Attorney-Verified Durable Power of Attorney Document for Tennessee

In the realm of personal and estate planning, the Tennessee Durable Power of Attorney (DPOA) emerges as a critical legal instrument, empowering individuals to designate an agent to manage their affairs in the event that they are no longer capable of doing so themselves. This form, unique to Tennessee, serves as a safeguard, ensuring that a person's financial, healthcare, and personal matters can be handled according to their wishes, even in their absence or incapacity. Its durability means that the appointed power remains effective even if the principal becomes incapacitated, distinguishing it from other forms of power of attorney that may terminate under such circumstances. By comprehensively detailing the scope of authority granted to the agent, the Tennessee DPOA form provides a structured approach to future planning, blending legal foresight with personal care. The selection of an agent is a decision that bears significant responsibility and requires trust, as this individual will have substantial control over the principal's affairs. The form not only outlines the powers granted but also includes provisions for revoking the power, ensuring that the principal retains ultimate control over the appointment. The strategic execution of this document necessitates a thorough understanding of its provisions and implications, underscored by the advice of legal professionals who can navigate the intricacies of Tennessee law and ensure that the document reflects the principal's intentions and complies with state requirements.

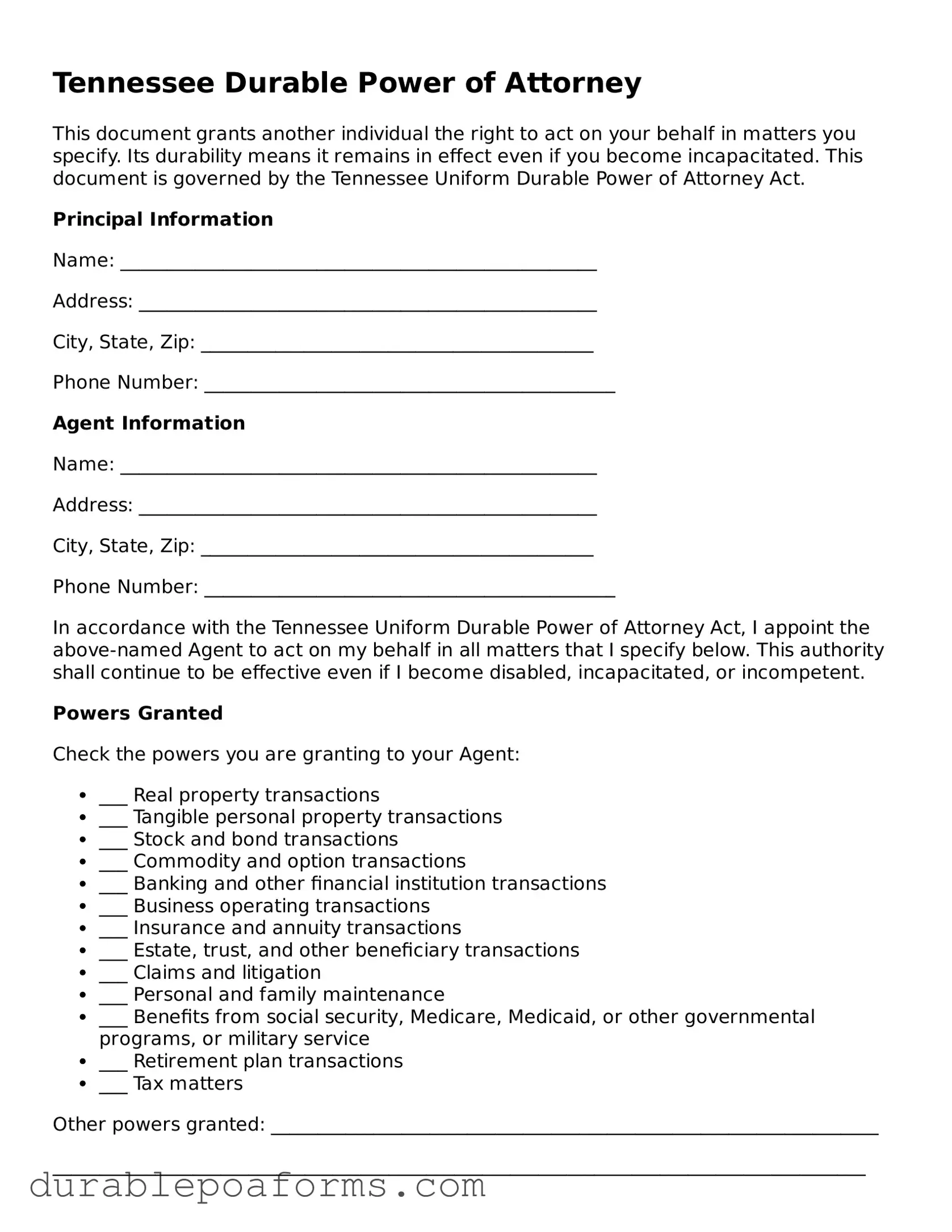

Form Preview

Tennessee Durable Power of Attorney

This document grants another individual the right to act on your behalf in matters you specify. Its durability means it remains in effect even if you become incapacitated. This document is governed by the Tennessee Uniform Durable Power of Attorney Act.

Principal Information

Name: ___________________________________________________

Address: _________________________________________________

City, State, Zip: __________________________________________

Phone Number: ____________________________________________

Agent Information

Name: ___________________________________________________

Address: _________________________________________________

City, State, Zip: __________________________________________

Phone Number: ____________________________________________

In accordance with the Tennessee Uniform Durable Power of Attorney Act, I appoint the above-named Agent to act on my behalf in all matters that I specify below. This authority shall continue to be effective even if I become disabled, incapacitated, or incompetent.

Powers Granted

Check the powers you are granting to your Agent:

- ___ Real property transactions

- ___ Tangible personal property transactions

- ___ Stock and bond transactions

- ___ Commodity and option transactions

- ___ Banking and other financial institution transactions

- ___ Business operating transactions

- ___ Insurance and annuity transactions

- ___ Estate, trust, and other beneficiary transactions

- ___ Claims and litigation

- ___ Personal and family maintenance

- ___ Benefits from social security, Medicare, Medicaid, or other governmental programs, or military service

- ___ Retirement plan transactions

- ___ Tax matters

Other powers granted: _________________________________________________________________

_______________________________________________________________________________________

Special Instructions

Special instructions for your Agent that limit or extend the powers granted above, if any:

_______________________________________________________________________________________

_______________________________________________________________________________________

By signing below, I affirm that the individual named as Agent is someone I trust to manage my affairs in my best interest. I acknowledge this document does not revoke any powers of attorney that were effective before the date this document is signed. I understand that this Durable Power of Attorney is not terminated by subsequent incapacity of the Principal except as provided by the Tennessee Uniform Durable Power of Attorney Act.

This Power of Attorney shall become effective on the date of ______________, 20_____, and shall remain effective indefinitely unless I specify a termination date here: _________________, 20_____.

Signature of Principal: _______________________________ Date: ______________, 20_____

This document was signed in the presence of:

Witness 1

Name: ___________________________________________________

Address: _________________________________________________

City, State, Zip: __________________________________________

Signature: _______________________________ Date: ______________, 20_____

Witness 2

Name: ___________________________________________________

Address: _________________________________________________

City, State, Zip: __________________________________________

Signature: _______________________________ Date: ______________, 20_____

Notarization (if required or desired):

This document was acknowledged before me on (date) _____________, 20_____, by (name of Principal) ________________________, who is personally known to me or has produced identification in the form of ___________________________.

Signature of Notary Public: _____________________________________

My commission expires: _____________, 20_____

Form Specifications

| Fact | Description |

|---|---|

| Durability | A Tennessee Durable Power of Attorney remains effective even if the principal becomes incapacitated, ensuring that the appointed agent can still make decisions on the principal's behalf. |

| Governing Law | The form and its execution are governed by the Tennessee Uniform Durable Power of Attorney Act, which outlines the creation, use, and requirements for a legally binding durable power of attorney in the state. |

| Principal Requirements | The individual creating a Durable Power of Attorney must be a legal adult of sound mind, fully understanding the implications and authority they are granting to their designated agent. |

| Agent Responsibilities | The chosen agent is obligated to act in the principal's best interest, manage affairs as directed or as they deem beneficial for the principal in the absence of specific directions, and to avoid conflicts of interest. |

Tennessee Durable Power of Attorney - Usage Guide

Filling out a Durable Power of Attorney (DPOA) form is a crucial step in planning for the future. It empowers someone you trust to make decisions on your behalf should you become unable to do so yourself. This guide will walk you through the process of completing a DPOA form in Tennessee, ensuring that all necessary fields are correctly filled in. It's important to approach this task with attention to detail to ensure that your wishes are clearly communicated and legally recognized. Let’s get started with the straightforward steps needed to fill out your form.

- Start by downloading the latest version of the Tennessee Durable Power of Attorney form from a reliable source to ensure you have the correct document.

- Enter your full legal name and address at the top of the form, where indicated, to establish your identity as the principal—the person granting power to another.

- Identify the person you are appointing as your attorney-in-fact—the individual who will make decisions on your behalf. Provide their full legal name and contact information.

- Specify the powers you are granting to your attorney-in-fact. Be as clear and detailed as possible. This could range from general powers handling financial matters to specific authorities like selling property or managing healthcare decisions.

- If you wish to impose any limitations on the powers granted, clearly outline them in the section provided. This ensures that your attorney-in-fact knows the bounds of their authority.

- For the DPOA to be considered "durable," meaning it remains in effect even if you become incapacitated, ensure the form includes language that specifies this intent. This is typically included in the default language of the form but review to confirm.

- Review the form thoroughly to ensure all information is accurate and complete. Any errors or omissions could impact its validity or effectiveness.

- Sign the form in the presence of a notary public. Tennessee law requires DPOA forms to be notarized to be legally binding. Ensure the notary also signs and places their official seal on the document.

- It is highly recommended to also have two witnesses sign the form, as this can add an additional layer of validation. Make sure these witnesses are adults and fully understand what they are witnessing.

- Finally, communicate with your attorney-in-fact about their appointment. Provide them with a copy of the completed form and discuss your wishes and expectations.

By following these steps, you can successfully complete the Tennessee Durable Power of Attorney form. This legal document is an important part of your planning, providing peace of mind for you and your loved ones. Remember, it is always advisable to consult with a legal professional or advisor to ensure that your DPOA meets all legal requirements and accurately reflects your wishes.

Common Questions

What is a Tennessee Durable Power of Attorney?

A Tennessee Durable Power of Attorney (DPOA) is a legal document that allows an individual, known as the principal, to designate another person, called the agent or attorney-in-fact, to make financial, legal, and sometimes health-related decisions on their behalf. The term "durable" means that the power of attorney remains in effect even if the principal becomes incapacitated.

Who can serve as an agent under a Durable Power of Attorney in Tennessee?

Any competent adult, such as a family member, friend, or professional, can serve as an agent. It's important that the principal trusts the person they choose as their agent, as they will be making critical decisions on the principal's behalf. The agent must also be willing to take on the responsibility.

What are the requirements for a Durable Power of Attorney to be valid in Tennessee?

In Tennessee, for a Durable Power of Attorney to be valid, it must be in writing, signed by the principal, and notarized. Additionally, it should clearly state that the principal intends for the authority to continue to be effective even if they become incapacitated. Some types of decisions may require specific language or stipulations to be included in the document for the DPOA to be effective.

Can a Durable Power of Attorney be revoked?

Yes, a DPOA can be revoked at any time by the principal as long as the principal is mentally competent. The revocation must be in writing and adheres to certain procedural requirements, such as being notarized or witnessed. It is also important to inform the agent and any institutions or individuals that were relying on the original DPOA of the revocation.

What happens if my Durable Power of Attorney is not recognized by a third party?

If a third party refuses to recognize a valid DPOA, first ensure the document meets all Tennessee legal requirements and specifically grants the authority needed for the situation. If refusal continues, legal advice may be necessary. In some cases, the third party may require their own forms to be completed in addition to recognizing the DPOA.

Is a Durable Power of Attorney from another state valid in Tennessee?

Generally, a Durable Power of Attorney executed in another state will be recognized in Tennessee as long as it complies with the laws of the state where it was executed. However, there may be specific instances or decision types where additional requirements must be met for it to be effective in Tennessee.

Do financial institutions have specific requirements for a Durable Power of Attorney?

Yes, financial institutions may have specific forms or requirements that need to be met in addition to presenting a Durable Power of Attorney. It is advisable to contact the financial institution beforehand to understand their specific requirements to ensure the DPOA will be accepted without issues.

What should I do if I lose my Durable Power of Attorney document?

If you lose your Durable Power of Attorney document, it is important to execute a new one as soon as possible. Ensure the new document specifies that it revokes all previous powers of attorney. Inform your agent, financial institutions, and any other relevant parties about the loss and provide them with the new DPOA.

Can a Durable Power of Attorney be used to make healthcare decisions?

In Tennessee, a Durable Power of Attorney can include provisions to allow the agent to make healthcare decisions on the principal's behalf if it is explicitly stated within the document. However, it is more common to have a separate document known as a Durable Power of Attorney for Health Care to specifically address healthcare decisions.

Common mistakes

In Tennessee, like in many other states, a Durable Power of Attorney (DPOA) serves as a crucial document, allowing an individual to appoint another person to make decisions on their behalf, particularly in financial matters. However, despite its importance, a significant number of people make errors while completing this form. These mistakes can undermine the document's effectiveness, leading to delays, complications, and even legal battles. Here are ten common missteps to avoid:

- Not specifying powers clearly: One of the most common errors is a failure to clearly outline the powers granted. Without specificity, it leaves room for interpretation, which might not align with the principal's original intent.

- Choosing the wrong agent: The agent’s role is pivotal. Selecting someone who is not trustworthy or reliable can have dire consequences. It’s vital to choose an agent who will act in the principal's best interests.

- Ignoring succession planning: Many overlook the importance of appointing a successor agent. If the original agent is unable or unwilling to serve, having a successor ensures continuity.

- Not discussing responsibilities with the agent: Failing to communicate with the chosen agent about their duties and the principal’s expectations can lead to confusion and mismanagement down the line.

- Omitting limitations on authority: Some people grant broader powers than necessary. Setting boundaries on the agent’s authority can prevent misuse of power.

- Forgetting to include a date: The document should be dated when signed. This can help in establishing the timeline, which is especially important if the document is contested.

- Failing to sign in the presence of the required witnesses or notary: Tennessee law mandates that a DPOA be signed in the presence of a notary and/or the required number of witnesses. Ignoring this requirement can invalidate the document.

- Not keeping the document accessible: Once signed, if a DPOA is not kept in a location where it can be easily accessed when needed, it defeats its purpose.

- Using a generic form without verifying state-specific requirements: State laws vary, and using a form that does not meet Tennessee’s specific requirements can render the document ineffective.

- Not updating the document: Circumstances change, and a DPOA should be reviewed and updated accordingly to reflect the current wishes of the principal and the law.

Creating a Durable Power of Attorney is a process that requires careful consideration and attention to detail. By avoiding these common mistakes, individuals can ensure that their financial affairs will be managed in accordance with their wishes, should they become unable to do so themselves. It is always advisable to consult with a legal professional to guide you through this process, ensuring that all legal requirements are met and that the document is tailored to your specific needs.

Documents used along the form

In the realm of legal documentation, the Durable Power of Attorney form in Tennessee plays a pivotal role in ensuring that individuals have a trusted representative to manage their affairs, should they become incapacitated. However, this form is often part of a more extensive portfolio of documents designed to cover various aspects of one’s legal and personal affairs. The careful assembly of these documents can offer comprehensive protection and ease of management for both the individual and their designated agents. Below is a list of forms and documents frequently used alongside the Tennessee Durable Power of Attorney, each serving a distinct yet complementary purpose.

- Advance Health Care Directive: Also known as a living will, this document specifies an individual’s health care preferences in situations where they're unable to make decisions themselves. It often designates a health care proxy.

- Will: A legal declaration by which an individual, the testator, names one or more persons to manage their estate and provides for the distribution of their property at death.

- Revocable Living Trust: Allows the grantor to maintain control over their assets during their lifetime and specifies how these assets should be managed and distributed after their death.

- General Power of Attorney: Different from a durable power, this grants an agent authority to handle affairs only while the principal is mentally competent.

- Medical Power of Attorney: Designates an individual to make health care decisions on the principal’s behalf when they are unable to do so.

- Authorization for Final Disposition: A document where an individual can outline their wishes for their funeral arrangements and disposition of their remains.

- HIPAA Release Form: Authorizes the release of an individual’s health information to designated persons, facilitating the management of health care decisions by agents.

- Declaration for Mental Health Treatment: Specifies an individual’s preferences regarding mental health treatment, including decisions about medications, counseling, and hospitalization.

- Financial Statement: While not a legal form, a detailed financial statement can aid the designated agent in understanding the scope of the principal’s assets and liabilities.

- Property Deeds: Legal documents that transfer property ownership. They’re crucial for managing real estate assets and ensuring they are correctly handled in accordance with the principal’s wishes.

Together, these documents form a robust legal framework that safeguards an individual’s wishes across various aspects of life and death. It's important for individuals to discuss their options with legal professionals who can provide guidance tailored to their specific circumstances. Ultimately, the careful selection and completion of these documents can offer peace of mind and a sense of preparedness for whatever the future holds.

Similar forms

The Tennessee Durable Power of Attorney form is similar to other estate planning documents, but there are unique distinctions worth noting. This legal instrument allows someone to appoint an agent to act on their behalf in financial matters, specifically designed to remain in effect if the principal becomes incapacitated. Its purpose and structure can be compared to a few other critical documents, each with its distinct role in comprehensive estate planning.

Health Care Power of Attorney: Much like the Durable Power of Attorney, a Health Care Power of Attorney empowers an agent to make decisions on someone else's behalf. The crucial difference lies in the scope of decision-making authority. While the Durable Power of Attorney focuses on financial and legal decisions, a Health Care Power of Attorney is dedicated to medical decisions. This distinction ensures that a person's well-being is managed separately from their financial affairs, allowing for specialized decision-making in each area.

Living Will: Another document sharing similarities with the Tennessee Durable Power of Attorney is the Living Will. Both are advance directives used to communicate a person's wishes regarding personal care and financial management in the event of incapacitation. However, a Living Will specifically addresses end-of-life decisions, such as life support and other medical interventions, whereas a Durable Power of Attorney authorizes someone to handle a broad range of financial matters. Thus, the Living Will complements the Durable Power of Attorney by covering aspects of care that fall outside the latter's financial scope.

General Power of Attorney: The General Power of Attorney and the Tennessee Durable Power of Attorney share a common foundation—they both authorize an agent to perform a wide range of acts on the principal's behalf. The pivotal difference is in their durability. A General Power of Attorney typically ceases to be effective if the principal becomes incapacitated or mentally incompetent. On the other hand, a Durable Power of Attorney is specifically designed to maintain its validity even under those circumstances, providing a continuous mechanism for managing the principal’s affairs without interruption.

Each of these documents serves a unique purpose within an individual's estate plan, addressing different areas of personal care and asset management. Understanding the specific roles and distinctions among them is crucial for thorough and effective estate planning. While the Durable Power of Attorney for financial affairs forms a cornerstone of this plan, integrating it with health care directives and living wills ensures comprehensive coverage for all aspects of one’s life and legacy.

Dos and Don'ts

When you're preparing to complete the Tennessee Durable Power of Attorney form, it's crucial to approach the task with attention to detail and care. This document significantly impacts your financial and legal affairs, allowing someone else to make decisions on your behalf. To help you navigate the process successfully, here are essential dos and don'ts:

Do:- Read the form thoroughly before you start filling it out, ensuring you understand every section and its implications.

- Choose a trusted person as your agent. This person will have considerable control over your affairs, so it's vital they are trustworthy and capable.

- Be specific about the powers you grant. Clearly outline what your agent can and cannot do on your behalf to prevent any abuse of power.

- Discuss your wishes with your agent before you finalize the document. It’s important they understand your preferences and are willing to act according to your instructions.

- Sign the form in the presence of a notary public to ensure its legality. This step is crucial for the document to be recognized as valid.

- Keep the original document in a safe place, and inform your agent and family members where it is stored.

- Review and update the document as needed. Life changes such as divorce, relocation, or the death of your chosen agent may necessitate adjustments.

- Leave any sections blank. If a section doesn’t apply, mark it as ‘N/A’ (not applicable) instead of leaving it empty.

- Rush through the process without understanding what you’re signing. Take your time to fill out the form accurately.

- Forget to specify the expiration date if you want the power of attorney to be limited to a certain period.

- Overlook the importance of legal advice. Consult a legal professional if you have any doubts or questions about the document.

- Use unclear or ambiguous language that could lead to multiple interpretations. Clarity is key in legal documents.

- Ignore state-specific requirements. Laws can vary significantly from one state to another, so it’s crucial to ensure your document complifies with Tennessee law.

- Fall for scams or predatory services offering to complete the form for you at an exorbitant price. Always verify the credibility of any service or individual offering help.

By following these guidelines, you can fill out the Tennessee Durable Power of Attorney form correctly and ensure your interests are protected. Remember, this document plays a foundational role in managing your affairs should you become unable to do so yourself, making it essential to approach the process with the gravity it deserves.

Misconceptions

Discussing the durable power of attorney in Tennessee, it's crucial to clarify common misconceptions. This legal document allows someone to act on your behalf in financial and legal matters when you cannot make decisions due to incapacity. Misunderstandings can lead to confusion and legal complications. Here are eight common misconceptions and the truths behind them:

- A durable power of attorney and a will are the same. Unlike a will, which takes effect upon death, a durable power of attorney is active during the principal's lifetime, particularly when they are incapacitated.

- It grants unlimited power. The truth is, the scope of authority is defined by the document itself. You can limit the agent's powers to specific areas.

- Any form downloaded from the internet will work. While templates can provide a starting point, Tennessee law has specific requirements that must be met for the document to be valid.

- Once signed, it cannot be revoked. The principal has the right to revoke this power as long as they are mentally competent.

- The agent can make healthcare decisions. A durable power of attorney in Tennessee is typically limited to financial and property matters. A separate document, known as a healthcare power of attorney, is needed for medical decisions.

- It is effective immediately upon signing. While this can be true, the principal can also specify that the powers come into effect under certain conditions, such as upon the principal's incapacitation.

- A court proceeding is needed to activate it. One of the advantages of a durable power of attorney is that it avoids the need for court involvement, as it becomes effective under the terms specified in the document.

- Your spouse automatically has the same powers. In actuality, for a spouse to have such powers, they must be named as the agent in the durable power of attorney document. Marital status alone doesn't grant any legal authority.

Clearing up these misconceptions about the Tennessee Durable Power of Attorney is important for ensuring your wishes are respected and your affairs are handled as you intend, especially under circumstances when you're unable to make decisions yourself.

Key takeaways

Filling out the Tennessee Durable Power of Attorney form is a significant step in planning for future financial and health decisions. This legal document allows you to appoint someone you trust to manage your affairs if you're unable to do so yourself. Here are six key takeaways to consider when filling out and using this form:

- Choose an Agent Carefully: The person you appoint as your agent (sometimes referred to as an attorney-in-fact) will have broad powers to manage your financial and legal affairs. It's crucial to choose someone who is not only trustworthy but also capable of making decisions that align with your wishes.

- Understand the Powers Granted: The Tennessee Durable Power of Attorney can cover a wide range of activities, including buying or selling property, managing bank accounts, and making healthcare decisions. Be clear on what powers you are granting to your agent.

- Durability is Key: The term "durable," in the context of power of attorney, means that the document remains in effect even if you become incapacitated. This is crucial for ensuring that your agent can act on your behalf if you're unable to make decisions yourself.

- Sign in the Presence of a Notary: To be valid, the Tennessee Durable Power of Attorney must be signed in the presence of a notary public. This step ensures that your signature is authenticated and the document is legally binding.

- Keep Copies in Safe Places: After the form is completed and notarized, it's essential to keep the original in a safe place and provide copies to your agent, as well as any institutions (like banks or healthcare providers) that might need it.

- Review and Update Regularly: Life changes such as marriage, divorce, the birth of a child, or a change in financial situation should prompt a review of your Durable Power of Attorney. Ensure it still reflects your wishes and update it as necessary.

By following these guidelines, you can make informed decisions about setting up a Durable Power of Attorney in Tennessee that protects your interests and ensures your affairs are managed according to your wishes.

More Durable Power of Attorney State Forms

How to Get Power of Attorney in Virginia - Grants the power to manage your financial life to someone else, under your terms.

Hawaii Power of Attorney - Guarantees that your financial dealings are in good hands, by appointing someone to make decisions on your behalf.

Free Power of Attorney Form Mississippi - This legal document is crucial for anyone wanting to secure their financial and personal matters.

Oregon Durable Power of Attorney Form Free - This legal arrangement can be customized to limit or expand the powers given to the agent, based on individual needs.