Attorney-Verified Durable Power of Attorney Document for Utah

In the arena of estate planning and personal affairs management, the importance of a well-prepared Utah Durable Power of Attorney (DPOA) form cannot be overstated. Serving as a crucial legal instrument, it enables an individual to appoint another person, known as an agent or attorney-in-fact, to manage their financial and legal matters in the event they become incapacitated or unable to make decisions themselves. Distinct from ordinary power of attorney forms, the durability provision ensures that the agent's authority persists even after the principal’s incapacitation, providing a seamless continuation of financial management without the need for court intervention. This form encompasses a broad range of powers, from handling bank transactions to making real estate decisions, thereby necessitating a comprehensive understanding and careful selection of powers granted to the agent. The state of Utah requires this document to meet specific formalities, including notarization, to be legally valid, highlighting the importance of adhering to precise legal requirements in its execution. Thus, the Utah Durable Power of Attorney form stands as a foundational tool in the management of personal affairs, ensuring individuals can confidently entrust another with the responsibility of safeguarding their financial well-being under unforeseen circumstances.

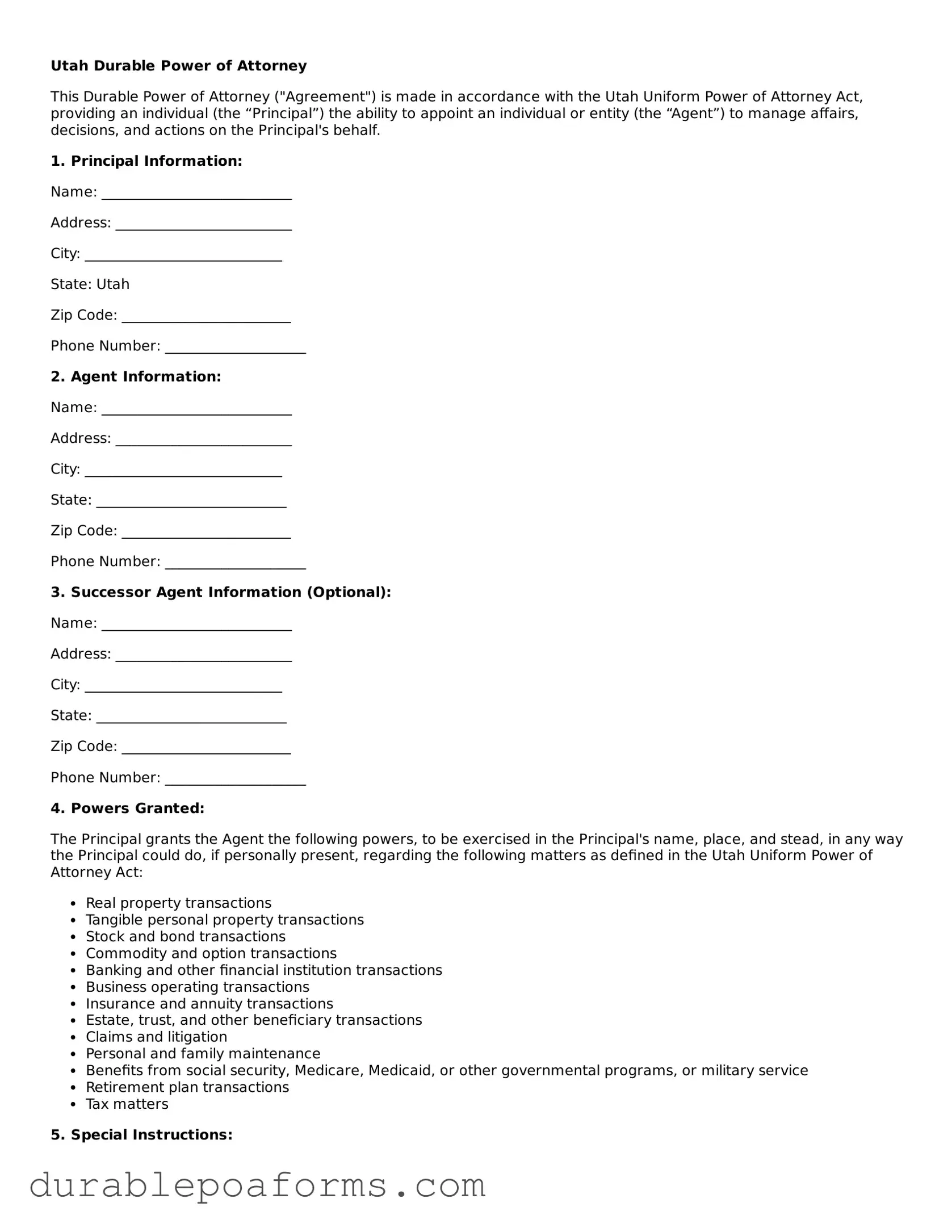

Form Preview

Utah Durable Power of Attorney

This Durable Power of Attorney ("Agreement") is made in accordance with the Utah Uniform Power of Attorney Act, providing an individual (the “Principal”) the ability to appoint an individual or entity (the “Agent”) to manage affairs, decisions, and actions on the Principal's behalf.

1. Principal Information:

Name: ___________________________

Address: _________________________

City: ____________________________

State: Utah

Zip Code: ________________________

Phone Number: ____________________

2. Agent Information:

Name: ___________________________

Address: _________________________

City: ____________________________

State: ___________________________

Zip Code: ________________________

Phone Number: ____________________

3. Successor Agent Information (Optional):

Name: ___________________________

Address: _________________________

City: ____________________________

State: ___________________________

Zip Code: ________________________

Phone Number: ____________________

4. Powers Granted:

The Principal grants the Agent the following powers, to be exercised in the Principal's name, place, and stead, in any way the Principal could do, if personally present, regarding the following matters as defined in the Utah Uniform Power of Attorney Act:

- Real property transactions

- Tangible personal property transactions

- Stock and bond transactions

- Commodity and option transactions

- Banking and other financial institution transactions

- Business operating transactions

- Insurance and annuity transactions

- Estate, trust, and other beneficiary transactions

- Claims and litigation

- Personal and family maintenance

- Benefits from social security, Medicare, Medicaid, or other governmental programs, or military service

- Retirement plan transactions

- Tax matters

5. Special Instructions:

Any special instructions limiting or extending the powers granted to the Agent go here: _________________________________________________________

__________________________________________________________________________________________________________________________

6. Durable:

This Power of Attorney is durable and shall remain effective even if the Principal becomes disabled, incapacitated, or incompetent.

7. Governing Law:

This Agreement shall be governed by and construed in accordance with the laws of the State of Utah.

8. Signatures:

This document must be signed by the Principal, and such signature should preferably be notarized to ensure its acceptance by third parties.

Principal’s Signature: ___________________________ Date: ____________

Agent's Signature: _____________________________ Date: ____________

Successor Agent's Signature (if applicable): ___________________________ Date: ____________

Notary Public: ___________________________________ Date: ____________

(Seal):

Form Specifications

| Fact | Description |

|---|---|

| Definition | A Utah Durable Power of Attorney (DPOA) is a legal document that allows an individual to designate another person to manage their financial affairs if they become incapacitated. |

| Governing Law | The Utah Uniform Power of Attorney Act, found in Sections 75-9-101 through 75-9-403 of the Utah Code, governs the creation and use of Durable Powers of Attorney in Utah. |

| Durability | Unlike a general power of attorney, a DPOA in Utah remains effective even if the principal becomes mentally incompetent or physically incapacitated. |

| Capacity Requirement | The principal must be of sound mind at the time of signing the DPOA, understanding the implications and scope of the authority they are granting. |

| Witnesses | Utah law requires that a DPOA be signed in the presence of a notary public or at least one adult witness (two are recommended for added legal protection), who cannot be the agent, related to the agent, or have any interest in the principal’s estate. |

| Designation of Agent | The individual chosen to act on behalf of the principal is known as the agent or attorney-in-fact. This person can be granted broad or limited financial powers, as specified in the document. |

| Revocation | The principal has the right to revoke the DPOA at any time, as long as they are mentally competent. Revocation should be done in writing and communicated to the agent and any third parties relying on the DPOA. |

| Springing Powers | A "springing" DPOA becomes effective upon a specific event, such as the principal's incapacitation, as defined by the document itself. This allows the principal to maintain control over their affairs until such a condition is met. |

Utah Durable Power of Attorney - Usage Guide

Filling out a Utah Durable Power of Attorney form is a critical process that allows individuals to appoint someone they trust to manage their financial affairs if they are unable to do so themselves. This legal document must be completed accurately to ensure that the appointed agent has the correct authority to act on the principal's behalf. By following the specific steps below, one can ensure that the form is filled out correctly and efficiently.

- Begin by downloading the official Utah Durable Power of Attorney form from a reliable source. Ensure that the form complies with the Utah Code Section 75-9-101 through 75-9-403 to guarantee its legality.

- Enter the full legal name and address of the principal (the person granting the power) in the designated sections at the top of the form.

- Specify the full legal name and address of the agent (the person who is being given the authority) in the corresponding section. If you wish to designate a successor agent, include their information as well.

- Go through the powers listed in the form, checking each box next to the power you wish to grant to your agent. These powers can range from managing personal finances to making decisions on your behalf about real estate transactions.

- If there are specific powers that you do not wish to grant, leave the boxes unchecked or strike through the text.

- For sections that require detailed information, such as specifics about real estate or personal property, provide clear and accurate descriptions.

- If additional instructions are necessary to guide the agent in making decisions, include these in the designated area for special instructions.

- Review the part of the form that specifies the conditions under which your power of attorney will become effective. Some forms have immediate effect, while others are triggered by future events, such as incapacitation.

- Sign and date the form in the presence of a notary public. Utah law requires durable power of attorney forms to be either notarized or witnessed by two adults, who are not the agent, to be legally valid.

- After notarization, provide your agent with a copy of the completed form. It's also advisable to keep a copy for yourself in a secure location and inform trusted family members of its existence and location.

Once the form is accurately completed and copies are appropriately distributed, the durable power of attorney becomes a legally binding document. It empowers the appointed agent to act on behalf of the principal, ensuring that their financial and personal affairs can be managed efficiently during times of incapacitation or absence. Remember, reviewing the form regularly and updating it as needed can help keep the document aligned with the principal's wishes and circumstances.

Common Questions

What is a Utah Durable Power of Attorney form?

A Utah Durable Power of Attorney form is a legal document that allows a person, known as the principal, to designate another person, called the agent, to manage their financial affairs and make decisions on their behalf. Unlike other power of attorney forms, this one remains effective even if the principal becomes incapacitated.

Why would someone need a Durable Power of Attorney in Utah?

People often create a Durable Power of Attorney as part of their estate planning to ensure their affairs can be managed without court intervention if they become unable to make decisions due to illness or incapacitation. It ensures someone they trust can handle their financial and legal matters smoothly.

How can one create a Durable Power of Attorney in Utah?

To create a Durable Power of Attorney in Utah, the principal must complete the form by clearly identifying themselves and the agent, describing the powers granted, and signing the document in the presence of a notary public. It’s recommended that the form also be witnessed by two adults who are not named as agents.

Does the Durable Power of Attorney need to be filed with the state of Utah?

No, the Durable Power of Attorney does not need to be filed with the state of Utah. However, it should be kept in a safe but accessible place. The agent may need to present the original document to financial institutions or other entities to act on the principal's behalf.

Can the Durable Power of Attorney be revoked in Utah?

Yes, the principal can revoke a Durable Power of Attorney at any time as long as they are mentally competent. The revocation must be in writing and should be notarized and distributed to any parties who were relying on the original power of attorney, including the agent and financial institutions.

What happens if the designated agent in the Durable Power of Attorney is unable or unwilling to serve?

If the designated agent is unable or unwilling to serve, the principal can appoint a new agent by creating a new Durable Power of Attorney. If the principal has not appointed an alternate agent and becomes incapacitated, it might be necessary for the court to appoint a conservator or guardian.

Is a Utah Durable Power of Attorney effective in other states?

While many states will honor a Utah Durable Power of Attorney as long as it complies with Utah law, it’s important to check the laws of any other state where the document might be used. Some states have specific forms or requirements, so it may be necessary to create a new Durable Power of Attorney that complies with those laws.

Common mistakes

Filling out the Utah Durable Power of Attorney form is a critical process that requires attention to detail. Unfortunately, people often make several common mistakes during this process. Understanding these pitfalls can help ensure that your legal documents accurately reflect your wishes and stand strong when needed.

The first mistake is not specifying the powers granted. This document allows you to give another person the authority to make decisions on your behalf. Being vague or too general about the powers you’re transferring can lead to confusion and misuse of authority.

Another common error is choosing the wrong agent. The agent, also known as the attorney-in-fact, should be someone you trust implicitly. This should be a person with the ability and willingness to act in your best interests. Yet, many people make the mistake of choosing an agent based on emotional reasons without considering the practical implications.

Also, many individuals fail to include a successor agent. Should your first choice be unable or unwilling to serve, having a backup ensures your affairs are still managed without delay.

Let's enumerate a few other critical mistakes:

- Not clarifying the scope of authority: Not being specific about what financial and legal powers the agent has can lead to overreach or conflict.

- Ignoring the need for notarization: In Utah, notarizing your Durable Power of Attorney is essential for it to be legally effective.

- Oversights in signing and dating: It sounds simple, but forgetting to sign, date, or have the form witnessed can invalidate the entire document.

- Not updating the document: As your situation changes, so too should your Durable Power of Attorney, but many fail to review and update their document accordingly.

- Lack of legal guidance: Attempting to navigate the form without professional advice can lead to mistakes that render the document ineffective when it’s needed most.

Additional slip-ups include not discussing your wishes with the chosen agent or failing to distribute copies of the executed document to relevant parties, such as financial institutions or healthcare providers. These steps are crucial for ensuring your agent can act when the time comes.

In essence, the Utah Durable Power of Attorney is a powerful tool for managing your affairs. By avoiding these common mistakes, you help protect your interests and ensure your wishes are honored. Careful consideration and consultation with a legal professional can provide peace of mind, knowing that everything is correctly in place.

Documents used along the form

In preparing for the future, it's essential to consider all aspects of estate and health care planning. The Utah Durable Power of Attorney form is a critical document that allows you to appoint someone to manage your financial affairs if you're unable to do so yourself. However, to ensure comprehensive protection and foresight, other documents are often utilized in conjunction with this form. These documents, detailed below, further safeguard your wishes and provide peace of mind for both you and your loved ones.

- Living Will – This document, also known as an advance health care directive, outlines your preferences for medical treatment in the event you cannot communicate your wishes yourself. It complements the Durable Power of Attorney by focusing specifically on health care decisions, including life-sustaining treatment preferences.

- Medical Power of Attorney – While the Durable Power of Attorney covers financial decisions, the Medical Power of Attorney designates someone to make health care decisions on your behalf. This form is crucial for instances where medical judgments need to be made, and you're incapacitated or otherwise unable to make those decisions.

- Last Will and Testament – This document specifies how you want your assets distributed after your death. It can also appoint guardians for any minor children. Although focused on after-death arrangements, it is an essential part of estate planning alongside the Durable Power of Attorney.

- Living Trust – A Living Trust provides a way to manage your assets during your lifetime and specify how they should be distributed upon your death. It can help avoid probate and can be either revocable or irrevocable, offering flexibility in asset management and protection.

Using these documents in tandem with the Utah Durable Power of Attorney form ensures a comprehensive approach to estate and health care planning. Each document serves a unique purpose, building a complete legal framework to protect your interests during life's unexpected turns. Consulting with a legal professional can help tailor these documents to your specific needs, offering further security and confidence in your future arrangements.

Similar forms

The Utah Durable Power of Attorney form is similar to other legal documents that enable individuals to designate representatives to act on their behalf, each with its unique application and scope of authority. These documents are essential tools for planning and managing personal affairs, medical decisions, and financial matters.

Health Care Proxy: Like the Utah Durable Power of Attorney, a Health Care Proxy enables an individual to appoint someone to make medical decisions on their behalf should they become unable to do so. While the Durable Power of Attorney can cover a broad range of legal and financial decisions, the Health Care Proxy is specifically designed for medical decisions. Both documents activate when the principal is incapacitated, but the Health Care Proxy is limited to healthcare.

General Power of Attorney: This document is closely related to the Durable Power of Attorney but with a key difference in its durability. A General Power of Attorney typically becomes void if the person who made it (the principal) becomes incapacitated. In contrast, a Durable Power of Attorney is specifically designed to remain in effect even after the principal's incapacitation, ensuring continuous management of their affairs without interruption.

Springing Power of Attorney: Similar to the Durable Power of Attorney in its durability, a Springing Power of Attorney has a unique feature: it only becomes effective under certain conditions, typically the incapacitation of the principal. This conditionality can provide an additional level of control and peace of mind for the principal, ensuring that the powers granted are only exercised when absolutely necessary. Both documents allow for the management of the principal's affairs in the event they can no longer do so themselves, but the Springing Power of Attorney offers a timing distinction.

Living Will: Although a Living Will is not a form of Power of Attorney, it shares a similar purpose with the Health Care Proxy segment of a Durable Power of Attorney. It allows individuals to record their wishes regarding life-sustaining treatment should they become terminally ill or permanently unconscious. While a Living Will outlines specific healthcare desires, a Durable Power of Attorney for Healthcare decisions permits someone to make health care decisions on behalf of the principal, in line with the principal's expressed wishes or best interests.

Dos and Don'ts

When preparing a Utah Durable Power of Attorney (DPOA), certain aspects require careful attention to ensure the document is valid and reflects your intentions. Below are categorized guidelines on what to do and what not to do during this process.

Do:

- Clearly identify the principal (the person granting the power) and the agent (the person receiving the power) with their full legal names and addresses to avoid any confusion.

- Specify the powers you are granting with as much detail as possible. General statements can lead to ambiguity and misuse of authority.

- Ensure the document meets all the requirements set forth by Utah law, including being signed in the presence of a notary public or two witnesses (or both, depending on current state laws).

- Consider specifying a duration for the DPOA. If no duration is stated, understand that the document will remain in effect until revoked or the principal dies.

- Discuss the responsibilities and expectations with the chosen agent to ensure they are willing and able to act on your behalf.

Don't:

- Omit a successor agent. It’s advisable to name an alternate in case your primary agent is unable or unwilling to serve.

- Forget to review and update the document periodically. Life changes such as marriage, divorce, the birth of children, or a change in financial status can impact the relevance of your DPOA.

- Fail to make your wishes known to family members or other relevant parties. While not a legal requirement, sharing your plans can mitigate potential conflicts or confusion later.

- Assume the form grants authority for all types of decisions. Understand that certain powers, such as healthcare decisions, require a separate form or additional stipulations.

Misconceptions

When people think about creating a Durable Power of Attorney (DPOA) in Utah, several misconceptions often cloud their understanding of its purpose, its powers, and its limitations. Correcting these misunderstandings is vital to ensure individuals make informed decisions about their legal and financial futures.

One common misconception is that a DPOA grants the agent complete control over the principal's affairs, regardless of the situation. In reality, a DPOA in Utah is designed to allow the agent to act in the principal's best interests, specifically in areas designated by the document. The powers can be as broad or as limited as the principal decides, but they do not permit unfettered control.

Another widespread belief is that executing a DPOA is an irreversible action. Many are surprised to learn that in Utah, as in other states, the principal can revoke a DPOA at any time, as long as they are mentally competent. This flexibility ensures the principal retains ultimate control over the authorization given.

Some assume that a DPOA is only useful if the principal becomes incapacitated. While it's true that a DPOA is often used in situations of incapacity, its utility is not confined to such circumstances. It can be equally valuable in situations where the principal is unavailable or prefers to delegate certain tasks, highlighting its role in comprehensive estate planning.

There's also a misunderstanding that a DPOA in Utah automatically covers healthcare decisions. However, a separate document, often known as a Healthcare Power of Attorney, is required to authorize someone to make medical decisions on the principal's behalf. It's crucial to prepare both types of documents to ensure comprehensive coverage of one's wishes.

Lastly, many believe that a standard form found online is sufficient to establish a DPOA in Utah. While online templates can provide a starting point, they may not address specific needs or comply with the latest legal requirements. Personalizing the document with the help of a legal professional ensures that it accurately reflects the principal’s intentions and meets all legal standards.

By dispelling these misconceptions, individuals can better appreciate the value and function of a Durable Power of Attorney in Utah, ensuring they take the necessary steps to protect their interests and those of their loved ones.

Key takeaways

The Utah Durable Power of Attorney form is a legal document that allows an individual, known as the principal, to designate another person, called the agent, to manage financial affairs on the principal's behalf. This document becomes especially significant if the principal becomes unable to handle their own matters due to illness or incapacitation. Understanding its key aspects ensures that the parties involved are aware of their responsibilities and the power of the document. Below are six essential takeaways for correctly filling out and utilizing the Utah Durable Power of Attorney form:

- Complete Accuracy is Crucial: When filling out the Utah Durable Power of Attorney form, it's imperative to provide accurate and clear information. This includes the full legal names of both the principal and the agent, comprehensive contact details, and specific powers granted to the agent. Incorrect or vague information can lead to misunderstandings or legal challenges.

- Specify Powers Wisely: The principal has the discretion to specify exactly what functions and areas the agent can make decisions about. These can range from managing real estate to handling financial transactions. It is vital for the principal to consider carefully which powers they are granting to their agent.

- Notarization is Required: For the form to be legally binding in Utah, it must be notarized. This means that once the form is filled out, the principal and the agent will need to sign it in front of a notary public. The notarization process validates the identity of the signatories, adding a layer of protection and authenticity.

- Effective Period: The "durable" aspect of the Power of Attorney means that the document remains in effect even if the principal becomes incapacitated. However, it is also important to note that it will only be effective upon the date of signing unless otherwise stated in the document itself.

- Revocation Process: The principal retains the right to revoke the Durable Power of Attorney at any time, as long as they are mentally capable. To do so, a formal revocation statement should be made in writing, and notice should be provided to the agent and any institutions or parties that were relying on the original document.

- Legal Advice is Recommended: Given the significance and potential complexity of the Durable Power of Attorney, consulting with a legal professional is advisable. An attorney can provide guidance tailored to the principal's specific situation, ensuring that the form is completed correctly and aligns with the principal's wishes and legal guidelines.

By keeping these key takeaways in mind, individuals preparing a Utah Durable Power of Attorney form can do so with greater confidence and understanding, ensuring their financial affairs are responsibly managed.

More Durable Power of Attorney State Forms

Power of Attorney Wyoming - Providing detailed instructions in the document can help guide your agent in making decisions that align with your preferences and values.

Arizona Durable Power of Attorney - Offers a way to delineate the scope of decisions your agent can make, from everyday activities to major financial ones.

Louisiana Power of Attorney Template - This declaration clearly outlines the scope of authority granted, offering legal clarity and direction for the appointed agent’s actions.

Vermont Durable Power of Attorney Form - The person you appoint is legally obligated to act in your best interests, known as a fiduciary duty.