Attorney-Verified Durable Power of Attorney Document for Virginia

The Virginia Durable Power of Attorney form plays a pivotal role in estate planning and personal financial management, ensuring that individuals can confidently entrust another person to make key decisions on their behalf should they become unable to do so themselves. This legal document, tailored specifically to remain in effect even if the principal (the person making the designation) becomes incapacitated, allows the chosen agent or attorney-in-fact ample authority to manage a wide range of affairs. These affairs include handling banking transactions, making investment decisions, and managing real estate assets, among other responsibilities. The durability of this power underscores its importance, making it a cornerstone document for those planning for the future of their estates and personal well-being. Understanding the components, legal requirements, and implications of this form is essential for anyone considering its execution. This ensures not only compliance with Virginia state laws but also the peace of mind that comes with knowing affairs will be handled as desired, even in challenging times.

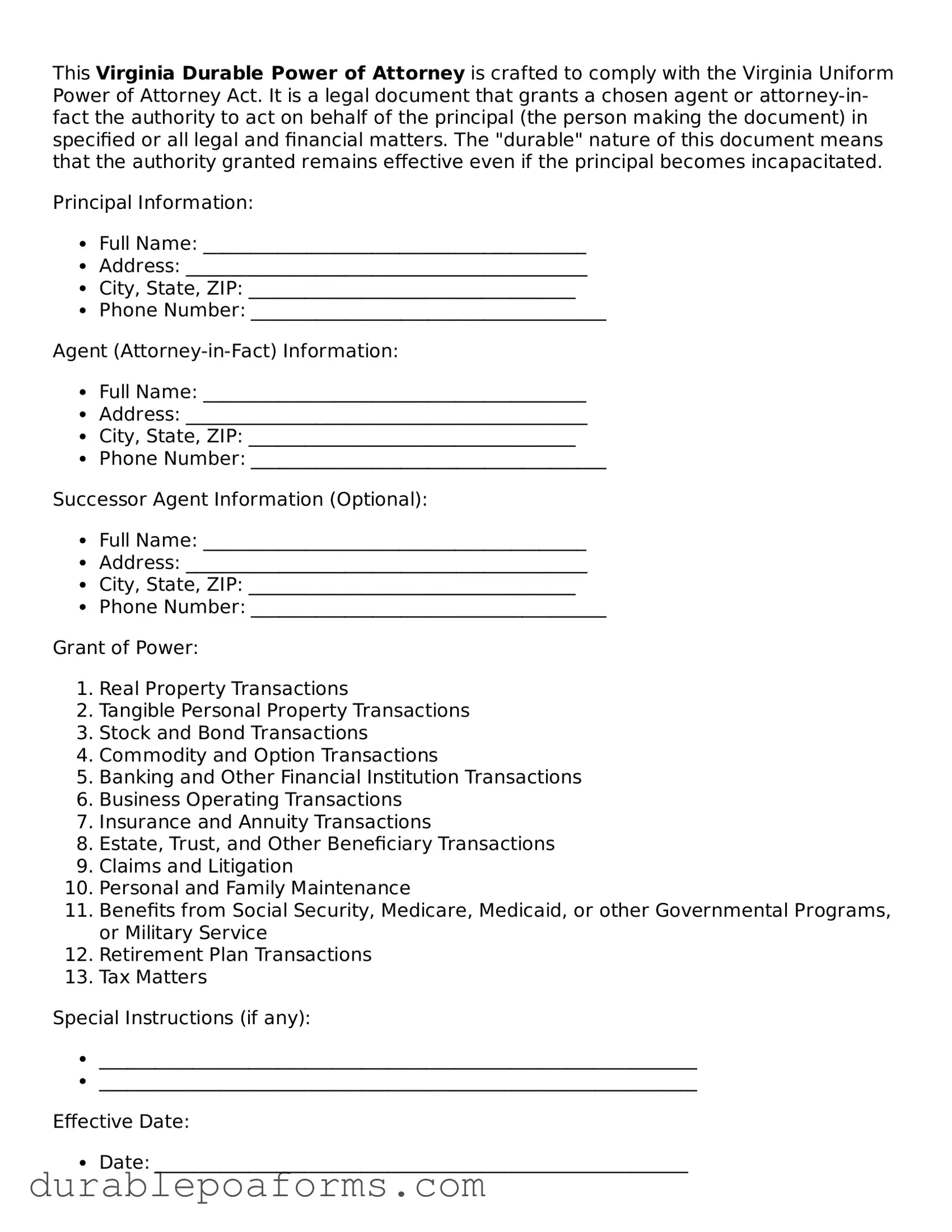

Form Preview

This Virginia Durable Power of Attorney is crafted to comply with the Virginia Uniform Power of Attorney Act. It is a legal document that grants a chosen agent or attorney-in-fact the authority to act on behalf of the principal (the person making the document) in specified or all legal and financial matters. The "durable" nature of this document means that the authority granted remains effective even if the principal becomes incapacitated.

Principal Information:

- Full Name: _________________________________________

- Address: ___________________________________________

- City, State, ZIP: ___________________________________

- Phone Number: ______________________________________

Agent (Attorney-in-Fact) Information:

- Full Name: _________________________________________

- Address: ___________________________________________

- City, State, ZIP: ___________________________________

- Phone Number: ______________________________________

Successor Agent Information (Optional):

- Full Name: _________________________________________

- Address: ___________________________________________

- City, State, ZIP: ___________________________________

- Phone Number: ______________________________________

Grant of Power:

- Real Property Transactions

- Tangible Personal Property Transactions

- Stock and Bond Transactions

- Commodity and Option Transactions

- Banking and Other Financial Institution Transactions

- Business Operating Transactions

- Insurance and Annuity Transactions

- Estate, Trust, and Other Beneficiary Transactions

- Claims and Litigation

- Personal and Family Maintenance

- Benefits from Social Security, Medicare, Medicaid, or other Governmental Programs, or Military Service

- Retirement Plan Transactions

- Tax Matters

Special Instructions (if any):

- ________________________________________________________________

- ________________________________________________________________

Effective Date:

- Date: _________________________________________________________

This Power of Attorney will continue to be effective upon the incapacity of the Principal, pursuant to the Virginia Uniform Power of Attorney Act.

Principal's Signature: ___________________________________ Date: ____________

Agent's Signature: ______________________________________ Date: ____________

Successor Agent's Signature (If applicable): _________________ Date: ____________

Witness #1 Signature: ___________________________________ Date: ____________

Witness #2 Signature: ___________________________________ Date: ____________

State of Virginia

County of ___________________

This document was acknowledged before me on __________________ by [Principal’s Name] as Principal of this Power of Attorney.

Notary Public's Signature: _______________________________ Date: ____________

My commission expires: _________________________

Form Specifications

| Fact Number | Detail |

|---|---|

| 1 | The Virginia Durable Power of Attorney form allows an individual to designate another person to manage their affairs. |

| 2 | This form remains effective even if the person who created it becomes incapacitated. |

| 3 | The person designated to make decisions is called the "agent" or "attorney-in-fact." |

| 4 | The person who creates the Power of Attorney is referred to as the "principal." |

| 5 | It can cover a broad range of matters, including financial, legal, and medical decisions. |

| 6 | The form must be signed by the principal in the presence of a notary to be legally binding. |

| 7 | It is governed by the Virginia Code, specifically § 64.2-1600 and subsequent sections. |

| 8 | The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent. |

| 9 | Choosing a trustworthy and reliable agent is crucial, as they will have significant power over the principal's affairs. |

| 10 | If there is no Durable Power of Attorney in place, a court may need to appoint a guardian or conservator if the principal becomes incapacitated. |

Virginia Durable Power of Attorney - Usage Guide

Preparing a Durable Power of Attorney in Virginia is an important step for ensuring that your affairs can be handled by someone you trust in case you are unable to make decisions for yourself. This document grants another individual, known as an agent, the authority to make decisions on your behalf. The following steps will guide you through the process of filling out the Virginia Durable Power of Attorney form accurately and effectively, ensuring that your needs and wishes are met.

- Gather necessary information including your full legal name, address, and the full legal name and address of the person you wish to appoint as your agent.

- Locate a current version of the Virginia Durable Power of Attorney form. This can be found online through legal resources or by consulting with a legal professional.

- Read through the form thoroughly before starting to fill it out, to understand all the sections and instructions.

- Fill in your personal information where requested at the beginning of the form, ensuring accuracy to avoid any potential legal issues.

- Designate your agent by filling in their full legal name and contact details in the specified section.

- Specify the powers you are granting to your agent. This can range from general authority to manage all your affairs to specific powers limited to certain tasks. Be clear and precise in your instructions.

- If you wish to limit the powers or set specific terms under which the power of attorney will become effective or expire, clearly state these conditions on the form.

- Include any additional instructions or limitations regarding the powers granted to your agent. Ensure these instructions are clear to avoid any misinterpretation.

- Review the form to ensure all information is correct and that you have not missed any sections.

- Sign and date the form in the presence of a notary public. This step is crucial as it validates the document.

- Have the agent sign the form if it is required by the form or as an additional step to affirm their acceptance of the responsibilities being assigned to them.

- Keep the original document in a safe but accessible place, and provide copies to your agent and any relevant institutions like your bank or healthcare provider.

Once the Virginia Durable Power of Attorney form is properly filled out and executed, you have taken a significant step in estate planning and ensuring your affairs can be managed according to your wishes if you are unable to do so yourself. Remember, this document can be revised or revoked by you at any time as long as you are mentally competent. It’s recommended to review this document periodically and after major life events to ensure that it still reflects your wishes and circumstances.

Common Questions

What is a Durable Power of Attorney in Virginia?

A Durable Power of Attorney in Virginia is a legal document that allows an individual (the principal) to grant another person (the agent) the authority to make decisions on their behalf. This power remains in effect even if the principal becomes incapacitated. The scope can include financial, legal, and real estate decisions among others.

How do I create a Durable Power of Attorney in Virginia?

To create a Durable Power of Attorney, the principal must complete a form that clearly identifies the parties involved, delineates the powers granted, and meets Virginia's legal requirements. These requirements include having the document signed by the principal and notarized. It is advisable to consult with a legal professional to ensure that the document accurately reflects the principal's wishes and complies with state law.

Who should I choose as my agent?

Choosing an agent is a significant decision. The selected agent should be someone the principal trusts implicitly, as they will have broad authority to act on the principal's behalf. This person should be responsible, understand the principal's wishes, and be capable of making decisions under potentially stressful circumstances. Family members, close friends, or trusted advisers are commonly selected, but the principal's choice is personal and should be made with care.

Can a Durable Power of Attorney be revoked?

Yes, a Durable Power of Attorney can be revoked at any time by the principal, as long as they are mentally competent. To revoke the power of attorney, the principal should provide a written notice to the agent and to any institutions or individuals that have been dealing with the agent under the authority of the document. Additionally, creating a new Power of Attorney can also automatically revoke the previous one, depending on the terms of the new Power of Attorney and state laws.

Common mistakes

The Virginia Durable Power of Attorney form is a crucial document that allows someone to act on your behalf should you become unable to do so yourself. When filling out this form, accuracy and attention to detail are essential. However, several common mistakes can undermine its effectiveness and lead to potential difficulties. By recognizing and avoiding these errors, you can ensure your interests are protected.

One prevalent mistake is not being specific about the powers granted. This document empowers another person, known as the agent, to make decisions on your behalf. Without specifying the scope of their authority, you might inadvertently give them more power than intended or restrict their ability too much, hindering their ability to act in your best interest.

Another common error involves choosing the wrong agent. The role of an agent is pivotal, requiring trust and confidence that they will act in your best interest. Selecting someone without considering their ability to handle financial matters or their proximity to you can lead to issues. It's crucial to choose someone who is not only trustworthy but also capable of managing the responsibilities that come with the role.

Many people fail to consider a contingency plan. If the original agent is unable to perform their duties, having no alternate agent listed can create a legal vacuum. This oversight can be particularly problematic, requiring court intervention to appoint a new agent, which can be time-consuming and costly.

Not regularly updating the document is another oversight. Life changes such as marriage, divorce, the death of an agent, or a change in your financial situation necessitate updates to the Power of Attorney to reflect your current wishes and circumstances.

A visibly overlooked mistake is neglecting to get the document properly witnessed or notarized, as required by Virginia law. This formality is not merely procedural but a legal requirement to ensure the document’s validity and enforceability. Without proper witnessing or notarization, the document might not be recognized by financial institutions or healthcare providers.

Finally, a significant error is failing to discuss the contents of the Durable Power of Attorney with the appointed agent. It's imperative that the agent understands their responsibilities, your expectations, and the extent of the powers granted to them. This discussion can prevent misunderstandances and ensure that your wishes are clearly communicated and more likely to be followed.

In summary, when completing the Virginia Durable Power of Attorney form, it is critical to:

- Specify the powers granted to the agent,

- Carefully choose the right agent,

- Include an alternate agent as a contingency plan,

- Regularly update the document to reflect current circumstances,

- Ensure the document is properly witnessed or notarized according to Virginia law, and

- Discuss the contents and expectations with your appointed agent.

Avoiding these mistakes can significantly enhance the effectiveness of your Durable Power of Attorney, safeguarding your interests and ensuring your wishes are honored.

Documents used along the form

When preparing a Virginia Durable Power of Attorney, it's important to consider additional forms and documents that might be necessary to ensure comprehensive coverage of one's affairs. These documents complement the Power of Attorney by covering aspects beyond the scope of financial decisions, addressing medical decisions, specifying end-of-life wishes, and ensuring your desires are honored in various circumstances. Including the right mix of legal documents provides a well-rounded approach to estate planning and personal care.

- Advance Medical Directive: This document allows an individual to outline their preferences for medical treatment in situations where they are unable to make decisions for themselves. It acts as a guide for healthcare providers and the appointed healthcare agent.

- Will: A legal document that communicates a person's wishes regarding the distribution of their property and the care of any minor children, if applicable, after their death.

- Living Trust: A trust established during an individual's lifetime that allows for the easy transfer of the trust's assets to beneficiaries designated by the individual, bypassing the often lengthy and complex probate process.

- HIPAA Authorization Form: This form permits healthcare providers to disclose an individual's healthcare information to designated persons, including the agent named in a durable power of attorney or an advance medical directive.

- Do Not Resuscitate (DNR) Order: A medical order that tells healthcare professionals not to perform CPR if an individual's breathing stops or if the heart stops beating. It is used in situations where the individual does not want to be resuscitated.

- Authorization for Final Disposition: A document that allows an individual to specify their wishes for their final arrangements, such as burial or cremation, and designate an agent to ensure these plans are carried out.

Together with a Virginia Durable Power of Attorney, these documents form a comprehensive legal strategy to manage one’s financial and healthcare decisions. It's advisable to consult with legal counsel to understand the implications of each document fully and ensure they are executed correctly, reflecting one's wishes accurately and providing peace of mind. Combining these documents appropriately ensures not only the management of financial and medical decisions but also the fulfillment of personal wishes concerning one's estate and health care preferences.

Similar forms

The Virginia Durable Power of Attorney form is similar to other legal documents that enable individuals to appoint representatives to make decisions on their behalf. These include the Medical Power of Attorney, General Power of Attorney, and Springing Power of Attorney. Each document serves a unique purpose but shares the core function of delegating decision-making authority under certain conditions.

In comparison to the Medical Power of Attorney, the Virginia Durable Power of Attorney form allows an individual, known as the principal, to designate an agent to make a wide range of decisions on their behalf, not limited to healthcare. The Medical Power of Attorney is specifically tailored for health care decisions, including treatment options and end-of-life care, should the principal become incapable of communicating their wishes due to illness or incapacitation. Both documents take effect under the conditions specified by the principal, but the scope of decision-making power is what sets them apart.

Similar to the General Power of Attorney, the Virginia Durable Power of Attorney form grants an agent broad powers to manage the principal's financial and legal affairs. However, the durable nature of the Virginia form means that the agent's authority continues even if the principal becomes incapacitated. The General Power of Attorney, on the other hand, typically ceases to be effective if the principal loses the ability to make informed decisions. This critical difference makes the durable version preferable for long-term planning, ensuring continuous management without the need for court intervention.

The Springing Power of Attorney is another related document, which also allows an individual to appoint an agent to handle their affairs. However, unlike the Virginia Durable Power of Attorney, which can become effective immediately upon signing, the Springing Power of Attorney only "springs" into effect upon the occurrence of a specific event, typically the incapacity of the principal. This mechanism provides an extra level of control and reassurance for individuals concerned about relinquishing power too soon, though it can introduce delays and complications as proof of the triggering condition is required to activate the agent's power.

Dos and Don'ts

Filling out a Virginia Durable Power of Attorney form is a responsible step in securing your future needs and ensuring your affairs are managed according to your wishes. To help guide you through this process smoothly, here are several dos and don'ts you should consider.

- Do carefully choose an agent who you trust implicitly. This person will be making decisions on your behalf, so their integrity and judgment should be beyond reproach.

- Do be specific about the powers you are granting. The form allows you to delineate exactly what your agent can and cannot do, providing you with tailored control over your affairs.

- Do discuss your decision with the person you’re appointing as your agent. It’s vital they understand the responsibilities involved and agree to take on this role.

- Do sign the document in the presence of a notary public. In Virginia, notarization is required for the form to be legally valid.

- Do keep the original document in a safe but accessible place, and inform your agent and close family members where it is kept.

- Don’t leave blanks on your form. If certain sections do not apply to your situation, clearly write “N/A” (not applicable) to prevent unauthorized additions after you’ve signed the document.

- Don’t forget to review and update your Durable Power of Attorney periodically. Life changes such as marriage, divorce, the birth of a child, or a significant change in financial status can affect your choices and decisions.

By following these guidelines, you can help ensure that your Virginia Durable Power of Attorney accurately reflects your wishes and provides the protection you intend. It’s a step that shouldn’t be rushed; take your time to consider all options and choose wisely to ensure your peace of mind and security.

Misconceptions

When it comes to preparing for the future, understanding the tools available for estate and health planning is crucial. One of those tools, the Durable Power of Attorney, is often surrounded by misconceptions, especially within the state of Virginia. Below are four common misunderstandings about the Virginia Durable Power of Attorney form and clarifications to help provide a clearer picture.

- Misconception: A Durable Power of Attorney grants control immediately upon signing.

Many individuals hesitate to create a Durable Power of Attorney, under the belief that it will immediately strip them of their autonomy. In Virginia, the individual granting power (the principal) has the flexibility to dictate when the powers begin. This can be immediately, upon a specific date, or upon the occurrence of a condition, typically the principal's incapacity. This customization ensures the principal retains control until they decide otherwise or are unable to make decisions themselves.

- Misconception: All Durable Power of Attorney forms are the same.

Not all Durable Power of Attorney forms are created equal. Each state has its own statutes and requirements that govern the creation and use of these documents. Virginia's laws specify particular language and conditions that must be met for a Durable Power of Attorney to be considered valid. It's substantial for those interested in executing such a document to use a state-specific form or ensure that a general form complies with Virginia's legal requirements.

- Misconception: A Durable Power of Attorney covers medical decisions.

One common mistake is conflating a Durable Power of Attorney with a Medical Power of Attorney. In Virginia, a Durable Power of Attorney typically grants the appointed person, or agent, the authority to make financial decisions on behalf of the principal. Health care decisions require a separate document known as an Advance Directive or Medical Power of Attorney. Individuals should consider preparing both documents to ensure comprehensive coverage of both financial and health-related decisions.

- Misconception: Once signed, a Durable Power of Attorney is irrevocable.

Many fear that once a Durable Power of Attorney is executed, it cannot be changed or revoked. However, in Virginia, as long as the principal is of sound mind, they may revoke or amend their Durable Power of Attorney at any time. It's important for individuals to review their estate planning documents periodically and make revisions as their wishes or circumstances change.

Key takeaways

Filling out and using the Virginia Durable Power of Attorney (DPOA) form is a crucial step in planning for future financial management and decision-making. This legal document allows you to appoint someone you trust to manage your financial affairs in case you become unable to do so yourself. Understanding the key aspects of this document ensures that your interests are safeguarded according to your wishes. Here are the significant takeaways that everyone should be aware of:

- Choose an agent wisely: The person you appoint as your agent should be someone you trust implicitly, as they will have significant control over your financial and legal affairs.

- Understand the power you're granting: A Virginia DPOA can give broad or limited powers to your agent, from managing daily finances to selling real estate. Clearly understanding and specifying the scope of these powers is crucial.

- Durability is key: The "durability" aspect indicates that the document remains in effect if you become incapacitated. Without specifying durability, the document may not serve its intended purpose when you most need it.

- Notarization and witnesses: For the DPOA to be legally effective in Virginia, it must be properly notarized and witnessed, as required by state laws. This helps in validating the authenticity of the document.

- Revocation process: It's possible to revoke a DPOA, as long as you are mentally competent. Understanding the correct process to revoke the document and informing all relevant parties is important.

- Communication with financial institutions: Once the DPOA is executed, it's advisable to inform your bank and any other financial institutions of the document and your appointed agent to avoid future hurdles.

- Annual review is advisable: Regularly reviewing and updating your DPOA ensures that it reflects your current wishes and circumstances. Changes in relationships, assets, or preferences may necessitate updates to the document.

- Defining incapacity: Some DPOAs become effective only upon the principal's incapacity. Clarifying how incapacity is determined—whether through a doctor's certification or court determination—can prevent confusion and delays when the document needs to be enacted.

- Limitations and restrictions: Be explicit about any limitations or restrictions you wish to place on your agent's power. Specificity prevents misuse of authority and ensures that your agent acts within the bounds you set.

- Safekeeping and accessibility: Keep the original DPOA document in a safe but accessible place. Ensure that your agent and possibly a trusted family member or friend know where to find it in case it needs to be used.

Taking these steps when filling out and using a Virginia Durable Power of Attorney form can provide peace of *mind,* knowing that your financial affairs will be managed according to your wishes in the event that you cannot manage them yourself. Remember, dealing with such important legal documents may also warrant consultation with a legal professional to ensure that your rights and interests are fully protected.

More Durable Power of Attorney State Forms

Free Printable Durable Power of Attorney Form Washington State - Requires formal execution and witness signatures, in accordance with state laws, to ensure its legitimacy and enforceability.

Free Power of Attorney Form Mississippi - Ensure seamless continuation of your personal and financial affairs through a Durable Power of Attorney.

Does a Power of Attorney Need to Be Recorded in Florida - It's a key tool for incapacity planning, making it an essential element for anyone looking to have a solid plan in place.

New Hampshire Power of Attorney Form - It's an essential element of a well-constructed estate plan, complementing your will and advance healthcare directive for a comprehensive approach to future planning.