Attorney-Verified Durable Power of Attorney Document for North Carolina

When individuals in North Carolina seek to plan for the future, especially in terms of ensuring their financial matters are handled according to their wishes, even in times when they might not be able to make decisions themselves, they turn to a Durable Power of Attorney form. This important document gives someone else, often referred to as the agent, the authority to make financial decisions on behalf of the person who fills it out, known as the principal. Unlike a general Power of Attorney, its durable nature means that the agent's power remains in effect even if the principal becomes incapacitated or unable to communicate their wishes. As it involves significant trust and legal implications, selecting the right agent and understanding the responsibilities involved are paramount. This form, customized for North Carolina residents, aligns with state-specific statutes, ensuring that the document is not only comprehensive but also compliant with local laws. By having one in place, individuals can ensure that their financial matters are taken care of in a manner that they deem fit, providing peace of mind to them and their families during uncertain times.

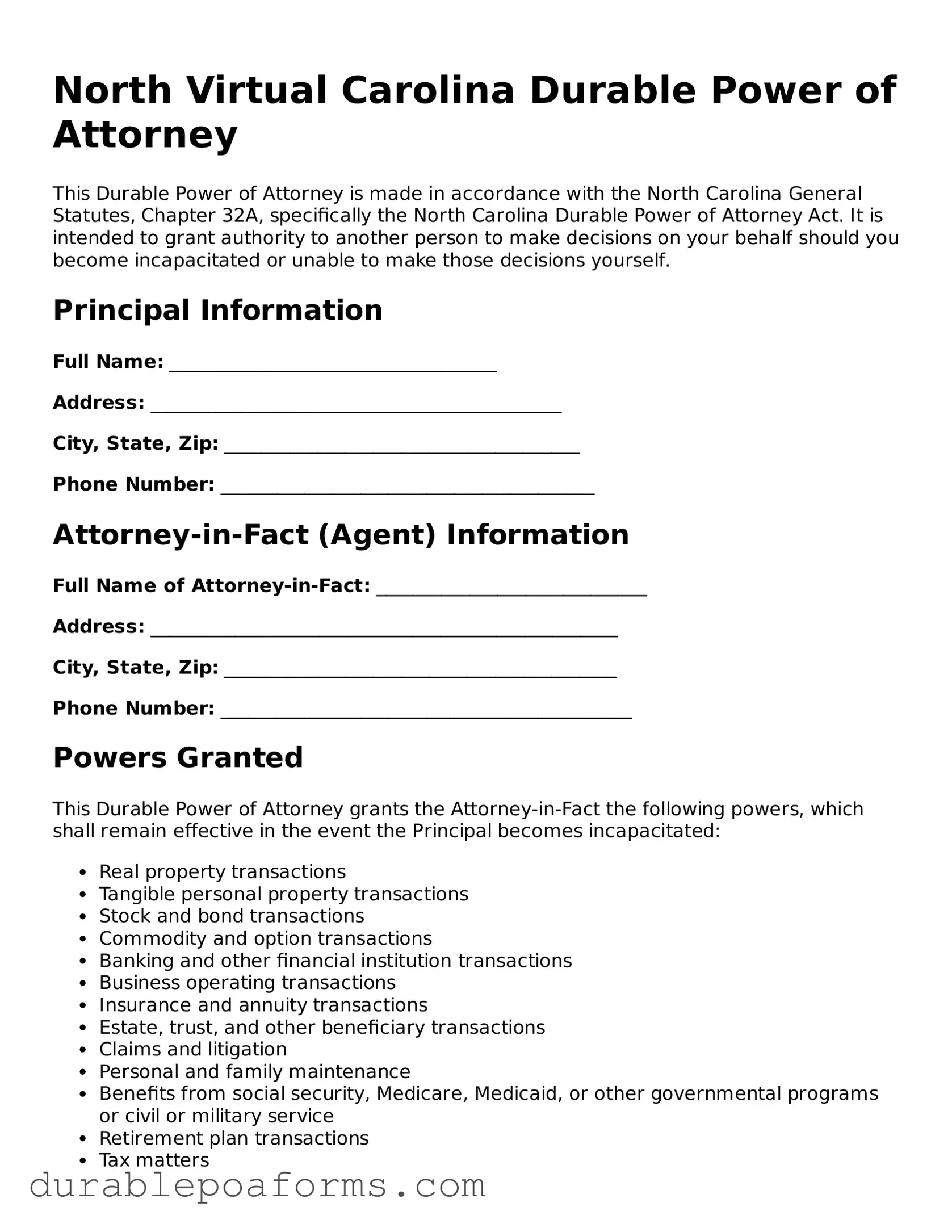

Form Preview

North Virtual Carolina Durable Power of Attorney

This Durable Power of Attorney is made in accordance with the North Carolina General Statutes, Chapter 32A, specifically the North Carolina Durable Power of Attorney Act. It is intended to grant authority to another person to make decisions on your behalf should you become incapacitated or unable to make those decisions yourself.

Principal Information

Full Name: ___________________________________

Address: ____________________________________________

City, State, Zip: ______________________________________

Phone Number: ________________________________________

Attorney-in-Fact (Agent) Information

Full Name of Attorney-in-Fact: _____________________________

Address: __________________________________________________

City, State, Zip: __________________________________________

Phone Number: ____________________________________________

Powers Granted

This Durable Power of Attorney grants the Attorney-in-Fact the following powers, which shall remain effective in the event the Principal becomes incapacitated:

- Real property transactions

- Tangible personal property transactions

- Stock and bond transactions

- Commodity and option transactions

- Banking and other financial institution transactions

- Business operating transactions

- Insurance and annuity transactions

- Estate, trust, and other beneficiary transactions

- Claims and litigation

- Personal and family maintenance

- Benefits from social security, Medicare, Medicaid, or other governmental programs or civil or military service

- Retirement plan transactions

- Tax matters

Special Instructions

If there are any special instructions limiting or extending the powers granted to the Attorney-in-Fact, list them here:

________________________________________________________________

________________________________________________________________

Execution

This Durable Power of Attorney must be signed and dated by the Principal in the presence of a Notary Public to be legally effective.

Date: ___________________________

Principal's Signature: ____________________________________

Printed Name: ____________________________________________

Notarization

This document was acknowledged before me on (date) _______________ by (name of Principal) ________________________________.

Notary Public: ____________________________ (Seal)

Commission Expires: _________________________

Form Specifications

| Fact Number | Detail |

|---|---|

| 1 | North Carolina durable power of attorney allows one person to grant another person the authority to make financial and legal decisions on their behalf. |

| 2 | It becomes effective immediately upon signing unless the document states otherwise. |

| 3 | The "durability" clause ensures that the agent's authority continues even if the principal becomes incapacitated. |

| 4 | To be legally valid, the document must be signed in the presence of a notary public. |

| 5 | The principal can specify limitations or specific powers they wish to grant to the agent in the document. |

| 6 | The agent should act in the principal's best interest, maintain accurate records, and avoid conflicts of interest. |

| 7 | The form can be revoked by the principal at any time, as long as they are mentally competent. |

| 8 | Governing law for the North Carolina Durable Power of Attorney is the North Carolina General Statutes, Chapter 32A. |

| 9 | A durable power of attorney in North Carolina does not grant the agent the ability to make healthcare decisions for the principal. |

| 10 | Choosing the right agent is crucial as they will have significant control over the principal's affairs and assets. |

North Carolina Durable Power of Attorney - Usage Guide

A Durable Power of Attorney in North Carolina is a legal document that allows you to appoint someone else to make decisions on your behalf, especially financial ones, in case you become unable to do so. This form is crucial for planning your estate and ensuring your affairs are managed according to your wishes, even when you're not able to oversee them personally. When filling out this form, accuracy and thoroughness are key to ensure that your appointed agent has the clear authority they need without any unnecessary legal hurdles. Here is a step-by-step guide to help you fill out the North Carolina Durable Power of Attorney form confidently.

- Start by reading the form thoroughly to understand all the sections and what information you need to fill in. This preparation step is essential for gathering all the necessary information before you begin.

- Enter your full legal name and address in the designated space at the beginning of the form to identify yourself as the principal.

- In the section designated for the appointment of your agent, write the full name, address, and contact information of the person you are choosing to act on your behalf. It's crucial that this information is accurate to avoid any confusion regarding the identity of your agent.

- Detail the powers you are granting to your agent. The form may list various financial responsibilities you can assign, such as handling real estate transactions, personal property, banking, and other financial dealings. Be specific about the powers you are granting to ensure your agent has the needed authority to act according to your wishes.

- If the form provides space for limitations, be sure to specify any powers or areas you do not want your agent to have authority over. This step is important to maintain control over certain aspects of your finances that you may wish to exclude from the agent's purview.

- Include any special instructions or conditions in the designated section. This could involve specifying how you want certain assets handled or preferences for managing your affairs.

- Choose a successor agent, if the form allows, by providing their full name, address, and contact details. A successor agent steps in if your primary agent is unable to serve for any reason.

- Date and sign the form in the presence of a notary public. The notarization process is crucial as it verifies the authenticity of your signature and the document.

- Have the designated agent(s) sign the form, if required. Some forms may not require this step, but it's important for the agent to acknowledge their appointment and the responsibilities it entails.

- Keep the original signed document in a safe but accessible place, and provide a copy to your appointed agent. It may also be wise to share copies with trusted family members or your attorney.

Filling out the Durable Power of Attorney form is a significant step in ensuring that your affairs can be properly managed according to your wishes if you're ever unable to do so yourself. By carefully selecting your agent and clearly defining their powers, you're taking a proactive approach to safeguard your financial well-being and peace of mind. Remember, it's also advisable to consult with a legal professional to ensure all aspects of your Durable Power of Attorney align with current North Carolina laws and your personal circumstances.

Common Questions

What is a North Carolina Durable Power of Attorney?

A North Carolina Durable Power of Attorney is a legal document that allows you to appoint someone you trust (referred to as your agent) to manage your affairs if you become unable to do so yourself. Unlike a general Power of Attorney, a Durable Power of Attorney remains in effect even if you become incapacitated or unable to make decisions for yourself.

How do I choose an agent for my Durable Power of Attorney in North Carolina?

Choosing an agent is a significant decision. It should be someone you trust implicitly, such as a family member or close friend, who demonstrates understanding and respect for your wishes and values. Consider their ability to handle financial matters and their willingness to take on this responsibility. It’s also smart to discuss your decision with them before finalizing the document to ensure they are willing and able to act on your behalf.

What powers can I grant with a North Carolina Durable Power of Attorney?

The scope of authority you can grant your agent can be as broad or as limited as you choose. Common powers include managing your bank accounts, buying or selling property, handling business transactions, and making decisions about your healthcare. However, make sure the document clearly outlines these powers to prevent any confusion or legal issues down the line.

Is a witness or notarization required for a Durable Power of Attorney to be valid in North Carolina?

Yes, North Carolina law requires that your Durable Power of Attorney must be notarized to be legally valid. Additionally, having one or two disinterested witnesses present at the signing—though not mandatory—can add an extra layer of legitimacy to your document.

Can I revoke my Durable Power of Attorney?

Yes, you can revoke your Durable Power of Attorney at any time as long as you are mentally competent. To do so, you should provide a written notice of revocation to your current agent and to any institutions or parties they have been dealing with on your behalf. It's also recommended to destroy all copies of the original document to prevent any future confusion or unauthorized use.

What should I do if my agent is not acting in my best interests?

If you believe your agent is not acting in your best interests, you have the right to revoke their authority through a written notice of revocation, as mentioned earlier. After revoking, you may appoint a new agent by creating a new Durable Power of Attorney. If you're unable to do this yourself due to incapacitation, a court intervention might be necessary. It's crucial to regularly review the actions of your agent and keep open communication lines whenever possible.

Where should I keep my Durable Power of Attorney document?

Keep your Durable Power of Attorney document in a safe but accessible place. Inform your agent of its location and consider providing copies to trusted family members or your attorney. Some people also choose to file a copy with their county recorder's office for added safety and to ensure it's easily locatable by family members or legal representatives when needed.

Common mistakes

The first mistake is not specifying the scope of powers granted. When individuals are unclear about the authority they're giving their agent, it can lead to ambiguity and legal challenges. It's important to be as detailed as possible regarding what decisions the agent can make on the principal's behalf.

Another error is neglecting to choose an alternate agent. Life is unpredictable. If the primary agent is unable or unwilling to serve, having no alternate agent can create a void. This oversight could necessitate court intervention, which is costly and time-consuming.

Failing to sign the form in accordance with North Carolina law is a critical mistake. For the document to be valid, it must be notarized and, in some cases, witnessed. Neglecting these formalities can render the document useless.

Many individuals make the mistake of not discussing their wishes with the chosen agent. It's essential for the agent to understand the principal's preferences and values. This understanding ensures the agent can make decisions that align with the principal's wishes.

People often overlook the necessity of updating the document. Life changes, such as marriage, divorce, or the death of an agent, can affect the relevance of the power of attorney. Regularly reviewing and updating the document ensures it reflects current wishes and circumstances.

Underestimating the importance of specificity is a common fault. Being vague about the powers granted can lead to conflicts and confusion. It's better to be specific about what the agent can and cannot do.

Ignoring the need to register the document is another oversight. While not always mandatory, registering the document with local authorities can facilitate its acceptance by financial institutions and other entities.

Choosing an agent based on personal relationships rather than capability is a mistake. The role of an agent requires trustworthiness, financial acumen, and the ability to act under pressure. Emotional closeness should not be the sole criterion for selection.

Lastly, many underestimate the power of a Durable Power of Attorney. Failing to recognize the legal authority it grants can lead to unintentional misuse or abuse. It's crucial to understand the document's power and limitations.

Avoiding these mistakes requires careful consideration and, often, guidance from a legal professional. By paying attention to these details, individuals can ensure their Durable Power of Attorney serves its intended purpose and safeguards their interests.Documents used along the form

When preparing for future uncertainties, it’s crucial to consider creating comprehensive legal documents that can speak on your behalf, especially when you're unable to do so. In North Carolina, alongside the Durable Power of Attorney (DPOA) form, several other essential documents can help ensure your wishes are respected and your affairs are in order. The DPOA is a powerful tool, allowing you to appoint someone you trust to manage your financial affairs. However, to cover different aspects of one's life and health, it's beneficial to be aware of additional forms that complement the DPOA, providing a more rounded approach to planning for the future.

- Health Care Power of Attorney: This document enables you to designate a trusted individual to make health care decisions on your behalf should you become unable to do so. It's particularly important for decisions that fall outside the scope of a Living Will, covering a broader range of health care scenarios and treatments.

- Living Will (Advance Directive): Often used in conjunction with a Health Care Power of Attorney, a Living Will allows you to express your wishes regarding end-of-life care and life-prolonging treatments. This document speaks directly to health care providers in the event that you are unable to communicate your preferences yourself.

- Last Will and Testament: While the Durable Power of Attorney focuses on financial decisions during your lifetime, a Last Will and Testament outlines your wishes regarding the distribution of your assets after your death. It also allows you to appoint a guardian for any minor children or dependents.

- Declaration for Mental Health Treatment: In North Carolina, this document allows individuals to state their preferences regarding mental health treatment in case they later become incapable of making these decisions themselves. It includes preferences about specific treatments and appoints an agent to make decisions when the individual is unable to do so.

Ensuring that you have these documents in place can provide peace of mind for both you and your loved ones. While the thought of preparing for incapacity or death may be daunting, taking these steps allows you to have a say in your financial, healthcare, and personal matters. Moreover, it can relieve your family from making difficult decisions during emotional times. Consulting with a legal professional to tailor these documents to your specific needs is always recommended, as they can offer guidance and ensure that your documents comply with North Carolina law, ultimately protecting your interests and those of your loved ones.

Similar forms

The North Carolina Durable Power of Attorney form is similar to other legal documents that also grant someone authority to act on another person’s behalf, but with distinct differences in their scope and purpose. Such comparisons help in understanding the nature and utility of each document.

General Power of Attorney: This document, like the Durable Power of Attorney, grants an agent the power to handle affairs on the principal's behalf. However, the critical difference lies in the durability aspect. A General Power of Attorney becomes invalid if the principal becomes incapacitated or unable to make decisions. In contrast, the "durable" in Durable Power of Attorney specifically means that the document remains in effect even if the principal becomes incapacitated, ensuring continuous representation and decision-making ability.

Health Care Power of Attorney: Similar to a Durable Power of Attorney, a Health Care Power of Attorney appoints an agent to make decisions on the principal's behalf. The major distinction is in the type of decisions the appointed agent is authorized to make. While a Durable Power of Attorney typically covers a broad range of actions, including financial, legal, and business decisions, a Health Care Power of Attorney is specifically designed to grant powers related to medical care and treatment decisions, especially when the principal cannot make these decisions themselves.

Living Will: Often confused with a Durable Power of Attorney, a Living Will is another document that comes into play under severe health conditions. It differs in that it does not appoint another person to make decisions. Instead, a Living Will provides instructions on the preferred medical treatments in certain situations where the individual is unable to communicate their decisions, such as life support withdrawal. It works in tandem with a Health Care Power of Attorney by guiding the agent’s decisions, but it does not confer decision-making authority like a Durable Power of Attorney does.

Dos and Don'ts

In North Carolina, filling out a Durable Power of Attorney (DPOA) form is a crucial step in managing your affairs if you become unable to do so. To ensure the process is smooth and your desires are accurately reflected, here’s a list of dos and don’ts:

Dos:- Read all instructions carefully before beginning the form to understand each section's requirements.

- Choose a trusted individual as your agent, someone you believe will act in your best interest.

- Be specific about the powers you are granting to your agent to avoid confusion or misuse.

- Discuss your wishes and the contents of the DPOA with the person you have chosen as your agent, ensuring they are willing and able to fulfill the responsibilities.

- Include a successor agent in the form in case the primary agent is unable to act.

- Sign the form in the presence of a notary public and, depending on the requirements, witnesses to ensure it is legally binding.

- Keep the original document in a safe but accessible place, and inform your agent and family members where it is stored.

- Distribute copies of the notarized form to your agent, doctors, and anyone else who might need access to it.

- Review and update your DPOA as necessary, especially after major life events or changes in your wishes.

- Consider consulting an attorney to ensure that your DPOA meets all legal requirements and fully protects your interests.

- Don’t rush through the process without fully understanding the document’s significance and the powers being granted.

- Don’t choose an agent based solely on personal relationships without assessing their capability and reliability.

- Don’t leave any sections incomplete, as this could lead to problems or delays when the document is needed.

- Don’t forget to specify any limitations or special instructions regarding the powers granted to your agent.

- Don’t sign the form without the required legal witnesses or notarization, as this could invalidate the document.

- Don’t keep your DPOA hidden; lack of access could render it useless in times of need.

- Don’t assume that once the DPOA is created, it never needs to be reviewed or updated.

- Don’t neglect to communicate your wishes and any subsequent changes to your DPOA to the relevant parties.

- Don’t rely on generic forms without ensuring they comply with North Carolina's specific legal requirements.

- Don’t hesitate to seek legal advice if you have any doubts or questions about the process.

Misconceptions

In considering the creation and understanding of the North Carolina Durable Power of Attorney (DPOA) form, it's essential to dispel common myths and misunderstandings. Individuals often navigate the complexities of legal documentation with preconceived notions that may not align with the law or practical aspects. Below are seven misconceptions related to the North Carolina DPOA form, clarified to enhance comprehension and decision-making.

- Durable Power of Attorney Forms Are Automatically Activated Upon Signing. Many believe that once a Durable Power of Attorney form is signed in North Carolina, it's immediately effective. However, the reality is that the document's activation depends on the specifics outlined within it. Some may be designed to come into effect immediately, while others only activate upon the principal's incapacity, as clearly stipulated in the document.

- Only Elderly People Need a DPOA. A common misunderstanding is that Durable Powers of Attorney are solely for older adults. The truth is that adults of any age can face situations where they're unable to make decisions due to sudden illness or accidents. A DPOA is a prudent measure for any adult to ensure their affairs can be managed according to their wishes, regardless of age.

- A DPOA Grants Unlimited Power. Some people hesitate to create a DPOA, fearing it gives the agent absolute control over all aspects of their lives. However, in North Carolina, the scope of authority granted to the agent can be specifically tailored within the document. It can limit the agent's power to particular types of decisions or transactions, offering the principal protection and peace of mind.

- Creating a DPOA Is a Complicated and Expensive Process. The process of creating a DPOA in North Carolina is often perceived as daunting and costly. While it is crucial to ensure the document is correctly drafted to reflect the principal's intentions and complies with state laws, templates and resources are available to make this process more straightforward and accessible. Consulting with a legal professional is advisable but does not necessarily mean exorbitant costs.

- A DPOA Is the Same as a Will. Confusion sometimes arises between the purpose of a Durable Power of Attorney and a will. It's important to note that a DPOA pertains to the management of a person's affairs while they are alive but incapacitated. In contrast, a will dictates how a person's assets should be distributed after their death. Both documents are integral parts of a comprehensive estate plan but serve different functions.

- Any Form of Power of Attorney Will Suffice in North Carolina. North Carolina has specific requirements for what constitutes a valid DPOA, including how it must be executed and what powers can be conferred. It's a misconception that any generic power of attorney form will be legally acceptable in the state. For a DPOA to be durable and effective, it must comply with North Carolina law.

- Once Created, a DPOA Cannot Be Changed. There's a false belief that once a Durable Power of Attorney is signed, it's set in stone. On the contrary, as long as the principal is mentally competent, they have the right to revoke or amend their DPOA at any time. This flexibility allows individuals to adjust their plans as life circumstances change, ensuring their current wishes are always accurately represented.

Understanding these elements is crucial for anyone considering the creation of a Durable Power of Attorney in North Carolina. By dispelling these myths, individuals can make informed decisions that best protect their interests and those of their loved ones.

Key takeaways

Filling out a Durable Power of Attorney (DPOA) form in North Carolina is an important step in planning for future financial management, but the process can seem complex. Here are key takeaways to help guide individuals through this critical task:

- Understanding the purpose: The DPOA allows you to appoint an agent (also known as an attorney-in-fact) to manage your financial affairs in case you become incapacitated. This could include paying bills, managing investments, or making real estate transactions.

- Choosing the right agent: Select someone who is trustworthy, financially savvy, and ideally, lives nearby. This person will have significant authority over your finances, so it’s crucial to choose wisely.

- Specificity is key: Be as specific as possible in the powers granted to your agent. The form allows you to tailor the powers given, which can range from broad to very specific tasks.

- Notarization is required: For your DPOA to be legally valid in North Carolina, it must be signed by you and notarized. This step confirms that you are signing the document willingly and under no duress.

- Consider a successor agent: Appointing a successor agent can provide a backup in case your first choice is unable or unwilling to serve. This ensures continuity in managing your affairs without needing to execute a new DPOA.

- Review and update regularly: Life changes, such as marriage, divorce, or the death of your chosen agent, may necessitate updating your DPOA. Review it periodically to ensure it still reflects your wishes and circumstances.

- Legality and compliance: Make sure the form complies with North Carolina state laws, as requirements can vary from state to state. It can be beneficial to consult with a legal professional to ensure all provisions are in order.

Completing a Durable Power of Attorney is a proactive step in financial planning, offering peace of mind that your affairs will be handled according to your wishes, even if you become incapacitated. Taking the time to carefully select your agent and specify their powers will help ensure that your financial health is maintained in any circumstances.

More Durable Power of Attorney State Forms

New Mexico Durable Power of Attorney - The form also serves a protective function, potentially preventing financial abuse and fraud by establishing a transparent, legally sanctioned framework for managing the principal's affairs.

Oregon Durable Power of Attorney Form Free - Effective immediately or upon a specific trigger event, it can be tailored to fit one’s unique circumstances and preferences.

Power of Attorney Rhode Island - The form must be completed while the principal is mentally capable of understanding the decision they are making.

Utah Durable Power of Attorney - The focus is on perpetuating the management of your financial realm without disruptions, safeguarding your economic stability.