Attorney-Verified Durable Power of Attorney Document for Wyoming

When individuals in Wyoming seek to ensure their personal, financial, and health-related decisions are in trusted hands, especially during times when they might not be able to express their wishes, the Wyoming Durable Power of Attorney form becomes a critical tool. This legal document, designed to be robust and effective even in circumstances where the principal (the person making the designation) becomes incapacitated, allows for the appointment of a durable power of attorney (DPOA). The chosen agent, thereby, is empowered to make decisions on behalf of the principal, spanning a wide range of matters from managing financial assets to addressing health care preferences. Its durability ensures that the agent's authority remains in effect under circumstances that would otherwise revoke a standard power of attorney. By setting out clear directives and choosing an agent the principal trusts, this arrangement not only provides peace of mind but also stands as a testament to the individual’s foresight in planning for the future. Importantly, for it to be effective, the form must comply with Wyoming’s specific legal requirements, including proper signing and, in some cases, notarization. This attention to legality emphasizes the form’s significance in safeguarding one's autonomy and welfare in uncertain times.

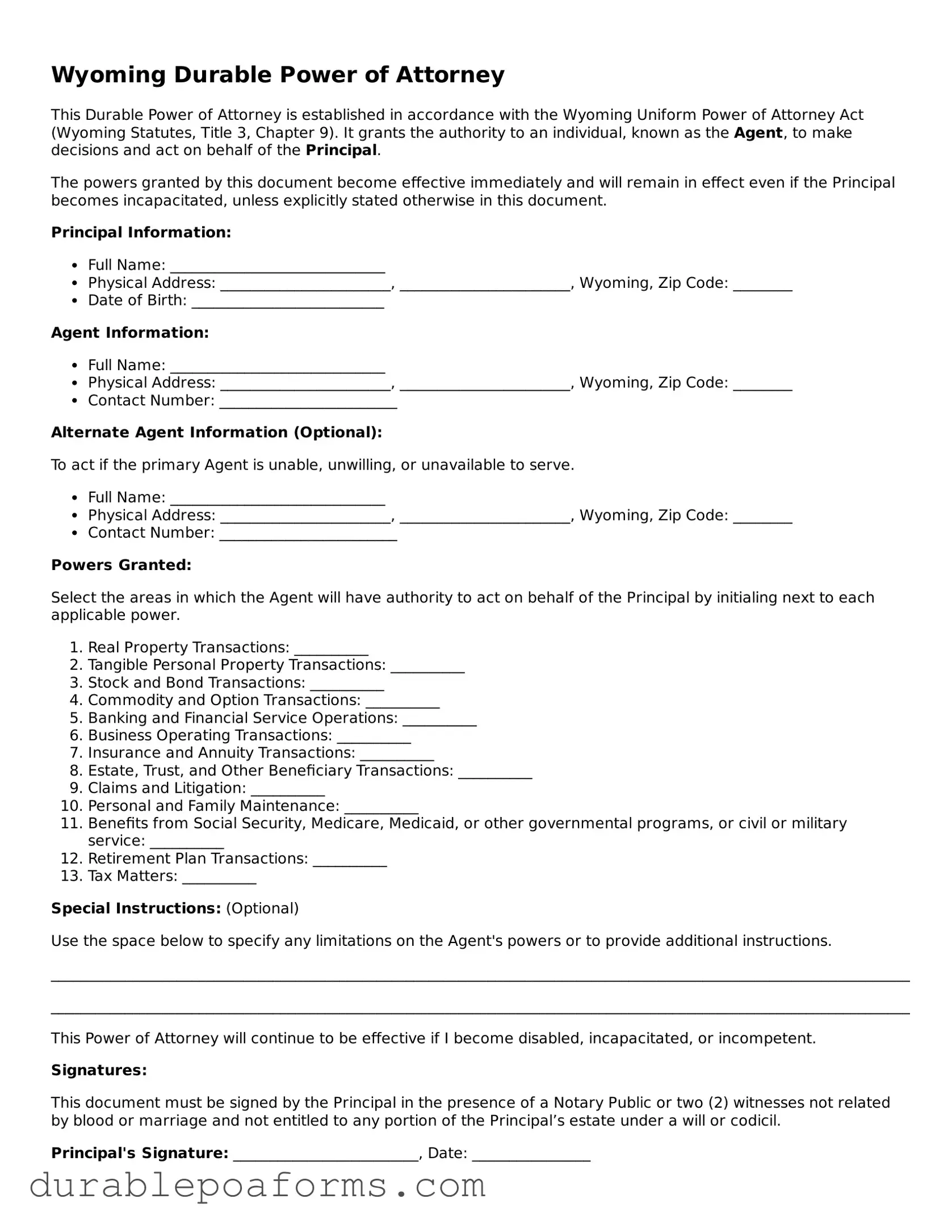

Form Preview

Wyoming Durable Power of Attorney

This Durable Power of Attorney is established in accordance with the Wyoming Uniform Power of Attorney Act (Wyoming Statutes, Title 3, Chapter 9). It grants the authority to an individual, known as the Agent, to make decisions and act on behalf of the Principal.

The powers granted by this document become effective immediately and will remain in effect even if the Principal becomes incapacitated, unless explicitly stated otherwise in this document.

Principal Information:

- Full Name: _____________________________

- Physical Address: _______________________, _______________________, Wyoming, Zip Code: ________

- Date of Birth: __________________________

Agent Information:

- Full Name: _____________________________

- Physical Address: _______________________, _______________________, Wyoming, Zip Code: ________

- Contact Number: ________________________

Alternate Agent Information (Optional):

To act if the primary Agent is unable, unwilling, or unavailable to serve.

- Full Name: _____________________________

- Physical Address: _______________________, _______________________, Wyoming, Zip Code: ________

- Contact Number: ________________________

Powers Granted:

Select the areas in which the Agent will have authority to act on behalf of the Principal by initialing next to each applicable power.

- Real Property Transactions: __________

- Tangible Personal Property Transactions: __________

- Stock and Bond Transactions: __________

- Commodity and Option Transactions: __________

- Banking and Financial Service Operations: __________

- Business Operating Transactions: __________

- Insurance and Annuity Transactions: __________

- Estate, Trust, and Other Beneficiary Transactions: __________

- Claims and Litigation: __________

- Personal and Family Maintenance: __________

- Benefits from Social Security, Medicare, Medicaid, or other governmental programs, or civil or military service: __________

- Retirement Plan Transactions: __________

- Tax Matters: __________

Special Instructions: (Optional)

Use the space below to specify any limitations on the Agent's powers or to provide additional instructions.

____________________________________________________________________________________________________________________

____________________________________________________________________________________________________________________

This Power of Attorney will continue to be effective if I become disabled, incapacitated, or incompetent.

Signatures:

This document must be signed by the Principal in the presence of a Notary Public or two (2) witnesses not related by blood or marriage and not entitled to any portion of the Principal’s estate under a will or codicil.

Principal's Signature: _________________________, Date: ________________

Agent's Signature: ____________________________, Date: ________________

Alternate Agent's Signature (if applicable): ____________________________, Date: ________________

Witness #1 Signature: _________________________, Date: ________________

Witness #2 Signature: _________________________, Date: ________________

Notary Public: (This section to be completed by a Notary Public)

State of Wyoming )

County of ____________ )

Subscribed and sworn to (or affirmed) before me on this ____ day of _____________, 20__, by ____________________________, known to me or satisfactorily proven to be the person whose name is subscribed to the within instrument, and acknowledged that he/she executed the same for the purposes therein contained.

In Witness Whereof, I have hereunto set my hand and notarial seal.

Notary Public: _________________________

My commission expires: ________________

Form Specifications

| Fact Name | Details |

|---|---|

| Purpose | Allows an individual to appoint a trusted person to manage their financial affairs. |

| Governing Law | Wyoming Uniform Power of Attorney Act (§§ 3-9-101 through 3-9-403). |

| Durability | Remains effective even if the principal becomes incapacitated. |

| Principal Requirements | Must be a legal adult with the capacity to make decisions. |

| Agent Eligibility | Must be 18 years of age or older and deemed trustworthy by the principal. |

| Revocation | May be revoked at any time by the principal, provided they are competent, through a written document. |

Wyoming Durable Power of Attorney - Usage Guide

Preparing a Durable Power of Attorney (POA) in Wyoming grants someone you trust the authority to handle your affairs if you can't. It's a powerful document that ensures your matters are in good hands. Filling out this form properly is crucial, as mistakes can lead to misunderstandings or legal complications. Here are the steps you need to follow to complete the Wyoming Durable Power of Attorney form correctly and to ensure your wishes are carried out as intended.

- Start by gathering all necessary information: your full legal name and address, the name and address of the person you are appointing as your agent (also known as the attorney-in-fact), and specific details about the powers you are granting them.

- Enter your full name and address at the top of the form where indicated.

- Fill in the name and address of the person you are choosing as your agent in the designated section.

- Specify the powers you are granting to your agent. This might include making financial decisions, handling real estate transactions, managing business affairs, or making healthcare decisions, among others. Be as clear and detailed as possible.

- If there are any powers you do not wish to grant, make sure to clearly state these exceptions in the form.

- Decide on the effective date of the POA. You must indicate whether the POA will become effective immediately or only in the event you are unable to make decisions for yourself.

- If applicable, specify any expiration date for the POA. If no expiration date is desired, state that the power of attorney will remain in effect indefinitely or until legally revoked.

- Review the form thoroughly to ensure all information is accurate and complete. Any mistakes could affect the validity of the document or the agent’s ability to act on your behalf.

- Sign the form in front of a notary public. Wyoming law requires durable powers of attorney to be notarized to be legally effective.

- Have your agent sign the form, if required. This step may not be mandatory for the POA to be valid in Wyoming, but it's a good practice to have the agent's acknowledgment on record.

- Distribute copies of the signed and notarized form to your agent, any institutions that may need it (like banks or healthcare providers), and anyone else who should be aware of the arrangement.

Now that the form is filled out and signed, your durable power of attorney is in place. This action gives your chosen agent the authority to manage your affairs according to the powers you’ve granted. Make sure to keep the original document in a safe but accessible place, and inform your agent where to find it if needed. Creating a durable power of attorney might seem like a daunting task, but it’s an essential step in planning for the future. By taking care today, you can ensure peace of mind for yourself and your loved ones.

Common Questions

What is a Durable Power of Attorney (DPOA) in Wyoming?

A Durable Power of Attorney in Wyoming is a legal document that allows you to appoint someone you trust (referred to as an "agent") to manage your financial affairs and make decisions on your behalf if you ever become incapacitated. Unlike a general power of attorney, the "durable" aspect means that the agent's authority to act on your behalf will continue even if you are no longer mentally competent to make decisions yourself.

How do I choose an agent for my Durable Power of Attorney?

Choosing an agent is a significant decision since this person will have the authority to manage your finances and legal affairs under certain circumstances. It's important to select someone who is not only trustworthy but also capable of handling the responsibilities that come with the role. Consider speaking with family members, close friends, or advisers that you feel would act in your best interests. It's also a good idea to name a successor agent who can take over if your original choice is unable or unwilling to serve when needed.

Does my Durable Power of Attorney in Wyoming need to be notarized?

Yes, for a Durable Power of Attorney to be legally valid in Wyoming, it must be notarized. This means that after you and your chosen agent have signed the document, it must be brought in front of a notary public who will confirm your identities and signatures. The notary will then seal the document, officially making it a valid legal instrument under Wyoming law.

Can I revoke my Durable Power of Attorney if I change my mind?

Yes, you have the right to revoke your Durable Power of Attorney at any time, as long as you are considered mentally competent to make such decisions. To do so, you must formally notify your agent and any institutions or individuals that were aware of the document's existence (such as banks or healthcare providers). It's recommended to put the revocation in writing and get it notarized to avoid any confusion or legal disputes later on.

What happens if I don't have a Durable Power of Attorney in Wyoming?

If you become incapacitated without having a Durable Power of Attorney in place, your family or close associates would have to petition the court to appoint a conservator or guardian to make decisions on your behalf. This process can be lengthy, costly, and stressful for your loved ones. Having a Durable Power of Attorney ensures that someone you personally trust can immediately take over managing your affairs without the need for court intervention, making it a crucial part of planning for the future.

Common mistakes

In the state of Wyoming, crafting a Durable Power of Attorney (DPOA) is a prudent step for anyone looking to ensure their affairs are managed in the event they're unable to do so themselves due to illness or incapacity. However, filling out this form often involves intricate details that, if overlooked or improperly handled, can lead to unintended consequences. Here are nine common mistakes people make when completing their Wyoming Durable Power of Attorney form.

Not tailoring the document to specific needs: A one-size-fits-all approach rarely suits the unique nuances of one's personal circumstances. Failing to customize the DPOA to address specific assets, wishes, or concerns often leads to gaps in the power granted.

Omitting an alternate agent: If the primary agent is unable or unwilling to serve, having no alternate agent listed can create a vacuum of power. This oversight might necessitate court intervention to assign a new agent.

Misunderstanding the powers granted: Power of Attorney documents can confer broad or narrowly defined powers. Misinterpretations or the use of ambiguous language can lead to agents wielding more power than intended or confusion about their duties.

Overlooking the need for witnesses and/or notarization: Wyoming law may require these formalities for the document to be legally valid. Neglecting these steps can render the DPOA ineffective.

Ignoring state-specific requirements: While many aspects of power of attorney laws are similar across states, Wyoming has its unique requirements. Failure to adhere to these can invalidate the document.

Not setting a durability clause: For a Power of Attorney to remain effective even if the principal becomes incapacitated, it must explicitly state it is "durable." Overlooking this can result in the document becoming null at the most critical time.

Lack of clarity in specifying end-of-life wishes: This document can also address health care decisions, including end-of-life care. Vague language can lead to actions that might not align with the principal's desires.

Not updating the document: Life changes—such as marriage, divorce, or the death of an agent—can impact the relevance and functionality of a DPOA. Letting the document gather dust without reviewing and updating it as circumstances change is a mistake.

Selecting the wrong agent: This perhaps is the gravest mistake. The chosen agent should be trustworthy and capable of handling financial matters with diligence. Placing one's trust in the wrong hands can lead to mismanagement or abuse of power.

Steering clear of these pitfalls involves meticulous attention to detail, a deep understanding of one's own needs and how they might change, and a clear communication with the chosen agent about the expectations and limitations of their role. Crafting a Durable Power of Attorney is not just a legal formality; it's a crucial part of life planning that requires thought, understanding, and care. Remember, the decisions made today will impact not just the individual, but potentially their loved ones as well. Thus, it's advisable to consult with a legal professional experienced in Wyoming's specific legal landscape to ensure that every box is ticked, every t crossed, and the individual's welfare is secured, come what may.

Documents used along the form

In Wyoming, a well-prepared estate plan often encompasses more than just a Durable Power of Attorney. This particular form is crucial as it grants someone the authority to make financial decisions on another's behalf, yet it is typically one part of a comprehensive strategy designed to ensure an individual's wishes are honored and assets are protected. Additional documents commonly used alongside the Durable Power of Attorney include, but are not limited to, the following:

- Advance Healthcare Directive: This serves as a guide for healthcare providers and loved ones regarding an individual’s preferences for medical treatments and interventions in situations where they are unable to communicate their decisions themselves.

- Last Will and Testament: It details how a person’s assets and possessions should be distributed after their passing. It also may designate guardians for any minor children.

- Living Trust: This document provides instructions for managing an individual’s assets during their lifetime and distributes the remaining assets after death, potentially avoiding the need for probate.

- Medical Power of Attorney: Also known as a healthcare proxy, it authorizes another person to make healthcare decisions on behalf of the principal when they are incapacitated or unable to make decisions for themselves.

- Do Not Resuscitate (DNR) Order: A medical order indicating that a person does not want to receive CPR or other life-saving treatments if their heart stops or if they stop breathing.

- Declaration of Last Remains: This document allows individuals to outline their wishes concerning the disposition of their body and the nature of their funeral services, ensuring their preferences are understood and respected.

Together, these forms and documents compose a protective legal framework that addresses a wide array of concerns—from healthcare and financial decisions to end-of-life wishes and asset distribution. Professionals often recommend that individuals periodically review these documents with a legal advisor to ensure they reflect current wishes and circumstances accurately. Involving an attorney in the drafting and maintenance of these documents can also offer peace of mind that all legal requirements are met and the individual’s intentions will be honored.

Similar forms

The Wyoming Durable Power of Attorney form is similar to other estate planning documents, each designed to facilitate various aspects of a person’s financial and health care decisions during their lifetime. Though these documents share common goals, notable differences exist in their purposes and the specificity of the powers they grant.

Similar to the General Power of Attorney, the Wyoming Durable Power of Attorney allows an individual, known as the principal, to designate an agent to make financial decisions on their behalf. The key difference, however, lies in the durability feature. While a General Power of Attorney typically becomes invalid if the principal becomes incapacitated, a Durable Power of Attorney remains in effect, thus ensuring continuous management of the principal's affairs during incapacity.

In comparison with a Medical Power of Attorney, the Wyoming Durable Power of Attorney focuses on financial matters, not healthcare decisions. A Medical Power of Attorney is specifically designed to empower an agent to make healthcare-related decisions if the principal is unable to. This distinction is crucial for individuals planning for the possibility of medical incapacitation, as it necessitates having both documents in place to comprehensively cover decision-making authority across both financial and health spheres.

Contrary to a Living Will, which directly stipulates an individual’s wishes concerning end-of-life care, the Durable Power of Attorney does not contain directives about medical treatment preferences. While a Living Will communicates specific health care wishes in circumstances where an individual is unable to communicate, a Durable Power of Attorney for finances designates another person to handle financial decisions without detailing specific preferences for health care interventions.

Lastly, it shares similarities with a Revocable Living Trust in that both instruments can manage an individual’s assets. However, a Revocable Living Trust usually avoids probate by transferring assets directly to beneficiaries upon the trustor's death, while a Durable Power of Attorney ceases to be effective at the principal's death. The primary role of a Durable Power of Attorney is to manage the principal's affairs during their lifetime, including periods of incapacity, but not beyond that.

Dos and Don'ts

When completing a Wyoming Durable Power of Attorney form, it's essential to approach the process with care and precision. This document grants another person the authority to make legal and financial decisions on your behalf, making it of utmost importance. Below are guidelines to help ensure your document is correctly filled out and effectively represents your interests.

Do's:

- Review the form thoroughly to understand each section before you start filling it out. This ensures you know what information is required and where.

- Clearly identify the agent (the person you are granting power to) and include their full legal name and contact information to prevent any confusion.

- Be specific about the powers you are granting. If there are any limitations to these powers, those should be explicitly stated in the document.

- Discuss your decision with the chosen agent beforehand. It's important they understand the responsibilities involved and agree to take them on.

- Include a succession plan by appointing an alternate agent in the event the original agent is unable to perform their duties.

- Sign the document in the presence of a notary public to authenticate its validity. Wyoming law may require notarization for the document to be legally binding.

- Keep the original document in a safe but accessible place, and provide copies to your agent and any alternate agents.

- Inform close family members or trusted friends of the arrangement and where the document is stored.

- Regularly review the document to ensure it still reflects your wishes, especially after major life events.

- Consult with a lawyer if you have questions about filling out the form to ensure it's completed correctly and meets all legal requirements.

Don'ts:

- Don't rush through the process without fully understanding the implications of what is being signed.

- Don't leave any sections incomplete, as this could lead to ambiguity or disputes later on.

- Don't choose an agent without carefully considering their ability to act in your best interest.

- Don't forget to date the document. The absence of a date could question the document's validity.

- Don't rely solely on generic templates without verifying they comply with Wyoming's specific legal requirements.

- Don't underestimate the importance of specifying the duration of the power of attorney, particularly if you want it to be durable.

- Don't ignore the need to notarize the document, if required, as failing to do so may render it invalid.

- Don't give out copies of the document without keeping track of who has them, as you may need to collect and destroy them if the document is revoked.

- Don't assume the document will be automatically revoked if you change your mind. Specific steps must be taken to legally revoke the document.

- Don't forget to plan for circumstances in which the chosen agent might decline or be unable to serve, without naming an alternate agent.

Misconceptions

When it comes to creating a Durable Power of Attorney (POA) in Wyoming, there are several misconceptions that can lead to confusion. Understanding the facts can help ensure that your desires are accurately represented and legally enforceable. Here, we dispel some common myths:

It's only for the elderly: A common misconception is that a Durable Power of Attorney is only for the elderly. In reality, any adult can benefit from having a Durable POA. This document allows you to appoint a trusted person to manage your affairs if you become unable to do so, regardless of your age.

A spouse automatically has authority: Another misconception is that a spouse automatically has the authority to make decisions on behalf of their partner. Without a Durable POA in place, a spouse may not have the legal right to make financial or medical decisions for you. A Durable POA grants them this specific authority.

It’s too complicated to set up: Some people believe that creating a Durable Power of Attorney is too complicated. However, with the correct information and assistance, drafting a Durable POA can be straightforward. It's about defining your wishes and selecting a trusted individual to act on your behalf.

It grants unlimited power: Lastly, there is a misconception that a Durable POA gives an agent unlimited power. In reality, you can tailor the document to your specific needs, choosing what powers your agent will have and for how long. This ensures your affairs are handled according to your wishes.

Key takeaways

When considering the creation of a Durable Power of Attorney (DPOA) in Wyoming, there are several key elements that individuals must keep in mind to ensure that their financial affairs will be appropriately managed in the event they become unable to do so themselves. A Durable Power of Attorney is a vital legal instrument, empowering a chosen agent to act on your behalf. Here are five crucial takeaways regarding the completion and utilization of the Wyoming Durable Power of Attorney form:

- Selection of Agent: The choice of an agent is perhaps the most critical decision when filling out the DPOA form. This individual will have the authority to handle your financial matters, including but not limited to property transactions, banking, and tax filings. It is imperative to choose someone who is not only trustworthy but also capable of managing these responsibilities efficiently and in your best interest.

- Specificity of Powers: While the DPOA form allows for broad powers to be granted, it also provides the option to limit or specify the powers your agent will have. Clearly delineating these powers can help in preventing any confusion or misuse of authority. It’s crucial to carefully consider which powers you wish to grant to ensure they align with your expectations and needs.

- Signing Requirements: For a Durable Power of Attorney to be legally binding in Wyoming, it must meet specific signing requirements. This includes being signed by the principal (the person granting the power) in the presence of a notary public. Ensuring that the document is correctly executed is essential for it to be recognized and enforceable.

- Witnesses: Although the Wyoming DPOA does not specifically require witnesses, having the document witnessed can add an additional layer of validity and may help in preventing challenges. Witnesses can attest to the principal’s mental capacity and voluntary signing, providing clear evidence of the document’s legitimacy.

- Revocation and Updates: Circumstances and relationships change, which may necessitate the revocation or updating of the DPOA. It is important for individuals to understand that they have the right to revoke their Durable Power of Attorney at any time, as long as they are mentally competent. Additionally, reviewing and updating the DPOA regularly ensures that it reflects your current wishes and that the chosen agent is still the best fit for their role.

In conclusion, effectively executing a Durable Power of Attorney in Wyoming involves careful consideration of who is chosen as an agent, the powers granted, and ensuring all legal requirements are met. Given its significance in managing one’s affairs, it is advisable to approach this process with diligence and, when possible, seek professional guidance to navigate the complexities involved.

More Durable Power of Attorney State Forms

Does a Power of Attorney Need to Be Recorded in Virginia - It remains effective even if you become mentally or physically unable to make decisions for yourself.

Financial Power of Attorney Form New Jersey - By establishing a Durable Power of Attorney, you take a proactive step in comprehensive financial planning.

Power of Attorney Michigan - It’s a strategic move to protect against financial vulnerability and ensure that personal finances are managed effectively and responsibly.