Attorney-Verified Durable Power of Attorney Document for Pennsylvania

In the realm of planning for unforeseen circumstances, the Pennsylvania Durable Power of Attorney form emerges as a crucial legal document. It serves as an empowering tool, allowing individuals to designate a trusted person to manage their financial and health-related decisions, should they become unable to do so themselves. This provision ensures continuity in personal affairs, safeguarding an individual's estate and health preferences in times of incapacity. Encapsulated within the form are guidelines that detail the breadth of powers granted, from managing financial transactions to making critical health care decisions. Moreover, it provides a legal framework that upholds the individual’s wishes, ensuring they are respected and executed in accordance with their directives. Spanning a diverse range of scenarios, the form is designed to provide peace of mind not only to the person it protects but also to their loved ones, who can avoid the often complicated and emotionally taxing court procedures otherwise necessary to obtain the right to make these decisions on their behalf. Its significance cannot be overstated, making it an essential document for adults of all ages in Pennsylvania.

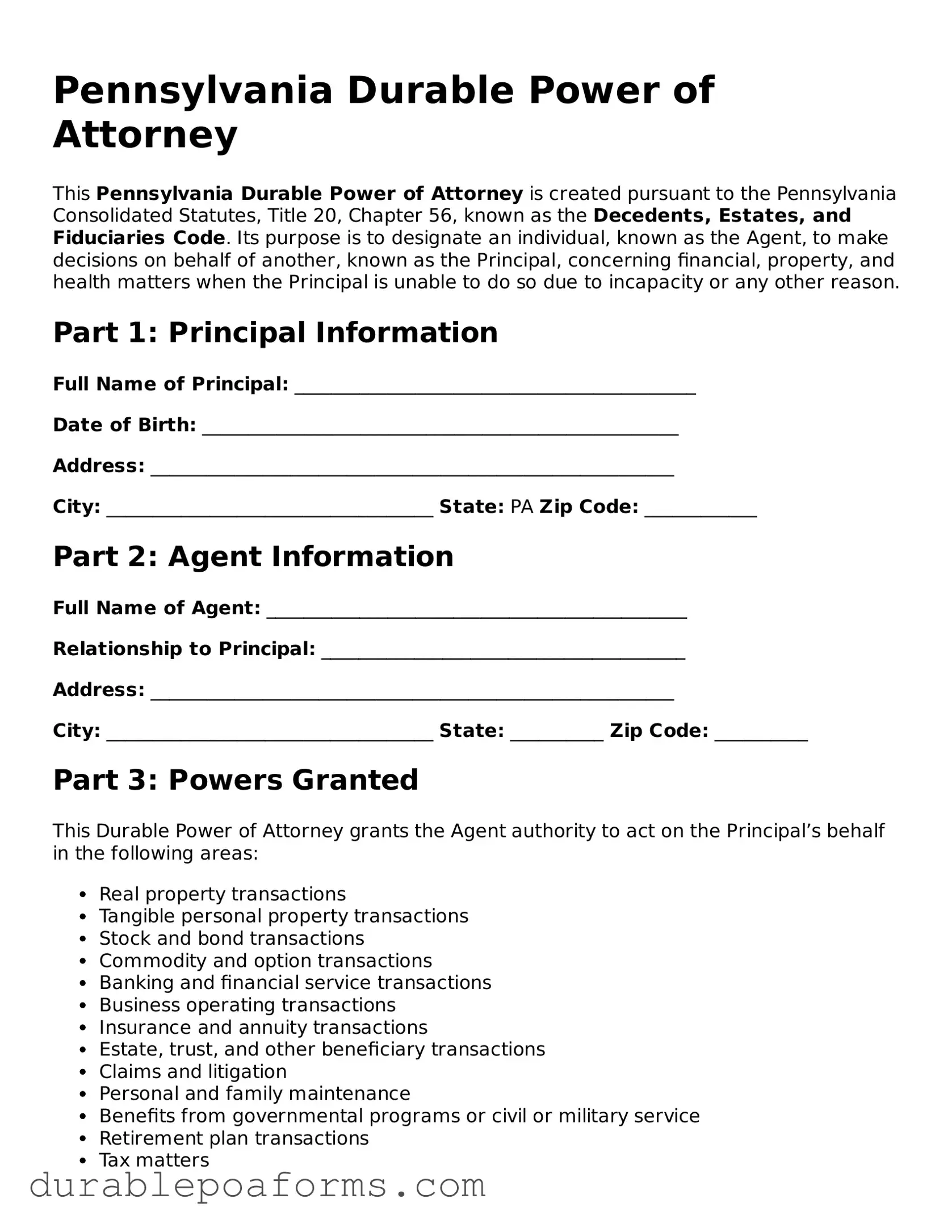

Form Preview

Pennsylvania Durable Power of Attorney

This Pennsylvania Durable Power of Attorney is created pursuant to the Pennsylvania Consolidated Statutes, Title 20, Chapter 56, known as the Decedents, Estates, and Fiduciaries Code. Its purpose is to designate an individual, known as the Agent, to make decisions on behalf of another, known as the Principal, concerning financial, property, and health matters when the Principal is unable to do so due to incapacity or any other reason.

Part 1: Principal Information

Full Name of Principal: ___________________________________________

Date of Birth: ___________________________________________________

Address: ________________________________________________________

City: ___________________________________ State: PA Zip Code: ____________

Part 2: Agent Information

Full Name of Agent: _____________________________________________

Relationship to Principal: _______________________________________

Address: ________________________________________________________

City: ___________________________________ State: __________ Zip Code: __________

Part 3: Powers Granted

This Durable Power of Attorney grants the Agent authority to act on the Principal’s behalf in the following areas:

- Real property transactions

- Tangible personal property transactions

- Stock and bond transactions

- Commodity and option transactions

- Banking and financial service transactions

- Business operating transactions

- Insurance and annuity transactions

- Estate, trust, and other beneficiary transactions

- Claims and litigation

- Personal and family maintenance

- Benefits from governmental programs or civil or military service

- Retirement plan transactions

- Tax matters

Part 4: Signatures

The effectiveness of this Durable Power of Attorney is not affected by the Principal’s subsequent incapacity. This document shall remain in effect until the Principal’s death unless revoked earlier by the Principal.

Date: ___________________________________________

Principal's Signature: __________________________________________

The Principal’s signature must be notarized for this Durable Power of Attorney to be effective.

State of Pennsylvania

County of _________________

On this day, ___________________ (date), before me, a Notary Public, personally appeared _____________________________________ (name of Principal), known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument and acknowledged that he/she executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand.

Notary Public's Signature: ________________________________________

My Commission Expires: __________________________________________

Part 5: Agent’s Acknowledgement

I, ___________________________________ (name of Agent), hereby acknowledge that I have been appointed as Agent under this Durable Power of Attorney. I understand my duties under this role and pledge to act to the best of my abilities and in the Principal’s best interest.

Date: ________________________________

Agent's Signature: ________________________________

Form Specifications

| Fact Number | Fact Description |

|---|---|

| 1 | The Pennsylvania Durable Power of Attorney form allows an individual to appoint someone else to manage their financial affairs. |

| 2 | This form remains effective even if the principal becomes incapacitated. |

| 3 | Governing laws for this form are found in the Pennsylvania Consolidated Statutes, Title 20, Chapters 56 and 57. |

| 4 | The appointed agent must act in the principal's best interest and in accordance with Pennsylvania law. |

| 5 | The document can be revoked by the principal at any time, as long as they are mentally competent. |

| 6 | It is recommended to have the Durable Power of Attorney form notarized, though Pennsylvania law does not strictly require notarization. |

| 7 | The form should be detailed, specifying the powers granted to the agent to prevent any confusion and legal disputes. |

| 8 | Upon execution, copies of the document should be distributed to financial institutions, family members, and others who may need to recognize the agent's authority. |

| 9 | If no expiration date is specified within the document, the Durable Power of Attorney will remain in effect indefinitely unless revoked. |

Pennsylvania Durable Power of Attorney - Usage Guide

Filling out a Pennsylvania Durable Power of Attorney form is a critical step in planning for situations where you may need someone to manage your affairs if you're unable to do so yourself. This document allows you to appoint a trusted person to handle your financial matters, ensuring your assets are managed according to your wishes. The process requires attention to detail, but by following these steps, you can complete the form accurately and effectively.

- Start by downloading the official Pennsylvania Durable Power of Attorney form from a reliable source.

- Enter your full legal name and address in the designated sections at the top of the form to identify yourself as the principal.

- Choose a trusted individual to serve as your agent (also referred to as the attorney-in-fact) and provide their full legal name and contact information in the space provided.

- If you wish to appoint a successor agent in case the primary agent is unable or unwilling to serve, fill in their information in the relevant section.

- Thoroughly review the powers you are granting to your agent, which are listed in the form. These powers include handling financial transactions, real estate matters, and other specified activities on your behalf. Initiate next to each power you agree to grant.

- If there are specific powers you do not wish to grant or special instructions you want to include, clearly write these exceptions or additional directives in the designated area of the form.

- Review the form to ensure all information is accurate and that you're comfortable with the powers being granted.

- Sign and date the form in the presence of a notary public. Pennsylvania law requires notarization for the Durable Power of Attorney to be legally valid.

- Have the notary public complete their section, including their signature and official seal, to notarize the document.

- Provide your agent with a copy of the signed and notarized Durable Power of Attorney. It's also wise to store the original in a safe but accessible place and inform a close family member or friend of its location.

By completing these steps, you create a legal document that ensures your affairs can be managed according to your wishes, even if you're unable to oversee them personally. It is a proactive measure that brings peace of mind to you and your loved ones.

Common Questions

What is a Durable Power of Attorney (DPOA) in Pennsylvania?

A Durable Power of Attorney (DPOA) is a legal document that allows an individual, known as the “principal,” to appoint someone else, referred to as the “agent” or “attorney-in-fact,” to manage their financial affairs and make decisions on their behalf. In Pennsylvania, the distinguishing feature of a DPOA is its durability, which means the agent’s power remains in effect even if the principal becomes mentally incapacitated.

How do I choose an agent for my Durable Power of Attorney?

Choosing an agent is a critical decision. It should be someone you trust completely, as they will have significant control over your affairs should you become unable to manage them yourself. Consider selecting an agent who is not only trustworthy but also financially savvy and capable of handling responsibilities that may arise under the DPOA. It can be a family member, friend, or professional advisor. It’s also wise to appoint a successor agent in case your first choice is unable or unwilling to serve when needed.

What powers can I grant with a Pennsylvania DPOA?

In Pennsylvania, you can grant your agent a wide range of powers with a DPOA, including managing bank accounts, buying or selling property, filing taxes, and handling investment decisions. You have the flexibility to tailor the powers you grant to your agent, allowing for everything from broad to very specific tasks. It is crucial to carefully outline these powers in your DPOA document to ensure it aligns with your wishes and needs.

Is a lawyer required to create a Durable Power of Attorney in Pennsylvania?

While Pennsylvania law does not require a lawyer to create a DPOA, consulting with a legal professional can provide valuable guidance and ensure that the document clearly reflects your intentions and complies with state laws. A lawyer can also help you understand the powers you are granting and advise on selecting an appropriate agent.

How can a Pennsylvania DPOA be revoked?

A DPOA in Pennsylvania can be revoked at any time by the principal, provided they are mentally competent. Revocation can be done in writing, with a signed and dated statement expressing the desire to revoke the power of attorney. It is important to notify the agent and any institutions or parties that were aware of the existence of the DPOA of the revocation. For added measure, destroying the original document and any copies can also help prevent future confusion.

Common mistakes

When individuals embark on the important task of filling out the Pennsylvania Durable Power of Attorney form, a document that grants another person the right to make decisions on their behalf, mistakes can sometimes occur. These errors can significantly impact the effectiveness of the document and its intended purpose. Recognizing and avoiding these common pitfalls can ensure the document fully reflects the principal's wishes and meets legal standards.

First among the frequent missteps is the failure to specify the scope of powers granted. Many individuals neglect to clearly outline what decisions the agent can and cannot make. This lack of specificity can lead to confusion and even legal disputes, potentially leaving important decisions unaddressed.

Another common error involves choosing the wrong agent. The importance of selecting an agent who is not only trustworthy but also capable of making difficult decisions cannot be overstated. Yet, often, the decision is made based on personal relationships rather than an evaluation of the person's ability and willingness to act in the principal's best interest.

A significant number of people also overlook the importance of including alternate agents. If the primary agent is unable or unwilling to serve, having no successor agent listed can render the document ineffective, requiring a court to step in.

- Not specifying the scope of powers granted.

- Choosing an inappropriate agent.

- Omitting alternate agents.

- Ignoring the need for a notary or proper witnesses, which varies by state law but is crucial for the document’s legal validity.

- Failing to discuss the document's contents and wishes with the chosen agent, leading to potential misunderstandings.

- Forgetting to include limitations or specific conditions, such as the commencement of the agent’s power, which can be vital for the document's operation.

- Lack of clarity regarding the power of attorney's duration, especially in cases where the document might need to be durable to remain in effect if the principal becomes incapacitated.

- Not updating the document to reflect changes in circumstances, relationships, or the law, which could make parts of the document obsolete or ineffective.

- Improperly signing or executing the document, lacking the formalities required to make it legally binding.

- Assuming a one-size-fits-all approach and using generic forms without adjusting for specific state requirements or personal situations.

In addition to these specific errors, several general but important points should be kept in mind:

- The document should be reviewed periodically to ensure it still aligns with the principal's wishes and legal standards.

- A complete understanding by both the principal and the agent of their roles and responsibilities is essential for the document's effective execution.

- Consulting with a legal professional can provide valuable insights and help avoid common pitfalls.

In conclusion, filling out a Pennsylvania Durable Power of Attorney form is a crucial step that requires careful consideration and attention to detail. By avoiding these common mistakes, individuals can ensure that their wishes are clearly understood and carried out in the event they can no longer make decisions for themselves. This proactive approach can provide peace of mind to all parties involved and help safeguard the principal's welfare and assets.

Documents used along the form

Completing a Pennsylvania Durable Power of Attorney (DPA) form is a significant step in planning for future financial management and personal care decisions. This form allows someone to act on your behalf if you're unable to do so. However, to ensure comprehensive coverage of one's affairs, several other forms and documents are often used along with the DPA. Understanding these additional documents can provide a more robust legal safeguard for an individual's health, financial interests, and personal wishes.

- Advance Health Care Directive (AHCD): This document, also known as a living will or medical power of attorney, specifies an individual's preferences for medical treatment and end-of-life care. It complements a DPA by covering health care decisions, whereas a DPA often focuses on financial matters.

- Will: A legal document that outlines how an individual's property and assets should be distributed after their death. While a DPA addresses decision-making during the individual's lifetime, a will applies after death, ensuring their wishes are honored and estate is properly managed.

- Trust: This entity can be created to manage an individual's assets during their lifetime and distribute them after death. Trusts are used alongside a DPA for more specific control over assets, potentially avoiding probate and providing tax benefits.

- HIPAA Release Form: The Health Insurance Portability and Accountability Act (HIPAA) privacy rule protects an individual's health information. A HIPAA release form grants permission to share medical records with designated individuals, such as those holding a DPA or AHCD, ensuring they have the information needed to make informed decisions.

Using these documents in conjunction with a Durable Power of Attorney in Pennsylvania equips individuals and their designated agents with the necessary tools to manage a wide range of legal, financial, and health-related matters. Consulting with legal professionals to understand and properly implement these forms can provide peace of mind and ensure that one's intentions are clearly expressed and legally sound.

Similar forms

The Pennsylvania Durable Power of Attorney form is similar to several other legal documents, yet distinctive in its purpose and scope. While it grants someone the authority to act on another's behalf in a broad range of financial matters, other documents share some similarities in structure and intent but are applied differently. Each of these documents serves a unique role in legal and estate planning.

Firstly, the document resembles a General Power of Attorney. Like the Durable Power of Attorney, a General Power of Attorney allows an individual to grant a wide range of powers to an agent. The key difference lies in the duration these powers are effective. A General Power of Attorney typically becomes void if the grantor becomes incapacitated or unable to make decisions, whereas the Durable Power of Attorney is specifically designed to remain in effect in such situations, ensuring that the agent can still act on the grantor's behalf.

Secondly, it is akin to a Health Care Power of Attorney. Both forms empower someone to make decisions on behalf of the individual granting the power. The critical differentiation is the domain in which the agent can make decisions. A Durable Power of Attorney focuses on financial and legal affairs, whereas a Health Care Power of Attorney designates someone to make medical and health-related decisions. Despite this different focus, both documents share the goal of appointing a trusted person to act in the best interests of the grantor.

Lastly, the form shares similarities with a Living Will. While the Living Will and Durable Power of Attorney operate in different legal territories, they both prepare for situations where the individual may not be able to communicate their wishes about personal matters. A Living Will articulates preferences regarding end-of-life care, but does not appoint someone to make decisions on other types of matters. The Durable Power of Attorney fills this gap by empowering an agent to handle financial, legal, and some personal affairs, complementing the directives laid out in a Living Will.

Dos and Don'ts

When you're filling out the Pennsylvania Durable Power of Attorney (DPOA) form, it's crucial to handle it correctly to ensure your wishes are respected and legally enforceable. Here are some guidelines on what to do and what not to do.

- Do read the form thoroughly before you start filling it out to understand all its provisions.

- Do choose an agent you trust implicitly, as they will have substantial control over your affairs.

- Do discuss your decision with the chosen agent to confirm they're willing and able to take on the responsibilities.

- Do be specific about the powers you are granting to ensure there's no confusion later on.

- Do sign the document in the presence of a notary public to add a layer of legal validity.

- Don't leave any sections blank. If a section does not apply, indicate this with "N/A" or "None" to avoid any assumptions.

- Don't use vague language when describing the powers you're granting. Clarity is key.

- Don't forget to review and possibly update your DPOA periodically to reflect any changes in your situation or preferences.

- Don't hesitate to consult a legal professional if you have any doubts or questions about the form or the process. It's better to seek advice than make an avoidable mistake.

Misconceptions

When considering creating a Durable Power of Attorney (POA) in Pennsylvania, various misconceptions can arise. Understanding these misconceptions is essential to making informed decisions. Below are nine common misunderstandings about the Pennsylvania Durable Power of Attorney form.

One Document Fits All: Many believe that a single Durable Power of Attorney document can address all matters, including health care decisions. However, in Pennsylvania, financial and healthcare decisions require separate documents— a Durable Power of Attorney for finances and a Health Care Power of Attorney or Living Will for health care decisions.

Immediate Loss of Control: A common fear is that by signing a Durable Power of Attorney, the principal immediately relinquishes control over their affairs to the agent. In reality, the principal can specify whether the document takes effect immediately or only upon incapacitation, retaining control until the specified conditions are met.

Revocation is Impossible: Some are under the misconception that once a Durable Power of Attorney is created, it cannot be revoked or amended. Pennsylvania law allows the principal to revoke or change their Durable Power of Attorney as long as they are mentally competent.

No Legal Oversight: There's a misconception that agents under a Durable Power of Attorney can act without any oversight or accountability. In Pennsylvania, agents are legally obligated to act in the principal's best interest, and the principal or their loved ones can seek legal recourse if the agent abuses their powers.

Limited to Elderly Individuals: Contrary to the belief that POAs are only for the elderly, individuals of any age can benefit from having a Durable Power of Attorney. It provides a safety net in case of sudden illness or accidents that can happen at any age.

A Lawyer is Always Required: While having legal guidance is beneficial, especially for complex estates, Pennsylvania law does not require a lawyer to draft a Durable Power of Attorney. However, specific signing procedures, such as notarization, may be necessary for the document to be valid.

Validity Across States: Some assume that a Durable Power of Attorney executed in Pennsylvania will automatically be valid in other states. Although this is often the case, the document's acceptance can vary depending on the other state's laws. It's advisable to check the regulations of any state where the POA might be used.

Complex and Costly Process: The process of creating a Durable Power of Attorney in Pennsylvania is perceived by many as complex and expensive. While the document should be thorough and reflect the principal's wishes accurately, creating a POA does not have to be overly complicated or costly, particularly if one's needs are straightforward.

Only Covers Financial Decisions: There's a common misconception that a Durable Power of Attorney only covers financial decisions. While it's true that financial matters are a significant aspect, the scope of a Durable Power of Attorney can also include real estate transactions, government benefits management, and more, depending on the wishes of the principal.

Clearing up these misconceptions is crucial for individuals considering a Durable Power of Attorney. With accurate information, they can make decisions that best protect their interests and ensure their wishes are respected.

Key takeaways

Understanding the Pennsylvania Durable Power of Attorney (POA) form is crucial for making informed decisions about your estate planning and ensuring your affairs are managed according to your wishes if you're unable to do so yourself. Here are seven key takeaways about filling out and using this form:

- The durability aspect of this Power of Attorney means that the document remains in effect even if the principal (the person who creates the POA) becomes incapacitated, allowing the appointed agent (also known as an attorney-in-fact) to continue making decisions on their behalf.

- It is important to carefully select your agent, as this person will have broad powers to manage your financial affairs, including but not limited to, buying and selling property, managing bank accounts, and handling tax matters.

- Specific instructions and limitations can be included in the document to tailor the agent's authority to the principal's wishes, ensuring they act within defined boundaries and according to the principal's expectations.

- In Pennsylvania, the form must be signed in front of a notary public and two witnesses to be legally valid. This process helps protect against fraud and confirms that the principal is signing the document willingly and without duress.

- Multiple agents can be appointed either to act jointly, requiring them to make decisions together, or severally, allowing them to act independently of each other. Carefully consider the dynamics and practicality of your chosen arrangement.

- Although not required, it is strongly recommended to consult with a legal professional when drafting a Durable Power of Attorney. This ensures that the document accurately reflects your wishes and is in compliance with Pennsylvania law.

- Once completed, the document should be kept in a safe place, and copies should be given to the agent and any relevant financial institutions, medical facilities, or others who may need to be aware of the arrangement.

By keeping these key points in mind, you can more confidently navigate the process of establishing a Durable Power of Attorney in Pennsylvania, ensuring your financial matters are handled according to your specific directions, even if you're not able to manage them yourself.

More Durable Power of Attorney State Forms

How to Get Power of Attorney in Virginia - Crucial for uninterrupted management of your financial affairs by someone you trust.

Power of Attorney Wyoming - Keeping the Durable Power of Attorney document in a safe but accessible location is crucial, and relevant parties should know where it is.

Vermont Durable Power of Attorney Form - It's advisable to consult with a legal professional when preparing a Durable Power of Attorney to ensure it meets your specific needs.