Attorney-Verified Durable Power of Attorney Document for Washington

A crucial component of estate planning, the Washington Durable Power of Attorney form, allows individuals to appoint someone they trust to manage their financial and legal affairs, should they become unable to do so themselves. This legal document remains effective even if the person becomes incapacitated, ensuring continued management of their assets and decisions in their best interest. It is pivotal for adults of all ages to consider, providing peace of mind that their matters will be handled according to their wishes, regardless of what the future holds. The form requires clear specification of powers granted, may include limitations, and needs to meet Washington state laws to be valid. Careful selection of the agent—who will wield this significant responsibility—is advised, as is consultation with a legal professional to ensure the form accurately reflects the grantor's intentions and complies with relevant legislation.

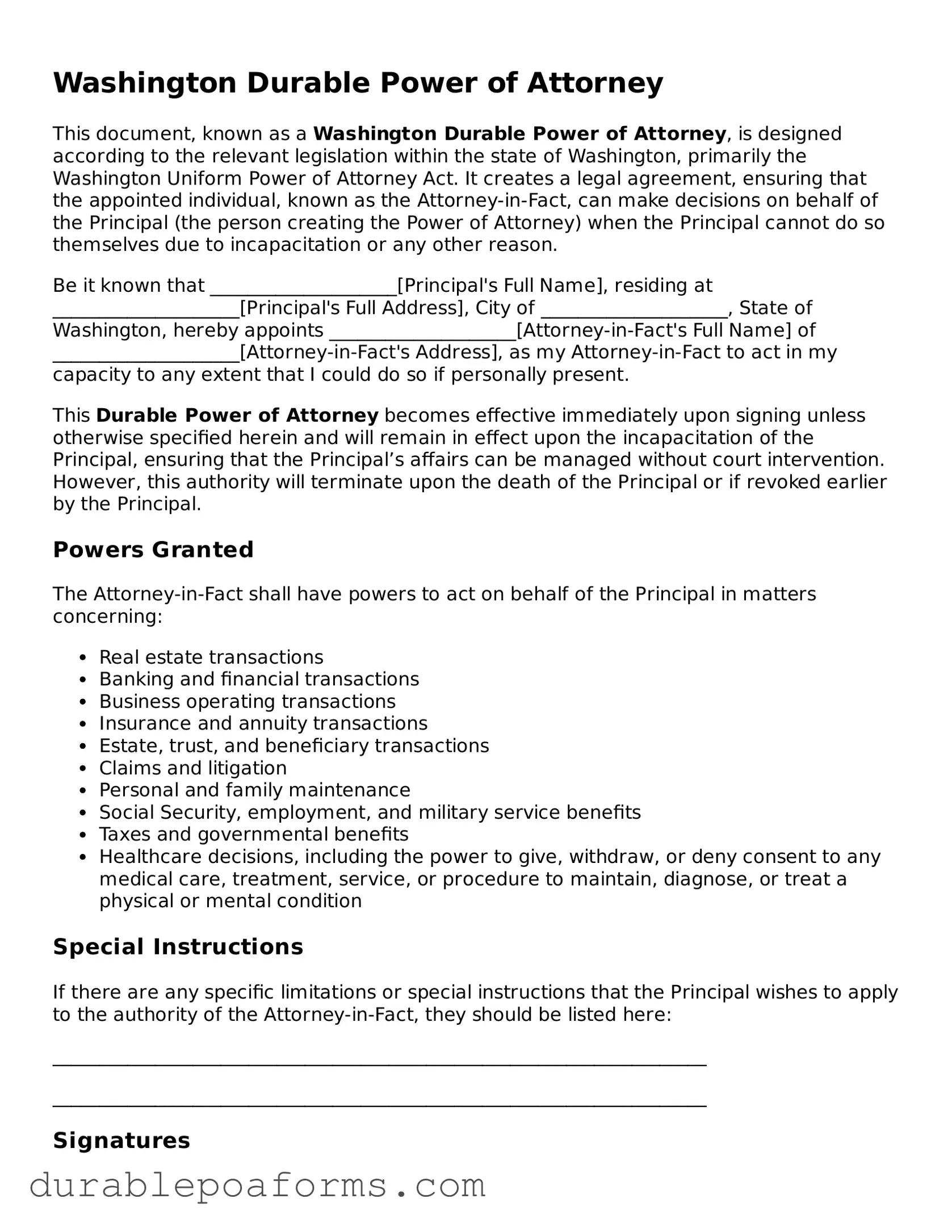

Form Preview

Washington Durable Power of Attorney

This document, known as a Washington Durable Power of Attorney, is designed according to the relevant legislation within the state of Washington, primarily the Washington Uniform Power of Attorney Act. It creates a legal agreement, ensuring that the appointed individual, known as the Attorney-in-Fact, can make decisions on behalf of the Principal (the person creating the Power of Attorney) when the Principal cannot do so themselves due to incapacitation or any other reason.

Be it known that ____________________[Principal's Full Name], residing at ____________________[Principal's Full Address], City of ____________________, State of Washington, hereby appoints ____________________[Attorney-in-Fact's Full Name] of ____________________[Attorney-in-Fact's Address], as my Attorney-in-Fact to act in my capacity to any extent that I could do so if personally present.

This Durable Power of Attorney becomes effective immediately upon signing unless otherwise specified herein and will remain in effect upon the incapacitation of the Principal, ensuring that the Principal’s affairs can be managed without court intervention. However, this authority will terminate upon the death of the Principal or if revoked earlier by the Principal.

Powers Granted

The Attorney-in-Fact shall have powers to act on behalf of the Principal in matters concerning:

- Real estate transactions

- Banking and financial transactions

- Business operating transactions

- Insurance and annuity transactions

- Estate, trust, and beneficiary transactions

- Claims and litigation

- Personal and family maintenance

- Social Security, employment, and military service benefits

- Taxes and governmental benefits

- Healthcare decisions, including the power to give, withdraw, or deny consent to any medical care, treatment, service, or procedure to maintain, diagnose, or treat a physical or mental condition

Special Instructions

If there are any specific limitations or special instructions that the Principal wishes to apply to the authority of the Attorney-in-Fact, they should be listed here:

______________________________________________________________________

______________________________________________________________________

Signatures

This document must be signed by the Principal in the presence of a Notary Public or two (2) witnesses to be legally effective. Witnesses must not be the Attorney-in-Fact or related to the Principal by blood, marriage, or adoption. The witness section is in accordance with RCW 11.125.050.

______________________[Date]

Principal’s Signature: ______________________

Principal’s Printed Name: ______________________

Attorney-in-Fact’s Signature: ______________________

Attorney-in-Fact’s Printed Name: ______________________

Witness 1 Signature: ______________________

Witness 1 Printed Name: ______________________

Witness 2 Signature: ______________________

Witness 2 Printed Name: ______________________

State of Washington

County of ______________________

Subscribed and sworn before me this _____ day of _______________, 20____, by ____________________[Principal's Full Name] and ____________________[Attorney-in-Fact's Full Name], who are personally known to me or have produced identification.

Notary Public Signature: ______________________

Notary Printed Name: ______________________

My commission expires: ______________________

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A Washington Durable Power of Attorney form allows an individual to appoint someone else to manage their financial affairs, even if the individual becomes incapacitated. |

| Governing Laws | The form and its use are governed by Chapter 11.125 RCW in Washington State, which outlines the laws related to durable powers of attorney. |

| Effective Time | This document is effective immediately upon signing, unless the form specifically states otherwise. |

| Duration | It remains effective even if the person who made it becomes incapacitated, hence the term "durable." |

| Revocation | The person who created the durable power of attorney can revoke it at any time, as long as they are mentally competent. |

| Agent's Duties | The appointed agent is legally obligated to act in the principal's (the person who created the power of attorney) best interest. |

| Signatory Requirements | The form must be signed by the principal and either witnessed by two individuals who are not related by blood or marriage and who are not named as agents, or notarized. |

Washington Durable Power of Attorney - Usage Guide

Creating a Durable Power of Attorney (DPOA) grants someone you trust the authority to handle your affairs should you become unable to do so yourself. It's a significant step in managing your life's logistics, ensuring decisions can be made on your behalf concerning your finances, property, or other important areas. Before embarking on this process, it's essential to thoroughly consider whom to appoint as your agent, as this individual will have considerable influence over your affairs. Once you've made this decision, filling out the form properly is crucial to ensure its validity and effectiveness.

To complete the Washington Durable Power of Attorney form accurately, follow these steps:

- Download the form: First, obtain the most recent version of the Washington Durable Power of Attorney form from a reliable source. Ensure it is the correct form for Washington State, as requirements may vary by jurisdiction.

- Gather required information: Collect all necessary information, including the full legal names, addresses, and contact details of both the principal (you) and the designated agent (the person you're appointing).

- Decision making: Decide the scope of powers you wish to grant your agent. These can range from broad to specific, such as managing bank accounts, selling property, or making healthcare decisions.

- Fill in the personal details: Enter your name and address in the designated section at the beginning of the form. Follow the form's structure to include the same details for your agent.

- Specify powers granted: Clearly mark or write the specific powers you're granting to your agent. The form may have checkboxes or require a written statement of these powers. Be precise to avoid any confusion or ambiguity.

- Sign and date the form: Review the form to ensure all information is correct and complete. Then, in the presence of a notary public, sign and date the form. Most states, including Washington, require a Durable Power of Attorney to be notarized to be valid.

Witness requirements: Some states require DPOA forms to be signed in the presence of one or more witnesses who are not related to you or named as your agent. Check the specific requirements for Washington to ensure compliance. - Distribute copies: After the form is fully executed, distribute copies to your agent, family members, or anyone else who may need to be aware of the arrangement. Consider also providing a copy to your attorney for safekeeping.

The completion of a Durable Power of Attorney form marks a significant step in planning for the future. With the form accurately filled out and properly executed, you can have peace of mind knowing that your affairs will be handled according to your wishes should the need arise. Remember, laws governing DPOAs can change, so it’s a good idea to review your arrangements periodically, especially after major life events or legal updates.

Common Questions

What is a Durable Power of Attorney in Washington State?

A Durable Power of Attorney in Washington State is a legal document that allows an individual (the principal) to appoint another person (the agent) to manage their financial affairs and make decisions on their behalf. This authority can include managing bank accounts, selling property, and making investment decisions. The term "durable" signifies that the document remains in effect even if the principal becomes incapacitated or unable to make decisions on their own.

How is a Durable Power of Attorney established in Washington State?

To establish a Durable Power of Attorney in Washington State, the principal must complete and sign the appropriate form, often in the presence of a notary public to ensure legality. The document must clearly state the powers granted to the agent and indicate that it is intended to be durable. Specific legal requirements may vary, so it is advisable to consult legal guidance to ensure the document meets all legal stipulations for it to be effective.

Can the Durable Power of Attorney be revoked?

Yes, the principal has the right to revoke their Durable Power of Attorney at any time, as long as they are mentally competent. To revoke the authority, the principal must notify the agent in writing and destroy all copies of the power of attorney document. Additionally, it's recommended to inform any financial institutions and other parties that were relying on the power of attorney that it has been revoked.

What happens if there is no Durable Power of Attorney in place and an individual becomes incapacitated?

If an individual becomes incapacitated without a Durable Power of Attorney in place, the court may need to appoint a guardian or conservator to manage their affairs. This process can be time-consuming, costly, and stressful for family members. It also removes control from the individual regarding who will make decisions on their behalf. Having a Durable Power of Attorney can prevent these complications by ensuring there is a trusted person designated to manage affairs according to the principal's wishes.

Common mistakes

When individuals embark on the process of filling out the Washington Durable Power of Attorney (POA) form, they often find themselves navigating through a maze of legal stipulations and requirements. This task, critical in ensuring that your affairs are managed according to your wishes in the event you are unable to do so yourself, can be daunting and fraught with potential pitfalls. Here, we explore the most common mistakes made during this process, aiming to provide clarity and guidance to those seeking to secure their future effectively.

Not Clearly Identifying the Parties: A widespread mistake is the failure to clearly identify both the principal (the person granting the power) and the agent (the person being granted the power) by their full legal names. This lack of clarity can lead to confusion and disputes, particularly in situations where the parties might share common last names or when there are multiple potential agents.

Ignoring Alternate Agents: Many individuals neglect to designate an alternate agent. This oversight can become problematic if the primary agent is unable or unwilling to serve, leaving the principal without a trusted individual to manage their affairs as initially intended.

Overlooking Specific Powers: The form allows for the granting of general or specific powers. A critical mistake is not specifying the powers you wish to grant your agent, or conversely, failing to limit the scope of authority if the intention is not to grant broad power. This could result in an unintended grant of authority, potentially leading to misuse.

Failing to Specify Durability: If the form does not explicitly state that the power of attorney is durable, it will not remain in effect if the principal becomes incapacitated. This omission defeats the purpose for many who execute a POA for the very reason of ensuring continued management of their affairs despite their incapacity.

Ignoring State-Specific Requirements: Each state has its unique requirements for a durable power of attorney to be considered valid. For Washington, this includes specific wording and notarization for the document to be legally binding. Ignorance of these requirements can render the document invalid.

Not Properly Executing the Document: Merely filling out the form is not sufficient. For a power of attorney to be legally binding in Washington, it must be properly executed, which includes being signed in the presence of a notary or two disinterested witnesses who are not named in the POA. This step is frequently overlooked, leading to the document's invalidity.

Lack of Customization for Specific Needs: Using a one-size-fits-all approach and not tailoring the POA to address the principal’s unique circumstances and needs is a common mistake. This could result in the agent not being empowered to make decisions in specific, crucial areas of the principal's life.

Failure to Review and Update: People’s circumstances and relationships change over time, yet a frequently encountered mistake is the failure to periodically review and update the POA. This can result in an outdated document that may not reflect the principal's current wishes or situation.

In summary, the process of completing a Washington Durable Power of Attorney form is critical but littered with potential pitfalls. By avoiding these common mistakes—ensuring clarity in party identification, considering alternate agents, specifying powers accurately, adhering to legal requirements for durability and state-specific criteria, correctly executing the document, customizing to specific needs, and periodically updating the document—individuals can ensure that their interests are protected and their wishes effectively carried out.

Documents used along the form

When preparing for the future, it's essential to understand the importance of comprehensive estate planning. The Washington Durable Power of Attorney (DPOA) form is a vital component, allowing you to appoint someone to handle your financial and legal affairs should you become unable to do so yourself. However, to create a robust legal and financial plan, other documents are also necessary. These documents work in tandem with the DPOA to ensure your wishes are respected and clear. Here is a list of up to nine other forms and documents often used alongside the Washington Durable Power of Attorney form, each serving its unique purpose.

- Advance Directive to Physicians (Living Will): This document specifies your wishes regarding medical treatments you would or would not want to be used to keep you alive and other aspects of your healthcare in the event that you can no longer communicate.

- Health Care Power of Attorney: Much like the DPOA, this form allows you to appoint someone to make healthcare decisions on your behalf if you're not able to do so, often complementing the living will by covering aspects not specified therein.

- Last Will and Testament: This document delineates how your property and assets should be distributed upon your death. It can also appoint guardians for any minor children.

- Revocable Living Trust: A living trust provides for the management of your assets during your lifetime and specifies how they should be distributed upon your death, potentially allowing your estate to avoid probate.

- Mental Health Advance Directive: This document lets you make decisions about your mental health care treatment in advance, in case there comes a time when you are not able to make decisions due to mental illness.

- Authorization for Final Disposition: This form allows you to outline your wishes for your funeral, burial, cremation, and other posthumous matters, including appointing an individual to carry out these wishes.

- Financial Information Sheet: Though not a formal legal document, this sheet is critical for the individual you appoint through a DPOA, providing them with necessary information about assets, liabilities, account numbers, and other financial data.

- Document of Gift (Organ Donation): This form specifies your wishes regarding organ and tissue donation upon your death.

- HIPAA Release Form: The Health Insurance Portability and Accountability Act (HIPAA) privacy rule can restrict the sharing of your health information. A HIPAA release form grants permission for healthcare providers to discuss your medical information with designated individuals.

Together, these documents provide a comprehensive approach to estate planning, ensuring that your health, financial affairs, and final wishes are addressed according to your specific desires. Using the Washington Durable Power of Attorney form alongside these additional documents helps safeguard not only your interests but also those of your loved ones, providing peace of mind to all involved.

Similar forms

The Washington Durable Power of Attorney form is similar to several other legal documents in terms of its purpose and the power it grants. However, it stands out due to its focus on financial matters and its durability clause, which ensures that the document remains in effect even if the principal becomes incapacitated. This characteristic is crucial for continuous management of the principal's affairs without court intervention. Below are documents to which it bears resemblance and the nuances that differentiate them.

Healthcare Power of Attorney: Similar to the Durable Power of Attorney, a Healthcare Power of Attorney grants an agent the authority to make decisions on behalf of the principal. While the Durable Power of Attorney is primarily focused on financial and property matters, the Healthcare Power of Attorney is specifically designed to grant decision-making power regarding medical and health-related issues. This document becomes critical when the principal is unable to make their own healthcare decisions due to incapacity or illness. It's tailored to ensure that the principal's medical treatment preferences are followed, emphasizing personal well-being over financial considerations.

Living Will: A Living Will, albeit distinct, shares similarities with the Durable Power of Attorney. It is a document that outlines the principal’s preferences regarding end-of-life care and treatment. Unlike the Durable Power of Attorney, which appoints another individual to make decisions on the principal's behalf, a Living Will directly expresses the principal’s own wishes concerning life-prolonging medical interventions. In essence, while a Living Will specifies what should be done, a Durable Power of Attorney designates someone to make those decisions, covering a broader scope beyond just healthcare.

General Power of Attorney: The General Power of Attorney and the Durable Power of Attorney both entrust an agent with the authority to make decisions and act on the principal's behalf. The principal difference lies in their operational durability. A General Power of Attorney typically becomes invalid if the principal becomes mentally incapacitated or unable to make decisions. Conversely, the durability clause in a Durable Power of Attorney ensures that the document remains effective even under such circumstances, providing uninterrupted management of the principal’s affairs regardless of their health status.

Dos and Don'ts

When filling out the Washington Durable Power of Attorney form, it's important to be aware of both the correct steps to follow and the mistakes to avoid. This guide provides a clear list of do's and don'ts to help ensure that your form is filled out accurately and effectively.

Do's:

- Thoroughly read the instructions provided with the form before beginning. Understanding each section's requirements is crucial to correctly complete the form.

- Use a pen with black ink for clarity and to ensure that the document can be easily copied or scanned if necessary.

- Include clear and detailed information about the powers you are granting. Being specific about what decisions the agent can make on your behalf helps prevent confusion and misinterpretation.

- Choose a trustworthy person as your agent. This should be someone you trust to make serious decisions about your finances, health, and other important matters if you are unable to do so yourself.

- Sign the form in the presence of a notary public. Washington State requires notarization for the document to be legally valid.

- Keep the original document in a safe yet accessible place, and provide copies to your agent and any relevant institutions (like your bank or healthcare provider).

Don'ts:

- Rush through the process without fully understanding the implications of what you are signing. Take your time to consider how each decision might affect your future.

- Use a pencil or any ink color other than black, as this can make the document appear unprofessional or challenging to photocopy.

- Leave sections of the form blank. If a section does not apply to your situation, write "N/A" (not applicable) to show that you did not overlook it.

- Choose an agent based solely on emotional relationships without considering their capability to handle the responsibility.

- Forget to update the form as your situation changes. If you need to change your agent or alter the powers granted, complete a new form.

- Fail to inform your agent about the powers you have granted them. It's important that they understand their responsibilities and your expectations.

Misconceptions

When discussing the Washington Durable Power of Attorney (DPOA) form, it's crucial to dispel some common misconceptions that can confuse and mislead. A clear understanding ensures that individuals can make informed decisions about managing their affairs, particularly in situations where they may be unable to make decisions for themselves. Below are four common misconceptions about the DPOA in Washington:

- It Grants Immediate Control: A widespread misconception is that by executing a Durable Power of Attorney, you are immediately relinquishing control over your finances or medical decisions. In truth, the form can be crafted to only become effective under circumstances you specify, such as incapacitation, ensuring you retain control until such conditions are met.

- It's Valid After Death: Some believe that a Durable Power of Attorney remains effective after the principal's death. However, the authority granted through a DPOA ceases upon the principal's death. At that point, the executor of the estate, as designated in a will, or state law if there's no will, takes over the management of the deceased's affairs.

- It Covers Health Care Decisions: Another common misunderstanding is that the Durable Power of Attorney for financial matters also covers health care decisions. Washington, like many states, requires a separate document, known as a Health Care Power of Attorney or Advance Directive, to appoint someone to make medical decisions on your behalf.

- One Size Fits All: People often assume that the DPOA form is a "one size fits all" document that doesn't need to be personalized. In reality, it's crucial to tailor the DPOA to your specific situation, including specifying the powers granted and under what conditions they can be exercised. An attorney can help customize your DPOA to ensure it accurately reflects your wishes and complies with Washington law.

Dispelling these misconceptions is essential for anyone considering establishing a Durable Power of Attorney. Understanding the specific provisions and limitations of the DPOA form in Washington ensures that individuals can plan effectively for their future, knowing their affairs will be managed according to their wishes.

Key takeaways

When filling out and using the Washington Durable Power of Attorney form, it's important to consider a variety of factors to ensure that the document is executed correctly and serves its intended purpose effectively. Below are key takeaways to guide you through this crucial legal process.

- Understanding the Purpose: The Durable Power of Attorney allows you to appoint someone to handle your financial affairs if you become incapacitated. This appointed person is called your "agent" and can make decisions regarding your property, finances, and more, on your behalf.

- Choosing the Right Agent: The choice of agent is critical. This should be someone you trust implicitly, as they will have significant control over your financial matters. Consider their ability to manage finances and their availability to undertake the role.

- Specificity is Key: Be as specific as possible when delineating the powers granted to your agent. The form allows for the inclusion of specific financial decisions you authorize your agent to make, which can range from managing bank accounts to selling property.

- Witnesses and Notarization: For the form to be legally valid in Washington, it must be signed in the presence of a notary public or two competent witnesses, none of whom can be the agent. This step is crucial for ensuring the document’s legality.

- Duration of the Power: While "durable" implies that the power of attorney remains in effect if you become incapacitated, it's important to note that it becomes effective as soon as it's signed and continues until you revoke it or pass away, unless otherwise specified.

- Revocation Process: You have the right to revoke the power of attorney at any time, provided you are of sound mind. This revocation should be done in writing and communicated to your agent and any institutions or individuals that were relying on the original power of attorney.

- Safekeeping and Copies: Once completed, the original document should be kept in a safe place. However, it is wise to give copies to your agent and any financial institutions involved in your affairs. Knowing where the document is and who has copies ensures that it can be used when needed without delay.

By carefully considering these key takeaways, you can ensure that your Washington Durable Power of Attorney form not only meets legal requirements but also effectively represents your wishes regarding the management of your finances, in the event that you are unable to do so yourself.

More Durable Power of Attorney State Forms

Power of Attorney Nevada - The document should be stored in a safe place, and copies should be provided to your agent and possibly your attorney.

Power of Attorney Services Near Me - This document streamlines the management of affairs, enabling the agent to act swiftly and efficiently in managing the principal's finances and legal matters.

New Hampshire Power of Attorney Form - The Durable Power of Attorney is recognized across states, but it's important to ensure it complies with local laws to guarantee its effectiveness.

Power of Attorney Michigan - It serves as an essential legal document for anyone facing major surgery, serious health conditions, or the challenges of aging.