Attorney-Verified Durable Power of Attorney Document for Ohio

In the realm of legal preparation and personal planning, the Ohio Durable Power of Attorney form stands as a crucial document, empowering individuals to designate someone they trust to manage their financial affairs should they become incapable of doing so themselves. This provision ensures that, even in times of unexpected health crises or incapacitation, a person's financial responsibilities and assets are managed according to their wishes. Unlike a general power of attorney, the durability aspect implies that the document remains in effect even if the person who made it is no longer mentally competent. It covers a broad range of financial actions, from simple bill payments to the management of real estate and investments, offering peace of mind to both the individual and their loved ones. Such a setup not only prevents potential legal complications and family disputes but also ensures that the principal's financial matters are handled responsibly and efficiently. Navigating the specifics of the Ohio Durable Power of Attorney form requires a clear understanding of its scope, execution requirements, and the protections it offers, making it a significant part of estate planning and personal financial management.

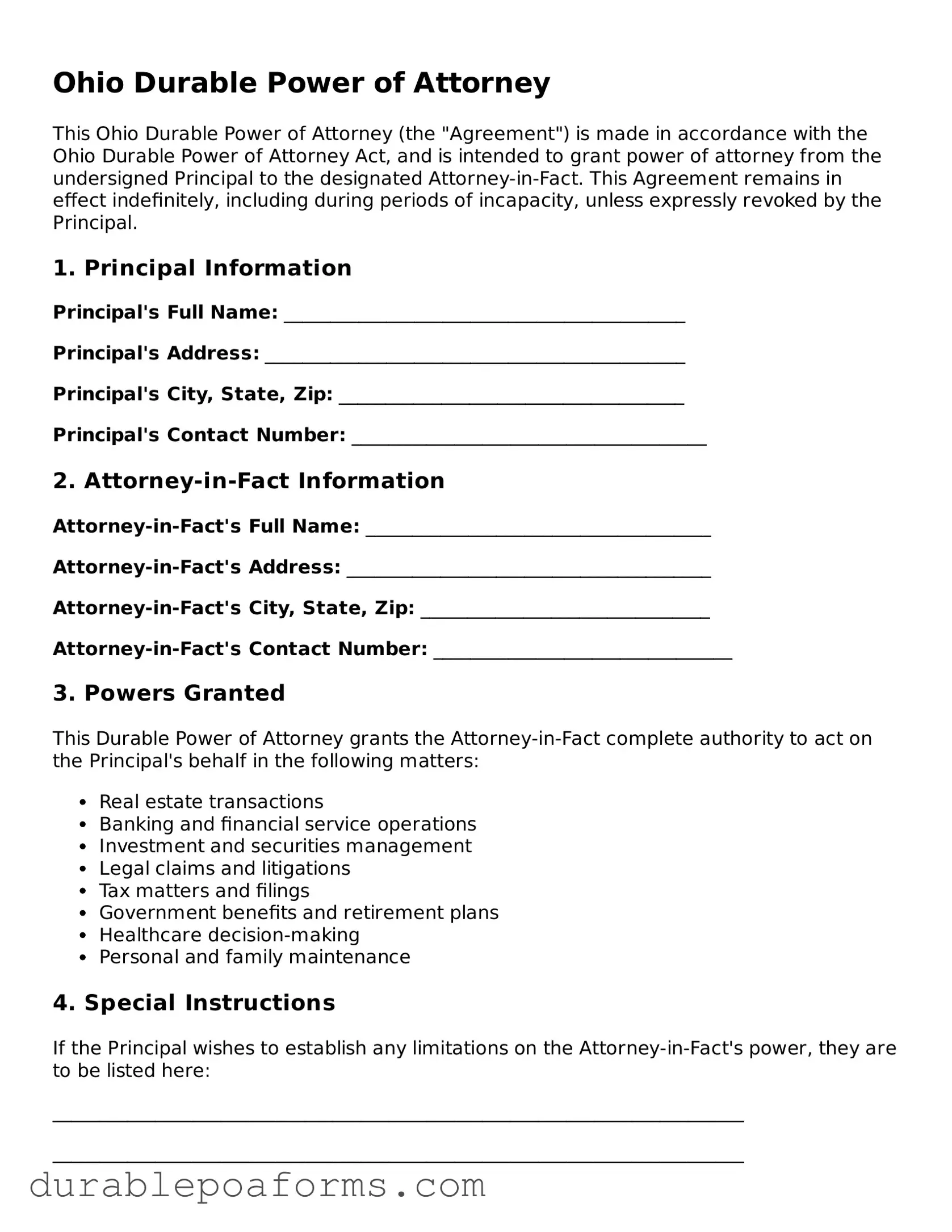

Form Preview

Ohio Durable Power of Attorney

This Ohio Durable Power of Attorney (the "Agreement") is made in accordance with the Ohio Durable Power of Attorney Act, and is intended to grant power of attorney from the undersigned Principal to the designated Attorney-in-Fact. This Agreement remains in effect indefinitely, including during periods of incapacity, unless expressly revoked by the Principal.

1. Principal Information

Principal's Full Name: ___________________________________________

Principal's Address: _____________________________________________

Principal's City, State, Zip: _____________________________________

Principal's Contact Number: ______________________________________

2. Attorney-in-Fact Information

Attorney-in-Fact's Full Name: _____________________________________

Attorney-in-Fact's Address: _______________________________________

Attorney-in-Fact's City, State, Zip: _______________________________

Attorney-in-Fact's Contact Number: ________________________________

3. Powers Granted

This Durable Power of Attorney grants the Attorney-in-Fact complete authority to act on the Principal's behalf in the following matters:

- Real estate transactions

- Banking and financial service operations

- Investment and securities management

- Legal claims and litigations

- Tax matters and filings

- Government benefits and retirement plans

- Healthcare decision-making

- Personal and family maintenance

4. Special Instructions

If the Principal wishes to establish any limitations on the Attorney-in-Fact's power, they are to be listed here:

__________________________________________________________________________

__________________________________________________________________________

5. Signatures

This Agreement must be signed by both the Principal and the Attorney-in-Fact, acknowledging their understanding and acceptance of the terms outlined within this document. Additionally, the Agreement should be signed in the presence of a notary public to ensure its legal validity.

Principal's Signature: ___________________________________ Date: __________

Attorney-in-Fact's Signature: ____________________________ Date: __________

6. Notarization

This section is to be completed by a notary public.

State of Ohio

County of ___________________

On the ___ day of ___________, 20__, before me, a notary public, personally appeared ______________________________________ (Principal) and ______________________________________ (Attorney-in-Fact), known to me (or satisfactorily proven) to be the persons whose names are subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

__________________________________________

Notary Public

My Commission Expires: ___________________

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | Allows an individual to designate another person to manage their financial affairs. |

| Durability | Remains in effect even if the principal becomes incapacitated. |

| Governing Law | Ohio Revised Code Chapter 1337 |

| Revocation | The principal can revoke it at any time when they are mentally competent. |

| Signing Requirements | Must be signed by the principal and notarized. |

| Agent Authority | The agent can handle financial transactions, real estate, and other specified tasks. |

| Choice of Agent | The principal can choose anyone they trust as their agent, usually a close family member or friend. |

| Limitations | An agent cannot make healthcare decisions unless specified in a separate healthcare power of attorney. |

| Effective Date | It becomes effective immediately upon signing unless otherwise specified. |

Ohio Durable Power of Attorney - Usage Guide

Filling out an Ohio Durable Power of Attorney form is a critical step for individuals wanting to assign someone the authority to manage their affairs, should they become unable to do so themselves. This form ensures that the selected person, known as an agent, can make decisions regarding finances, property, and other personal matters in the best interest of the individual who is assigning the authority. Below are the detailed steps to accurately complete the Ohio Durable Power of Attorney form.

- Gather all necessary information, including the full legal names and addresses of the person filling out the form and the designated agent.

- Read the form carefully to understand the scope of authority being granted to the agent.

- In the designated section, write the full legal name and address of the individual granting the power.

- Enter the full legal name and address of the designated agent in the section provided.

- Specify the powers being granted to the agent. Be clear and precise about what the agent can and cannot do.

- If there are any restrictions or specific conditions, list these clearly in the section provided.

- Choose when the power of attorney will become effective. Some choose its immediate effect, while others may specify a triggering event, like the incapacitation of the person granting the power.

- Sign and date the form in the presence of a notary public. The notarization of the document is crucial for its legal validity.

- The designated agent should also sign the document, acknowledging their acceptance of the responsibilities assigned to them.

- Store the completed form in a safe and accessible place. Inform a trusted individual where the document is kept for easy retrieval when needed.

By following these steps, individuals can ensure that their affairs will be managed according to their wishes, should they be unable to do so themselves. It's advisable to consult with a legal professional if there are any uncertainties or specific concerns regarding the durable power of attorney process in Ohio.