Attorney-Verified Durable Power of Attorney Document for Vermont

When individuals in Vermont wish to ensure that their financial affairs are handled according to their preferences, especially during times when they are unable to make decisions themselves due to incapacitation or illness, a Durable Power of Attorney (DPOA) form becomes an essential tool. This legal document grants another person, often termed as an "agent" or "attorney-in-fact," the authority to make financial decisions on behalf of the "principal" — the person creating the power of attorney. What sets the Durable Power of Attorney apart from other forms is its resilience in the face of the principal’s incapacity. It remains in effect until the principal's death unless revoked sooner by the principal themselves, making it a crucial component of estate planning and personal financial management. Tailored to meet Vermont’s legal requirements, the form must be completed accurately, reflecting the principal's wishes regarding the extent and limitations of the agent’s power. Understanding this document’s legal implications, the selection process for an agent, and the correct way to fill out and execute the form is essential for anyone considering creating a Durable Power of Attorney in Vermont.

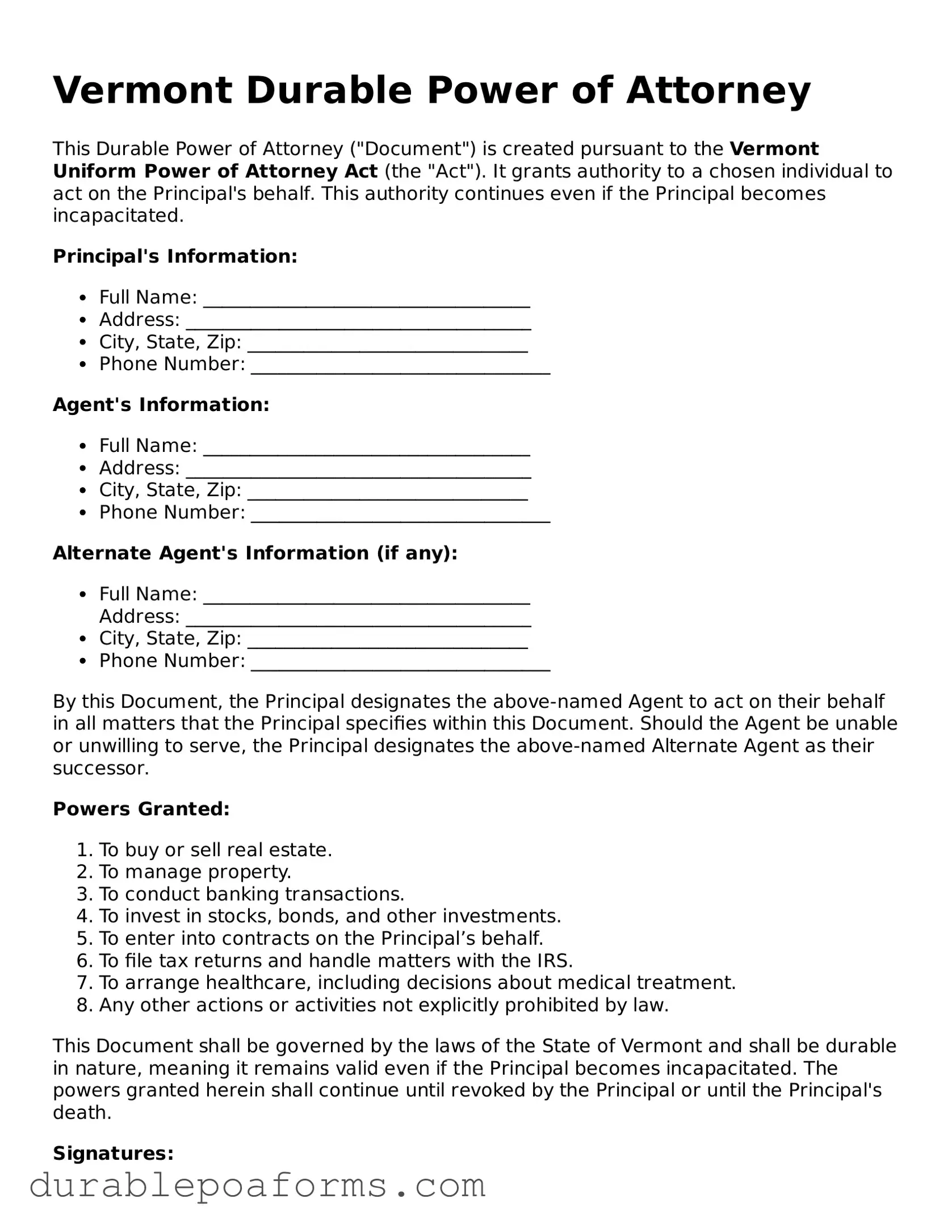

Form Preview

Vermont Durable Power of Attorney

This Durable Power of Attorney ("Document") is created pursuant to the Vermont Uniform Power of Attorney Act (the "Act"). It grants authority to a chosen individual to act on the Principal's behalf. This authority continues even if the Principal becomes incapacitated.

Principal's Information:

- Full Name: ___________________________________

- Address: _____________________________________

- City, State, Zip: ______________________________

- Phone Number: ________________________________

Agent's Information:

- Full Name: ___________________________________

- Address: _____________________________________

- City, State, Zip: ______________________________

- Phone Number: ________________________________

Alternate Agent's Information (if any):

- Full Name: ___________________________________

- City, State, Zip: ______________________________

- Phone Number: ________________________________

By this Document, the Principal designates the above-named Agent to act on their behalf in all matters that the Principal specifies within this Document. Should the Agent be unable or unwilling to serve, the Principal designates the above-named Alternate Agent as their successor.

Powers Granted:

- To buy or sell real estate.

- To manage property.

- To conduct banking transactions.

- To invest in stocks, bonds, and other investments.

- To enter into contracts on the Principal’s behalf.

- To file tax returns and handle matters with the IRS.

- To arrange healthcare, including decisions about medical treatment.

- Any other actions or activities not explicitly prohibited by law.

This Document shall be governed by the laws of the State of Vermont and shall be durable in nature, meaning it remains valid even if the Principal becomes incapacitated. The powers granted herein shall continue until revoked by the Principal or until the Principal's death.

Signatures:

In witness whereof, the Principal has executed this Durable Power of Attorney on this _____ day of __________, 20____.

Principal's Signature: _______________________________

Principal's Printed Name: _____________________________

The Agent's acceptance and agreement to act under this Durable Power of Attorney:

Agent's Signature: ___________________________________

Agent's Printed Name: ________________________________

If applicable, the Alternate Agent's acceptance and agreement to act, if the primary Agent is unable:

Alternate Agent's Signature: __________________________

Alternate Agent's Printed Name: ________________________

State of Vermont

County of ______________________

This document was acknowledged before me on _____ day of __________, 20____, by _______________________________ (Principal’s Name).

Notary Public's Signature: ____________________________

Printed Name: ________________________________________

My Commission Expires: _______________________________

Form Specifications

| Fact | Description |

|---|---|

| Function | Enables an individual to designate another person to make decisions on their behalf regarding financial matters. |

| Duration | Remains in effect even if the principal becomes incapacitated, ensuring uninterrupted management of their affairs. |

| Principal | The person who creates the Durable Power of Attorney and assigns decision-making authority to another. |

| Agent | The individual appointed by the principal to act on their behalf in financial matters. |

| Governing Law | Governed by Title 14, Chapter 123 of the Vermont Statutes, which outlines the legal requirements and protections for durable powers of attorney. |

| Signing Requirements | Must be signed by the principal and either notarized or signed by two witnesses to be legally valid, as per Vermont law. |

| Revocation | The principal has the right to revoke the Durable Power of Attorney at any time, as long as they are mentally competent. |

| Scope | The document can be tailored to grant broad or specific powers, depending on the principal’s preferences and needs. |

Vermont Durable Power of Attorney - Usage Guide

When preparing to set up a durable power of attorney in Vermont, individuals are taking a proactive step in managing their affairs. This legal document allows a person (the principal) to designate another person (the agent) to make decisions about their property, finances, or medical care should they become unable to do so. Understanding the proper procedure for filling out this form ensures that the document reflects the principal's wishes accurately and is deemed valid under Vermont law. Below are the steps necessary to carefully complete the Vermont Durable Power of Attorney form.

- Begin by clearly printing the full name and address of the principal (the person making the document) at the top of the form.

- Enter the full name and address of the agent (the person appointed to act on behalf of the principal) in the designated section.

- If you wish to appoint a successor agent, provide the name and address of this individual. This step is optional but recommended in case the original agent is unable to fulfill their duties.

- Specify the powers you are granting to your agent. This can include decisions related to financial matters, real estate, legal actions, health care, and other personal affairs. Be as specific as possible to ensure clear direction is given.

- If there are specific powers you do not wish to grant to your agent, clearly list these exceptions in the appropriate section of the form.

- For the power of attorney to be effective in medical decisions, specifically indicate this by including a stipulation that the durable power of attorney extends to health care decisions, in compliance with Vermont state laws.

- Review the form to ensure all information is accurate and complete. Any error could affect the legal enforceability of the document.

- The principal must sign and date the form in the presence of a notary public or two witnesses, as required by Vermont law. Note that the witnesses cannot be the agent appointed in the document.

- Have the agent sign the form, acknowledging their acceptance of the responsibilities designated by the power of attorney.

- Keep the original signed document in a safe place, and provide the agent with a copy. Consider also giving copies to financial institutions, doctors, or others who may need to recognize the agent’s authority.

In the preparation and execution of a durable power of attorney in Vermont, attention to detail and adherence to state-specific requirements are essential. By following these steps, individuals can ensure their affairs will be managed according to their wishes, providing peace of mind for both them and their loved ones. It's important to consider consulting with a legal professional to ensure the form meets all legal standards and adequately addresses the principal's needs.

Common Questions

What is a Vermont Durable Power of Attorney?

A Vermont Durable Power of Attorney (DPOA) is a legal document that allows an individual, known as the principal, to designate another person, known as the agent or attorney-in-fact, to make decisions on their behalf even if they become incapacitated or unable to make decisions for themselves. The "durable" aspect implies that the document remains in effect even if the principal loses mental capacity.

Who can serve as an agent under a Vermont Durable Power of Attorney?

In Vermont, any competent adult whom the principal trusts can be designated as the agent in a Durable Power of Attorney. This could be a family member, friend, or any other individual the principal chooses. It is advised that the principal selects someone who is not only trustworthy but also capable of handling financial and legal responsibilities effectively.

What powers can be granted through a Vermont Durable Power of Attorney?

The scope of authority granted to an agent can vary widely based on the principal's preferences and needs. Powers can include managing financial affairs, buying or selling real estate, handling banking transactions, and making healthcare decisions. However, the specific powers granted must be clearly outlined in the DPOA document to be legally binding.

How can someone create a Vermont Durable Power of Attorney?

To create a Durable Power of Attorney in Vermont, the principal must complete a DPOA form that complies with Vermont law. The document must detail the powers granted to the agent and be signed by the principal in the presence of a notary public to ensure its legality. It is recommended to consult with an attorney to guarantee that the document aligns with the principal's wishes and adheres to all state legal requirements.

Is a Vermont Durable Power of Attorney revocable?

Yes, a Vermont Durable Power of Attorney is revocable at any time by the principal, as long as the principal is mentally competent. To revoke the document, the principal should provide written notice to the agent and any institutions or parties that were relying on the DPOA. Additionally, destroying the original document and any copies is advisable to prevent its future use.

Does a Vermont Durable Power of Attorney need to be recorded or registered?

While a Vermont Durable Power of Attorney does not need to be registered to be effective, it may be necessary to record the document if it grants the agent authority to handle real estate transactions. In such cases, the DPOA should be recorded with the county clerk's office where the property is located to provide public notice of the agent's authority.

What happens if the designated agent in a Vermont Durable Power of Attorney is unable or unwilling to serve?

If the designated agent is unable or unwilling to serve, the DPOA can specify alternate agents to step in. If no alternates are designated, or if they are also unable or unwilling to take on the responsibilities, the principal may need to execute a new DPOA, assuming they are still competent. Otherwise, it may become necessary for a court to appoint a guardian or conservator.

How does a Vermont Durable Power of Attorney end?

A Vermont Durable Power of Attorney ends upon the death of the principal, the principal's revocation of the DPOA (as long as the principal is mentally competent), the specific end date stated in the document, or the occurrence of a condition specified in the DPOA that results in its termination. Additionally, if the DPOA was created for a single transaction, it would end once that transaction is completed.

Common mistakes

Filling out a Vermont Durable Power of Attorney (DPOA) form is an important process that grants someone else the authority to act on your behalf in financial and legal matters, should you be unable to do so yourself. While straightforward in nature, the process is susceptible to a few common mistakes, which can potentially invalidate the form or cause confusion and difficulties later on.

Firstly, many people neglect to choose an agent who is both trustworthy and capable of managing their affairs effectively. The agent’s role is crucial; they will have significant power and responsibility. It’s essential to select someone who not only understands your wishes but also possesses the ability to act on them judiciously under various circumstances.

Another error occurs with the lack of specificity in defining the powers granted to the agent. The DPOA form allows you to grant broad authority or limit it to specific actions. Being too vague or too broad can lead to situations where the agent is unsure of their authority, leading to hesitancy and inefficiency, especially in time-sensitive situations. Conversely, overly restrictive instructions can impede the agent's ability to act effectively on your behalf.

A critical oversight is failing to have the document properly witnessed or notarized, as required by Vermont law. This step is vital for the document's legality and enforceability. Without proper witnessing or notarization, the DPOA may not be recognized by financial institutions, healthcare providers, or courts, which could severely limit its intended purpose.

Not regularly revisiting and updating the DPOA can also be problematic. Life changes such as marriage, divorce, the death of the chosen agent, or changes in your personal wishes require updates to the document. An outdated DPOA might not reflect your current situation or preferences, leading to challenges in its execution.

Lastly, many make the mistake of not discussing their plans with the chosen agent or alternate agents. Communication is key. It's important that the agent understands their responsibilities and agrees to take them on. Furthermore, informing close family members or others impacted by the contents of the DPOA can prevent misunderstandings and conflicts down the line.

In summary, when completing a Vermont Durable Power of Attorney form, careful consideration should be given to choosing a reliable agent, clearly defining their powers, adhering to all legal formalities, regularly updating the document, and maintaining open lines of communication with all parties involved.

Documents used along the form

When preparing for one's future, particularly in the context of estate planning and healthcare decisions in Vermont, it's often wise to go beyond just drafting a Durable Power of Attorney (POA). The Durable POA is a vital document that allows someone you trust to manage your affairs should you become incapacitated. However, to ensure comprehensive planning, several other forms and documents might also be utilized alongside the Durable POA. Let's explore some of these essential documents.

- Advance Directive for Health Care: This document complements the Durable POA by specifying your wishes regarding medical treatment and end-of-life care. It might include a Living Will and Health Care Proxy, detailing what medical actions should be taken if you're unable to make decisions yourself.

- Will: A foundational estate planning tool that dictations how your property and affairs are to be handled after your death. This document can specify guardians for any minor children, bequests, and the executor of your estate.

- Trusts: Trusts can be established for various purposes, including avoiding probate, managing assets during your lifetime and after your death, and specifying conditions under which beneficiaries receive their inheritance.

- HIPAA Authorization Form: This authorizes the release of your healthcare information to individuals you choose, often allowing those holding a Durable or Healthcare POA to access medical records necessary for making informed decisions on your behalf.

- Living Will: Often part of an Advance Directive, it records your wishes regarding life-sustaining treatments in scenarios where you’re unable to communicate them directly.

- Funeral and Burial Instructions: While not a formal legal document, detailing your wishes for your funeral and burial can relieve a significant burden from your loved ones during a difficult time.

- Financial Inventory: Although not a legal document in itself, maintaining a list of your financial assets, liabilities, account numbers, and contact information for financial advisors can be incredibly helpful alongside a Durable POA.

- Letter of Intent: This personal letter can provide guidance and explanations about your wishes that aren’t legally binding but can help inform your named agents or trustees about your personal effects and desires regarding the distribution of your assets.

Each of these documents serves a unique purpose in safeguarding your health, assets, and personal wishes. Together, they provide a comprehensive plan that ensures your well-being and legacy are cared for according to your desires. Drafting these documents can be complex, so it's often beneficial to seek legal guidance to ensure that each form complements the others effectively and reflects your intentions accurately.

Similar forms

The Vermont Durable Power of Attorney form is similar to other legal documents that allow individuals to appoint another person to make decisions on their behalf. These documents share the common purpose of ensuring that an individual's preferences are respected, especially during times when they may not be able to express their wishes directly. The key distinction lies in the scope and focus of the legal authority granted in each document.

The Medical Power of Attorney is one such document that shares similarities with the Vermont Durable Power of Attorney. While both enable an individual to designate another person to make important decisions, the Medical Power of Attorney specifically focuses on health care decisions. This includes the power to make choices about medical treatments, health care providers, and end-of-life care. The Durable Power of Attorney, however, is more comprehensive, covering financial and legal decisions in addition to health care in some cases.

Living Wills, also known as advance healthcare directives, are parallel to the Vermont Durable Power of Attorney in their foresight for future incapacitation. However, Living Wills primarily document an individual's wishes concerning medical treatments and life-sustaining measures in specific scenarios. They do not appoint another person to make decisions but serve as a guide for healthcare providers and loved ones. Unlike the Durable Power of Attorney, which delegates decision-making authority, Living Wills are declarative statements about one's healthcare preferences.

General Power of Attorney forms bear resemblance to the Vermont Durable Power of Attorney by authorizing a person to act on another's behalf. The principal difference lies in the durability aspect. A General Power of Attorney typically becomes invalid if the individual becomes incapacitated or unable to make decisions for themselves. In contrast, a Durable Power of Attorney is specifically designed to remain in effect or take effect upon the incapacitation of the individual, ensuring continuous decision-making authority.

Dos and Don'ts

When you fill out a Vermont Durable Power of Attorney (POA) form, you're taking a crucial step in planning for the future. It's important to approach this document with care, ensuring your wishes are clearly outlined and legally sound. Here are ten dos and don'ts to keep in mind during the process:

- Do carefully select who will serve as your agent. This person will have significant power over your affairs, so it's essential they are trustworthy and capable of handling the responsibility.

- Do clearly define the scope of the agent's powers. Be explicit about what they can and cannot do on your behalf to prevent any confusion or abuse of power.

- Do discuss your decision with the chosen agent before finalizing the document. This ensures they are willing and prepared to take on the role.

- Do have the POA form properly witnessed or notarized, as required by Vermont law, to ensure its legality.

- Do consider specifying a start and end date for the POA, if applicable. Some situations may call for a POA that is only effective for a certain period.

- Don't leave any sections incomplete. An incomplete form can lead to questions about your intentions and potentially render the document invalid.

- Don't use vague language. Be clear and concise to avoid misinterpretation of your wishes.

- Don't forget to keep a copy of the POA for your records. It's also wise to share copies with your attorney, if you have one, and any financial institutions you deal with.

- Don't assume the form doesn't need to be updated. Review and potentially update your POA regularly, especially after significant life changes.

- Don't hesitate to seek legal advice if you have questions or concerns about filling out the form. A professional can help clarify the process and ensure your document is legally sound.

By following these guidelines, you can make sure your Vermont Durable Power of Attorney form accurately reflects your wishes and stands up to legal scrutiny. This planning tool can offer peace of mind, knowing that your affairs will be managed according to your wishes, should you become unable to do so yourself.

Misconceptions

When it comes to legal forms and procedures, misinformation can lead to serious missteps. This is especially true for a Durable Power of Attorney (DPOA) in Vermont. Understanding the misconceptions surrounding this document is crucial for ensuring your interests and wishes are accurately represented. Here are six common myths and the truths behind them:

Myth 1: A Durable Power of Attorney Grants Unlimited Power

This is not the case. In Vermont, the scope of authority granted to the agent under a DPOA can be as broad or as narrow as the person creating it (the principal) decides. The principal can specify what decisions the agent can make on their behalf, including financial, real estate, and other personal matters.

Myth 2: It's Only for the Elderly

A common misconception is that DPOAs are only necessary for older adults. However, unexpected situations such as accidents or sudden illness can happen at any age, making it important for adults of all ages to consider establishing a DPOA.

Myth 3: It’s too Expensive

Many assume that creating a DPOA in Vermont is costly, requiring extensive legal assistance. While it’s wise to consult with a lawyer to ensure your DPOA meets your needs and state requirements, the process doesn’t have to be expensive. Forms are available that can be completed without incurring high legal fees.

Myth 4: A Durable Power of Attorney and a Will are the Same

These are two distinct documents serving different purposes. A will becomes effective upon death, detailing how assets should be distributed. A DPOA, on the other hand, is effective during the principal’s lifetime, allowing the agent to act on the principal’s behalf in specified matters.

Myth 5: Once Signed, it Can't be Changed

Actually, as long as the principal is mentally competent, they can revoke or amend their DPOA at any time. It’s important to review and possibly update your DPOA periodically to reflect changes in your life circumstances or wishes.

Myth 6: A Power of Attorney from Another State is Always Valid in Vermont

While Vermont law does recognize DPOAs executed in other states, the document must comply with Vermont's legal requirements to be effective. It’s prudent to have a Vermont attorney review any out-of-state DPOA to ensure it is valid and effective in Vermont.

Key takeaways

The Vermont Durable Power of Attorney form is an essential legal document, empowering an individual to make decisions on another’s behalf, primarily concerning financial and property matters. When filling out and using this form, it's crucial to consider several key takeaways to ensure the agreement's effectiveness and legality.

- Understanding the Purpose: The form allows a person (the principal) to appoint another individual (the agent) to handle decisions related to finances and property in the event that the principal becomes unable to make those decisions due to incapacity.

- Choosing an Agent Wisely: Select an agent who is not only trustworthy but also capable of handling financial matters prudently. The agent's ability to act in the principal’s best interest is paramount.

- Specificity is Key: Clearly delineate the powers you are granting to your agent. The form should specify what the agent can and cannot do, providing clarity and preventing potential abuses of power.

- Durability: By nature, the "durable" aspect of this Power of Attorney means it remains in effect even if the principal becomes incapacitated, differentiating it from a general Power of Attorney.

- Signing Requirements: Ensure the form is signed according to Vermont state laws, which typically include requiring witnesses and/or notarization to validate the document.

- Effective Date: The document should clearly state when the agent’s power begins. Some decisions take effect immediately, while others might only do so upon the incapacitation of the principal.

- Revocation Process: The form should include instructions on how the principal can revoke the Power of Attorney, providing flexibility and control over the arrangement.

- Third Party Recognition: Financial institutions and other third parties may require a specific format or additional information to recognize the document. Consult with relevant entities to ensure compliance.

- Legal Advice: Considering the implications of granting someone else the power to make financial decisions, consulting with a legal professional to understand the form and its consequences fully is advisable.

In conclusion, when filling out the Vermont Durable Power of Attorney form, attention to detail, understanding the legal implications, and thorough planning can protect the interests of all parties involved. Properly executed, this document provides peace of mind and ensures that financial matters can be managed effectively, even under unforeseen circumstances.

More Durable Power of Attorney State Forms

Free Printable Durable Power of Attorney Form Washington State - Necessitates careful selection of your agent, as they will have significant control over your personal and financial realms.

Power of Attorney Nevada - This document can cover a wide range of authorities, from managing investments to making healthcare decisions.

Montana Power of Attorney - Each state has its own requirements for a Durable Power of Attorney, so it’s important to follow your state’s laws.