Attorney-Verified Durable Power of Attorney Document for South Dakota

In South Dakota, as in many states, planning ahead for the unexpected is a crucial step in managing one’s affairs. The Durable Power of Attorney (POA) form stands out as a vital legal document through which individuals, known as "principals," can appoint someone they trust, referred to as an "agent," to manage their financial affairs. This arrangement becomes especially critical should the principal become incapacitated and unable to make decisions themselves. Unlike other POA forms, the durable variant retains its effectiveness even after the principal's incapacitation, ensuring continuity in handling personal, financial, or business matters without court intervention. It encompasses a range of activities including, but not limited to, buying or selling property, managing bank accounts, and handling investments, therefore providing peace of mind that one’s affairs will be appropriately managed in challenging times. The process of creating a Durable Power of Attorney in South Dakota involves understanding state-specific requirements and legalities, including how to correctly fill out the form, the need for witnesses or notarization, and considerations regarding the scope and limitations of the agent's power. This safeguarding document empowers individuals to make proactive decisions about their future, reflecting the principle that planning ahead is not just prudent but essential.

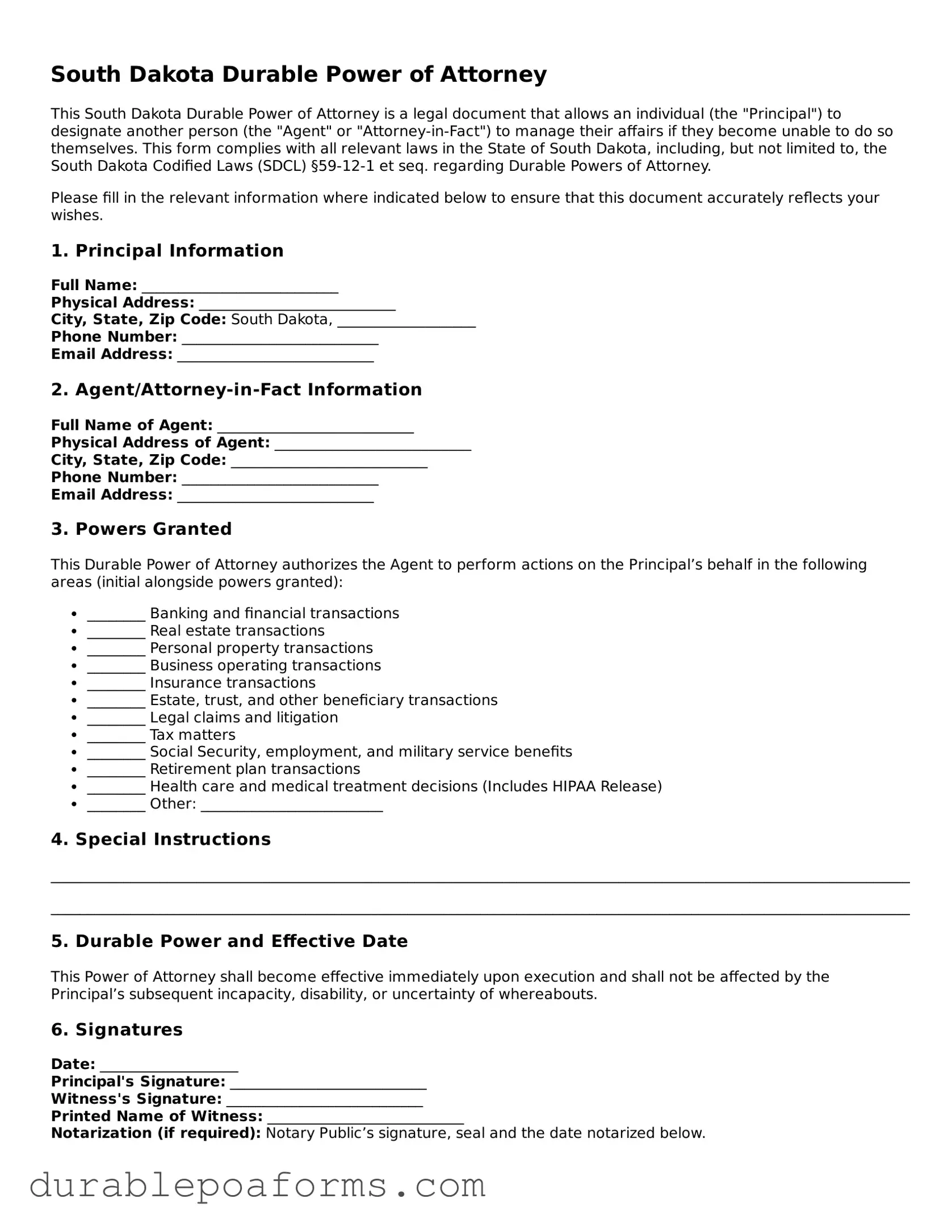

Form Preview

South Dakota Durable Power of Attorney

This South Dakota Durable Power of Attorney is a legal document that allows an individual (the "Principal") to designate another person (the "Agent" or "Attorney-in-Fact") to manage their affairs if they become unable to do so themselves. This form complies with all relevant laws in the State of South Dakota, including, but not limited to, the South Dakota Codified Laws (SDCL) §59-12-1 et seq. regarding Durable Powers of Attorney.

Please fill in the relevant information where indicated below to ensure that this document accurately reflects your wishes.

1. Principal Information

Full Name: ___________________________

Physical Address: ___________________________

City, State, Zip Code: South Dakota, ___________________

Phone Number: ___________________________

Email Address: ___________________________

2. Agent/Attorney-in-Fact Information

Full Name of Agent: ___________________________

Physical Address of Agent: ___________________________

City, State, Zip Code: ___________________________

Phone Number: ___________________________

Email Address: ___________________________

3. Powers Granted

This Durable Power of Attorney authorizes the Agent to perform actions on the Principal’s behalf in the following areas (initial alongside powers granted):

- ________ Banking and financial transactions

- ________ Real estate transactions

- ________ Personal property transactions

- ________ Business operating transactions

- ________ Insurance transactions

- ________ Estate, trust, and other beneficiary transactions

- ________ Legal claims and litigation

- ________ Tax matters

- ________ Social Security, employment, and military service benefits

- ________ Retirement plan transactions

- ________ Health care and medical treatment decisions (Includes HIPAA Release)

- ________ Other: _________________________

4. Special Instructions

______________________________________________________________________________________________________________________

______________________________________________________________________________________________________________________

5. Durable Power and Effective Date

This Power of Attorney shall become effective immediately upon execution and shall not be affected by the Principal’s subsequent incapacity, disability, or uncertainty of whereabouts.

6. Signatures

Date: ___________________

Principal's Signature: ___________________________

Witness's Signature: ___________________________

Printed Name of Witness: ___________________________

Notarization (if required): Notary Public’s signature, seal and the date notarized below.

This document was prepared in accordance with the laws of the State of South Dakota and is intended to be valid throughout the state. By signing, the Principal and Agent agree to the terms and conditions set forth in this Durable Power of Attorney.

Form Specifications

| Fact | Description |

|---|---|

| 1. Definition | A Durable Power of Attorney in South Dakota allows an individual to grant another person the authority to make decisions on their behalf, even in the event of the principal’s incapacitation. |

| 2. Governing Laws | South Dakota Codified Laws, specifically SDCL §§ 59-7-1 to 59-12-28, govern Durable Powers of Attorney within the state. |

| 3. Durability | This type of Power of Attorney remains effective even if the principal becomes mentally incompetent or is unable to make decisions for themselves. |

| 4. Powers Granted | The agent can be given a wide range of powers, including managing financial affairs, real estate transactions, and other personal matters. |

| 5. Execution Requirements | The form must be signed by the principal and notarized to be legally effective in South Dakota. |

| 6. Springing Powers | It is possible to create a "springing" Durable Power of Attorney, which only becomes effective upon the occurrence of a specified event, usually the principal's incapacity. |

| 7. Revocation | The principal can revoke a Durable Power of Attorney at any time, as long as they are mentally competent. |

| 8. Agent’s Duties | The chosen agent is legally required to act in the principal's best interests, maintain accurate records, and avoid conflicts of interest. |

| 9. Acceptance by Third Parties | Financial institutions and other third parties in South Dakota are generally required to accept a validly executed Durable Power of Attorney. |

South Dakota Durable Power of Attorney - Usage Guide

Filling out a Durable Power of Attorney (POA) form in South Dakota is a pivotal step for anyone wanting to ensure that their affairs can be managed by someone they trust, should they become unable to do so themselves. This legal document provides the individual chosen, known as the agent or attorney-in-fact, with the authority to make decisions pertaining to the principal’s (the person who is creating the power of attorney) property, finances, and other non-medical issues. Carefully selecting your agent and understanding the scope of power granted are crucial. The following steps aim to guide you through the process of completing the South touching on every necessary detail to ensure clarity and validity.

- Begin by obtaining a Durable Power of Attorney form specific to South Dakota. These forms can usually be found online through legal services or at a local attorney’s office.

- Clearly print the principal’s full legal name and address at the top of the document where indicated. This establishes who is creating the power of attorney.

- Designate your agent by writing their full legal name and address in the designated space. This person will have the authority to act on your behalf.

- If you wish to appoint a successor agent, should the primary agent be unable or unwilling to serve, include their information in the specified section. This is optional but recommended.

- Detail the specific powers you are granting to your agent. The form may have checkboxes for common financial and property transactions; read each item carefully and mark the appropriate boxes that apply. If the form allows, you may also specify any powers you do not wish to grant.

- Some forms require you to specify the conditions under which the power of attorney becomes effective. If applicable, indicate whether the POA is immediate or upon the occurrence of a future event, such as the principal’s incapacitation.

- Review any sections relating to the duration of the POA. South Dakota law permits a durable power of attorney to remain in effect until the principal's death unless a different termination date is noted. Make any necessary specifications.

- Sign and date the form in front of a notary public. South Dakota requires the principal’s signature on a durable power of attorney to be notarized for the document to be legally binding.

- Have the designated agent sign the document, if required. This step varies depending on the specific form and is not always mandatory but serves as acknowledgement of their acceptance of the responsibilities.

- Keep the original signed document in a safe but accessible place, and provide your agent with a copy. Inform a trusted individual where this document is stored in case it needs to be accessed quickly.

By carefully following these steps, you can fill out a Durable Power of Attorney form in South Dakota with confidence. This preparation ensures that your financial affairs and property management can be adequately handled according to your wishes, providing peace of mind for you and your loved ones. Remember, it's advisable to consult with a legal professional if you have any questions or need clarification on any part of this process. Ensuring the form is correctly completed and legally sound protects everyone involved.

Common Questions

What is a Durable Power of Attorney (DPOA) in South Dakota?

A Durable Power of Attorney in South Dakota is a legal document that allows an individual (the principal) to appoint someone else (the agent or attorney-in-fact) to manage their financial affairs. This arrangement continues to be effective even if the principal becomes incapacitated.

Why is it called 'durable'?

The term 'durable' refers to the power of attorney's ability to remain in effect even after the principal has become incapacitated. Unlike other forms of power of attorney, a durable power does not expire upon the incapacitation of the principal.

How do you create a DPOA in South Dakota?

To create a DPOA in South Dakota, the principal must complete and sign the Durable Power of Attorney form in the presence of a notary public. It is crucial that the form complies with South Dakota laws to ensure its validity. Consulting with a legal professional before executing the document is often recommended.

Who should be chosen as an agent?

The agent chosen should be someone the principal trusts implicitly, as they will have broad powers to manage the principal's financial affairs. This person can be a family member, a close friend, or someone with professional expertise, like an attorney or financial advisor.

Can a DPOA in South Dakota be revoked?

Yes, as long as the principal is mentally competent, they can revoke their Durable Power of Attorney at any time. To do so, they should provide written notice to the agent and any institutions or individuals that were relying on the DPOA.

What happens if the DPOA is not accepted by a financial institution?

Although rare, if a financial institution refuses to accept a DPOA, the principal or agent can seek legal advice to determine the next steps. Sometimes, simply providing additional documentation or clarification about the DPOA can resolve the issue.

Does a DPOA in South Dakota allow the agent to make health care decisions?

No, a Durable Power of Attorney for finance in South Dakota specifically grants the agent authority to make financial decisions on behalf of the principal. Health care decisions require a separate document known as a Durable Power of Attorney for Health Care.

Is a DPOA filed with the court in South Dakota?

Typically, a Durable Power of Attorney is not filed with court. It is a private arrangement between the principal and the agent. However, it may be necessary to present the DPOA to financial institutions, government agencies, or other entities to demonstrate the agent's authority.

Common mistakes

Filling out a Durable Power of Attorney form is a significant step in planning for the future. In South Dakota, as elsewhere, this document enables someone to make crucial decisions on your behalf, should you become unable to do so. However, many people make avoidable errors in the process. Understanding these missteps can ensure your wishes are carried out exactly as you intend.

Firstly, one of the most common mistakes is not choosing the right agent. The agent, or attorney-in-fact, should be someone you trust implicitly. This person will have the authority to make financial decisions on your behalf, so their integrity and reliability are paramount. It's essential to consider the person's financial acumen and their ability to act in your best interests under potentially stressful circumstances.

Secondly, many people fail to specify the scope of the agent's powers clearly. A Durable Power of Attorney can be broad or limited; the document should precisely outline what decisions the agent is authorized to make. Without detailed instructions, your agent may not be empowered to act as you would wish or could be granted more power than you intended.

Another mistake is not keeping the document accessible. Once completed, the Durable Power of Attorney should be stored in a safe but accessible place. Key people, such as family members or your chosen agent, should know where to find it. If the document is locked away or misplaced, it cannot serve its purpose when needed.

People often overlook the need to update the document. Life changes, such as marriage, divorce, the birth of a child, or a change in your financial situation, can all affect your decisions about who should serve as your agent or what powers they should have. Regularly reviewing and updating your Durable Power of Attorney ensures that it always reflects your current wishes.

Furthermore, some individuals mistakenly assume that a Durable Power of Attorney is only for the elderly. However, unexpected situations can arise at any age, making it prudent for adults to have a Durable Power of Attorney in place well before it's needed.

Many also neglect to consult with a professional when completing the form. While it's possible to fill out the document on your own, legal nuances can impact its effectiveness. Consulting with a professional can ensure that the document is correctly executed and valid under South Dakota law.

Last but not least, a significant error is not signing the document in accordance with state laws. In South Dakota, a Durable Power of Attorney must be signed in the presence of a notary public. Failure to follow these legal formalities can invalidate the document.

By being mindful of these mistakes, you can create a Durable Power of Attorney that accurately reflects your wishes and stands up to legal scrutiny. It's not just a formality; it's a crucial component of your personal and financial planning.

Documents used along the form

When planning for the future or navigating through personal and financial affairs, individuals often utilize the South Dakota Durable Power of Attorney form. This document allows a person to appoint an agent to handle their financial and legal matters, especially in cases where they become unable or unavailable to manage these issues themselves. However, to ensure comprehensive coverage and peace of mind, a few other documents are frequently used alongside the South Dakota Durable Power of Attorney form. Each document serves a distinct purpose, complementing the protections and directives provided by a Durable Power of Attorney.

- Last Will and Testament: This crucial document outlines how a person’s assets and estate will be distributed upon their death. It also designates guardians for any minor children and can specify funeral arrangements, ensuring wishes are respected and clearly communicated.

- Living Will: Also known as an advance healthcare directive, this document specifies a person’s preferences regarding medical treatment in scenarios where they are no longer able to make decisions due to incapacity or terminal illness. It often includes decisions about life support and end-of-life care.

- Healthcare Power of Attorney: While the Durable Power of Attorney covers financial and legal matters, a Healthcare Power of Attorney appoints someone to make medical decisions on a person’s behalf if they are incapacitated. It complements the Living Will by naming a trusted agent to enforce medical wishes.

- Revocable Living Trust: This estate planning tool allows individuals to place assets into a trust for the benefit of beneficiaries, which can be altered or revoked during the grantor’s lifetime. It aids in avoiding probate and can provide detailed instructions for asset management and distribution.

- Designation of Preneed Guardian: This document can be especially important if there’s ever a court need to appoint a guardian. It allows a person to nominate a guardian for themselves and their minor children in advance, which courts generally honor unless found unsuitable.

Together, these documents form a comprehensive legal framework that not only takes care of financial and property affairs but also addresses health care decisions and the care of dependents. It’s wise to consult with a legal professional to ensure that these forms align with personal wishes and legal requirements, providing a solid foundation for estate planning and personal care decisions.

Similar forms

The South Dakota Durable Power of Attorney form is similar to other advance directive documents that allow individuals to plan for their future care and decision-making. These documents share a common purpose: to outline a person's wishes regarding financial and health care decisions in the event they become unable to communicate their preferences. While the specifics of each document can vary, they all serve to empower someone else to act in the best interest of the individual who creates the document, ensuring that their personal and financial affairs are handled according to their wishes. Below are some of the documents that share similarities with the South Dakota Durable Power of Attorney form.

Living Will: The Living Will is one such document that resembles the South Dakota Durable Power of Attorney form in its intention to plan for future incapacity. However, while the Durable Power of Attorney focuses on appointing an agent to make decisions across a range of financial and sometimes health-related actions, a Living Will specifically addresses medical treatment preferences. This document outlines the types of medical care a person wants, or does not want, in situations where they are unable to communicate, such as life support and resuscitation efforts. The primary difference lies in the scope of decisions covered; the Living Will is exclusively health-focused, without the financial stipulations present in a Durable Power of Attorney.

Healthcare Proxy or Medical Power of Attorney: This document is another counterpart to the Durable Power of Attorney, with a specific emphasis on health care. Like the Durable Power of Attorney, a Healthcare Proxy appointS an agent to make medical decisions on behalf of the individual if they cannot do so themselves due to incapacity. The scope of this proxy is strictly limited to health-related decisions, contrasting the broader authority often granted in a financial Durable Power of Attorney. The appointed agent in a Healthcare Proxy has the responsibility to ensure that medical and end-of-life care decisions align with the individual’s wishes, ensuring that they receive the type of care they desire.

General Power of Attorney: Closely related to the Durable Power of Attorney, the General Power of Attorney allows an individual to appoint an agent to manage their financial and legal affairs. However, the key difference between the two lies in their durability. A General Power of the Attorney typically becomes invalid if the person who created it becomes incapacitated. Conversely, a Durable Power of Attorney retains its validity even after the individual loses the ability to make their own decisions, providing a continuous mechanism for decision-making. This distinction is critical for ensuring ongoing management of an individual's affairs, even in cases of sudden or progressive incapacitation.

Dos and Don'ts

When it comes to filling out the South Dakota Durable Power of Attorney form, it’s crucial to pay attention to detail and exercise caution. This document grants significant authority to someone else, handling your affairs if you're unable to do so. Here are four dos and don'ts to consider during the process:

Do:

- Review the form thoroughly to ensure you understand the extent of the powers being granted. This understanding is critical as it shapes the future handling of your affairs.

- Choose an agent you trust implicitly. The person you appoint will have considerable control over your finances and legal decisions, so it’s important they are trustworthy and capable.

- Be specific about the powers you are granting. If there are particular areas you want your agent to have control over—or limitations you wish to impose—make these clear in the document.

- Sign the form in the presence of a notary public. This formalizes the document, making it legally binding and more likely to be respected by financial institutions and other entities.

Don’t:

- Delay in completing and signing the form. Life is unpredictable, and having a Durable Power of Attorney in place is a proactive step in managing your affairs, regardless of what the future holds.

- Fill out the form in a hurry without considering all the relevant factors. This legal document requires thoughtful consideration to ensure your interests are fully protected.

- Forget to discuss your wishes and any specific instructions with the person you’ve chosen as your agent. Clear communication can prevent misunderstandings and conflicts later on.

- Overlook the importance of updating the document. As your circumstances change, it may be necessary to revise the powers granted or even choose a different agent.

Misconceptions

When discussing the Durable Power of Attorney (POA) form in South Dakota, various misconceptions can lead to confusion and hesitancy. Understanding these misconceptions is crucial for individuals preparing to make important decisions regarding their financial affairs in the event they cannot manage them personally.

- Misconception 1: The Durable Power of Attorney grants the agent complete control over all of the principal's assets immediately after signing. In reality, the principal specifies the extent of power given to the agent, which can be as broad or as limited as desired. The document can also specify when the agent's power becomes effective.

- Misconception 2: A Durable Power of Attorney is only for the elderly. While it's often part of planning for older age, anyone at any time can face situations where they're unable to manage their affairs due to unexpected illness or injury. It's a valuable document for adults of all ages.

- Misconception 3: Creating a Durable Power of Attorney means losing independence. This is not the case; it's about safeguarding one's independence by appointing a trusted agent to act only if necessary. The principal retains the ability to make decisions as long as they're able.

- Misconception 4: The agent can make health care decisions under a Durable Power of Attorney. In South Dakota, the Durable Power of Attorney typically relates to financial and property matters. Health care decisions require a separate document, known as a Health Care Power of Attorney.

- Misconception 5: A Durable Power of Attorney cannot be revoked. As long as the principal is mentally competent, they can revoke the Durable Power of Attorney at any time. It's essential to communicate the revocation to all relevant parties effectively.

- Misconception 6: A form found online will be sufficient. While online forms can provide a basic structure, South Dakota laws have specific requirements that might not be met by a generic form. Consulting with a legal professional ensures that the document is valid and meets all legal standards in South Dakota.

Understanding these misconceptions is vital for anyone considering a Durable Power of Attorney in South Dakota. By clarifying these points, individuals can take informed steps to manage their affairs responsibly and according to their wishes.

Key takeaways

When considering the use of a Durable Power of Attorney (DPOA) form in South Dakota, it's important to grasp its significance and how it operates. This document allows you to appoint someone to make decisions on your behalf should you become incapacitated. Below are five key points to guide you through the completion and use of the South Dakota DPOA form:

- Choose the right agent: The individual you select as your agent holds significant responsibility. It should be someone you trust implicitly to make decisions in your best interests, not just someone who is willing to take on the role. This person will have the authority to manage your financial affairs, including, but not limited to, handling bank transactions, managing real estate, and making investment decisions.

- Understand the powers you are granting: It's crucial to be clear about what your agent can and cannot do with a DPOA in South Dakota. The form allows you to specify and limit the powers you delegate, ensuring the agent acts within the scope you are comfortable with. Read each section carefully to tailor the powers to your needs.

- Sign in the presence of a notary: For a DPOA to be legally valid in South Dakota, it must be signed in the presence of a notary. This step is essential to confirm the authenticity of the document and your signature, providing an extra layer of legal protection and credibility.

- Consider a springing DPOA: South Dakota allows for the creation of a "springing" DPOA, which becomes effective only if and when you become incapacitated. This arrangement can offer peace of mind to those concerned about relinquishing control too soon, as it ensures the document only takes effect under the circumstances you specify.

- Keep records and copies safe: Once executed, it's important to keep the original DPOA in a secure location and inform your agent where it can be found. Additionally, providing copies to financial institutions and other relevant parties ensures that your agent's authority is recognized and can be acted upon without unnecessary delay.

More Durable Power of Attorney State Forms

Poa Papers - This form allows you to choose someone to legally represent your interests when necessary.

New Mexico Durable Power of Attorney - It offers an alternative to more restrictive guardianship or conservatorship arrangements, favoring a more flexible and personalized approach to managing one's affairs.

Power of Attorney Ct - Discussing the decision and the contents of the Durable Power of Attorney with close family members can prevent conflicts later.

Power of Attorney Alaska - Eases the burden of financial management through the appointment of a trusted agent.