financial matters to making gifts on your behalf. However, if the powers aren't clearly defined, it can lead to ambiguity and disputes. It's crucial to think carefully about what exactly you want your agent to be able to do and to spell that out in the document.

- Choosing the Wrong Agent: The person you choose as your agent (or attorney-in-fact) holds significant responsibility. Some people make the mistake of selecting an agent based on their relationship to them rather than their ability to handle the tasks. The agent should be someone you trust implicitly but also someone capable of managing financial affairs, understanding legal documents, and acting in your best interest.

- Failing to Include a Successor Agent: Life is unpredictable, and the person you initially choose as your agent might not always be able to serve in that role. Failing to appoint a successor agent is a major oversight. If your first choice can no longer fulfill their duties due to illness, death, or any other reason, having a successor already named ensures that your affairs won't be left in limbo.

- Not Properly Executing the Document: The New York Durable Power of Attorney form has specific signing requirements that must be followed for it to be legally valid. These include signing in the presence of a notary and possibly witnesses, depending on your circumstances. Overlooking these formalities can render the document invalid, which means it won't be recognized by financial institutions, healthcare providers, or the courts.

When completing the New York Durable Power of Attorney form, taking the time to get it right is critical. This means carefully considering whom you appoint, defining their powers concisely, planning for contingencies like selecting a successor agent, and making sure the document is properly executed. By avoiding these common mistakes, you can ensure that your affairs will be managed according to your wishes, even if you are unable to oversee them yourself.

Documents used along the form

When preparing for the future, especially regarding financial and health matters, it is prudent to have a well-rounded collection of legal documents. The New York Durable Power of Attorney form is an essential document that allows an individual, the principal, to designate another person, known as the agent, to make financial decisions on their behalf. However, to ensure thorough preparation and protection, several other forms and documents are often used in conjunction with this form. These documents complement the Durable Power of Attorney and address areas not covered by it, providing a comprehensive approach to planning.

- Health Care Proxy - A document that names someone you trust as your proxy or agent to express your wishes and make health care decisions for you in the event you are unable to communicate. This is crucial for medical care and end-of-life decisions.

- Living WillA

Similar forms

The New York Durable Power of Attorney form is similar to several other legal documents, each of which grants or acknowledges different types of authority or preferences in healthcare, financial, or general affairs. However, the distinction lies in the scope of the power granted and the conditions under which it becomes effective.

Living Will: Both a Living Will and a New York Durable Power of Attorney allow individuals to outline their preferences for future situations. A Living Will specifically focuses on an individual's preferences regarding medical treatment and life-sustaining measures in situations where they are unable to make decisions due to incapacity. Unlike the Durable Power of Attorney, which allows an appointed agent to make decisions across a wide range of matters, a Living Will provides directives specifically for healthcare providers about the individual's healthcare preferences.

Healthcare Proxy: Similar to the New York Durable Power of Attorney, a Healthcare Proxy involves designating an agent to make decisions on the individual's behalf. The crucial difference is that a Healthcare Proxy is strictly confined to decisions about medical care and treatment when the individual cannot make those decisions themselves. The Durable Power of Attorney, especially when it includes healthcare decisions, grants broader authority that can extend beyond healthcare to financial and legal matters, but both documents activate upon the principal's incapacity.

General Power of Attorney: The General Power of Attorney and the New York Durable Power of Attorney share the function of granting an agent the authority to make decisions and act on the principal's behalf. However, the significant difference lies in their duration and durability. A General Power of Attorney typically ceases to be effective if the principal becomes incapacitated or disabled. In contrast, a Durable Power of Attorney is specifically designed to remain in effect or become effective upon the incapacity of the principal, ensuring continuous management of the principal's affairs without interruption.

Dos and Don'ts

Completing a New York Durable Power of Attorney form is a significant step in managing your affairs. This document allows someone you trust to legally make decisions on your behalf, should you become unable to do so yourself. To ensure the process goes smoothly and your intentions are clearly represented, here are several dos and don'ts to keep in mind:

Do:Thoroughly read and understand each section of the form before you start filling it out. If there's anything you're unsure about, don't hesitate to seek clarification from a legal expert.

Choose a trusted individual, known as an agent, who will have your best interests at heart. Discuss your expectations with them in detail to ensure they're willing and able to take on the responsibilities.

Be specific about the powers you are granting. The New York Durable Power of Attorney form allows you to give broad or limited authority to your agent. Clearly define what they can and cannot do on your behalf.

Sign the form in the presence of a notary public to validate your identity and understanding of the document's significance.

Keep the original document in a safe but accessible place. Inform your agent and a close family member or friend of its location.

Regularly review and update the form as needed. Your circumstances or your relationship with your agent may change, necessitating adjustments to the document.

Consult with a lawyer to ensure the form meets all legal requirements and accurately reflects your wishes. A professional can offer advice tailored to your situation.

Rush the process. Taking the time to carefully choose your agent and clearly define their powers can prevent issues in the future.

Appoint someone based solely on their relationship to you. The chosen agent should be trustworthy and capable of managing your affairs responsibly.

Leave any sections of the form blank. Incomplete forms may be invalid or lead to confusion about your intentions.

Forget to sign and date the form in the presence of a notary public, as this step is crucial for the document's legality.

Fail to inform your agent about the power of attorney or neglect to discuss your wishes and expectations with them.

Store the document where no one can find it. If your agent or loved ones cannot access the form in an emergency, it will not serve its purpose.

Assume that the form doesn't need to be updated. Reevaluate your durable power of attorney regularly, especially after major life events.

By following these guidelines, you can ensure that your New York Durable Power of Attorney form accurately reflects your wishes and that your appointed agent is fully prepared to act on your behalf if necessary.

Misconceptions

In the context of estate planning and management, New York's Durable Power of Attorney (DPOA) is a critical document, yet it's often misunderstood. Here, we address eight common misconceptions about the Durable Power of Attorney form in New York to provide clearer insight into its function and importance.

Misconception 1: A Durable Power of Attorney grants unlimited power. Contrary to popular belief, the scope of authority granted by a DPOA in New York is defined by the specific powers laid out in the document. The person who creates the DPOA, known as the principal, can limit or extend the powers given to their agent as they see fit.

Misconception 2: It's effective immediately upon the principal's incapacity. A common misunderstanding is that a DPOA only becomes effective when the principal becomes incapacitated. However, in New York, a DPOA is typically effective immediately upon signing, unless the document specifies otherwise.

Misconception 3: A Durable Power of Attorney is the same as a will. A DPOA and a will serve different purposes. A DPOA ceases to be effective upon the principal's death, whereas a will comes into effect after death, dictating the distribution of the deceased's assets.

Misconception 4: Only elderly people need a DPOA. While it's true that DPOAs are commonly used in elder law and estate planning, individuals of any age can benefit from having a DPOA. Unforeseen circumstances such as illness or accidents can occur at any age, making a DPOA a wise precaution.

Misconception 5: You can use a generic DPOA form for any state. DPOA regulations vary significantly from state to state. A form that is valid in one state may not meet the legal requirements of New York, potentially rendering the document ineffective.

Misconception 6: Creating a DPOA means losing control over your finances. Some people believe that by naming an agent in a DPOA, they relinquish their ability to manage their own finances. In reality, the principal retains full control and can revoke the DPOA at any time as long as they are competent.

Misconception 7: A DPOA allows the agent to make healthcare decisions. A DPOA in New York is focused on financial and property matters. Healthcare decisions require a separate legal document known as a Healthcare Proxy.

Misconception 8: Once executed, a DPOA cannot be changed. Circumstances and relationships change over time, and New York law allows for the amendment or complete revocation of a DPOA, provided the principal is competent to do so. Any changes should be done formally, following legal procedures to ensure they are valid.

Understanding these misconceptions is essential in recognizing the value and limitations of a Durable Power of Attorney in New York. Proper legal guidance can ensure that individuals are fully informed and able to make decisions that best protect their interests and those of their loved ones.

Key takeaways

Filling out the New York Durable Power of Attorney (POA) form is a critical step for individuals looking to ensure their affairs can be managed by someone they trust, in the event they are unable to make decisions for themselves. Here are key takeaways to consider:

- The New York Durable Power of Attorney form allows you to appoint an agent to manage your financial, real estate, and personal affairs if you become incapacitated.

- Choosing an agent is a significant decision; it's essential to select someone who is trustworthy, reliable, competent, and understands your wishes.

- The "durable" aspect of the POA means that the agent's power remains effective even if you become incapacitated.

- It is important to be specific about the powers granted to your agent. The form allows you to define these powers clearly and limit them if necessary.

- Multiple agents can be named. You can appoint more than one agent either to act together or to name a successor agent in case the primary agent is unable to serve.

- The form must be signed in the presence of a notary public to be legally valid.

- You have the right to revoke the powers granted as long as you are mentally competent. This revocation must be done in writing.

- Discussing your wishes and the contents of the POA with your chosen agent(s) beforehand is crucial to ensure they are willing and understand their responsibilities.

- The POA does not grant your agent the ability to make healthcare decisions for you. A separate document, known as a Health Care Proxy, is needed for health care decisions.

- Keeping the original document in a safe but accessible location is important, and consider providing copies to your agent or other trusted individuals.

Completing a Durable Power of Attorney form in New York can offer peace of mind, not just for you, but also for your family and loved ones, by ensuring that your affairs are in capable hands should the need arise.

More Durable Power of Attorney State Forms

Power of Attorney Wyoming - This document can help ensure your business operations continue smoothly if you're temporarily or permanently unable to manage them.

Maryland Power of Attorney - This form remains effective even if the person who signed it becomes unable to make decisions due to mental or physical disability.

Maine Durable Power of Attorney - The appointed agent is obligated to act in your best interest, guided by the principles you've outlined in the document.