Attorney-Verified Durable Power of Attorney Document for Texas

Life often presents unpredictable challenges that require preparation, especially when it comes to managing personal and financial affairs. In Texas, the Durable Power of Attorney form serves as a critical tool for individuals planning ahead for situations where they might not be able to make decisions for themselves. By appointing a trusted person as their agent, individuals can ensure that their financial matters are handled according to their wishes, even if they are incapacitated. This form stands out because, unlike regular power of attorney documents that lose their validity if the principal becomes incapacitated, the durable version remains in effect, providing peace of mind and continuity. It's important for both the person filling out the form and the appointed agent to understand the responsibilities and powers being granted, which can range from managing bank accounts to handling real estate transactions. Addressing these considerations in the Texas Durable Power of Attorney form not only protects the principal's assets but also minimizes confusion and conflict among family members during difficult times.

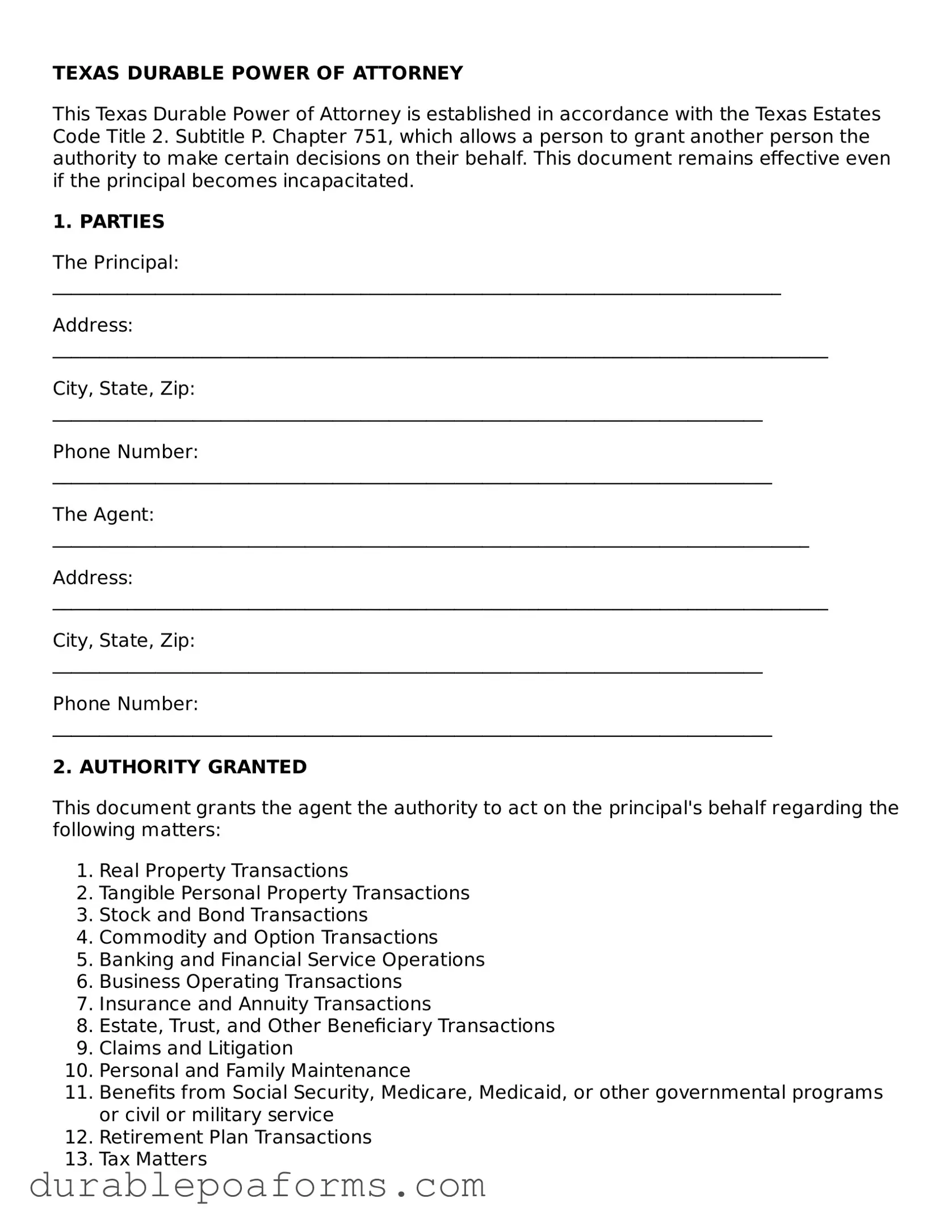

Form Preview

TEXAS DURABLE POWER OF ATTORNEY

This Texas Durable Power of Attorney is established in accordance with the Texas Estates Code Title 2. Subtitle P. Chapter 751, which allows a person to grant another person the authority to make certain decisions on their behalf. This document remains effective even if the principal becomes incapacitated.

1. PARTIES

The Principal: ______________________________________________________________________________

Address: ___________________________________________________________________________________

City, State, Zip: ____________________________________________________________________________

Phone Number: _____________________________________________________________________________

The Agent: _________________________________________________________________________________

Address: ___________________________________________________________________________________

City, State, Zip: ____________________________________________________________________________

Phone Number: _____________________________________________________________________________

2. AUTHORITY GRANTED

This document grants the agent the authority to act on the principal's behalf regarding the following matters:

- Real Property Transactions

- Tangible Personal Property Transactions

- Stock and Bond Transactions

- Commodity and Option Transactions

- Banking and Financial Service Operations

- Business Operating Transactions

- Insurance and Annuity Transactions

- Estate, Trust, and Other Beneficiary Transactions

- Claims and Litigation

- Personal and Family Maintenance

- Benefits from Social Security, Medicare, Medicaid, or other governmental programs or civil or military service

- Retirement Plan Transactions

- Tax Matters

3. DURATION

This Power of Attorney shall become effective immediately upon execution and shall remain effective indefinitely unless a specific termination date is otherwise provided here: _______________________.

4. THIRD PARTY RECOGNITION

Any third party who receives a copy of this document may act under it. Revocation of this Durable Power of Attorney is not effective as to a third party until the third party learns of the revocation.

5. SIGNATURES

This document must be signed and dated by the principal in the presence of a Notary Public or two adult witnesses to be legally effective.

Principal's Signature: ___________________________ Date: ________________

State of Texas, County of ______________________:

This document was acknowledged before me on __________________ (date) by _________________________ (name of principal).

Notary Public: __________________________________

My Commission Expires: _________________________

Witness #1 Signature: ___________________________ Date: ________________

Print Name: _____________________________________

Witness #2 Signature: ___________________________ Date: ________________

Print Name: _____________________________________

Form Specifications

| Fact | Description |

|---|---|

| Definition | A Texas Durable Power of Attorney form is a legal document that allows a person (the principal) to designate another person (the agent) to make financial decisions and take certain actions on their behalf. |

| Governing Law | This form is governed by the Texas Estates Code, specifically Title 2, Subtitle P, Chapter 751. |

| Durability | It remains in effect even if the principal becomes incapacitated, ensuring that the agent can continue to act on their behalf. |

| Revocation | The principal can revoke the power of attorney at any time, as long as they are competent. |

| Execution Requirements | To be legally valid, the form must be signed by the principal, in the presence of two witnesses or acknowledged before a notary public. |

| Scope of Powers | The document can grant broad powers, including managing bank accounts, real estate transactions, and personal property, or it can be limited to specific actions. |

| Appointment of Multiple Agents | The principal can appoint more than one agent, either to act jointly or separately in making decisions. |

| Springing Powers | The document can be designed to become effective only upon the occurrence of a specified event, usually the principal's incapacitation. |

| Notarization | While notarization is not mandatory under Texas law, it is highly recommended to ensure the document's acceptance by third parties. |

| Financial Institution Acceptance | Banks and other financial institutions may have their own requirements for accepting a durable power of attorney, and in some cases, may require their own forms to be completed. |

Texas Durable Power of Attorney - Usage Guide

When preparing to fill out the Texas Durable Power of Attorney form, it's crucial to understand that this document allows you to designate someone to make important decisions on your behalf should you become unable to do so yourself. This could cover a wide range of decisions, including financial, real estate, and other personal matters. It's a significant step that requires careful thought and precision to ensure your wishes are clearly communicated and legally binding. The following steps will guide you through the process of completing the form accurately.

- Start by downloading the latest version of the Texas Durable Power of Attorney form from a reliable source to ensure it's up-to-date with current laws.

- Read the entire form carefully before filling it out to understand all sections and instructions. This will help you gather all the necessary information beforehand.

- In the designated area, print your full legal name and address to identify yourself as the principal (the person granting the power).

- Identify the agent (the person who will be making decisions on your behalf) by writing their full legal name and address in the specified section. Make sure the agent is a trustworthy individual who understands your wishes.

- If you wish to appoint a successor agent (a backup in case the primary agent is unable or unwilling to serve), fill in their information in the appropriate section. This step is optional but recommended.

- Specify the powers you are granting to your agent by initialing next to each power listed on the form. Only grant powers that you are comfortable with and that you have discussed with your agent.

- For powers not expressly listed on the form, use the special instructions section to describe them clearly and concisely. Be as specific as possible to avoid any confusion or ambiguity.

- Review the form thoroughly to ensure all information is correct and that you have not missed any important sections.

- Sign and date the form in the presence of a notary public. This step is crucial for the document to be legally valid. The notary will also need to sign and affix their seal.

- Provide a copy of the fully executed document to your agent and any successor agent you have named. It's also advisable to keep several copies in a safe place and inform a trusted individual of where to find it.

After completing the Texas Durable Power of Attorney form, it becomes a crucial part of your personal and legal preparedness. Keep in mind that circumstances can change, so it's wise to review and potentially update the document periodically, especially after major life events. If you decide to change your agent or modify the powers granted, you will need to complete a new form and formally revoke the previous one to ensure your current wishes are honored.

Common Questions

What is a Texas Durable Power of Attorney?

A Texas Durable Power of Attorney is a legal document that allows an individual, known as the principal, to designate another person, known as the agent or attorney-in-fact, to make decisions and take actions on their behalf. Unlike a general power of attorney, a durable power of attorney remains in effect even if the principal becomes incapacitated or mentally incompetent.

Who can be appointed as an agent in a Texas Durable Power of Attorney?

In Texas, any competent adult can be appointed as an agent in a Durable Power of Attorney. It is important for the principal to choose someone they trust implicitly, as the agent will have significant control over their affairs, potentially including financial, legal, and medical decisions.

What kinds of powers can I grant to my agent?

An individual can grant their agent a wide range of powers in a Durable Power of Attorney, including buying or selling property, managing financial affairs, making healthcare decisions, and handling legal claims. The specific powers granted can be tailored to the principal's needs and may be as broad or as limited as the principal desires.

Is a Texas Durable Power of Attorney form legally binding once signed?

Yes, a Texas Durable Power of Attorney becomes legally binding once it is properly signed. However, Texas law may require specific signing requirements to be met for the document to be valid, such as being signed in the presence of a notary public or witnesses, depending on the powers being granted.

What happens if I change my mind after creating a Durable Power of Attorney?

A principal has the right to revoke or change their Durable Power of Attorney at any time, as long as they are mentally competent. To do so, they should inform their agent in writing and, if necessary, create a new Durable Power of Attorney document to reflect their wishes.

Does a Durable Power of Attorney need to be filed with the state of Texas?

While it is not required to file a Durable Power of Attorney with the state of Texas, it may need to be presented to various institutions, such as banks or hospitals, to be recognized. Safekeeping and proper dissemination when needed are the responsibilities of the principal or their appointed agent.

Common mistakes

Filling out a Texas Durable Power of Attorney form is a significant step in planning for your future. This document allows someone you trust to manage your affairs if you're unable to do so yourself. However, people often make mistakes that can undermine their intentions. Understanding these common errors can help ensure your Durable Power of Attorney effectively reflects your wishes.

- Not thoroughly reading the form: It's crucial to understand each section of the Durable Power of Attorney form before filling it out. Skipping over sections or not fully understanding the implications of what you're signing can lead to issues down the line. Every choice should be made with a clear understanding of its consequences.

- Choosing the wrong agent: The role of the agent, or the person you designate to act on your behalf, is pivotal. Failing to choose someone who is both trustworthy and capable of handling your financial matters can result in mismanagement of your affairs. Consider this decision carefully.

- Failing to specify powers: The form allows you to detail what your agent can and cannot do. Being too vague or granting too broad powers without restrictions can lead to unintended outcomes. Be specific about what powers you are granting to ensure your agent can act as you would wish.

- Ignoring alternate agents: It’s wise to appoint an alternate agent in case your primary agent is unable or unwilling to serve. Neglecting to do so can leave your affairs in limbo if the unexpected happens.

- Not setting limitations: While it's important to grant your agent sufficient authority, setting limitations on their power can protect you from potential abuse. Specify any limits on the agent's authority in the document.

- Overlooking the need for notarization: In Texas, notarizing your Durable Power of Attorney is necessary for it to be legally valid. Failing to properly notarize the document can render it ineffective.

- Misunderstanding the durability provision: The “durability” aspect ensures that the document remains in effect if you become incapacitated. Make sure you understand how this works to avoid mistakenly believing the document will not remain in effect if you're incapacitated.

- Forgetting to discuss your wishes with your agent: It’s not enough to simply name someone as your agent; you must also communicate your preferences and expectations to them. Failure to do so can lead to decisions that don't align with your wishes.

- Not keeping the document accessible: After completing and notarizing your Durable Power of Attorney, keeping it in a safe but accessible location is vital. Your agent should know where to find it if they need to act on your behalf. Securely storing the document but ensuring its accessibility is key.

In summary, when filling out a Texas Durable Power of Attorney form, it’s imperative to approach the task with diligence and foresight. Avoiding these common mistakes can help ensure that the document accurately represents your intentions and can effectively guide your agent in managing your affairs. Remember, this document is a crucial part of your future planning and deserves careful consideration.

Documents used along the form

In the realm of legal documentation, especially when preparing for future financial management and health care decisions, the Texas Durable Power of Attorney form is a pivotal document. This form allows an individual to appoint another person to make financial decisions on their behalf should they become unable to do so. Alongside this essential document, there are several other forms and documents typically utilized to ensure a comprehensive approach to planning. These documents complement the Durable Power of Attorney by covering various aspects of personal and health decision-making.

- Medical Power of Attorney: This document enables an individual to designate a trusted person to make health care decisions on their behalf if they are unable to communicate their wishes directly. It ensures that health care providers follow the individual's preferences regarding treatments and medical interventions.

- Living Will: Often known as an Advance Directive, this document outlines an individual's wishes concerning life-sustaining treatment if they are terminally ill or in a persistent vegetative state. It guides health care providers and loved ones in making difficult end-of-life care decisions.

- Declaration of Guardian in Advance: This form allows an individual to choose a guardian for themselves before the need arises. It becomes effective if a court needs to appoint a guardian due to the individual's incapacity.

- HIPAA Release Form: The Health Insurance Portability and Accountability Act (HIPAA) privacy rule restricts access to an individual's health information. A HIPAA Release Form authorizes health care providers to disclose an individual's health information to designated persons, allowing loved ones to make informed decisions about the individual's health care.

Collectively, these documents create a robust legal framework that anticipates various facets of personal and health care decision-making. By addressing financial, health, end-of-life, and privacy considerations, individuals can ensure that their wishes are respected and that they are well-prepared for the future. It is advisable for individuals to consult with legal professionals to understand the implications and requirements of each document fully.

Similar forms

The Texas Durable Power of Attorney form is similar to other legal documents that allow individuals to appoint someone to make decisions on their behalf. This form is particularly focused on financial and property matters, enabling the designated person, known as an agent, to manage the principal's affairs if they become incapacitated.

One such document is the Medical Power of Attorney. Like the Durable Power of Attorney, a Medical Power of Attorney allows someone to appoint a trusted individual to make decisions on their behalf. However, the focus here is on healthcare decisions rather than financial ones. This distinction is crucial; while the Durable Power of Attorney covers financial management, the Medical Power of Attorney grants authority over medical treatment and health care decisions when the principal cannot make these decisions themselves.

Another document similar to the Texas Durable Power of Attorney is the General Power of Attorney. The General Power of Attorney also enables an individual to designate an agent to handle their affairs. The key difference lies in its durability. Unlike the Durable Power of Attorney, which remains in effect if the principal becomes incapacitated, the authority granted under a General Power of Attorney typically ceases if the principal loses the ability to make informed decisions. This element makes the Durable Power of Attorney a more robust option for planning long-term.

The Springing Power of Attorney bears resemblance too. It is designed to become effective only under certain conditions, such as the principal's incapacitation, as defined within the document itself. This feature closely aligns with the Durable Power of Attorney's focus on preparing for potential future incapacitation. However, the Springing Power of Attorney's activation is contingent upon specific events, making it distinct from the immediately effective Durable Power of Attorney.

Dos and Don'ts

Filling out a Texas Durable Power of Attorney form is an important process that gives another individual the legal authority to make decisions on your behalf should you become unable to do so. As you approach this task, there are key steps to follow and pitfalls to avoid to ensure the document meets legal standards and reflects your wishes accurately.

Things you should do:

Read and understand all sections of the form before beginning to fill it out. This ensures you are fully informed about the powers you are granting and to whom.

Select an agent whose judgment you trust implicitly. This individual will have significant responsibility, so choose someone who understands your values and wishes.

Be specific about the powers you are granting. The Texas Durable Power of Attorney form allows you to specify or limit the authority you give your agent, ensuring they can only act in ways you are comfortable with.

Discuss your wishes and instructions with the chosen agent before completing the form. Clear communication can prevent misunderstandings and ensure your agent feels comfortable with their duties.

Sign and date the form in the presence of a notary public. This step is crucial for the document to be legally valid and enforceable in Texas.

Things you shouldn't do:

Do not select an agent without considering their ability to handle the responsibility. It's important to choose someone who is not only trustworthy but also capable of managing the tasks required.

Avoid vague language when specifying the powers granted to your agent. Ambiguities could lead to confusion or legal challenges down the line.

Do not forget to update your Durable Power of Attorney as your situation changes. Life events such as marriage, divorce, or the death of an agent can necessitate adjustments to your document.

Refrain from using a Durable Power of Attorney form that is not specific to Texas. State-specific legal requirements ensure your document is valid and enforceable.

Do not delay in having the form legally executed. Procrastination can leave you unprotected in the event of an unexpected illness or incapacity.

By following these guidelines, you can complete the Texas Durable Power of Attorney form correctly and with confidence, knowing you've taken steps to secure your future financial and medical decisions in a manner that best reflects your wishes.

Misconceptions

Many people have misunderstandings about the Texas Durable Power of Attorney form, which can lead to confusion and sometimes even legal challenges. Here are five common misconceptions:

-

It grants power immediately upon signing. People often think that as soon as the Texas Durable Power of Attorney form is signed, the agent gains immediate power. In reality, the document can be structured to only take effect upon the principal's incapacitation, depending on how it's set up. This allows the principal to retain control until they are unable to make decisions for themselves.

-

The agent can do anything with the principal’s assets. While an agent under a Durable Power of Attorney has broad powers, they are bound by a fiduciary duty to act in the principal's best interest. They cannot simply do anything they want with the principal’s assets. The powers granted can also be limited by the specifications in the document itself.

-

It's valid in all states once signed in Texas. People often misconceive that a Power of Attorney signed in Texas is valid in all states. While many states will recognize out-of-state documents, this is not guaranteed. Each state has its own laws and regulations, and some may require specific language or a document to be signed in the presence of a state official.

-

It allows the agent to make health care decisions. A common misconception is that the Durable Power of Attorney covers health care decisions. In Texas, financial and health care powers of attorney are separate documents. The Durable Power of Attorney is for financial decisions, while medical decisions require a Medical Power of Attorney.

-

It overrides a will upon the principal's death. Some people believe that the Durable Power of Attorney can override the principal’s will upon their death. However, the authority granted through a Durable Power of Attorney ends upon the principal’s death. After death, the executor named in the will or an appointed administrator takes over, and the estate is settled according to the will or state law if there is no will.

Key takeaways

When it comes to managing your affairs, especially in times when you might not be able to make decisions for yourself, the Texas Durable Power of Attorney (DPOA) form is a significant legal document. Tackling this document requires a clear understanding of its implications and careful consideration to ensure your interests are appropriately safeguarded. Here are seven key takeaways to guide you through filling out and using the Texas Durable Power of Attorney form:

Understand the Purpose: A Durable Power of Attorney in Texas allows you to appoint someone you trust (the agent) to manage your financial affairs if you become incapacitated or unable to handle them yourself. Unlike a general power of attorney, it remains in effect if you become mentally incompetent.

Choose Your Agent Wisely: The person you choose as your agent will have significant power over your financial and legal matters. It's crucial to select someone who is not only trustworthy but also capable of handling the responsibilities and acting in your best interest.

Be Specific About Powers Granted: The DPOA form allows you to specify exactly which powers you grant to your agent. These can range from handling bank transactions to making real estate decisions. Being explicit about what your agent can and cannot do is essential.

Sign in the Presence of a Notary: For your Durable Power of Attorney to be valid in Texas, it must be signed in the presence of a notary public. This step is crucial to ensure that the document is legally binding and recognized.

Consider a Springing DPOA: Texas law allows for the creation of a "springing" DPOA, which means it only comes into effect under certain conditions, such as a doctor certifying that you are incapacitated. This adds an extra layer of control over when the document becomes active.

Keep the Document Accessible: Once the DPOA is signed and notarized, keep it in a safe but accessible place. Inform your agent where the document is stored, so it can be accessed quickly if needed.

Regularly Review and Update: Your circumstances and relationships can change over time. Regularly review your DPOA to ensure it remains relevant to your current situation. If necessary, update it to reflect new agents or altered powers.

Filling out and using a Texas Durable Power of Attorney form is a matter of thinking ahead and preparing for the unexpected. With thoughtful consideration and careful planning, you can ensure that your financial and legal matters are in trusted hands, even in times when you might not be able to manage them yourself.

More Durable Power of Attorney State Forms

Power of Attorney Nevada - It remains effective even if you become mentally incapacitated, ensuring continuous management of your matters.

Power of Attorney Services Near Me - It assists in the meticulous preparation for the possibility of diminishing mental faculties, safeguarding against the implications of dementia or similar conditions.

Poa Papers - Maintains control over your assets and decisions by specifying who can act in your stead.

Durable Power of Attorney Form Pennsylvania - Documentary proof giving someone else the right to manage your personal business.