Attorney-Verified Durable Power of Attorney Document for North Dakota

In the vast plains of North Dakota, preparing for the future is a fundamental part of life. Among the critical tools residents can utilize is the North Dakota Durable Power of Attorney form, designed to ensure that personal affairs are managed according to individual wishes, even in times when they are not able to make decisions for themselves. This legal document allows a person to appoint someone else, often referred to as an agent or attorney-in-fact, to make decisions on their behalf. What sets it apart is its durability - it remains in effect even if the person becomes incapacitated. Covering a broad spectrum of authorities, from financial decisions to real estate transactions, the form requires careful consideration and understanding. It is a powerful document that demands precision in its execution, including the necessity for it to be witnessed and notarized to attain legal validity. This form, foundational in estate planning and personal finance management, underscores the importance of preparedness and clear communication regarding one's personal affairs.

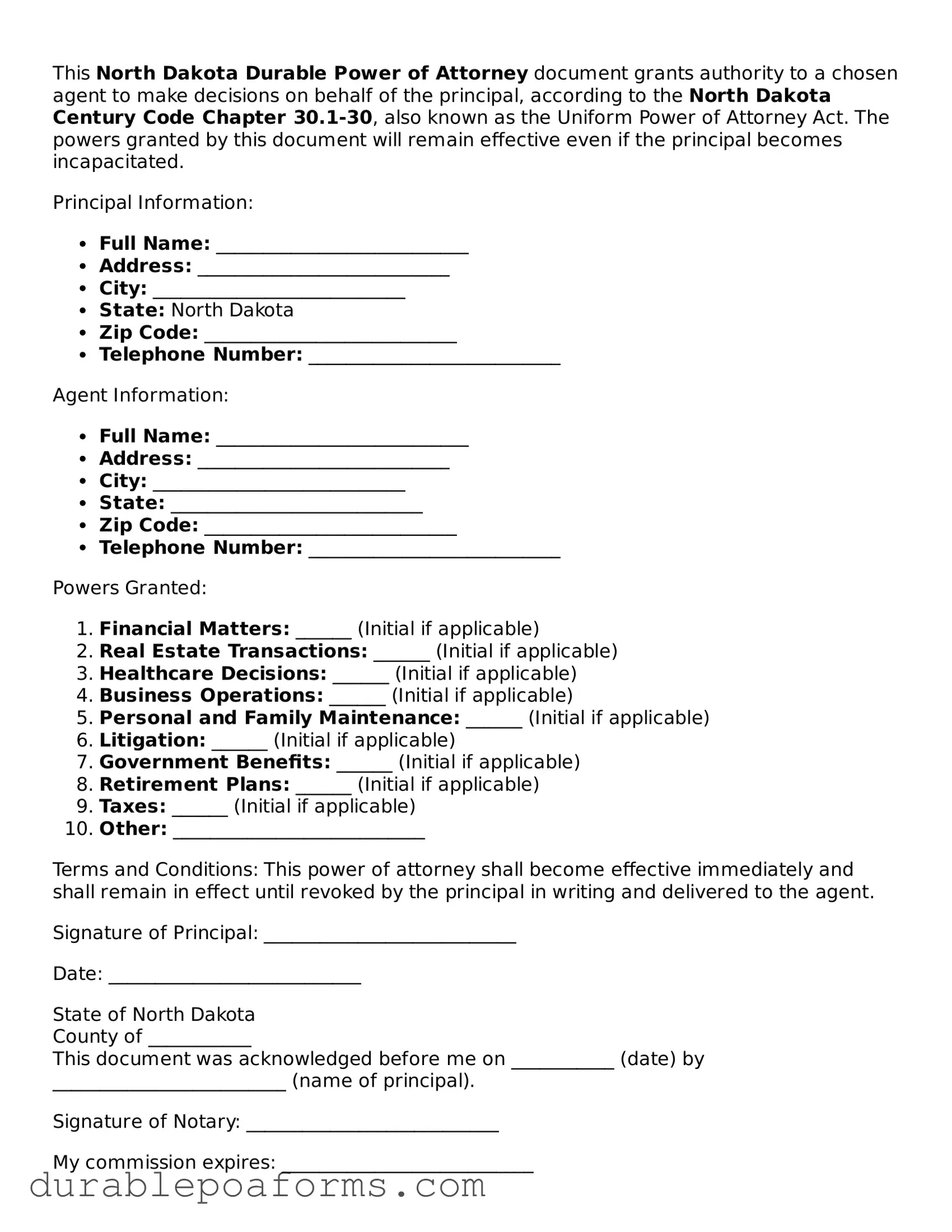

Form Preview

This North Dakota Durable Power of Attorney document grants authority to a chosen agent to make decisions on behalf of the principal, according to the North Dakota Century Code Chapter 30.1-30, also known as the Uniform Power of Attorney Act. The powers granted by this document will remain effective even if the principal becomes incapacitated.

Principal Information:

- Full Name: ___________________________

- Address: ___________________________

- City: ___________________________

- State: North Dakota

- Zip Code: ___________________________

- Telephone Number: ___________________________

Agent Information:

- Full Name: ___________________________

- Address: ___________________________

- City: ___________________________

- State: ___________________________

- Zip Code: ___________________________

- Telephone Number: ___________________________

Powers Granted:

- Financial Matters: ______ (Initial if applicable)

- Real Estate Transactions: ______ (Initial if applicable)

- Healthcare Decisions: ______ (Initial if applicable)

- Business Operations: ______ (Initial if applicable)

- Personal and Family Maintenance: ______ (Initial if applicable)

- Litigation: ______ (Initial if applicable)

- Government Benefits: ______ (Initial if applicable)

- Retirement Plans: ______ (Initial if applicable)

- Taxes: ______ (Initial if applicable)

- Other: ___________________________

Terms and Conditions: This power of attorney shall become effective immediately and shall remain in effect until revoked by the principal in writing and delivered to the agent.

Signature of Principal: ___________________________

Date: ___________________________

State of North Dakota

County of ___________

This document was acknowledged before me on ___________ (date) by _________________________ (name of principal).

Signature of Notary: ___________________________

My commission expires: ___________________________

Form Specifications

| Fact | Description |

|---|---|

| Definition | A Durable Power of Attorney in North Dakota allows an individual to appoint someone else to manage their financial affairs, even after the individual becomes incapacitated. |

| Governing Law | In North Dakota, the Durable Power of Attorney is governed by North Dakota Century Code, Chapter 30.1-30. |

| Document Durability | This type of Power of Attorney remains in effect even if the individual who created it becomes incapacitated, unlike other forms of Power of Attorney. |

| Agent Authority | The appointed agent can handle tasks such as paying bills, managing investments, and other financial decisions on behalf of the principal. |

| Agent Selection | The individual creating the Power of Attorney can choose anyone they trust to act as their agent, often a family member or close friend. |

| Revocation | The principal has the right to revoke the Durable Power of Attorney at any time, as long as they are mentally competent. |

| Execution Requirements | To be valid, the document must be signed by the principal in the presence of a notary public or at least two adult witnesses, in accordance with North Dakota law. |

| Protection | The law includes protections to help prevent abuse, requiring the agent to act in the principal’s best interests and keep accurate records. |

North Dakota Durable Power of Attorney - Usage Guide

Facing the task of ensuring that your wishes and affairs are handled according to your expectations when you can't do so yourself can seem daunting. Preparing a Durable Power of Attorney (DPOA) in North Dakota is a strategic move to address this concern. This document grants someone you trust the authority to manage your financial and legal affairs, should you become unable to do so. Getting started may seem complex, but with a clear guide, the process becomes straightforward. Let's walk through the steps needed to fill out a North Dakota Durable Power of Attorney form.

- Identify the Parties: Begin by inserting your full legal name and address as the principal, and the individual you are appointing as your attorney-in-fact (agent), including their full legal name and address.

- Designation of Attorney-in-Fact: Clearly specify that you are granting authority to your chosen agent. This section often requires the date from which the DPOA will become effective.

- Authorities Granted: Detail the specific powers you are transferring to your agent. This may include handling financial transactions, buying or selling property, or managing business operations. North Dakota law requires you to be explicit about the powers granted.

- Special Instructions: If there are specific limits to the authority you are granting, or particular wishes you want to be followed, list them clearly. This helps ensure your agent acts within the bounds of your expectations.

- Successor Agent: Optionally, you may appoint a successor agent who will assume responsibility if your primary agent is unable, unwilling, or unavailable to serve.

- Durability Clause: Affirm the document's durability by stating that the power of attorney shall remain in effect even if you become incapacitated. This is crucial for the document to be considered durable.

- Signatures: For the DPOA to be legally valid, you must sign and date the document in the presence of a notary public. The agent(s) may also be required to sign, acknowledging their acceptance of the responsibilities.

- Notarization: The final step involves having the document notarized. This typically includes your signature, the notary's signature, their official seal, and the date.

Completing the North Dakota Durable Power of Attorney form is a vital step in ensuring that your affairs are managed according to your wishes, even when you're not able to oversee them personally. By carefully selecting your agent and clearly defining their powers, you create a robust document that upholds your interests. Remember, consulting with a legal professional can provide valuable insight and peace of mind throughout this essential process.

Common Questions

What is a North Dakota Durable Power of Attorney?

A North Dakota Durable Power of Attorney is a legal document that allows an individual, known as the principal, to designate another person, called the agent or attorney-in-fact, to manage their affairs. This could include making financial decisions, handling business transactions, and other personal matters. The term "durable" means that the power of attorney remains in effect even if the principal becomes incapacitated or unable to make decisions for themselves.

How do I create a Durable Power of Attorney in North Dakota?

To create a Dossier Power of Attorney in North Dakota, you must complete a form that meets the state’s legal requirements. This includes clearly identifying the principal and agent, specifying the powers granted, and ensuring that the document is signed by the principal in the presence of a notary public. It is highly recommended to consult with a legal professional to ensure that all aspects of the form comply with state laws and accurately reflect the principal's wishes.

When does a Durable Power of Attorney come into effect?

In North Dakota, a Durable Power of Attorney can be structured to come into effect as soon as it is signed or only upon the occurrence of a specified event, such as the principal's incapacity. The principal has the flexibility to decide when the powers will be granted to the agent, which should be clearly stated in the document. This flexibility allows the principal to tailor the document to their personal needs and preferences.

Can a Durable Power of Attorney be revoked in North Dakota?

Yes, a Durable Power of Attorney can be revoked at any time by the principal, as long as they are mentally competent. To revoke the power of attorney, the principal should provide written notice to the agent and any other parties who were relying on the document. It's also advisable to destroy all copies of the power of attorney. For a revocation to be effective, proper notification is key to ensure that all relevant parties are aware that the agent no longer has the authority to act on the principal's behalf.

Common mistakes

A Durable Power of Attorney (DPOA) is a critical legal document that grants someone else the power to make decisions on your behalf, especially when you're unable to do so yourself. While it's a powerful tool within the legal landscape of North Dakota, a few missteps can significantly impact its effectiveness. Here are eight common mistakes people make when filling out the North Dakota Durable Power of Attorney form:

One common mistake is not specifying the powers granted. A DPOA can cover a wide range of decisions, from financial to healthcare. Failing to detail the specific powers leaves too much room for interpretation, potentially leading to unintended consequences.

Another mistake is choosing the wrong agent. The person you appoint—your agent—holds significant responsibility. It's crucial to select someone who is not only trustworthy but also capable of making tough decisions under pressure.

Overlooking the need for a successor agent is also common. Life’s unpredictable nature means your first choice might not always be available. Without a backup, the court could end up making decisions for you.

People often ignore the importance of specificity in the effective date. Whether it becomes effective immediately or upon incapacitation needs clear indication to avoid any ambiguity or legal challenges.

Forgetting to revoke previous DPOAs can lead to confusion and conflict. It's essential to explicitly revoke any prior DPOAs to ensure your current wishes are the only ones considered.

Many individuals fail to consider state-specific requirements. Each state, including North Dakota, has unique laws regarding DPOAs. Ignoring these can render your document ineffective.

Another oversight is neglecting to add contingencies. Including conditions that alter the document's effectiveness ensures that your wishes are followed as closely as possible.

Finally, lack of proper witnesses and notarization is a frequent error. These are not merely formalities but essential steps for making the document legally binding in North Dakota.

When setting up a Durable Power of Attorney, taking the time to avoid these mistakes can make all the difference. It's about protecting yourself, your assets, and your loved ones. Ensuring that your document is clear, valid, and precisely reflects your wishes is paramount. Careful consideration and occasionally seeking professional advice can help navigate this legal terrain smoothly.

Documents used along the form

When handling affairs that require a North Dakota Durable Power of Attorney, understanding the full landscape of necessary or complementary forms and documents is essential. A Durable Power of Attorney form empowers an individual to act on another's behalf, typically in financial or healthcare decisions. However, this pivotal document doesn't stand alone. Various other documents often work in concert with it, ensuring an individual's wishes are fully captured and legally actionable across different scenarios.

- Advance Healthcare Directive: This document outlines a person’s preferences regarding medical treatment and care, should they become unable to make decisions for themselves. It often accompanies a Durable Power of Attorney for healthcare decisions, clarifying the principal's health care wishes.

- Living Will: Closely related to an Advance Healthcare Directive, a Living Will specifies desires for end-of-life care. It's a critical document for ensuring that an individual's healthcare preferences are known and honored when they are not able to communicate their wishes directly.

- Last Will and Testament: This legal document specifies how an individual’s property and assets are distributed after death. While a Durable Power of Attorney handles affairs during a person's lifetime, a Last Will takes effect after death, making these documents complementary.

- Declaration of Guardianship for Minor Children: For parents, this document is crucial. It designates a guardian for their children in the event of the parents' incapacity or death, working alongside a Durable Power of Attorney to ensure children's care and financial needs are met.

- Trust Documents: Trusts manage how assets are distributed either during an individual's lifetime or after death. When created alongside a Durable Power of Attorney, they provide a comprehensive plan for financial management and legacy.

- HIPAA Release Form: This form grants healthcare providers the ability to share an individual's medical information with designated persons. It is often essential for those holding a Durable Power of Attorney for healthcare to ensure they have the necessary information to make informed decisions.

- Personal Property Memorandum: Tied to a Last Will, this document itemizes personal property and whom it should be distributed to. It complements a Durable Power of Attorney by detailing specific gifts, adding clarity and reducing potential conflicts.

- Financial Records Organizer: While not a legal document, this organizer is invaluable. It compiles account numbers, passwords, and other financial information, making it easier for those holding a Durable Power of Attorney to manage affairs efficiently.

- Funeral Directive: This outlines an individual's preferences for their funeral and burial arrangements, ensuring wishes are respected and relieving loved ones of decision-making pressure during a difficult time.

- Letter of Intent for Estate Plan: This informal document offers an overall view of an individual's estate plan, providing guidance and explanations that legal documents may not cover. It can clarify decisions made in the Durable Power of Attorney and other legal instruments.

To effectively prepare for life's uncertainties, individuals often find themselves navigating a suite of legal documents alongside the North Dakota Durable Power of Attorney. Each document serves its unique purpose, collectively ensuring that personal, healthcare, and financial decisions are covered comprehensively. By understanding and utilizing these forms, individuals can offer clear guidance on their wishes, providing peace of mind for themselves and their loved ones.

Similar forms

The North Dakota Durable Power of Attorney form is similar to other legal documents that allow individuals to designate decision-making authority to another person. These documents are instrumental in estate planning, healthcare decisions, and managing financial affairs when one cannot do so themselves. While the durable power of attorney focuses primarily on financial decisions, several other documents share its foundational principle of assigning authority to an agent, albeit with different scopes and focuses.

The form is similar to the General Power of Attorney, as both enable an individual to grant broad powers to an agent to manage their affairs. However, the crucial difference lies in their durability. A Durable Power of Attorney remains in effect if the principal becomes incapacitated, while a General Power of Attorney does not. This distinction is vital in ensuring that an individual's affairs can still be managed during times of incapacity.

Another comparable document is the Health Care Power of Attorney. This document specifically allows an individual to appoint someone else to make healthcare decisions on their behalf if they are unable to do so. While the Durable Power of Attorney often covers financial decisions, the Health Care Power of Attorney focuses solely on health-related issues, emphasizing the importance of specifying preferences in medical treatment and care.

The Living Will is also similar to the Durable Power of Attorney in its forward-thinking approach to planning for incapacity. However, instead of appointing an agent, a Living Will outlines an individual’s wishes regarding life-sustaining treatment if they become terminally ill or permanently unconscious. This document serves as a guide for healthcare providers and loved ones in making critical medical decisions, complementing the Health Care Power of Attorney by addressing specific medical directives.

Dos and Don'ts

Filling out a durable power of attorney form is a significant step in planning for future financial and health decisions. In North Dakota, this legal document allows you to appoint someone else to manage your affairs if you become unable to do so. Here are important do's and don'ts to remember when completing this form:

- Do carefully consider who you choose as your agent. This person should be trustworthy, reliable, and capable of handling financial and legal responsibilities.

- Do clearly define the powers you are granting. Specify what your agent can and cannot do on your behalf to avoid any confusion or misuse of authority.

- Do discuss your decision with the person you want to appoint as your agent. They should be aware of their responsibilities and agree to take on this role.

- Do sign the form in the presence of a notary public. This step is crucial for the document to be legally binding in North Dakota.

- Don't leave any sections blank. If a section does not apply, write "N/A" (not applicable) to ensure there are no ambiguities in your document.

- Don't forget to review and update your durable power of attorney regularly. Life changes such as divorce, death, or relocation can affect your choice of agent.

- Don't use vague language. Be as specific as possible when outlining the powers granted to your agent to prevent any misunderstands or legal challenges.

- Don't neglect to inform your family members or other close individuals about your durable power of attorney. It's important they know who will be making decisions on your behalf should the need arise.

Following these guidelines will help ensure your North Dakota durable power of attorney form accurately reflects your wishes and provides clear instructions for handling your affairs. Remember, this document plays a critical role in your future planning, so it's worth taking the time to complete it correctly.

Misconceptions

Understanding legal documents can often be a daunting task, particularly when it comes to crucial forms like the North Dakota Durable Power of Attorney (DPOA). This document grants another person the authority to make decisions on one's behalf, mainly in matters of financial or health-related situations. However, there are several misconceptions about the DPOA that can lead to confusion. To ensure clarity, let's discuss 10 common misunderstandings:

- It grants unlimited power. Many believe that a Durable Power of Attorney gives the appointed agent carte blanche to make any decision. However, the truth is it allows the agent to act only within the scope outlined in the document. Specific powers must be granted explicitly.

- It's effective only after incapacity. A common misconception is that a DPOA comes into effect only if the principal becomes incapacitated. In reality, unless the document specifies otherwise, it becomes effective as soon as it is signed and notarized.

- It covers medical decisions. Some individuals think a Durable Power of Attorney includes making medical decisions. However, in North Dakota, healthcare decisions require a separate document, known as a Healthcare Power of Attorney.

- It's valid after death. Another misunderstanding is that a DPOA remains valid after the principal's death. Actually, all powers granted through a DPOA terminate upon the principal's death.

- The appointed agent can override the principal's wishes. This is incorrect. The agent is legally obligated to act in the principal’s best interests and according to their wishes as articulated in the DPOA document.

- It's irrevocable. Some think once a Durable Power of Attorney is created, it cannot be changed or canceled. However, as long as the principal is competent, they can revoke or amend the DPOA at any time.

- A spouse automatically has the same powers. It is a common belief that a spouse would automatically have the authority to make decisions if something happens. In fact, without a properly executed DPOA, this is not the case, even for married couples.

- It can be signed on behalf of the principal. No one, not even a spouse, can sign a DPOA document on the principal's behalf. The principal must sign the document themselves, in the presence of a notary, to ensure its validity.

- It's a complicated process. The process of setting up a DPOA is often viewed as complex and daunting. While it does require careful consideration, the actual steps to create this legal document are straightforward, especially with professional guidance.

- A standard form fits all situations. Lastly, many believe that one standard DPOA form works for every situation. While North Dakota provides statutory forms, it's crucial to tailor the document to suit individual needs and circumstances, potentially consulting with legal professionals to ensure all bases are covered.

Dispelling these misconceptions ensures that individuals are better informed about the nuances of the North Dakota Durable Power of Attorney. It's a powerful and necessary tool for managing one's affairs, but understanding its parameters is essential for its effective use.

Key takeaways

When preparing to fill out and use the North Dakota Durable Power of Attorney form, understanding its key elements is crucial for ensuring your wishes are respected and your affairs are managed according to your expectations. Below are seven important takeaways to keep in mind:

A Durable Power of Attorney (DPOA) allows you to appoint someone you trust, known as an agent, to manage your financial and legal affairs in the event you become unable to do so yourself.

Choosing an agent is a significant decision. Select a person who is not only trustworthy but also capable of managing your affairs responsibly and in your best interest.

The form must be completed accurately and in accordance with North Dakota law to ensure it is valid. This includes specifying the powers granted to your agent and any limitations to those powers.

It is essential for the document to be signed in the presence of a notary public to be legally binding. North Dakota law may also require witness signatures.

Discuss your wishes with the person you are appointing as your agent before completing the form. It's important they understand your preferences and the responsibilities involved.

Once signed, copies of the DPOA should be distributed appropriately. Your agent, family members, and any relevant financial or legal institutions should have access to it.

Remember, a Durable Power of Attorney can be revoked at any time, provided you are mentally competent. Inform your agent, any institutions holding the document, and replace it with a new form if your wishes or circumstances change.

Handling personal affairs through a Durable Power of Attorney is a proactive step in planning for the future. It requires careful consideration and proper execution but ensures peace of mind knowing your affairs will be managed as you see fit, even if you are not in a position to oversee them yourself.

More Durable Power of Attorney State Forms

Power of Attorney Alaska - Establishes a legal framework for one to perform financial duties on behalf of another.

Ohio Power of Attorney Requirements - The document can be tailored to meet the individual needs of the principal, offering flexible solutions for managing an array of financial and legal situations.