What is a Rhode Island Durable Power of Attorney?

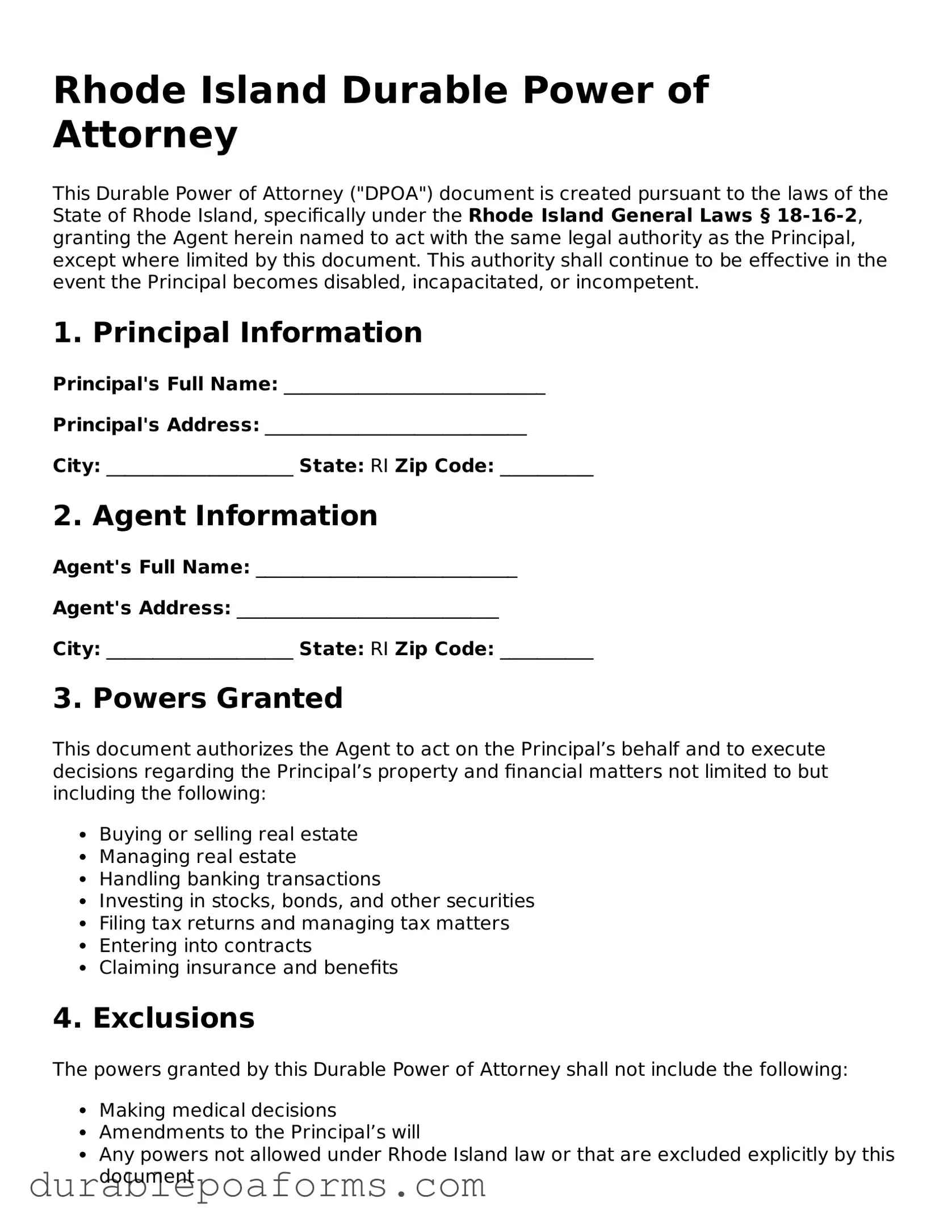

A Rhode Island Durable Power of Attorney (DPOA) is a legal document that lets you (the principal) give another person (the agent) the authority to make decisions on your behalf if you're unable to do so yourself. This power remains in effect even if you become incapacitated, ensuring that your affairs can be handled without interruption.

When does a Rhode Island Durable Power of Attorney become effective?

It becomes effective as soon as it is signed and notarized, unless the document states a specific date or event that will trigger its activation. It's important to clearly specify any conditions for its activation in the document itself.

Is a Rhode Island Durable Power of Attorney revocable?

Yes, as long as you are mentally competent, you can revoke your Durable Power of Attorney at any time. To do so, you should provide a written notice of revocation to your agent and to any institutions or individuals that were relying on the original Power of Attorney.

How do I choose an agent for my Durable Power of Attorney in Rhode Island?

Choose someone you trust deeply, such as a family member or a close friend, who is competent and willing to take on the responsibility. Consider their ability to make difficult decisions under pressure and their understanding of your wishes and values.

Can I have more than one agent for my Rhode Island Durable Power of Attorney?

Yes, you can appoint more than one agent. You must specify whether they need to make decisions together (joint authority) or if they can act independently of each other (several authority). Clearly outline how conflicts between agents should be resolved in the document.

What powers can I grant with my Rhode Island Durable Power of Attorney?

You can grant a wide range of powers, including handling financial transactions, managing real estate, making healthcare decisions, and dealing with government benefits. Be specific about the powers you're granting to avoid any confusion in the future.

Do I need a lawyer to create a Durable Power of Attorney in Rhode Island?

While it's not mandatory to use a lawyer, consulting with one can be beneficial. A lawyer can ensure that your DPOA complies with Rhode Island law and truly reflects your wishes, offering peace of mind that your affairs will be handled as you desire.

Does my Rhode Island Durable Power of Attorney need to be notarized?

Yes, for your DPOA to be legally valid in Rhode Island, it must be signed in the presence of a notary public. This helps confirm your identity and your voluntary decision to grant power of attorney.

How can I ensure my Durable Power of Attorney is accepted by financial institutions and others?

To ensure acceptance, provide clear and specific instructions in your DPOA. You may also want to talk to the institutions you deal with ahead of time to understand any additional requirements they may have. Keeping the document updated and regularly reaffirming your agent's authority can also help.

What happens if I don't have a Durable Power of Attorney in Rhode Island?

Without a DPOA, if you become incapacitated, your family may have to go through a lengthy and potentially costly court process to appoint a guardian or conservator to make decisions for you. This can add stress and delay in managing your affairs when time is of the essence.