Attorney-Verified Durable Power of Attorney Document for Oklahoma

Contemplating the unpredictable nature of life, it's wise to consider mechanisms that ensure our affairs are managed according to our wishes, even when we're not in a position to oversee them ourselves. This is where the Oklahoma Durable Power of Attorney form steps into the spotlight, offering a robust solution for individuals looking to secure their financial and legal interests. Unlike other forms that may lose their validity should the principal become incapacitated, the durability factor of this specific document ensures it remains in effect, providing a layer of continuity and peace of mind. It's a critical legal tool designed to empower a trusted individual, known as the agent, with the authority to act on the principal's behalf across a wide range of actions, from managing bank accounts to handling real estate transactions. The form’s comprehensive nature and the irreversible authority it grants underscore the importance of careful selection of the agent and a clear understanding of the powers being conferred. Obtaining this form, and more importantly, understanding its implications, are crucial steps in safeguarding one's financial well-being and ensuring that life's uncertainties do not derail one's estate planning objectives.

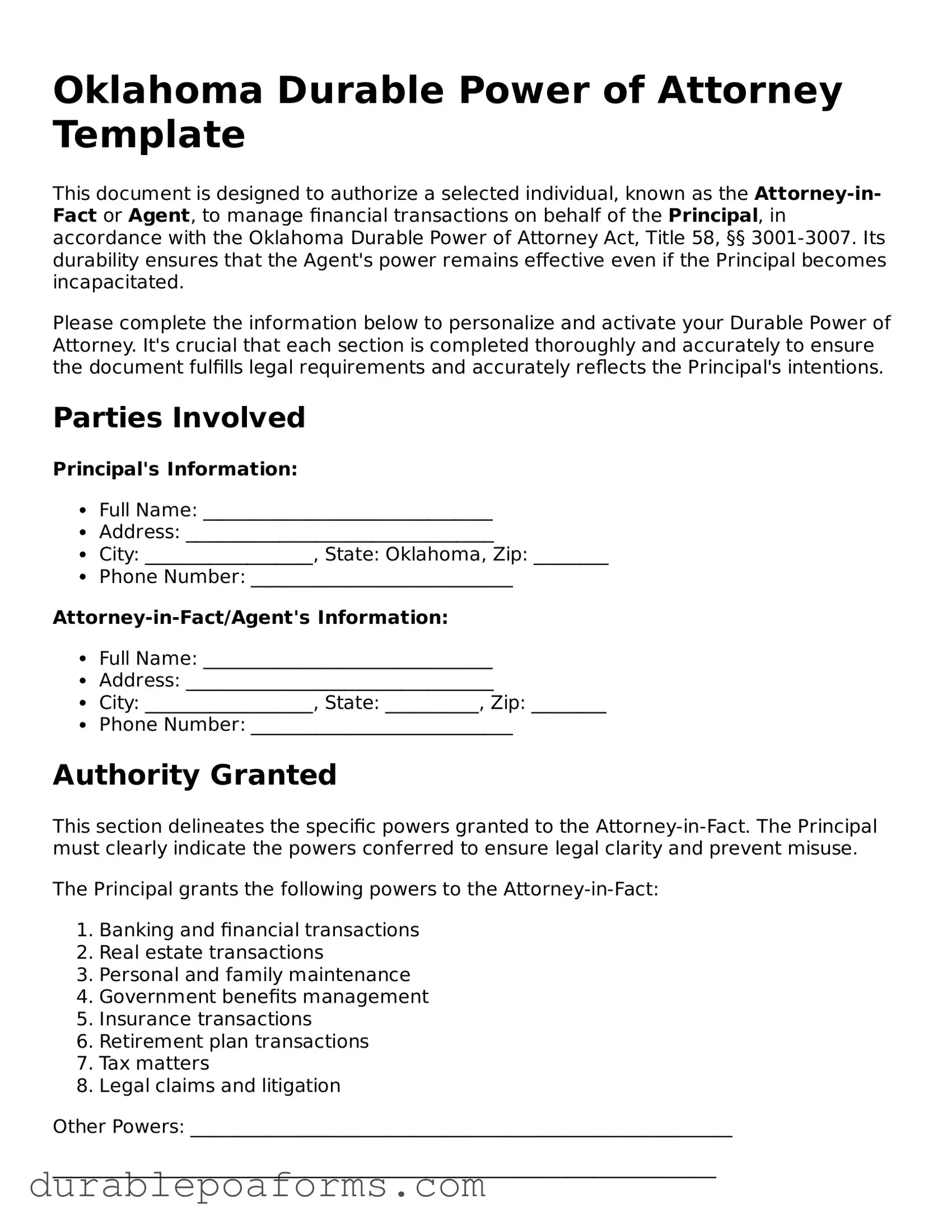

Form Preview

Oklahoma Durable Power of Attorney Template

This document is designed to authorize a selected individual, known as the Attorney-in-Fact or Agent, to manage financial transactions on behalf of the Principal, in accordance with the Oklahoma Durable Power of Attorney Act, Title 58, §§ 3001-3007. Its durability ensures that the Agent's power remains effective even if the Principal becomes incapacitated.

Please complete the information below to personalize and activate your Durable Power of Attorney. It's crucial that each section is completed thoroughly and accurately to ensure the document fulfills legal requirements and accurately reflects the Principal's intentions.

Parties Involved

Principal's Information:

- Full Name: _______________________________

- Address: _________________________________

- City: __________________, State: Oklahoma, Zip: ________

- Phone Number: ____________________________

Attorney-in-Fact/Agent's Information:

- Full Name: _______________________________

- Address: _________________________________

- City: __________________, State: __________, Zip: ________

- Phone Number: ____________________________

Authority Granted

This section delineates the specific powers granted to the Attorney-in-Fact. The Principal must clearly indicate the powers conferred to ensure legal clarity and prevent misuse.

The Principal grants the following powers to the Attorney-in-Fact:

- Banking and financial transactions

- Real estate transactions

- Personal and family maintenance

- Government benefits management

- Insurance transactions

- Retirement plan transactions

- Tax matters

- Legal claims and litigation

Other Powers: __________________________________________________________

_______________________________________________________________________

Terms and Conditions

The authority of the Attorney-in-Fact is subject to the following conditions:

- The powers granted herein shall remain effective in the event of the Principal's disability or incapacity.

- The Attorney-in-Fact must act in good faith with the Principal's best interest in mind at all times.

- This Durable Power of Attorney is to be interpreted and governed by the laws of the State of Oklahoma.

- The powers granted in this document do not include the power to make healthcare decisions on behalf of the Principal.

Signatures

To activate this Durable Power of Attorney, it must be signed by the Principal in the presence of a Notary Public. The signature of the Principal signifies agreement to all terms and powers described within this document.

Principal's Signature: _______________________________ Date: ____________

Attorney-in-Factic/Agent's Signature: __________________ Date: ____________

State of Oklahoma

County of ________________________

This document was acknowledged before me on (date) ___________ by (name of Principal) _____________________.

Notary Public Signature: _______________________________

My commission expires: _______________

Form Specifications

| Fact | Detail |

|---|---|

| Definition | A Durable Power of Attorney in Oklahoma grants another person the legal authority to make decisions on someone’s behalf even after they become incapacitated. |

| Governing Law | Oklahoma Statutes Title 58, Sections 1071 to 1077 |

| Effective Date | It becomes effective immediately upon signing unless the document specifies a different start date. |

| Witness Requirement | It must be signed by the Principal and either notarized or witnessed by two individuals who are not related by blood or marriage to the Principal. |

| Revocation | The Principal can revoke it at any time as long as they are mentally competent, by written notice to the Attorney-in-fact. |

| Powers | It can cover a broad range of powers, including financial, real estate, personal, and business transactions. |

| Duration | It remains effective unless it explicitly states an expiration date, until the Principal dies or revokes the power granted. |

| Importance of Specificity | Being specific about the powers granted helps prevent abuse and ensures the Attorney-in-fact clearly understands their responsibilities. |

Oklahoma Durable Power of Attorney - Usage Guide

Completing the Oklahoma Durable Power of Attorney form is a critical step in ensuring that an individual's financial affairs can be managed according to their wishes, even if they become incapacitated. This process involves designating a trusted person as an attorney-in-fact to make financial decisions on their behalf. The steps outlined below are designed to guide individuals through the process efficiently and effectively, ensuring they understand each section and requirement.

- Locate the official Oklahoma Durable Power of Attorney form. This can usually be found online through state government websites or legal services.

- Begin by reading the notice to the person executing the Durable Power of Attorney (Principal) carefully. Understand the authority you are granting and the implications of signing the document.

- Fill in your full legal name and address in the designated spots at the beginning of the form to identify yourself as the Principal.

- Identify the person you wish to grant authority to by filling in their full legal name and address in the section provided. This person will act as your Attorney-in-Fact.

- Specify the powers you are granting to your Attorney-in-Fact. Be clear and concise in detailing what financial decisions they are allowed to make on your behalf. If necessary, you can also specify any powers you do not wish to grant.

- If you wish to make the power of attorney durable, meaning it remains in effect even if you become incapacitated, affirm this by initialing the specific clause provided in the form.

- For added security and validity, specify any special instructions or limitations regarding the powers granted to your Attorney-in-Fact. This section allows you to maintain control over certain decisions or to outline specific wishes.

- Review the entire form to ensure all information is accurate and all necessary sections are completed. Any mistakes can lead to delays or legal complications in the future.

- Sign and date the form in the presence of a notary public. The notary will verify your identity and witness your signature, adding an official stamp or seal to authenticate the document.

- Have your Attorney-in-Fact sign the form, if required by state law or if you wish to document their acceptance of the responsibilities being granted.

- Distribute copies of the completed form to your Attorney-in-Fact, financial institutions, and any other parties who may need to be aware of the arrangement.

Once the form has been properly completed and distributed, it is important to store the original document in a safe, accessible location. Inform your Attorney-in-Fact and close relatives or friends of where it can be found, ensuring it can be accessed quickly if needed. Regularly review and, if necessary, update the document to reflect any changes in preferences, relationships, or financial situation.

Common Questions

What is a Durable Power of Attorney in Oklahoma?

A Durable Power of Attorney in Oklahoma is a legal document that grants someone else the authority to make decisions on your behalf. This power continues to be effective even if you become incapacitated. It can cover a wide range of decisions, including financial, legal, and health-related matters. The person you select to act on your behalf is referred to as the "agent," while you are known as the "principal."

How do you revoke a Durable Power of Attorney in Oklahoma?

Revoking a Durable Power of Attorney in Oklahoma requires you to inform your agent in writing about your decision to revoke the power. Additionally, you should inform any financial institutions and other entities that might be affected by this change. It's recommended to create a formal revocation document, signing it in front of a notary public for legal validity. Afterward, distribute copies of this revocation to all relevant parties to ensure your agent's authority is completely terminated.

Who should you choose as your Agent for a Durable Power of Attorney?

Choosing an agent for your Durable Power of Attorney is a significant decision. Ideally, the person should be someone you trust implicitly, such as a family member or a close friend. They should understand your values and wishes, and be capable of making tough decisions under pressure. It's also important that they are willing to take on this responsibility and that they will be available to act on your behalf when needed. Consider discussing their duties with them in detail before making your decision.

Is a lawyer needed to complete a Durable Power of Attorney form in Oklahoma?

While it's not a legal requirement to have a lawyer when completing a Durable Power of Attorney form in Oklahoma, consulting with one can be very helpful. A lawyer can ensure that the document clearly outlines your wishes and meets all state legal requirements. They can also provide advice on choosing an agent and discuss potential scenarios your agent might need to handle. Having a professional review your form can provide peace of mind that your document is legally sound and your interests are protected.

Common mistakes

In the realm of legal documentation, precision is paramount, yet navigating forms like the Oklahoma Durable Power of Attorney (POA) can be fraught with pitfalls. People often stumble when filling out such forms, not because they lack the intent or understanding but due to common mistakes that are easy to overlook. The consequences of these errors can range from minor annoyances to significant legal headaches, potentially undermining the very purpose of the document. Here are ten such mistakes frequently encountered in the execution of the Oklahoma Durable Power of Attorney form.

- Not specifying the powers granted sufficiently. Often, people are vague about the powers they are transferring. It's crucial to delineate the scope of authority clearly, whether it's financial decisions, real estate transactions, or healthcare directives.

- Failing to designate an alternate agent. Life is unpredictable. If the primary agent is unable to fulfill their role, having an alternate or successor agent ensures that the principal's affairs are not left unattended.

- Overlooking the need for notarization. The Oklahoma Durable Power of Attorney form must be notarized to be legally binding. Skipping this step can render the document ineffective.

- Leaving out a durability clause. Without explicitly stating that the Power of Attorney should remain effective even if the principal becomes incapacitated, its "durability" is compromised, defeating the purpose of having it in the first place.

- Misunderstanding the form's scope. Some assume that the form grants broader powers than it actually does. It's essential to understand that certain decisions, like those altering a will, cannot be authorized through a POA.

- Incorrectly signing the document. The principal must sign the POA form for it to be valid. Mistakes, such as having the agent sign instead, invalidate the document.

- Not discussing the contents with the chosen agent. Effective communication ensures that the agent understands the expectations and responsibilities bestowed upon them.

- Neglecting state-specific requirements. Each state has its own legal nuances for POA documents. Ignoring the requirements particular to Oklahoma can lead to an unenforceable POA.

- Delaying the execution of the form. Waiting until an emergency arises to create a POA can result in a rushed process, increasing the likelihood of mistakes.

- Not seeking professional advice. Given the legal complexities and potential ramifications of a POA, consulting with a legal professional to review the document can prevent costly errors.

The firm foundation of any legal document lies in the meticulous attention to detail during its composition. The Oklahoma Durable Power of Attorney form is no exception. Overlooking the essentials or mishandling the procedures not only diminishes the document's efficacy but can also place the principal's interests in jeopardy. Thus, whether you are drafting a new POA or reviewing an existing one, being cognizant of these common pitfalls is paramount. Investing the time and resources to do it right not only safeguards one's interests but also ensures peace of mind for all parties involved.

Documents used along the form

When taking care of important legal tasks, it's wise to have all the necessary documents at hand. One such key document is the Oklahoma Durable Power of Attorney form. This form allows someone to act on your behalf in financial matters if you're unable to do so yourself. However, to cover a wider range of situations and ensure your wishes are fully protected, there are several other forms and documents often used alongside it. Let’s explore some of these important documents.

- Advance Directive for Health Care: This crucial document lets you outline your preferences for medical treatment and end-of-life care, should you become unable to communicate your wishes. It can include a living will and the designation of a health care proxy.

- Last Will and Testament: This document specifies how you want your assets and estate to be distributed after your death. It’s essential for ensuring your property is transferred according to your wishes and can help avoid potential disputes among heirs.

- HIPAA Authorization Form: This form gives specified individuals the right to access your protected health information. It’s particularly useful in situations where your health status is a factor in financial or legal decisions made on your behalf.

- Revocable Living Trust: This allows you to maintain control over your assets while alive and specifies how those assets are to be handled after your death. It can help avoid probate and ensure a smoother transition of assets to your beneficiaries.

- Financial Information Release Form: This document authorizes the release of your financial records to designated individuals. It's often used in conjunction with a Durable Power of Attorney to ensure your appointed agent has access to the necessary information to make informed decisions.

Each of these documents plays a vital role in a comprehensive estate plan. Together with the Oklahoma DurableuspendLayout

Similar forms

The Oklahoma Durable Power of Attorney form is similar to several other key legal documents, each serving unique yet sometimes overlapping purposes in managing one’s personal and financial affairs. These documents include the General Power of Attorney, Health Care Power of Attorney, and Living Will. Understanding the similarities and differences helps in making informed decisions.

The General Power of Attorney and the Durable Power of Attorney share common features in allowing someone to act on your behalf regarding financial matters. However, the key difference lies in their durability. The General Power of Attorney typically ceases to be effective if the principal becomes incapacitated. In contrast, the Oklahoma Durable Power of Attorney is specifically designed to remain in effect even if the principal loses the ability to make decisions for themselves, emphasizing the 'durable' aspect of this arrangement.

Similarly, the Health Care Power of Attorney authorizes someone to make medical decisions on your behalf. Like the Durable Power of Attorney, it can remain effective during periods of incapacitation. The distinction is in the scope of powers granted. While the Durable Power of Attorney may encompass a broad range of decisions including health care, a Health Care Power of Attorney is exclusively focused on medical decisions, ensuring that health care wishes are followed when one cannot make those decisions independently.

The Living Will, another important document, often works in concert with the Health Care Power of Attorney. It specifies your wishes regarding life-sustaining treatments in the event of terminal illness or incapacitation. Although it does not grant anyone decision-making power, a Living Will guides those who hold the Health Care Power of Attorney, providing clarity on your health care preferences. This specificity ensures that your medical treatment aligns with your values and desires, even when you cannot articulate them yourself.

Dos and Don'ts

When filling out an Oklahoma Durable Power of the Attorney form, it is crucial to avoid common mistakes and follow best practices to ensure the form is legally binding and accurately reflects your wishes. Here are some essential dos and don'ts to consider:

Do:- Read the entire form carefully before starting to fill it out, ensuring you understand every section and its purpose.

- Use black ink or type your responses to ensure legibility for all parties involved, including legal entities and financial institutions.

- Clearly identify the principal (the person granting the power) and the agent (the person receiving the power) with full legal names and addresses.

- Specify the powers being granted with as much detail as possible, avoiding ambiguity about the agent’s authority.

- Include any limitations on the power of attorney you wish to impose to safeguard your interests and assets.

- Have the document notarized, if required by Oklahoma law, to add a layer of validation and legal protection.

- Provide copies of the signed and completed form to relevant parties, such as financial institutions, doctors, or family members, as appropriate.

- Leave sections incomplete or fill out the form in a hurry, as doing so can lead to errors or omissions that could invalidate the document.

- Sign the form without two witnesses present, as required by Oklahoma law, to ensure the validity of the document.

By adhering to these guidelines, you can create a Durable Power of Attorney in Oklahoma that effectively communicates your wishes and stands up to legal scrutiny. Remember, consulting with a legal professional can provide added assurance that your form complies with Oklahoma law and serves your interests.

Misconceptions

When it comes to legal documents, misunderstandings can lead to significant consequences. The Oklahoma Durable Power of Attorney (DPOA) form is no exception. People often have misconceptions about its purpose and use. Let's clarify some of these to ensure individuals make informed decisions:

It grants total control: Many believe that by assigning a DPOA, they are giving up all decision-making rights. In reality, this form allows you to specify exactly what powers your agent has, be it managing finances, real estate, or other specified tasks.

It’s effective immediately: While some DPOAs may be effective right away, others are "springing," meaning they become effective only under circumstances you define, like if you become incapacitated.

A DPOA and a Living Will are the same: This is not true. A DPOA focuses on financial and administrative decisions, while a Living Will deals with healthcare choices in the event you cannot express your wishes.

Any form will do: Some people think a generic form from the internet will suffice. However, Oklahoma law may have specific requirements. Using an officially recognized form ensures it’s valid and binding.

It’s only for the elderly: Individuals often assume DPOAs are only for senior citizens. However, unexpected situations can arise at any age, making a DPOA a wise choice for adults of all ages.

A DPOA cannot be revoked: This is incorrect. As long as you are mentally competent, you can revoke your DPOA at any time. It’s vital to communicate any revocation to all relevant parties.

Only family members can be agents: While family members are commonly chosen, you can appoint anyone you trust as your agent, including friends or professionals like attorneys.

It lasts after death: A DPOA is only valid during your lifetime. Upon your death, the authority you granted through the DPOA ends, and your will or estate plan takes precedence.

Lawyer involvement is optional: It’s true that not every DPOA requires a lawyer’s touch, but consulting with one ensures your document meets all legal standards and accurately reflects your wishes. This can prevent potential issues down the line.

Understanding these points helps ensure that when you decide to create a Durable Power of Attorney, your rights and intentions are clearly protected and represented. Education and careful planning can make all the difference in these important legal matters.

Key takeaways

The Oklahoma Durable Power of Attorney form is designed to grant an individual, known as the agent, the authority to make decisions on behalf of another person, referred to as the principal, particularly in matters relating to financial and property affairs.

To ensure the form is legally valid, both the principal and the chosen agent must carefully fill out and sign the document in the presence of a notary public. This step is crucial for the document's enforceability.

The form allows the principal to specify the extent of powers granted to the agent. These can range from managing everyday financial tasks to handling complex real estate transactions.

It's important for the principal to select an agent who is trustworthy and capable of managing financial matters competently, given the significant authority the document provides.

One of the unique features of the Durable Power of Attorney is that it remains in effect even if the principal becomes incapacitated. This aspect ensures that the agent can continue to handle the principal’s affairs without interruption.

The principal has the flexibility to either grant broad general powers to the agent or limit them to specific acts, depending on their preferences and level of trust in the agent.

For the protection of the principal, it's advisable to review the powers granted under the form periodically and make adjustments as necessary. Changes or revocations of the form require a formal process similar to the original setup, including notarization.

Communication between the principal and the agent is key to a successful implementation of a Durable Power of Attorney. The principal should discuss their wishes and expectations with the agent in detail before finalizing the document.

In Oklahoma, the Durable Power of Attorney form should be stored securely but accessible. Copies might be needed by financial institutions or other parties with whom the agent will interact on the principal's behalf.

More Durable Power of Attorney State Forms

Free Power of Attorney Form Mississippi - This document is essential for planning ahead, giving you peace of mind about the future of your affairs.

Ohio Power of Attorney Requirements - Designed to offer peace of mind by appointing a reliable individual to oversee and safeguard the principal's financial stability and legal interests.