Attorney-Verified Durable Power of Attorney Document for Oregon

Many people find themselves in situations where making their own decisions about their finances, health, or other personal matters becomes impossible due to illness or incapacity. Recognizing this possibility and preparing for it is where the Oregon Durable Power of Attorney form comes into play. This important legal document allows an individual, known as the principal, to appoint someone they trust, often referred to as the agent or attorney-in-fact, to make decisions on their behalf when they are no longer able to do so themselves. Its 'durable' nature means that the agent's power remains in effect even if the principal becomes incapacitated, ensuring continuous management of their affairs without the need for court intervention. Covering a broad spectrum of authorities, the form can be tailored to include financial decisions, property management, and even specific health-related determinations, depending on the principal's needs and preferences. As a critical component of estate planning and personal care planning in Oregon, this document underscores the importance of foresight and the trust placed in the chosen agent to act in the principal's best interests.

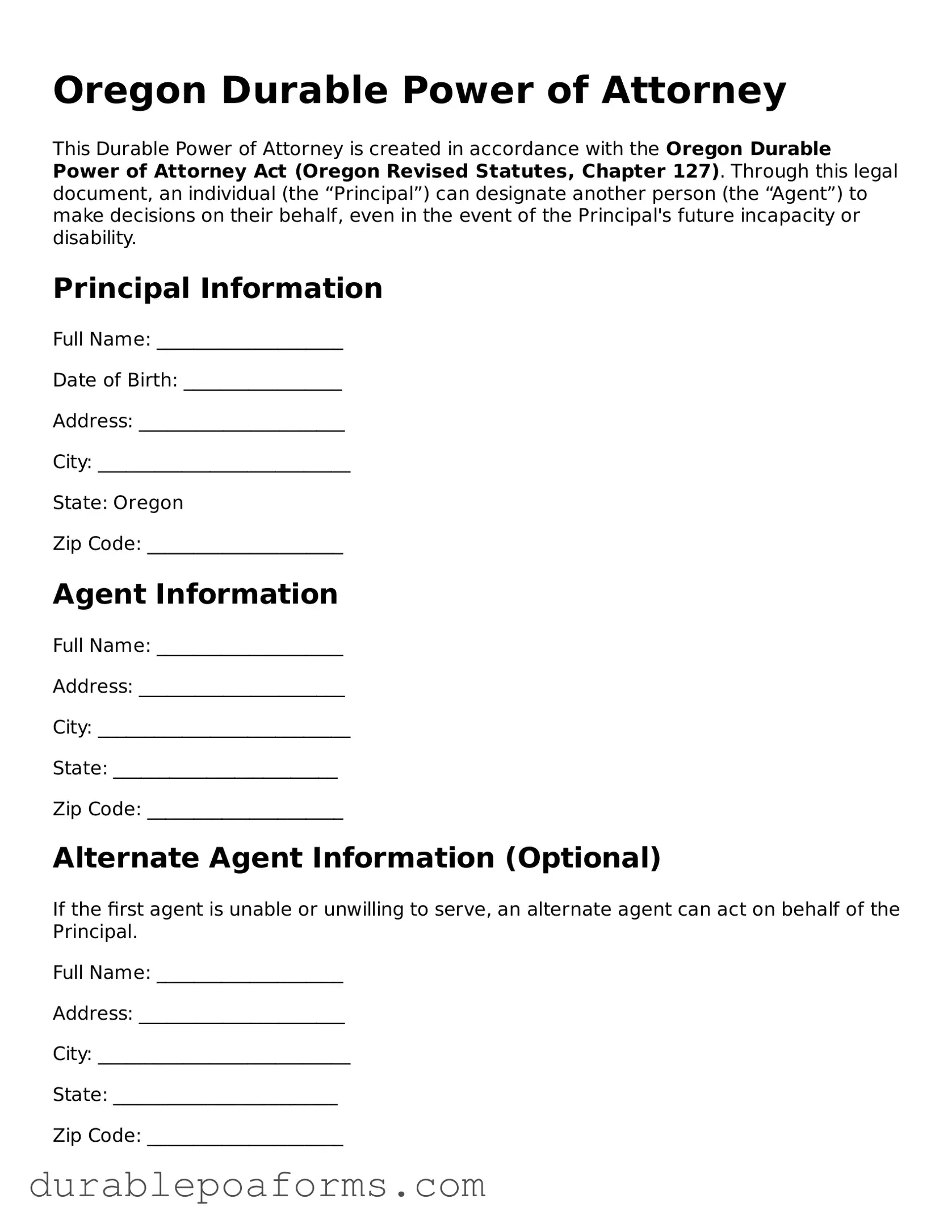

Form Preview

Oregon Durable Power of Attorney

This Durable Power of Attorney is created in accordance with the Oregon Durable Power of Attorney Act (Oregon Revised Statutes, Chapter 127). Through this legal document, an individual (the “Principal”) can designate another person (the “Agent”) to make decisions on their behalf, even in the event of the Principal's future incapacity or disability.

Principal Information

Full Name: ____________________

Date of Birth: _________________

Address: ______________________

City: ___________________________

State: Oregon

Zip Code: _____________________

Agent Information

Full Name: ____________________

Address: ______________________

City: ___________________________

State: ________________________

Zip Code: _____________________

Alternate Agent Information (Optional)

If the first agent is unable or unwilling to serve, an alternate agent can act on behalf of the Principal.

Full Name: ____________________

Address: ______________________

City: ___________________________

State: ________________________

Zip Code: _____________________

Powers Granted

The Agent is hereby granted the following powers, to be exercised in the Principal’s name and on the Principal’s behalf:

- Financial decisions

- Real estate transactions

- Business operating transactions

- Insurance and annuity transactions

- Banking and other financial institution transactions

- Estate, trust, and other beneficiary transactions

- Litigation and personal matters

- Personal and family maintenance

- Benefits from Social Security, Medicare, Medicaid, or other governmental programs, or civil or military service

- Tax matters

Special Instructions (Optional)

Here, the Principal may include any special instructions limiting or extending the powers granted to the Agent.

Instructions: __________________________________________________________

_______________________________________________________________________

Duration

This Durable Power of Attorney will become effective immediately and will continue to be effective until the Principal’s death, unless revoked earlier by the Principal in writing.

Signatures

The Principal and the appointed Agent(s) must provide their signatures below to acknowledge and accept their roles as outlined in this document.

Principal’s Signature: _____________________ Date: _______________

Agent’s Signature: _____________________ Date: _______________

Alternate Agent’s Signature (If applicable): _____________________ Date: _______________

Notarization (Optional but Recommended)

This document is not required to be notarized under Oregon law, but it is recommended to provide an additional layer of legal validation.

Witness Acknowledgment (Optional)

Having a witness can further safeguard the integrity of this document, although it is not a requirement under Oregon law.

Witness’s Signature: _____________________ Date: _______________

Form Specifications

| Fact Number | Description |

|---|---|

| 1 | Under Oregon law, a Durable Power of Attorney (DPOA) allows an individual to grant another person the authority to make decisions on their behalf even after the individual becomes incapacitated. |

| 2 | The Oregon Revised Statutes (ORS) Chapter 127 governs the implementation and requirements of Durable Power of Attorney forms within the state. |

| 3 | To be considered valid, a Durable Power of Attorney in Oregon must be signed by the principal (the person granting the authority), in the presence of two witnesses or acknowledged before a notary public. |

| 4 | Witnesses to the DPOA cannot be related to the principal by blood, marriage, registered domestic partnership, or adoption, nor can they be entitled to any portion of the estate of the principal upon death under a will or by operation of law. |

| 5 | An Oregon DPOA can grant broad, general powers, or it can specify limited powers for actions like financial management, property transactions, or healthcare decisions. |

| 6 | The principal has the right to revoke the DPOA at any time, provided they are of sound mind to make such a decision. |

| 7 | If there is no specified expiration date within the DPOA document, it remains effective until the principal's death or until it is legally revoked. |

| 8 | A DPOA in Oregon becomes effective immediately upon signing, unless the document states otherwise. |

| 9 | It is recommended that the principal discusses their wishes with the chosen agent (the person given authority) in advance to ensure their intentions are carried out as desired. |

| 10 | Despite the authority conferred by a DPOA, healthcare providers in Oregon may refuse to follow healthcare directives if they contradict the provider's policy, provided the policy is in compliance with Oregon law. |

Oregon Durable Power of Attorney - Usage Guide

Filling out a Durable Power of Attorney form in Oregon is an important step in ensuring your affairs are managed according to your wishes, should you become unable to manage them yourself. This legal document allows you to appoint someone you trust as your agent, giving them the authority to make decisions on your behalf. It's a straightforward process, but requires attention to detail to ensure it accurately reflects your intentions and is legally binding.

- Start by obtaining the most current version of the Oregon Durable Power of Attorney form. Ensure it complies with Oregon law to be considered valid.

- Read the form carefully before you begin filling it out. Understand the responsibilities and powers you are entrusting to your chosen agent.

- Enter your full legal name and address in the designated sections to identify yourself as the principal.

- Fill in the full legal name, address, and contact details of the person you are appointing as your agent. Ensure all details are accurate to avoid any confusion or disputes.

- If you wish to appoint a successor agent, should your primary agent be unable or unwilling to serve, fill in their details in the specified section. Include their full legal name, address, and contact information.

- Specify the powers you are granting to your agent. Be clear about what they can and cannot do on your behalf. This can include financial decisions, property management, and personal affairs.

- Review any limitations you wish to place on your agent’s authority. Specify any decisions or areas where you do not wish your agent to have power.

- Date and sign the form in the presence of a notary public. Oregon law may require your agent’s acceptance to be signed and dated as well, so check the current legal requirements.

- Have the form notarized. This step is crucial for the document to be legally valid and enforceable in Oregon.

- Provide a copy to your agent, any successor agents, and possibly third parties such as banks or healthcare providers, as necessary. Keep the original document in a safe place where it can be accessed if needed.

Once the form is fully completed and notarized, it goes into effect either immediately or according to the specifications you outlined. It's a legal tool that provides peace of mind, knowing that your affairs will be looked after by someone you trust, in accordance with your wishes. Remember, circumstances can change, so it's wise to review and update your Durable Power of Attorney as needed to reflect your current wishes and situations.

Common Questions

What is a Durable Power of Attorney (DPOA) in Oregon?

A Durable Power of Attorney is a legal document that allows you (the "principal") to designate another person (called the "agent" or "attorney-in-fact") to make decisions on your behalf. This document remains in effect even if you become incapacitated and unable to make decisions for yourself. In Oregon, a DPOA can cover decisions related to your finances, property, and medical care, allowing your agent to act in your best interests according to the powers you grant them.

How do I create a Durable Power of Attorney in Oregon?

To create a Durable Power of Attorney in Oregon, you must fill out a proper form that includes your name, the name of your chosen agent, and the specific powers you are granting. Oregon law requires that this document be signed in the presence of a notary public or two witnesses who are not related to you and will not benefit from the DPOA. It's recommended that you consult with a legal professional to ensure the document fully adheres to Oregon laws and accurately represents your wishes.

Can I revoke a Durable Power of Attorney in Oregon?

Yes, you have the right to revoke your Durable Power of Attorney at any time, as long as you are of sound mind. To revoke it, you should provide written notice to your current agent and any institutions or individuals that might be affected by the revocation. Destroying all copies of the DPOA and creating a new one (if desired) can also help ensure the old one is no longer considered valid.

Who should I choose as my agent?

Choosing an agent is a significant decision. You should select someone you trust completely, as they will potentially be making critical decisions about your finances, healthcare, or other personal matters. This person should understand your values and wishes and be willing and able to act on them, even in challenging situations. Many people choose a spouse, adult child, or close friend, but it's crucial that the person chosen is both trustworthy and capable of handling the responsibility.

Does my agent have unlimited power?

No, the powers of your agent are limited to those you specify in your Durable Power of Attorney document. Oregon law allows you to grant broad or limited powers to your agent, including decisions related to financial matters, real estate transactions, business operations, and healthcare, among others. It's essential to clearly outline these powers and any limitations in the document to prevent any confusion or misuse of authority.

What if I change my mind about the decisions made by my agent under a DPOA?

As long as you are mentally capable, you retain the right to override any decision made by your agent or revoke their authority entirely. Communicating your wishes directly and promptly is crucial to ensure your desires are followed. Regularly reviewing the DPOA and discussing your wishes with your agent can also help prevent conflicts.

Is a Durable Power of Attorney in Oregon valid in other states?

Most states recognize a Durable Power of Attorney created in another state, provided it complies with the originating state's laws. However, there can be exceptions and nuances, especially regarding medical or healthcare decisions, as laws can vary significantly from one state to another. It's advisable to consult with a legal professional if you spend a lot of time in another state or move to ensure your DPOA meets the specific legal requirements and is recognized as valid outside Oregon.

Common mistakes

Filling out the Oregon Durable Power of Attorney (POA) form is a critical step for ensuring that someone can legally make decisions on your behalf if you're unable to do so. However, it's easy to make mistakes during this process. Being aware of common errors can help avoid complications down the line.

One of the most frequent mistakes is not clearly identifying the parties involved. The person granting the power is referred to as the principal, and the one receiving the power is the agent. It's vital that the names, addresses, and other identifying details of both parties are accurately and clearly stated to prevent any confusion about who is involved.

Failing to specify the powers granted is another common oversight. The Oregon Durable POA form allows the principal to grant a wide range of powers to the agent, from financial decisions to real estate transactions. If these powers are not specified, it may lead to disputes or confusion regarding the agent's authority. It's essential to be explicit about what the agent can and cannot do.

Often, individuals neglect to define the term or conditions under which the POA comes into effect or terminates. A durable POA remains in effect even if the principal becomes incapacitated, but it's still important to state any specific conditions, such as a definitive end date or a particular event that would terminate the POA.

Errors in not properly witnessing or notarizing the document are also frequent. Oregon law may require that the POA be signed in the presence of specific witnesses or a notary to be considered valid. Skipping these steps can render the entire document void.

- Not clearly identifying the parties involved.

- Failing to specify the powers granted.

- Neglecting to define the term or conditions of the POA.

- Not properly witnessing or notarizing the document.

- Omitting a successor agent. In case the original agent is unable or unwilling to serve, it's wise to name a successor agent to ensure there's no gap in representation.

- Ignoring the need to regularly update the document. Circumstances change, and a POA should reflect the current state of affairs and relationships.

- Assuming one form fits all circumstances. It's crucial to understand that a generic form may not cover specific wishes or legal requirements unique to Oregon.

Furthermore, many people overlook the importance of discussing the POA with the agent and any successor agents. Ensuring everyone understands their roles and responsibilities can prevent potential disputes and ensure that the principal's wishes are honored.

Finally, it's beneficial to seek legal advice when filling out the Oregon Durable POA form. A professional can help tailor the document to your specific needs, ensuring all legal requirements are met, and avoid common mistakes that could undermine the document's validity.

Documents used along the form

In the context of preparing for future uncertainties, individuals often complement the Oregon Durable Power of Attorney form with other essential documents. This ensemble of legal documents ensures a well-rounded approach to personal, financial, and health-related planning. Each of these documents plays a unique role, supporting different aspects of the individual's wishes and instructions.

- Advance Health Care Directive: This document allows individuals to outline their preferences for medical treatment in situations where they are no longer able to communicate their wishes directly. It includes the appointment of a health care representative.

- Living Will: Similar to an Advance Health Care Directive, a Living Will enables individuals to express their desires regarding end-of-life care, such as life support and other life-sustaining measures.

- Will (Last Will and Testament): This key document specifies how an individual's property and assets are to be distributed after their death. It also names an executor to manage the estate until its final distribution.

- Revocable Living Trust: This document allows individuals to manage their assets during their lifetime and specify how these assets should be handled after their death. A Revocable Living Trust can help avoid the often lengthy and costly probate process.

- HIPAA Release Form: The Health Insurance Portability and Accountability Act (HIPAA) release form permits healthcare providers to share an individual's medical information with specified persons, not limited to the ones listed in a Durable Power of Attorney for Health Care.

- Financial Information Sheet: Often used for practical purposes, this document lists an individual’s financial accounts, insurance policies, and contact information for financial advisors or attorneys, providing a comprehensive overview for the appointed attorney-in-fact.

Combining the Oregon Durable Power of Attorney form with these documents can offer thorough preparation for a range of future scenarios. Each document serves to safeguard an individual's preferences and ensure their well-being and peace of mind, laying a solid foundation for personal and estate planning.

Similar forms

The Oregon Durable Power of Attorney form is similar to the General Power of Attorney and the Medical Power of Attorney, though it has specific distinctions that are important for anyone considering establishing a power of attorney to understand.

The form is similar to a General Power of Attorney in that it grants someone else the authority to make decisions on your behalf. However, the key difference lies in its durability. While a general power of attorney typically becomes invalid if the principal becomes incapacitated, a durable power of attorney continues to remain in effect. This ensures that your affairs can still be managed if you are unable to do so yourself due to mental or physical incapacity.

It also shares similarities with a Medical Power of Attorney. Both allow you to appoint someone to make decisions on your behalf; however, a Medical Power of Attorney is specifically limited to decisions about your health care. In contrast, a Durable Power of Attorney covers a broader range of decisions, including financial, legal, and personal affairs, not just medical or health-related decisions. This distinction makes the Durable Power of Attorney a more comprehensive tool for planning future incapacity.

Dos and Don'ts

Filling out the Oregon Durable Power of Attorney (DPOA) form is a vital step in planning for future uncertainties. It allows you to appoint someone you trust to handle your affairs if you become incapacitated. To ensure that the process is completed correctly and your intentions are clearly expressed, here are some dos and don'ts to consider:

- Do carefully choose an agent. This person will have significant control over your financial matters if you can't handle them yourself. It's important to select someone who is trustworthy, reliable, and capable of managing financial decisions.

- Do clearly define the powers you are granting. The Oregon DPOA form allows you to specify exactly what authority your agent will have. Be as detailed as necessary to ensure your wishes are followed.

- Do discuss your decision with your chosen agent before completing the form. They need to understand the responsibility they're taking on and agree to act on your behalf.

- Do have the document properly signed and witnessed as required by Oregon law. This often means having it notarized to ensure its legality and prevent challenges.

- Don't leave any sections incomplete. An incomplete form may lead to confusion or could be considered invalid, undermining your intentions.

- Don't choose an agent based solely on their relationship to you. While family members are commonly appointed, their ability to manage your affairs effectively and objectively is what's truly important.

- Don't forget to review and update your DPOA periodically. Life changes such as marriage, divorce, the birth of children, or a change in your financial situation may necessitate adjustments to your document.

- Don't neglect to inform key people of your decision. Besides your agent, other family members, your attorney, and sometimes financial institutions should know where the document is stored and what it contains.

By following these guidelines, you can ensure that your Oregon Durable Power of Attorney form accurately reflects your wishes and is completed in a legally sound manner. This planning tool is a crucial part of ensuring that your affairs are handled as you see fit, even if you're not able to oversee them yourself.

Misconceptions

Understanding legal documents can sometimes feel like deciphering an ancient script. This is particularly true for the Durable Power of Attorney (DPOA) forms in Oregon, which are crucial but often misunderstood. Let’s clarify some common misconceptions to shed light on this important legal document:

- A Durable Power of Attorney and a Will are the same. The two documents serve very different purposes. A Will becomes effective upon death, distributing your assets according to your wishes. In contrast, a DPOA enables a chosen agent to make decisions on your behalf if you're unable to do so, effective during your lifetime.

- The agent has unlimited power. Although it seems like the agent can make any decision, the reality is their powers are defined by the specific terms of the DPOA. Oregon law further restricts agents from making decisions that the principal (the person who made the DPOA) did not authorize, especially those involving high-stake choices such as end-of-life treatment.

- A Durable Power of Attorney is effective immediately upon signing. This is a common assumption but not always true. The document’s effectiveness can be immediate or springing—meaning it only takes effect upon a certain condition, usually the principal's incapacity, as defined within the document itself.

- Once granted, a DPOA cannot be revoked. The truth is, as long as the principal is competent, they have the right to revoke their DPOA at any time. This ensures that the principal maintains control over their affairs and can make changes as their situation or relationships evolve.

- Creating a DPOA means losing control over your finances immediately. This is a misconception. A DPOA is designed to allow another person to act in your stead, not to strip you of your autonomy. You retain control over your affairs until you decide or are deemed unable to manage them.

- Only family members can be designated as agents. While many choose family members for this role, the principal is free to select anyone they trust—be it a friend, lawyer, or anyone else—as their agent, provided the person is of legal age and capable of making decisions.

- All DPOA forms are essentially the same. Although there are standard templates, the specifics can vary widely based on personal preferences, the nature of the assets, and the types of decisions the agent is authorized to make. It's crucial to customize the DPOA to fit individual needs.

- There’s no need for a lawyer to create a DPOA. While it’s true that anyone can create their own DPOA using forms found online, consulting with a lawyer can provide valuable customization to the document and ensure that it meets all legal requirements in Oregon.

- A Durable Power of Attorney covers medical decisions. This is a specific area where general misunderstanding occurs. A regular DPOA typically grants authority over financial or general matters, whereas a separate document, often known as an Advance Directive or a Health Care Power of Attorney, is needed for medical decisions.

- The same DPOA form works in every state. While a DPOA created in Oregon might be recognized in other states, laws governing these documents differ from one state to another. It’s advisable to create a DPOA that specifically aligns with Oregon law to avoid any issues.

Demystifying the Durable Power of Attorney helps ensure that individuals are better prepared to make informed decisions about their own futures and the handling of their affairs. By understanding what a DPOA can and cannot do, Oregon residents can confidently plan ahead, knowing their choices will be respected.

Key takeaways

When preparing to use the Oregon Durable Power of Attorney form, understanding the key elements will ensure the process is handled correctly and effectively. This document is a vital tool for planning your future, allowing you to designate someone you trust to manage your affairs if you're unable to do so yourself. Here are eight important takeaways to keep in mind:

- Choose a trustworthy agent. The person you designate as your agent should be someone you trust implicitly. This person will have substantial control over your financial or health decisions, so choose wisely.

- Understand the scope. Clearly define the powers you are granting to your agent. The form can be tailored to include general or specific duties, depending on your needs and preferences.

- Durability is a key feature. Unlike a standard Power of Attorney, a Durable Power of Attorney remains in effect if you become incapacitated, ensuring that your affairs can be managed without interruption.

- Notarization is required. For your Durable Power of Attorney to be legally valid in Oregon, it must be properly notarized. This step verifies your identity as the principal and confirms that you are signing the document of your own free will.

- Consider a successor agent. It’s wise to appoint a successor agent in the event your primary agent is unable or unwilling to serve. Having a backup ensures that your affairs remain in trusted hands without delay.

- Keep it accessible. Once signed and notarized, ensure your Durable Power of Attorney is stored in a safe but accessible place. Your agent, successor agent, and perhaps a trusted family member or friend should know where it is kept.

- Review and update periodically. As your circumstances change, so might your needs and preferences regarding your Durable Power of Attorney. Regularly reviewing and updating the document will ensure it always reflects your current wishes.

- Consult with a professional. While it's possible to fill out a Durable Power of Attorney on your own, seeking advice from a legal professional can provide peace of mind. An attorney can help clarify any confusion and ensure the document meets all legal requirements.

By keeping these points in mind, you can make informed decisions when preparing your Oregon Durable Power of Attorney, safeguarding your future and ensuring your peace of mind.

More Durable Power of Attorney State Forms

South Dakota Durable Power of Attorney - It is advisable to consult with an attorney to tailor the powers granted to your specific needs and circumstances.

Power of Attorney Texas Pdf - It allows your designated agent to act on your behalf, making key financial decisions smoothly and effectively.