Attorney-Verified Durable Power of Attorney Document for South Carolina

Stepping into the realm of future planning, many individuals often overlook the importance of equipping themselves with a sturdy legal instrument that can stand the test of unforeseen circumstances, such as incapacitation. Among these essential documents, the South Carolina Durable Power of Attorney form plays a pivotal role, empowering a chosen individual, known as the agent, to make pivotal financial decisions on behalf of the principal — the person who filled out the form. This enabling document stands out for its durability; unlike other forms of power of attorney, it remains in effect even if the principal becomes incapacitated. The scope of authority given through this form can encompass a wide array of financial activities, from managing bank accounts and real estate transactions to handling investments and tax filings. Its preparation requires careful consideration and adherence to South Carolina's specific legal requirements to ensure its validity. By incorporating this document into their estate planning, individuals can ensure their financial affairs are managed according to their wishes, even when they are not in a position to do so themselves, thereby offering peace of mind to both them and their loved ones.

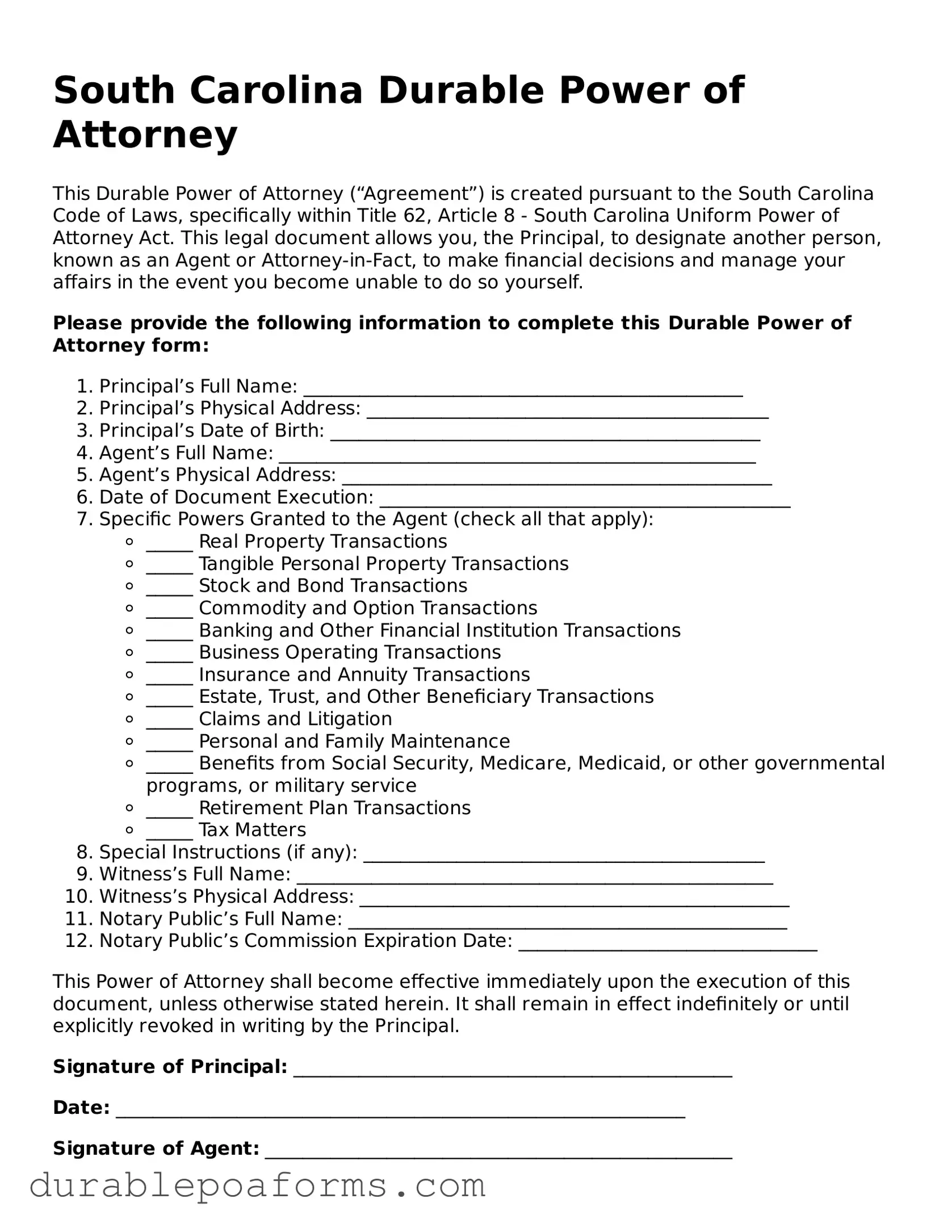

Form Preview

South Carolina Durable Power of Attorney

This Durable Power of Attorney (“Agreement”) is created pursuant to the South Carolina Code of Laws, specifically within Title 62, Article 8 - South Carolina Uniform Power of Attorney Act. This legal document allows you, the Principal, to designate another person, known as an Agent or Attorney-in-Fact, to make financial decisions and manage your affairs in the event you become unable to do so yourself.

Please provide the following information to complete this Durable Power of Attorney form:

- Principal’s Full Name: _______________________________________________

- Principal’s Physical Address: ___________________________________________

- Principal’s Date of Birth: ______________________________________________

- Agent’s Full Name: ___________________________________________________

- Agent’s Physical Address: ______________________________________________

- Date of Document Execution: ____________________________________________

- Specific Powers Granted to the Agent (check all that apply):

- _____ Real Property Transactions

- _____ Tangible Personal Property Transactions

- _____ Stock and Bond Transactions

- _____ Commodity and Option Transactions

- _____ Banking and Other Financial Institution Transactions

- _____ Business Operating Transactions

- _____ Insurance and Annuity Transactions

- _____ Estate, Trust, and Other Beneficiary Transactions

- _____ Claims and Litigation

- _____ Personal and Family Maintenance

- _____ Benefits from Social Security, Medicare, Medicaid, or other governmental programs, or military service

- _____ Retirement Plan Transactions

- _____ Tax Matters

- Special Instructions (if any): ___________________________________________

- Witness’s Full Name: ___________________________________________________

- Witness’s Physical Address: ______________________________________________

- Notary Public’s Full Name: _______________________________________________

- Notary Public’s Commission Expiration Date: ________________________________

This Power of Attorney shall become effective immediately upon the execution of this document, unless otherwise stated herein. It shall remain in effect indefinitely or until explicitly revoked in writing by the Principal.

Signature of Principal: _______________________________________________

Date: _____________________________________________________________

Signature of Agent: __________________________________________________

Date: _____________________________________________________________

This document was signed in the presence of a witness and notarized on the date mentioned above, ensuring its validity as per the laws of the State of South Carolina.

Witness Signature: ___________________________________________________

Date: _____________________________________________________________

Notary Public Signature: ______________________________________________

Notary Seal:

Form Specifications

| Fact | Description |

|---|---|

| Definition | A South Carolina Durable Power of Attorney form allows an individual to authorize someone else to handle their financial affairs. |

| Durability | This form remains effective even if the person who made it becomes incapacitated. |

| Governing Laws | It is governed by the South Carolina Code of Laws, specifically under Title 62, Article 8. |

| Execution Requirements | To be valid, it must be signed by the principal, two witnesses, and a notary public as per South Carolina law. |

| Agent’s Duties | The chosen agent is required to act in the principal's best interest, maintain accurate records, and keep the principal's property separate from their own. |

| Revocation | The principal can revoke the power of attorney at any time, provided they are mentally competent. |

| Types of Powers | The form can grant broad or specific powers, including handling financial transactions, real estate management, and personal and family maintenance. |

| Limitations | Even with a durable POA, an agent cannot make healthcare decisions unless specifically authorized through a separate healthcare POA. |

| Springing Powers | Some POAs are "springing", meaning they only take effect upon the principal's incapacitation. |

| Effect on Death | The authority granted through a durable POA ends when the principal dies. |

South Carolina Durable Power of Attorney - Usage Guide

Filling out a Durable Power of Attorney (DPOA) form in South Carolina is a straightforward process, but it's important to pay close attention to detail. This document allows you to appoint someone else to manage your finances and property if you're unable to do so. Before diving into the paperwork, ensure you're ready to provide comprehensive information about yourself and the person you're designating as your attorney-in-fact. Let's go through the steps you need to follow to complete this essential legal document accurately.

- Gather all necessary information, including your full legal name, address, and the details of the individual you are appointing, known as your agent or attorney-in-fact.

- Begin by entering your name and address in the designated spaces at the top of the form.

- Identify the agent (attorney-in-fact) by writing their full name, address, and contact information in the provided section.

- If you wish to appoint an alternate agent in case the first is unable or unwilling to serve, include their details as well.

- Specify the powers you are granting to your agent. This could include managing real estate, financial, and personal property transactions, as well as tax and legal matters. Be as specific as possible to ensure clarity.

- Indicate the duration of the DPOA. If it's meant to be effective immediately and continue if you become incapacitated, make sure this is clearly stated. Some choose to have the DPOA activate only upon incapacity; if this is your preference, include detailed instructions regarding how incapacity is determined.

- Review any special instructions section carefully. This is where you can limit or extend the powers granted to your agent. If you have specific wishes, like not selling a particular property or making gifts of your assets, state them here.

- Sign and date the form in the presence of a notary public. South Carolina requires that your durable power of attorney be notarized to be legally valid.

- Have your agent sign the document as well, if required by the form. This acknowledges their acceptance of the responsibilities you're assigning to them.

- Finally, distribute copies of the completed and notarized form to your agent, financial institutions, and anyone else who might need it. Keep the original in a safe but accessible place.

Completing a Durable Power of Attorney is a significant step in ensuring your affairs will be handled according to your wishes, even if you're not able to manage them yourself. By carefully selecting your agent and specifying your instructions, you're taking a proactive approach to your future and peace of mind. Remember, it's also a good idea to consult with a legal professional if you have questions or need advice specific to your situation.

Common Questions

What is a Durable Power of Attorney in South Carolina?

A Durable Power of Attorney (DPOA) in South Carolina is a legal document that allows an individual (known as the "principal") to designate another person (known as the "agent" or "attorney-in-fact") to make decisions on their behalf, even if the principal becomes incapacitated. This document remains in effect until the principal dies or revokes the power granted, regardless of their mental state.

How does a Durable Power of Attorney differ from a general Power of Attorney?

Unlike a general Power of Attorney, which becomes invalid if the principal becomes incapacitated, a Durable Power of Attorney in South Carolina remains in effect during the principal's incapacity. This feature makes the DPOA an important tool for estate planning and managing affairs when one is unable to do so themselves.

What powers can I grant with a Durable Power of Attorney in South Carolina?

You can grant a wide range of powers with a Durable Power of Attorney in South Carolina, including managing real estate, handling financial and banking transactions, making legal decisions, and addressing tax matters, among others. The specific powers granted can be customized in the DPOA document according to the principal's wishes.

How can I create a Durable Power of Attorney in South Carolina?

To create a Durable Power of Attorney in South Carolina, you must complete a DPOA form that complies with state laws, including clear designation of the agent, the powers granted, and the signature of the principal. It's recommended to have the document witnessed and notarized, although not always required, to strengthen its validity.

Do I need a lawyer to create a Durable Power of Attorney in South Carolina?

While it's not a legal requirement to have a lawyer create a Durable Power of Attorney in South Carolina, consulting with a legal professional can provide guidance and ensure that the document meets legal standards and accurately reflects your wishes. A lawyer can also help customize the powers granted to your specific needs.

Who should I choose as my agent in a Durable Power of Attorney?

Choosing an agent for a Durable Power of Attorney is a significant decision. It should be someone you trust implicitly, such as a family member, a close friend, or a professional with fiduciary obligations. This person should be capable, reliable, and willing to take on the responsibilities involved.

Can I revoke a Durable Power of Attorney in South Carolina?

Yes, as long as you are mentally competent, you can revoke a Durable Power of Attorney in South Carolina at any time. To do so effectively, you should provide written notice to your agent and any institutions or parties that were relying on the DPOA.

Is a Durable Power of Attorney in South Carolina valid in other states?

Generally, a Durable Power of Attorney created in South Carolina will be recognized in other states. However, because state laws vary, it is possible that specific provisions may not be enforced the same way elsewhere. If you frequently conduct business or reside in another state, it may be wise to consult with an attorney familiar with that state's laws.

What happens if I don't have a Durable Power of Attorney and become incapacitated?

If you become incapacitated without a Durable Power of Attorney in place in South Carolina, the court may need to appoint a conservator or guardian to make decisions on your behalf. This process can be lengthy, costly, and may not result in the appointment of your preferred person.

Can a Durable Power of Attorney be used to make healthcare decisions?

In South Carolina, a Durable Power of Attorney for healthcare, often called a healthcare power of attorney, is a separate legal document specifically designed to grant an agent authority to make healthcare decisions on your behalf if you become unable to do so. While a general DPOA focuses on financial and legal affairs, you would need a healthcare POA for medical decisions.

Common mistakes

When filling out a South Carolina Durable Power of Attorney form, it is essential to approach the task with care. Despite the best of intentions, many people make mistakes that can have significant repercussions. A well-executed form can ensure your affairs are managed according to your wishes, should you be unable to do so yourself. On the other hand, errors can lead to confusion, delays, and at times, legal complications.

One common issue arises from not being specific enough about the powers granted. A Durable Power of Attorney can cover a vast range of decisions, from financial to medical, and it's crucial to detail exactly what authority you are transferring. This specificity prevents ambiguity and ensures the appointed agent understands their responsibilities and limitations.

Another area where mistakes occur is in the selection of the agent. This choice should not be taken lightly. The person you choose will have considerable control over your affairs, and as such, it's vital to select someone who is not only trustworthy but also capable of handling the responsibilities. Some people make the mistake of choosing an agent based on emotional connections rather than practical considerations. This selection should also be discussed with the potential agent to ensure they are willing and able to take on the role.

Incorrectly filling out the form, including misspelling names, incorrect addresses, or failing to adhere to the required signing formalities can invalidate the entire document. In South Carolina, the Durable Power of Attorney needs to be notarized, and in some cases, witnessed. Neglecting these formalities can result in a document that is essentially useless.

Failing to provide clear guidance on how disputes among agents should be handled is another mistake. If you appoint more than one person, specifying whether they can act independently or must agree on decisions can prevent future conflicts.

Not keeping the document accessible is a practical oversight many make. After going through the process of filling it out, the document should be kept in a safe yet accessible location. Not informing your appointed agent or close family members of the document’s existence or where it can be found defeats its purpose. In an emergency, time wasted searching for the document could lead to unwanted consequences.

Last but not least, neglecting to update the document as circumstances change is a mistake that can render it ineffective when it's needed most. Relationships, addresses, and state laws change. Reviewing and updating your Durable Power of Attorney periodically ensures that it reflects your current wishes and complies with current legal standards.

In summary, when filling out a Durable Power of Attorney in South Carolina, pay special attention to:

- Being specific about the powers granted.

- Choosing the right agent for the role.

- Correctly filling out the form and adhering to signing formalities.

- Providing clear guidance for dispute resolution among agents.

- Keeping the document in an accessible location and informing the right people of its existence.

- Regularly updating the document to reflect current circumstances and laws.

By avoiding these pitfalls, you can ensure that your Durable Power of Attorney effectively protects your interests and provides clear instructions for your appointed agent.

Documents used along the form

In the state of South Carolina, a Durable Power of Attorney (POA) form allows you to appoint someone to make important decisions on your behalf should you become unable to do so. This legal document is a crucial part of a comprehensive estate plan, but it's often used in conjunction with several other forms and documents to ensure that all aspects of one's financial and health matters are well-managed. Here's a look at six additional documents that are commonly utilized together with a Durable Power of Attorney form.

- Last Will and Testament: This document outlines how you want your assets to be distributed after your death. It also allows you to appoint an executor who will manage your estate’s affairs.

- Living Will: Also known as an advance healthcare directive, it specifies your preferences for medical treatment if you become incapacitated and cannot communicate your decisions about end-of-life care.

- Health Care Power of Attorney: It complements the Living Will by appointing a specific person to make health care decisions on your behalf in case you are unable to do so yourself.

- Revocable Living Trust: This document helps manage your assets during your lifetime and distribute them after your death, often allowing the estate to avoid probate, which can save time and money.

- HIPAA Authorization Form: This form allows designated individuals to access your medical records and discuss your health situation with doctors, improving the flow of information among caregivers.

- Financial Records Organizing System: While not a formal legal document, having a system that organizes all your financial accounts, insurance policies, and other assets can be invaluable for the person you designate in your Durable Power of Attorney.

Together, these documents form a robust legal framework that can protect you and your assets in various circumstances. Creating a comprehensive estate plan that includes a Durable Power of Attorney and these additional documents can give you peace of mind, knowing that you and your loved ones are well-prepared for the future.

Similar forms

The South Carolina Durable Power of Attorney form is similar to Health Care Power of Attorney and General Power of Attorney forms in various respects, though it has its unique functions and purposes. These documents enable individuals to appoint someone else to make decisions on their behalf, but they diverge in the scope and circumstances of their application.

The Health Care Power of Attorney is a specialized form allowing an individual to designate another person, often referred to as a health care agent, to make medical decisions for them if they become unable to do so. Unlike the Durable Power of Attorney, which can cover a wide range of matters including financial affairs, the Health Care Power of Attorney is exclusively focused on health-related decisions. This document comes into play specifically during medical crises or when the principal is incapacitated, making it critical for ensuring that health care preferences are respected.

The General Power of Attorney, on the other hand, is broader than the Durable Power of Attorney in terms of the powers it conveys, yet it has a significant limitation. It grants an agent the authority to handle a wide array of transactions and decisions on behalf of the principal. However, this authority typically ceases if the principal becomes incapacitated or disabled. This is a key distinction from the Durable Power of Attorney, which remains in effect or can even become effective upon the incapacitation of the principal, ensuring continuous management of the principal's affairs without interruption.

Dos and Don'ts

When it comes to legally appointing someone to make decisions on your behalf in South Carolina, the Durable Power of Attorney (DPOA) form is a critical document. Its completion requires precision and understanding, ensuring your wishes are respected and potential legal complications are avoided. Here are nine dos and don'ts to guide you through this important process.

Things You Should Do:

Thoroughly read the instructions provided with the form to ensure you understand how to fill it out correctly.

Choose a trusted individual as your agent, someone who understands your wishes and is capable of acting in your best interest.

Be specific about the powers you are granting to your agent. Clearly outline what they can and cannot do on your behalf.

Consult with a lawyer if you have any questions or need advice specific to your situation, especially regarding the scope of the powers granted.

Sign the form in the presence of a notary public to ensure it is legally binding. South Carolina law may also require witness signatures.

Things You Shouldn't Do:

Don't leave any sections of the form blank. If a section does not apply to your situation, you should write “N/A” (not applicable) to indicate this.

Don't choose an agent based solely on their relationship to you. Make sure they are willing and able to carry out your wishes accurately and responsibly.

Don't forget to discuss your wishes and expectations with your chosen agent. They need to be fully aware of their responsibilities and your preferences.

Don't fail to keep a copy of the signed document for your records and provide one to your chosen agent as well. It’s also wise to inform key family members or trusted friends where this document is stored.

Executing a Durable Power of Attorney in South Carolina is a significant step in planning for the future. By carefully selecting a reliable agent and clearly communicating your wishes, you can help ensure that your affairs are managed according to your preferences, even if you're unable to make decisions yourself. Remember, legal documents like these play an essential role in your overall planning strategy and should be approached with diligence and care.

Misconceptions

When it comes to the South Carolina Durable Power of Attorney form, misconceptions are quite common. Understanding the truth behind these can help ensure your wishes are effectively and accurately represented.

One must be elderly or ill to create a Durable Power of Attorney (DPOA). This is a misconception. Being prepared is wise at any adult age since unexpected situations like accidents or sudden illness can happen to anyone, at any time.

A Durable Power of Attorney covers medical decisions. This is not accurate. In South Carolina, a Durable Power of Attorney grants someone authority to handle financial and property matters, not medical decisions. For healthcare decisions, a separate document known as a Healthcare Power of Attorney is needed.

Creating a DPOA means losing control over your finances immediately. This isn't true. A DPOA can be structured to take effect only if and when the person becomes incapacitated, allowing them to retain control over their finances as long as they are able.

Only families can be appointed in a DPOA. The fact is, one can appoint anyone they trust, whether a family member, a friend, or someone else as their agent under a DPOA. The key is to choose someone who is trustworthy and capable of handling the responsibility.

A DPOA is permanently binding once signed. Actually, as long as the person who created the DPOA is of sound mind, they can revoke or change their DPOA at any time. It's important to review and possibly update the document periodically, especially after major life events.

If a married person doesn’t have a DPOA, their spouse automatically has the legal authority to handle their affairs. While spouses do have certain rights, without a DPOA, they may not have the authority to manage all aspects of their spouse’s financial matters. It's essential to have a DPOA in place to clearly outline the powers granted to the spouse or another agent.

All DPOAs are the same. This is not correct. DPOAs can be tailored to fit individual needs and preferences. They can grant broad authority or be limited to specific actions or timeframes. It’s crucial to ensure your DPOA accurately reflects your wishes and is drafted in accordance with South Carolina law.

Key takeaways

When preparing to fill out the South Carolina Durable Power of Attorney form, it's crucial to understand its purpose, implications, and the careful approach required for its completion. This legal document grants another individual, known as the agent, the authority to make decisions on your behalf regarding financial matters. Below are ten key takeaways to guide you in accurately filling out and utilizing this form.

- Understanding the significance of the form is imperative. It empowers an agent to act on your behalf if you are unable to manage your affairs, ensuring continuity in financial decision-making.

- The choice of agent requires careful consideration. The selected person will have considerable control over your financial matters, so trust and reliability are paramount.

- Clarity in the document is essential. Specify the powers you are granting to avoid any ambiguity. This ensures that your wishes are clearly understood and followed.

- Limitations can be placed on the agent's power. If certain decisions are to remain beyond the agent's scope, these must be outlined explicitly within the document.

- Durability is a key feature. This form remains in effect even if you become incapacitated, highlighting the need for a trusted agent.

- The requirement for witnesses or notarization varies by state. In South Carolina, having the document notarized can add a layer of legal protection and validity.

- Be aware of state-specific laws. South Carolina law may have unique provisions concerning Durable Power of Attorney forms, so it's crucial to follow local guidelines.

- Keep the original document in a safe, accessible place. Inform your agent and a close family member or friend of its location.

- Review and update the form as necessary. Life changes may require adjustments to your Durable Power of Attorney to reflect current wishes and circumstances.

- Consider consulting with a legal professional. They can provide valuable insight and ensure that the document meets all legal requirements and accurately reflects your intentions.

Accurately completing the South Carolina Durable Power of Attorney form is a significant step in managing your financial affairs. By considering the points above, you can ensure that your interests are protected and your wishes are clearly expressed. Remember, this legal document plays a crucial role in your financial planning and should be handled with the seriousness it deserves.

More Durable Power of Attorney State Forms

Montana Power of Attorney - You can include instructions about medical decisions in some versions of this form, but usually, a separate document is needed for health care directives.

Power of Attorney Rhode Island - It’s important for the agent to keep detailed records of all actions taken on behalf of the principal.

Power of Attorney Alaska - Facilitates financial transactions on behalf of another through a designated proxy.