Attorney-Verified Durable Power of Attorney Document for Wisconsin

In the realm of estate planning and personal health care management, the Wisconsin Durable Power of Attorney form stands out as a critical tool. This legal document enables individuals to appoint a trusted agent to make important financial and health care decisions on their behalf, in the event they become incapacitated or unable to make these decisions themselves. The "durable" aspect of this power of attorney is particularly significant; it ensures that the agent's authority remains in effect even if the principal loses mental capacity. Designed to protect the principal's interests and provide continuity of care and financial management, this form requires careful consideration and compliance with Wisconsin state laws to ensure its validity. The process of selecting an agent, specifying the powers granted, and understanding the responsibilities involved highlights the form's importance in maintaining an individual's autonomy and welfare, even in times of uncertainty.

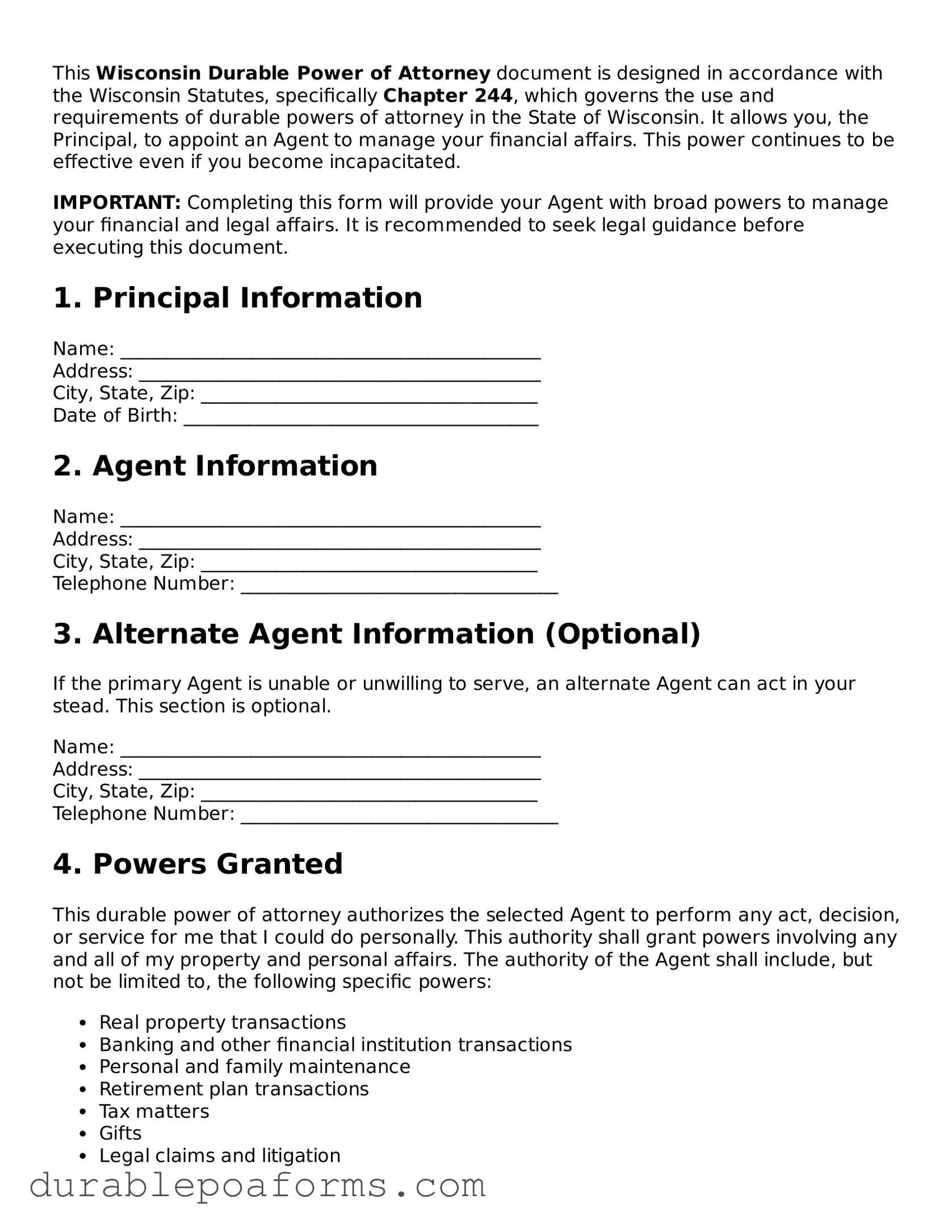

Form Preview

This Wisconsin Durable Power of Attorney document is designed in accordance with the Wisconsin Statutes, specifically Chapter 244, which governs the use and requirements of durable powers of attorney in the State of Wisconsin. It allows you, the Principal, to appoint an Agent to manage your financial affairs. This power continues to be effective even if you become incapacitated.

IMPORTANT: Completing this form will provide your Agent with broad powers to manage your financial and legal affairs. It is recommended to seek legal guidance before executing this document.

1. Principal Information

Name: _____________________________________________

Address: ___________________________________________

City, State, Zip: ____________________________________

Date of Birth: ______________________________________

2. Agent Information

Name: _____________________________________________

Address: ___________________________________________

City, State, Zip: ____________________________________

Telephone Number: __________________________________

3. Alternate Agent Information (Optional)

If the primary Agent is unable or unwilling to serve, an alternate Agent can act in your stead. This section is optional.

Name: _____________________________________________

Address: ___________________________________________

City, State, Zip: ____________________________________

Telephone Number: __________________________________

4. Powers Granted

This durable power of attorney authorizes the selected Agent to perform any act, decision, or service for me that I could do personally. This authority shall grant powers involving any and all of my property and personal affairs. The authority of the Agent shall include, but not be limited to, the following specific powers:

- Real property transactions

- Banking and other financial institution transactions

- Personal and family maintenance

- Retirement plan transactions

- Tax matters

- Gifts

- Legal claims and litigation

5. Special Instructions

Include any special instructions limiting or extending the powers granted to your Agent here:

________________________________________________________________

________________________________________________________________

6. Durable Power of Attorney Effective Date

This durable power of attorney is effective immediately unless a specific date or event is listed here:

Effective Date: _________________________________________________

7. Signature

To make this durable power of attorney valid, the Principal must sign the document in the presence of a notary public:

Principal’s Signature: ___________________________ Date: ___________

State of Wisconsin

County of ____________________

This document was acknowledged before me on (date) ______________ by (name of Principal) ______________________>.

Notary Public: ____________________________

My commission expires: _____________________

8. Acceptance by Agent

By signing below, the Agent accepts this appointment and agrees to act and serve to the best of their abilities, in accordance with this document and under Wisconsin law.

Agent’s Signature: ___________________________ Date: ___________

The information provided in this template is intended to be used as a guide and should not replace professional legal advice. When creating a durable power of attorney, it is important to tailor the document to reflect your specific desires and needs under the guidance of a qualified attorney.

Form Specifications

| Fact | Detail |

|---|---|

| 1. Purpose | This form grants an agent the authority to act on behalf of the principal in financial matters. |

| 2. Durability | It remains in effect even if the principal becomes incapacitated. |

| 3. Governing Law | Wisconsin Statutes Section 244.41 governs the use of this form. |

| 4. Activation | The form takes effect as soon as it is signed, unless specified otherwise in the document itself. |

| 5. Agent’s Duties | The agent is expected to act in the principal's best interest, maintaining accurate records of all transactions. |

| 6. Selection of Agent | Any competent adult can be chosen as an agent. |

| 7. Co-Agents | The principal can appoint more than one agent to act together or separately. |

| 8. Successor Agents | The form allows the designation of successor agents in case the original agent cannot serve. | to

| 9. Termination | The authority granted terminates upon the principal's death, revocation, or when a specified end date is reached. |

| 10. Signing Requirements | It must be signed by the principal and notarized to be valid. |

Wisconsin Durable Power of Attorney - Usage Guide

When preparing to fill out a Wisconsin Durable Power of Attorney form, it's crucial to understand the implications and the process to ensure that your wishes are accurately reflected and legally valid. This document enables you to appoint someone you trust to manage your affairs if you become unable to do so yourself. The following steps are designed to guide you through the process smoothly and effectively, ensuring that your form is filled out correctly.

- Start by obtaining the most current version of the Wisconsin Durable Power of Attorney form. Ensure you have the correct form, as there may be different forms for financial or healthcare decisions.

- Read through the entire form before you begin filling it out. This will help you understand all the sections and the type of information you will need to provide.

- In the section designated for the principal's information, fill in your full legal name, date of birth, and complete address. It's important that this information is accurate and matches your legal documents.

- Identify the person you are appointing as your agent (also referred to as your attorney-in-fact) by providing their full legal name, address, and contact information. Choose someone you trust implicitly to act in your best interest.

- Detail the powers you are granting to your agent. Be as specific as possible to ensure there is no ambiguity regarding their authority. If there are any powers you do not wish to grant, clearly indicate these exceptions.

- If you wish to grant your agent the power to handle real estate transactions, specify this clearly in the designated section. Wisconsin law may require additional documentation or steps for these powers to be effective.

- Indicate any special instructions or limitations you wish to place on your agent's powers. This could include temporal limitations or specific conditions under which their powers can be exercised.

- Choose a successor agent in the event your primary agent is unable or unwilling to serve. Provide the same detailed information for your successor agent as you did for your primary agent.

- Review the sections regarding the effective date and duration of your Durable Power of Attorney. Decide whether the powers will become effective immediately or upon a specific event, such as your incapacitation, and document this choice accordingly.

- Sign and date the form in the presence of two witnesses and a notary public. Wisconsin law requires your signature to be notarized for the Durable Power of Attorney to be considered valid.

- Ensure that your witnesses also sign and date the form. Their signatures will attest to your competence and voluntary signing of the document.

- Finally, provide your agent with a copy of the signed and notarized Durable Power of Attorney. Consider also giving copies to financial institutions, healthcare providers, and anyone else who may need to be aware of its existence.

After completing these steps, your Wisconsin Durable Power of Attorney will be in effect according to the terms you specified. Remember, it's wise to review this document periodically and after any major life changes to ensure it still reflects your wishes. If necessary, you can revoke or amend this document at any time as long as you are competent. Taking the time to accurately complete this form can provide peace of mind and ensure that your affairs are managed according to your wishes in times when you may not be able to do so yourself.

Common Questions

What is a Durable Power of Attorney (DPOA) in Wisconsin?

A Durable Power of Attorney in Wisconsin is a legal document that allows an individual, known as the "principal," to designate another person, the "agent," to manage their financial affairs. This authorization continues to be effective even if the principal becomes incapacitated.

How do I create a Durable Power of Attorney in Wisconsin?

To create a DPOA in Wisconsin, you must complete a form that clearly indicates your intention to grant durable powers to your chosen agent. The form must be signed in the presence of a notary public or two adult witnesses, neither of whom can be the agent.

Who should I choose as my agent?

It's important to choose someone you trust completely as your agent because they will have the authority to manage your financial affairs. This person could be a close family member, a trusted friend, or a professional with fiduciary responsibilities.

What powers can I grant with a DPOA?

With a DPOA, you can grant your agent the power to handle a wide range of financial tasks on your behalf. These include, but are not limited to, banking transactions, real estate management, tax filings, and investment decisions.

Can I revoke a Durable Power of Attorney?

Yes, as long as you are mentally competent, you can revoke your DPOA at any time. To do so, you should provide written notice to your agent and to any institutions or individuals that were relying on the authority of the document.

Does a DPOA in Wisconsin require witnessing or notarization?

Yes, for a DPOA to be legally valid in Wisconsin, it must either be notarized or signed in the presence of two adult witnesses. These witnesses should not be the agent appointed in the DPOA or close relatives of the principal.

Is a Durable Power of Attorney effective immediately?

In many cases, a DPOA becomes effective as soon as it is signed and notarized. However, you can specify in the document that it should only become effective under certain conditions, such as if a doctor certifies that you are unable to manage your financial affairs.

What happens if I don't have a DPOA and become incapacitated?

If you become incapacitated without having a DPOA in place, a court may need to appoint a conservator or guardian to manage your affairs. This process can be lengthy, costly, and may not result in the appointment of your preferred person.

Can I limit the powers granted to my agent?

Yes, the DPOA form allows you to specify exactly which powers your agent will have. You can limit their authority to certain types of decisions or transactions, or you can grant them broad powers to handle all of your financial affairs.

Does my agent have the right to compensation?

While an agent is often a family member or friend who does not expect payment, you can choose to compensate your agent. The terms of compensation should be outlined in the DPOA document to avoid any confusion or disputes.

Common mistakes

The Wisconsin Durable Power of Attorney (POA) form is a vital legal document allowing individuals to appoint a trusted agent to manage their financial affairs. However, mistakes made during its completion can significantly undermine its effectiveness. Understanding these common errors is essential for anyone seeking to ensure their financial matters are handled according to their wishes.

Not Specifying Powers Clearly: Sometimes, individuals fail to clearly outline the specific powers their agent can exercise. This vagueness can lead to confusion or legal challenges, especially when the agent must make critical financial decisions.

Choosing the Wrong Agent: A significant mistake is appointing an agent without the necessary trustworthiness or financial acumen. The agent's decisions can profoundly impact one's financial health, making their selection critical.

Ignoring Alternates: Not naming an alternate agent is a common oversight. If the primary agent is unable or unwilling to serve, the absence of a successor can complicate financial management.

Failing to Date the Document: A surprising number of individuals forget to date their POA form. This omission can question the document's validity or relevance, especially if the financial landscape has changed since its creation.

Omitting a Durability Clause: Without a specific clause stating that the POA remains effective even if the principal becomes incapacitated, its power may inadvertently cease when it is most needed.

Not Understanding Limitations: Some people do not fully comprehend the limitations of a POA. For instance, it cannot be used to make healthcare decisions unless expressly stated, which is a separate document.

Poor Execution: Proper execution, including witnessing and notarization, is critical. Errors in these formalities can invalidate the document or delay its acceptance by financial institutions.

Neglecting to Review and Update: Circumstances change, and a POA form may need updates to reflect new financial realities, relationships, or laws. Failure to periodically review and revise the document can lead to outdated or inefficient management of one’s affairs.

In conclusion, when completing a Wisconsin Durable Power of Attorney form, attention to detail is paramount. Common mistakes can often be avoided by thoroughly reviewing the document, understanding its scope, and consulting with legal expertise if necessary. By avoiding these errors, individuals can ensure their financial affairs are managed accurately and according to their wishes.

Documents used along the form

When preparing for the future, it's critical to have all necessary legal documents in order. Along with the Wisconsin Durable Power of Attorney form, which allows someone to manage your financial affairs if you're unable to, there are several other documents you should consider to ensure complete protection and clarity regarding your wishes. These documents complement the Durable Power of Attorney by covering different aspects of one's personal, financial, and health care needs.

- Advance Directive – This document lays out your wishes for medical care if you become unable to communicate or make decisions for yourself. It often includes a living will and a health care power of attorney.

- Last Will and Testament – Specifies how you want your property and assets distributed after you pass away. It also names an executor to manage the process.

- Revocable Living Trust – Allows you to manage your assets while alive and specify how they should be distributed upon your death, potentially avoiding probate.

- Living Will – A type of advance directive that specifically details the types of medical treatments and life-sustaining measures you wish to accept or refuse.

- Health Care Power of Attorney – Appoints someone to make health care decisions on your behalf if you're unable to do so.

- Declaration to Physicians (Wisconsin Do Not Resuscitate Order) – Specifies your wish not to have cardiopulmonary resuscitation (CPR) in the event of a cardiac or respiratory arrest.

- Authorization for Release of Medical Records – Permits health care providers to release your medical records to individuals or organizations you designate.

- Financial Information Release Form – Similar to the medical records release, this authorizes the disclosure of your financial information to designated parties.

- Funeral Planning Declaration – Allows you to outline your preferences for funeral arrangements and can include the appointment of an agent to make decisions on your behalf.

- HIPAA Release Form – Grants permission for health care providers to discuss your medical information with designated individuals, complementing the Health Care Power of Attorney.

Collectively, these documents provide a comprehensive framework for managing your affairs. Preparing them in advance can offer peace of mind to you and your loved ones, ensuring that your wishes are respected and followed. It’s advisable to consult with a legal professional to ensure that these documents are properly executed and reflect your current wishes and legal requirements.

Similar forms

The Wisconsin Durable Power of Attorney form is similar to other legal documents that allow individuals to designate agents to act on their behalf, but it is unique in its durability, meaning it remains effective even if the principal becomes incapacitated. Several documents share features with the Wisconsin Durable Power of Attorney, each serving specialized functions tailored to different aspects of the principal's life and needs.

Health Care Power of Attorney: This document is akin to the Wisconsin Durable Power of Attorney, as both authorize someone else to make decisions on the principal's behalf. However, the Health Care Power of Attorney is specifically designed for medical decision-making. While the Durable Power of Attorney often covers a broad range of actions, including financial or legal matters, the Health Care Power of Attorney is exclusively focused on health care decisions. This is crucial when the principal cannot make these decisions due to illness or incapacity. It allows the agent to access the principal's medical records, talk to doctors, and make decisions about medical treatments.

Living Will: Another document related to the Wisconsin Durable Power of Attorney is the Living Will. A Living Will, unlike a Durable Power of Attorney, provides directives for medical care in the event the principal is unable to communicate their wishes directly, typically at the end of life. While a Durable Power of Attorney allows the agent to make decisions across a wide range of scenarios, including health decisions if specified, a Living Will focuses specifically on end-of-life decisions. It outlines the principal's preferences regarding life-sustaining treatment, organ donation, and other critical care decisions without appointing an agent.

General Power of Attorney: The General Power of Attorney shares similarities with the Wisconsin Durable Power of Attorney in that it grants an agent authority to act on the principal's behalf. The key difference lies in its duration; a General Power of Attorney usually becomes void if the principal becomes incapacitated or mentally incompetent. In contrast, a Durable Power of Attorney, as its name implies, is designed to survive the principal's incapacity. This enduring feature makes the Durable Power of Attorney especially valuable for long-term planning and care considerations.

Each of these documents serves an essential role in comprehensive life planning and decision-making. While they share some similarities with the Wisconsin Durable Power of Attorney, understanding the unique features and purposes of each can help individuals and their families make informed decisions about their use and implementation.

Dos and Don'ts

Filling out a Wisconsin Durable Power of Attorney form is an important step in planning for the future. It allows you to designate someone you trust to manage your affairs should you become unable to do so. Below are some essential do's and don'ts to keep in mind during this process:

Do:- Read the form carefully. Understand every section before you start filling it out to ensure that you know what powers you are granting.

- Choose a trustworthy agent. This person will have significant control over your finances, so select someone reliable and capable.

- Be specific about the powers granted. Clearly outline what your agent can and cannot do to avoid any confusion or misuse of power.

- Include a secondary agent. If your primary agent is unable to serve, having a secondary (or alternate) agent listed is prudent.

- Sign in the presence of a notary public. This step is crucial for the form to be legally valid and enforceable.

- Leave any sections blank. If a section does not apply, write "N/A" or "None" to confirm you did not overlook it.

- Forget to review and update periodically. Changes in relationships, finances, or preferences might necessitate adjustments to your Power of Attorney form.

Misconceptions

The Wisconsin Durable Power of Attorney (DPOA) form is a powerful legal instrument that allows individuals to appoint someone else to manage their affairs if they are unable to do so themselves. Despite its importance, there are several misconceptions about this document. Understanding these misconceptions is crucial in making informed decisions regarding one’s personal and financial future.

- Misconception 1: The Durable Power of Attorney grants complete control over all aspects of the principal’s life.

In reality, the scope of authority granted to the agent can be as broad or as limited as the principal desires. The principal specifies the powers given to the agent.

- Misconception 2: The Durable Power of Attorney is only for the elderly.

This document is useful for individuals of all ages because unforeseen circumstances, such as illness or injury, can render anyone incapable of managing their affairs.

- Misconception 3: A Durable Power of Attorney is the same as a will.

Unlike a will, which only takes effect after one's death, a Durable Power of Attorney is effective during the principal’s lifetime, specifically when they are unable to make their own decisions.

- Misconception 4: Once signed, the Durable Power of Attorney cannot be revoked.

The principal can revoke a Durable Power of Attorney at any time as long as they are mentally competent to do so, contrary to the belief that it is irrevocable.

- Misconception 5: The appointed agent can make decisions immediately after the document is signed.

Some Durable Power of Attorney documents may require that a certain condition, such as the principal's incapacitation, is met before the agent's power becomes effective.

- Misconception 6: Creating a Durable Power of Attorney means losing independence.

This document is actually a means of maintaining control by choosing someone to manage affairs according to one's wishes, rather than leaving these decisions to the courts.

- Misconception 7: A Durable Power of Attorney can be executed without legal assistance.

While it is possible to create this document on one’s own, consulting with a legal professional can ensure that it accurately reflects the principal’s intents and complies with Wisconsin law.

Key takeaways

When looking into the preparation and utilization of the Wisconsin Durable Power of Attorney form, here are some critical points to remember:

- Understanding the Importance: It grants a chosen individual, referred to as the "agent," the authority to make financial decisions on your behalf, should you become incapacitated. This role requires trust and confidence in the agent's ability to act in your best interests.

- Selection of Agent: Careful consideration must be given to selecting an agent. This person should be someone reliable, trustworthy, and with the competency to handle financial matters. Discussing your expectations and the responsibilities involved with the prospective agent before appointing them is advisable.

- Specificity is Key: While filling out the form, being specific about the powers granted to the agent is crucial. This specificity helps in preventing any future misunderstandings or legal complications. It allows you to tailor the document to fit your exact needs and preferences.

- Legal Requirements: The form must adhere to Wisconsin’s legal requirements to be valid. This includes having it signed in the presence of a notary or two adult witnesses, neither of whom can be the agent. Ensuring the form is completed accurately and meets all state-specific stipulations is important for its effectiveness.

By considering these factors, individuals can ensure that their financial affairs will be managed according to their wishes, even if they are unable to oversee them personally. The Wisconsin Durable Power of Attorney form is a powerful tool, providing peace of mind and financial security when it’s needed most.

More Durable Power of Attorney State Forms

Hawaii Power of Attorney - A precautionary measure, empowering a chosen representative to oversee your financial affairs under unforeseen circumstances.

Power of Attorney Form Idaho - This document ensures your financial affairs can be managed by someone you trust when you're incapacitated.